- WORLD EDITIONAustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Quarterly Activities and Cash Flow Report For The Period Ending 31 December 2022

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to present its Quarterly Report and Cash Flow Report.

HIGHLIGHTS

Ta Khoa Project – Mining and Refinery Project

Blackstone announced the completion of the Ta Khoa Refinery piloting programme at ALS Metallurgy in Western Australia. The pilot program successfully developed a scaled version of the Ta Khoa Refinery, processing concentrate to battery grade nickel and cobalt sulphates. The pilot program achieved:

- Validation of the refinery process;

- Production of mixed hydroxide precipitate (MHP);

- Distribution of battery grade nickel and cobalt sulphates;

- Processing of third-party MHP and cobalt supply.

Exploration

Ta Khoa Nickel Project, Vietnam:

- Results from the most recent round of infill drilling at King Snake and Ban Chang were received.

- Resource definition drilling at King Snake massive sulphide vein deposit confirmed continuity and high grades (up to 4.3% Ni and 18.2 g/t PGE1).

- Strong nickel and copper drill results returned from the Suoi Phang massive sulphide vein target;

- 2.95m @ 2.42% Ni, 0.52% Cu, 0.06% Co & 0.05g/t PGE from 37.05m.

- 2.95m @ 2.42% Ni, 0.52% Cu, 0.06% Co & 0.05g/t PGE from 37.05m.

- Vietnam team ramping up regional greenfields exploration.

Twilight Nickel-Copper Project, Canada:

- Ground electro-magnetic (FLTEM) surveys conducted during the quarter. Program targeting potential Ni-Cu-Co sulfides.

Corporate

- Cash position of $18.2m and listed investments of $15.7m at the end of the quarter.

- Research and Development rebate of $3.7m submitted in December 2022.

Sustainability Report

Blackstone released its FY2022 Sustainability Report. The report supports the Company’s commitment to transparency in the business and the development of an industry leading, low CO2 emission Green Nickel™ sulphide project in Vietnam to supply into the growing Lithium-ion battery industry.

Highlights of the report included:

- Results of a Life Cycle Assessment that confirmed the Ta Khoa Project as the lowest Global Warming Potential (9.8 kg CO2 eq. per kg Nickel:Cobalt:Manganese 811) compared to existing producers of NCM911 precursor;

- Undertaking a Greenhouse Gas Emissions Assessment to advance the understanding of Blackstone’s baseline emissions prior to project development and enabling the Company to address climate related risks and identify reduction opportunities;

- Establishing a structured Remuneration Framework with an equity incentive plan to reward, incentivise, attract, and retain high calibre people to the business;

- Introducing a personal Health and Safety pre-start program (Take-5) with the help of the workforce; and

- Building a Communities and Social Performance team to support the Company’s commitment to Community Development and Engagement.

Blackstone announced the strengthening of its Board of Directors with the appointment of Dan Lougher, a qualified mining engineer with over 40 years of experience in all aspects of resource and mining project exploration, feasibility, development and operations and a significant corporate network in the financial and mining community, as Non-Executive Director on 26 October 2022. Following this appointment, Mr Hoirim Jung resigned from his position as Non-Executive Director with effect from 24 November 2022.

In addition, on 24 November 2022, the Board reviewed the structure of Committees with the following changes:

- Newly formed Technical Committee to oversee the company’s Ta Khoa Project’s development, chaired by Dan Lougher;

- Alison Gaines appointed as the Independent Nomination Committee Chair; and

- Frank Bierlein joined the Audit, Risk, and ESG Committee, the People, Remuneration, Culture and Diversity Committee and the Technical Committee.

Research and Development Rebate

During the period, an application for a $3.7 million research and development rebate was completed for submission to the Australian Tax Office in recognition of flowsheet technology developed in FY2021/2022. Blackstone will update the market upon receipt of the research and development rebate.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Blackstone Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Blackstone Minerals

Overview

As the world moves closer to a sustainable net-zero future, the need for battery metals continues to mount and nickel may soon be among the metals to see a supply crunch. Though its roots are in the stainless steel sector, it's also a critical component of lithium-ion batteries.

Given that many nations are aiming to replace combustion vehicles with electric cars by 2030, the metal is already experiencing a massive spike in demand. Benchmark Minerals expects the need for battery-grade nickel will increase about 950 percent by 2040.

It's imperative to ramp up global nickel production but the resource sector, for its part, must do so with a much-reduced carbon footprint to influence the sustainability of the entire value chain. Blackstone Minerals (ASX:BSX, OTC:BLSTF, FRA:B9S) recognizes this. As a vertically integrated producer of low-cost, low-carbon nickel, the company aims to become a leading source of low CO2 emission nickel sulphide. Its flagship Ta Khoa Project in Vietnam is representative of that goal.

With over 20 active mines and a burgeoning technology sector, Vietnam is on the road to becoming a hub of electric vehicle production and innovation, with low labor costs and regulated electricity pricing further driving its growth. Steadily increasing foreign direct investment in the region is indicative of this as the country seeks to attract $50 billion in new foreign investment by 2030.

Blackstone is uniquely positioned to take advantage of this, thanks to two factors. US President Joe Biden's Inflation Reduction Act, which came into force in August 2022, represents the largest investment into climate action in United States history. A similar initiative is rolling out in the European Union (EU), which maintains a Free Trade Agreement with Vietnam — something multiple partners of the company have expressed interest in.

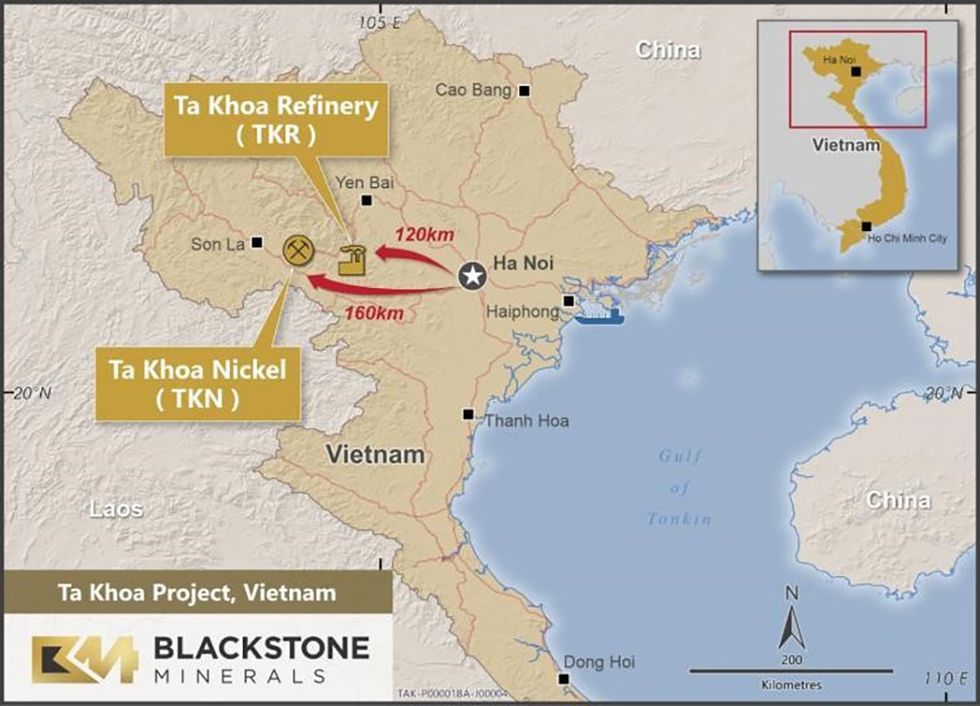

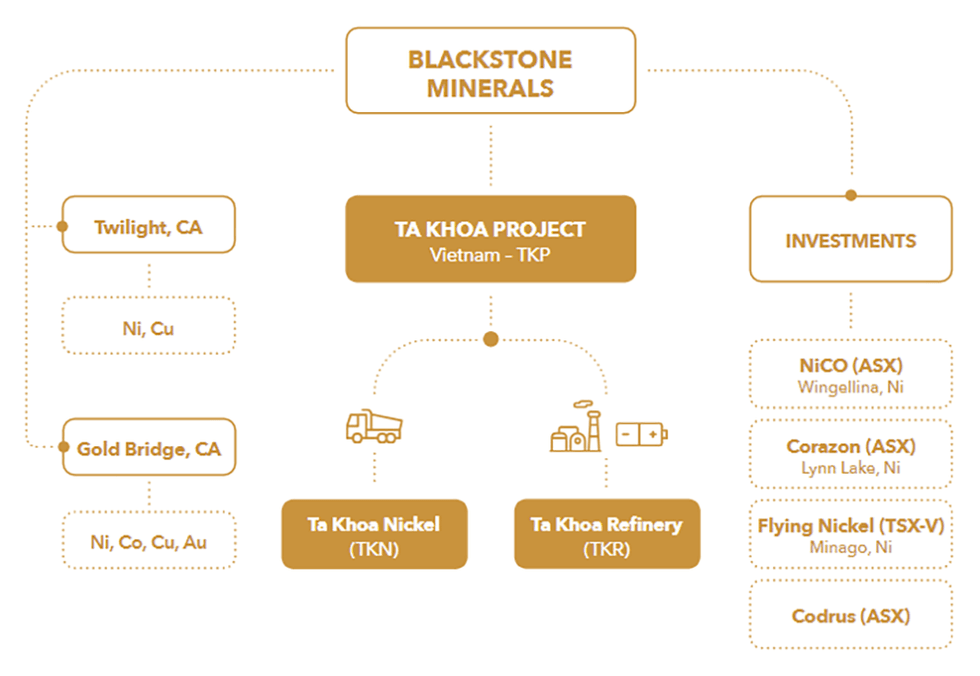

Blackstone's Ta Khoa Project consists of two streams, the Ta Khoa Nickel Mine and the Ta Khoa Refinery. Recent milestones point to Blackstone’s commitment to advancing this game-changing project.

These milestones include a memorandum of understanding with Cavico Laos Mining to collaborate in a number of areas associated with CLM’s nickel mine in Lao People's Democratic Republic and supply of nickel products for Blackstone’s Ta Khoa Refinery in Vietnam. Blackstone also partnered with Arca Climate Technologies to further investigate the carbon capture potential at the Ta Khoa Project through carbon mineralisation, and explore opportunities to utilise Arca’s carbon capture technologies within the project.

In a bid to collaborate on the supply of renewable wind energy to the Ta Khoa Project, Blackstone signed a direct power purchase agreement with Limes Renewables Energy.

Blackstone received AU$2.8 million as an advance from a research & development (R&D) lending fund backed by Asymmetric Innovation Finance and Fiftyone Capital. The advanced payment reflects the significant investment by Blackstone to develop the Ta Khoa Refinery process and Blackstone’s unique strategy to convert nickel concentrate blends into battery products in the form of precursor cathode active material (pCAM).

In addition to Ta Khoa, the company also maintains the Gold Bridge cobalt and gold project near Vancouver, Canada.

In December 2023, Blackstone entered into an option agreement with CaNickel Mining to acquire the Wabowden nickel project located in the world-class Thompson Nickel Belt in Manitoba, Canada.Company Highlights

- The global nickel market is currently entering a structural deficit, with demand expected to grow 950 percent by 2040.

- Blackstone Minerals is well-positioned to address this deficit as a vertically integrated producer of low-cost, low-carbon nickel.

- Blackstone's flagship project Ta Khoa is a brownfield project situated in Vietnam, one of the lowest capital cost countries in the world and an emerging hub for the electric vehicle market with vast reserves of nickel.

- Vietnam is an increasingly attractive region for investment with direct foreign investments that grew from $1.3 billion in 2000 to $15.6 billion in 2020.

- The Ta Khoa project also has infrastructure advantages, via the existing Ban Phuc mine, and processing facilities, access to low-cost and underutilized hydroelectricity, a trained labor force and support from the local government.

- Blackstone Minerals’ downstream pre-feasibility study confirms a technically and economically robust hydrometallurgical refining process to upgrade nickel sulphide concentrate to produce battery-grade nickel

- Blackstone’s key nickel and cobalt feedstocks for the Ta Khoa Refinery Pilot program were delivered to the metallurgical laboratory in Western Australia as of April 2022.

Key Projects

Ta Khoa

Blackstone holds a 90 percent interest in the Ta Khoa Nickel-Copper-PGE Project, located 160 kilometers west of Hanoi in the Son La Province of Vietnam. It includes an existing modern nickel mine built to Australian Standards, which is currently under care and maintenance. The Ban Phuc nickel mine successfully operated as a mechanized underground nickel mine from 2013 to 2016.

Blackstone intends to complement the existing mine through the installation of a large concentrator, refinery and precursor facility, supporting integrated on-site production of nickel, cobalt and manganese precursor products for the Asia-Pacific market. One of Blackstone's key Research and Development objectives with Ta Khoa is to develop a flowsheet that will support this production.

To fulfill this goal, Blackstone is focusing on a partnership model, collaborating with groups committed to sustainable mining. It is also working to minimize its carbon footprint and implement a vertically integrated supply chain.

In addition to the early development of the King Snake and Ban Chang Massive Sulphide deposits, Blackstone plans to produce crystal nickel and cobalt sulphide intermediate products. Staged development of the refinery, meanwhile, predicts an initial train capacity of 200,000 tonnes annually in the first year, with a planned expansion to 400,000 by the second.

The mine is expected to begin production in 2025 and then ramp up to 8 million tons per annum (Mtpa) of nickel sulphide by 2027. Pilot Plant testing and definitive feasibility studies are also underway. Five groups visited the project in 2022 as part of the partnership due diligence process, accompanied by meetings with government representatives, Austrade, Australian department of foreign affairs and trade, financial institutions and other important stakeholders

Project Highlights:

- Multiple Massive Sulphide Deposits: The Ta Khoa project features several incredibly promising deposits including King Snake (up to 4.3 percent nickel and 18.2 grams per ton (g/t) PGE), Sui Phong (2.95 meters @ 2.42 percent nickel, 0.52 percent copper, 0.06 percent cobalt and 0.05 g/t PGE), and Ban Chang. The project is also the site of the Ban Phuc nickel mine, which was operated from 2013 to 2016 by Asia Mineral Resources, along with several exploration targets that have yet to be tested.

- Experienced Leadership: Internally, Blackstone’s owners’ team brings over 50 years of experience in leadership roles at major nickel mines and refineries globally. This experience has been complemented by ALS Group, Wood, Future Battery Industries CRC, Curtin University and the Electric Mining Consortium.

- Large Reserve and Mining Inventory: The entirety of Ta Khoa is estimated to contain probable reserves of 48.7 Mt at 0.43 percent nickel for 210 kilotons (kt) of nickel and a mining inventory of 64.5 Mt at 0.41 percent nickel for 265 kt nickel. This excludes Ban Khoa and other developing prospects.

- A Long-lived Project: The Ta Khoa mine is expected to produce a yearly average of 18 kt of annual nickel concentrate over its ten-year lifespan. Blackstone believes the refinery can potentially extend its life past ten years.

- An Established Mining Operation: Existing infrastructure onsite includes a 450 ktpa Mill and mining camp. The mine will also benefit from a highly supportive community and favorable government legislation — Blackstone is committed to collaborating with community stakeholders in the project's development.

- Feed Flexibility: Ta Khoa's refinery will offer multiple feed options, including nickel concentrate, mixed hydroxide precipitate, nickel matte and black mass. This flexibility greatly improves the security and greatly reduces the risk of the project overall.

- Valued Partnerships: Blackstone is collaborating with multiple industry leaders and groups in the development of Ta Khoa

- Compelling Pre-feasibility Study: The financial outcomes of a base case pre-feasibility study on the project are promising. Based on a conservative NCM811 precursor price forecast, Ta Khoa displays an exceptional internal return rate on capital invested.

- Integrated Vertical Strategy: Blackstone is constructing both the Ta Khoa mine and refinery against a highly supportive ESG, macroeconomic and fiscal backdrop. This along with Ta Khoa's low capital intensity gives the company a significant advantage over competitors. Said low intensity is the result of multiple factors, including competitive labor costs, favorable regulations and low-cost renewable hydroelectric power.

- A Leader in Low Emissions: Independent assessments from Digbee, Minviro and Circulor, alongside an audit from the Nickel Institute, have confirmed that Ta Khoa will be the lowest-emitting flowsheet in the industry, at 9.8 kilograms of CO2 per kilogram of precursor with opportunities for even further reduction.

- Promising Pilots: With the support of ALS and process engineering partner Wood, Blackstone recently completed a 12-month programme of work that developed a scaled version of its concentrate to sulphate flowsheet. The refinery, which processed more than 9 tonnes of concentrate and MHP, successfully achieved battery-grade nickel sulphate of 99.95 percent, with a nickel recovery rate of 97 percent.

- Current Roadmap: Blackstone's next priority is to complete a series of definitive feasibility studies. Once those are complete, it will focus on fully integrating the mine into the electric vehicle consumer supply chain and finalizing its refining partnership structure.

Gold Bridge

The Gold Bridge Project is located approximately 200 kilometers northwest of Vancouver, BC. It comprises 365 square kilometers of 100 percent Blackstone-owned mining claims located in the Cordilleran Terranes of BC. It includes several, high-grade hydrothermal gold, cobalt, nickel and copper deposits and targets the historic Little Gem and Jewel mines.

Project Highlights:

- Significant Potential: Blackstone's geological model for the Jewel mine suggests it may have a similar geological setting to the world-class Bou-Azzer primary cobalt district in Morocco. There is potential for multiple similar deposits throughout the project.

- Favorably Located Anomalies: Having completed an extensive maiden exploration program, Blackstone has identified multiple large-scale IP anomalies at Little Gem, Erebor, Jewel and Roxey.

- A Nascent Venture: Blackstone is currently actively seeking joint venture partners for the Gold Bridge project.

Management Team

Hamish Halliday - Non-executive Chairman

Hamish Halliday is a geologist with over 20 years of corporate and technical experience. He is also the founder of Adamus Resources Limited, an AU$3 million float that became a multimillion-ounce emerging gold producer.

Scott Williamson - Managing Director

Scott Williamson is a mining engineer with a commerce degree from the West Australian School of Mines and Curtin University. He has over 10 years of experience in technical and corporate roles in the mining and finance sectors.

Dr. Frank Bierlein - Non-executive Director

Dr. Frank Bierlein is a geologist with 30 years of technical and corporate experience, focusing on grassroots to mine-stage mineral exploration, target generation, project management and oversight, due diligence studies, mineral prospectivity analysis, metallogenic framework studies and mineral resources market and investment analysis.

Alison Gaines - Non-executive Director

Alison Gaines has over 20 years of experience as a director in Australia and internationally. She has experience in the roles of board chair and board committee chair, particularly remuneration and nomination and governance committees. She is also the managing director of Gaines Advisory P/L and was recently global CEO of international search and board consulting firm Gerard Daniels, with a significant mining and energy practice.

Gaines has a Bachelor of Laws and a Bachelor of Arts (hons) from the University of Western Australia, a Graduate Diploma in Legal Practice from Australian National University and an honorary doctorate of the University and Master of Arts (Public Policy) from Murdoch University. She is a fellow of the Australian Institute of Company Directors and holds the INSEAD certificate in corporate governance. She is currently the governor of the College of Law Ltd, and non-executive director of Tura New Music.

Dan Lougher - Non-executive Director

Daniel Lougher’s career spans more than 40 years involving a range of exploration, feasibility, development, operations and corporate roles with Australian and international mining companies including a period of eighteen years spent in Africa with BHP Billiton, Impala Plats, Anglo American and Genmin. He was the managing director and chief executive officer of the successful Australian nickel miner Western Areas Ltd until its takeover by Independence Group.

Lougher also holds a first class mine manager’s certificate of competency (WA) and is a fellow of the Australasian Institute of Mining and Metallurgy (AusIMM). Lougher is the chair of the company’s technical committee and nomination committee.

Jamie Byrde - CFO and Company Secretary

Jamie Byrde has over 16 year's experience in corporate advisory, public and private company management since commencing his career with big four and mid-tier chartered accounting firms positions. Byrde specializes in financial management, ASX and ASIC compliance and corporate governance of mineral and resource focused public companies. He is also currently company secretary for Venture Minerals Limited.

Dr. Stuart Owen - Executive

Dr. Stuart Owen holds a Bsc and PhD in geology with over 20 years of experience in mineral exploration. He was senior geologist in the team that discovered the Paulsens Mine (+1Moz) and as an exploration manager at Adamus discovered the Southern Ashanti Gold deposits (+2Moz). Finally, at Venture, he discovered the Mt Lindsay Tin-Tungsten-Magnetite deposits.

Tessa Kutscher - Executive

Tessa Kutscher is an executive with more than 20 years of experience in working with C-Level executive teams in the fields of business strategy, business planning/optimisation and change management. After starting her career in Germany, she has worked internationally across different industries, such as mining, finance, tourism and tertiary education.

Kutscher holds a master’s degree in literature, linguistics and political science from the University of Bonn, Germany and a master’s degree in teaching from Ludwig Maximilian University of Munich.

Andrew Strickland - Executive

Andrew Strickland is an experienced study and project manager, a fellow of the Australian Institute of Mining and Metallurgy, University of WA MBA graduate, with undergraduate degrees in chemical engineering and extractive metallurgy from Curtin and WASM.

Before joining Blackstone, Strickland was a senior study manager for GR Engineering Services where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects. Over his career, he has held a variety of project development roles across both junior to mid-tier developers (including Straits Resources, Perseus Mining and Tiger Resources) and major multi-operation producers (South32).

Graham Rigo - Executive

Graham Rigo is an experienced study manager with over a decade of on-site production experience, holding undergraduate degrees in chemical engineering and finance from Curtin University, WA.

Before joining Blackstone, Rigo was a study manager for Ausenco where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects over a range of different commodities.

Rigo has over 11 years of site experience in nickel and cobalt hydromet production experience, in supervisory/superintendent level roles as well as process engineer experience.

Lon Taranaki - Executive

Lon Taranaki is an international mining professional with over 25 years of extensive experience in all aspects of resources and mining, feasibility, development and operations. Taranaki is a qualified process engineer from the University of Queensland Australia. He holds a Master of Business Administration, and is a fellow of the Australian Institute of Company Directors. Taranaki has established his career in Asia where he has successfully worked (and lived) across multiple jurisdictions and commodities ranging from technical, mine management and executive management roles.

Prior to joining Blackstone in February 2022, Taranaki was the chief executive officer of Minegenco, a renewable-energy-focused independent power producer. Preceding this, he was managing director of his private consultancy, AMG Mining Global, where he was providing services to the mining industry in Singapore, Guyana, Indonesia and Cambodia. Additionally, Taranaki has held various senior positions with Sakari Resources, PTT Asia Pacific Mining, Straits Resources, Sedgmans and BHP Coal.

Top 3 ASX Nickel Stocks of 2024

With its diverse applications in both technology and industry, nickel is a metal that will never go out of style.

Nickel is commonly used in alloys to create stainless steel, but more recently has found a modern use: batteries. As the electric vehicle trend gains steam, the base metal is in high demand for its role in lithium-ion batteries.

Nickel has encountered much volatility in the past few years. Prices spiked abruptly to a record US$100,000 per tonne in March 2022, prompting the suspension of trading on the London Metal Exchange.

The metal sank much lower in 2023, ending the year at around US$16,300 on the back of global economic uncertainties and a ramp up in production in top nickel producer Indonesia. However, improving global manufacturing data and supply concerns out of the Philippines sent prices for the metal up over the US$17,500 mark as of mid-April.

Against that backdrop, some ASX nickel companies are making moves. Here the Investing News Network has listed the top nickel stocks on the ASX by year-to-date gains. Data was gathered using TradingView's stock screener on April 11, 2024, and all companies had market caps above AU$10 million at that time. Read on to learn more about them.

1. Ardea Resources (ASX:ARL)

Year-to-date gain: 45.83 percent; market cap: AU$139.88 million; current share price: AU$0.70

Ardea Resources is developing its wholly owned Kalgoorlie nickel project in Western Australia, which includes the Goongarrie Hub deposit. The company has said the project “hosts the largest nickel-cobalt resource in the developed world.” It is currently working towards a planned definitive feasibility study (DFS).

A 2023 prefeasibility study for Goongarrie Hub shows an ore reserve of 194.1 million tonnes at 0.7 percent nickel and 0.05 percent cobalt, resulting in 1.36 million tonnes of contained nickel and 99,000 tonnes of contained cobalt. The study indicates an open-pit operation with a 40 year life and annual output of 30,000 tonnes of nickel and 2,000 tonnes of cobalt.

Last July, the company signed a memorandum of understanding to develop Goongarrie Hub with a Japanese consortium consisting of Sumitomo Metal Mining (TSE:5713), Mitsubishi (TSE:8058) and Mitsui (TSE:8031). On February 29, Ardea shared that it has agreed with the consortium on a DFS budget and the scopes of work for the study. Following the release, the company's share price climbed through March to hit a peak of AU$0.74 on March 18, and has remained elevated.

As of March 27, Ardea and the consortium were in the final stages of hashing out a final cooperative agreement .

2. Nickel Industries (ASX:NIC)

Year-to-date gain: 27.34 percent; market cap: AU$3.75 billion; current share price: AU$0.885

Nickel Industries has built a large portfolio of nickel-mining and downstream processing assets in Indonesia.

A major producer of nickel pig iron for the stainless steel sector, the company began its transition to a battery-grade nickel producer for the electric vehicle battery market in 2022. Nickel Industries holds 80 percent interests in four nickel rotary kiln electric furnace operations, as well as the Hengjaya nickel mine in Indonesia.

In October 2023, Nickel Industries reached a positive final investment decision to participate in the Excelsior nickel-cobalt high-pressure acid leach project in the Indonesia Morowali Industrial Park. The operation is expected to produce a total of 72,000 tonnes per year of contained nickel equivalent across three products: mixed hydroxide precipitate, nickel sulphate and nickel cathode. First production is slated to commence in 2025's fourth quarter.

In its 2023 annual report, released in late February, Nickel Industries shared record annual production of 131,126 tonnes of nickel metal, for a record group EBITDA of US$403.3 million. Shares of the company traded at AU$0.885 on April 11, the highest year-to-date price for the stock.

3. Legend Mining (ASX:LEG)

Year-to-date gain: 7.14 percent; market cap: AU$37.76 million; current share price: AU$0.015

Exploration-stage Legend Mining’s main focus is the Rockford nickel-copper project in Western Australia, a joint venture with prospector Mark Creasy's Creasy Group and IGO (ASX:IGO,OTC Pink:IPGDF).

Creasy Group and IGO are also the two largest shareholders in the company.

As the second quarter of 2024 begins, Legend Mining shares are up slightly from the start of the year. They saw a year-to-date high of AU$0.02 on February 12. According to the company's quarterly report, released on April 11, Legend’s 2024 field program for Rockford will include an extension of a high-power, fixed-loop electromagnetics survey at the Octagonal prospect. That should begin in May, and will be followed by seismic reprocessing for Octagonal, which is expected to be completed in June. Both will help to inform the selection of future drill targets on the property.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Funds Received from Partial Sale of Codrus Shares

Blackstone Minerals Limited (ASX: BSX) (“Blackstone” or the “Company”) is pleased to announce that it has received A$0.9 million from the sale of 25 million Codrus Minerals Limited (ASX: CDR) (“Codrus”) shares through broker facilitated off market transfers.

The Company ended the March 2024 quarter with ~$4m of cash and cash equivalents and following the partial sell down of its investment in Codrus, has an estimated cash position of ~$4.9m.

Blackstone retains 10 million shares in Codrus and will maintain exposure to the portfolio of gold, uranium and rare earths projects.

Blackstone’s Managing Director Scott Williamson commented“the additional cash injection, further strengthens our cash position, coupled with the cost reduction initiatives announced earlier this year, gives the company are longer runway to advancing the joint venture partner search whilst finalising the studies and permitting activities at the Ta Khoa Project in Vietnam”.

Click here for the full ASX Release

This article includes content from Blackstone Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Ramp Metals: Battery Metals Exploration Company Focused on Mining Assets in Saskatchewan

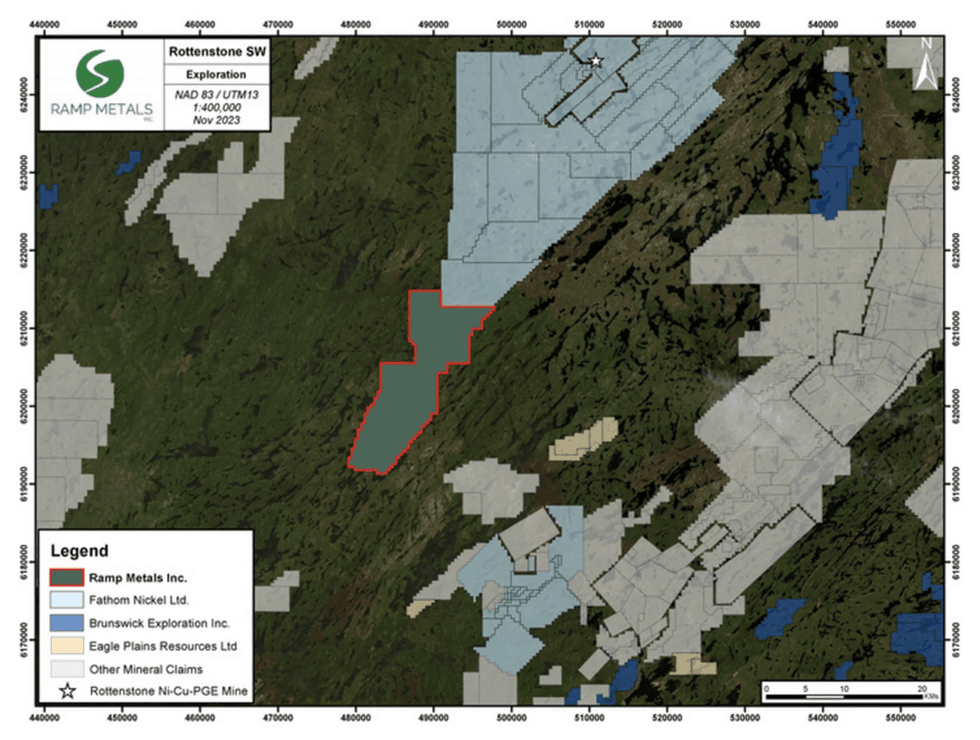

Ramp Metals (TSXV:RAMP) specializes in battery and base metals, particularly nickel and lithium with three properties, two situated in Northern Saskatchewan, Canada, and one in Nevada, United States. The company's Rottenstone SW Claims is situated along a geological structure that historically yielded the highest-grade nickel and platinum group elements (PGE) in Canada. Rottenstone exhibits similarities to the Nova-Bollinger nickel-copper mine in Western Australia, which was discovered by Sirius Resources and ultimately sold to IGO Limited for AU$1.8 billion. The Nova-Bollinger mine had an estimated resource of 13.1 million tons (Mt) grading 2 percent nickel, 0.8 percent copper, and 0.07 percent cobalt.

Ramp Metals' fully permitted drill program in 2024 consists of four drilling locations with eight holes. The current drill program is focused on testing two of these targets. The first target is positioned at the anomaly within the center of the claims and falls within the "Rottenstone Eye" structure. The second target is an anomaly located outside the eye structure, approximately 3 kilometers east-southeast from the first location. To date, Ramp has successfully drilled four holes for a total of 1,180 meters.

The striking similarity between Rottenstone and Nova-Bollinger mine is encouraging and the appointment of Dr. Mark Bennett, the discoverer of the Nova-Bollinger deposit, as a strategic advisor, reinforces Ramp’s belief in the potential of the Rottenstone property. Bennett has over three decades of experience in establishing mines, and played a key role in multiple discoveries, such as the Wahgnion gold mine, the Thunderbox gold mine, and the Waterloo nickel mine, in addition to the Nova-Bollinger nickel-copper mine. Along with Bennett, Ramp Metals has also appointed leading geologist Scott McLean, a 35-year veteran in the mining industry, as its strategic advisor.

Company Highlights

- Ramp Metals is a battery and base metals exploration company with a focus on exploring high-grade nickel-copper-PGE in Northern Saskatchewan. Ramp intends to uncover the next major discovery essential for driving the green technology movement.

- The company has three properties covering a total area of 20,000 hectares. Of these, two are located in Northern Saskatchewan – Rottenstone SW Claims and Peter Lake Domain (PLD). The third property is located in Nye County, Nevada.

- The company’s flagship project Rottenstone SW property is situated adjacent to a northeast-southwest geological formation connected to the renowned Rottenstone Mine. This mine yielded 40,000 tons of high-grade nickel-copper-platinum group elements (PGE) and gold ore, with grades averaging 3.28 percent nickel, 1.83 copper, and 9.63 grams per ton platinum-palladium-gold.

- The geophysical program at Rottenstone highlights striking similarities with the Nova-Bollinger mine in Australia owned by Sirius Resources, which was eventually sold for AU$1.8 billion.

- Dr. Mark Bennett, founder of Sirius Resources who oversaw the development of the Nova-Bollinger mine, is a strategic advisor to Ramp Metals.

This Ramp Metals profile is part of a paid investor education campaign.*

Click here to connect with Ramp Metals (TSXV:RAMP) to receive an Investor Presentation

Nickel Price Update: Q1 2024 in Review

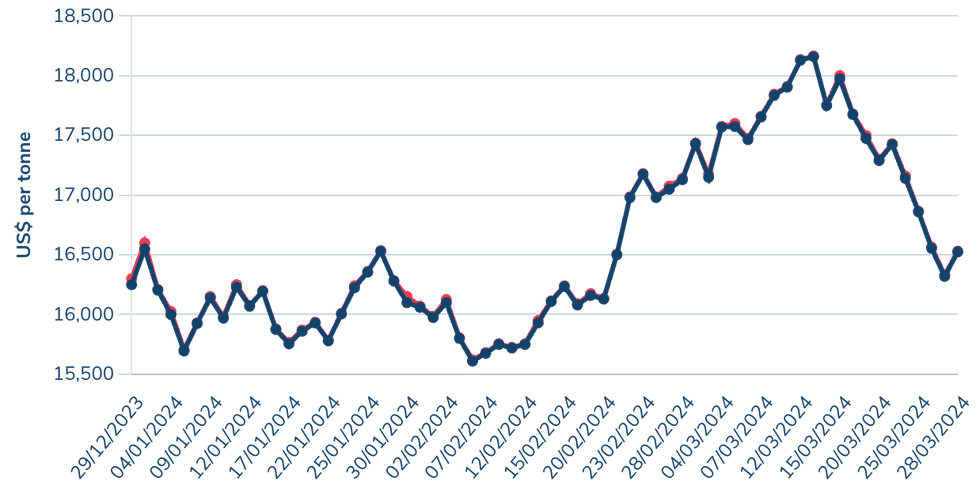

At the start of the year, experts predicted nickel supply to maintain a surplus and the price would stay rangebound through 2024. It opened the first quarter priced at US$16,600 per metric ton (MT) on January 2.

The price was stable during January and February, but March brought with it some volatility with strong gains pushing it to a quarterly high of US$18,165 per MT on March 13.

However, the rising price failed to hold and nickel once again dropped below the US$17,000 mark by the end of the month. Ultimately, the metal fell to US$16,565 on March 28, resulting in a slight loss for the quarter.

Oversupply from Indonesia

Lackluster pricing in the nickel markets is largely the result of the metal's ongoing oversupply position. The largest factor is the continued elevated production rates from Indonesia, which maintains its position as the global leader for the metal. The country produced 1.8 million MT of nickel in 2023, according to the USGS's latest Mineral Commodity Summary, representing half of global supply.

The country’s production has climbed exponentially over the past decade, and this was exacerbated by government initiatives that placed strict limits on the export of raw materials to encourage investment in production and refinement.

In an email to the Investing News Network, Exploration Insights Editor and Analyst Joe Mazumdar wrote, “The growth in EV production and the escalating demand for nickel in batteries prompted the Indonesian government to mandate increased local refining and manufacturing capacity from companies operating in the country.”

Data from S&P Global Market Intelligence provided by Mazumdar showed results of the mandates saw an estimated US$20 billion flowing into the industry in early 2023, with another US$10 billion in undisclosed funding, much of it originating from China.

Despite the lower quality of material coming from Indonesia, the investment was made to shore up supply lines for Chinese battery makers and earmarked for electric vehicle production. However, EV demand has waned through 2023 and into 2024 due to the high-interest rates, range anxiety and charging capacity, increasing nickel stockpiles and contributing to an ongoing oversupply situation.

A report on the nickel market provided by Jason Sappor, senior analyst with the metals and mining research team at S&P Global Commodity Insight, showed that short positions began to accumulate through February and early March on speculation that Indonesian producers were cutting operating rates due to a lack of raw material from mines, which helped push the price up.

The lack of material was caused by delays from a new government approvals process for mining output quotas Indonesia implemented in September 2023. The new system will allow mining companies to apply for approvals every three years instead of every year. The implementation has been slow, which was exacerbated by further delays while the country went through general elections.

The nickel market found additional support on speculation the United States government was eyeing sanctions on nickel supply out of Russia. However, base metals were ultimately not included in the late February sanctions. The price began to decline through the end of March as Indonesian quota approvals accelerated.

Production cuts from western producers

According to data from Macquarie Capital provided by Mazumdar, nickel prices slumping below the US$18,000 mark has made approximately 35 percent of production unprofitable, which would jump to 75 percent if the price were to fall below US$15,000.

Mazumdar indicated the pricing challenges have led to cuts from Australian producers like First Quantum (TSX:FM,OTC Pink:FQVLF) and Wyloo Metals which both announced the suspension of their respective Ravensthorpe and Kambalda nickel mining operations. Additionally, major Australian nickel producer BHP (ASX:BHP,NYSE:BHP,LSE:BHP) is considering cuts of its own.

Nickel price, Q1 2024.

Chart via the London Metal Exchange.

French territory New Caledonia’s nickel mining industry is facing severe difficulties due to faltering prices. The French government has been in talks with Glencore (LSE:GLEN,OTC Pink:GLCNF), Eramet (EPA:ERA) and raw material trader Trafigura, who have significant stakes in nickel producers in the country, and has offered a 200 million euro bailout package for the nation. The French government set a March 28 deadline for New Caledonia to agree to its rescue package, but a decision has not yet been reached as of April 11.

Earlier this year, Glencore announced plans to shutter and search for a buyer for its Koniambo operations, which it said has yet to turn a profit and is unsustainable even with government assistance. For its part, Trafigura has declined to contribute bail-out capital for its 19 percent stake in Prony Resources Nouvelle-Caledonie and its Goro mine, which is forcing Prony to find a new investor before it will be able to secure government funding. On April 10, Eramet (EPA:ERA) reached its own deal with France for its subsidiary SLN’s nickel operations that would see the company extending financial guarantees to SLN.

The situation has exacerbated tensions over independence from France, with opponents of the agreement arguing it risks the New Caledonia's sovereignty and that the mining companies aren’t contributing enough to bailouts of the mines, which employ thousands of New Caledonians. Reports on April 10 indicated that protests have turned violent.

While cuts from Australian and New Caledonian miners aren’t expected to shift the market from a surplus, Mazumdar expects it will help to maintain some price stability in the market.

“The most recent forecast projects demand (7 percent CAGR) will grow at a slower pace than demand (8 percent CAGR) over the next several years, which should generate more market surpluses,” he said.

Government intervention

In an email to INN, Ewa Manthey, Commodities Strategist at ING, suggests this places western producers in a challenging position to affect the market, even with cuts to production.

“The recent supply curtailments also limit the supply alternatives to the dominance of Indonesia, where the majority of production is backed by Chinese investment. This comes at a time when the US and the EU are looking to reduce their dependence on third countries to access critical raw materials, including nickel,” Manthey said.

This was affirmed by Mazumdar, who said the US is working to combat the situation through a series of subsidies designed to encourage western producers and aid in the development of new critical minerals projects.

“The US Inflation Reduction Act (IRA) promotes via subsidies sourcing of critical minerals and EV parts from countries with which it has a free trade agreement or a bilateral agreement. Indonesia and China do not have free trade agreements with the US,” Mazumdar said.

He went on to suggest that the biggest benefactors of this plan would be Australia and Canada, but also noted that with prices remaining depressed multi-billion dollar projects would face headwinds to get off the ground.

Green nickel

One way to encourage western production has been creating a separate price scheme with the creation of a green nickel market that plays into western producers' focus on environmental, social and governance (ESG). Green nickel is defined as a low-carbon product that produces less than 20 MT of carbon dioxide per MT of production.

The oversupply of lower-grade laterite has pulled prices down across the board, including for higher-grade and more environmentally friendly sulfide projects like those in Australia and Canada. This has led to the suggestion of premium pricing for green nickel; however, this hasn’t gained much traction on the London Metals Exchange (LME).

“There is little evidence that a premium for ‘green nickel’ producers or developers has much momentum although an operation with low carbon emissions may have a better chance of getting funding from institutional investors in western countries,” Mazumdar said.

Even though there might not be much interest in green nickel on the LME, there have been some vocal proponents like Wyloo’s CEO Luca Giacovazzi. He sees the premium as being essential for the industry, adding the industry should be looking for a new marketplace if the LME is unwilling to pursue a separate listing for green nickel.

The calls for a premium have largely come from western producers that incur higher labor and production costs to meet ESG initiatives, which is happening less amongst their counterparts in China, Indonesia and Russia.

Western producers were caught off guard early in March as PT CNGR Ding Xing New Energy, a joint venture between China’s CNGR Advanced Material (SHA:300919) and Indonesia’s Rigqueza International PTE, applied to be listed as a “good delivery brand” on the LME. The designation would allow the company, which produces Class 1 nickel, to be recognized as meeting responsible sourcing guidelines set by the LME.

If it is approved, which is considered to be likely, this would be the first time an Indonesian company would be represented on the LME. However, there has been pushback from western miners who have noted that production in Indonesia faces a range of ESG and responsible resourcing challenges.

Investor takeaway

Nickel is a critical metal for the production of batteries to be used in EVs. Generally, battery-grade nickel is processed from the higher quality raw material produced from sulfides, but more recently Chinese production has turned to lower quality laterites. While batteries made from laterite nickel have lower energy density, their cost is also much lower, which may provide key cost savings for EV buyers.

However, with lingering inflation and high interest rates globally, demand for EVs has fallen off over the past two years, which has in turn reduced the demand for nickel.

Meanwhile, despite some slow down due to the approval process, high supply rates from Indonesia have continued into 2024 and there doesn’t seem to be cuts on the horizon from the nation.

These factors have led to a drop in profits and curtailments from large nickel operations in western nations, and made companies unlikely to pursue the construction of new projects in the near term.

“Looking ahead, we believe nickel prices are likely to remain under pressure, at least in the near term, amid a weak macro picture and a sustained market surplus,” Manthey said.

The continued surplus in the market may provide some opportunities for investors looking to get into a critical minerals play at a lower cost, but a reversal may take some time.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Ramp Metals CEO Shares 2024 Drill Plans for Rottenstone Project in Saskatchewan

Ramp Metals (TSXV:RAMP) CEO Jordan Black discussed the company's veteran team of geologists and advisors, and its plans for drilling at its Rottenstone SW nickel-copper-platinum project in Northern Saskatchewan, Canada, to better understand the property’s subsurface geology.

The project's Rottenstone Eye structure is believed to be a major feeder chamber with conductive targets showing striking similarities to the geophysical response of the Nova-Bollinger deposit in Western Australia, which was discovered by geologist Dr. Mark Bennett and his team and later sold for AU$1.8 billion.

After Ramp discovered the similarities between the Rottenstone Eye and the Nova Eye structure at Nova-Bollinger, the company contacted Bennett to get his thoughts about its project. Bennett joined the team as a strategic advisor.

“He was surprised at the similarities between our project and his," Black said. "So we've built this world-class advisory team, including (Bennett) himself to help mentor us through this discovery process."

In addition to Bennett, Ramp also brought in veteran geologists Scott McLean and Richard Murphy. McLean has undertaken significant work at the Sudbury Nickel Camp in Ontario, Canada.

“We're a small team, but we have these great technical advisors on our team as well,” Black said.

The company plans to conduct an extensive ground geophysics program in the summer. The project is permitted for up to 2,000 meters of drilling, according to Black. Ramp plans to expand the drilling program to 5,000 or 10,000 meters to further define the resource under the surface.

Watch the full interview with Ramp Metals CEO Jordan Black above.

Disclaimer: This interview is sponsored by Ramp Metals (TSXV:RAMP). This interview provides information which was sourced by the Investing News Network (INN) and approved by Ramp Metalsin order to help investors learn more about the company. Ramp Metals is a client of INN. The company’s campaign fees pay for INN to create and update this interview.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Ramp Metals and seek advice from a qualified investment advisor.

This interview may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The issuer relies upon litigation protection for forward-looking statements. Investing in companies comes with uncertainties as market values can fluctuate.

MT Survey Outlines Large Undrilled Conductive Anomalies and an Extensive Host Horizon at BAGB

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide results and interpretation from the magnetotelluric (“MT”) survey conducted across the Alotta and Midrim areas of its 100% owned Belleterre Angliers Greenstone Belt “BAGB” projects in Quebec, Canada.

Highlights

- MT survey identifies large conductive anomalies below the shallow Midrim and Alotta discoveries, where historical intersection highlights include:

- 9.4m @ 3.5% Ni, 4.3% Cu and 4.6g/t 2PGM+Au from 56.6m in MR-17-011

- 4.3m @ 6.5% Ni, 5.2% Cu and 7.2g/t 2PGM+Au from 57.2m in MR-00-051

- 9.2m @ 2.6% Ni, 2.8% Cu and 3.6 g/t 2PGM+Au from 85.2m in ZA-18-082

- Extensive mafic intrusive contact ‘host horizon’ successfully mapped in 3D across the entire survey area.

- The prospectivity of this host horizon is validated by its coincidence with the high grade discoveries at Alotta and Midrim.

- Location and orientation of the interpreted structures further supports prospectivity of the targets identified.

- Small fraction of this host horizon has been tested by drilling at surface, and not drill tested at depth.

- Important targets now identified for follow-up work, which will include historic VTEM reinterpretation prior to drill testing.

- Survey area is only 5% of Pivotal’s 100% owned 157km2 BAGB project which hosts a large number of near surface, high grade intersections, showings, and geophysical anomalies requiring follow-up exploration.

Managing Director, Mr Fairhall said:

“This MT survey is an exciting enhancement in the understanding of the opportunity at BAGB. It supports the geological model that Midrim and Alotta are indicators of an extensive magmatic intrusion which acted as the plumbing system for these high grade surficial deposits. The survey allows us to map this prospective horizon and highlight prospective conductors as targets for sizeable accumulations of sulphide mineralisation.

It is clear that previous operators had a narrow focus on specific shallow anomalies, and that the property remains wide open for discovery potential – significantly accumulations at depth, but also for on strike surficial repeats of Midrim and Alotta.

We are advancing our target prioritisation to design a program to drill test these anomalies, alongside others on the remainder of the very prospective 100% owned claim package we have assembled at BAGB.”

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Blackstone Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.