- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Gidji JV Exploration Update

Belararox Raises $2.5 Million Via Placement

Belararox Limited (ASX:BRX) (“Belararox” or “the Company”) is pleased to announce a placement (“Placement”) raising $2.5 million (before costs), at $0.33 per share, to fund a range of exploration activities at the Company’s Australian projects while simultaneously accelerating exploration at the highly prospective TMT project in Argentina.

Investment Highlights

- Successful share placement undertaken, with commitments to raise $2.5 million.

- Placement was strongly supported by new and existing sophisticated and professional investors.

- The new equity will help fund a range of exploration activities at the Company’s Argentine and Australian projects over the next 6-12 months.

- Belararox is focused on commencing exploration work at 11 significant porphyry and associated targets at the TMT Project in Argentina as well as pursuing the significant outcropping pegmatites reported at Bullabulling (WA) and progressing exploration work at Belara (NSW).

“The overwhelming support received by existing and new shareholders is most encouraging as we commence exploration activities at the exciting TMT Project in Argentina and progress the good work achieved at our Bullabulling and Belara / Native Bee Projects in Australia.

The Company has a pipeline of activities planned for the 2nd half of 2023 on our 3 Projects which are now funded. We expect a continuous release of news flow as we build on the successful exploration results achieved to date.”

Placement

The structure of the Placement is as follows:

i. 7.58 million fully paid ordinary shares at $0.33 per share (“Placement Shares”), representing a 16.5% discount to both the last traded price of BRX shares on 14 June 2023 and the 15-day volume weighted average price; and

ii. 3.79 million free attaching options to subscribe for fully paid ordinary shares to be issued to investors on a one-for-two basis with an exercise price of $0.66 (being a 100% premium to the Placement price) and an expiry date that is three years from their date of issue (“Placement Options”).

The Placement Shares will rank equally with, and carry the same terms as, existing shares on issue.

The Placement Shares, Placement Options and Lead Manager Options are not subject to shareholder approval and will be issued within the Company’s existing placement capacity under ASX Listing Rules 7.1 and 7.1A. It is expected that the Placement Shares will be issued on or about 27 June 2023. The Placement Options and Lead Manager Options will be issued on or about the same date together with a prospectus or cleansing notice (as applicable) to facilitate their quotation (and on-sale) on the ASX, subject to meeting the ASX’s minimum listing requirements.

Furthermore, the attaching Placement Options are expected to provide meaningful additional capital the Company’s balance sheet, at a materially higher valuation than the Placement price, should the Company achieve further exploration success at either of its Australian or Argentinian projects.

Click here for the full ASX Release

This article includes content from Belararox Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Multiple Thick Scandium Zones at Murga

Rimfire Pacific Mining (ASX: RIM, “Rimfire” or “the Company”) is pleased to advise that a recent 100-hole air core drilling program has successfully defined thick zones of strong scandium anomalism from surface, across multiple locations at the Murga Scandium Prospect which is located on Rimfire’s Fifield Project 70kms NW of Parkes NSW (Figure 1).

Highlights

- Thick zones of strong scandium anomalism defined from surface across multiple locations throughout 20km² Murga Intrusive Complex (true widths);

- 22m @ 232ppm Sc from surface incl 12m @ 305ppm Sc,

- 22m @ 156ppm Sc from 2m incl 4m @ 220ppm Sc,

- 28m @ 148ppm Sc from 5m incl 6m @ 291ppm Sc,

- 13m @ 188ppm Sc from 3m incl 4m @ 248ppm Sc,

- 18m @ 174ppm Sc from 1m incl 3m @ 226ppm Sc

- Drill Intercepts remain open in all directions with further air core and diamond drilling planned to determine the lateral extents of the scandium at each location

- Scandium occurs within a flat-lying weathered saprolite horizon developed on top of ultramafic (pyroxenite) intrusive rocks

Rimfire’s primary objective is to build a globally significant scandium resource inventory at our Fifield and Avondale Projects. The Murga intersections announced today in conjunction with the upcoming Melrose resource are the first components in satisfying that objective.

Rimfire offers unique ASX exposure to scandium and we feel that the shallow mineralisation which occurs over a large footprint gives rise to the potential for Murga to host a large-scale scandium resource”.

Drilling details

100 Air core holes (FI2472 to FI2571 - 2,664 metres: Table 1) were drilled to determine the significance of a Rimfire 2023 reconnaissance air core drilling program which successfully intersected strongly anomalous scandium in multiple drillholes at Murga (See Rimfire ASX Announcement dated 3 October 2023).

At Murga, scandium occurs within a flat – lying weathered saprolite (clay) horizon overlying magnetic ultramafic (pyroxenite) intrusive rocks of the Ordovician-age Murga Intrusive Complex, which have been demonstrated from previous drilling at both Murga and the adjacent Melrose Prospect to be intimately associated with scandium mineralisation (See Rimfire ASX Announcement dated 6 December 2023).

The most recent air core holes were drilled on 100 x 100 metre centres at Murga North and on 400 x 400 metre centres over the remainder of the Murga Intrusive Complex. In total the drilling was carried out over an area of approximately 20km² with locations shown in Figures 4 and 5.

The drilling has successfully defined an initial 4 areas - Murga North, Murga Northwest, Murga East and Murga South within the Murga Intrusive Complex for immediate drill follow up Figures 2 - 6).

All are characterised by thick vertical widths of strong scandium anomalism (+100ppm) with little of no associated nickel and / or cobalt anomalism which is in contrast to other scandium prospects in the area.

Significantly all the areas remain open and further drilling is required to determine the lateral extents of the scandium at each location.

Also, several magnetic features within the Murga Intrusive Complex that were not assessed by this phase of air core drilling have (based on the latest drilling results) been subsequently identified as new scandium targets for drill testing. These targets are additional to the 4 areas detailed below and include a +1 kilometre – long, WNW trending linear magnetic feature immediately west of the Murga East scandium area (Figure 2).

Click here for the full ASX Release

This article includes content from Rimfire Pacific Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Firebird Metals Limited (ASX: FRB) – Trading Halt

Description

The securities of Firebird Metals Limited (‘FRB’) will be placed in trading halt at the request of FRB, pending it releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of the commencement of normal trading on Wednesday, 8 May 2024 or when the announcement is released to the market.

ASX Compliance

Click here for the full ASX Release

This article includes content from Firebird Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Investor Presentation Fiery Creek Georgetown

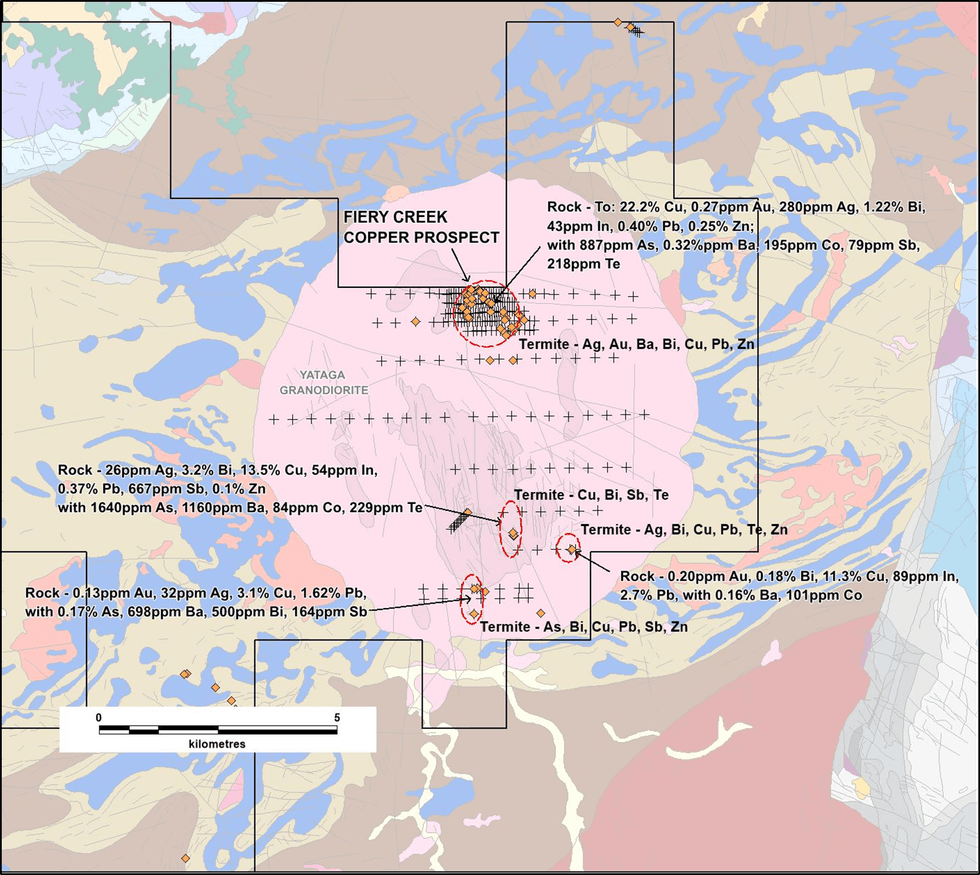

FIERY CREEK COPPER PROSPECT

- Georgetown Project Queensland

- Fiery Creek Copper Prospect

- 29 square kilometre Yataga Granitoid Intrusive Complex

- Identified as potential massive scale constrained copper porphyry system

- Targeting millions of tonnes of contained copper in “pencil porphyry style” Cadia type system

- 1,000 mines, prospects, mineral occurrences in Georgetown District

- 3 exploration permits covering 850km2

- Significant historical gold production, very little systematic modern exploration

- Gold, lithium, silver, lead, zinc, copper, tin, tantalum, niobium, uranium, fluorine and molybdenite

- 8 potential scale prospects gold, copper, silver lead identified to date

- 23% copper, 14 ounces silver (460 g/t)* from rock samples in quartz breccia hosted veins at Fiery Creek

- Hosted within the massive Yataga Granitoid Complex

- 1600m x 750m outcropping copper veining up to 2m wide

- Interpreted shallow constrained, scale porphyry copper system

- Veining has extensive secondary copper mineralisation at surface

- Multi element assays point to possibility of a significant copper polymetallic system

- Pathfinder element anomalism widespread

- 2 geochemistry surveys completed by EMU

Click here for the full ASX Release

This article includes content from EMU NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EIS Grant for Minnie Springs Copper Porphyry Drilling

Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to advise the grant of a co-funded EIS drilling grant of up to $110,000 for the Minnie Springs Cu-Mo project in the Gascoyne Region. Augustus thanks the State Government and DEMIRS for supporting exploration in Western Australia with these grants.

- Augustus Minerals has been granted a co-funded drilling grant of up to $110,000 for 2 x 700m deep diamond drill holes under the WA Government’s Exploration Incentive Scheme (EIS) for the Minnie Springs prospect.

- The deeper diamond drill program is designed to test and to provide a 550m deep, 1km wide geological/geochemical/structural cross-section through the large 3km long by 1km wide copper moly porphyry system, linking the Mo mineralised leucogranite to the extensive Cu in soil anomaly to the northeast.

- Previous RC drilling at Minnie Springs intersected mineralisation, geology and alteration halo consistent with the zoning of a large porphyry copper / moly system.

Andrew Ford, GM Exploration

“The Company is pleased to receive an EIS grant to complete deeper drilling at the Minnie Springs Copper Molybdenum Project. The resultant data will enable mapping of the lithology and alteration to a depth of 550m and potentially intersect, or provide vectors to, higher grade Mo-Cu mineralisation using a Mo-Cu porphyry geological model”.

Minnie Springs

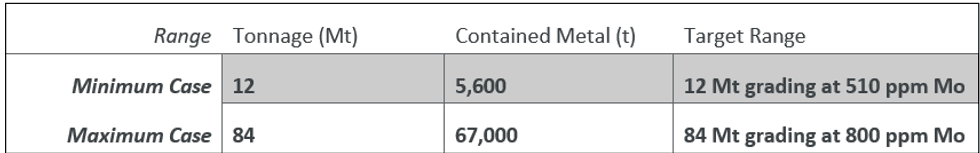

Minnie Springs hosts porphyry related copper molybdenum mineralisation previously drilled and defined by Catalyst Metals. A molybdenum Exploration target has been defined for the historicdrillingareacomprisedofbetween12-84Mtasoutlinedbelow (Table 1 and Figure 1, 2.)1.

The potential quantity and grade of the exploration target is conceptual in nature, there has been insufficient exploration to estimate a Mineral Resources, and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

The planned diamond drilling will complement the recently completed 3,200m RC drilling program that infilled around hole MSRC012 (18m @ 0.37% Cu and 9.7 g/t Ag from 94m downhole, and 16m @ 0.38% Cu and 19.4g/t Ag from 121m downhole2) and tested the northern half of the 2km long copper-in soil anomaly. Assays from this program are expected to become available over the next month.

The limited exploration in the region, highlighted by 95% of the Ti-Tree project having no previous exploration, demonstrates the prospectivity of this underexplored mineral province.

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activity Report 31 March 2024

EMU NL (ASX: EMU) (“EMU” or “the Company”) is pleased to report on its activities for the quarter ending 31 March 2024.

Continuing with its primary exploration focus on the Georgetown project in the latter half of 2023, EMU received assay results during the quarter from its second, in field reconnaissance work. The geochemical sampling programme covered the Fiery Creek high grade copper vein swarm and the Snake Creek prospects with significant element results returned from the Fiery Creek Copper (elevated Cu-Au-Ag-Bi-In-Pb-Sb-Te) and Snake Creek (elevated Pb-Ag-Au-Sb).

Whilst the survey was cut short due to inclement weather, EMU was encouraged by the significant success reflected in the assays results. The results from mineralogical studies confirmed EMU’s interpretation of an indicative, scale Copper-Porphyry system at the Fiery Creek prospect and was a highlight of the survey with new information building on the scale and potential of the prospect1.

Assay results returned included:

- Fiery Creek rock assay results up to 23.5% Cu, 0.27ppm Au, 460ppm Ag, 1.9% Bi, 89ppm In, 2.7% Pb, 667ppm Sb, 1470ppm Zn2.

- evidence of strong potential for the presence of critical and strategic minerals (Cu, Bi, In), with precious and base metals.

- evidence of alteration mineralogy, mineralisation geochemistry and areal extent of the Fiery Creek quartz-Cu-Bi vein swarm strongly suggesting a previously unrecognised subjacent porphyry Cu-Mo system.

- Yataga Granitoid Complex termite mound and coincident rock chip sampling returned several anomalous polymetallic zones for follow up.

- Snake Creek Prospect assays returned 0.20ppm Au, 390ppm Ag, 22.4% Pb, 464ppm Sb1.

Significant results were returned from the Fiery Creek Copper prospect with elevated Cu-Au- Ag-Bi-In-Pb-Sb-Te and from the Snake Creek prospect with elevated Pb-Ag-Au-Sb.

The elevated pathfinder element results and a macro-petrology assessment3 of rock samples completed by Mr Nigel Maund, Consulting Economic Geologist, from the previously unexplored Fiery Creek Prospect, point to the discovery of a porphyry copper system.

The sampling program assessed a number of high-priority prospects within the Georgetown Project tenements utilising termite mound and outcrop rock chip geochemistry. A total of 46 rock chip and 489 termite mound samples were collected across eight prospects.

Click here for the full ASX Release

This article includes content from EMU NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Report for the Period Ending 31 March 2024

Redstone Resources Limited (ASX: RDS) (Redstone or the Company) is pleased to provide its quarterly report for the period ending 31 March 2024 (the Quarter).

HIGHLIGHTS

WEST MUSGRAVE COPPER PROJECT (100% RDS) – WEST MUSGRAVE, WESTERN AUSTRALIA

- Redstone currently planning work programs to advance its copper exploration strategy at its 100% owned West Musgrave Project in WA

- Foundation set for growth ‐ existing copper resource base at West Musgrave:

- Tollu copper vein deposit with a resource of 3.8 million tonnes at 1% Cu, containing 38,000 tonnes of copper (ASX announcement of 15 June 2016).

- Significant drilling intersections of high‐grade Cu mineralisation at the Chatsworth and Forio Prospects within Tollu (dating back to 2017) are yet to be included in the existing JORC 2012 resource estimate.

- Significant and consistent high‐grade copper results at depth and to the surface at Tollu:

- Most recent drilling at Chatsworth intersected 11m at 1.2% Cu from only 29m downhole (TLC205), extending the previously intersected high‐grade copper lens a further 20m towards the surface.

- Together with prior drilling, TLC205 also confirmed the targeted high‐grade Cu lens at Chatsworth has the following encouraging characteristics:

- Up to 26m thick (downhole) and has a consistent Cu grade over 1% Cu;

- Extends over 140m vertical from TLC205 to its deepest intersection to date in TLC188;

- A consistent high average grade of over 1% in numerous holes; and

- Remains open at depth

- Historical Cu intersections at Chatsworth include mineralisation that continues from the surface to the maximum vein intersection depth at over 424m (downhole), where grades of 3.73% Cu over 10m, including 5m at 5.3% Cu from 427m (downhole), still continue and are not closed out

- Drilling at the Forio Prospect, which included the highest grade intersection ever recorded at Tollu, being 1m at 18.5% Cu from 18m downhole (TLC203) within an intersection of 8m at 4.1% Cu from 13m downhole, extend Forio’s high grade Cu mineralisation zone at Forio to a 60m strike length (north and south) of continuous high grade copper.

- The high grade Forio Cu Zone extends all the way to the surface with lenses of Cu mineralisation up to 34m thick (downhole) with average grades always over 1% Cu (34m at 1.04% Cu from 15m downhole in TLC181)

- Nearby to major BHP deposit: Tollu copper deposit is located 40km east of BHP’s world‐class Nebo‐ Babel Ni‐Cu‐Co‐PGE deposit ‐ estimated to have a resource of 390 million tonnes grading 0.33% copper and 0.30% nickel, for 1.2 million tonnes of contained nickel metal and 1.3 million tonnes of contained copper metal

- Redstone has been successfully awarded a $220,000 drilling grant from the DMIRS under the Round 29 Exploration Incentive Scheme (EIS) – grant will co‐fund a single deep drill hole of approximately 1,000m at the Chatsworth Prospect at Tollu

Click here for the full ASX Release

This article includes content from Redstone Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.