- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Fireweed Metals

Cyclone Metals

Lancaster Resources

Element79 Gold Corp.

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Auroch Minerals Investor Presentation

Auroch Minerals (ASX:AOU) is pleased to present its investor presentation.

Auroch’s Strategic Portfolio

High-grade shallow nickel sulphide resources that are being driven towards development and production to leverage the strong nickel price and the EV demand

Currently evaluating a demerger of non-nickel assets into new listed company to unlock further value for shareholders

Strategic Acquisition: Step change for AOU

Nevada Lithium Project

Highly prospective for large sedimentary-hosted lithium deposits

- Strategic acquisition of an 80% interest in the Nevada Lithium Project

- Four prospects comprising an area of 65km2 – Traction, San Antone, Heller and Lone Mountain

- Region is home to multiple large sedimentary-hosted lithium deposits, including American Lithium Corp’s TLC Deposit

- 340km southeast of the Tesla Gigafactory and close proximity to major California ports

Strategically Located Nickel Sulphide Portfolio

Auroch (ASX:AOU) holds some of the most prospective nickel sulphide tenure in the Norseman-Wiluna Greenstone Belt

Scoping studies underway to realise value from the potential development of existing shallow high grade nickel sulphide resources

Create further value via new nickel sulphide discoveries – exploration and drilling at priority prospects to build resources inventory

Click here for the full ASX Release

This article includes content from Auroch Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Ramp Metals: Battery Metals Exploration Company Focused on Mining Assets in Saskatchewan

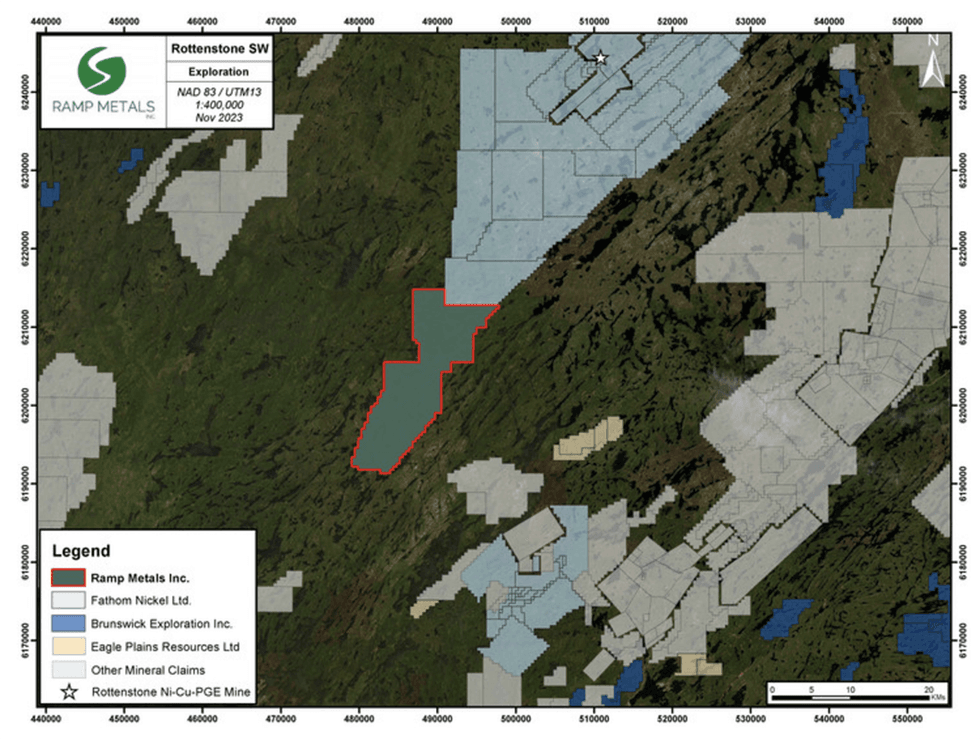

Ramp Metals (TSXV:RAMP) specializes in battery and base metals, particularly nickel and lithium with three properties, two situated in Northern Saskatchewan, Canada, and one in Nevada, United States. The company's Rottenstone SW Claims is situated along a geological structure that historically yielded the highest-grade nickel and platinum group elements (PGE) in Canada. Rottenstone exhibits similarities to the Nova-Bollinger nickel-copper mine in Western Australia, which was discovered by Sirius Resources and ultimately sold to IGO Limited for AU$1.8 billion. The Nova-Bollinger mine had an estimated resource of 13.1 million tons (Mt) grading 2 percent nickel, 0.8 percent copper, and 0.07 percent cobalt.

Ramp Metals' fully permitted drill program in 2024 consists of four drilling locations with eight holes. The current drill program is focused on testing two of these targets. The first target is positioned at the anomaly within the center of the claims and falls within the "Rottenstone Eye" structure. The second target is an anomaly located outside the eye structure, approximately 3 kilometers east-southeast from the first location. To date, Ramp has successfully drilled four holes for a total of 1,180 meters.

The striking similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s belief in the potential of the Rottenstone property. Bennett has over three decades of experience in establishing mines, and played a key role in multiple discoveries, such as the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, in addition to the Nova-Bollinger nickel-copper mine. Along with Bennett, Ramp Metals has also appointed leading geologist Scott McLean, a 35-year veteran in the mining industry, as its strategic advisor.

Company Highlights

- Ramp Metals is a battery and base metals exploration company with a focus on exploring high-grade nickel-copper-PGE in Northern Saskatchewan. Ramp intends to uncover the next major discovery essential for driving the green technology movement.

- The company has three properties covering a total area of 20,000 hectares. Of these, two are located in Northern Saskatchewan – Rottenstone SW Claims and Peter Lake Domain (PLD). The third property is located in Nye County, Nevada.

- The company’s flagship project Rottenstone SW property is situated adjacent to a northeast-southwest geological formation connected to the renowned Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-platinum group elements (PGE) and gold ore, with grades averaging 3.28 percent nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

- The geophysical program at Rottenstone highlights striking similarities with the Nova-Bollinger mine in Australia owned by Sirius Resources, which was eventually sold for AU$1.8 billion.

- Dr. Mark Bennett, founder of Sirius Resources who oversaw the development of the Nova-Bollinger mine, is a strategic advisor to Ramp Metals.

This Ramp Metals profile is part of a paid investor education campaign.*

Click here to connect with Ramp Metals (TSXV:RAMP) to receive an Investor Presentation

Nickel Price Update: Q1 2024 in Review

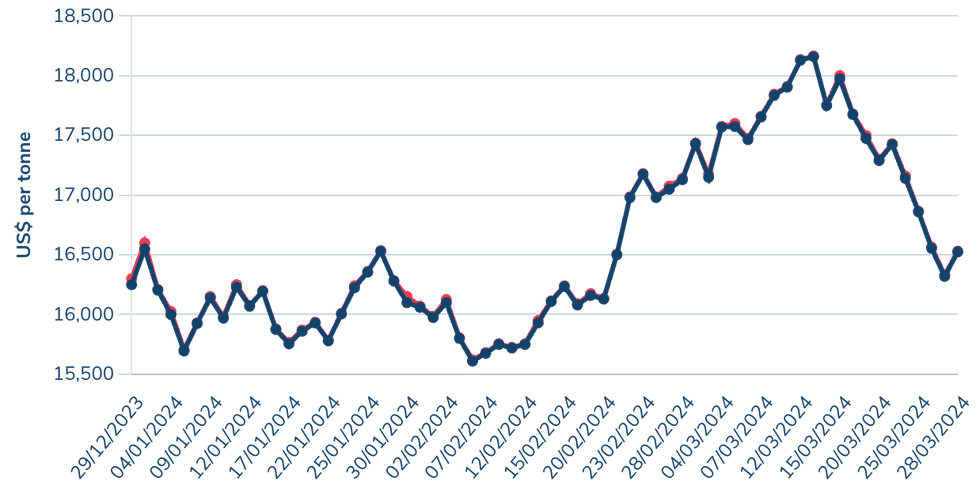

At the start of the year, experts predicted nickel supply to maintain a surplus and the price would stay rangebound through 2024. It opened the first quarter priced at US$16,600 per metric ton (MT) on January 2.

The price was stable during January and February, but March brought with it some volatility with strong gains pushing it to a quarterly high of US$18,165 per MT on March 13.

However, the rising price failed to hold and nickel once again dropped below the US$17,000 mark by the end of the month. Ultimately, the metal fell to US$16,565 on March 28, resulting in a slight loss for the quarter.

Oversupply from Indonesia

Lackluster pricing in the nickel markets is largely the result of the metal's ongoing oversupply position. The largest factor is the continued elevated production rates from Indonesia, which maintains its position as the global leader for the metal. The country produced 1.8 million MT of nickel in 2023, according to the USGS's latest Mineral Commodity Summary, representing half of global supply.

The country’s production has climbed exponentially over the past decade, and this was exacerbated by government initiatives that placed strict limits on the export of raw materials to encourage investment in production and refinement.

In an email to the Investing News Network, Exploration Insights Editor and Analyst Joe Mazumdar wrote, “The growth in EV production and the escalating demand for nickel in batteries prompted the Indonesian government to mandate increased local refining and manufacturing capacity from companies operating in the country.”

Data from S&P Global Market Intelligence provided by Mazumdar showed results of the mandates saw an estimated US$20 billion flowing into the industry in early 2023, with another US$10 billion in undisclosed funding, much of it originating from China.

Despite the lower quality of material coming from Indonesia, the investment was made to shore up supply lines for Chinese battery makers and earmarked for electric vehicle production. However, EV demand has waned through 2023 and into 2024 due to the high-interest rates, range anxiety and charging capacity, increasing nickel stockpiles and contributing to an ongoing oversupply situation.

A report on the nickel market provided by Jason Sappor, senior analyst with the metals and mining research team at S&P Global Commodity Insight, showed that short positions began to accumulate through February and early March on speculation that Indonesian producers were cutting operating rates due to a lack of raw material from mines, which helped push the price up.

The lack of material was caused by delays from a new government approvals process for mining output quotas Indonesia implemented in September 2023. The new system will allow mining companies to apply for approvals every three years instead of every year. The implementation has been slow, which was exacerbated by further delays while the country went through general elections.

The nickel market found additional support on speculation the United States government was eyeing sanctions on nickel supply out of Russia. However, base metals were ultimately not included in the late February sanctions. The price began to decline through the end of March as Indonesian quota approvals accelerated.

Production cuts from western producers

According to data from Macquarie Capital provided by Mazumdar, nickel prices slumping below the US$18,000 mark has made approximately 35 percent of production unprofitable, which would jump to 75 percent if the price were to fall below US$15,000.

Mazumdar indicated the pricing challenges have led to cuts from Australian producers like First Quantum (TSX:FM,OTC Pink:FQVLF) and Wyloo Metals which both announced the suspension of their respective Ravensthorpe and Kambalda nickel mining operations. Additionally, major Australian nickel producer BHP (ASX:BHP,NYSE:BHP,LSE:BHP) is considering cuts of its own.

Nickel price, Q1 2024.

Chart via the London Metal Exchange.

French territory New Caledonia’s nickel mining industry is facing severe difficulties due to faltering prices. The French government has been in talks with Glencore (LSE:GLEN,OTC Pink:GLCNF), Eramet (EPA:ERA) and raw material trader Trafigura, who have significant stakes in nickel producers in the country, and has offered a 200 million euro bailout package for the nation. The French government set a March 28 deadline for New Caledonia to agree to its rescue package, but a decision has not yet been reached as of April 11.

Earlier this year, Glencore announced plans to shutter and search for a buyer for its Koniambo operations, which it said has yet to turn a profit and is unsustainable even with government assistance. For its part, Trafigura has declined to contribute bail-out capital for its 19 percent stake in Prony Resources Nouvelle-Caledonie and its Goro mine, which is forcing Prony to find a new investor before it will be able to secure government funding. On April 10, Eramet (EPA:ERA) reached its own deal with France for its subsidiary SLN’s nickel operations that would see the company extending financial guarantees to SLN.

The situation has exacerbated tensions over independence from France, with opponents of the agreement arguing it risks the New Caledonia's sovereignty and that the mining companies aren’t contributing enough to bailouts of the mines, which employ thousands of New Caledonians. Reports on April 10 indicated that protests have turned violent.

While cuts from Australian and New Caledonian miners aren’t expected to shift the market from a surplus, Mazumdar expects it will help to maintain some price stability in the market.

“The most recent forecast projects demand (7 percent CAGR) will grow at a slower pace than demand (8 percent CAGR) over the next several years, which should generate more market surpluses,” he said.

Government intervention

In an email to INN, Ewa Manthey, Commodities Strategist at ING, suggests this places western producers in a challenging position to affect the market, even with cuts to production.

“The recent supply curtailments also limit the supply alternatives to the dominance of Indonesia, where the majority of production is backed by Chinese investment. This comes at a time when the US and the EU are looking to reduce their dependence on third countries to access critical raw materials, including nickel,” Manthey said.

This was affirmed by Mazumdar, who said the US is working to combat the situation through a series of subsidies designed to encourage western producers and aid in the development of new critical minerals projects.

“The US Inflation Reduction Act (IRA) promotes via subsidies sourcing of critical minerals and EV parts from countries with which it has a free trade agreement or a bilateral agreement. Indonesia and China do not have free trade agreements with the US,” Mazumdar said.

He went on to suggest that the biggest benefactors of this plan would be Australia and Canada, but also noted that with prices remaining depressed multi-billion dollar projects would face headwinds to get off the ground.

Green nickel

One way to encourage western production has been creating a separate price scheme with the creation of a green nickel market that plays into western producers' focus on environmental, social and governance (ESG). Green nickel is defined as a low-carbon product that produces less than 20 MT of carbon dioxide per MT of production.

The oversupply of lower-grade laterite has pulled prices down across the board, including for higher-grade and more environmentally friendly sulfide projects like those in Australia and Canada. This has led to the suggestion of premium pricing for green nickel; however, this hasn’t gained much traction on the London Metals Exchange (LME).

“There is little evidence that a premium for ‘green nickel’ producers or developers has much momentum although an operation with low carbon emissions may have a better chance of getting funding from institutional investors in western countries,” Mazumdar said.

Even though there might not be much interest in green nickel on the LME, there have been some vocal proponents like Wyloo’s CEO Luca Giacovazzi. He sees the premium as being essential for the industry, adding the industry should be looking for a new marketplace if the LME is unwilling to pursue a separate listing for green nickel.

The calls for a premium have largely come from western producers that incur higher labor and production costs to meet ESG initiatives, which is happening less amongst their counterparts in China, Indonesia and Russia.

Western producers were caught off guard early in March as PT CNGR Ding Xing New Energy, a joint venture between China’s CNGR Advanced Material (SHA:300919) and Indonesia’s Rigqueza International PTE, applied to be listed as a “good delivery brand” on the LME. The designation would allow the company, which produces Class 1 nickel, to be recognized as meeting responsible sourcing guidelines set by the LME.

If it is approved, which is considered to be likely, this would be the first time an Indonesian company would be represented on the LME. However, there has been pushback from western miners who have noted that production in Indonesia faces a range of ESG and responsible resourcing challenges.

Investor takeaway

Nickel is a critical metal for the production of batteries to be used in EVs. Generally, battery-grade nickel is processed from the higher quality raw material produced from sulfides, but more recently Chinese production has turned to lower quality laterites. While batteries made from laterite nickel have lower energy density, their cost is also much lower, which may provide key cost savings for EV buyers.

However, with lingering inflation and high interest rates globally, demand for EVs has fallen off over the past two years, which has in turn reduced the demand for nickel.

Meanwhile, despite some slow down due to the approval process, high supply rates from Indonesia have continued into 2024 and there doesn’t seem to be cuts on the horizon from the nation.

These factors have led to a drop in profits and curtailments from large nickel operations in western nations, and made companies unlikely to pursue the construction of new projects in the near term.

“Looking ahead, we believe nickel prices are likely to remain under pressure, at least in the near term, amid a weak macro picture and a sustained market surplus,” Manthey said.

The continued surplus in the market may provide some opportunities for investors looking to get into a critical minerals play at a lower cost, but a reversal may take some time.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Ramp Metals CEO Shares 2024 Drill Plans for Rottenstone Project in Saskatchewan

Ramp Metals (TSXV:RAMP) CEO Jordan Black discussed the company's veteran team of geologists and advisors, and its plans for drilling at its Rottenstone SW nickel-copper-platinum project in Northern Saskatchewan, Canada, to better understand the property’s subsurface geology.

The project's Rottenstone Eye structure is believed to be a major feeder chamber with conductive targets showing striking similarities to the geophysical response of the Nova-Bollinger deposit in Western Australia, which was discovered by geologist Dr. Mark Bennett and his team and later sold for AU$1.8 billion.

After Ramp discovered the similarities between the Rottenstone Eye and the Nova Eye structure at Nova-Bollinger, the company contacted Bennett to get his thoughts about its project. Bennett joined the team as a strategic advisor.

“He was surprised at the similarities between our project and his," Black said. "So we've built this world-class advisory team, including (Bennett) himself to help mentor us through this discovery process."

In addition to Bennett, Ramp also brought in veteran geologists Scott McLean and Richard Murphy. McLean has undertaken significant work at the Sudbury Nickel Camp in Ontario, Canada.

“We're a small team, but we have these great technical advisors on our team as well,” Black said.

The company plans to conduct an extensive ground geophysics program in the summer. The project is permitted for up to 2,000 meters of drilling, according to Black. Ramp plans to expand the drilling program to 5,000 or 10,000 meters to further define the resource under the surface.

Watch the full interview with Ramp Metals CEO Jordan Black above.

Disclaimer: This interview is sponsored by Ramp Metals (TSXV:RAMP). This interview provides information which was sourced by the Investing News Network (INN) and approved by Ramp Metalsin order to help investors learn more about the company. Ramp Metals is a client of INN. The company’s campaign fees pay for INN to create and update this interview.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Ramp Metals and seek advice from a qualified investment advisor.

This interview may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The issuer relies upon litigation protection for forward-looking statements. Investing in companies comes with uncertainties as market values can fluctuate.

Ramp Metals

Overview

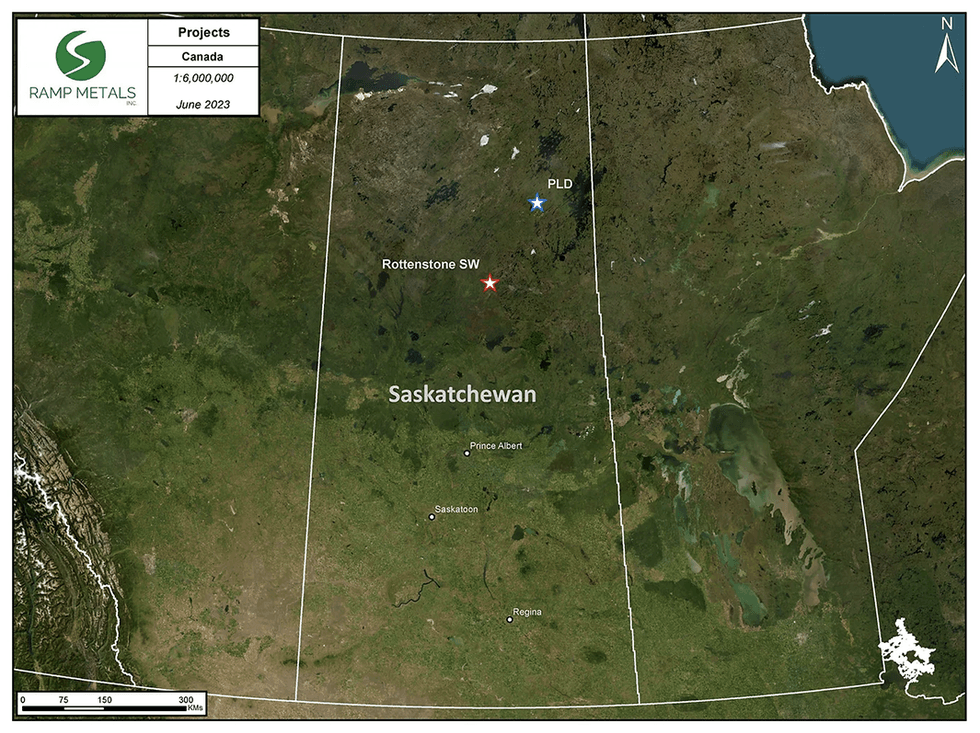

Ramp Metals (TSXV:RAMP) is an exploration company specializing in battery and base metals, particularly nickel and lithium. The company has three properties, two situated in Northern Saskatchewan, Canada, and one in Nevada, United States.

The flagship property, Rottenstone SW Claims is situated along a geological structure that historically yielded the highest-grade nickel and platinum group elements (PGE) in Canada. It exhibits remarkable parallels to the Nova-Bollinger nickel-copper mine in Western Australia, which was discovered by Sirius Resources and ultimately sold to IGO Limited for AU$1.8 billion. The Nova-Bollinger mine had an estimated resource of 13.1 million tons (Mt) grading 2 percent nickel, 0.8 percent copper, and 0.07 percent cobalt.

Ramp Metals has a fully permitted drill program scheduled for 2024. The company is planning four drilling locations with a total of eight holes. These drilling locations were identified based on the geophysical program completed by Ramp Metals. The current drilling program is focused on testing two of these targets, both of which are near-surface. The first target is positioned at the anomaly within the center of the claims and falls within the "Rottenstone Eye" structure. The second target is an anomaly located outside the eye structure, approximately 3 kilometers east-southeast from the first location. To date, Ramp has successfully drilled four holes for a total of 1,180 meters.

The striking similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s belief in the potential of the Rottenstone property. Bennett has over three decades of experience in establishing mines, and played a key role in multiple discoveries, such as the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, in addition to the Nova-Bollinger nickel-copper mine. Along with Bennett, Ramp Metals has also appointed leading geologist Scott McLean, a 35-year veteran in the mining industry, as its strategic advisor.

The project’s presence in Saskatchewan is also encouraging for investors given the region’s mining-friendly policies. Saskatchewan was ranked second globally and the top in Canada by the Fraser Institute as the most attractive jurisdiction for mining investment in 2021. Saskatchewan has gained prominence for its abundant uranium resources, yet its geological diversity presents significant potential beyond this. Exploration for other battery metals in the region has been limited or largely unexplored.

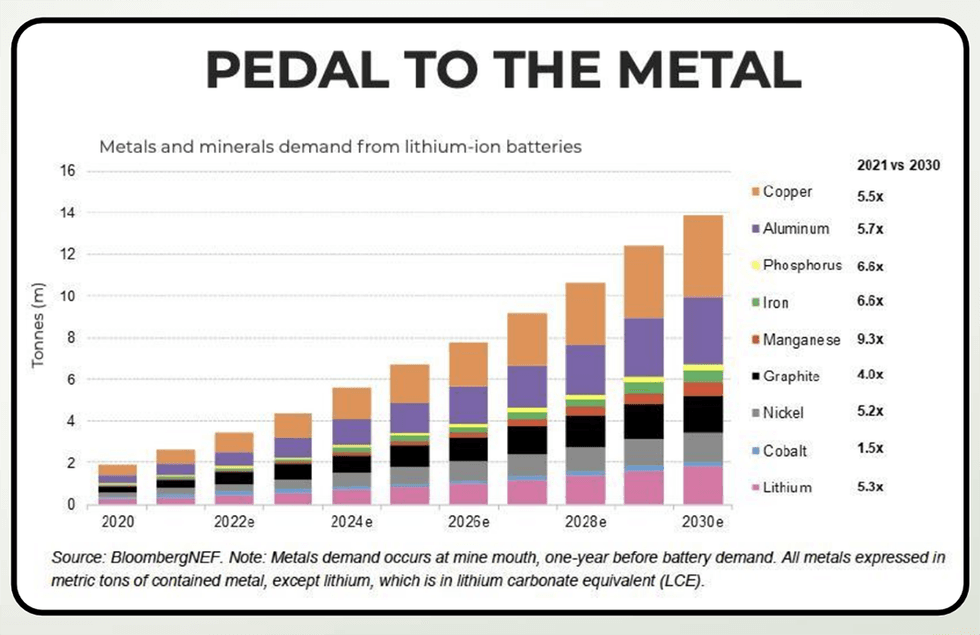

The demand for battery metals will continue to grow, due to a strengthening EV market. S&P Global Mobility's 2024 global sales forecast anticipates battery-electric passenger vehicles will reach approximately 13.3 million units worldwide by the end of 2024, an increase of 40 percent year-over-year. In terms of market share, EVs will constitute around 16.2 percent of the total global passenger vehicle sales in 2024, compared to 12 percent in 2023.

Further, the emerging trend toward high-density batteries using nickel and cobalt, and less lithium, is also expected to boost demand for these metals. As one of the top critical minerals in the US and Canada, nickel projects are likely to see increased funding over the coming years.

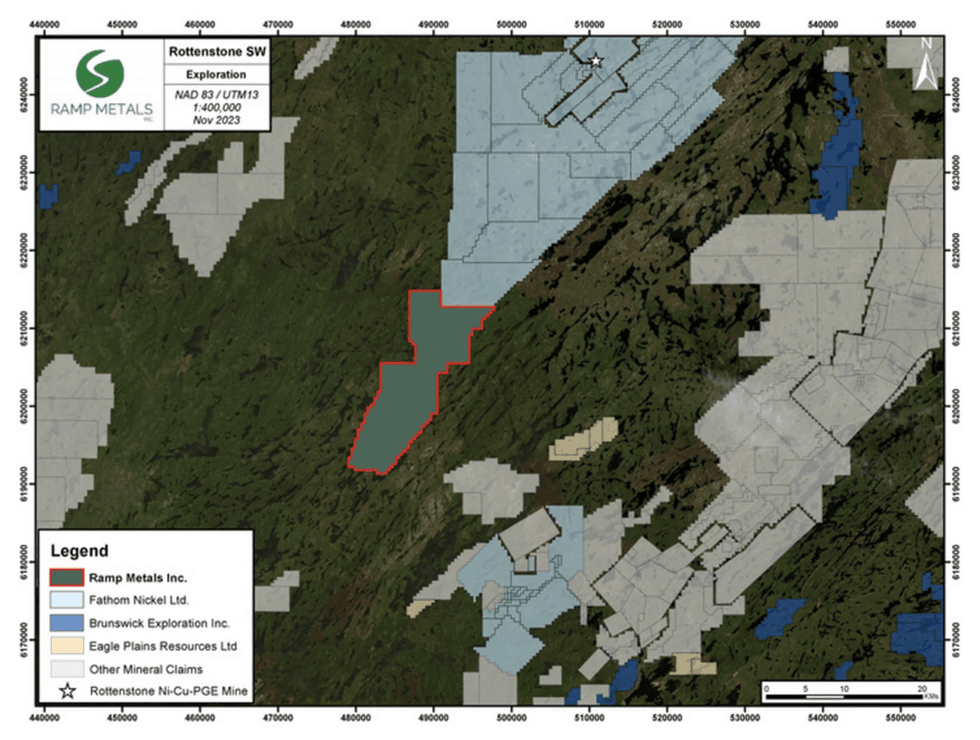

There is a strong demand in the market for new, high-quality nickel-copper and lithium opportunities. Rottenstone SW borders Fathom Nickel, which recently secured C$4.6 million in funding and seems to be focusing on a similar geological system. The Rottenstone SW eye structure presents an ideal target for nickel-copper-PGE exploration.

Company Highlights

- Ramp Metals is a battery and base metals exploration company with a focus on exploring high-grade nickel-copper-PGE in Northern Saskatchewan. Ramp intends to uncover the next major discovery essential for driving the green technology movement.

- The company has three properties covering a total area of 20,000 hectares. Of these, two are located in Northern Saskatchewan – Rottenstone SW Claims and Peter Lake Domain (PLD). The third property is located in Nye County, Nevada.

- The company’s flagship project Rottenstone SW property is situated adjacent to a northeast-southwest geological formation connected to the renowned Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-platinum group elements (PGE) and gold ore, with grades averaging 3.28 percent nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

- The geophysical program at Rottenstone highlights striking similarities with the Nova-Bollinger mine in Australia owned by Sirius Resources, which was eventually sold for AU$1.8 billion.

- Dr. Mark Bennett, founder of Sirius Resources who oversaw the development of the Nova-Bollinger mine, is a strategic advisor to Ramp Metals.

Key Projects

Rottenstone SW Claims

The Rottenstone SW property is approximately 115 kilometers north of La Ronge, Saskatchewan. The property comprises 12 claims encompassing 17,285.5 hectares and is situated adjacent to a northeast-southwest geological formation connected to the renowned Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-PGE and gold ore, with grades averaging 3.28 percent nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

The company has completed various geophysical surveys including time-domain airborne geophysical measurements (TDEM), and soil sampling, all aimed at identifying potential drill targets. The survey results show striking similarities between Rottenstone SW Claims and the Nova-Bollinger deposit. The Rottenstone SW conductors show a strong correlation with the conductors identified at the Nova-Bollinger deposit. Based on the geophysical survey results, the company has identified four high-priority targets.

The company’s current drilling program is focused on testing two of these targets, both of which are near-surface. The first target is positioned at the anomaly within the center of the claims and falls within the "Rottenstone Eye" structure. The second target is an anomaly outside the eye structure, approximately 3 kilometers east-southeast from the first location. To date, Ramp Metals has successfully drilled four holes for a total of 1,180 meters. The project has a fully permitted drill program totaling 2,000 meters scheduled for 2024.

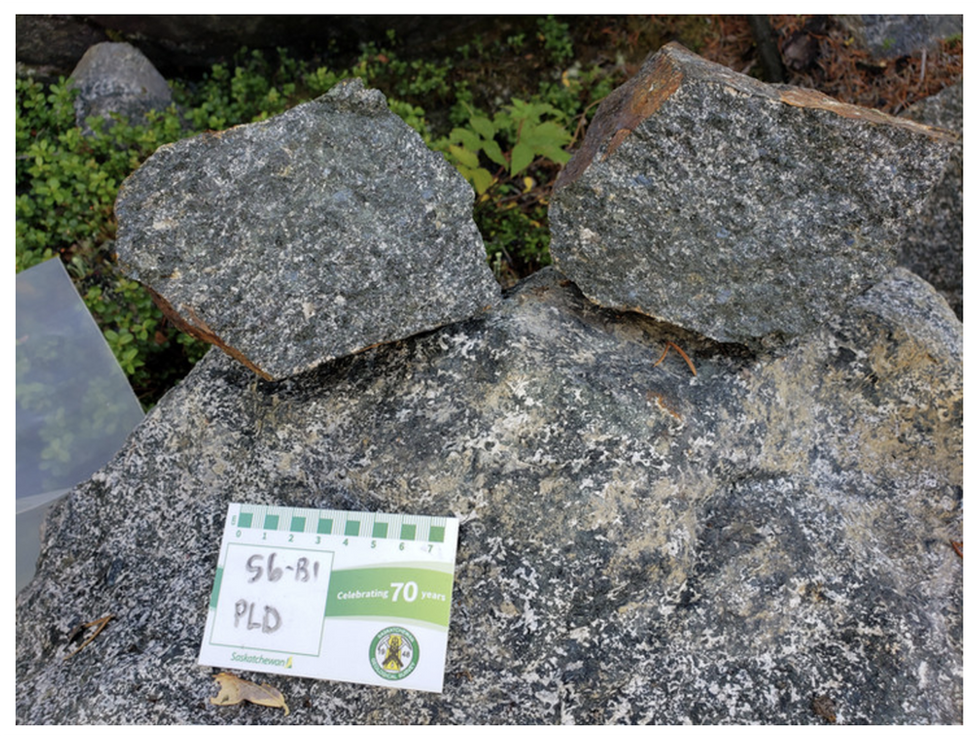

Peter Lake Domain Claims

The Peter Lake Domain (PLD) property is situated within the Peter Lake Domain of the Swan River complex in Northern Saskatchewan, Canada, around 260 kilometers northeast of La Ronge, Saskatchewan. The property comprises four mineral deposit claims spanning approximately 2,163 hectares.

Peter Lake Domain has a history of exploration done by earlier operators. The previous exploration work returned surface grab samples of gabbro outcrop with disseminated pyrite and chalcopyrite (SMDI 5545) having values of 1,860 parts per million (ppm) copper, 461 ppm nickel, 41 parts per billion (ppb) platinum and 49 ppb palladium. A historical VTEM survey conducted by Geotech outlined compelling targets. According to Ramp Metals, the earlier operators drilled the property inaccurately and did not properly test the targets that were generated.

The project has the potential to be a major new discovery. Ramp Metals plans to undertake an airborne TDEM survey to build upon historical data and identify exploration targets. Once the targets are identified, the company will implement a drill program of about 2,000 to 2,500 meters.

Management Team

Jordan Black – Chief Executive Officer and Director

Jordan Black brings over 12 years of geotechnical engineering experience for various infrastructure, renewable energy and mining projects. Black was previously the vice-president of business development at GoldSpot Discoveries and worked as a senior geotechnical engineer at WSP Canada.

Garrett Smith – VP Exploration

Garrett Smith graduated with a B.Sc. in geology from the University of Regina. Throughout his career, he has been involved in projects across Western Canada, focusing on various commodities. His extensive expertise ranges from greenfield mapping and exploration to on-site drill management. Driven by a genuine passion for exploration, Smith has dedicated the past few years to assembling a collection of base metal projects in northern Saskatchewan.

Brett Williams – VP Operations and Senior Geologist

Brett Williams is a seasoned geologist with a diverse background, having worked as a mine geologist in both open pit and underground mining, as well as an exploration geologist in the diamond, base metals, gold and uranium sectors for Rio Tinto and SSR Mining. He earned his B.Sc. in geology and a diploma in business administration from the University of Regina. Williams is a registered member of the Professional Engineers and Geoscientists of Saskatchewan.

Prit Singh – Director

Prit Singh is a seasoned capital markets professional and presently serves as the CEO of Thesis Capital, an advisory firm offering support to high-growth companies in fundraising, Canadian market initial public offerings and investor relations. Throughout his career, Singh has collaborated with more than 50 issuers, facilitating fundraising and providing counsel, resulting in the procurement of over $100 million in capital across various emerging sectors. Before establishing Thesis Capital, he gained experience in investment banking and wealth management, fostering enduring relationships within Canada's buy-side and sell-side communities. Singh holds a BBA with a specialization in finance from Brock University.

David Parker – Director

David Parker has more than 15 years of experience in business financing, consulting and recapitalizing public/private companies in the mining, technology, and media sectors. He also has experience in retail, office, and industrial real estate sales and development. He has led projects from initial market analysis to acquisition, design, approval, site servicing, construction and disposition. He understands the financial implications of technical issues and planning policy changes, making him an effective director.

Peter Schloo – Director

Peter Schloo has a decade of experience and expertise in capital markets, operations and assurance, and holds CPA, CA and CFA designations. Additionally, he is a licensed prospector in the province of Ontario, Canada. His track record includes facilitating over C$85 million in associated capital raising opportunities for both public and private enterprises. Currently, he is the CEO, president, and director of Heritage Mining, and a director of Pacific Empire Minerals. His previous roles included CFO of Spirit Banner Capital and VP corporate development and interim CFO for Ion Energy.

Michael Romanik

Michael Romanik has over 14 years of resource exploration and public market experience with an emphasis on management, promotion and corporate finance. He has built an impressive network of resource and investment industry contacts over the years, and demonstrated a proven ability to utilize those relationships to advance his business objectives. Romanik has served as the president and CEO of GoldON Resources (TSXV:GLD.V) since 2009 and is a founding shareholder and the CEO of Silver Dollar Resources (CSE:SLVDF).

This profile was written in collaboration with Couloir Capital.

MT Survey Outlines Large Undrilled Conductive Anomalies and an Extensive Host Horizon at BAGB

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide results and interpretation from the magnetotelluric (“MT”) survey conducted across the Alotta and Midrim areas of its 100% owned Belleterre Angliers Greenstone Belt “BAGB” projects in Quebec, Canada.

Highlights

- MT survey identifies large conductive anomalies below the shallow Midrim and Alotta discoveries, where historical intersection highlights include:

- 9.4m @ 3.5% Ni, 4.3% Cu and 4.6g/t 2PGM+Au from 56.6m in MR-17-011

- 4.3m @ 6.5% Ni, 5.2% Cu and 7.2g/t 2PGM+Au from 57.2m in MR-00-051

- 9.2m @ 2.6% Ni, 2.8% Cu and 3.6 g/t 2PGM+Au from 85.2m in ZA-18-082

- Extensive mafic intrusive contact ‘host horizon’ successfully mapped in 3D across the entire survey area.

- The prospectivity of this host horizon is validated by its coincidence with the high grade discoveries at Alotta and Midrim.

- Location and orientation of the interpreted structures further supports prospectivity of the targets identified.

- Small fraction of this host horizon has been tested by drilling at surface, and not drill tested at depth.

- Important targets now identified for follow-up work, which will include historic VTEM reinterpretation prior to drill testing.

- Survey area is only 5% of Pivotal’s 100% owned 157km2 BAGB project which hosts a large number of near surface, high grade intersections, showings, and geophysical anomalies requiring follow-up exploration.

Managing Director, Mr Fairhall said:

“This MT survey is an exciting enhancement in the understanding of the opportunity at BAGB. It supports the geological model that Midrim and Alotta are indicators of an extensive magmatic intrusion which acted as the plumbing system for these high grade surficial deposits. The survey allows us to map this prospective horizon and highlight prospective conductors as targets for sizeable accumulations of sulphide mineralisation.

It is clear that previous operators had a narrow focus on specific shallow anomalies, and that the property remains wide open for discovery potential – significantly accumulations at depth, but also for on strike surficial repeats of Midrim and Alotta.

We are advancing our target prioritisation to design a program to drill test these anomalies, alongside others on the remainder of the very prospective 100% owned claim package we have assembled at BAGB.”

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Top 3 Canadian Nickel Stocks of 2024

Nickel has been trending down since early 2023, and bearish sentiment still pervades the market in 2024 even though prices for the base metal tacked upward in mid-March and early April.

Supply is expected to outflank demand over the short term, but the longer-term outlook for the metal is strong. Speaking to the Investing News Network (INN), analysts shared their thoughts on the biggest nickel trends to watch for in 2024, and what they think will affect the market moving forward. They discussed factors such as oversupply, weaker-than-expected demand from China and doubts about the London Metal Exchange after it suspended trading last year.

Demand from the electric vehicle industry is one reason nickel's future looks bright further into the future.

“Global nickel consumption is expected to increase due to recovery of the stainless steel sector and increased usage of nickel in electric vehicle batteries. Batteries now account for almost 17 percent of total nickel demand, behind stainless steel," Ewa Manthey, commodities strategist at financial services firm ING, told INN in the lead-up to 2024. “The metal’s appeal to investors as a key green metal will support higher prices in the longer term."

Below INN has listed the top nickel stocks on the TSXV by share price performance so far this year. TSX and CSE stocks were considered, but didn't make the cut. All year-to-date and share price data was obtained on April 3, 2024, using TradingView’s stock screener. The top nickel stocks listed had market caps above C$10 million at that time.

1. EV Nickel (TSXV:EVNI)

Year-to-date gain: 106.67 percent; market cap: C$38.84 million; current share price: C$0.62

EV Nickel’s primary project is the 30,000 hectare Shaw Dome asset in Ontario. It includes the high-grade W4 deposit, which has a resource of 2 million metric tons at 0.98 percent nickel for 43.3 million pounds of Class 1 nickel across the measured, indicated and inferred categories. Shaw Dome also holds the large-scale CarLang A zone, which has a resource of 1 billion metric tons at 0.24 percent nickel for 5.3 billion pounds of Class 1 nickel across the indicated and inferred categories.

EV Nickel is also working on integrating carbon capture and storage technology for large-scale clean nickel production, and has procured funding from the Canadian government and Ontario's provincial government. In late 2023, the company announced it was moving its carbon capture research and development to the pilot plant stage.

The company's only news so far in 2024 has been the announcement, upsizing and closure of a flow-through financing. Ultimately EV Nickel raised C$5.12 million to fund the development of its high-grade large-scale nickel resources.

The Canadian nickel exploration company's share price started off the year at C$0.30 before steadily climbing to reach a year-to-date high of C$0.73 on March 3.

2. Canada Nickel (TSXV:CNC)

Year-to-date gain: 15.2 percent; market cap: C$249.55 million; current share price: C$1.44

Canada Nickel Company has honed its efforts on its wholly owned flagship Crawford nickel sulfide project in Ontario’s productive Timmins Mining Camp. A bankable feasibility study for the asset demonstrates a large-scale nickel deposit with a mine life of 41 years, an after-tax net present value of US$2.5 billion and an internal rate of return of 17.1 percent. The company has said it is targeting both the electric vehicle and stainless steel markets.

A few big-name companies hold significant ownership positions in Canada Nickel, including Agnico Eagle Mines (TSX:AEM,NYSE:AEM), which holds an 11 percent stake, and Anglo American (LSE:AAL,OTCQX:AAUKF), which has a 7.6 percent stake. In February of this year, battery and electronic materials manufacturer Samsung SDI (KRX:006400) made an equity investment of US$18.5 million for an 8.7 percent ownership stake in the company.

Canada Nickel’s share price started 2024 at C$1.40 before jumping to a year-to-date high of C$2.24 on January 16.

In early February, the company shared that its wholly owned subsidiary, NetZero Metals, is planning to develop a nickel-processing facility and stainless steel and alloy production facility in the Timmins Nickel District. Canada Nickel’s share price had slid to C$1.35 on February 5 before rising up to C$1.46 on February 9 following the news.

Later in the month, Canada Nickel shared successful results from initial infill drilling at its 100 percent owned Bannockburn property, and announced a new discovery at the Mann property. Mann is a joint venture with Noble Mineral Exploration (TSXV:NOB,OTCQB:NLPXF) in which Canada Nickel can earn an 80 percent interest.

3. Sama Resources (TSXV:SME)

Year-to-date gain: 10 percent; market cap: C$26.41 million; current share price: C$0.11

Sama Resources’ focus is the Samapleu nickel, copper and platinum-group metals (PGMs) project in Côte d’Ivoire, West Africa, which includes the Samapleu and Grata deposits. Samapleu is a joint venture between Sama (70 percent) and Ivanhoe Electric (30 percent); Ivanhoe Electric, which is backed by Robert Friedland, recently earned the option to acquire a 60 percent interest in the project with the completion of a new preliminary economic assessment.

In the first few weeks of the year, Sama has already dropped a few press releases. The company shared highlights from its ongoing 3,800 meter winter drilling program at the Yepleu prospect. Importantly, the work has confirmed that newly discovered nickel-copper-PGMs mineralization measures 500 by 400 meters, is near surface and open in all directions. Drill results from the program so far include hole S-349, which intersected 53 meters of combined mineralization layers grading 0.29 percent nickel, including 2.6 meters at 1.31 percent nickel and 0.95 percent copper.

Sama’s share price started off the year at C$0.11 before jumping to a year-to-date high of C$0.14 on February 12.

FAQs for nickel investing

How to invest in nickel?

There are a variety of ways to invest in nickel, but stocks and exchange-traded products are the most common. Nickel-focused companies can be found globally on various exchanges, and through the use of a broker or a service such as an app, investors can purchase companies and products that match their investing outlook.

Before buying a nickel stock, potential investors should take time to research the companies they’re considering; they should also decide how many shares will be purchased, and what price they are willing to pay. With many options on the market, it's critical to complete due diligence before making any investment decisions.

Nickel stocks like those mentioned above could be a good option for investors interested in the space. Experienced investors can also look at nickel futures.

What is nickel used for?

Nickel has a variety of applications. Its main use is an alloy material for products such as stainless steel, and it is also used for plating metals to reduce corrosion. It is used in coins as well, such as the 5 cent nickel in the US and Canada; the US nickel is made up of 25 percent nickel and 75 percent copper, while Canada's nickel has nickel plating that makes up 2 percent of its composition.

Nickel's up-and-coming use is in electric vehicles as a component of certain lithium-ion battery compositions, and it has gotten extra attention because of that purpose.

Where is nickel mined?

The world's top nickel-producing countries are primarily in Asia: Indonesia, the Philippines and New Caledonia make up the top three. Rounding out the top five are Russia and Canada. Indonesia's production stands far ahead of the rest of the pack, with 2023 output of 1.8 million MT compared to the Philippines' 400,000 MT and New Caledonia's 230,000 MT.

Significant nickel miners include Norilsk Nickel (OTC Pink:NILSY,MCX:GMKN), Nickel Asia, BHP Group (NYSE:BHP,ASX:BHP,LSE:BHP) and Glencore (LSE:GLEN,OTC Pink:GLCNF).

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Canada Nickel and Noble Mineral Exploration are clients of the Investing News Network. This article is not paid-for content.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.