Conquest Resources Limited (TSXV: CQR) ("Conquest" or the "Company") has entered into a Royalty Purchase and Sale Agreement with VDI Resources LLC (VDI), a subsidiary of VerAI Discoveries Inc. (VerAI), an artificial intelligence (AI) powered mineral discovery generator, pursuant to which the Company agrees to grant to VDI a 1.5% net smelter return royalty on certain target areas with recommended drilling locations generated by VerAI utilizing its proprietary AI technology. The Company agrees to grant VDI an additional 1.5% NSR in return for funding a drill program for testing of the targets identified by VerAI on the Belfast TeckMag Project, a 350 sq. km. land package located northeast of Sudbury, Ontario.

- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Anson Delivers Further 87% Increase in Lithium Grades in Drilling of Mississippian Units at Long Canyon No. 2

Anson Resources Limited (ASX: ASN, ASNOC, ASNOD) (Anson or the Company) is pleased to announce that drilling of the targeted Mississippian Units at the Long Canyon No. 2 well at the Paradox Lithium Project (the Project) in Utah, USA, has delivered a further 87% increase in lithium grade over the most recent reported assays at the Project.

Highlights:

- Anson has delivered a further 87% increase in Lithium assay grade in drilling of the targeted Mississippian Unit at the Long Canyon No. 2 well at its Paradox Lithium Project

- Drilling returned an average assay grade of 187ppm Lithium and 3,793ppm Bromine through the entire drilled zone compared to recently reported 100ppm Li

- Lithium and bromine grades are also significantly higher than the maximum grade range used in the Project’s Exploration Target

- The assay results confirm the Mississippian Units’ massive, supersaturated brine aquifer is lithium and bromine rich

- The brines are similar to those of the previously sampled Clastic Zones where the Project’s existing Indicated and Inferred JORC Resource has been estimated

- Drilling is progressing on the Cane Creek 32-1 well to sample the Mississippian brines, which is designed to increase the JORC resource

- Mississippian Units within historic wells on the western side of the Project (‘western strategy”) are to be re-entered and drilled to further expand the Paradox Resource

The Company is now pleased to advise that results of all four brine samples from the recent drilling into the Mississippian units at Long Canyon No. 2 have been returned and have delivered an average assay value of 187ppm lithium (and 3,793ppm bromine).

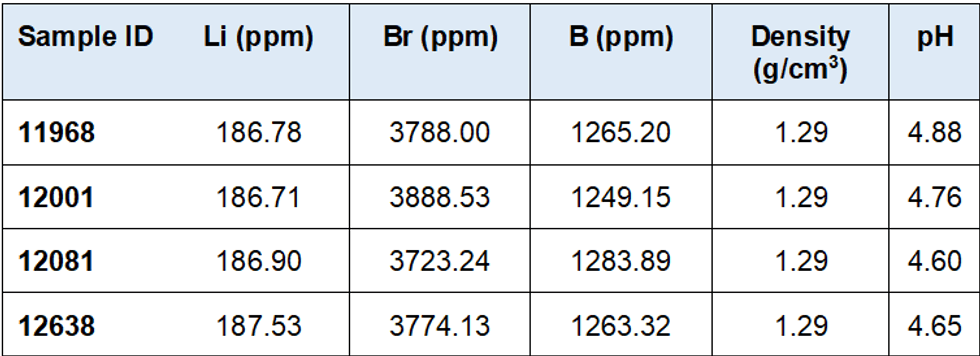

See Table 1 for sample assay results from the recent drilling at Long Canyon No. 2.

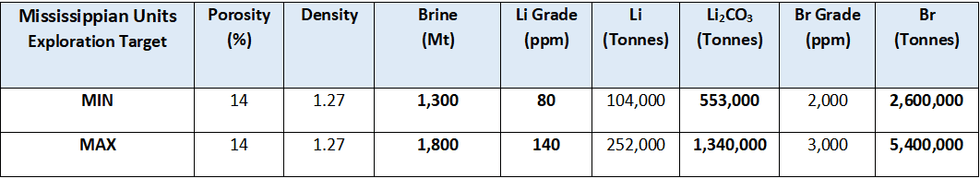

This assay grade represents an 87% increase on the first assay value from the recent drilling (100ppm lithium), and a 134% increase on the only historical lithium value recorded at the Project (80ppm lithium). They are also higher than the maximum lithium grade range used in the Exploration Target for the Mississippian Units (140ppm) (summarised in Table 2).

Table 1: Assay results from sampling the Mississippian Unit from the Long Canyon Unit 2 well.

The Mississippian Units host a massive brine aquifer with a thickness of between 70m to 170m. It is situated approximately 500m below the clastic zones that have been used to calculate the existing Indicated and Inferred JORC resource estimate.

The ability to now include assay results from the Mississippian Units provides the opportunity to significantly expand the Paradox resource in Anson’s planned upcoming resource upgrade for the Project.

Paradox Exploration Target

The Project has an Exploration Target for the Mississippian supersaturated brines of 1.3Bt – 1.8Bt of brine grading 80 – 140ppm Li and 2,000 – 3,000ppm Br (see ASX announcement April 6, 2021) (summarised in Table 2). The maximum assay ranges in the Exploration Target are 140ppm Li and 3,000ppm Br, which are significantly lower than the latest laboratory assay results reported in this announcement - average grade of 187ppm Li and 3793ppm Br.

The latest assay results may indicate a connectivity between the Mississippian and Paradox Formation Clastic zones due to the Robert’s Rupture geological feature, which has resulted in the Mississippian rocks being faulted against the Paradox salt beds near the Long Canyon No. 2 well.

Table 2: The Mississippian Units Exploration Target Range with brine & grade variables.

The Exploration Target figure is conceptual in nature as there has been insufficient exploration undertaken on the Project to define a mineral resource for the Mississippian Units. It is uncertain that future exploration will result in a mineral resource.

The Mississippian Units for the entire Project area are currently only included as an Exploration Target in the JORC estimate (See Announcement 6 April 2021).

This Exploration Target was calculated by an independent third party and used data generated during previous oil and gas-focused drilling programs. The review identified several wells within the Project area that have been drilled into the Mississippian Units. They included Long Canyon No1, Long Canyon Unit 2, Coors USA 1-10LC, White Cloud 1, Big Flat Unit 5 and Mineral Canyon Fed 1–3, see Figure 2.

In addition to these wells, numerous other wells that abut the project area have been drilled into or through this limestone unit. These include holes such as Big Flat 1, 2 and 3, the locations of which are shown in Figure 1.

Click here for the full ASX Release

This article includes content from Anson Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Anson Resources: Developing a Near-Term Clean Energy Project in Utah

Anson Resources (ASX:ASN) focuses on the resources necessary to meet the energy demands of the future. The company’s flagship project, the Paradox Lithium Project, has the potential to become a world-class lithium producer and is located near Tesla’s massively productive gigafactory in the United States. Additional projects target nickel, copper, and uranium.

The company's flagship Paradox Project is located in Utah, a mining-friendly and politically stable jurisdiction. The asset holds significant lithium brine deposits, and the company has identified an extraction method that has delivered an extraction rate of 91.5 percent. This technique calls for passing the lithium through the resin, which captures the resin, and can then be separated from the resin with water. From that state, it can be processed into lithium carbonate. The company is currently undertaking a major JORC resource expansion drilling program, the results of which will feed into a Detailed Feasibility Study being carried out by global engineering firm, Worley.

Company Highlights

- Anson Resources is focused on developing its flagship project, the Paradox Lithium Project, into a significant lithium producing operation.

- The company is currently undertaking a major JORC Resource expansion program at Paradox, which will form part of a Detailed Feasibility Study which is being undertaken by leading global engineering consultants, Worley.

- The Paradox Project contains multiple lithium brine targets, and the company has identified an extraction method that produces an impressive return rate of 91.5 percent. Also, the project’s Direct Lithium Extraction (DLE) method is expected to deliver significant ESG benefits

- In addition, the project’s brine also contains bromine, creating a valuable second potential revenue stream for the asset.

- Anson Resources’ other projects target nickel, copper, vanadium and uranium. The company aims to supply energy markets with the mineral resources necessary to power the future.

- The company has an experienced management team with a mix of technical, corporate and commercial skills driving the project towards its ambitious goals.

This Anson Resources company profile is part of a paid investor education campaign.*

Mineral Resource Upgrade Paves Way for Northern Silica Project PFS

Emerging silica sands developer, Diatreme Resources Limited (ASX:DRX) announced today a significant upgrade to the estimated Si2 Mineral Resource at the Company’s Northern Silica Project (NSP) in Far North Queensland, highlighting the critical mineral project’s potential amid an accelerating solar energy boom.

- Significant 17% increase in Indicated Resource and establishment of maiden 49.5 Mt Measured Mineral

- Resource for Diatreme’s flagship Northern Silica Project (NSP) in Far North Queensland

- Results provide strong Resource foundation for upcoming Pre-Feasibility Study (PFS) and maiden Ore Reserve

- Bulk sample testing and further specialist metallurgical testwork currently underway at external laboratories

- NSP on track for development amid increasing demand for critical mineral key to solar energy industry.

The latest data has shown an increase in both the estimated Mineral Resource categories, with the inclusion of a maiden Measured Resource of 49.5 Mt, as well as increasing the size of the Indicated Resource to 120.5 Mt (up 17% from the previous estimate). Diatreme’s total low iron, high purity silica sand resource base exceeds 402 Mt, an extremely strategic and highly valuable resource that is well positioned to supply the fast-growing solar PV market.

Diatreme’s CEO, Neil McIntyre commented: “It is pleasing to report a further enhancement in the quality of the resource estimate for our flagship NSP, with the establishment of its first Measured category Mineral Resource and significant increase in its Indicated category Mineral Resource.

“The enhanced resource allows us to advance our PFS with greater confidence, providing a deeper understanding of the extraordinary potential for commercialisation contained within the Si2 dune complex at the NSP.

“We look forward to delivering the project’s PFS by mid-2024, together with a maiden Ore Reserve, as we ramp up development of this asset vital to the clean energy revolution, both in Australia and internationally.”

The resource upgrade follows moves by the Australian Government to promote the domestic manufacturing of solar panels under its $1 billion “Solar Sunshot” program. Low iron, high purity silica sand is a key ingredient in the solar PV manufacturing process (solar glass), which is currently dominated by China.

The NSP is also located near Cape Flattery, an area identified as a potential critical minerals hub for silica sand by the Queensland Government in its 2023 “Critical Minerals Strategy.”

Click here for the full ASX Release

This article includes content from Diatreme Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Conquest Resources Enters into Agreement with VerAI Discoveries for AI Targeting on Belfast TeckMag Project

Tom Obradovich, CEO of Conquest stated, "It has been a unique experience working with the VerAI team to integrate their AI technology as another layer of targeting, which enhances our ability to potentially discover subsurface mineral deposits at the Belfast TeckMag Project. This area of Canada is one of the most cost-effective exploration regions and mineral-endowed belts in the world."

Belfast TeckMag Project MIAC Investigation

Over the past several years, Conquest has completed airborne electromagnetic and magnetic geophysical surveys, Mobile MT surveys, ground gravity surveys and regional drill programs. Recent examination of drill core by Dr. JF Montreuil, in particular diamond drill hole BC21-05, has indicated that mineralization and alteration facies are related to hydrothermal systems capable of forming IOCG and affiliated deposits. These systems are referred to as Metasomatic Iron and Alkali-Calcic systems or MIAC. The identified alteration types are similar to the Cloncurry region of Australia which hosts the Earnest Henry Mine in addition to other notable deposits. An exploration program beginning with prospecting and geological mapping of the areas of interest identified by VerAI and compiled with previous data will be conducted this spring under the direction of Joerg Kleinboeck, P.Geo, Vice President Exploration for Conquest. A program of diamond drilling is intended to commence later this year on VerAI targets as well as additional targets established by previous programs.

Yair Frastai, CEO of VerAI, expressed his confidence in the partnership, stating, "It's a privilege to work with Conquest, a well-experienced explorer in the region. Our team is committed to maximizing the chance of discovery by using our AI technology to provide Conquest with higher-probability drilling locations, calibrated from the ongoing drilling inputs."

ABOUT VERAI DISCOVERIES, INC.

VerAI Discoveries ("VerAI") is an AI-powered mineral discovery generator focused on uncovering essential critical minerals for the green energy transition and a sustainable future. Their mission involves working with mining partners to target new mineral discoveries in covered areas in mature mining jurisdictions that remain largely unexplored. By deploying their novel proprietary AI/ML Discovery Platform, VerAI significantly increases the probability of discovering economic mineral deposits of different commodities and in various geological jurisdictions, shortens targeting time, and reduces exploration costs. For more information, visit https://ver-ai.com/.

ABOUT CONQUEST

Conquest Resources Limited, incorporated in 1945, is a mineral exploration company that is exploring for base metals and gold on mineral properties in Ontario.

Conquest holds a 100% interest in the Belfast-TeckMag Project, located in the Temagami Mining Camp at Emerald Lake, Ontario, which is believed to have exceptional exploration upside for magmatic sulphide deposits (Cu-Ni-PGE), VMS, IOCG, Iron formation hosted Au and Paleo-placer Au. The Belfast-TeckMag Project is the Company's flagship property, evolved from the Golden Rose Project, which was initially acquired in December 2017, and significantly augmented through the acquisition of Canadian Continental Exploration Corp. ("CCEC") in 2020 and subsequent additional claim staking and purchases in its adjacent Belfast Copper Project and TeckMag Property.

Conquest now controls over 300 square kilometers of underexplored territory in the Temagami Mining Camp, including the past producing Golden Rose Mine at Emerald Lake.

Conquest also holds a 100% interest in the Alexander Gold Property located immediately east of the Red Lake and Campbell mines in the heart of the Red Lake Gold Camp along the important "Mine Trend" regional structure. Conquest's property is almost entirely surrounded by Evolution Mining landholdings.

In addition, the Company holds interests in the Smith Lake Gold Property, Lake Nipigon Basin Property, and the Marr Lake Property.

FOR FURTHER INFORMATION CONTACT:

general@conquestresources.com

www.ConquestResources.com

Tom Obradovich

President & Chief Executive

416-985-7140

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/205667

News Provided by Newsfile via QuoteMedia

SOURCE ROCK ROYALTIES ANNOUNCES INCREASED MONTHLY DIVIDEND

/Not for distribution to U.S. news wire services or dissemination in the U.S./

Source Rock Royalties Ltd. ("Source Rock") (TSXV: SRR), a pure-play oil and gas royalty company with an established portfolio of oil royalties, announces that its board of directors has declared a monthly dividend of $0.0065 per common share, payable in cash on May 15, 2024 to shareholders of record on April 30, 2024 . This represents an increase of 8% to the monthly dividend. Source Rock has now increased its monthly dividend by 30% since March 2023 .

This dividend is designated as an "eligible dividend" for Canadian income tax purposes.

Source Rock is a pure-play oil and gas royalty company with an existing portfolio of oil royalties in southeast Saskatchewan , central Alberta and west-central Saskatchewan . Source Rock targets a balanced growth and yield business model, using funds from operations to pursue accretive royalty acquisitions and to pay dividends. By leveraging its niche industry relationships, Source Rock identifies and acquires both existing royalty interests and newly created royalties through collaboration with industry partners. Source Rock's strategy is premised on maintaining a low-cost corporate structure and achieving a sustainable and scalable business, measured by growing funds from operations per share and maintaining a strong netback on its royalty production.

Contact Information

For more information about Source Rock, visit www.sourcerockroyalties.com .

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE Source Rock Royalties Ltd.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/15/c4373.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/15/c4373.html

News Provided by Canada Newswire via QuoteMedia

Compelling Cobalt Copper and REE Targets Identified at Broken Hill

Rimfire Pacific Mining (ASX: RIM, “Rimfire” or “the Company”) is pleased to advise that multiple cobalt, copper, and Rare Earth Element [REE] targets have been identified at its recently expanded 100% - owned Broken Hill Project which is located 17-30 kilometres west of Broken Hill, NSW (Figures 1 and 2).

Highlights

- Detailed ground magnetics identifies a potential extension to high grade cobalt mineralisation drilled by Rimfire at Bald Hill last year, including;

- 125m @ 0.13% Co from 198 metres in FI2470 including 97m @ 0.15% Co

- Bald Hill Extension magnetic anomaly which has not been drilled present over 450 x 400m to a vertical depth of ~300m

- Additional magnetic anomalies identified 2km northeast of Bald Hill with initial rock chip samples up to 0.72% cobalt and 0.46% copper

- Rimfire will shortly commence reconnaissance mapping & sampling to refine new targets and plan for drilling in 2H CY24

Commenting on the announcement, Rimfire’s Managing Director Mr David Hutton said: “Rimfire is exploring throughout New South Wales for critical minerals that are associated with global decarbonisation strategies, such as scandium, PGEs, copper, and cobalt.

While we remain firmly focussed on the scandium exploration program currently underway at Fifield and Avondale, we are also keen to advance our recently expanded Broken Hill Project.

Broken Hill is shaping up as a compelling exploration opportunity for Rimfire with ground magnetics highlighting a potential extension to high grade cobalt sulphides drilled last year at Bald Hill, as well as the cobalt, copper and REE targets outlined in this announcement.

With executed Access Agreements in place, we will shortly commence a ground inspection of the targets with a view to drill testing during the second half of 2024 and look forward to further market updates as new information comes to hand.”

Click here for the full ASX Release

This article includes content from Rimfire Pacific Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Rights Issue and Shortfall

Reach Resources Limited (ASX: RR1 & RR1O) (“Reach” or “the Company”) is pleased to announce it has received $822,595 from the recently completed non-renounceable rights issue.

As announced on 21 February 2024, eligible shareholders who participated will receive 1 fully paid ordinary share in the capital of the Company (“Share”) for every 3 Shares held, at an issue price of $0.002 per Share (pre-consolidation) (or $0.01 on a post-consolidation basis), together with 1 free attaching option to acquire a Share (“Option”) for every 2 Shares subscribed for and issued (“Rights Issue”).

Each Option issued under the Rights Issue will be exercisable within 3 years from the date of issue with an exercise price of $0.003 (pre-consolidation) (or $0.015 on a post-consolidation basis) (“New Options”). Participants in the Rights Issue will be issued Shares and New Options prior to 10am AWST, this morning.

In addition to the Rights Issue, the Company will be offering eligible holders of the existing RR1O listed Options (“RR1O Options”) a non-renounceable priority offer to subscribe for 1 New Option for every 1 RR1O held at an issue price of $0.0002 (pre-consolidation) or $0.001 (post-consolidation) per New Option, to raise up to approximately a further $0.26 million (“Priority Offer”). The issue of the New Options under the Priority Offer is subject to shareholder approval at the meeting to be held at 9:30 am AWST on the date of this announcement.

The Company intends to apply for the quotation of the New Options to be issued under the Rights Issue and the Priority Offer (together, the “Offers”).

Funds raised under the Offers will be allocated towards funding the exploration of the Company’s projects and for general working capital purposes.

The Company engaged Westar Capital Limited (AFSL 255789) (“Westar”) to act as lead manager for the Offers. In consultation with the Company, Westar has the exclusive right to the placement of any shortfall under the Rights Issue (ASX Announcement 14 March 2024 – Entitlement Issue Prospectus) (“Shortfall Offer”). Westar have been advised of the shortfall and the Company looks forward to providing an update to shareholders regarding the placement of the shortfall, in the short term.

Consolidation

Subject to receipt of shareholder approval at this morning’s General Meeting, the Company plans to consolidate its issued capital on a 1 for 5 basis (“Consolidation”).

The Consolidation will apply equally to all shareholders, individual shareholdings will be reduced in the same ratio as the total number of shares (subject to rounding of fractions). The Consolidation will have no material effect on the percentage interest in the Company of each shareholder from a pre- consolidation basis to a post-consolidation basis.

Click here for the full ASX Release

This article includes content from Reach Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

McKinsey: Commodities Trading Generated US$104 Billion in 2023

A recent report from McKinsey highlights trends seen in commodities trading over the past year.

The document shows that despite global uncertainty, commodities trading generated over US$100 billion in earnings before interest and taxes in 2023, translating into more than US$150 billion in gross margin.

McKinsey mentions challenges related to COVID-19 and geopolitical conflicts, such as increased price volatility and supply chain disruptions, but notes that commodities trading value pools have show resilience.

Total trading values remained relatively stable in 2023 following rapid growth from 2021 to 2022.

Commodities trading trends in 2023

Looking at specific commodities, McKinsey notes that oil and oil-based products remain the largest value pool, although their profitability decreased in 2023. The firm also notes that the year brought physical volatility.

Total demand for oil is seen growing for the majority of this decade, followed by a decline after 2030. Demand for the commodity is forecast to decrease by nearly 50 percent by 2050.

Until then, competition is anticipated to escalate as more large players enter the fray. According to McKinsey, national oil companies and legacy oil marketers are already bolstering their trading capabilities.

For power and gas, trading pool value saw a bump in 2023, with markets seeing above-average volatility.

New opportunities are emerging in power and gas trading, particularly around entering new markets, data-driven trading and investments in new assets like battery energy storage systems.

The liquefied natural gas (LNG) market continued to grow in 2023, playing a crucial role in maintaining energy security in Europe. Similar to oil, market competition is poised to escalate as players that traditionally relied on long-term pipeline gas contracts, particularly in Europe, can now leverage their existing customer base to bolster their trading capabilities.

For metals and mining, trading profitability decreased in 2023, driven by elevated energy prices and lower commodities prices. Even so, nickel production saw a notable upsurge, largely driven by Indonesia, while lithium output experienced only modest growth. McKinsey sees the energy transition driving metals demand in the years to come.

Commodities sector increasingly interconnected

Aside from that, the McKinsey report highlights two major trends shaping commodities markets today.

The first is increasing interconnectedness. According to McKinsey, the average correlation between commodities vital to the energy transition has doubled, reaching 56 percent from 2015 to 2019.

Part of the reason for that is increased diversification of supply, which has led to a decrease in long-term relationships and a surge in short-term contracts. The LNG market exemplifies this shift, notes McKinsey, with approximately 100 new LNG tankers launched in the past three years, poised to surpass oil carriers by 2028.

Similarly, flexible contracts are gaining traction as buyers seek to mitigate risk. This shift often leads to higher exposure to global prices, as residual volumes are typically priced based on current market levels. The competition between Asia and Europe for additional LNG volumes highlights the growing preference for spot or indexed contracts.

However, not all markets follow this pattern. Critical industries like agriculture and certain metals, where supply chain security is paramount, often enjoy protection from local authorities.

Power to play a key role in the energy transition

The second major trend McKinsey mentions is the growing role of power in the energy transition.

The firm notes that power will be key to meeting the net-zero goals outlined in the Paris Agreement, and states that the power sector's value is anticipated to grow by up to 5 percent annually, reaching US$1.3 trillion to US$2.4 trillion by 2040.

However, the road to a sustainable energy future is not straightforward. Unlike other commodities, power demands immediate generation and consumption in close proximity. While solar and wind have spearheaded initial efforts in the energy transition, the journey to achieving the next 50 percent reduction in emissions presents complex hurdles.

Solutions such as nuclear, hydrogen and carbon capture necessitate substantial investments, alongside urgent grid expansions to accommodate evolving demands.

In Germany alone, the annual buildout of the transmission grid is projected to skyrocket by a factor of five, with approximately 1,900 kilometers added per annum by 2035, compared to a mere 400 kilometers previously.

Renewables, particularly wind and solar, are also set to dominate the power mix from 2030 to 2050. Yet this reliance on renewables introduces dependencies on other commodities. For instance, wind turbines, which are integral to renewable energy infrastructure, heavily rely on materials like steel, copper and aluminum.

Investor takeaway

As uncertainty drives large value pools in commodities trading, McKinsey is suggesting that players in this market embrace data-driven trading, which involves artificial intelligence.

The firm believes this approach can give commodities traders an advantage, particularly in power and gas.

"To expand capabilities and agility, players will need to think through the macrotrends to determine which cross-commodity opportunities are the best fit, what role traders can play in power, and how to differentiate across managing illiquid risks, data-driven trading, and having deep capabilities in niche commodities," states McKinsey.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.