- WORLD EDITIONAustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Basin Energy

Developing High-Grade Uranium Projects in the Athabasca Basin

Company Highlights

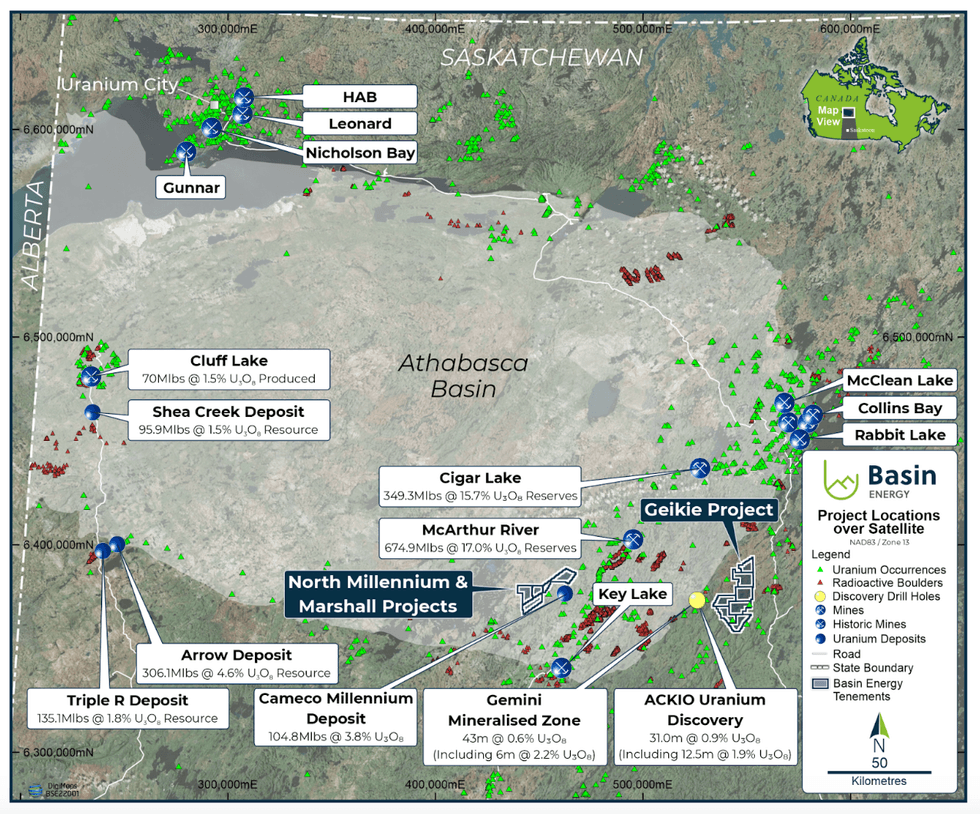

- Basin Energy is a uranium exploration and development company with three highly prospective projects in the world-renowned Athabasca Basin in Canada, known for being a consistent top three global uranium producer.

- Basin Energy’s board, management team and joint venture partner have direct extensive experience in uranium exploration and development along with comprehensive expertise in corporate financing, investment banking and geology. The company’s highly prospective uranium exploration portfolio comprises:

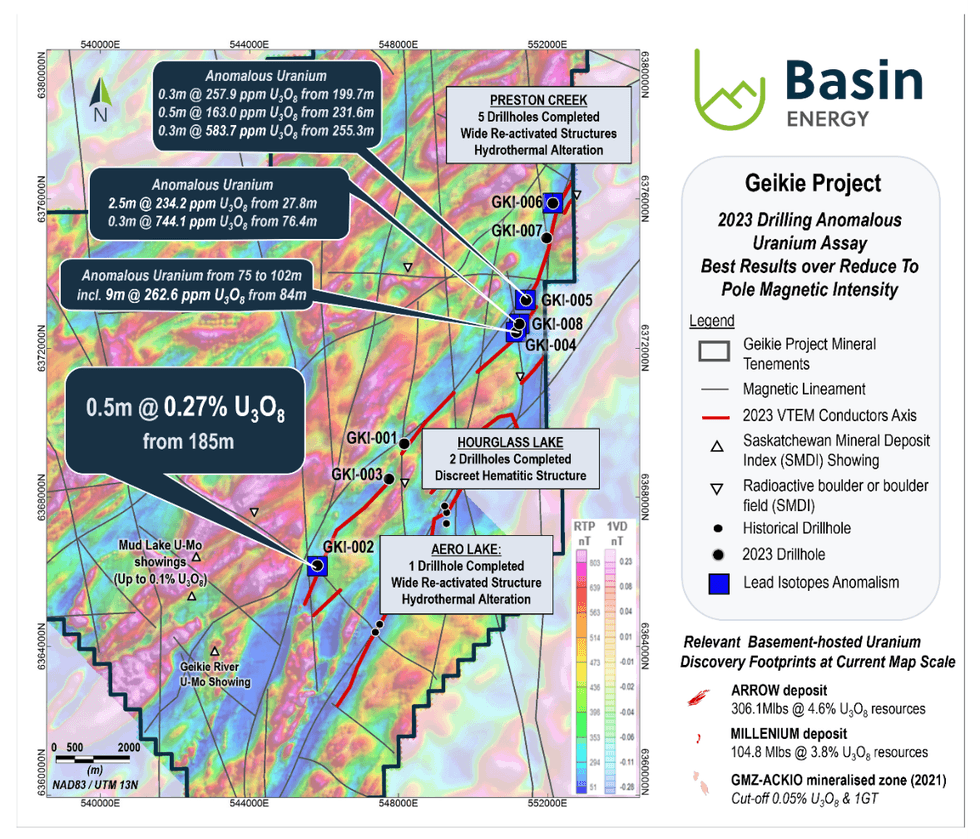

- The Geikie Project - located on the eastern margin of the Athabasca Basin occupying an extensive land position of 351 square kilometers, showing multiple uranium and uranium pathfinder occurrences, and is prospective for shallow, high-grade mineralization with maiden drilling identifying uranium up to 0.27 percent;

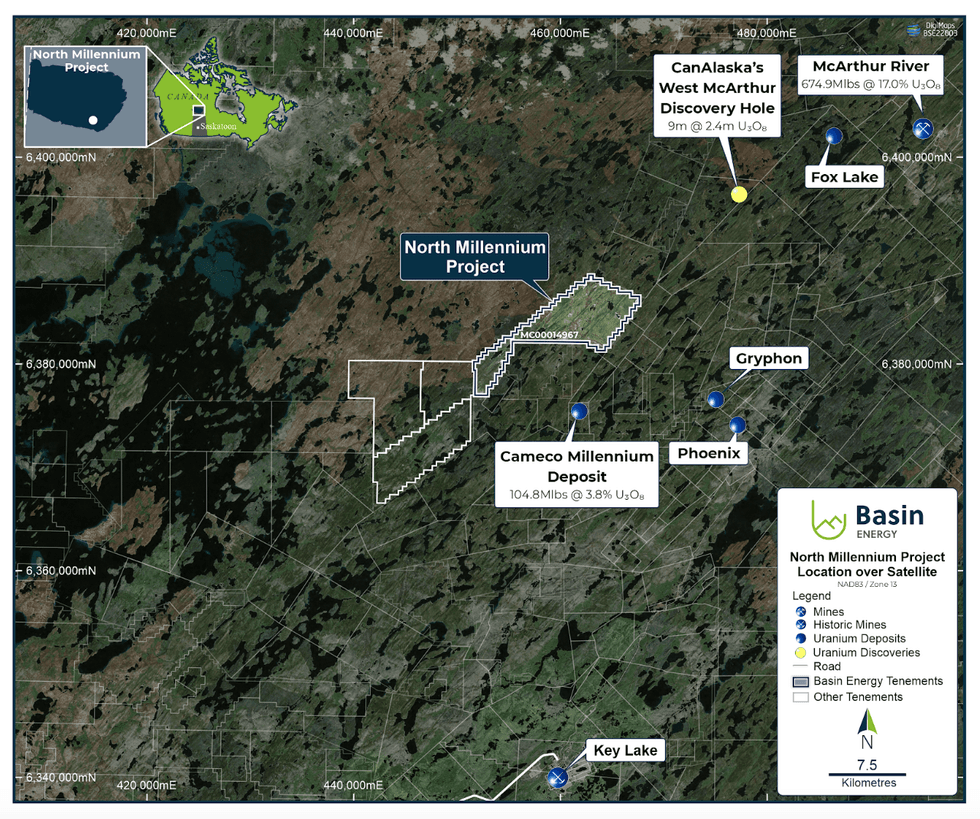

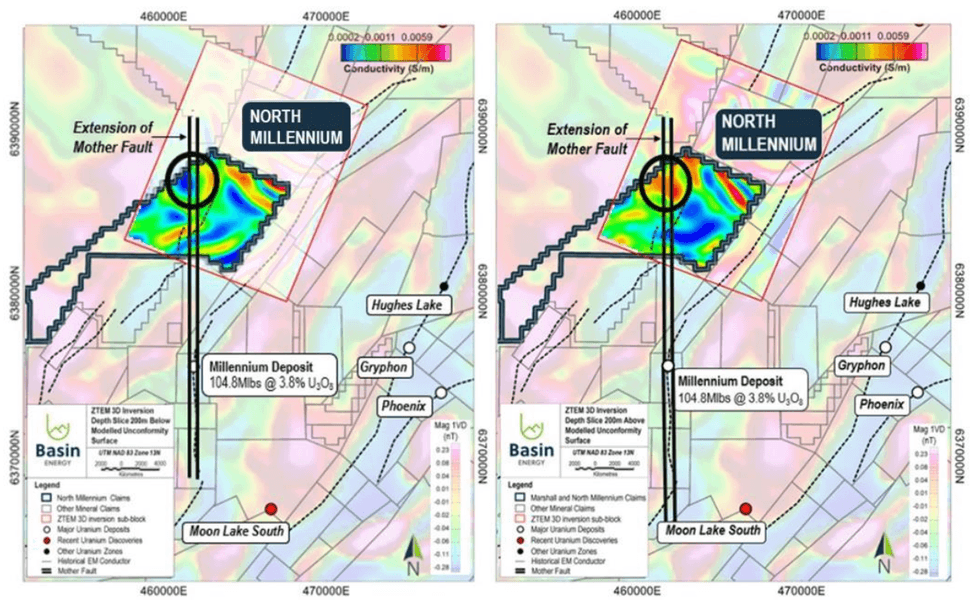

- The North Millennium Project - an interpreted extension of the Mother Fault that hosts Cameco’s Millennium Deposit (104.8 Mlb U3O8 3.76 percent), located just 7 kilometers to the south; and

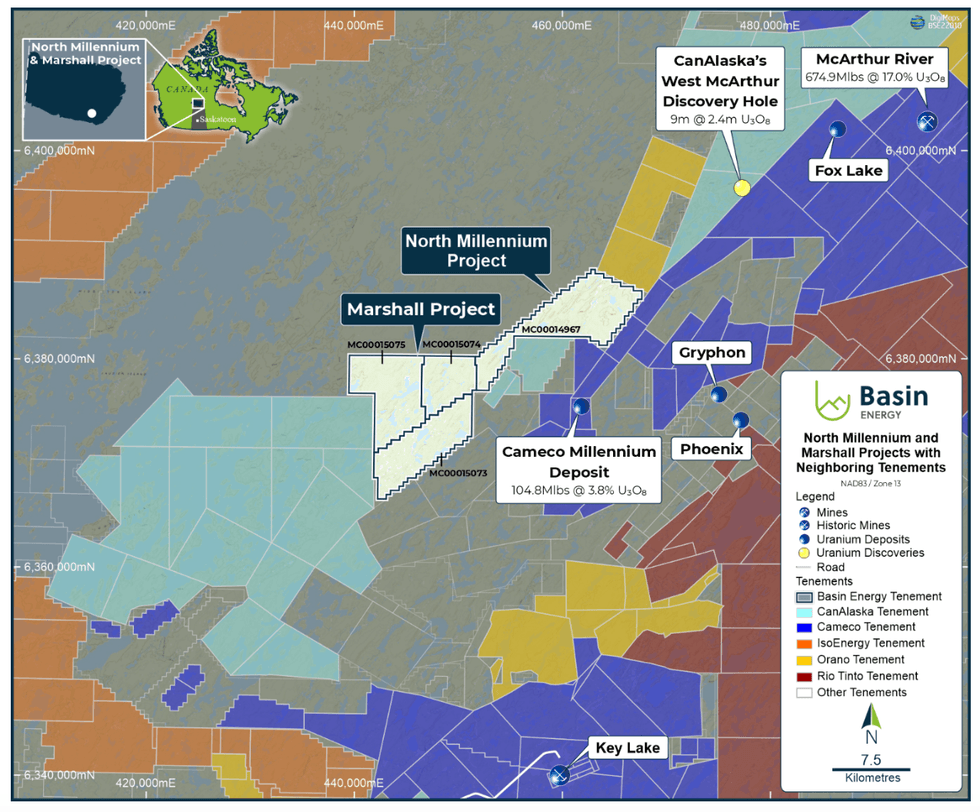

- The Marshall Project - located only 7 kilometers west of Cameco’s Millennium deposit centered on a strong magnetic and conductive anomaly interpreted as a significant unconformity-type uranium target.

- Basin Energy is committed to sustainable development throughout its operations, aiming to minimize environmental impact from all stages of the exploration and development cycle.

Basin Energy Successfully Completes A$3.3M Placement

Basin Energy Limited (ASX: BSN) – Trading Halt

Overview

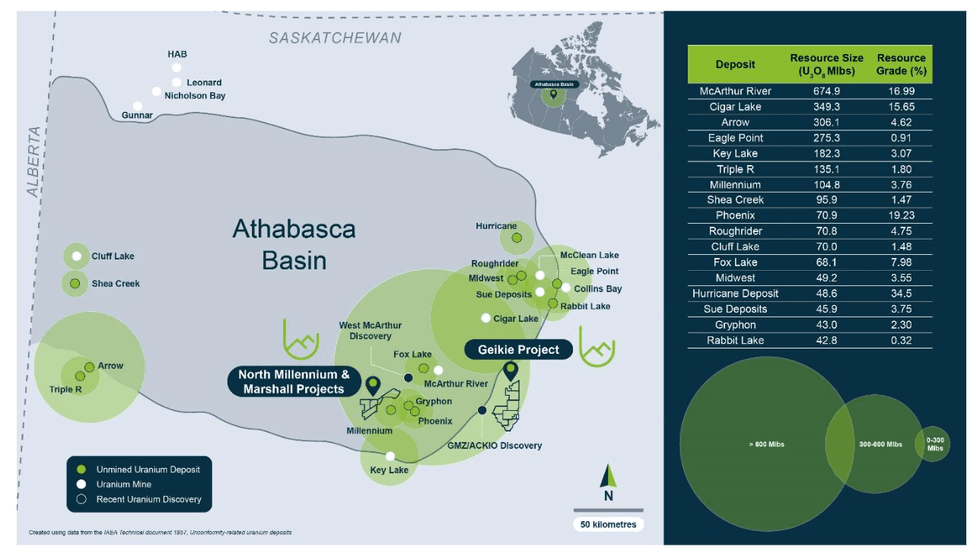

Basin Energy (ASX:BSN) completed an IPO in October 2022 and is well-positioned as a uranium exploration and development company to take full advantage of the current political and economic environment for the global supply of uranium. The company operates three projects in the world-class Athabasca Basin in Saskatchewan, Canada, known as the world’s leading source of high-grade uranium, currently accounting for approximately 10 percent of global uranium production. The company’s projects are in close proximity to high-grade uranium discoveries and mining operations within the Athabasca Basin.

Interest in uranium has skyrocketed in recent months, driven by the need for lower emissions and stable power generation. Nuclear reactors provide significant power for 32 countries globally, including the US, Canada, China, France, Hungary, Japan and Finland.

Demand has become a key driver of uranium prices, with Sprott Asset Management further enhancing demand by launching two investment vehicles that have already found rapid success: Physical Uranium Trust (TSX:UUN) and Uranium Miners ETF (ARCA:URNM). Combined, existing demand and investment interest create a compelling opportunity for uranium miners and their investors.

Basin Energy Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Overview

Basin Energy (ASX:BSN) completed an IPO in October 2022 and is well-positioned as a uranium exploration and development company to take full advantage of the current political and economic environment for the global supply of uranium. The company operates three projects in the world-class Athabasca Basin in Saskatchewan, Canada, known as the world’s leading source of high-grade uranium, currently accounting for approximately 10 percent of global uranium production. The company’s projects are in close proximity to high-grade uranium discoveries and mining operations within the Athabasca Basin.

Interest in uranium has skyrocketed in recent months, driven by the need for lower emissions and stable power generation. Nuclear reactors provide significant power for 32 countries globally, including the US, Canada, China, France, Hungary, Japan and Finland.

Demand has become a key driver of uranium prices, with Sprott Asset Management further enhancing demand by launching two investment vehicles that have already found rapid success: Physical Uranium Trust (TSX:UUN) and Uranium Miners ETF (ARCA:URNM). Combined, existing demand and investment interest create a compelling opportunity for uranium miners and their investors. In an interview with INN, founding director Peter Bird said, "It's hard to look past the Athabasca Basin as the premium mining jurisdictions for large, high-grade uranium deposits. The region also ranks highly as one of the most stable mining jurisdictions worldwide, which is an increasingly important factor given the current scrutiny on the source of uranium.”

In an interview with INN, founding director Peter Bird said, "It's hard to look past the Athabasca Basin as the premium mining jurisdictions for large, high-grade uranium deposits. The region also ranks highly as one of the most stable mining jurisdictions worldwide, which is an increasingly important factor given the current scrutiny on the source of uranium.”

Company Highlights

- Basin Energy is a uranium exploration and development company with three highly prospective projects in the world-renowned Athabasca Basin in Canada, known for being a consistent top three global uranium producer.

- Basin Energy’s board, management team and joint venture partner have direct extensive experience in uranium exploration and development along with comprehensive expertise in corporate financing, investment banking and geology. The company’s highly prospective uranium exploration portfolio comprises:

- The Geikie Project - located on the eastern margin of the Athabasca Basin occupying an extensive land position of 351 square kilometers, showing multiple uranium and uranium pathfinder occurrences, and is prospective for shallow, high-grade mineralization with maiden drilling identifying uranium up to 0.27 percent;

- The North Millennium Project - an interpreted extension of the Mother Fault that hosts Cameco’s Millennium Deposit (104.8 Mlb U3O8 3.76 percent), located just 7 kilometers to the south; and

- The Marshall Project - located only 7 kilometers west of Cameco’s Millennium deposit centered on a strong magnetic and conductive anomaly interpreted as a significant unconformity-type uranium target.

- Basin Energy is committed to sustainable development throughout its operations, aiming to minimize environmental impact from all stages of the exploration and development cycle.

Key Projects

Basin has interest in and is actively exploring three highly prospective properties positioned in the southeast corner and margins of the Athabasca Basin, an area well known for its uranium endowment and pedigree. These are the Geikie (60 percent, North Millenium (40 percent) and Marshall (100 percent) projects.

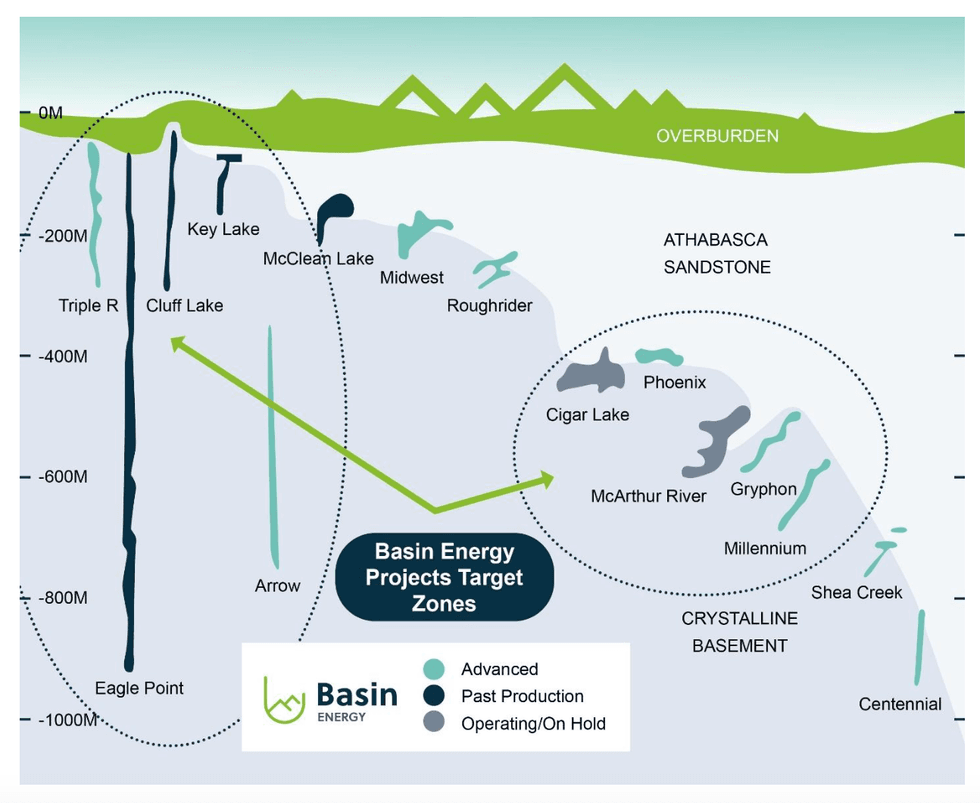

The project portfolio provides exposure to traditional “unconformity style” exploration, targeting the same mineralisation model as Cameco’s (TSE:CCO) prolific McArthur River mine which hosts 674.9Mlb uranium at 16.9 percent at its North Millenium and Marshall projects, as well as exposure to potentially shallower “basement style” exploration targeting deposits similar to NexGen Energy’s (TSE:NXE) Arrow deposit which hosts 30.61Mlb uranium at 4.6 percent.

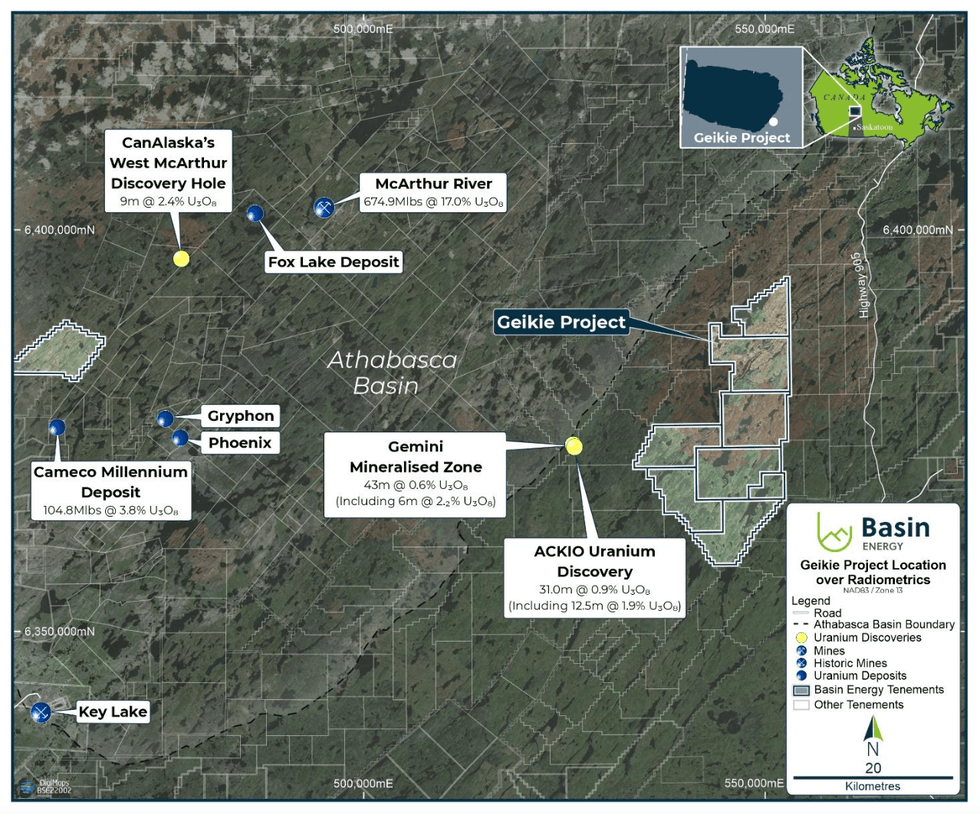

Geikie Project

The Geikie Project covers a significant area of 351 square kilometers on the eastern fringe of the Athabasca Basin and is easily accessible from Highway 905, which is located just 10 kilometers to the east. This portion of the Athabasca Basin is deemed perspective for shallow “basement style” mineralisation, but has traditionally been overlooked from much of the previous campaigns of uranium exploration. The discovery of multiple basement-hosted uranium ore bodies in recent years elsewhere in the district has driven a focus on the area.

The project was initially prioritized following a targeting review utilizing historical geophysics. Historical geochemistry confirmed the presence of uranium and suitable host lithologies. Recent nearby high-grade, shallow uranium discoveries by 92 Energy (ASX:92E) and Baselode Energy (TSXV:FIND), further enhance the overall prospectivity of the asset.

Project Highlights:

- Exploration underway: Basin Energy has completed mapping, geochemical sampling, airborne geophysics and maiden drilling. Further drilling is planned for 2024-.

- Shallow targets amenable to rapid exploration: Target horizon sits directly beneath glacial cover, in what was historically an overlooked part of the district.

- Nearby high-grade discoveries: The proximity of recent discoveries creates further confidence in the prospectivity of the project geology, being located adjacent to two recent discoveries:

- 92 Energy’s Gemini discovery 43 meters at 0.6 percent eU3O8 including 6 meters at 2.2 percent U308.

- Baseload Energy’s AKIO discovery was 13.2 meters at 0.55 percent U3O8 including 6.3 meters @ 0.99 percent U3O8.

- Presence of uranium: The maiden drilling program intersected anomalous uranium in four of the eight holes drilled, with assays returning up to 0.27 percent U3O8.

- Extensive scale: Geophysical data, combined with drilling data demonstrates significant scale opportunity with over 30 metres of intense alteration and brecciation intersected in drilling, that can be correlated to regional structural features identified in magnetics. This provides immediate follow up targets.

Since its IPO, the company has completed an extensive campaign of high resolution modern airborne geophysics including magnetics, radiometrics, electromagnetics and gravity gradiometry, as well as initial ground prospecting. These surveys have confirmed the pre-IPO geological interpretation and successfully identified a series of uranium targets.

Basin Energy completed its maiden 2,217-meter drilling program at Geikie in the summer of 2023, the first drilling to occur within the Project area in over 50 years. Drilling successfully identified uranium mineralisation with assays up to 0.27 percent U3O8. Uranium mineralisation is located proximal to two regionally significant structures at Aero Lake and Preston Creek with associated extensive hydrothermal alteration indicative of large uranium mineralising systems. Furthermore, an extensive geochemical pathfinder halo has been identified at Preston Creek, characteristic of uranium mineralising systems seen elsewhere in the district.

The company further expanded the Geikie Project with two additional claims consisting of 11.87 square kilometers, bringing the total Geikie project area to 350.87 square kilometers. The newly staked claims are adjacent to the Preston Creek and Hourglass Lake prospects, where Basin’s maiden exploration drilling is underway.

The company currently owns 60 percent of the Geikie Uranium Project following the fulfillment of expenditure requirements to meet the option payment. Basin has elected to proceed with the option agreement to increase its ownership to up to 80 percent through earn-in stages.

North Millennium Project

North Millennium is located just 7 kilometers north of Cameco’s (NYSE:CCJ) Millennium Deposit, which contains 104.8 million pounds (Mlb) U3O8 at 3.76 percent, and 40 kilometers southwest of their flagship McArthur River Mine hosting 674.9 Mlbs U3O8 at 16.9 percent. Within the property, Basin Energy has identified two high-priority targets along a 5-kilometer corridor for initial priority exploration. The initial target is where an interpreted extension of the Millennium Mother Fault intersects a strong basement conductor.

Project Highlights:

- Favorable geology: The interpreted structural and stratigraphic geology has strong similarities with some of the major uranium deposits within the Athabasca, such as a basement conductor trend disrupted by an interpreted extension of the Millennium Deposit Mother Fault.

- Proximity to known mineralization and recent discoveries:

- Located 7 kilometers north of Cameco’s Millennium deposit

- Drilling to the south of the project, proximal to the Millennium Deposit Mother Fault intersected uranium and uranium pathfinder elements.

- A drill hole on a nearby property completed by joint venture partner CanAlaska (TSXV:CVV) identified high-grade mineralization of 9 meters at 2.4 percent U3O8, further enhancing confidence in the project.

- Thoroughly defined exploration strategy: The company is currently compiling historical data, including completing a 3D inversion of results from an existing historic airborne ZTEM campaign. Exploration work will subsequently consist of:

- Targeted ground geophysics

- Stepwise moving loop time domain electromagnetics

- Potentially DCIP resistivity

- Exploration diamond drilling

- Targeted ground geophysics

Marshall Project

Located in the southeast corner of the Athabasca Basin, the Marshall Project has received limited historic exploration between 1979 and 2009, which included surface geochemistry, electromagnetic surveys and ground geophysics.

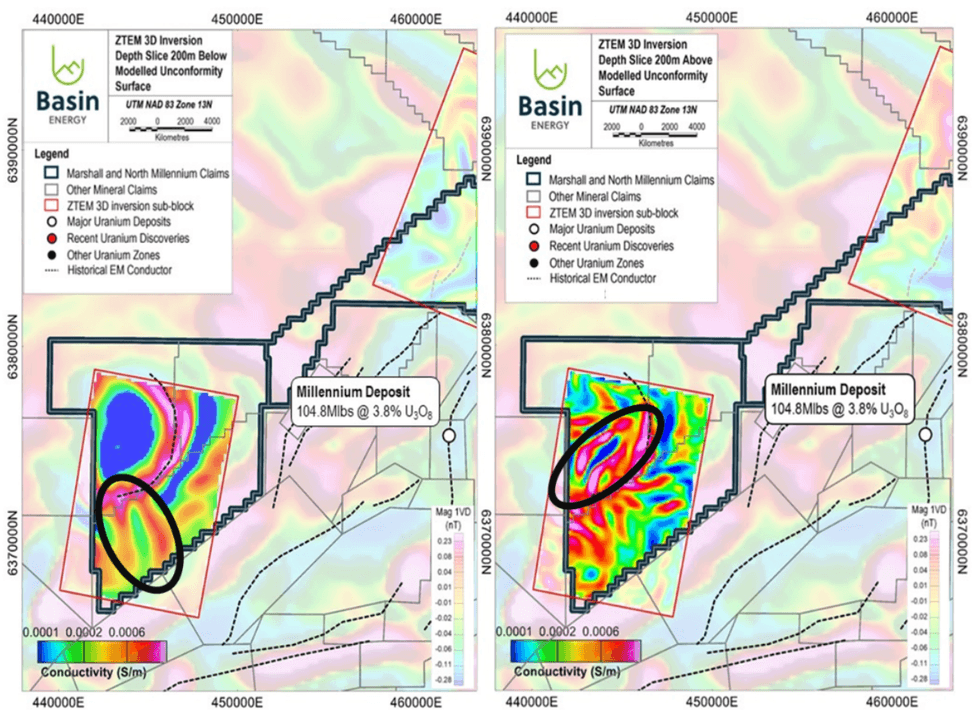

The Marshall Project contains a strong magnetic and conductive structure indicative of an unconformity-type uranium target, the asset’s primary target. Recently completed modern 3D inversion and processing works of historical geophysical data identified multiple geophysical anomalies above and below the Athabasca unconformity within the sandstone and basement stratigraphy at the Marshall Project.

Project Highlights:

- Significant geophysical anomalies: Interpretation of historical geophysical data suggests a metasedimentary basin with a graphitic basal unit, cross-cut by a magnetic and conductive NE/SW structure – indicative of a geological setting suitable for high-grade uranium mineralization.

- Proximity to known mineralization and recent discoveries:

- Located 10 kilometers west of Cameco’s Millennium deposit

- A drill hole along strike at the McArthur West project, completed by joint venture partner CanAlaska (TSXV:CVV) identified high-grade mineralization of 9 meters at 2.4 percent U3O8, further enhancing confidence in the project.

- Thoroughly defined exploration strategy: The company is currently compiling historical data, including completing a 3D inversion of results from an existing historic airborne ZTEM campaign.

- Exploration work will subsequently consist of:

- Targeted ground geophysics

- Stepwise moving loop time domain electromagnetics

- Potentially DCIP resistivity

- Exploration diamond drilling as merited

Management Team

Blake Steele - Non-executive Chairman

Blake Steele is an experienced metals and mining industry executive and director with extensive knowledge across public companies and capital markets. He was formerly president and chief executive officer of Azarga Uranium Corp (Azarga), a US-focused integrated uranium exploration and development company. He led Azarga into an advanced stage multi- asset business, which was ultimately acquired by enCore Energy Corp (TSX.V:EU) for C$200 million in February 2022.

Pete Moorhouse - Managing Director

Pete Moorhouse has 18 years of mining and exploration geology experience with extensive experience in the junior uranium sector, having spent over 10 years with ASX-listed uranium explorer and developer Alligator Energy (ASX:AGE). He holds significant competencies in evaluating, exploring, resource drilling and feasibility studies across many global uranium and resource projects.

Jeremy Clark - Non-executive Director

Jeremy Clark has over 19 years of mining and exploration geology experience. He previously held technical and management roles at the recognized consultancy firm RPM Global for over 13 years, gaining experience across a number of uranium, base metals, and precious metals deposits globally. Subsequent to RPM, Clark established his own boutique geological consultancy firm, Lily Valley, focused in regards to compliance-related issues, IPOs and M&A.

Cory Belyk - Non-executive Director

Cory Belyk holds 30 years’ experience in exploration and mining operations, project evaluation, business development and extensive global uranium experience most recently employed by Cameco in the Athabasca Basin. He was a member of the exploration management team that discovered Fox Lake & West McArthur uranium deposits. Currently CEO/VP of Canadian Athabasca uranium explorer & project generator, CanAlaska (TSXV:CVV).

Peter Bird - Non-executive Director

Peter Bird is an investment banking professional with experience leading and managing a variety of global transactions including IPOs, Capital Raises and M&A Currently working with New York based investment fund, where he provides strategic funding solutions to a variety of international clients. He previously held the role of associate director at a Perth-based boutique corporate advisory firm focused on natural resources.

Ben Donovan - NED/ Company Secretary

Ben Donovan has over 22 years of experience in the provision of corporate advisory and company secretary services. He holds extensive experience in ASX listing rules compliance and corporate governance and has served as a Senior Adviser to the ASX for nearly 3 years Currently CoSec to several ASX listed resource companies including M3 Mining (ASX:M3M), Magnetic Resources (ASX:MAU) and Legacy Iron Ore (ASX:LCY).

Odile Maufrais - Exploration Manager

Odile Maufrais is an exploration geologist with over 14 years of experience and has an extensive understanding of the uranium exploration and mining industry, having worked at ORANO, one of the largest global uranium producers for 12 years on various assignments in Canada, Niger, and France. Maufrais has significant Athabasca Basin-specific experience, being involved on over 15 greenfield and brownfield uranium exploration projects located throughout the Basin. Her most recent roles for ORANO comprised leading various uranium exploration campaigns and being an active member of the ORANO research and development team, which involved working on trialing and implementing cost-effective and streamlined drilling techniques within the Athabasca Basin. She also played a key role in the update of the National Instrument 43-101 compliant mineral resource estimate for the Midwest Main and Midwest A deposits. Mrs. Maufrais holds a Master of Science from Montpellier II University, France.

Basin Energy Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.