- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

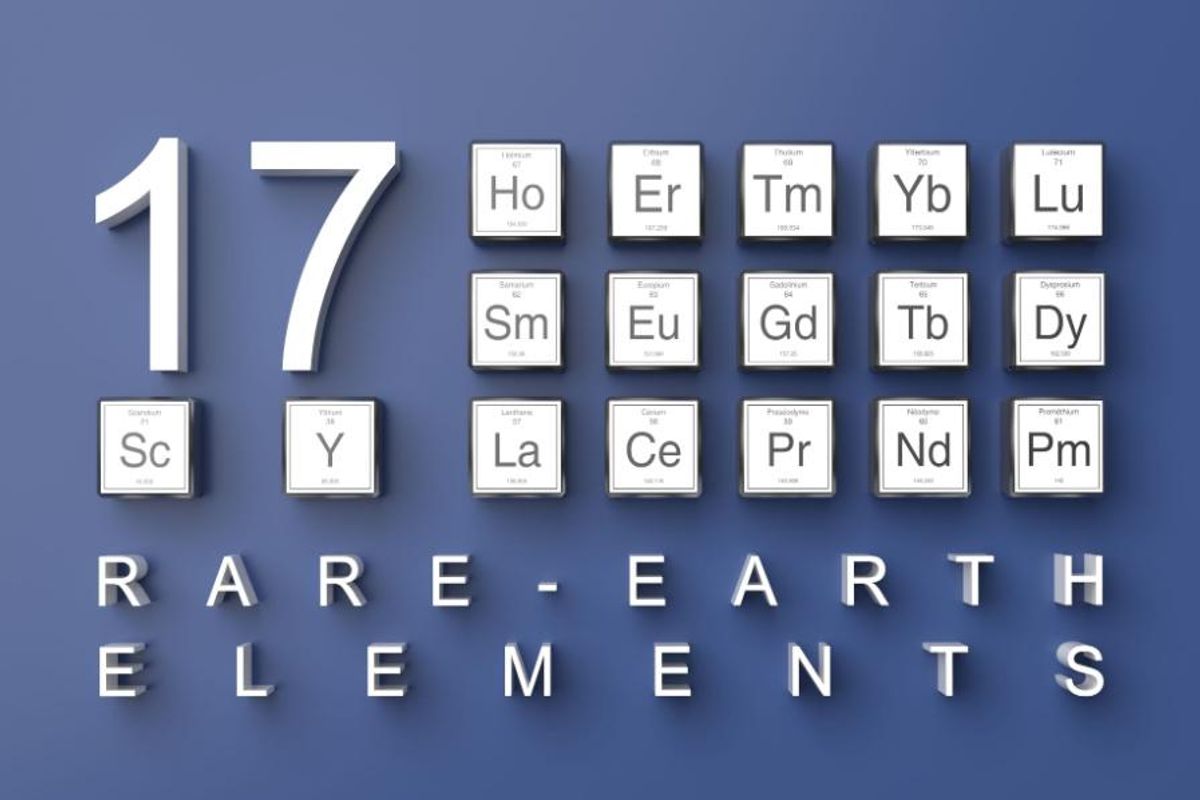

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

How to Invest in Rare Earths in Australia

The rare earths market is dominated by China, but Australia is a key player. Here's a look at ASX rare earth stocks with projects on the boil in Australia.

Rare earths are a group of commodities that Australia has done well with, not because of a monopoly on resources (indeed, Australia only accounts for 3 percent of global reserves), but because it was ahead of the curve when it comes to investment.

The story of rare earths in Australia — the modern success story at least — has its roots in a 2010 trade dispute between Japan and China, when China throttled exports of rare earths to Japan as retribution for a fisheries clash.

Long story short, Japan looked to diversify its rare earths import partners. Until then, it had been beholden to the whims of its larger neighbour, which at the time accounted for over 93 percent of rare earths output.

So Japan looked to Australia, and by investing in a then little-known company called Lynas (ASX:LYC,OTC Pink:LYSCF), Australia's rise as a reliable import partner for rare earths began.

Where are rare earths found in Australia?

Australia is one of the world's top producers of rare earths, accounting for 22,000 tonnes of the world's 2020 total of 280,000 tonnes in 2021. The year before, the country had produced 21,000 tonnes.

Australia is behind the king of rare earths, China (168,000 tonnes); the US, which has long sought to lock down its own rare earths supply (43,000 tonnes); and Myanmar (26,000 tonnes).

Australia's relationship with the US and key allied partners is a major component of its attraction as a rare earths mining jurisdiction. Rare earths are vital in the production of high-tech defense materials — something the US excels in and wishes to safeguard. Rare earths are also important in the production of electric vehicles, navigation equipment, computers, chips, mobile phones and more.

Australia and the US signed a critical minerals agreement in 2019. Rare earths are a focus of the deal, which binds the two countries together at a high level and paves the way for the geological research departments of the two countries (and Canada) to cooperate in exploration and research, and attempt to reduce the sector's vulnerabilities to trade disruption.

Public companies in Australia list on the Australian Securities Exchange (ASX). The Sydney-based stock exchange has 2,035 companies listed, of which nearly half play in the basic material and energy sectors.

It's easy to invest on the ASX, which has done investors' homework with an explanation on how to get started on its website. But the first step for those who want to jump in is to get set up with a stockbroker (which the ASX has also provided a useful tool for).

The outlook for Australian rare earths production is bright — while Lynas remains the top producer in the country, with a mine in Western Australia and a processing facility in Malaysia, there are multiple "shovel-ready" projects around the country, according to top government sources.

Rare earths stocks on the ASX

So what about the stocks themselves? For investors interested in stepping into the rare earths market, below is a list of some of the biggest ASX-listed rare earths companies with projects on Australian grounds.

Market cap and share price data for this stocks list was collected from TradingView’s stock screener on October 5, 2022, and market caps were above AU$900 billion at the time.

1. Lynas

Market cap: AU$71.68 billion; current share price: AU$7.97

Lynas describes itself as the largest rare earths developer in Australia and the only major producer of refined rare earths outside of China. The company has a mine at Mount Weld in Western Australia, a processing facility in Malaysia and a recent US$120 million contract to build a heavy rare earths facility in the US. To keep up with the growing demand for rare earth materials, Lynas has a AU$500 million plan to expand its capacity at the Mount Weld mine and concentration plant. The hope is to increase capacity by 50 percent and, by 2025, ramp up production up to 10,500 tonnes per year.

2. Arafura Resources

Market cap: AU$569.11 million; current share price: AU$0.33

Arafura Resources (ASX:ARU) is based in Perth and is in the process of developing the Nolans project in the Northern Territory. Nolans is in the development phase with a definitive feasibility study.

The company describes Nolans as "shovel ready" as of early 2021, and it has support from key ministers within the Australian government. The project is unique in Australia in that the company has plans for Nolans to be a vertically integrated operation with processing facilities on-site. An updated mine report from 2022 states that Nolans has a 38 year mine life at a capacity of 340,000 tonnes of concentrate production per year.3. Australian Strategic Materials

Market cap: AU$911.1 billion; current share price: AU$2.41

Australian Strategic Materials (ASX:ASM) is a vertically integrated metals producer for technology and energy production industries. The flagstone project of the “mine to metals” process is the Dubbo project in Central-western New South Wales. With all of its necessary approvals and permits in hand, the project is currently ready for construction. In June 2022, Hyundai Engineering proposed a conditional contract by ASM for the Dubbo project to provide engineering and construction work.

This is an updated version of an article first published by the Investing News Network in 2021.

Don't forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Marlee John, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2382.91 | +1.10 | |

| Silver | 28.10 | -0.79 | |

| Copper | 4.30 | -0.08 | |

| Oil | 85.31 | -0.10 | |

| Heating Oil | 2.66 | 0.00 | |

| Natural Gas | 1.68 | -0.02 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Originally from a smaller town just outside of Toronto, Marlee has a BA in English from York University. Marlee is comfortable writing about various topics and has a passion for journalism and current events. Outside of writing she loves reading, music and peanut butter on a spoon.

Learn about our editorial policies.