- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Azure Minerals Stays Course with Encouraging Scoping Study

The company says it will now dive headfirst into completing the necessary feasibility studies for its Oposura zinc-lead-silver project in Mexico.

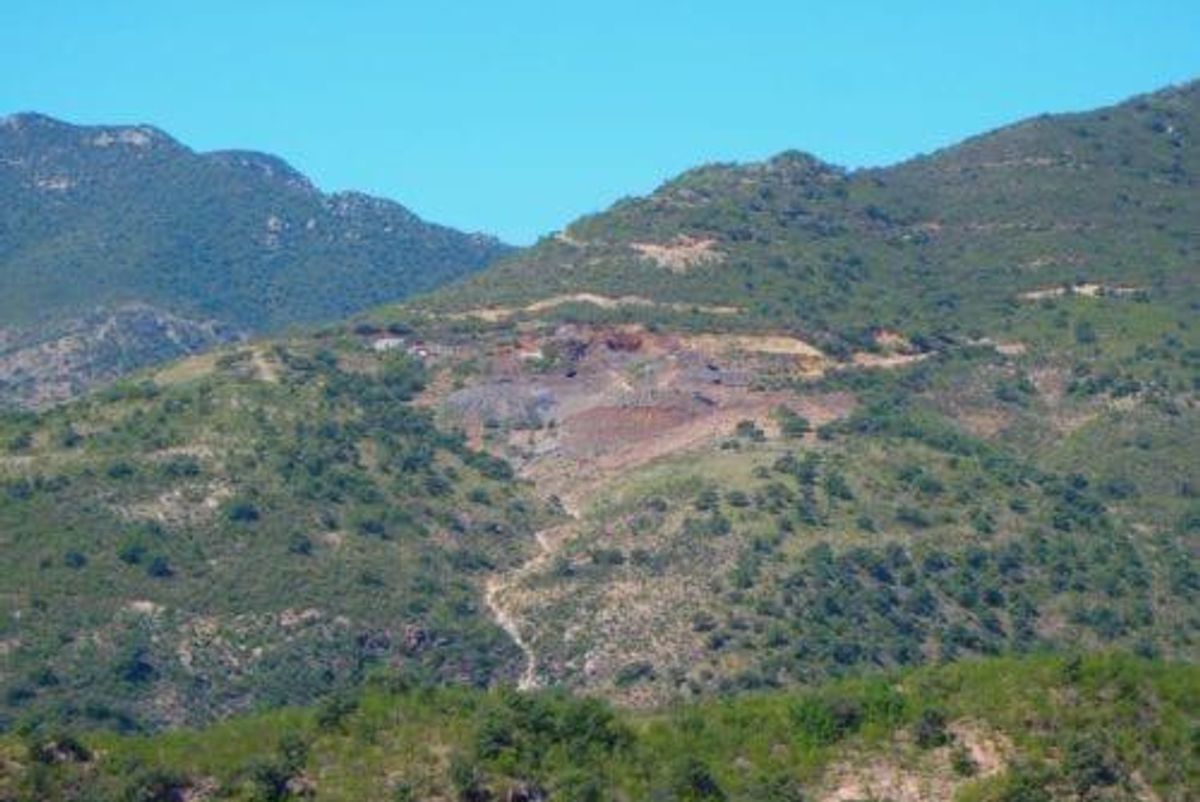

Azure Minerals (ASX:AZS) has released a scoping study for its Oposura zinc-lead–silver project in Mexico, revealing that it likes what it sees and is now aiming for early production.

Since releasing a maiden mineral resource estimate for Oposura in July, Azure has been working towards developing a feasibility study for the project, located in Northern Mexico in Sonora state.

Tony Rovira, managing director of Azure, said the “positive project economics” of the scoping study have encouraged the company to proceed with Oposura post haste.

“We’re immediately progressing into the Feasibility Study stage with the intention of developing Oposura into the company’s first operating mine as swiftly as possible to take advantage of the strong zinc thematic,” said Rovira on Monday (October 15).

That thematic may be the three-pronged zinc supply crunch potentially in the cards. Experts have pointed to the possibility of a rapid increase in the zinc price in the near to medium term due to the trade war, consumers drawing down on stockpiles and a dearth of new zinc mines.

For Azure, the Oposura scoping study shows that under the model investigated (a combined open-pit and underground mine with a conventional crushing, milling and flotation circuit), Oposura will have a life-of-mine EBITDA of AU$237 million, a NPV of AU$112 million and an IRR of 76 percent.

According to to the release, that “confirms Oposura as an economically and technically robust, high-margin project.”

Oposura is one of Azure’s flagship projects. All of its assets are located in Mexico, which the company describes as one of the world’s most attractive mineral exploration and mining districts.

Rovira said the study shows Oposura is ideal for low operational costs thanks to its near-surface characteristics, which could be exploited by the company’s open-pit and underground mining methods.

“The company has received strong expressions of interest from debt providers, concentrate offtakers and strategic parties interested at the asset level,” he said.

Under the scoping study, the company envisages average annual production of 19,000 tonnes of zinc, 10,000 tonnes of lead and 145,000 ounces of silver over an initial 5.3-year mine life, which could be extended through further exploration.

The company hopes to achieve its first lead-silver and zinc concentrate shipments in 2020 or 2021. Its timeline now envisages a prefeasibility study being completed by mid-2019 and a definitive feasibility study by the end of 2019.

Under the current plan, construction would be rapid, with approvals granted by Q1 2020 and construction completed by the end of 2020.

For the remainder of 2018, Azure said it is adequately funded to complete “the next stage of studies,” which would include the aforementioned feasibility studies as well as additional infill drilling to convert inferred resources to indicated resources.

Oposura has a mineral resource estimate of 2.9 million tonnes grading 5 percent zinc, 2.8 percent lead and 17 grams per tonne of silver in the indicated and inferred categories.

On the ASX, Azure was trading down 2.56 percent at market close on Monday at AU$0.19.

Image courtesy of Azure Minerals.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2321.11 | +4.82 | |

| Silver | 27.31 | +0.13 | |

| Copper | 4.51 | +0.02 | |

| Oil | 82.90 | +0.09 | |

| Heating Oil | 2.57 | +0.01 | |

| Natural Gas | 1.67 | +0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Scott has a Master's Degree in journalism from the University of Melbourne and reports on the resources industry for INN.

Scott has experience working in regional and small-town newsrooms in Australia. With a background in history and politics, he's interested in international politics and development and how the resources industry plays a role in the future.

Learn about our editorial policies.