- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Blackstone Intersects 200M Long High-Grade Nickel-Copper-PGE Zone At Ban Chang

Blackstone Mineral’s (ASX:BSX) maiden drill hole BC20-02 at Ban Chang has delineated a 200m long zone of highgrade Nickel-Copper-PGE with high-grade results.

Blackstone Mineral’s (ASX:BSX) maiden drill hole BC20-02 at Ban Chang has delineated a 200m long zone of highgrade Nickel-Copper-PGE with the following high-grade results:

- BC20-02 4.1m @ 0.92% Ni, 0.69% Cu, 0.05% Co & 0.26g/t PGE 1 from 85.9m

- or 2.3m @ 1.6% Ni, 1.09% Cu, 0.09% Co & 0.43g/t PGE from 85.9m

- Incl. 1.8m @ 2.01% Ni, 1.27% Cu, 0.12% Co & 0.53g/t PGE from 86.4m 1 Platinum (Pt) + Palladium (Pd) + Gold (Au)

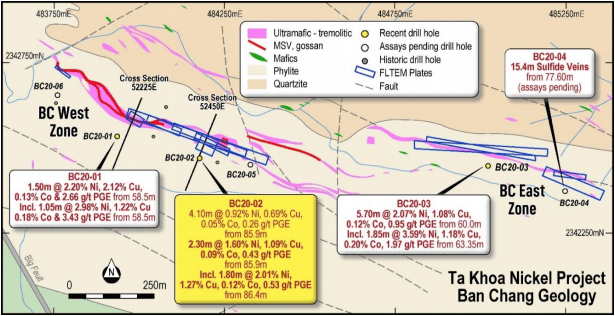

- Blackstone’s four maiden drill holes at Ban Chang have all intersected massive sulfide nickel over a 1.2km strike within a 1.2km long massive sulfide target zone defined by high priority electromagnetic (EM) plates (refer to Figure 1);

- Assays are pending for drill hole BC20-04 (ASX announcement 11 June 2020), which intersected 15.4m of sulfide vein mineralisation;

- Blackstone is targeting massive sulfide vein (MSV) prospects analogous to the Ban Phuc MSV, where previous owners successfully mined 975kt of high-grade ore at average grades of 2.4% Ni & 1.0% Cu from an average vein width of 1.3m for 3.5 years between 2013 and 2016, producing 20.7kt Ni, 10.1kt Cu and 0.67kt Co;

- A recently purchased third drill rig will follow the geophysics crew throughout the Ta Khoa nickel sulfide district, testing high priority EM targets generated from 25 MSV prospects including King Snake, Ban Khoa, Ban Chang, and Ta Cuong (refer to Figure 4);

- Drilling continues with Blackstone’s largest drill rig testing the King Cobra Discovery zone (KCZ) and Blackstone’s two smaller drill rigs at Ban Chang East and Ban Chang West;

- With its third diamond drill rig, the Company has an “all-in” diamond drilling cost of US$50/m at Ta Khoa, a ~60% reduction in drilling costs relative to Australian industry averages2; 2Industry average refers to quoted rates received in Australia for equivalent diamond drilling

- Blackstone’s Scoping Study on downstream processing to produce nickel sulfate for the lithiumion battery industry and Ban Phuc maiden resource are on track for completion in Q3, CY20;

Blackstone Minerals’ Managing Director Scott Williamson commented: “Our latest assays confirm further high-grade mineralisation at Ban Chang. We continue to demonstrate strong potential for a bulk underground mining scenario at Ban Chang which could be significantly larger scale than the previously mined Ban Phuc massive sulfide underground mine. At Ban Phuc, the previous owners successfully mined a 1.3m wide MSV at much lower nickel prices than today. We are seeing broader widths and significant by-products which could lend to potentially better economics than when this mine previously operated.

“We have now drilled significant massive sulfide nickel mineralisation over 1.2km of strike at Ban Chang and our in-house geophysics crew continues to test for further massive sulfide mineralisation at the new target, Ta Cuong.

Ban Chang and Ta Cuong are the first of our 25 MSV targets to be tested throughout the Ta Khoa Ni-CuPGE district, leaving plenty of upside for adding high-grade feed to what looks like a bulk open pit mining scenario at Ban Phuc and the KCZ.”

Blackstone Minerals Limited (ASX code: BSX) is pleased to announce it has intersected massive sulfide in four maiden drill holes at Ban Chang, part of its Ta Khoa Nickel-Cu-PGE project in Vietnam (refer to Figure 5). The drill holes were drilled more than 1.2km apart and along strike within a 1.2km-long massive sulfide target zone defined by high priority EM plates.

Figure 1: Ban Chang prospect with 1.2km long of EM plates and drill holes BC20-01, BC20-02, BC20-03 & BC20-04

2Industry average refers to quoted rates received in Australia for equivalent diamond drilling

Click here to read the full press release.

Click here to connect with Blackstone Minerals Limited (ASX:BSX) for an Investor Presentation

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2317.23 | -6.46 | |

| Silver | 27.19 | -0.09 | |

| Copper | 4.48 | -0.01 | |

| Oil | 82.79 | -0.02 | |

| Heating Oil | 2.56 | 0.00 | |

| Natural Gas | 1.67 | +0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.