- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

How to Play the Battery Metals Market in Australia Today

INN spoke to experts to find out how to play the battery metals market in Australia today. Here's what they had to say.

Australia's role in the global green energy transition is crucial. The country has key resources needed to feed growing demand for critical minerals and has strategic partnerships along the supply chain.

When it comes to battery metals, ASX-listed companies have seen their share prices surge in the past year and have been able to move forward with projects by raising more cash than many analysts anticipated.

With current and future prospects looking positive for the land down under, the Investing News Network (INN) asked experts about how to play the battery metals market in Australia today.

Interest growing for battery metals

Battery metals had a couple of rough years following a price surge in 2017 and 2018, and when the coronavirus hit the world in early 2020 the short-term picture for these raw materials was uncertain.

But against all odds, interest in metals used in the batteries that power electric vehicles (EVs) surged despite the pandemic, as the world accelerated efforts to reduce carbon emissions and move towards green energy.

Battery metals such as lithium, cobalt, graphite and even nickel have seen prices increase — with more or less volatility — with new and seasoned investors turning their attention to these markets.

But what's ahead for stocks focused in this space? Canaccord Genuity continues to see a bright outlook for ASX-listed battery metals companies in 2021.

"We have been bullish on the outlook for demand for battery raw materials for many years now, with our views supported by continued strong growth in EV sales," mining analyst Reg Spencer told INN. "If anything, our conviction in the outlook has only strengthened since the start of 2021."

EV adoption continues to grow, with sales on track to increase by up to 60 to 70 percent year-on-year, and OEMs are making more assertive pushes in response to increasingly stringent government emissions targets; these factors are causing demand growth estimates to be rebased upwards, according to the analyst.

Similarly, Owen Hegarty of EMR Capital sees strong demand overall for commodities over the next multiple decades, led by China and followed by India and Indonesia — all are looking to get on the "superhighway" of economic growth and prosperity.

"The ones that are going to be sharper, faster, stronger, higher growth are going to be those energy transition metals — battery metals, renewables and so on," he told INN.

For the expert, a big winner will be copper, because it is used in a wide range of applications, but he is also interested in the battery metals complex.

"There will be some winners there. Lithium will be a winner, graphite will be a winner, cobalt will be a winner," he said. "There's a lot of those materials and commodities ... that will be winners, some going up and down a bit, because remember, it's all part of a technology play too."

Australian miners' advantages

Battery metals demand from the EV space is not just about well-known US pioneer Tesla (NASDAQ:TSLA). In the last 12 months, most major automotive OEMs have announced even more aggressive electrification targets. At the same time, week after week governments around the world continue to outline plans to reduce carbon emissions and move to electrify transportation.

On the supply side, movement has not been as fast. In the case of lithium, low prices from 2019 to 2020 led to many new projects or capacity expansions being delayed.

For Spencer, this has meant that as demand growth recovered through late 2020 and into 2021, the supply side was not able to keep pace, leading to significant price increases for lithium feedstock and chemicals as inventories were wound down.

"Noting the significant increase in production capacity required to meet long-term demand forecasts, the substantial capital required to bring on this new capacity and the long lead times to develop new projects, lithium prices are expected to remain elevated," he explained to INN. "This high pricing environment should provide for a very favourable investment backdrop."

EMR Capital's Hegarty also pointed at the fundamentals when talking about where to invest capital. For the resource expert, investors should look for sectors where demand is growing fast and supply is slower.

"You need to actually choose those commodities that are going to be under price tension all the time," he said. "Of course, there'll be some disruptions, then there'll be higher prices of electricity, there'll be higher prices of energy, but the direction and the force is perfectly clear that you're going to have good strong demand."

Despite the economic downturn brought by COVID-19, many battery metals companies in Australia have been able to raise funds to move forward with their projects. In fact, Australian mineral explorers in general were able to raise more capital last year than in the last 10, according to a recent report from BDO.

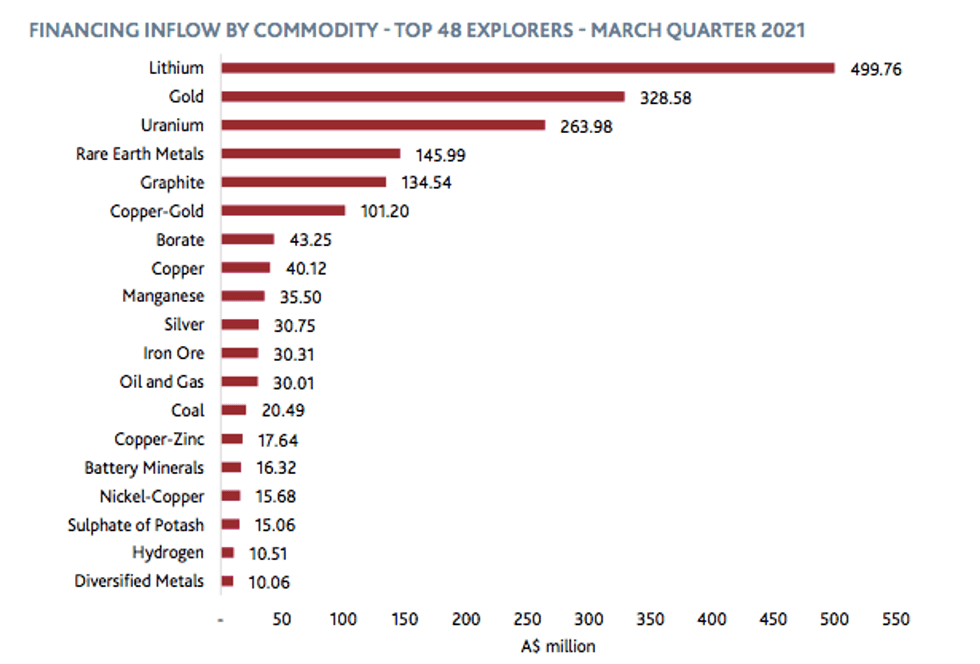

In the March 2021 quarter, 48 companies raised $10 million or more, five more than the 43 companies recorded in December. Of the 48 companies, there were 10 gold companies, nine lithium companies, four uranium companies, four rare earths companies and four graphite companies; the remaining 17 companies were across 14 different sectors, most notably copper-gold, copper and oil and gas.

Financing inflow by commodity. Top 48 explorers, Q1 2021. Chart via BDO.

"We knew the battery minerals industry has been hot in recent times, however the current dominance of lithium and other battery minerals companies in terms of fund raisings, surprised even us," the BDO report states. "Clean energy alternative, uranium, also appeared to be an attractive investment, raising the third most funds among our Fund Finders."

Canaccord's Spencer expects this trend to continue for the rest of 2021.

"While we have seen a meaningful amount of new equity raised in the last 12 months, it's worth pointing out that a majority of this was raised for recapitalisation and or M&A, with rates of capital investment into new capacity tracking well below what is required to meet long-term demand estimates," he said.

As an example, Spencer pointed to the average capital intensities for new lithium chemical supply — which is estimated at US$15,000 to US$20,000 per tonne, implying that more than US$3 billion must be invested each year in new capacity to meet 2030 demand estimates.

"A high pricing environment is needed to incentivise this level of capital investment, and that should see investor sentiment toward the sector remain positive," he said.

Significant consolidation among mid-cap battery materials companies in the last six to nine months has also been a trend in the space. "Combined with the positive outlook for the sector, that should see investors more willing to support the next wave of project developers emerging over the coming two to three years looking to help fill an expected supply gap," Spencer added.

For Hegarty, capital raises are going to continue on a fast trajectory going forward.

"I think that capital is going to be available, and the people will be there. So there's a bit of balancing and rebalancing and trends to watch," he said. "And the best markets to raise that sort of money are the trusted markets of the TSX, TSXV and our well-regulated, well-experienced Australian Securities Exchange."

What to look for in juniors and metals to watch

When looking at companies for investing in the battery metals space, Spencer said the usual filters still apply, including resource quality, capital intensity, position on the cost curve, access to infrastructure, sovereign risk and permitting and capable and experienced management, among others.

"That said, as the world, and specifically the EV supply chain, embraces sustainability, we are increasingly looking to companies with projects that have better ESG credentials, such as low-CO2-intensity production, social licence, a smaller environmental footprint, etc.," he said. "In addition, with supply chain localisation becoming more important (both from a sustainability and economic aspect), we are also looking to projects that are situated within, or close to, key end markets (ie. the EU, North America)."

For Spencer, these characteristics apply to investors looking for opportunities in the battery metals sector, including those looking specifically at the Australian market.

Hegarty agreed, saying that despite the fact that these once unrecognisable metals are now becoming popular, investors should be looking at similar factors, starting with the people behind the projects.

"Then of course you go into the particular deposit of that particular metal," he said. "Take a look at, you know, where it is, what it is, how long they're going to take. And then of course the fundamentals of the project."

When asked about which battery metal he is more interested in this year, Spencer said Canaccord is most optimistic about the near-term prospects for lithium and rare earths — not quite battery metals, but certainly a market increasingly driven by EVs and renewable energy.

"High-purity manganese (in metal/sulphate form) probably interests us the most," he said. "Recent developments in cathode chemistry (as announced by major OEMs such as VW (OTC Pink:VLKAF,ETR:VOW3) and Stellantis (NYSE:STLA)) point to the potential commercialisation of high-manganese cathodes for mass market EVs, and with few options for low-cost/low-impurity production (ie. projects based on manganese carbonate resources), we see this as an interesting space."

For his part, Hegarty mentioned copper, and reminded investors not to forget zinc, which is used to galvanise steel. In the battery metals complex, he is optimistic about lithium, cobalt and to a lesser extent graphite.

Don't forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Priscila Barrera, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2332.07 | +15.78 | |

| Silver | 27.43 | +0.25 | |

| Copper | 4.56 | +0.07 | |

| Oil | 83.77 | +0.96 | |

| Heating Oil | 2.57 | +0.01 | |

| Natural Gas | 1.61 | -0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Priscila is originally from Buenos Aires, Argentina, where she earned a BA in Communications at Universidad de San Andres. She moved to Vancouver for the first time in 2010 and fell in love with the city. A few years after she went to London, UK, to study a MA in Journalism at Kingston University and came back in 2016. She enjoys reading, drinking coffee and travelling.

Learn about our editorial policies.