- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Botanix Relishes Scheduling Update for Synthetic CBD

Botanix Pharmaceuticals announced a critical scheduling update from the US Drug Enforcement Administration regarding synthetic CBD used by its business associate Purisys.

Botanix Pharmaceuticals (ASX:BOT) noticed a boost thanks to a regulation change for the synthetic cannabidiol (CBD) produced with its business partner, Purisys.

In a press release issued on Monday (November 25), the company said that on November 22 Purisys received confirmation that its CBD, which carries less than 0.001 percent of tetrahydrocannabinol (THC), was removed from the scheduling as a controlled substance by the US Drug Enforcement Administration (DEA) within the Controlled Substances Act.

“This change in the regulation of synthetic CBD in the US will make a major difference to the speed of developing Botanix products and greatly reduces the risks and costs of clinical development,” Vince Ippolito, executive chairman and president of Botanix, said in a press release.

The executive said this ruling from the American federal authority comes at just the right time for the company since it’s getting ready for studies in its dermatology programs.

Botanix and Purisys are tied together by way of a supply agreement signed in October.

The duo is celebrating the change from the DEA; prior to this resolution, the use of synthetic CBD for clinical studies needed licensing from the federal agency. According to Botanix, this led to “significant management and cost overheads to Botanix’s pharmaceutical development activities.”

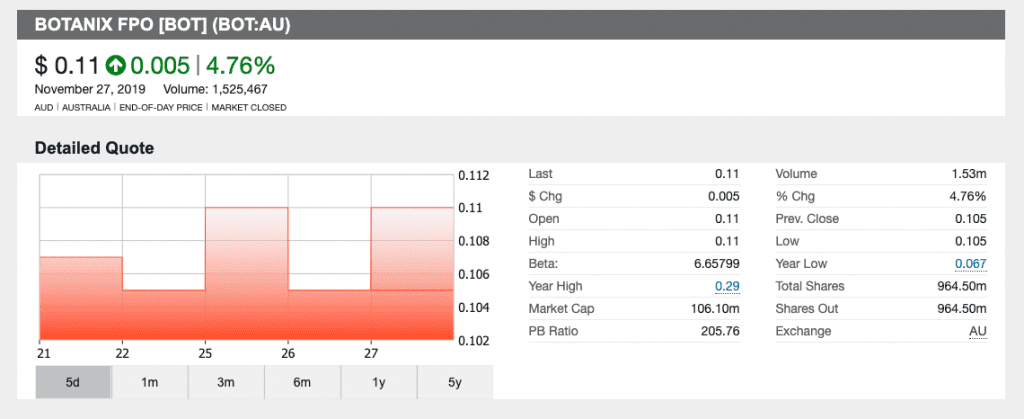

Shares of Botanix jumped nearly 5 percent on Monday when it first informed investors of the crucial change. As of Wednesday’s (November 27) trading session, the company is up nearly 5 percent for a price per share of AU$0.11.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Cannabis Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2322.78 | -0.91 | |

| Silver | 27.24 | -0.04 | |

| Copper | 4.50 | +0.04 | |

| Oil | 82.89 | -0.47 | |

| Heating Oil | 2.56 | -0.02 | |

| Natural Gas | 1.74 | -0.07 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Bryan is a Senior Editor with INN. After graduating from the Langara journalism program he did some freelance reporting with community newspapers in British Columbia. He initially wrote about the life science space for INN and now spends his time covering the marijuana market, from Canadian LPs to US-based companies, and the impact of this sector on investors.

Learn about our editorial policies.