Kinross Gold Corporation (TSX: K, NYSE: KGC) ("Kinross" or the "Company") today announced its results for the first quarter ended March 31, 2024.

This news release contains forward-looking information about expected future events and financial and operating performance of the Company. We refer to the risks and assumptions set out in our Cautionary Statement on Forward-Looking Information located on pages 27 and 28 of this release. All dollar amounts are expressed in U.S. dollars, unless otherwise noted.

2024 first-quarter highlights:

- Production of 527,399 gold equivalent ounces (Au eq. oz.), a 13% year-over-year increase.

- Production cost of sales 1 , 2 of $982 per Au eq. oz. sold and all-in sustaining cost 2 , 3 of $1,310 per Au eq. oz. sold, both of which are in line with Q1 2023.

- Margins 4 increased by 20% to $1,088 per Au eq. oz. sold, outpacing the rise in the average realized gold price.

- Operating cash flow 5 of $374.4 million and adjusted operating cash flow 3 of $424.9 million. Attributable 6 free cash flow 3 of $145.3 million.

- Reported net earnings 7 of $107.0 million, or $0.09 per share, with adjusted net earnings 3, 8 of $124.9 million, or $0.10 per share 3 .

- Kinross' Board of Directors declared a quarterly dividend of $0.03 per common share payable on June 13, 2024, to shareholders of record at the close of business on May 30, 2024.

- On track to meet annual guidance: On an attributable basis 6 , Kinross expects to produce 2.1 million Au eq. oz. (+/- 5%) at a production cost of sales per Au eq. oz. 1 of $1,020 (+/- 5%) and all-in sustaining cost 3 of $1,360 (+/- 5%) per ounce sold for 2024. Total attributable 6 capital expenditures 3 are forecast to be approximately $1,050 million (+/- 5%).

- Balance sheet strength: Kinross has improved its debt metrics and continues to maintain its investment grade credit ratings. As of March 31, 2024, Kinross had cash and cash equivalents of $406.9 million, for total liquidity 9 of approximately $2 billion.

- Operations:

- Kinross' three largest producing mines – Tasiast , Paracatu and La Coipa – delivered 68% of total production, with production cost of sales of $821 per Au eq. oz. sold 1 and margins 4 of $1,251 per Au eq. oz. sold.

- Tasiast achieved record quarterly throughput as the mine continued its strong performance since the completion of the 24k project.

- Paracatu achieved record quarterly throughput and La Coipa continued to deliver high margin production.

- Development projects:

- Kinross' pipeline of development projects continues to advance on plan.

- At Great Bear , the drilling campaign made strong progress in Q1 2024 and continues to successfully target extensions of the resource at depth.

- At Manh Choh , operations are ramping up and the project is on track for first production in early Q3 2024.

- At Round Mountain , Phase S mining is on plan, and the exploration decline at Phase X is progressing well, with approximately 1,800 metres developed to date.

- Sustainability Report: Kinross expects to publish its 2023 Sustainability Report later this month, providing a comprehensive summary of its performance over the past year.

CEO commentary:

J. Paul Rollinson, CEO, made the following comments in relation to 2024 first-quarter results:

"We have had a strong start to the year and are well positioned to meet our annual guidance. Our portfolio of mines performed well, driven by strong operational performance, disciplined cost management and higher gold prices. The Company delivered a 20% increase in margins to $1,088 per ounce sold, which is approximately double the percentage increase in the gold price over the same period. As a result, free cash flow more than tripled over Q1 2023.

"With the strong sustained gold price, we will continue to prioritize our financial discipline and operational excellence. We will focus on maintaining our margins and cost profile, prudent capital allocation and debt reduction.

"Our development projects are all proceeding as planned. At Great Bear, we made excellent progress on our 2024 drilling campaign, which continued to successfully target extensions of the resource at depth, and we remain on track to release a preliminary economic assessment( PEA) in the second half of the year. At Round Mountain, Phase S and Phase X are advancing well. We are also looking forward to first production at Manh Choh early in the third quarter. At Tasiast, our solar power plant is complete and generating power at full capacity.

"Kinross' commitment to Sustainability is deeply rooted in our values and culture, and we are proud of our consistent high rankings in our industry. We are looking forward to publishing our 2023 Sustainability Report later this month, marking our 16 th year of reporting in this important area."

Summary of financial and operating results

| | Three months ended |

| | March 31, |

| (unaudited, in millions of U.S. dollars, except ounces, per share amounts, and per ounce amounts) | 2024 | 2023 |

| Operating Highlights | | | |

| Total gold equivalent ounces (a) | | |

| Produced | | 527,399 | | 466,022 |

| Sold | | 522,400 | | 490,330 |

| | | |

| Financial Highlights | | | |

| Metal sales | | $ | 1,081.5 | $ | 929.3 |

| Production cost of sales | | $ | 512.9 | $ | 483.9 |

| Depreciation, depletion and amortization | | $ | 270.7 | $ | 211.9 |

| Operating earnings | | $ | 193.2 | $ | 143.9 |

| Net earnings attributable to common shareholders | | $ | 107.0 | $ | 90.2 |

| Basic earnings per share attributable to common shareholders | | $ | 0.09 | $ | 0.07 |

| Diluted earnings per share attributable to common shareholders | | $ | 0.09 | $ | 0.07 |

| Adjusted net earnings attributable to common shareholders (b) | | $ | 124.9 | $ | 87.6 |

| Adjusted net earnings per share (b) | | $ | 0.10 | $ | 0.07 |

| Net cash flow provided from operating activities | | $ | 374.4 | $ | 259.0 |

| Adjusted operating cash flow (b) | | $ | 424.9 | $ | 358.2 |

| Capital expenditures (c) | | $ | 241.9 | $ | 221.2 |

| Attributable (d) capital expenditures (b) | | $ | 232.1 | $ | 211.8 |

| Attributable (d) free cash flow (b) | | $ | 145.3 | $ | 47.8 |

| Average realized gold price per ounce (e) | | $ | 2,070 | $ | 1,894 |

| Production cost of sales per equivalent ounce (a) sold (f)(g) | | $ | 982 | $ | 987 |

| Production cost of sales per ounce sold on a by-product basis (b)(g) | | $ | 941 | $ | 929 |

| All-in sustaining cost per ounce sold on a by-product basis (b)(g) | | $ | 1,281 | $ | 1,284 |

| All-in sustaining cost per equivalent ounce (a) sold (b)(g) | | $ | 1,310 | $ | 1,321 |

| Attributable (d) all-in cost per ounce sold on a by-product basis (b) | | $ | 1,613 | $ | 1,616 |

| Attributable (d) all-in cost per equivalent ounce (a) sold (b) | | $ | 1,630 | $ | 1,634 |

| (a) | | "Gold equivalent ounces" include silver ounces produced and sold converted to a gold equivalent based on a ratio of the average spot market prices for the commodities for each period. The ratio for the first quarter of 2024 was 88.70:1 (first quarter of 2023 – 83.82:1). |

| (b) | | The definition and reconciliation of these non-GAAP financial measures and ratios is included on pages 16 to 21 of this news release. Non-GAAP financial measures and ratios have no standardized meaning under IFRS and therefore, may not be comparable to similar measures presented by other issuers. |

| (c) | | "Capital expenditures" is as reported as "Additions to property, plant and equipment" on the interim condensed consolidated statements of cash flows. |

| (d) | | "Attributable" includes Kinross' 70% share of Manh Choh costs, capital expenditures and cash flow, as appropriate. |

| (e) | | "Average realized gold price per ounce" is defined as gold metal sales divided by total gold ounces sold. |

| (f) | | "Production cost of sales per equivalent ounce sold" is defined as production cost of sales divided by total gold equivalent ounces sold. |

| (g) | | As production from Manh Choh is expected to commence in the third quarter of 2024, production cost of sales and attributable all-in sustaining cost figures and ratios for Manh Choh are nil for all periods presented. As a result, production cost of sales and all-in sustaining cost figures and ratios are equal to attributable production cost of sales and attributable all-in sustaining cost figures and ratios, as applicable. |

| | |

The following operating and financial results are based on first-quarter gold equivalent production:

Production : Kinross produced 527,399 Au eq. oz. in Q1 2024, compared with 466,022 Au eq. oz. in Q1 2023. The 13% year-over-year increase was primarily due to higher throughput at Tasiast, higher grades at La Coipa, and higher production at Bald Mountain due to timing of ounces recovered from the heap leach pads.

Average realized gold price 10 : The average realized gold price in Q1 2024 was $2,070 per ounce, compared with $1,894 per ounce in Q1 2023.

Revenue : During the first quarter, revenue increased to $1,081.5 million, compared with $929.3 million during Q1 2023. The 16% year-over-year increase is primarily due to increases in gold equivalent ounces sold and average metal prices realized.

Production cost of sales : Production cost of sales per Au eq. oz. sold 1 , 2 decreased slightly to $982 for the quarter, compared with $987 in Q1 2023.

Production cost of sales per Au oz. sold on a by-product basis 2 , 3 was $941 in Q1 2024, compared with $929 in Q1 2023, based on gold sales of 503,604 ounces and silver sales of 1,667,248 ounces.

Margins 4 : Kinross' margin per Au eq. oz. sold increased by 20% to $1,088 for Q1 2024, compared with the Q1 2023 margin of $907, outpacing the 9% increase in average realized gold price 10 .

All-in sustaining cost 2 , 3 : All-in sustaining cost per Au eq. oz. sold was $1,310 in Q1 2024, compared with $1,321 in Q1 2023.

In Q1 2024, all-in sustaining cost per Au oz. sold on a by-product basis was $1,281, compared with $1,284 in Q1 2023.

Operating cash flow 5 : Operating cash flow was $374.4 million for Q1 2024, compared with $259.0 million for Q1 2023.

Adjusted operating cash flow 3 for Q1 2024 was $424.9 million, compared with $358.2 million for Q1 2023.

Attributable 6 free cash flow 3 : Attributable free cash flow more than tripled to $145.3 million in Q1 2024, compared with $47.8 million in Q1 2023.

Earnings : Reported net earnings 7 increased by 19% to $107.0 million for Q1 2024, or $0.09 per share, compared with reported net earnings of $90.2 million, or $0.07 per share, for Q1 2023.

Adjusted net earnings 3 , 8 increased by 43% to $124.9 million, or $0.10 per share, for Q1 2024, compared with $87.6 million, or $0.07 per share, for Q1 2023.

Attributable 6 capital expenditures 3 : Attributable capital expenditures increased to $232.1 million for Q1 2024, compared with $211.8 million for Q1 2023, primarily due to an increase in capital stripping at Tasiast and Fort Knox 11 , as well as the start of Phase S capital development at Round Mountain, partially offset by a decrease in capital stripping at La Coipa.

Balance sheet

Kinross had cash and cash equivalents of $406.9 million as of March 31, 2024, compared with $352.4 million at December 31, 2023. The increase was primarily due to the increase in operating cash flow.

Kinross has improved its debt metrics and continues to prioritize maintaining and strengthening its investment grade balance sheet. Kinross plans to further reduce debt during the year by allocating excess free cash generated towards the term loan due in 2025.

The Company had additional available credit 12 of $1.6 billion and total liquidity 9 of approximately $2 billion as of March 31, 2024.

Dividend

As part of its continuing quarterly dividend program, the Company declared a dividend of $0.03 per common share payable on June 13, 2024, to shareholders of record as of May 30, 2024.

Operating results

Mine-by-mine summaries for 2024 first-quarter operating results may be found on pages 10 and 14 of this news release. Highlights include the following:

At Tasiast , production was in line with the previous quarter, and was higher year-over-year mainly due to record quarterly throughput following the completion of the Tasiast 24k project in the second half of 2023, partly offset by lower grades, as planned. Cost of sales per ounce sold was largely in line quarter-over-quarter, and lower year-over-year mainly due to the higher ounces sold.

Paracatu delivered according to plan, with production largely in line with the previous quarter, and higher year-over-year mainly due to an increase in throughput, partly offset by lower grades as a result of planned mine sequencing. Cost of sales per ounce sold decreased quarter-over-quarter primarily due to lower maintenance, labour and contractor costs. Year-over-year, cost of sales per ounce sold increased mainly due to an increase in labour, drilling, blasting and fuel costs related to an increase in tonnes mined.

At La Coipa , production was slightly lower than the previous quarter mainly as a result of a decrease in throughput, which was offset by higher grades and recoveries. Production increased compared with the same period last year primarily due to an increase in gold grades, and an increase in mill throughput. Cost of sales per ounce sold was largely in line with both comparable periods.

At Fort Knox 1 1 , production was lower quarter-over-quarter due to lower mill grade, throughput and recovery, and the seasonal effect of fewer ounces recovered from the heap leach pads. Year-over-year, production was lower due to lower mill grade, throughput and recovery. In both comparable periods, cost of sales per ounce sold was higher primarily due to lower production.

Round Mountain performed well, with production increasing quarter-over-quarter due to higher mill throughput, grade, and recoveries, partially offset by fewer ounces recovered from the heap leach pads. The increase in production compared to Q1 2023 was primarily due to higher mill grade and throughput, partially offset by lower mill recovery and fewer ounces recovered from the heap leach pads. In both comparable periods, cost of sales per ounce sold was lower due to the increase in production as well as an increase in capital development related to the start of stripping Phase S.

At Bald Mountain , production increased in both comparable periods mainly due to an increase in ounces recovered from the heap leach pads. Cost of sales per ounce sold was lower quarter-over-quarter mainly as a result of a higher proportion of capital development, and similarly, lower year-over-year due to a higher proportion of capital development as well as higher production.

Development Projects and Exploration

Great Bear

At the Great Bear project, the Company's robust exploration program continues to make excellent progress, execution planning for the advanced exploration program is well underway, and permitting continues to advance on plan.

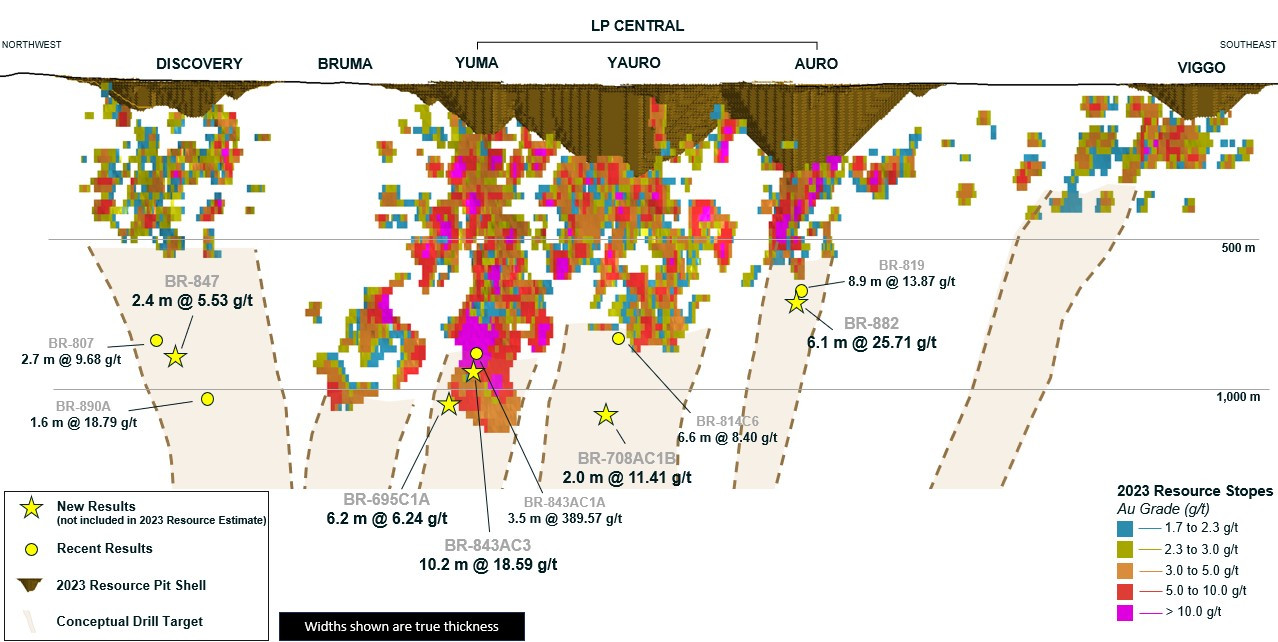

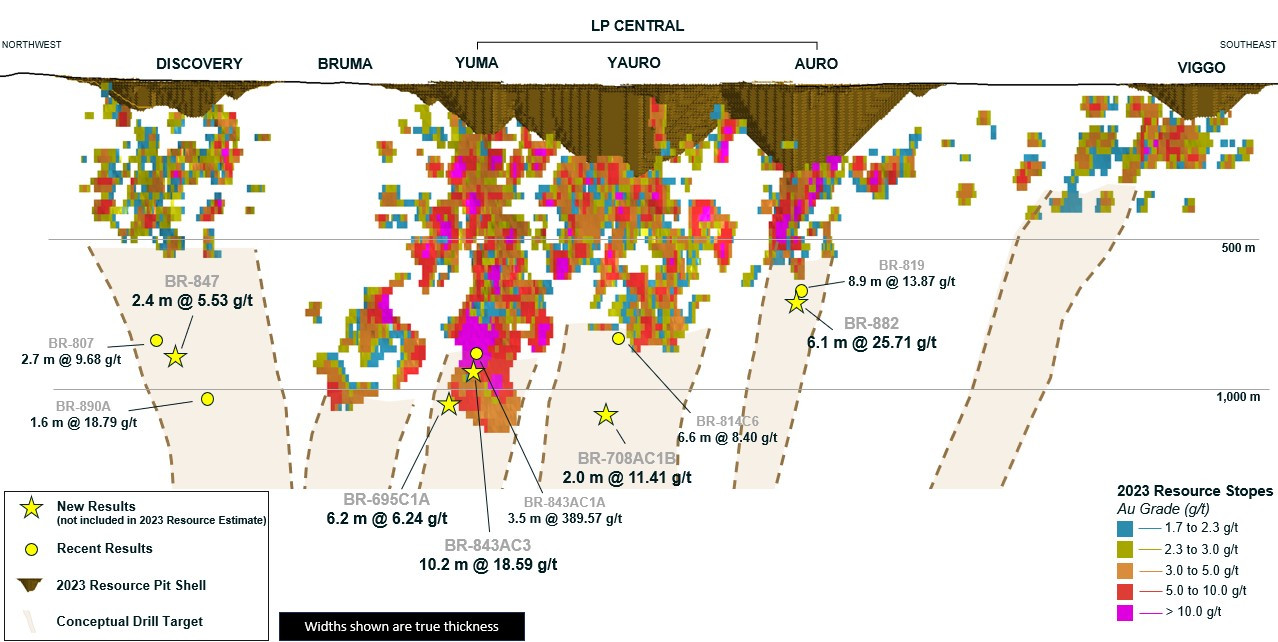

The drilling results below (at true width) continue to support the view of a high-grade, long-life mining complex at Great Bear, with recent results showing extension of mineralization at depth across multiple zones.

At Yuma, results continue to intersect higher grade mineralization at depth in close proximity to the current resource, with holes BR-843AC3 and BR-695C1A intersecting 10.2m @ 18.59 g/t at 975m vertical depth and 6.2m @ 6.24 g/t at 1,085m vertical depth, respectively.

At Yauro, BR-708AC1B intersected 2.0m @ 11.41 g/t at a vertical depth of 1,095m well below the current resources, showing the potential for Yauro to continue to expand at depth with high grade mineralization, similar to how depth extensions progressed with continued drilling at Yuma.

At Auro, recent drilling also intersected high grade mineralization with a minable width below the current resources with hole BR-882 intersecting 6.1m @ 25.71 g/t at a vertical depth of 720m.

At Discovery to the northwest, hole BR-847 has intersected 2.4m @ 5.53 g/t at 870m in the under-tested area beneath the current resource, demonstrating continuity of mineralization between previously reported drill holes. The 2024 drill program will continue to target mineralization below the existing mineral resource, explore for additional deposits along strike, and expand our Red Lake style mineralization at Hinge and Limb.

For the Advanced Exploration (AEX) program, Kinross is progressing provincial permitting, engineering, and execution planning activities that would establish an underground decline to obtain a bulk sample and allow for definition and infill drilling in the LP zone. Kinross has the necessary surface rights to develop the AEX project, subject to obtaining the required provincial permits.

Detailed engineering, execution planning, and procurement continue to progress well. Some required infrastructure such as the camp and water treatment plant have now been purchased.

Kinross is targeting a start of the surface construction for the AEX program in the second half of 2024, subject to receipt of permits, with start of the underground decline planned in mid-2025.

For the Main Project, Kinross continues to advance technical studies, including engineering and field test work campaigns. In the last quarter, substantial geotechnical field work was conducted to help de-risk project construction through strong early technical studies.

Kinross remains on track to release a PEA in the second half of 2024. Kinross has opted to pursue a PEA as it enables the inclusion of a portion of the inferred underground resource. This provides visibility into the potential production scale, construction capital, all-in sustaining cost and margins for both the open pit and the underground. The PEA will only include a subset of the ounces in the measured, indicated, and inferred resources drilled to date.

The Detailed Project Description for the Main Project was submitted to the Impact Assessment Agency of Canada in Q1 2024, as planned, and the Federal Impact Assessment is underway. Studies are ongoing and the Company expects to file its Impact Statement in the first half of 2025.

Selected Great Bear Drill Results

See Appendix A for full results.

Hole ID

| | From

(m) | To

(m) | Width

(m) | True Width

(m) | Au

(g/t) | Target

|

| BR-695C1A | | 1,324.7 | 1,333.0 | 8.3 | 7.3 | 5.35 | Yuma |

| BR-695C1A | Including | 1,324.7 | 1,331.7 | 7.0 | 6.2 | 6.24 | |

| BR-695C1A | | 1,441.2 | 1,444.2 | 3.0 | 2.6 | 0.58 | |

| BR-695C1A | | 1,469.0 | 1,517.5 | 48.5 | 42.7 | 0.86 | |

| BR-695C1A | Including | 1,502.6 | 1,506.3 | 3.7 | 2.8 | 4.49 | |

| BR-695C1A | | 1,524.5 | 1,537.8 | 13.3 | 11.3 | 0.81 | |

| BR-708AC1B | | 1,271.7 | 1,276.7 | 5.0 | 4.5 | 0.64 | Yauro |

| BR-708AC1B | | 1,319.9 | 1,323.7 | 3.8 | 3.4 | 0.50 | |

| BR-708AC1B | | 1,376.2 | 1,441.7 | 65.5 | 59.0 | 0.96 | |

| BR-708AC1B | Including | 1,438.7 | 1,441.1 | 2.4 | 2.0 | 11.41 | |

| BR-843AC3 | | 1,256.3 | 1,259.8 | 3.5 | 2.7 | 0.68 | Yuma |

| BR-843AC3 | | 1,354.7 | 1,395.0 | 40.3 | 36.3 | 5.65 | |

| BR-843AC3 | | 1,377.4 | 1,388.8 | 11.3 | 10.2 | 18.59 | |

| BR-843AC3 | | 1,509.7 | 1,513.7 | 4.0 | 3.5 | 3.39 | |

| BR-847 | | 934.7 | 950.0 | 15.3 | 13.0 | 2.08 | Discovery |

| BR-847 | Including | 934.7 | 937.5 | 2.8 | 2.4 | 5.21 | |

| BR-847 | | 975.0 | 992.5 | 17.5 | 14.9 | 0.85 | |

| BR-847 | | 998.8 | 1,001.8 | 3.0 | 2.6 | 0.48 | |

| BR-847 | | 1,027.2 | 1,036.1 | 8.9 | 7.8 | 1.54 | |

| BR-847 | | 1,048.5 | 1,051.5 | 3.0 | 2.7 | 0.35 | |

| BR-847 | | 1,052.9 | 1,080.0 | 27.1 | 24.4 | 1.38 | |

| BR-847 | Including | 1,063.6 | 1,066.3 | 2.7 | 2.4 | 5.53 | |

| BR-882 | | 953.0 | 957.5 | 4.5 | 3.7 | 0.45 | Auro |

| BR-882 | | 1,015.2 | 1,022.4 | 7.2 | 6.1 | 25.71 | |

| BR-882 | Including | 1,017.5 | 1,019.4 | 1.9 | 1.6 | 95.27 | |

Results are preliminary in nature and are subject to on-going QA/QC. Lengths are subject to rounding.

See Appendix B for a LP zone long section.

Fort Knox

At the Kinross-operated, 70%-owned Manh Choh project, the Company is on track for first production in early Q3 2024. Ore and waste mining are ongoing with the full mining fleet now in operation as planned. Following several months of orientation runs, transportation of ore to Fort Knox, where the ore will be processed, continues to ramp up with all contracted trucks received, the majority of the drivers onboarded, and trailer manufacturing now complete.

At Fort Knox, mill modifications and site preparation remain on plan, including the completion of the ore delivery road and tie-ins for the pebble recycle conveyor. Building construction is advancing well, along with interior piping and electrical works.

Round Mountain

The extension strategy at Round Mountain is advancing well. At Phase S , mining is on plan. For the heap leach pad expansion, earthworks began during the quarter, procurement is advancing as expected and construction activities remain on track.

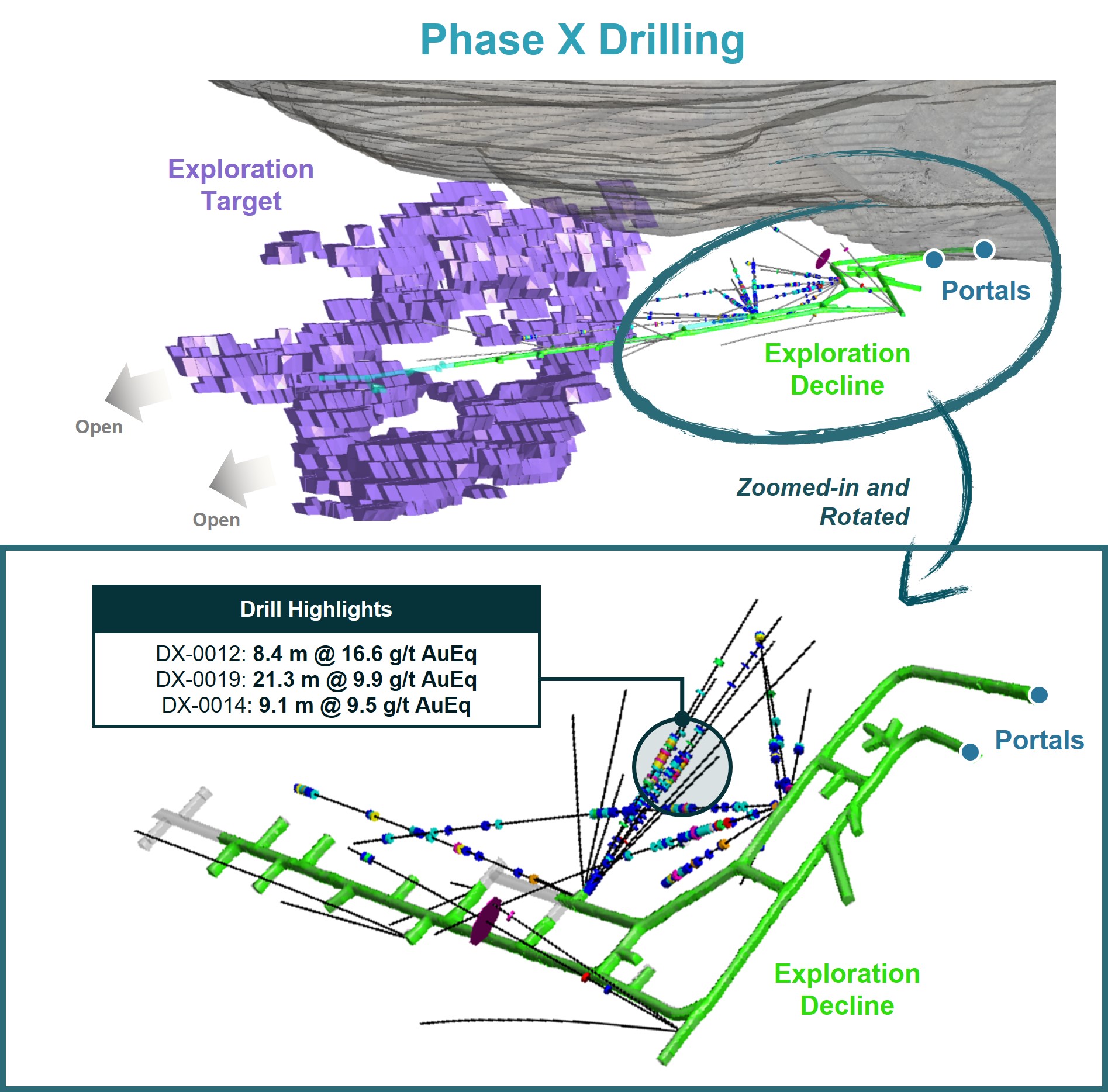

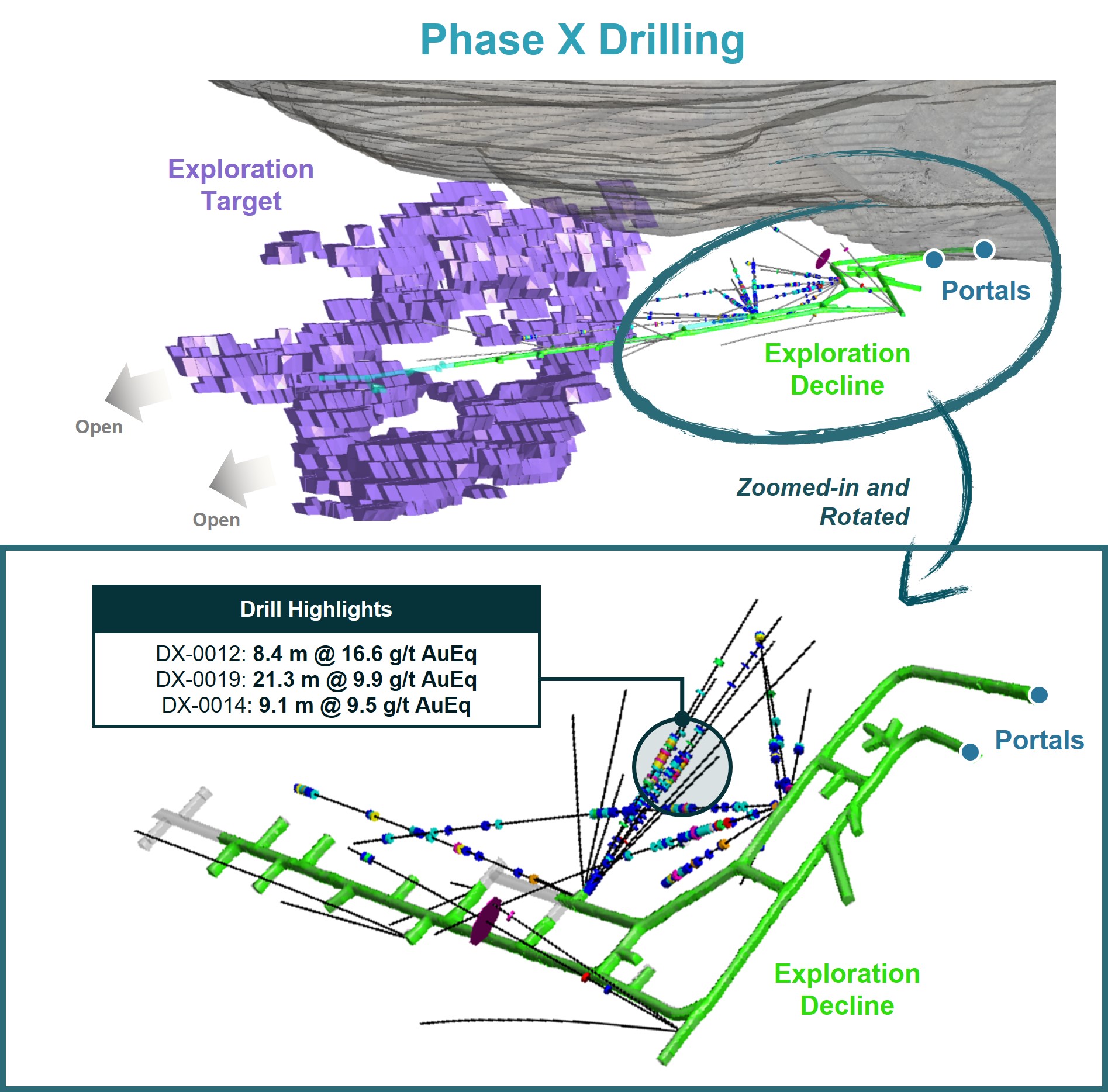

At Phase X , development of the exploration decline is progressing well, with over 1,800 metres developed to date. The decline has now progressed to the point that infill drilling of the primary Phase X target can commence in Q2 2024, as planned.

The Company also took the opportunity, as the decline was advancing, to perform exploration drilling in between the open pit and the underground target. This drilling 13 has intersected high-grade mineralization with significant widths in this area outside of the primary Phase X target, which is also an area that did not have significant historic drilling, as highlighted below:

- DX-0012: 8.4m @ 16.6 g/t Au Eq

- DX-0019: 21.3m @ 9.9 g/t Au Eq

- DX-0014: 9.1m @ 9.5 g/t Au Eq

These results show potential for expansion of the target area for mineralization and for potential future mining at Phase X (see Appendix C).

At Gold Hill , infill drilling of the underground targets is being completed from the bottom of the historical pit and exploration drilling is being completed from surface, testing continuity and extensions at depth and on strike.

Chile

Kinross' activities in Chile are currently focused on La Coipa and potential opportunities to extend its mine life. The Lobo-Marte project continues to provide optionality as a potential large, low-cost mine upon the conclusion of mining at La Coipa. While the Company focuses its technical resources on La Coipa, it will continue to engage and build relationships with communities related to Lobo-Marte and government stakeholders.

Curlew Basin exploration

At Curlew, Kinross is working on optimizing the potential mine design with a focus on improving the efficiency and margin of potential underground mining. The Company continues to progress underground drilling to follow up on recent high-grade intersections at the Roadrunner and Stealth vein zones, and has intersected multiple zones of stockwork veining with assays pending.

Conference call details

In connection with this news release, Kinross will hold a conference call and audio webcast on Wednesday, May 8, 2024, at 7:45 a.m. EDT to discuss the results, followed by a question-and-answer session. To access the call, please dial:

Canada & US toll-free – 1 (888) 330-2446; Passcode: 4915537

Outside of Canada & US – 1 (240) 789-2732; Passcode: 4915537

Replay (available up to 14 days after the call):

Canada & US toll-free – 1 (800) 770-2030; Passcode: 4915537

Outside of Canada & US – 1 (647) 362-9199; Passcode: 4915537

You may also access the conference call on a listen-only basis via webcast at our website www.kinross.com . The audio webcast will be archived on www.kinross.com .

Virtual Annual Meeting of Shareholders

Kinross' virtual Annual Meeting of Shareholders will be held on Wednesday, May 8, 2024, at 10:00 a.m. EDT.

The virtual meeting will be accessible online at: web.lumiagm.com/#/429018094 . The link to the virtual meeting will also be accessible at www.kinross.com and will be archived for later use.

Voting and participation instructions for eligible shareholders are provided in the Company's Notice of Annual Meeting of Shareholders and Management Information Circular .

This release should be read in conjunction with Kinross' 2024 first-quarter unaudited Financial Statements and Management's Discussion and Analysis report at www.kinross.com. Kinross' 2024 first-quarter Financial Statements and Management's Discussion and Analysis have been filed with Canadian securities regulators (available at www.sedarplus.ca ) and furnished with the U.S. Securities and Exchange Commission (available at www.sec.gov ). Kinross shareholders may obtain a copy of the financial statements free of charge upon request to the Company.

About Kinross Gold Corporation

Kinross is a Canadian-based global senior gold mining company with operations and projects in the United States, Brazil, Mauritania, Chile and Canada. Our focus is on delivering value based on the core principles of responsible mining, operational excellence, disciplined growth, and balance sheet strength. Kinross maintains listings on the Toronto Stock Exchange (symbol: K) and the New York Stock Exchange (symbol: KGC).

Media Contact

Victoria Barrington

Senior Director, Corporate Communications

phone: 647-788-4153

victoria.barrington@kinross.com

Investor Relations Contact

Chris Lichtenheldt

Vice-President, Investor Relations

phone: 416-365-2761

chris.lichtenheldt@kinross.com

Review of operations

| | | | | | | | | | | |

| Three months ended March 31, (unaudited) | | Gold equivalent ounces | | | | | | | |

| Produced | | Sold | | Production cost of sales

($millions) | | Production cost of

sales/equivalent ounce sold |

| 2024 | 2023 | | 2024 | 2023 | | 2024 | 2023 | | 2024 | 2023 |

| | | | | | | | | | | |

| Tasiast | 159,199 | 131,045 | | 151,014 | 128,479 | | 99.7 | 88.4 | | 660 | 688 |

| Paracatu | 128,273 | 123,334 | | 128,110 | 128,344 | | 135.7 | 118.0 | | 1,059 | 919 |

| La Coipa | 71,245 | 53,596 | | 71,125 | 61,780 | | 52.1 | 44.9 | | 733 | 727 |

| | | | | | | | | | | |

| Fort Knox | 53,350 | 65,387 | | 56,292 | 65,404 | | 82.5 | 77.6 | | 1,466 | 1,186 |

| Round Mountain | 68,352 | 58,832 | | 68,169 | 58,226 | | 90.6 | 96.5 | | 1,329 | 1,657 |

| Bald Mountain | 46,980 | 33,828 | | 47,241 | 47,283 | | 52.1 | 58.0 | | 1,103 | 1,227 |

| United States Total | 168,682 | 158,047 | | 171,702 | 170,913 | | 225.2 | 232.1 | | 1,312 | 1,358 |

| | | | | | | | | | | |

| Maricunga | - | - | | 449 | 814 | | 0.2 | 0.5 | | 445 | 614 |

| | | | | | | | | | | |

| Operations Total | 527,399 | 466,022 | | 522,400 | 490,330 | | 512.9 | 483.9 | | 982 | 987 |

| | | | | | | | | | | |

Interim condensed consolidated balance sheets

| (unaudited, expressed in millions of U.S. dollars, except share amounts) | | | | | |

| | | | | |

| | As at | |

| | March 31, | | December 31, | |

| | 2024

| | 2023

| |

| | | | | |

| Assets | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | | $ | 406.9 | | | $ | 352.4 | | |

| Restricted cash | | | 10.3 | | | | 9.8 | | |

| Accounts receivable and other assets | | | 283.2 | | | | 268.7 | | |

| Current income tax recoverable | | | 2.7 | | | | 3.4 | | |

| Inventories | | | 1,117.7 | | | | 1,153.0 | | |

| Unrealized fair value of derivative assets | | | 10.9 | | | | 15.0 | | |

| | | 1,831.7 | | | | 1,802.3 | | |

| Non-current assets | | | | | |

| Property, plant and equipment | | | 7,942.4 | | | | 7,963.2 | | |

| Long-term investments | | | 49.4 | | | | 54.7 | | |

| Other long-term assets | | | 716.8 | | | | 710.6 | | |

| Deferred tax assets | | | 12.6 | | | | 12.5 | | |

| Total assets | | $ | 10,552.9 | | | $ | 10,543.3 | | |

| | | | | |

| Liabilities | | | | | |

| Current liabilities | | | | | |

| Accounts payable and accrued liabilities | | $ | 466.8 | | | $ | 531.5 | | |

| Current income tax payable | | | 68.6 | | | | 92.9 | | |

| Current portion of long-term debt and credit facilities | | | 999.3 | | | | - | | |

| Current portion of provisions | | | 47.0 | | | | 48.8 | | |

| Other current liabilities | | | 12.1 | | | | 12.3 | | |

| | | 1,593.8 | | | | 685.5 | | |

| Non-current liabilities | | | | | |

| Long-term debt and credit facilities | | | 1,234.0 | | | | 2,232.6 | | |

| Provisions | | | 893.9 | | | | 889.9 | | |

| Long-term lease liabilities | | | 16.4 | | | | 17.5 | | |

| Other long-term liabilities | | | 86.8 | | | | 82.4 | | |

| Deferred tax liabilities | | | 458.6 | | | | 449.7 | | |

| Total liabilities | | $ | 4,283.5 | | | $ | 4,357.6 | | |

| | | | | |

| Equity | | | | | |

| Common shareholders' equity | | | | | |

| Common share capital | | $ | 4,486.5 | | | $ | 4,481.6 | | |

| Contributed surplus | | | 10,640.3 | | | | 10,646.0 | | |

| Accumulated deficit | | | (8,912.5 | ) | | | (8,982.6 | ) | |

| Accumulated other comprehensive loss | | | (62.4 | ) | | | (61.3 | ) | |

| Total common shareholders' equity | | | 6,151.9 | | | | 6,083.7 | | |

| Non-controlling interests | | | 117.5 | | | | 102.0 | | |

| Total equity | | | 6,269.4 | | | | 6,185.7 | | |

| Total liabilities and equity | | $ | 10,552.9 | | | $ | 10,543.3 | | |

| | | | | |

| Common shares | | | | | |

| Authorized | | Unlimited

| | | Unlimited | | |

| Issued and outstanding | | | 1,228,982,701 | | | | 1,227,837,974 | | |

| | | | | |

Interim condensed consolidated statements of operations

| (unaudited, expressed in millions of U.S. dollars, except per share amounts) | | | | | |

| | Three months ended | |

| | March 31, | | March 31, | |

| | 2024

| | 2023

| |

| Revenue | | | | | |

| Metal sales | | $ | 1,081.5 | | | $ | 929.3 | | |

| | | | | |

| Cost of sales | | | | | |

| Production cost of sales | | | 512.9 | | | | 483.9 | | |

| Depreciation, depletion and amortization | | | 270.7 | | | | 211.9 | | |

| Total cost of sales | | | 783.6 | | | | 695.8 | | |

| Gross profit | | | 297.9 | | | | 233.5 | | |

| Other operating expense | | | 27.6 | | | | 31.2 | | |

| Exploration and business development | | | 41.7 | | | | 34.0 | | |

| General and administrative | | | 35.4 | | | | 24.4 | | |

| Operating earnings | | | 193.2 | | | | 143.9 | | |

| Other income - net | | | 0.1 | | | | 4.4 | | |

| Finance income | | | 3.9 | | | | 9.4 | | |

| Finance expense | | | (21.5 | ) | | | (27.5 | ) | |

| Earnings before tax | | | 175.7 | | | | 130.2 | | |

| Income tax expense - net | | | (69.1 | ) | | | (39.8 | ) | |

| Net earnings | | $ | 106.6 | | | $ | 90.4 | | |

| Net earnings (loss) attributable to: | | | | | |

| Non-controlling interests | | $ | (0.4 | ) | | $ | 0.2 | | |

| Common shareholders | | $ | 107.0 | | | $ | 90.2 | | |

| Earnings per share attributable to common shareholders | | | | | |

| Basic | | $ | 0.09 | | | $ | 0.07 | | |

| Diluted | | $ | 0.09 | | | $ | 0.07 | | |

Interim condensed consolidated statements of cash flows

| (unaudited, expressed in millions of U.S. dollars) | | | | | | |

| | | Three months ended | |

| | | March 31, | | March 31, | |

| | | 2024 | | 2023 | |

| Net inflow (outflow) of cash related to the following activities: | | | | | | |

| Operating: | | | | | | |

| Net earnings | | | $ | 106.6 | | | $ | 90.4 | | |

| Adjustments to reconcile net earnings to net cash provided from operating activities: | | | | | | |

| Depreciation, depletion and amortization | | | | 270.7 | | | | 211.9 | | |

| Finance expense | | | | 21.5 | | | | 27.5 | | |

| Deferred tax expense | | | | 8.6 | | | | 9.0 | | |

| Foreign exchange losses and other | | | | 17.5 | | | | 15.4 | | |

| Reclamation expense | | | | - | | | | 4.0 | | |

| Changes in operating assets and liabilities: | | | | | | |

| Accounts receivable and other assets | | | | 10.3 | | | | 20.0 | | |

| Inventories | | | | 5.9 | | | | (43.2 | ) | |

| Accounts payable and accrued liabilities | | | | 12.1 | | | | (5.8 | ) | |

| Cash flow provided from operating activities | | | | 453.2 | | | | 329.2 | | |

| Income taxes paid | | | | (78.8 | ) | | | (70.2 | ) | |

| Net cash flow provided from operating activities | | | | 374.4 | | | | 259.0 | | |

| Investing: | | | | | | |

| Additions to property, plant and equipment | | | | (241.9 | ) | | | (221.2 | ) | |

| Interest paid capitalized to property, plant and equipment | | | | (34.9 | ) | | | (38.3 | ) | |

| Net (additions) disposals to long-term investments and other assets | | | | (3.1 | ) | | | 15.3 | | |

| Increase in restricted cash - net | | | | (0.5 | ) | | | (0.8 | ) | |

| Interest received and other - net | | | | 3.9 | | | | 2.7 | | |

| Net cash flow of continuing operations used in investing activities | | | | (276.5 | ) | | | (242.3 | ) | |

| Net cash flow of discontinued operations provided from investing activities | | | | - | | | | 5.0 | | |

| Financing: | | | | | | |

| Proceeds from drawdown of debt | | | | - | | | | 100.0 | | |

| Interest paid | | | | (18.5 | ) | | | (24.2 | ) | |

| Payment of lease liabilities | | | | (3.4 | ) | | | (15.5 | ) | |

| Funding from non-controlling interest | | | | 15.5 | | | | 5.1 | | |

| Dividends paid to common shareholders | | | | (36.9 | ) | | | (36.8 | ) | |

| Other - net | | | | 0.3 | | | | 2.1 | | |

| Net cash flow (used in) provided from financing activities | | | | (43.0 | ) | | | 30.7 | | |

| Effect of exchange rate changes on cash and cash equivalents | | | | (0.4 | ) | | | 0.5 | | |

| Increase in cash and cash equivalents | | | | 54.5 | | | | 52.9 | | |

| Cash and cash equivalents, beginning of period | | | | 352.4 | | | | 418.1 | | |

| Cash and cash equivalents, end of period | | | $ | 406.9 | | | $ | 471.0 | | |

| | | | | | |

Operating Summary

|

| Mine | Period | Tonnes Ore Mined | Ore

Processed (Milled) | Ore

Processed (Heap Leach) | Grade

(Mill) | Grade

(Heap Leach) | Recovery

(a)(b) | Gold Eq Production (c) | Gold Eq Sales (c) | Production

cost of sales | Production

cost of sales/oz (d) | Cap Ex - sustaining (e) | Total Cap Ex (e) | DD&A |

| | | ('000 tonnes) | ('000 tonnes) | ('000 tonnes) | (g/t) | (g/t) | (%) | (ounces) | (ounces) | ($ millions) | ($/ounce) | ($ millions) | ($ millions) | ($ millions) |

West Africa

| Tasiast

| Q1 2024 | 2,044 | 2,073 | - | 2.46 | - | 91 % | 159,199 | 151,014 | $ | 99.7 | $ | 660 | $ | 10.1 | $ | 79.5 | $ | 77.9 |

| Q4 2023 | 2,937 | 2,056 | - | 3.04 | - | 93% | 160,764 | 171,199 | $ | 110.4 | $ | 645 | $ | 9.7 | $ | 85.2 | $ | 70.6 |

| Q3 2023 | 3,486 | 1,796 | - | 3.10 | - | 92% | 171,140 | 162,823 | $ | 108.5 | $ | 666 | $ | 12.2 | $ | 77.3 | $ | 69.0 |

| Q2 2023 | 1,688 | 1,663 | - | 3.25 | - | 93% | 157,844 | 152,564 | $ | 99.5 | $ | 652 | $ | 9.1 | $ | 81.9 | $ | 58.6 |

| Q1 2023 | 1,690 | 1,208 | - | 3.49 | - | 91% | 131,045 | 128,479 | $ | 88.4 | $ | 688 | $ | 14.6 | $ | 64.6 | $ | 46.2 |

Americas

| Paracatu

| Q1 2024 | 14,078 | 15,609 | - | 0.31 | - | 79 % | 128,273 | 128,110 | $ | 135.7 | $ | 1,059 | $ | 19.6 | $ | 19.6 | $ | 46.7 |

| Q4 2023 | 16,865 | 15,279 | - | 0.35 | - | 79% | 127,940 | 132,886 | $ | 144.2 | $ | 1,085 | $ | 41.6 | $ | 41.6 | $ | 43.3 |

| Q3 2023 | 14,725 | 14,669 | - | 0.41 | - | 79% | 172,482 | 167,105 | $ | 141.2 | $ | 845 | $ | 58.4 | $ | 58.4 | $ | 53.1 |

| Q2 2023 | 14,199 | 15,104 | - | 0.42 | - | 80% | 164,243 | 163,889 | $ | 135.2 | $ | 825 | $ | 39.7 | $ | 39.7 | $ | 49.8 |

| Q1 2023 | 8,056 | 15,130 | - | 0.37 | - | 79% | 123,334 | 128,344 | $ | 118.0 | $ | 919 | $ | 27.8 | $ | 27.8 | $ | 40.4 |

La Coipa (f)

| Q1 2024 | 1,035 | 827 | - | 2.09 | - | 87 % | 71,245 | 71,125 | $ | 52.1 | $ | 733 | $ | 7.2 | $ | 7.2 | $ | 50.0 |

| Q4 2023 | 1,591 | 1,188 | - | 1.92 | - | 78% | 73,823 | 73,477 | $ | 52.9 | $ | 720 | $ | 7.0 | $ | 10.9 | $ | 54.8 |

| Q3 2023 | 1,137 | 1,017 | - | 1.69 | - | 81% | 65,975 | 65,856 | $ | 41.4 | $ | 629 | $ | 7.5 | $ | 15.2 | $ | 48.3 |

| Q2 2023 | 869 | 971 | - | 1.62 | - | 81% | 66,744 | 67,378 | $ | 43.6 | $ | 647 | $ | 19.9 | $ | 23.3 | $ | 48.3 |

| Q1 2023 | 748 | 691 | - | 1.68 | - | 88% | 53,596 | 61,780 | $ | 44.9 | $ | 727 | $ | 1.6 | $ | 25.4 | $ | 36.4 |

Fort Knox

(100%) ( g)

| Q1 2024 | 10,037 | 1,850 | 8,778 | 0.67 | 0.24 | 76 % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 78.6 | $ | 20.5 |

| Q4 2023 | 11,018 | 2,173 | 9,930 | 0.69 | 0.22 | 78% | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 114.3 | $ | 31.5 |

| Q3 2023 | 6,667 | 1,912 | 5,961 | 0.81 | 0.21 | 78% | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 96.0 | $ | 24.6 |

| Q2 2023 | 7,624 | 2,075 | 6,837 | 0.82 | 0.24 | 82% | 69,438 | 69,206 | $ | 79.3 | $ | 1,146 | $ | 52.1 | $ | 90.3 | $ | 22.1 |

| Q1 2023 | 7,412 | 1,966 | 5,972 | 0.78 | 0.22 | 82% | 65,387 | 65,404 | $ | 77.6 | $ | 1,186 | $ | 38.6 | $ | 67.8 | $ | 18.6 |

Fort Knox

(attributable) (g)

| Q1 2024 | 10,009 | 1,850 | 8,778 | 0.67 | 0.24 | 76 % | 53,350 | 56,292 | $ | 82.5 | $ | 1,466 | $ | 37.7 | $ | 68.8 | $ | 20.5 |

| Q4 2023 | 11,014 | 2,173 | 9,930 | 0.69 | 0.22 | 78% | 84,215 | 81,306 | $ | 104.3 | $ | 1,283 | $ | 50.6 | $ | 100.7 | $ | 31.5 |

| Q3 2023 | 6,667 | 1,912 | 5,961 | 0.81 | 0.21 | 78% | 71,611 | 71,616 | $ | 82.3 | $ | 1,149 | $ | 52.1 | $ | 84.5 | $ | 24.6 |

| Q2 2023 | 7,624 | 2,075 | 6,837 | 0.82 | 0.24 | 82% | 69,438 | 69,206 | $ | 79.3 | $ | 1,146 | $ | 52.1 | $ | 81.5 | $ | 22.1 |

| Q1 2023 | 7,412 | 1,966 | 5,972 | 0.78 | 0.22 | 82% | 65,387 | 65,404 | $ | 77.6 | $ | 1,186 | $ | 38.6 | $ | 58.4 | $ | 18.6 |

Round Mountain

| Q1 2024 | 4,246 | 960 | 3,257 | 1.32 | 0.37 | 73 % | 68,352 | 68,169 | $ | 90.6 | $ | 1,329 | $ | 3.7 | $ | 19.3 | $ | 47.3 |

| Q4 2023 | 4,666 | 884 | 2,729 | 0.91 | 0.48 | 68% | 55,764 | 56,495 | $ | 82.6 | $ | 1,462 | $ | 4.6 | $ | 4.8 | $ | 45.0 |

| Q3 2023 | 8,474 | 911 | 7,644 | 0.75 | 0.38 | 75% | 63,648 | 61,931 | $ | 93.1 | $ | 1,503 | $ | 7.7 | $ | 7.8 | $ | 44.1 |

| Q2 2023 | 10,496 | 1,021 | 10,028 | 0.67 | 0.35 | 76% | 57,446 | 57,412 | $ | 85.5 | $ | 1,489 | $ | 10.5 | $ | 10.5 | $ | 33.5 |

| Q1 2023 | 5,019 | 878 | 4,367 | 0.81 | 0.44 | 79% | 58,832 | 58,226 | $ | 96.5 | $ | 1,657 | $ | 7.4 | $ | 7.4 | $ | 34.6 |

Bald Mountain

| Q1 2024 | 1,480 | - | 1,480 | - | 0.42 | nm | 46,980 | 47,241 | $ | 52.1 | $ | 1,103 | $ | 32.4 | $ | 32.4 | $ | 27.0 |

| Q4 2023 | 3,894 | - | 3,918 | - | 0.47 | nm | 44,007 | 49,375 | $ | 57.1 | $ | 1,156 | $ | 36.3 | $ | 38.8 | $ | 25.0 |

| Q3 2023 | 7,412 | - | 7,412 | - | 0.39 | nm | 40,593 | 41,300 | $ | 53.9 | $ | 1,305 | $ | 20.6 | $ | 24.9 | $ | 23.3 |

| Q2 2023 | 4,142 | - | 4,119 | - | 0.42 | nm | 39,321 | 42,181 | $ | 54.5 | $ | 1,292 | $ | 16.5 | $ | 31.4 | $ | 25.6 |

| Q1 2023 | 1,864 | - | 1,857 | - | 0.47 | nm | 33,828 | 47,283 | $ | 58.0 | $ | 1,227 | $ | 6.1 | $ | 25.2 | $ | 33.9 |

| (a) | | Due to the nature of heap leach operations, recovery rates at Bald Mountain cannot be accurately measured on a quarterly basis. Recovery rates at Fort Knox and Round Mountain represent mill recovery only. |

| (b) | | "nm" means not meaningful. |

| (c) | | Gold equivalent ounces include silver ounces produced and sold converted to a gold equivalent based on the ratio of the average spot market prices for the commodities for each period. The ratios for the quarters presented are as follows: Q1 2024: 88.70:1; Q4 2023: 85.00:1; Q3 2023: 81.82:1; Q2 2023: 81.88:1; Q1 2023: 83.82:1. |

| (d) | | "Production cost of sales per equivalent ounce sold" is defined as production cost of sales divided by total gold equivalent ounces sold. |

| (e) | | "Total Cap Ex" is as reported as "Additions to property, plant and equipment" on the interim condensed consolidated statements of cash flows. "Cap Ex - sustaining" is a non-GAAP financial measure. The definition and reconciliation of this non-GAAP financial measure is included on pages 20 and 21 of this news release. |

| (f) | | La Coipa silver grade and recovery were as follows: Q1 2024: 87.20 g/t, 58%; Q4 2023: 96.24 g/t, 44%; Q3 2023: 106.70 g/t, 63%; Q2 2023: 109.84 g/t, 56%; Q1 2023: 125.77 g/t, 70%. |

| (g) | | The Fort Knox segment is composed of Fort Knox and Manh Choh, and comparative results shown are presented in accordance with the current year's presentation. Manh Choh tonnes of ore processed and grade were nil for all periods presented as production is expected to commence in the third quarter of 2024. The attributable results for Fort Knox include 100% of Fort Knox and 70% of Manh Choh. |

| | |

Reconciliation of non-GAAP financial measures and ratios

The Company has included certain non-GAAP financial measures and ratios in this document. These financial measures and ratios are not defined under IFRS and should not be considered in isolation. The Company believes that these financial measures and ratios, together with financial measures and ratios determined in accordance with IFRS, provide investors with an improved ability to evaluate the underlying performance of the Company. The inclusion of these financial measures and ratios is meant to provide additional information and should not be used as a substitute for performance measures prepared in accordance with IFRS. These financial measures and ratios are not necessarily standard and therefore may not be comparable to other issuers.

Adjusted Net Earnings Attributable to Common Shareholders and Adjusted Net Earnings per Share

Adjusted net earnings attributable to common shareholders and adjusted net earnings per share are non-GAAP financial measures and ratios which determine the performance of the Company, excluding certain impacts which the Company believes are not reflective of the Company's underlying performance for the reporting period, such as the impact of foreign exchange gains and losses, reassessment of prior year taxes and/or taxes otherwise not related to the current period, impairment charges (reversals), gains and losses and other one-time costs related to acquisitions, dispositions and other transactions, and non-hedge derivative gains and losses. Although some of the items are recurring, the Company believes that they are not reflective of the underlying operating performance of its current business and are not necessarily indicative of future operating results. Management believes that these measures and ratios, which are used internally to assess performance and in planning and forecasting future operating results, provide investors with the ability to better evaluate underlying performance, particularly since the excluded items are typically not included in public guidance. However, adjusted net earnings and adjusted net earnings per share measures and ratios are not necessarily indicative of net earnings and earnings per share measures and ratios as determined under IFRS.

The following table provides a reconciliation of net earnings to adjusted net earnings for the periods presented:

| | | |

(unaudited, expressed in millions of U.S. dollars,

except per share amounts)

| Three months ended |

| March 31, |

| | 2024

| 2023

|

| | | |

| Net earnings attributable to common shareholders - as reported | $ | 107.0 | | $ | 90.2 | |

| Adjusting items: | | |

| Foreign exchange gains | | (3.5 | ) | | (3.8 | ) |

| Foreign exchange losses (gains) on translation of tax basis and foreign exchange on deferred income taxes within income tax expense | | 4.0 | | | (13.2 | ) |

| Taxes in respect of prior periods | | 8.0 | | | 12.0 | |

| Other (a) | | 10.5 | | | 2.8 | |

| Tax effects of the above adjustments | | (1.1 | ) | | (0.4 | ) |

| | | 17.9 | | | (2.6 | ) |

| Adjusted net earnings attributable to common shareholders | $ | 124.9 | | $ | 87.6 | |

| Weighted average number of common shares outstanding - Basic | | 1,228.3 | | | 1,225.0 | |

| Adjusted net earnings per share | $ | 0.10 | | $ | 0.07 | |

| Basic earnings per share attributable to common shareholders - as reported | $ | 0.09 | | $ | 0.07 | |

| | | |

| (a) | | Other includes various impacts, such as one-time costs at sites, restructuring costs, and gains and losses on hedges and the sale of assets, which the Company believes are not reflective of the Company's underlying performance for the reporting period. |

| | |

Attributable Free Cash Flow

Attributable free cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities less attributable capital expenditures and non-controlling interest included in net cash flows provided from operating activities. The Company believes that this measure, which is used internally to evaluate the Company's underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors with the ability to better evaluate the Company's underlying performance. However, this measure is not necessarily indicative of operating earnings or net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of free cash flow for the periods presented:

| | |

(unaudited, expressed in millions of U.S. dollars)

| Three months ended |

| March 31, |

| 2024 | 2023 |

| | |

| Net cash flow provided from operating activities - as reported | $ | 374.4 | | $ | 259.0 | |

| Adjusting items: | | |

| Attributable (a) capital expenditures | | (232.1 | ) | | (211.8 | ) |

| Non-controlling interest (b) cash flow used in operating activities | | 3.0 | | | 0.6 | |

| Attributable (a) free cash flow | $ | 145.3 | | $ | 47.8 | |

| | |

See page 21 for details of the endnotes referenced within the table above.

Adjusted Operating Cash Flow

Adjusted operating cash flow is a non-GAAP financial measure and is defined as net cash flow provided from operating activities excluding certain impacts which the Company believes are not reflective of the Company's regular operating cash flow and excluding changes in working capital. Working capital can be volatile due to numerous factors, including the timing of tax payments. The Company uses adjusted operating cash flow internally as a measure of the underlying operating cash flow performance and future operating cash flow-generating capability of the Company. However, the adjusted operating cash flow measure is not necessarily indicative of net cash flow provided from operating activities as determined under IFRS.

The following table provides a reconciliation of adjusted operating cash flow for the periods presented:

| | | |

(unaudited, expressed in millions of U.S. dollars)

| Three months ended |

| March 31, |

| | 2024

| 2023

|

| | | |

| Net cash flow provided from operating activities - as reported | $ | 374.4 | | $ | 259.0 | |

| | | |

| Adjusting items: | | |

| Working capital changes: | | |

| Accounts receivable and other assets | | (10.3 | ) | | (20.0 | ) |

| Inventories | | (5.9 | ) | | 43.2 | |

| Accounts payable and other liabilities, including income taxes paid | | 66.7 | | | 76.0 | |

| Total working capital changes | | 50.5 | | | 99.2 | |

| Adjusted operating cash flow | $ | 424.9 | | $ | 358.2 | |

| | | |

See page 21 for details of the endnotes referenced within the table above.

Production Cost of Sales per Ounce Sold on a By-Product Basis (l)

Production cost of sales per ounce sold on a by-product basis is a non-GAAP ratio which calculates the Company's non-gold production as a credit against its per ounce production costs, rather than converting its non-gold production into gold equivalent ounces and crediting it to total production, as is the case in co-product accounting. Management believes that this ratio provides investors with the ability to better evaluate Kinross' production cost of sales per ounce on a comparable basis with other major gold producers who routinely calculate their cost of sales per ounce using by-product accounting rather than co-product accounting.

The following table provides a reconciliation of production cost of sales per ounce sold on a by-product basis for the periods presented:

| | | |

(unaudited, expressed in millions of U.S. dollars,

except ounces and production cost of sales per equivalent ounce)

| Three months ended |

| March 31, |

| | 2024

| 2023

|

| | | |

| Production cost of sales - as reported | $ | 512.9 | | $ | 483.9 | |

| Less: silver revenue (c) | | | (39.1 | ) | | (54.9 | ) |

| Production cost of sales net of silver by-product revenue | $ | 473.8 | | $ | 429.0 | |

| | | |

| Gold ounces sold | | 503,604 | | | 461,696 | |

| Total gold equivalent ounces sold | | 522,400 | | | 490,330 | |

| Production cost of sales per equivalent ounce sold (d) | $ | 982 | | $ | 987 | |

| Production cost of sales per ounce sold on a by-product basis | $ | 941 | | $ | 929 | |

| | | |

See page 21 for details of the endnotes referenced within the table above.

All-In Sustaining Cost (l) and Attributable All-In Cost per Ounce Sold on a By-Product Basis

All-in sustaining cost and attributable all-in cost per ounce sold on a by-product basis are non-GAAP financial measures and ratios, as applicable, calculated based on guidance published by the World Gold Council ("WGC"). The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies including Kinross. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these metrics. Adoption of the all-in sustaining cost and all-in cost metrics is voluntary and not necessarily standard, and therefore, these measures and ratios presented by the Company may not be comparable to similar measures and ratios presented by other issuers. The Company believes that the all-in sustaining cost and all-in cost measures complement existing measures and ratios reported by Kinross.

All-in sustaining cost includes both operating and capital costs required to sustain gold production on an ongoing basis. The value of silver sold is deducted from the total production cost of sales as it is considered residual production, i.e. a by-product. Sustaining operating costs represent expenditures incurred at current operations that are considered necessary to maintain current production. Sustaining capital represents capital expenditures at existing operations comprising mine development costs, including capitalized stripping, and ongoing replacement of mine equipment and other capital facilities, and does not include capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

All-in cost is comprised of all-in sustaining cost as well as operating expenditures incurred at locations with no current operation, or costs related to other non-sustaining activities, and capital expenditures for major growth projects or enhancement capital for significant infrastructure improvements at existing operations.

All-in sustaining cost and attributable all-in cost per ounce sold on a by-product basis are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| | | |

(unaudited, expressed in millions of U.S. dollars,

except ounces and costs per ounce)

| Three months ended |

| March 31, |

| | 2024 | 2023 |

| | | |

| Production cost of sales - as reported | $ | 512.9 | | $ | 483.9 | |

| Less: silver revenue (c) | | (39.1 | ) | | (54.9 | ) |

| Production cost of sales net of silver by-product revenue | $ | 473.8 | | $ | 429.0 | |

| Adjusting items: | | |

| General and administrative (e) | | 30.7 | | | 24.4 | |

| Other operating expense - sustaining (f) | | 0.8 | | | 6.5 | |

| Reclamation and remediation - sustaining (g) | | 18.3 | | | 14.3 | |

| Exploration and business development - sustaining (h) | | 8.7 | | | 6.6 | |

| Additions to property, plant and equipment - sustaining (i) | | 109.3 | | | 96.6 | |

| Lease payments - sustaining (j) | | 3.4 | | | 15.2 | |

| All-in Sustaining Cost on a by-product basis | $ | 645.0 | | $ | 592.6 | |

| Adjusting items on an attributable (a) basis: | | |

| Other operating expense - non-sustaining (f) | | 10.1 | | | 8.7 | |

| Reclamation and remediation - non-sustaining (g) | | 1.7 | | | 1.9 | |

| Exploration and business development - non-sustaining (h) | | 32.9 | | | 27.6 | |

| Additions to property, plant and equipment - non-sustaining (i) | | 122.8 | | | 115.2 | |

| Lease payments - non-sustaining (j) | | - | | | 0.3 | |

| All-in Cost on a by-product basis - attributable (a) | $ | 812.5 | | $ | 746.3 | |

| Gold ounces sold | | 503,604 | | | 461,696 | |

| Production cost of sales per equivalent ounce sold (d) | $ | 982 | | $ | 987 | |

| All-in sustaining cost per ounce sold on a by-product basis | $ | 1,281 | | $ | 1,284 | |

| Attributable (a) all-in cost per ounce sold on a by-product basis | $ | 1,613 | | $ | 1,616 | |

| | | |

See page 21 for details of the endnotes referenced within the table above.

The Company also assesses its all-in sustaining cost and attributable all-in cost on a gold equivalent ounce basis. Under these non-GAAP financial measures and ratios, the Company's production of silver is converted into gold equivalent ounces and credited to total production.

All-In Sustaining Cost (l) and Attributable All-In Cost per Equivalent Ounce Sold

The Company also assesses its all-in sustaining cost and attributable all-in cost on a gold equivalent ounce basis. Under these non-GAAP financial measures and ratios, the Company's production of silver is converted into gold equivalent ounces and credited to total production.

All-in sustaining cost and attributable all-in cost per equivalent ounce sold are calculated by adjusting production cost of sales, as reported on the interim condensed consolidated statements of operations, as follows:

| | | |

(unaudited, expressed in millions of U.S. dollars,

except ounces and costs per ounce)

| Three months ended |

| March 31, |

| | 2024 | 2023 |

| | | |

| Production cost of sales - as reported | $ | 512.9 | $ | 483.9 |

| Adjusting items: | | |

| General and administrative (e) | | 30.7 | | 24.4 |

| Other operating expense - sustaining (f) | | 0.8 | | 6.5 |

| Reclamation and remediation - sustaining (g) | | 18.3 | | 14.3 |

| Exploration and business development - sustaining (h) | | 8.7 | | 6.6 |

| Additions to property, plant and equipment - sustaining (i) | | 109.3 | | 96.6 |

| Lease payments - sustaining (j) | | 3.4 | | 15.2 |

| All-in Sustaining Cost | $ | 684.1 | $ | 647.5 |

| Adjusting items on an attributable (a) basis: | | |

| Other operating expense - non-sustaining (f) | | 10.1 | | 8.7 |

| Reclamation and remediation - non-sustaining (g) | | 1.7 | | 1.9 |

| Exploration and business development - non-sustaining (h) | | 32.9 | | 27.6 |

| Additions to property, plant and equipment - non-sustaining (i) | | 122.8 | | 115.2 |

| Lease payments - non-sustaining (j) | | - | | 0.3 |

| All-in Cost - attributable (a) | $ | 851.6 | $ | 801.2 |

| Gold equivalent ounces sold | | 522,400 | | 490,330 |

| Production cost of sales per equivalent ounce sold (d) | $ | 982 | $ | 987 |

| All-in sustaining cost per equivalent ounce sold | $ | 1,310 | $ | 1,321 |

| Attributable (a) all-in cost per equivalent ounce sold | $ | 1,630 | $ | 1,634 |

| | | |

See page 21 for details of the endnotes referenced within the table above.

Capital Expenditures and Attributable Capital Expenditures

Capital expenditures are classified as either sustaining capital expenditures or non-sustaining capital expenditures, depending on the nature of the expenditure. Sustaining capital expenditures typically represent capital expenditures at existing operations including capitalized exploration costs and capitalized stripping unless related to major projects, ongoing replacement of mine equipment and other capital facilities and other capital expenditures and is calculated as total additions to property, plant and equipment (as reported on the interim condensed consolidated statements of cash flows), less non-sustaining capital expenditures. Non-sustaining capital expenditures represent capital expenditures for major projects, including major capital stripping projects at existing operations that are expected to materially benefit the operation, as well as enhancement capital for significant infrastructure improvements at existing operations. Management believes the distinction between sustaining capital expenditures and non-sustaining expenditures is a useful indicator of the purpose of capital expenditures and this distinction is an input into the calculation of all-in sustaining costs per ounce and attributable all-in costs per ounce. The categorization of sustaining capital expenditures and non-sustaining capital expenditures is consistent with the definitions under the WGC all-in cost standard. Sustaining capital expenditures and non-sustaining capital expenditures are not defined under IFRS, however, the sum of these two measures total to additions to property, plant and equipment as disclosed under IFRS on the interim condensed consolidated statements of cash flows.

Additions to property, plant and equipment per the statement of cash flow includes 100% of capital expenditures for Manh Choh. Attributable capital expenditures includes Kinross' 70% share of capital expenditures for Manh Choh. Management believes this to be a useful indicator of Kinross' cash resources utilized for capital expenditures.

The following table provides a reconciliation of the classification of capital expenditures for the periods presented:

| (unaudited, expressed in millions of U.S. dollars) | | | | | | | | | | |

| Three months ended March 31, 2024 | Tasiast

(Mauritania) | Paracatu

(Brazil) | La Coipa

(Chile) | Fort Knox (k)

(USA) | Round Mountain

(USA) | Bald Mountain

(USA) | Total

USA | | Other | Total |

| Sustaining capital expenditures | $ | 10.1 | $ | 19.6 | $ | 7.2 | $ | 37.7 | | $ | 3.7 | $ | 32.4 | $ | 73.8 | | | $ | (1.4 | ) | $ | 109.3 | |

| Non-sustaining capital expenditures | | 69.4 | | - | | - | | 40.9 | | | 15.6 | | - | | 56.5 | | | | 6.7 | | | 132.6 | |

| Additions to property, plant and equipment - per cash flow | $ | 79.5 | $ | 19.6 | $ | 7.2 | $ | 78.6 | | $ | 19.3 | $ | 32.4 | $ | 130.3 | | | $ | 5.3 | | $ | 241.9 | |

| Less: Non-controlling interest (b) | $ | - | $ | - | $ | - | $ | (9.8 | ) | $ | - | $ | - | $ | (9.8 | ) | | $ | - | | $ | (9.8 | ) |

| Attributable (a) capital expenditures | $ | 79.5 | $ | 19.6 | $ | 7.2 | $ | 68.8 | | $ | 19.3 | $ | 32.4 | $ | 120.5 | | | $ | 5.3 | | $ | 232.1 | |

| | | | | | | | | | |

| Three months ended March 31, 2023 | | | | | | | | | | |

| Sustaining capital expenditures | $ | 14.6 | $ | 27.8 | $ | 1.6 | $ | 38.6 | | $ | 7.4 | $ | 6.1 | $ | 52.1 | | | $ | 0.4 | | $ | 96.5 | |

| Non-sustaining capital expenditures | | 50.0 | | - | | 23.8 | | 29.2 | | | - | | 19.1 | | 48.3 | | | | 2.6 | | | 124.7 | |

| Additions to property, plant and equipment - per cash flow | $ | 64.6 | $ | 27.8 | $ | 25.4 | $ | 67.8 | | $ | 7.4 | $ | 25.2 | $ | 100.4 | | | $ | 3.0 | | $ | 221.2 | |

| Less: Non-controlling interest (b) | $ | - | $ | - | $ | - | $ | (9.4 | ) | $ | - | $ | - | $ | (9.4 | ) | | $ | - | | $ | (9.4 | ) |

| Attributable (a) capital expenditures | $ | 64.6 | $ | 27.8 | $ | 25.4 | $ | 58.4 | | $ | 7.4 | $ | 25.2 | $ | 91.0 | | | $ | 3.0 | | $ | 211.8 | |

See page 21 for details of the endnotes referenced within the table above.

Endnotes

| (a) | | "Attributable" includes Kinross' share of Manh Choh (70%) free cash flow, costs and capital expenditures. |

| (b) | | "Non-controlling interest" represents the non-controlling interest portion in Manh Choh (30%) and other subsidiaries for which the Company's interest is less than 100% for cash flow from operating activities and capital expenditures. |

| (c) | | "Silver revenue" represents the portion of metal sales realized from the production of the secondary or by-product metal (i.e. silver). Revenue from the sale of silver, which is produced as a by-product of the process used to produce gold, effectively reduces the cost of gold production. |

| (d) | | "Production cost of sales per equivalent ounce sold" is defined as production cost of sales divided by total gold equivalent ounces sold. |

| (e) | | "General and administrative" expenses are as reported on the interim condensed consolidated statements of operations. General and administrative expenses are considered sustaining costs as they are required to be absorbed on a continuing basis for the effective operation and governance of the Company. |

| (f) | | "Other operating expense – sustaining" is calculated as "Other operating expense" as reported on the interim condensed consolidated statements of operations, less other operating and reclamation and remediation expenses related to non-sustaining activities as well as other items not reflective of the underlying operating performance of our business. Other operating expenses are classified as either sustaining or non-sustaining based on the type and location of the expenditure incurred. The majority of other operating expenses that are incurred at existing operations are considered costs necessary to sustain operations, and are therefore classified as sustaining. Other operating expenses incurred at locations where there is no current operation or related to other non-sustaining activities are classified as non-sustaining. |

| (g) | | "Reclamation and remediation - sustaining" is calculated as current period accretion related to reclamation and remediation obligations plus current period amortization of the corresponding reclamation and remediation assets, and is intended to reflect the periodic cost of reclamation and remediation for currently operating mines. Reclamation and remediation costs for development projects or closed mines are excluded from this amount and classified as non-sustaining. |

| (h) | | "Exploration and business development – sustaining" is calculated as "Exploration and business development" expenses as reported on the interim condensed consolidated statements of operations, less non-sustaining exploration and business development expenses. Exploration expenses are classified as either sustaining or non-sustaining based on a determination of the type and location of the exploration expenditure. Exploration expenditures within the footprint of operating mines are considered costs required to sustain current operations and so are included in sustaining costs. Exploration expenditures focused on new ore bodies near existing mines (i.e. brownfield), new exploration projects (i.e. greenfield) or for other generative exploration activity not linked to existing mining operations are classified as non-sustaining. Business development expenses are classified as either sustaining or non-sustaining based on a determination of the type of expense and requirement for general or growth related operations. |

| (i) | | "Additions to property, plant and equipment – sustaining" and non-sustaining are as presented on pages 20 and 21. Non-sustaining capital expenditures included in the calculation of attributable all-in-cost includes Kinross' share of Manh Choh (70%) costs. |

| (j) | | "Lease payments – sustaining" represents the majority of lease payments as reported on the interim condensed consolidated statements of cash flows and is made up of the principal and financing components of such cash payments, less non-sustaining lease payments. Lease payments for development projects or closed mines are classified as non-sustaining. |

| (k) | | The Fort Knox segment is composed of Fort Knox and Manh Choh for all periods presented. |

| (l) | | As production from Manh Choh is expected to commence in the third quarter of 2024, production cost of sales and attributable all-in sustaining cost figures and ratios for Manh Choh are nil for all periods presented. As a result, production cost of sales and all-in sustaining cost figures and ratios are equal to attributable production cost of sales and attributable all-in sustaining cost figures and ratios, as applicable. |

| | |

APPENDIX A

Recent LP zone assay results

| Hole ID | | From

(m) | To

(m) | Width

(m) | True

Width (m) | Au (g/t) | Target |

| BR-695C1A | | 1,324.7 | 1,333.0 | 8.3 | 7.3 | 5.35 | Yuma |

| BR-695C1A | Including | 1,324.7 | 1,331.7 | 7.0 | 6.2 | 6.24 | |

| BR-695C1A | | 1,441.2 | 1,444.2 | 3.0 | 2.6 | 0.58 | |

| BR-695C1A | | 1,469.0 | 1,517.5 | 48.5 | 42.7 | 0.86 | |

| BR-695C1A | Including | 1,502.6 | 1,506.3 | 3.7 | 2.8 | 4.49 | |

| BR-695C1A | | 1,524.5 | 1,537.8 | 13.3 | 11.3 | 0.81 | |

| BR-695C2 | | 1,460.3 | 1,463.3 | 3.0 | 2.7 | 0.61 | Yuma |

| BR-695C2 | | 1,477.9 | 1,482.6 | 4.7 | 4.2 | 0.58 | |

| BR-695C2 | | 1,509.0 | 1,521.4 | 12.4 | 11.2 | 0.82 | |

| BR-695C2 | | 1,532.5 | 1,536.1 | 3.6 | 3.2 | 1.08 | |

| BR-695C3 | No Significant Intersections | Yuma |

| BR-708AC1B | | 1,271.7 | 1,276.7 | 5.0 | 4.5 | 0.64 | Yauro |

| BR-708AC1B | | 1,319.9 | 1,323.7 | 3.8 | 3.4 | 0.50 | |

| BR-708AC1B | | 1,376.2 | 1,441.7 | 65.5 | 59.0 | 0.96 | |

| BR-708AC1B | Including | 1,438.7 | 1,441.1 | 2.4 | 2.0 | 11.41 | |

| BR-708AC2 | No Significant Intersections | Yauro |

| BR-770C1 | | 541.3 | 544.9 | 3.6 | 3.0 | 2.13 | Yauro |

| BR-770C1 | | 1,229.9 | 1,236.9 | 6.9 | 5.8 | 1.60 | |

| BR-770C1 | | 1,293.5 | 1,297.1 | 3.6 | 3.0 | 1.13 | |

| BR-770C1 | | 1,304.0 | 1,307.0 | 3.0 | 2.5 | 1.88 | |

| BR-770C2B | No Significant Intersections | Yauro |

| BR-799DC1 | | 1,566.7 | 1,573.7 | 7.0 | 5.2 | 0.91 | Bruma |

| BR-799DC1 | | 1,584.5 | 1,591.9 | 7.5 | 5.6 | 0.61 | |

| BR-843AC2 | | 1,189.5 | 1,192.5 | 3.0 | 2.3 | 1.19 | Yuma |

| BR-843AC2 | | 1,245.0 | 1,248.0 | 3.0 | 2.3 | 0.33 | |

| BR-843AC2 | | 1,316.4 | 1,319.4 | 3.0 | 2.6 | 0.48 | |

| BR-843AC2 | | 1,321.7 | 1,325.3 | 3.5 | 2.7 | 0.39 | |

| BR-843AC2 | | 1,335.5 | 1,347.3 | 11.8 | 8.9 | 2.91 | |

| BR-843AC2 | Including | 1,337.8 | 1,340.5 | 2.7 | 2.4 | 9.66 | |

| BR-843AC2 | | 1,365.5 | 1,373.1 | 7.6 | 6.7 | 0.91 | |

| BR-843AC2 | | 1,376.5 | 1,379.5 | 3.0 | 2.7 | 0.55 | |

| BR-843AC3 | | 1,256.3 | 1,259.8 | 3.5 | 2.7 | 0.68 | Yuma |

| BR-843AC3 | | 1,354.7 | 1,395.0 | 40.3 | 36.3 | 5.65 | |

| BR-843AC3 | | 1,377.4 | 1,388.8 | 11.3 | 10.2 | 18.59 | |

| BR-843AC3 | | 1,509.7 | 1,513.7 | 4.0 | 3.5 | 3.39 | |

| BR-844C2B | | 1,444.1 | 1,450.2 | 6.1 | 5.4 | 0.81 | Bruma |

| BR-844C2B | | 1,500.9 | 1,527.0 | 26.2 | 23.0 | 0.52 | |

| BR-844C3A | | 1,436.8 | 1,440.0 | 3.2 | 2.8 | 1.08 | Bruma |

| BR-844C3A | | 1,502.0 | 1,509.1 | 7.1 | 6.1 | 0.95 | |

| BR-844C3A | | 1,518.0 | 1,530.0 | 12.0 | 10.2 | 0.65 | |

| BR-847 | | 934.7 | 950.0 | 15.3 | 13.0 | 2.08 | Discovery |

| BR-847 | Including | 934.7 | 937.5 | 2.8 | 2.4 | 5.21 | |

| BR-847 | | 975.0 | 992.5 | 17.5 | 14.9 | 0.85 | |

| BR-847 | | 998.8 | 1,001.8 | 3.0 | 2.6 | 0.48 | |

| BR-847 | | 1,027.2 | 1,036.1 | 8.9 | 7.8 | 1.54 | |

| BR-847 | | 1,048.5 | 1,051.5 | 3.0 | 2.7 | 0.35 | |

| BR-847 | | 1,052.9 | 1,080.0 | 27.1 | 24.4 | 1.38 | |

| BR-847 | Including | 1,063.6 | 1,066.3 | 2.7 | 2.4 | 5.53 | |

| BR-848 | | 1,015.3 | 1,024.8 | 9.5 | 7.9 | 0.70 | Bruma |

| BR-848 | | 1,031.2 | 1,054.3 | 23.1 | 19.4 | 0.51 | |

| BR-848 | | 1,095.4 | 1,113.7 | 18.3 | 15.3 | 0.61 | |

| BR-849 | | 867.0 | 872.4 | 5.4 | 4.3 | 0.91 | Bruma |

| BR-849 | | 884.5 | 897.5 | 13.1 | 10.4 | 0.70 | |

| BR-849 | | 916.0 | 920.9 | 4.9 | 4.0 | 0.95 | |

| BR-851 | No Significant Intersections | Viggo |

| BR-853 | | 469.9 | 474.5 | 4.6 | 3.8 | 1.34 | Auro |

| BR-853 | | 665.5 | 668.5 | 3.0 | 2.3 | 0.42 | |

| BR-854A | | 701.5 | 706.0 | 4.5 | 4.0 | 1.13 | Auro |

| BR-854A | | 874.0 | 880.1 | 6.0 | 5.3 | 4.79 | |

| BR-854A | Including | 878.5 | 880.1 | 1.5 | 1.4 | 17.73 | |

| BR-855 | | 810.2 | 814.5 | 4.4 | 3.8 | 1.63 | Discovery |

| BR-856A | No Significant Intersections | Discovery |

| BR-870C5B | | 1,229.0 | 1,232.0 | 3.0 | 2.6 | 0.39 | Yuma |

| BR-870C5B | | 1,313.5 | 1,319.0 | 5.5 | 4.7 | 0.68 | |

| BR-870C5B | | 1,349.2 | 1,353.0 | 3.8 | 3.3 | 0.51 | |

| BR-870C5B | | 1,366.3 | 1,380.5 | 14.2 | 12.2 | 1.53 | |

| BR-871 | | 1,173.5 | 1,194.7 | 21.3 | 18.3 | 0.36 | Yuma |

| BR-872 | | 990.6 | 997.4 | 6.8 | 6.1 | 0.42 | Yuma |

| BR-872 | | 1,005.8 | 1,010.3 | 4.5 | 3.7 | 0.80 | |

| BR-872 | | 1,017.2 | 1,033.5 | 16.3 | 12.9 | 0.54 | |

| BR-882 | | 953.0 | 957.5 | 4.5 | 3.7 | 0.45 | Auro |

| BR-882 | | 1,015.2 | 1,022.4 | 7.2 | 6.1 | 25.71 | |

| BR-882 | Including | 1,017.5 | 1,019.4 | 1.9 | 1.6 | 95.27 | |

| BR-884 | | 716.9 | 722.8 | 5.9 | 4.9 | 2.56 | Auro |

| BR-884 | Including | 720.1 | 722.8 | 2.6 | 2.3 | 4.55 | |

| BR-884 | | 801.4 | 805.9 | 4.5 | 3.9 | 0.83 | |

| BR-885 | | 714.1 | 715.5 | 1.4 | 1.1 | 26.60 | Yuma |

| BR-885 | | 871.4 | 883.2 | 11.9 | 9.4 | 1.36 | |

| BR-885 | | 914.1 | 922.7 | 8.5 | 6.8 | 0.73 | |

| BR-886 | | 1,060.5 | 1,070.7 | 10.2 | 8.0 | 0.39 | Yuma |

| BR-886 | | 1,078.2 | 1,085.4 | 7.3 | 5.7 | 2.80 | |

| BR-886 | Including | 1,082.4 | 1,084.5 | 2.2 | 1.7 | 7.86 | |

| BR-886 | | 1,131.1 | 1,134.2 | 3.1 | 2.7 | 1.26 | |

| BR-886 | | 1,141.7 | 1,160.7 | 19.0 | 16.9 | 0.76 | |

| BR-886 | | 1,170.0 | 1,175.8 | 5.8 | 4.8 | 1.33 | |

| BR-886 | | 1,184.7 | 1,188.0 | 3.3 | 2.7 | 0.49 | |

| BR-886 | | 1,231.2 | 1,231.7 | 0.5 | 0.4 | 44.80 | |

| BR-891 | | 432.0 | 435.0 | 3.0 | 2.5 | 1.07 | Discovery |

| BR-891 | | 1,096.0 | 1,111.0 | 15.1 | 12.3 | 1.44 | |

| BR-891 | Including | 1,096.6 | 1,100.1 | 3.5 | 2.9 | 3.00 | |

| BR-891 | | 1,117.5 | 1,125.0 | 7.5 | 6.2 | 0.82 | |

| BR-891 | | 1,137.0 | 1,141.0 | 4.0 | 3.3 | 0.52 | |

| BR-891 | | 1,194.0 | 1,197.0 | 3.0 | 2.5 | 0.40 | |

| BR-891 | | 1,242.3 | 1,308.4 | 66.1 | 54.2 | 0.42 | |

| BR-900B | | 1,214.6 | 1,223.6 | 9.0 | 7.4 | 0.73 | Yauro |

| DL-131C4 | | 929.2 | 934.3 | 5.1 | 4.3 | 1.24 | Hinge |

| DL-131C5 | No Significant Intersections | Hinge |

| DL-131C6 | No Significant Intersections | Hinge |

| DL-131C6W | No Significant Intersections | Hinge |

APPENDIX B

Great Bear: LP long section demonstrating potential for extension of a high-grade underground resource.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/12d656a2-96da-42d9-ac04-3da030e75ce6

Composites generated from drill intersections received since the February 14, 2024, news release includes assays from 29 fully assayed drill holes at the LP zone and 4 fully assayed drill holes at the Hinge and Limb zone. Composites are generated using 0.3 g/t minimum grade, maximum linear internal dilution of 5.0 m, and allows short high-grade intervals greater than 8 GXM to be retained. Results are preliminary in nature and are subject to on-going QA/QC. For full list of significant, composited assay results, see Appendix A.

APPENDIX C

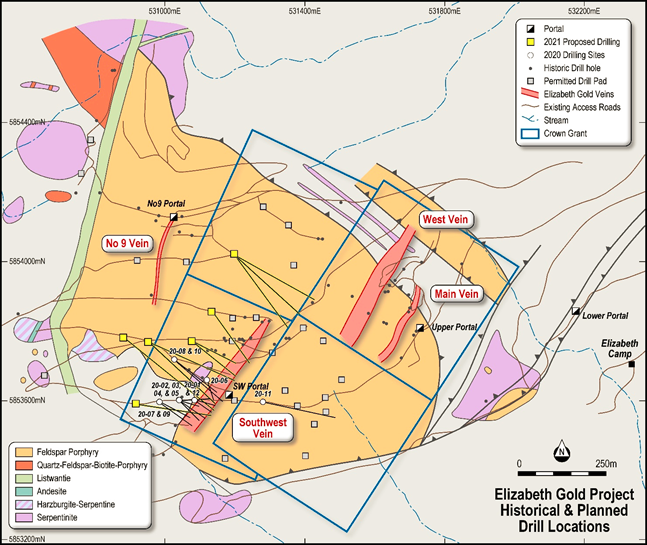

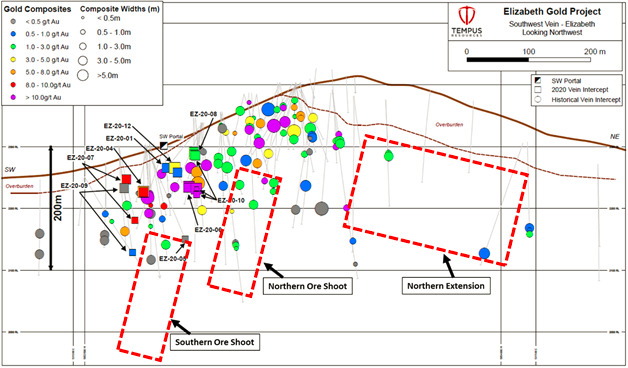

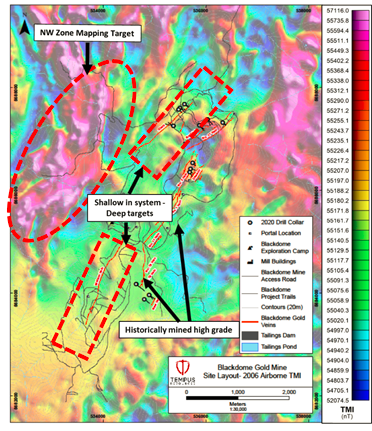

Round Mountain Phase X drilling: High-grade zones encountered between portals and targeted mineralization.

An infographic accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bc9fd7a8-a1f1-45cc-bea5-8119f4ee672c

Cautionary statement on forward-looking information