- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Blackstone Signs MOU with Arca: Seizing Carbon Capture Opportunity

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to announce the Company has entered into a Memorandum of Understanding (“MOU”) with Arca Climate Technologies Inc. (“Arca”).

Announcement Highlights

- Blackstone and Arca sign MOU to further investigate the carbon capture potential at Ta Khoa Project via carbon mineralisation and explore opportunities to utilise Arca’s carbon capture technologies within the Project,

- Studies indicate that passive CO2 capture is possible at a scale of kilo-tonnes of CO2 per year from the Project’s mine waste. This is significant compared to similar projects,

- In July 2023 the European Union Council declared from 18 February 2025, every industrial or electric vehicle battery on the EU market with a capacity of over 2 kWh will require a battery passport containing information on items including carbon footprint declaration1,

- Life Cycle Analysis has shown the Project is capable to produce a nickel product with one of the lowest carbon footprints in the industry, with identified pathways to reduce the carbon footprint further with additional studies,

- Carbon mineralisation is one technology being considered to further reduce the Project’s carbon footprint.

Arca is developing a portfolio of carbon capture technologies to measure, maximise and monetise the carbon mineralisation potential of mine waste. Using its proprietary intellectual property, Arca helps its partners in the minerals industry to transform mine waste into an industrial-scale carbon sink, advancing the future of carbon-negative mining.

Blackstone continues its pursuit to be one of the greenest nickel producers in the world. Successful implementation of Arca’s proprietary intellectual property will enable Blackstone to further reduce the Company’s Ta Khoa Project’s (“TKP”) carbon footprint, allowing Blackstone to realise its Green Nickel™ vision and position the Company to meet the growing global demand for low carbon intensity battery raw materials.

Under the MOU, Arca and Blackstone agree to collaborate on the following:

- Blackstone and Arca will enter non-exclusive strategic relationship to further investigate the carbon capture potential at TKP via carbon mineralisation,

- Arca will expand on previous characterisation work which has indicated the Ta Khoa Project contains minerals such as brucite, known to be highly reactive to CO2 in air,

- Data collected from this engagement will inform future design considerations to maximise carbon mineralisation, further reducing TKP’s carbon footprint and providing a pathway to carbon-negative mining.

Significance of the Green Nickel™ strategy

Lower carbon emissions intensity has potential to add value to the Company and differentiate it from competitors in relation to its product offering. There is increasing global pressure on disclosing carbon emissions intensity within battery supply chains and their lifecycle. From 18 February 2025, every industrial or electric vehicle (“EV”) battery on the EU market with a capacity of over 2 kWh will require a battery passport (refer to https://www.circulor.com/battery-passport), containing information on items including a carbon footprint declaration as well as human rights and battery supply chain due diligence obligations throughout the battery value chain2.

As an example, Polestar, the Swedish electric performance car brand, is setting the trend to provide transparency throughout the automotive industry by working with Circulor, a supply chain technology provider. With the partnership, Polestar and Circulor will track a wide range of raw materials. Consumers will be able to follow the journey thanks to Polestar’s Product Sustainability Declaration, which discloses carbon footprint and traced risk materials through labelling on the company website and in Polestar Spaces, setting a unique transparency precedent for the industry and an ambitious standard for the carbon tracking scheme within the battery passport3.

It is expected that this legislative environment will support and incentivise battery manufacturers to source raw materials from suppliers with demonstrated lower carbon emissions intensity in their supply chains, supporting demand and pricing for Ta Khoa Project’s nickel products.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Blackstone Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Blackstone Minerals

Overview

As the world moves closer to a sustainable net-zero future, the need for battery metals continues to mount and nickel may soon be among the metals to see a supply crunch. Though its roots are in the stainless steel sector, it's also a critical component of lithium-ion batteries.

Given that many nations are aiming to replace combustion vehicles with electric cars by 2030, the metal is already experiencing a massive spike in demand. Benchmark Minerals expects the need for battery-grade nickel will increase about 950 percent by 2040.

It's imperative to ramp up global nickel production but the resource sector, for its part, must do so with a much-reduced carbon footprint to influence the sustainability of the entire value chain. Blackstone Minerals (ASX:BSX, OTC:BLSTF, FRA:B9S) recognizes this. As a vertically integrated producer of low-cost, low-carbon nickel, the company aims to become a leading source of low CO2 emission nickel sulphide. Its flagship Ta Khoa Project in Vietnam is representative of that goal.

With over 20 active mines and a burgeoning technology sector, Vietnam is on the road to becoming a hub of electric vehicle production and innovation, with low labor costs and regulated electricity pricing further driving its growth. Steadily increasing foreign direct investment in the region is indicative of this as the country seeks to attract $50 billion in new foreign investment by 2030.

Blackstone is uniquely positioned to take advantage of this, thanks to two factors. US President Joe Biden's Inflation Reduction Act, which came into force in August 2022, represents the largest investment into climate action in United States history. A similar initiative is rolling out in the European Union (EU), which maintains a Free Trade Agreement with Vietnam — something multiple partners of the company have expressed interest in.

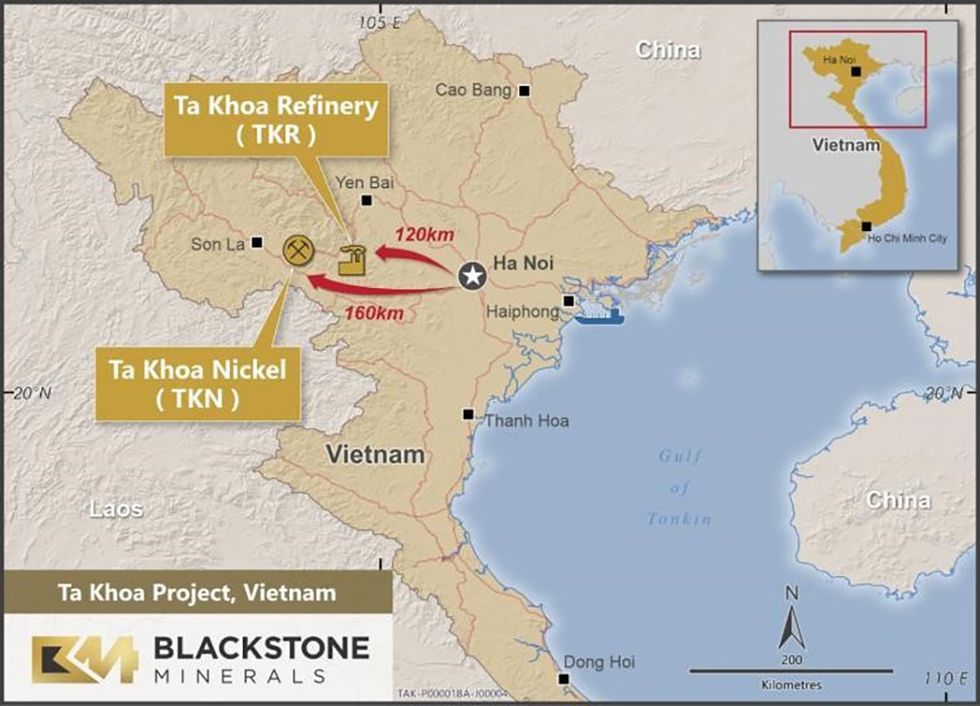

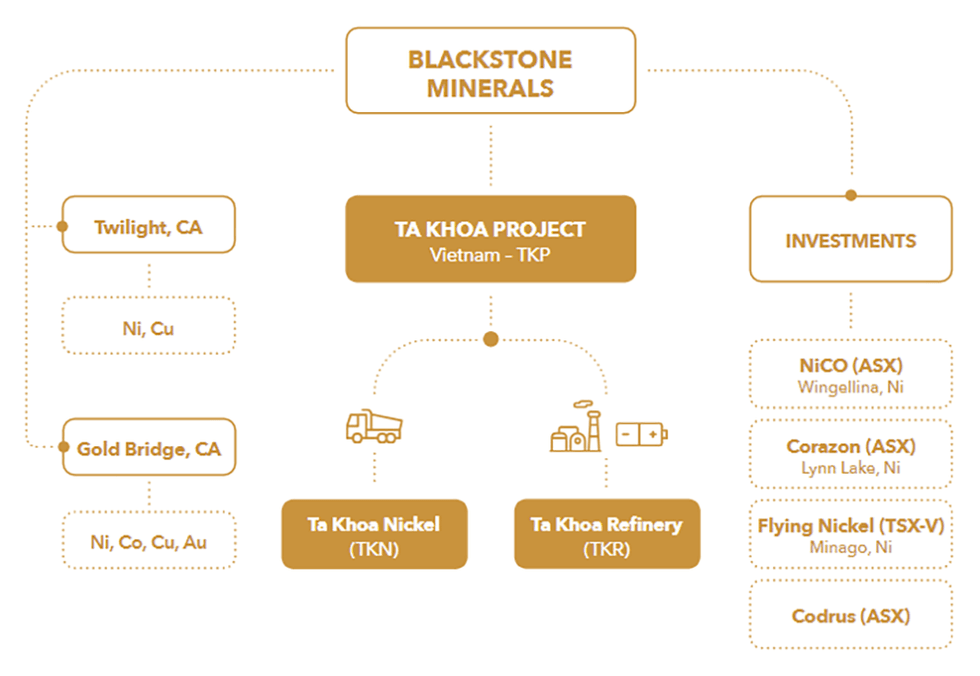

Blackstone's Ta Khoa Project consists of two streams, the Ta Khoa Nickel Mine and the Ta Khoa Refinery. Recent milestones point to Blackstone’s commitment to advancing this game-changing project.

These milestones include a memorandum of understanding with Cavico Laos Mining to collaborate in a number of areas associated with CLM’s nickel mine in Lao People's Democratic Republic and supply of nickel products for Blackstone’s Ta Khoa Refinery in Vietnam. Blackstone also partnered with Arca Climate Technologies to further investigate the carbon capture potential at the Ta Khoa Project through carbon mineralisation, and explore opportunities to utilise Arca’s carbon capture technologies within the project.

In a bid to collaborate on the supply of renewable wind energy to the Ta Khoa Project, Blackstone signed a direct power purchase agreement with Limes Renewables Energy.

Blackstone received AU$2.8 million as an advance from a research & development (R&D) lending fund backed by Asymmetric Innovation Finance and Fiftyone Capital. The advanced payment reflects the significant investment by Blackstone to develop the Ta Khoa Refinery process and Blackstone’s unique strategy to convert nickel concentrate blends into battery products in the form of precursor cathode active material (pCAM).

In addition to Ta Khoa, the company also maintains the Gold Bridge cobalt and gold project near Vancouver, Canada.

In December 2023, Blackstone entered into an option agreement with CaNickel Mining to acquire the Wabowden nickel project located in the world-class Thompson Nickel Belt in Manitoba, Canada.Company Highlights

- The global nickel market is currently entering a structural deficit, with demand expected to grow 950 percent by 2040.

- Blackstone Minerals is well-positioned to address this deficit as a vertically integrated producer of low-cost, low-carbon nickel.

- Blackstone's flagship project Ta Khoa is a brownfield project situated in Vietnam, one of the lowest capital cost countries in the world and an emerging hub for the electric vehicle market with vast reserves of nickel.

- Vietnam is an increasingly attractive region for investment with direct foreign investments that grew from $1.3 billion in 2000 to $15.6 billion in 2020.

- The Ta Khoa project also has infrastructure advantages, via the existing Ban Phuc mine, and processing facilities, access to low-cost and underutilized hydroelectricity, a trained labor force and support from the local government.

- Blackstone Minerals’ downstream pre-feasibility study confirms a technically and economically robust hydrometallurgical refining process to upgrade nickel sulphide concentrate to produce battery-grade nickel

- Blackstone’s key nickel and cobalt feedstocks for the Ta Khoa Refinery Pilot program were delivered to the metallurgical laboratory in Western Australia as of April 2022.

Key Projects

Ta Khoa

Blackstone holds a 90 percent interest in the Ta Khoa Nickel-Copper-PGE Project, located 160 kilometers west of Hanoi in the Son La Province of Vietnam. It includes an existing modern nickel mine built to Australian Standards, which is currently under care and maintenance. The Ban Phuc nickel mine successfully operated as a mechanized underground nickel mine from 2013 to 2016.

Blackstone intends to complement the existing mine through the installation of a large concentrator, refinery and precursor facility, supporting integrated on-site production of nickel, cobalt and manganese precursor products for the Asia-Pacific market. One of Blackstone's key Research and Development objectives with Ta Khoa is to develop a flowsheet that will support this production.

To fulfill this goal, Blackstone is focusing on a partnership model, collaborating with groups committed to sustainable mining. It is also working to minimize its carbon footprint and implement a vertically integrated supply chain.

In addition to the early development of the King Snake and Ban Chang Massive Sulphide deposits, Blackstone plans to produce crystal nickel and cobalt sulphide intermediate products. Staged development of the refinery, meanwhile, predicts an initial train capacity of 200,000 tonnes annually in the first year, with a planned expansion to 400,000 by the second.

The mine is expected to begin production in 2025 and then ramp up to 8 million tons per annum (Mtpa) of nickel sulphide by 2027. Pilot Plant testing and definitive feasibility studies are also underway. Five groups visited the project in 2022 as part of the partnership due diligence process, accompanied by meetings with government representatives, Austrade, Australian department of foreign affairs and trade, financial institutions and other important stakeholders

Project Highlights:

- Multiple Massive Sulphide Deposits: The Ta Khoa project features several incredibly promising deposits including King Snake (up to 4.3 percent nickel and 18.2 grams per ton (g/t) PGE), Sui Phong (2.95 meters @ 2.42 percent nickel, 0.52 percent copper, 0.06 percent cobalt and 0.05 g/t PGE), and Ban Chang. The project is also the site of the Ban Phuc nickel mine, which was operated from 2013 to 2016 by Asia Mineral Resources, along with several exploration targets that have yet to be tested.

- Experienced Leadership: Internally, Blackstone’s owners’ team brings over 50 years of experience in leadership roles at major nickel mines and refineries globally. This experience has been complemented by ALS Group, Wood, Future Battery Industries CRC, Curtin University and the Electric Mining Consortium.

- Large Reserve and Mining Inventory: The entirety of Ta Khoa is estimated to contain probable reserves of 48.7 Mt at 0.43 percent nickel for 210 kilotons (kt) of nickel and a mining inventory of 64.5 Mt at 0.41 percent nickel for 265 kt nickel. This excludes Ban Khoa and other developing prospects.

- A Long-lived Project: The Ta Khoa mine is expected to produce a yearly average of 18 kt of annual nickel concentrate over its ten-year lifespan. Blackstone believes the refinery can potentially extend its life past ten years.

- An Established Mining Operation: Existing infrastructure onsite includes a 450 ktpa Mill and mining camp. The mine will also benefit from a highly supportive community and favorable government legislation — Blackstone is committed to collaborating with community stakeholders in the project's development.

- Feed Flexibility: Ta Khoa's refinery will offer multiple feed options, including nickel concentrate, mixed hydroxide precipitate, nickel matte and black mass. This flexibility greatly improves the security and greatly reduces the risk of the project overall.

- Valued Partnerships: Blackstone is collaborating with multiple industry leaders and groups in the development of Ta Khoa

- Compelling Pre-feasibility Study: The financial outcomes of a base case pre-feasibility study on the project are promising. Based on a conservative NCM811 precursor price forecast, Ta Khoa displays an exceptional internal return rate on capital invested.

- Integrated Vertical Strategy: Blackstone is constructing both the Ta Khoa mine and refinery against a highly supportive ESG, macroeconomic and fiscal backdrop. This along with Ta Khoa's low capital intensity gives the company a significant advantage over competitors. Said low intensity is the result of multiple factors, including competitive labor costs, favorable regulations and low-cost renewable hydroelectric power.

- A Leader in Low Emissions: Independent assessments from Digbee, Minviro and Circulor, alongside an audit from the Nickel Institute, have confirmed that Ta Khoa will be the lowest-emitting flowsheet in the industry, at 9.8 kilograms of CO2 per kilogram of precursor with opportunities for even further reduction.

- Promising Pilots: With the support of ALS and process engineering partner Wood, Blackstone recently completed a 12-month programme of work that developed a scaled version of its concentrate to sulphate flowsheet. The refinery, which processed more than 9 tonnes of concentrate and MHP, successfully achieved battery-grade nickel sulphate of 99.95 percent, with a nickel recovery rate of 97 percent.

- Current Roadmap: Blackstone's next priority is to complete a series of definitive feasibility studies. Once those are complete, it will focus on fully integrating the mine into the electric vehicle consumer supply chain and finalizing its refining partnership structure.

Gold Bridge

The Gold Bridge Project is located approximately 200 kilometers northwest of Vancouver, BC. It comprises 365 square kilometers of 100 percent Blackstone-owned mining claims located in the Cordilleran Terranes of BC. It includes several, high-grade hydrothermal gold, cobalt, nickel and copper deposits and targets the historic Little Gem and Jewel mines.

Project Highlights:

- Significant Potential: Blackstone's geological model for the Jewel mine suggests it may have a similar geological setting to the world-class Bou-Azzer primary cobalt district in Morocco. There is potential for multiple similar deposits throughout the project.

- Favorably Located Anomalies: Having completed an extensive maiden exploration program, Blackstone has identified multiple large-scale IP anomalies at Little Gem, Erebor, Jewel and Roxey.

- A Nascent Venture: Blackstone is currently actively seeking joint venture partners for the Gold Bridge project.

Management Team

Hamish Halliday - Non-executive Chairman

Hamish Halliday is a geologist with over 20 years of corporate and technical experience. He is also the founder of Adamus Resources Limited, an AU$3 million float that became a multimillion-ounce emerging gold producer.

Scott Williamson - Managing Director

Scott Williamson is a mining engineer with a commerce degree from the West Australian School of Mines and Curtin University. He has over 10 years of experience in technical and corporate roles in the mining and finance sectors.

Dr. Frank Bierlein - Non-executive Director

Dr. Frank Bierlein is a geologist with 30 years of technical and corporate experience, focusing on grassroots to mine-stage mineral exploration, target generation, project management and oversight, due diligence studies, mineral prospectivity analysis, metallogenic framework studies and mineral resources market and investment analysis.

Alison Gaines - Non-executive Director

Alison Gaines has over 20 years of experience as a director in Australia and internationally. She has experience in the roles of board chair and board committee chair, particularly remuneration and nomination and governance committees. She is also the managing director of Gaines Advisory P/L and was recently global CEO of international search and board consulting firm Gerard Daniels, with a significant mining and energy practice.

Gaines has a Bachelor of Laws and a Bachelor of Arts (hons) from the University of Western Australia, a Graduate Diploma in Legal Practice from Australian National University and an honorary doctorate of the University and Master of Arts (Public Policy) from Murdoch University. She is a fellow of the Australian Institute of Company Directors and holds the INSEAD certificate in corporate governance. She is currently the governor of the College of Law Ltd, and non-executive director of Tura New Music.

Dan Lougher - Non-executive Director

Daniel Lougher’s career spans more than 40 years involving a range of exploration, feasibility, development, operations and corporate roles with Australian and international mining companies including a period of eighteen years spent in Africa with BHP Billiton, Impala Plats, Anglo American and Genmin. He was the managing director and chief executive officer of the successful Australian nickel miner Western Areas Ltd until its takeover by Independence Group.

Lougher also holds a first class mine manager’s certificate of competency (WA) and is a fellow of the Australasian Institute of Mining and Metallurgy (AusIMM). Lougher is the chair of the company’s technical committee and nomination committee.

Jamie Byrde - CFO and Company Secretary

Jamie Byrde has over 16 year's experience in corporate advisory, public and private company management since commencing his career with big four and mid-tier chartered accounting firms positions. Byrde specializes in financial management, ASX and ASIC compliance and corporate governance of mineral and resource focused public companies. He is also currently company secretary for Venture Minerals Limited.

Dr. Stuart Owen - Executive

Dr. Stuart Owen holds a Bsc and PhD in geology with over 20 years of experience in mineral exploration. He was senior geologist in the team that discovered the Paulsens Mine (+1Moz) and as an exploration manager at Adamus discovered the Southern Ashanti Gold deposits (+2Moz). Finally, at Venture, he discovered the Mt Lindsay Tin-Tungsten-Magnetite deposits.

Tessa Kutscher - Executive

Tessa Kutscher is an executive with more than 20 years of experience in working with C-Level executive teams in the fields of business strategy, business planning/optimisation and change management. After starting her career in Germany, she has worked internationally across different industries, such as mining, finance, tourism and tertiary education.

Kutscher holds a master’s degree in literature, linguistics and political science from the University of Bonn, Germany and a master’s degree in teaching from Ludwig Maximilian University of Munich.

Andrew Strickland - Executive

Andrew Strickland is an experienced study and project manager, a fellow of the Australian Institute of Mining and Metallurgy, University of WA MBA graduate, with undergraduate degrees in chemical engineering and extractive metallurgy from Curtin and WASM.

Before joining Blackstone, Strickland was a senior study manager for GR Engineering Services where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects. Over his career, he has held a variety of project development roles across both junior to mid-tier developers (including Straits Resources, Perseus Mining and Tiger Resources) and major multi-operation producers (South32).

Graham Rigo - Executive

Graham Rigo is an experienced study manager with over a decade of on-site production experience, holding undergraduate degrees in chemical engineering and finance from Curtin University, WA.

Before joining Blackstone, Rigo was a study manager for Ausenco where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects over a range of different commodities.

Rigo has over 11 years of site experience in nickel and cobalt hydromet production experience, in supervisory/superintendent level roles as well as process engineer experience.

Lon Taranaki - Executive

Lon Taranaki is an international mining professional with over 25 years of extensive experience in all aspects of resources and mining, feasibility, development and operations. Taranaki is a qualified process engineer from the University of Queensland Australia. He holds a Master of Business Administration, and is a fellow of the Australian Institute of Company Directors. Taranaki has established his career in Asia where he has successfully worked (and lived) across multiple jurisdictions and commodities ranging from technical, mine management and executive management roles.

Prior to joining Blackstone in February 2022, Taranaki was the chief executive officer of Minegenco, a renewable-energy-focused independent power producer. Preceding this, he was managing director of his private consultancy, AMG Mining Global, where he was providing services to the mining industry in Singapore, Guyana, Indonesia and Cambodia. Additionally, Taranaki has held various senior positions with Sakari Resources, PTT Asia Pacific Mining, Straits Resources, Sedgmans and BHP Coal.

Tartisan Nickel Corp. Acquires Additional Claims for the Kenbridge Nickel Project, Advances Baseline Studies

Tartisan Nickel Corp. (CSE: TN) (OTCQB: TTSRF) (FSE: 8TA)("Tartisan", or the "Company") is pleased to announce that the Company has acquired additional contiguous claims at the Kenbridge Nickel Project, Northwestern Ontario. The total property size now consists of 93 contiguous patents, 153 single cell mining claims and 4 Mining Licenses which in total cover 4,273 ha. The patents and staked cells are owned 100% by Tartisan Nickel Corp. through wholly owned subsidiaries.

The Kenbridge Nickel Project is in the north-central part of the Atikwa Lake area and the south-central part of the Fisher Lake area, Kenora Mining Division, 70 kms east-southeast of the Town of Kenora in northwestern Ontario, Canada. The Kenbridge Nickel Deposit hosts a Nickel-Copper Resource with a 622-meter shaft.

Tartisan Nickel Corp. is also pleased to announce that Aspen Biological Ltd. staff have commenced 2024 baseline study field work which includes completing the baseline aquatic and terrestrial fieldwork within the project footprint and access road options. These studies, along with baseline data previously collected will be used to develop baseline environmental reports to support provincial and federal reviews, approvals, and permitting for advanced exploration and eventual mine development. Ongoing species at risk surveys will also help meet monitoring requirements for exploration activities under Ontario's Endangered Species Act.

Aspen Biological Ltd. is a biological consulting firm based in Thunder Bay, Ontario and provides professional consulting services to the natural resources sectors in northern Ontario. Aspen's principal, Lindsay Spenceley (H.B.Sc-Biology) is a biologist with 23 years of professional experience across North America, specializing in Species at Risk, terrestrial and aquatic baseline environmental assessments and post-development monitoring and compliance. Ms. Spenceley has provided biological support for over 70 hydroelectric, mining, solar, wind, transmission, and development projects during the baseline, impact assessment, construction & operations, and decommissioning phases of a project's life cycle. Ms. Spenceley's main professional focus has involved Species at Risk baseline screenings, habitat assessments, surveys, mitigation, monitoring, and permitting within boreal ecosystems. She has significant expertise carrying out monitoring programs for boreal caribou, wolverine, SAR bat species, and eastern whip-poor-will. She has been involved with and contributed to SAR early exploration mitigation plans, permitting under Ontario's Endangered Species Act, and baseline studies for several mining projects in northern Ontario. Mark Appleby, CEO of Tartisan Nickel Corp. states, "In addition to excellent field skills in all seasons and environments, Lindsay has considerable project management skills. Aspen Biological can leverage its network of experienced resource professionals to pull together, as needed, multi-disciplinary teams to deliver upon project requirements and timelines in a cost-effective manner".

Mark Appleby goes onto say, "Lindsay is also experienced in indigenous consultation and engagement, aboriginal traditional knowledge interviews, land use and occupancy studies, and providing environmental and biological training to Indigenous communities. She routinely works collaboratively with environmental monitors during field programs and is always willing to incorporate input, perspectives, and the opinions of others. Lindsay recently completed a 10-day Indigenous Traditional Values Data Collection Training by Terry Tobias and Associates".

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian based mineral exploration and development company which own; the Kenbridge Nickel Project in northwestern Ontario; the Sill Lake Silver Property in Sault Ste. Marie, Ontario as well as the Don Pancho Manganese-Zinc-Lead Liver Property in Peru.

Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE: TN) (OTCQB: TTSRF) (FSE: 8TA). Currently, there are 121,969,004 shares outstanding (127,669,004 fully diluted).

For further information, please contact Mark Appleby, President & CEO, and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedar.com.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

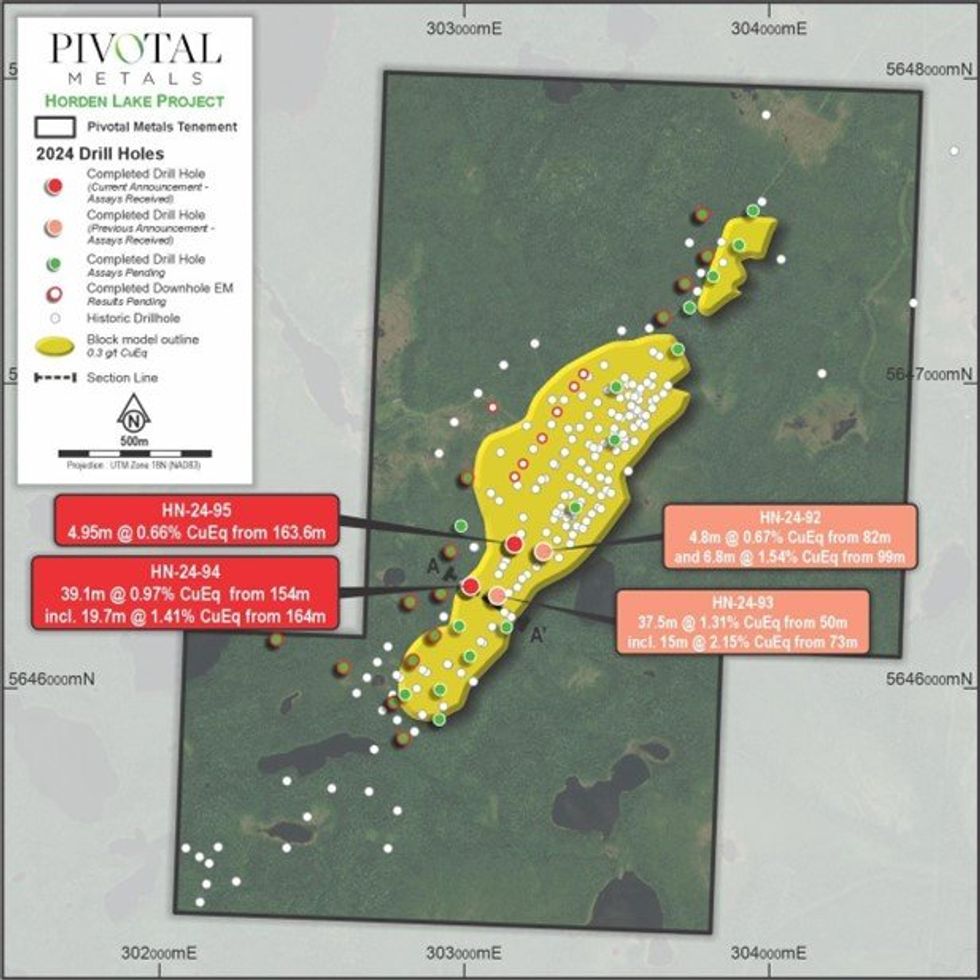

Drilling Confirms Thick Copper Zone Continuity at Horden Lake

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide assay results from two further drill holes from its 2024 diamond drill program completed at its 100% owned Horden Lake Project in Quebec, Canada.

Highlights

- HN-24-94 extends broad zones of copper rich mineralisation down-plunge of previously reported HN-24-93.

- 39.1m @ 0.97% CuEq (0.4% Cu, 0.17% Ni, 0.06g/t Au, 0.14g/t Pd) plus additional 0.07g/t Pt, 131ppm Co, 4.7g/t Ag from 154.1m

- Including 19.7m at 1.41% CuEq from 163.6m

- Includes multiple 2-3m sections grading >2% CuEq

- Drill hole infills a large area, almost 100m from any previous drill hole

- HN-24-95 confirms mineralisation continuity below HN-24-92.

- 4.95m @ 0.66% CuEq (0.23% Cu, 0.12% Ni, 0.05g/t Au, 0.14g/t Pd) plus additional 0.05g/t Pt, 240ppm Co, 3.3g/t Ag from 155.7m

- Assay results and mineralisation consistent with the lower magnetic response between the central and southern zones of the deposit

- Significant gold, silver, palladium, platinum and cobalt metals delineated once again, which were not assayed for in this part of the deposit during previous drill campaigns.

- Consistent news-flow ahead, including results from the remaining 6,392 m / 30 diamond drill holes and downhole EM surveys to be released progressively through the quarter, followed by mineral resource update and metallurgical testwork in H2.

Managing Director, Mr Fairhall said:

“Horden Lake delivers further confirmation of the wide zones of mineralisation indicative of the large, open-pittable copper project that has been defined on the project. The meaningful assays of palladium, gold, cobalt, platinum and silver, previously ignored, further reinforce the upside potential of this asset.

Logging and analysis continues, and we expect consistent news flow over the coming months as we release assays and downhole geophysics interpretations to target both grade and tonnage upside potential on the project.”

Overview

Horden Lake is a copper dominant Cu-Ni-Au-PGM-Co Project located 131km north-northwest of Matagami, in Quebec Canada. The Project hosts a 28mt at 1.5% CuEq indicated and inferred mineral resource estimate, as a result of over 52,464m of drilling already completed on the property. Pivotal has recently completed a 7,097m 34 hole diamond drilling campaign. 2 drill holes / 264m have been reported prior to this announcement.

The objectives of the drilling program were to infill missing by-product multi-element assay information, potentially expand the resource (which remains open at depth across its full extent), and collect a distribution of metallurgical sample for a complete test work program. Downhole EM surveys have also been completed to dimension future exploration potential and targeting.

Drill Hole Discussion

Holes HN-24-92 and HN-24-93 were designed to target gaps in the resource blocks, infill and add additional missing metals assay information. Table 1 contains significant intercepts, and Figure 2 is a longitudinal section showing the spatial distribution of historical and new drill hole pierce points.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

3 Top Weekly TSXV Stocks: Power Nickel Leads with 70 Percent Gain

The S&P/TSX Venture Composite Index (INDEXTSI:JX) gained 14.25 points last week to close at 595.95.

One of the biggest news items this past week was Panama's presidential election, held on Sunday (May 5). Jose Raul Mulino secured 34 percent of the vote against five other candidates to become the country’s president.

Mulino was a last-minute replacement after former President Ricardo Martinelli was barred from running due to a money laundering conviction. Mulino was minister of public security during Martinelli's presidency, which ended in 2014.

The incoming president will replace outgoing President Laurentino Cortizo, who has reached the term limit for the office. Under Cortizo, Canadian mining company First Quantum Minerals (TSX:FM,OTC Pink:FQVLF) was forced to shut down its Cobre Panama mine in November 2023. The order came after a review by Panama’s Supreme Court — it determined that a mining contract renewed earlier in 2023, which sparked protests due to its terms, was unconstitutional.

While viewed as pro-business, Mulino has indicated that he will not move forward with discussions unless First Quantum drops its US$20 billion arbitration against the country. He also vowed that any solution will not involve a contract.

For its part, First Quantum has said it will work with Panama's new administration to find a solution to reopen the mine, which accounts for more than 300,000 metric tons (MT) of copper annually and was responsible for providing more than 40,000 direct and indirect jobs in the country when it was operational.

Against that backdrop, which TSXV-listed mining stocks performed the best last week? Here are the top gainers.

1. Power Nickel (TSXV:PNPN)

Weekly gain: 70 percent; market cap: C$76.6 million; current share price: C$0.68

Power Nickel is a nickel exploration company that is currently focused on the development of its Nisk nickel-copper project in the Eeyou Istchee James Bay region of Québec, Canada. The project comprises 90 mineral claims covering an area of 4,589 hectares, and has seen significant exploration from 2021 to 2024.

Power Nickel released an initial resource estimate for Nisk in November 2023, and it outlines an indicated resource of 5.43 million MT at a weighted average grade of 1.05 percent nickel equivalent. The inferred resource stands at 1.79 million MT grading 1.35 percent nickel equivalent. The company used a nickel equivalent cut-off grade of 0.2 percent for inside the open pit and 0.55 percent for the underground portion of the deposit.

Shares of Power Nickel have seen significant gains since the middle of April, when the firm announced significant initial assay results from its Lion copper-platinum-palladium target, located 5 kilometers north of the main deposit at Nisk.

More recently, the company announced on April 24 that it had concluded its earn-in agreement for Nisk with Critical Elements Lithium (TSXV:CRE,OTCQX:CRECF), giving it an 80 percent stake in the project. Power Nickel was granted the final 30 percent interest after Critical Elements accepted the technical report it completed during the first quarter.

Last Friday (May 10), Power Nickel released further assays that expanded Lion with a new polymetallic discovery. One 5 meter interval graded 1.76 grams per MT (g/t) gold, 102.9 g/t silver, 12.7 percent copper, 20.87 g/t palladium, 1.02 g/t platinum and 0.4 percent nickel.

2. Flying Nickel Mining (TSXV:FLYN)

Weekly gain: 52.63 percent; market cap: C$13.65 million; current share price: C$0.145

Flying Nickel Mining is a nickel and platinum-group metals (PGMs) developer working to advance its flagship Minago nickel-PGMs project to production. The site is located on the southern end of the Thompson Nickel Belt in Manitoba, Canada.

The company’s most recent news came on April 11, when it released an update to Minago's measured and indicated resource. The site hosts 43.44 million MT grading 0.2 g/t palladium, 0.09 g/t platinum and 0.72 percent nickel for a total of 689.53 million pounds of nickel, 279,330 ounces of palladium and 125,700 ounces of platinum.

This marked the first addition of PGMs to the resource estimate for Minago, as well as a 42 percent increase in contained nickel from in-pit resources. In the release, Flying Nickel also said it is expecting a decision this fall for the notice of alteration to its environment act license. The company filed the notice in July 2022.

3. Sandfire Resources America (TSXV:SFR)

Weekly gain: 46.15 percent; market cap: C$388.87 million; current share price: C$0.38

Sandfire Resources America is a copper development company focused on its Black Butte copper project located east of Helena, Montana, in the US. In 2021, a state district court revoked the company's mine operating permit for Black Butte, halting construction activities at the underground mine.

Sandfire describes the project as one of the highest-grade undeveloped copper deposits in the world; a resource estimate for the project's Johnny Lee deposit completed in 2020 outlines a measured and indicated resource of 10.9 million MT grading 2.9 percent copper for a total of 311,000 MT of contained copper.

Shares of Sandfire soared following the Montana Supreme Court's February 26 decision to reinstate the company's mine operating permit. The win is a crucial step for Sandfire to continue the construction of its mine.

The most recent news from Sandfire came on April 29, when it announced assay results from exploration at Black Butte. It highlighted an intercept of 7.4 percent copper over 9.54 meters, including 10.7 percent copper over 6.26 meters. The company said the additional drilling has the potential to increase the resource and extend Black Butte's mine life.

FAQs for TSXV stocks

What is the difference between the TSX and TSXV?

The TSX, or Toronto Stock Exchange, is used by senior companies with larger market caps, while the TSXV, or TSX Venture Exchange, is used by smaller-cap companies. Companies listed on the TSXV can graduate to the senior exchange.

How many companies are listed on the TSXV?

As of September 2023, there were 1,713 companies listed on the TSXV, 953 of which were mining companies. Comparatively, the TSX was home to 1,789 companies, with 190 of those being mining companies.

Together the TSX and TSXV host around 40 percent of the world’s public mining companies.

How much does it cost to list on the TSXV?

There are a variety of different fees that companies must pay to list on the TSXV, and according to the exchange, they can vary based on the transaction’s nature and complexity. The listing fee alone will most likely cost between C$10,000 to C$70,000. Accounting and auditing fees could rack up between C$25,000 and C$100,000, while legal fees are expected to be over C$75,000 and an underwriters’ commission may hit up to 12 percent.

The exchange lists a handful of other fees and expenses companies can expect, including but not limited to security commission and transfer agency fees, investor relations costs and director and officer liability insurance.

These are all just for the initial listing, of course. There are ongoing expenses once companies are trading, such as sustaining fees and additional listing fees, plus the costs associated with filing regular reports.

How do you trade on the TSXV?

Investors can trade on the TSXV the way they would trade stocks on any exchange. This means they can use a stock broker or an individual investment account to buy and sell shares of TSXV-listed companies during the exchange's trading hours.

Data for this 5 Top Weekly TSXV Performers article was retrieved at 1:00 p.m. PST on May 3, 2024, using TradingView's stock screener. Only companies with market capitalizations greater than C$10 million prior to the week's gains are included. Companies within the non-energy minerals and energy minerals were considered.

Article by Dean Belder; FAQs by Lauren Kelly.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Lauren Kelly, hold no direct investment interest in any company mentioned in this article.

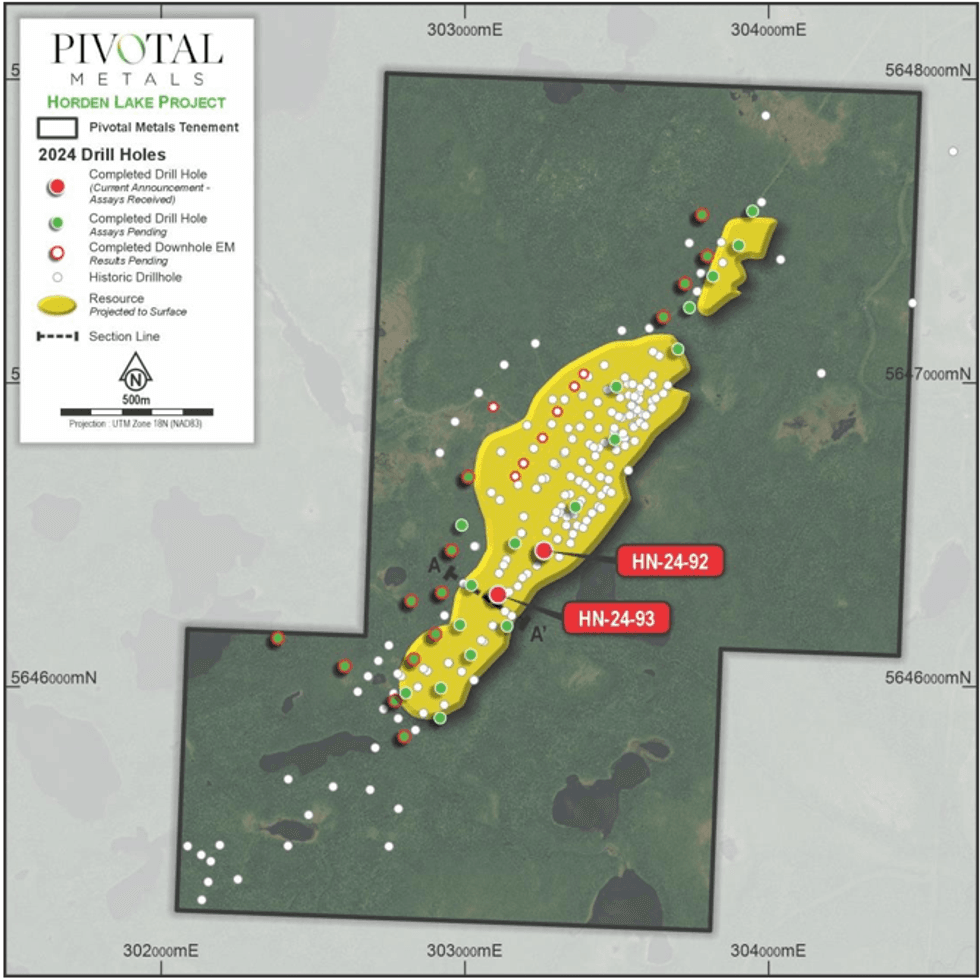

First Assays Confirm Thick Copper Zone and Significant By-Products at Horden Lake

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide the first assay results from the first 2 of 34 diamond drill holes completed at its 100% owned Horden Lake Project in Quebec, Canada.

Highlights

- Drilling confirms broad zones of copper rich Cu-Ni-Au-PGM-Co mineralisation at Horden Lake, including 37.5m at 1.31% CuEq.

- Significant gold, silver, palladium, platinum and cobalt metals delineated, which were not assayed for in this part of the deposit during historical drill campaigns.

- The first two drill holes fall within the pit constrained portion of the 28 Mt at 1.5% CuEq Indicated and Inferred Mineral Resource Estimate1,2, and display moderately thicker and better grades than the surrounding historical holes.

- Consistent news-flow ahead, including results from the remaining 6,833 m / 32 diamond drill holes and downhole EM surveys to be released progressively through the quarter, followed by mineral resource update and metallurgical testwork in H2.

Assay Highlights

HN-24-93

- 37.5m @ 1.31% CuEq2 (0.57% Cu, 0.22% Ni, 0.10g/t Au, 0.15g/t Pd) plus additional 0.05g/t Pt, 180ppm Co, 7.2g/t Ag from 51.15m

Including 15.0m @ 2.15% CuEq (0.98% Cu, 0.35% Ni, 0.2g/t Au, 0.18g/t Pd) plus additional 0.04g/t Pt, 261ppm Co, 13.4g/t Ag from 73.65m - 1.2m @ 4.44% CuEq (2.73% Cu, 0.35% Ni, 0.81g/t Au, 0.39g/t Pd) plus additional 0.11g/t Pt, 324ppm Co, 33.1g/t Ag from 87.45m

HN-24-92

- 4.8m @ 0.67% CuEq (0.2% Cu, 0.12% Ni, 0.05g/t Au, 0.18g/t Pd) plus additional 0.07g/t Pt, 96ppm Co, 2g/t Ag from 82m

- 6.75m @ 1.54% CuEq (0.63% Cu, 0.28% Ni, 0.07g/t Au, 0.20g/t Pd) plus additional 0.10g/t Pt, 179ppm Co, 7.2g/t Ag from 99m

Including 3.85m @ 2.14% CuEq (0.85% Cu, 0.40% Ni, 0.09g/t Au, 0.26g/t Pd) plus additional 0.12g/t Pt, 234ppm Co, 9.5g/t Ag from 101.2m

Managing Director, Mr Fairhall said:

“I am very pleased to be sharing the first of many assays from Pivotal’s maiden drilling campaign at Horden Lake. These results showcase the shallow wide zones of copper rich mineralisation that characterises Horden Lake. Importantly they validate the existence of significant gold, palladium, platinum, cobalt and silver which were never previously assayed in this part of the deposit, and will serve as potential upside to our mineral resource update later this year.

We look forward to sharing consistent news-flow in the coming months as we receive more assays and downhole geophysics interpretations, to complement our strategy to grow Horden Lake and demonstrate its high-quality development credentials.”

Overview

Horden Lake is a copper dominant Cu-Ni-Au-PGM-Co Project located 131km north-northwest of Matagami, in Quebec Canada. The Project hosts a 28mt at 1.5% CuEq indicated and inferred mineral resource estimate, as a result of over 52,464m of drilling already completed on the property. Pivotal has recently completed a 7,097m 34 hole diamond drilling campaign. The objectives of the drilling program were to infill missing by-product multi-element assay information, potentially expand the resource (which remains open at depth across its full extent), and collect a distribution of metallurgical sample for a complete test work program. Downhole EM surveys have also been completed to dimension future exploration potential and targetting.

Drill Hole Discussion

Holes HN-24-92 and HN-24-93 were designed to target gaps in the resource blocks, infill and add additional missing metals assay information. Table 1 contains significant intercepts, and Figure 2 is a longitudinal section showing the spatial distribution of historical and new drill holes.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Ramp Metals Announces Proposed Debt Settlements

Ramp Metals Inc. (TSXV:RAMP) ("Ramp Metals" or the "Company") announces that the Company intends to settle outstanding accounts payable in the aggregate amount of $131,476.90 (collectively, the "Debt") owing to certain creditors through the issuance of 730,424 common shares in the capital of Ramp (collectively, the "Settlement Shares") at a deemed price of $0.18 per Settlement Share (the "Transaction").

No new Control Person (as that term is defined in the policies of the TSX Venture Exchange (the "TSXV")) will be created pursuant to the Transaction; however, two non-arm's length parties are expected to receive a total of 62,500 Settlement Shares upon the settlement of $11,250 worth of the Debt. The issuance of those Settlement Shares constitutes a "related party transaction" as that term is defined in Multilateral Instrument 61-101 Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on exemptions from the formal valuation and minority approval requirements under MI 61-101, and in particular, Sections 5.5(a) and 5.7(1)(a) of MI 61-101, as neither the fair market value of the subject matter of, nor the fair market value of the consideration for, the transaction, insofar as it involves those parties, exceeds 25% of the Company's market capitalization.

The board of directors and management of the Company believe that the Transaction is in the best interests of the Company because it will allow the Company to preserve its cash to fund future operations.

The Settlement Shares will be subject to a statutory four-month and one-day hold period from the date of issuance. The Transaction remains subject to the approval of the TSXV.

About Ramp Metals Inc.

Ramp Metals is a battery and base metal exploration company with two flagship properties located in northern Saskatchewan and one property in Nye County, Nevada. The management team is passionate about green field exploration and new technologies. The vision of Ramp Metals is to make the next big discovery required to fuel the green technology movement.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking statements. Generally, such forward-looking information or forward- looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein include, but are not limited to, statements regarding the Transaction.

These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: the ability of Ramp to complete the Transaction; requirements for additional capital; future prices of minerals; changes in general economic conditions; changes in the financial markets and in the demand and market price for commodities; other risks of the mining industry; the inability to obtain any necessary governmental and regulatory approvals; changes in laws, regulations and policies affecting mining operations; hedging practices; and currency fluctuations.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

For further information, please contact:

Ramp Metals Inc.

Jordan Black Chief Executive Officer jordaneblack@rampmetals.com

Click here to connect with Ramp Metals Inc. (TSXV:RAMP) to receive an Investor Presentation

March 2024 Quarterly Report

Updated Mineral Resource Estimate for the Hotinvaara Prospect establishes the Pulju Project as a globally significant nickel sulphide district; Base of Till drilling program commences at the recently granted Holtinvaara Exploration Licence.

Nordic Nickel Limited’s (“Nordic Nickel” or “the Company”) (ASX: NNL) flagship 100%-owned Pulju Nickel Project is located in the Central Lapland Greenstone Belt (CLGB), 50km north of Kittilä in Finland, with access to world-class infrastructure, grid power, a national highway, international airport and, importantly, Europe’s only two nickel smelters.

HIGHLIGHTS

- Updated Mineral Resource Estimate (MRE) completed for the Hotinvaara Prospect:

- MRE increased to 418Mt @ 0.21% Ni, 0.01% Co and 53ppm Cu for 862,800t of contained Ni, 40,000t of contained Co and 22,100t of contained Cu;

- Indicated Resource now 42Mt @ 0.22% Ni, for 92,700t of contained Ni;

- Inferred Resource of 376Mt @ 0.21% Ni, for 770,100t of contained Ni.

- A substantial portion of the updated MRE, over 459kt of contained Ni, is located within 250m of surface.

- The Company’s 28 holes drilled during 2023 have more than tripled the in-situ contained nickel estimate and the updated MRE now exceeds the upper end of the Company’s previously published Exploration Target1.

- Detailed metallurgical test work program on Hotinvaara ore is continuing.

- Base of Till (BOT) drilling campaign commenced on the recently granted Holtinvaara Exploration Licence (EL) area, designed to test nickel and copper sulphide targets on one of the three major prospective magnetic anomalies in the area within an interpreted extension of the mineralised ultramafics seen at Hotinvaara.

- New Investor Hub launched to enhance shareholder engagement.

- Cash of $1.96m as of 31 March 2024.

The known nickel mineralisation in the CLGB is typically associated with ultramafic cumulate and komatiitic rocks with high-grade, massive sulphide lenses and veins enveloped by very large, lower grade disseminated nickel sulphide near-surface. The disseminated nickel at Pulju is widespread and indicates the presence of a vast nickel-rich system.

During the March 2024 Quarter, Nordic Nickel reported an updated Mineral Resource Estimate for Hotinvaara comprising 418 million tonnes grading 0.21% Ni, 0.01% Co and 53ppm Cu for 862,800 tonnes of contained Ni, 40,000t of contained Co and 22,100t of contained Cu2.

Pulju is located 195km from Boliden’s Kevitsa Ni-Cu-Au-PGE mine and 9.5Mtpa processing plant in Sodankylä, Finland. Kevitsa provides feed for the 35ktpa Harjavalta smelter, which is located approximately 950km to the south and processes concentrate from Kevitsa’s low-grade disseminated nickel sulphide ore (Mineral Resource Estimate Ni grade ~0.21%). Europe’s only other smelter is Terrafame’s 37ktpa Sotkamo smelter, located 560km south-east of Pulju.

Click here for the full ASX Release

This article includes content from Nordic Nickel, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Blackstone Minerals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.