- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Centaurus Metals: The World’s Next Green Nickel Project

Centaurus Metals (ASX:CTM) focuses on the near-term production of a nickel sulfide project in Brazil. The Company’s goal is to have a nickel sulfide-producing mine by the end of 2024 to answer the increasing demand for the mineral in the production of lithium-ion batteries.

The Jaguar Nickel Sulphide Project is the company’s flagship project and is located in a world-class mining region in Brazil known as Carajás Mineral Province. Centaurus Metals formally completed the acquisition of the asset in 2020 and delivered its maiden Mineral Resource Estimate later that year. Two Mineral Resource updates were delivered in 2021 with the most recent being a massive 80.6Mt at 0.91 percent Ni for 730,700 tonnes of contained nickel metal. The strong presence of high-grade nickel sulfide means that Centaurus Metals has the potential to become a Class-1 nickel producer.

Company Highlights

- The Jaguar Nickel Sulphide Project is the company’s flagship asset and historical and new survey results indicate the presence of high-grade nickel sulfide

- Its JORC Mineral Resource Estimate indicates that the project contains 80.6Mt at 0.91 percent Ni for 730,700 tonnes of contained nickel metal.

- Scoping Study work completed in May 2021 demonstrates the potential to become a Class-1 nickel producer.

- At conservative nickel price of US$7.50/lb and sulphate premium of only US$0.50/lb, the Scoping Study showed that by producing +20,000 tonnes of nickel in sulphate over an initial mine life of 13 years, the project could generate cash flows in the order of US$200m per annum and had a post-tax NPV of A$1.1 billion and IRR of 52%.

- These NPV increases to over A$1.6 billion with an IRR of 70% at a nickel price of US$9.00/lb.

- The company also operates the Jambreiro Iron Ore Project in Brazil, which helped establish a foothold in the country.

- An updated Pre-Feasibility Study on Jambreiro outlined a 1Mtpa start-up project capable of generating life-of-mine revenues of A$1.08 billion and EBITDA of A$647 million over its initial 18-year life.

- A strong management team with applicable experience in developing mining assets in Brazil and nickel means they have the potential to create a highly productive asset at Jaguar.

Click here to connect with Centaurus Metals (ASX:CTM) to receive an Investor Presentation

This article includes content from Centaurus Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

March 2024 Quarterly Report

Updated Mineral Resource Estimate for the Hotinvaara Prospect establishes the Pulju Project as a globally significant nickel sulphide district; Base of Till drilling program commences at the recently granted Holtinvaara Exploration Licence.

Nordic Nickel Limited’s (“Nordic Nickel” or “the Company”) (ASX: NNL) flagship 100%-owned Pulju Nickel Project is located in the Central Lapland Greenstone Belt (CLGB), 50km north of Kittilä in Finland, with access to world-class infrastructure, grid power, a national highway, international airport and, importantly, Europe’s only two nickel smelters.

HIGHLIGHTS

- Updated Mineral Resource Estimate (MRE) completed for the Hotinvaara Prospect:

- MRE increased to 418Mt @ 0.21% Ni, 0.01% Co and 53ppm Cu for 862,800t of contained Ni, 40,000t of contained Co and 22,100t of contained Cu;

- Indicated Resource now 42Mt @ 0.22% Ni, for 92,700t of contained Ni;

- Inferred Resource of 376Mt @ 0.21% Ni, for 770,100t of contained Ni.

- A substantial portion of the updated MRE, over 459kt of contained Ni, is located within 250m of surface.

- The Company’s 28 holes drilled during 2023 have more than tripled the in-situ contained nickel estimate and the updated MRE now exceeds the upper end of the Company’s previously published Exploration Target1.

- Detailed metallurgical test work program on Hotinvaara ore is continuing.

- Base of Till (BOT) drilling campaign commenced on the recently granted Holtinvaara Exploration Licence (EL) area, designed to test nickel and copper sulphide targets on one of the three major prospective magnetic anomalies in the area within an interpreted extension of the mineralised ultramafics seen at Hotinvaara.

- New Investor Hub launched to enhance shareholder engagement.

- Cash of $1.96m as of 31 March 2024.

The known nickel mineralisation in the CLGB is typically associated with ultramafic cumulate and komatiitic rocks with high-grade, massive sulphide lenses and veins enveloped by very large, lower grade disseminated nickel sulphide near-surface. The disseminated nickel at Pulju is widespread and indicates the presence of a vast nickel-rich system.

During the March 2024 Quarter, Nordic Nickel reported an updated Mineral Resource Estimate for Hotinvaara comprising 418 million tonnes grading 0.21% Ni, 0.01% Co and 53ppm Cu for 862,800 tonnes of contained Ni, 40,000t of contained Co and 22,100t of contained Cu2.

Pulju is located 195km from Boliden’s Kevitsa Ni-Cu-Au-PGE mine and 9.5Mtpa processing plant in Sodankylä, Finland. Kevitsa provides feed for the 35ktpa Harjavalta smelter, which is located approximately 950km to the south and processes concentrate from Kevitsa’s low-grade disseminated nickel sulphide ore (Mineral Resource Estimate Ni grade ~0.21%). Europe’s only other smelter is Terrafame’s 37ktpa Sotkamo smelter, located 560km south-east of Pulju.

Click here for the full ASX Release

This article includes content from Nordic Nickel, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals Limited (ASX: BSX) (“Blackstone” or the “Company”), Yulho Co. Ltd (“Yulho”) and EN Plus Co. Ltd (“EN Plus”) (together, “the Parties”), have signed a non-binding Memorandum of Understanding (“MOU”) to explore one or more strategic Joint Ventures (“JV”).

HIGHLIGHTS

- In January 2024, Blackstone entered into a Memorandum of Understanding with Yulho Co. Ltd and EN Plus Co. Ltd to explore one or more strategic joint ventures,

- In February, His Excellency, Mr Andrew Goledzinowski, Australian Ambassador to Vietnam visited Son La Province in northern Vietnam, where Blackstone’s vertically integrated mining and refining projects are located. The Ambassador met with Son La Provincial Peoples Committee and toured the Company’s projects, the visit highlights the key role the Ta Khoa project plays in the global transition to net zero,

- Blackstone provided an update on its funding strategy and corporate activities in February, the primary focus being on project permitting, finalising the Ta Khoa Refinery definitive feasibility study and the joint venture partner search,

- In March, Blackstone provided an update to its refinery byproduct offtake strategy, signing a non- binding Memorandum of Understanding with three Vietnamese companies to sell Ta Khoa Refinery byproducts, being manganese sulphate (or epsomite) and sodium sulphate.

CORPORATE

- End of quarter cash position of $4.18m,

- Post quarter end received $0.9m from the sale of 25 million shares in Codrus Minerals Ltd,

- $2m received from the sale of shareholding in NiCo Resources Ltd,

- Listed investments of $1.6m at the end of the quarter,

- Completion of the retail component of the Non-Renounceable Entitlement Offer launched on 5th December 2023, raising an additional $323k before costs,

- Research and Development rebate of $4.25m received during the quarter, and the repayment of the $2.8m advance received in July 2023 to Asymmetric Innovation Finance.

Blackstone, Yulho and EN Plus Sign Memorandum of Understanding to Develop a Global Nickel Business

The MOU aims to establish a collaboration across the businesses including EN Plus and Yulho who are in JV on the Ntaka Hill nickel sulphide project in Tanzania, and the Dinagat Island nickel laterite project in the Philippines.

The Parties will investigate the feasibility of establishing a strategic partnership, focusing on the following project specifics:

1. Yulho, via the creation of a joint venture in Tanzania, will engage in nickel mining, primarily to supply concentrate to Blackstone's facilities in Vietnam.

2. Blackstone's Vietnamese refining facility will be tasked with producing NCM811 precursor.

Yulho Overview

Yulho is a company that specialises in providing comprehensive IT infrastructure solutions encompassing servers, storage, networking, virtualization, and cloud computing. It was acquired by EN Plus in December 2023. Yulho will be the holding company for EN Plus’s mining and battery materials businesses which currently include the Ntaka Hill nickel sulphide project in Tanzania, and the Dinagat Island nickel laterite project in the Philippines.

Click here for the full ASX Release

This article includes content from Blackstone Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Top 9 Nickel-producing Countries (Updated 2024)

Stainless steel accounts for the vast majority of nickel demand, but electric vehicle (EV) batteries represent a growing application for the base metal as the shift toward a greener future gains steam.

But while nickel's long-term outlook appears bright, it may face headwinds in the short term. After a tough 2023, experts are projecting a surplus this year as weak usage coincides with strong output from top producer Indonesia.

What other dynamics are affecting nickel supply? If you're interested in getting exposure to the market, you should be aware of the factors at play. To get you started, here's a look at the top nickel-producing countries.

Figures are based on the latest US Geological Survey data. Read on to learn more.

1. Indonesia

Mine production: 1.8 million MT

Claiming first place for production by a long shot, Indonesia is a prime example of a country wanting to get in on the exploding market for nickel. Its output of the base metal has grown tremendously from 2017’s number of 345,000 metric tons (MT) to a whopping 1.8 million MT in 2023. Indonesia also hosts 55 million MT of nickel reserves.

The nation is actively building out its EV battery industry, and Indonesia's close proximity to China, the world’s current leader in EV manufacturing, makes for an ideal setup. In May 2021, the country welcomed the commissioning of its first plant to process nickel for use in EV batteries. Dozens more such projects are reportedly in the pipeline, according to East Asia Forum. "In just three years, Indonesia has signed more than a dozen deals worth more than $15 billion for battery materials and EV production with global manufacturers," Euronews reported.

Major auto maker Ford (NYSE:F) announced in December 2023 that it is taking a direct stake in the proposed Pomalaa battery nickel plant, which is slated to begin production in 2026.

2. Philippines

Mine production: 400,000 MT

The Philippines has been one of the top nickel-producing countries for quite some time, as well as a nickel ore exporter. Another country with close proximity to China, the Philippines currently has more than 30 nickel mines, including Rio Tuba, operated by Nickel Asia, one of the nation’s top nickel ore producers. After taking a small hit between 2017 and 2018, when nickel production fell from 366,000 MT to 340,000 MT, the Philippines increased its nickel output to 420,000 MT in 2019. The upward trend was seemingly short-lived as the country continues to deal with record rainfall that has flooded mining operations. In 2022, the archipelagic country saw its nickel output slip to 345,000 MT.

2023 was a big year for recovery as the country's nickel mines managed to increase their output to 400,000 MT. That resurgence could continue as two of the Philippines' biggest nickel producers, Nickel Asia and Global Ferronickel, are planning to invest about a combined US$2 billion to build new nickel-processing plants, as per Bloomberg.

3. New Caledonia

Mine production: 230,000 MT

The economy of this French territory just off the coast of Australia depends heavily on the price of nickel. Although its production has decreased in recent years, dropping from 220,000 MT in 2019 to 190,000 MT in 2022, output picked up steam in 2023 to land at 230,000 MT, giving New Caledonia the third spot over Russia.

More recently, New Caledonia’s nickel industry has been plagued by rising energy costs and sociopolitical unrest. This February, major miner Glencore (LSE:GLEN,OTC Pink:GLCNF) made the decision to shutter its Koniambo nickel mine and put it up for sale. The company cited high operating costs and a weak nickel market.

Given these circumstances, the French government has offered a 200 million euro bailout package for New Caledonia’s nickel industry. But the move hasn't gone as planned, with trader Trafigura deciding not to contribute to the bailout of Prony Resources Nouvelle-Calednie and the Goro mine, in which it has a 19 percent stake.

As of mid-April, the situation remained in limbo.

4. Russia

Mine production: 220,000 MT

Even though it holds the fourth spot on this list of the world's top nickel producers, Russia has seen its nickel output drop in the past few years. In 2018, the nation’s nickel output totaled 272,000 MT, but it came in at 220,000 MT in 2023.

Russia’s Norilsk Nickel (OTC Pink:NILSY,MCX:GMKN) is one of the world’s largest nickel and palladium producers. Nornickel owns nickel reserves on the Taymyr Peninsula in Siberia and the Kola Peninsula in Northwest Russia.The company saw its production decline by 5 percent in 2023, and is expecting further declines in 2024, reported Retuers. "In 2024, we expect that risks related to an adverse geopolitical situation will continue to impact our operations," said Senior Vice President and Operational Director Sergey Stepanov. "Furthermore, this year we are planning capital repairs of the flash smelting furnace #2 at Nadezhda Metallurgical Plant."

5. Canada

Mine production: 180,000 MT

Canada’s nickel production declined from 180,000 MT in 2019 to 143,000 MT in 2022. However, its nickel producers turned it around in 2023 to yet again post 180,000 MT in output of the metal. The country’s Sudbury Basin is the second largest supplier of nickel ore in the world, and Vale’s (NYSE:VALE) Sudbury operation is located there.

Another key nickel producer in Canada is Glencore, which owns the Raglan mine in Québec, as well as the Sudbury Integrated Nickel Operations in Ontario. The major miner's Sudbury site includes the Nickel Rim South mine, the Fraser mine, the Strathcona mill and the Sudbury smelter.

In February, Canada Nickel Company (TSXV:CNC,OTCQX:CNIKF) said it is planning to develop a US$1 billion nickel processing plant in Ontario, which once complete would be North America’s largest.

Canada's nickel industry stands to benefit from the US Inflation Reduction Act which promotes the sourcing of critical minerals for EV batteries from countries with which the US has free trade agreements or bilateral agreements.

6. Australia

Mine production: 160,000 MT

Australia, another top nickel-producing country, saw its production increase slightly from 155,000 MT in 2022 to 160,000 MT in 2023. One top miner in the country is BHP (NYSE:BHP,ASX:BHP,LSE:BHP) with its Nickel West division.

Australia's largest nickel mines also include First Quantum Minerals' (TSX:FM,OTC Pink:FQVLF) Ravensthorpe, and Glencore's Murrin Murrin. Low prices have wreaked havoc on nickel mining in the country, leading to reduced or sidelined operations at six different nickel facilities in the country starting in December 2023, including Ravensthorpe. The situation was enough to prompt the Australian government to add nickel to its critical minerals list.

Like Canada, Australia is considered a potential benefactor of the US Inflation Reduction Act's emphasis on sourcing battery materials from nations with free trade agreements or bilateral agreements with the US.

7. China

Mine production: 110,000 MT

China’s nickel production has remained relatively consistent in recent years. In addition to being a top nickel-producing country, China is the world’s leading producer of nickel pig iron, a low-grade ferronickel used in stainless steel. Jinchuan Group, a subsidiary of Jinchuan Group International Resources (HKEX:2362), is a large nickel producer in China.

China's key role in stainless steel production means that it also influences nickel price dynamics. This was a key factor in 2023 as Indonesia's surplus weighed on the market, as China is a major importer of the country's nickel.

According to a US Geological Survey report, by early 2023, "the surplus had cascaded into an excess of nickel sulfate causing numerous companies in China to convert nickel sulfate to Class I metal, which was expected to add more than 150,000 tons of Class I metal capacity by yearend 2024."

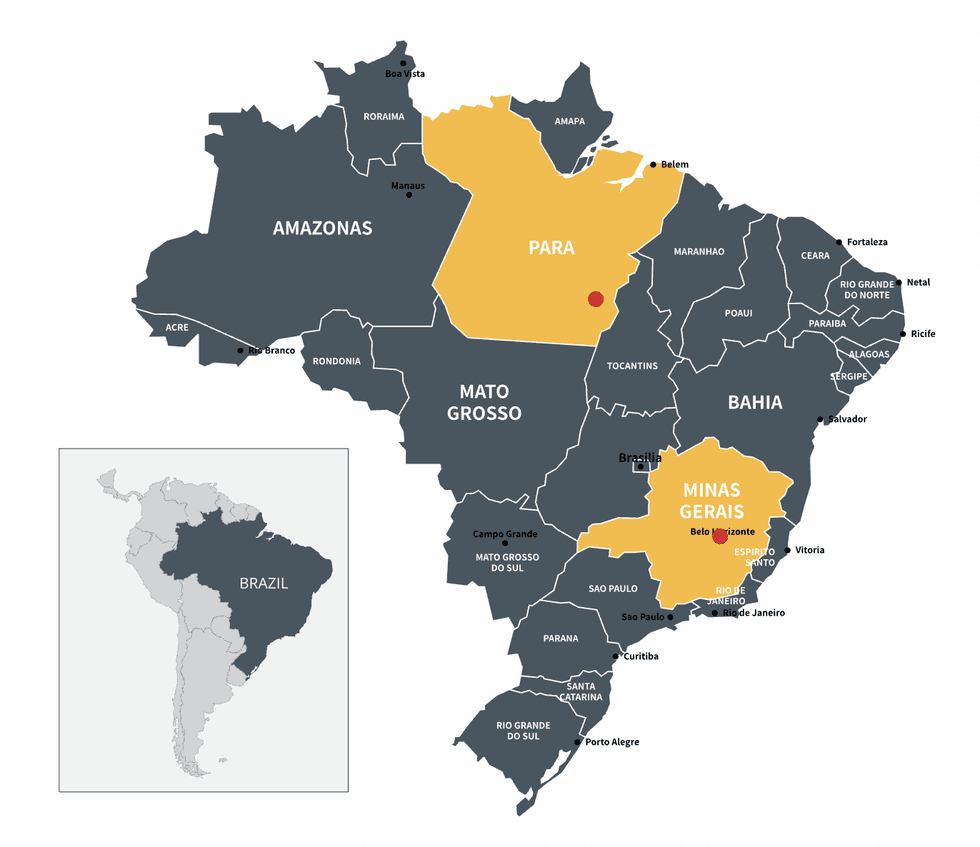

8. Brazil

Mine production: 89,000 MT

In recent years, Brazil’s nickel production has trended upward from 74,400 MT in 2019 to 89,000 MT in 2023. Brazil’s nickel project pipeline has a planned CAPEX of US$1.06 billion through 2025.

Vale, a major producer based in Brazil, sold the Jaguar nickel project in the Carajás mineral province to Centaurus Metals (ASX:CTM,OTCQX:CTTZF) in April 2020. The project hosts a resource of 40.4 million MT at 0.78 percent nickel, totaling 315,000 MT of contained nickel. Jaguar was one of three mining projects selected by the Brazilian government to receive support in obtaining environmental licenses.

9. United States

Mine production: 17,000 MT

Lastly, US nickel production has increased from 2019’s mark of 14,000 MT to 17,000 MT in 2023. The Eagle mine is the only primary nickel-mining property in the US. The asset, located on the Yellow Dog Plains in the Upper Peninsula of Michigan, is a small, high-grade nickel-copper mine owned by Lundin Mining (TSX:LUN,OTC Pink:LUNMF).

Nickel is included on the US' critical minerals list, and in September 2023, under the Defense Production Act, the US Department of Defense awarded US$20.6 million to Talon Metals (TSX:TLO,OTC Pink:TLOFF) for further exploration and mineral resource definition at its Tamarack nickel-copper-cobalt project in Minnesota.

FAQs for nickel production

How is nickel mined and processed?

How nickel is mined and processed depends upon many factors, such as the size, grade, morphology and depth of the nickel deposit that's under consideration. While lateritic nickel deposits are generally mined from open pits via strip mining, sulfide nickel deposits are often mined using underground extraction methods.

After mining, nickel ore is processed into higher-grade concentrates through crushing and separating nickel-bearing material from other minerals using various physical and chemical processing methods. Next, the concentrates are smelted in a furnace before the final stage of refinement using pyrometallurgical and hydrometallurgical processes.

How bad is nickel mining for the environment?

Nickel mining involves serious environmental concerns, including air and water pollution, habitat destruction, community displacement, wildlife migration pattern disturbances, greenhouse gas emissions and carbon-intensive energy use. Nickel-mining companies looking to supply the EV market are feeling the pressure to lessen the environmental footprint of their operations.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Canada Nickel Company is a client of the Investing News Network. This article is not paid-for content.

Nickel Investor Report

2024 Nickel Outlook Report

Five times the amount of nickel will be needed to meet global demand by 2050. Don't miss out on investing in a metal that is crucial to the EV revolution!

The Investing News Network spoke with analysts, market watchers and insiders to get the scoop on the trends and stocks that you need to watch to stay ahead of the markets in 2024.

| ✓ Trends | ✓ Forecasts | ✓ Top Stocks |

Table of Contents:

|  |

A Sneak Peek At What The Insiders Are Saying

“Global nickel consumption is expected to increase due to recovery of the stainless steel sector and increased usage of nickel in EV batteries. Batteries now account for almost 17 percent of total nickel demand, behind stainless steel."

— Ewa Manthey, ING

"While LME nickel prices are expected to find support from a weaker US dollar in 2024 as the Federal Reserve eases monetary policy, we expect prices to remain subdued as further primary nickel output growth from Indonesia and China keeps the market in a surplus for the third consecutive year."

— Jason Sappor, S&P Global Commodity Insights.

Who We Are

The Investing News Network is a growing network of authoritative publications delivering independent, unbiased news and education for investors. We deliver knowledgeable, carefully curated coverage of a variety of markets including gold, cannabis, biotech and many others. This means you read nothing but the best from the entire world of investing advice, and never have to waste your valuable time doing hours, days or weeks of research yourself.

At the same time, not a single word of the content we choose for you is paid for by any company or investment advisor: We choose our content based solely on its informational and educational value to you, the investor.

So if you are looking for a way to diversify your portfolio amidst political and financial instability, this is the place to start. Right now.

Nickel and the Battery Boom in 2024

Table of Contents

Nickel Price 2023 Year-End Review

Nickel Price Forecast: Top Trends That Will Impact Nickel in 2024

Nickel Price 2023 Year-End Review

Nickel soared to its highest price ever in 2022, breaking through US$100,000 per metric ton (MT).

2023 was a different story. As governments worked to combat inflation and investors faced considerable uncertainty, commodities saw a great deal of volatility. Nickel was no exception, especially in the first half of the year.

Ultimately the base metal couldn't hold onto 2022's momentum and has spent the last 12 months trending downward. Read on to learn what trends impacted the nickel sector in 2023, moving supply, demand and pricing.

How did nickel perform in 2023?

Nickel price from January 2, 2023, to December 29, 2023.

Chart via Trading Economics.

Nickel opened 2023 at US$31,238.53 on January 2, riding on the back of momentum that started in Q4 2022, and flirted with the US$31,000 mark again on January 30. As January closed, the metal began to retreat, and by March 22 nickel had reached a quarterly low of US$22,499.53. It made slight gains in April and May, but spent the rest of the year in decline, reaching a yearly low of US$15,843 on November 26. In the final month of the year, the nickel price largely fluctuated between US$16,000 and US$17,000 before closing the year at US$16,375, much lower than where it started.

Despite nickel's return to normal price levels, 2022's rise to more than US$100,000 made more headlines this past year. The substantial increase came after a short squeeze, and the London Metal Exchange (LME) was criticized by some market participants for halting trading and canceling US$12 billion in contracts.

In June 2023, Jane Street Global Trading and hedge fund Elliott Associates filed a lawsuit for US$472 million in compensation for the canceled trades, stating that the LME acted unlawfully. However, judgment came down in favor of the LME on November 29. Elliott Associates has been granted permission to appeal the decision, which it intends to do.

Indonesian supply growth weighs on nickel price

At the end of 2022, analysts were predicting that nickel would enter oversupply territory due to increased production, primarily from Indonesia and China. Speaking to the Investing News Network (INN) at the time, Ewa Manthy of ING commented, "We believe rising output in Indonesia will pressure nickel prices next year."

This prediction came true — production surpluses continued to be a theme in 2023, weighing on prices.

Indonesia continued its aggressive increase in nickel production, more than doubling the 771,000 MT it produced in 2020. A forecast from an Indonesian government official in early December indicates the country is on track to reach production in the 1.65 million to 1.75 million MT range, further adding to a growing supply glut.

In an email to INN, Jason Sappor of S&P Global Commodity Insights said nickel was the worst-performing metal in 2023 due to expanding supply. “We consequently expect the global primary nickel market surplus to expand to 221,000 MT in 2023. This would be the largest global primary nickel market surplus in 10 years, according to our estimates,” he said.

The reason for Indonesia's higher output in recent years is that the country has been working to gain greater value through the production chain, and in 2020 strictly regulated export of raw nickel ore. This decision forced refining and smelting initiatives in the country to ramp up rapidly and brought in foreign investment.

In H2, Indonesia's attempts to combat illegal mining led to delays in its mining output quota application system. While the country originally said it would begin to process applications again in 2024, lack of supply forced steel producers to purchase nickel ore from the Philippines to meet demand, and Indonesia ultimately issued temporary quotas for Q4.

Nickel demand hampered by weak Chinese recovery

Supply is only part of the problem for nickel. Coming into 2023, Manthy suggested demand would be impacted by China’s zero-COVID policy, which had been affecting the country's real estate sector. “China’s relaxation of its COVID policy would have a significant effect on the steel market, and by extension on the nickel market,” she said.

This idea was echoed by analysts at FocusEconomics, who noted, “The resilience of the Chinese economy and the country’s handling of new COVID-19 outbreaks are key factors to watch.”

While China ended its zero-COVID policy in December 2022, the year that followed was less than ideal for the country, with sharp declines in real estate sales and two major developers seeing continued troubles. In August, China Evergrande Group (HKEX:3333) filed for bankruptcy in the US, and at the end of October, Country Garden Holdings (OTC Pink:CTRYF,HKEX:2007) defaulted on its debt. Because the Chinese real estate sector is a major driver of steel demand, this has had a dramatic impact on nickel and is one of the primary causes for its price retreat.

There have also been wider implications for the Chinese economy. Deflation has been triggered in the country as its outsized property sector implodes, with downstream effects for the more than 50 million people employed in the construction industry. Some, including the International Monetary Fund and Japanese officials, have compared the situation in China to Japan in the 1990s, when that country’s housing bubble burst and created economic turmoil.

With uncertainty rife, China’s central bank still isn’t ready to begin cuts on its key five year loan prime interest rate, but it has been working to improve market liquidity to stimulate real estate sector growth. In aid of that, it cut the reserve requirement ratio by 25 basis points twice in 2023, lowering the amount of cash reserves banks have to keep on hand.

So far, these stimulus efforts haven’t had much effect on the real estate market, and its continued struggles have ensured that commodities attached to the sector, including nickel, are still trading at depressed prices. China has vowed to continue to work on its fiscal policy by removing purchasing restrictions on home buying and providing better access to funding for real estate developers.

EVs not boosting nickel price just yet

Nickel is one of many metals that has been labeled as critical to the transition to a low-carbon future. It’s essential as a cathode in the production of electric vehicle (EV) batteries, and when INN spoke to Rodney Hooper of RK Equity at the end of 2022, he noted that people were initially quite conservative on their estimates of EV sales.

However, that's now begun to change. “That’s all turned on its head now. EVs represent a big percentage of nickel demand, and they will continue to rise going forward," Hooper explained at the time.

While the EV outlook remains bright, the sector hasn’t grown fast enough to make up for declining steel sector demand for nickel. And with limited charging infrastructure, range concerns and the effects of higher-for-longer interest rates, EV sales slowed in 2023. The slowdown is welcome news for battery makers as it will allow them time to build out factories and further develop technology, but it’s not good for investors and producers of nickel looking for pricing gains.

Investor takeaway

2023 wasn’t a great year for nickel. It faced increasing supply against lowered demand from both the Chinese real estate sector and slower EV sales. The rebound in the Chinese economy that was hoped for after COVID-19 restrictions were removed never occurred, and instead it has regressed further, pushing into deflationary territory.

Nickel investors may feel a little stung at the close of the year, especially as uncertainty in the market persists.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Nickel Price Forecast: Top Trends That Will Impact Nickel in 2024

Nickel started 2023 high after a rally at the end of 2022, but supply and demand pressures saw the base metal's price decline throughout the year to close nearly 50 percent lower at US$16,375 per metric ton (MT).

Production has increased rapidly in recent years, and oversupply played a big role in nickel's 2023 price dynamics. Indonesia in particular has ramped up its output and now accounts for more than 50 percent of global nickel supply.

Excess supply was compounded by weak demand out of China, which has continued to struggle since ending its zero-COVID policy in January. China's central bank is now working to stimulate the economy to prevent runaway deflation.

What does 2024 have in store for nickel? The Investing News Network (INN) spoke to experts about what could happen to the metal in the next year in terms of supply, demand and price. Read on to learn their thoughts.

Experts call for another nickel surplus in 2024

Nickel is coming into the year with a holdover surplus from 2023. This glut has mainly come from an increase in Class 2, lower-purity nickel produced in Indonesia, but it's also been driven by an increase in the production of Class 1, higher-purity product from China. The former category, which includes nickel pig iron and ferronickel, is used in products such as steel, while the latter is necessary to create nickel sulfate and nickel cathodes for electric vehicles (EVs).

Against that backdrop of higher supply, both nickel products have also faced decreased demand.

The resulting oversupply concerns have been reflected in core metals markets, and Ewa Manthey, commodities strategist at ING, told INN that nickel has the largest short position of the six London Metal Exchange (LME) base metals.

“This buildup is making nickel vulnerable to violent price spikes should inventors unwind their short positions,” she said. This type of situation occurred in 2022, when the nickel price catapulted rapidly to over US$100,000 before the exchange canceled billions of dollars in trades and suspended nickel trading. The LME’s approach to the situation has been criticized, but was recently ruled lawful by London’s High Court of Justice.

The International Nickel Study Group (INSG), an intergovernmental body consisting of government and industry representatives, met in October to discuss the current state and outlook for the nickel market.

At the time, the group forecast that surplus conditions would continue into 2024, with oversupply reaching 239,000 MT on the back of increases in nickel pig iron output from Indonesia. Meanwhile, decreases in nickel pig iron production from China are expected to be offset by increases in nickel cathode and nickel sulfate production.

Even though the INSG expects demand to grow from 3.195 million MT in 2023 to 3.474 million MT in 2024, production is still anticipated to be higher, rising from from 3.417 million MT in 2023 to 3.713 million MT in 2024.

Chinese recovery needed to buoy nickel price

At the outset of 2023, experts thought Chinese demand for nickel would increase as the country ended its strict zero-COVID policy. China's construction industry is a key consumer of nickel, which is used to make stainless steel.

However, the recovery was slower than predicted, and demand from the real estate sector never materialized.

“China’s flagging recovery following COVID lockdowns has hurt the country’s construction sector and has weighed on demand for nickel this year,” Manthey explained to INN.

While the lack of recovery in China’s real estate sector negatively impacted nickel demand and pricing through 2023, according to Fitch Ratings’ China Property Developers Outlook 2024, the country has been targeting construction and development policy in higher-tier cities and injecting liquidity in the market. This has largely been a balancing act as it tries to stem deflation in its market and battles with inflation globally.

If China's efforts to provide real estate sector support are successful that could be a boon for the nickel price. But as 2024 begins, more economists are forecasting a continued downtrend in the Chinese economy.

Even so, the INSG's October forecast indicated that demand for stainless steel was set to grow in the second half of 2023, and the group was calling for further growth in 2024.

EV demand for nickel rising slowly but surely

While the Chinese real estate market is a key factor in nickel demand, it's not the only one.

The expanding EV sector is also a growing purchaser of nickel. “Global nickel consumption is expected to increase due to recovery of the stainless steel sector and increased usage of nickel in EV batteries,” Manthey said. “Batteries now account for almost 17 percent of total nickel demand, behind stainless steel.”

As a cathode material in EV batteries, nickel has become a critical component in the transition away from fossil fuels, which the expert anticipates will help its price in the future.

“The metal’s appeal to investors as a key green metal will support higher prices in the longer term,” she said.

While demand for battery-grade nickel is predicted to grow over the next few years as the metal is used in the prolific nickel-manganese-cobalt (NMC) cathodes, manufacturers and scientists have been working to find alternatives that don’t rely on nickel and cobalt due to environmental and human rights concerns, as well as the high costs of these cathodes.

Lithium-iron-phosphate (LFP) batteries have become a contender in recent years, growing in popularity in Asia and seeing uptake from major EV producers like Tesla (NASDAQ:TSLA), owing to their longer lifespans and lower production costs. However, because of their lower range, LFP batteries have low demand in regions such as North America, where the ability to drive long distances is an important factor in purchase decisions.

This means that for now, NMC batteries will remain an essential part of the EV landscape.

EV demand has also declined recently as the industry faces headwinds that have soured consumer interest, including charging infrastructure shortfalls, inconsistent supply chains and elevated interest rates. These factors are already starting to have an impact, with Ford (NYSE:F) and GM (NYSE:GM), among others, cutting production forecasts for 2024.

What will happen to the nickel price in 2024?

Following its near 50 percent drop in 2023, the nickel price is expected to be rangebound for most of 2024.

“While LME nickel prices are expected to find support from a weaker US dollar in 2024 as the Fed eases monetary policy, we expect prices to remain subdued next year as further primary nickel output growth from Indonesia and China keeps the market in a surplus for the third consecutive year,” said Jason Sappor of S&P Global Commodity Insights.

Manthey agreed that the price is likely to stay flat. “We see prices averaging US$16,600 in Q1, with prices gradually moving up to average US$17,000. We forecast an average of US$16,813 in 2024,” she said. Manthey also noted that nickel is set to remain elevated compared to average levels before the short squeeze in March 2022.

Sappor suggested that the nickel surplus and the metal's rangebound price may prompt producers to reduce their output. “Nickel prices have sunk deeper into the global production cost curve, raising the possibility that the market could be hit by price-supportive mine supply curtailments,” he said.

At this time there is no indication that producers will ease production next year, and Vale (NYSE:VALE), one of the world’s top nickel miners, is expecting its Indonesian subsidiary to produce slightly more versus 2023.

Investor takeaway

Much like the rest of the mining industry, nickel is being affected by broad macroeconomic forces in the post-COVID era. Higher interest rates are stymying investment across the mining industry, while also lowering demand for big-ticket items like real estate and cars, which help to drive demand for metals.

For nickel, this means another year of oversupply. A potential rebound in the Chinese real estate market and increased demand from upfront tax credits for EVs could shift its trajectory, but the headwinds in 2024 look to be strong.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Blackstone Minerals, Falcon Gold and FPX Nickel are clients of the Investing News Network. This article is not paid-for content.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Additional information on Nickel stocks investing — FREENickel Price Update: Q1 2024 in Review

After a difficult 2023, Q1 saw a variety of factors affect the nickel price, including supply cuts from western producers.

At the start of the year, experts were predicting that nickel prices would be rangebound in 2024.

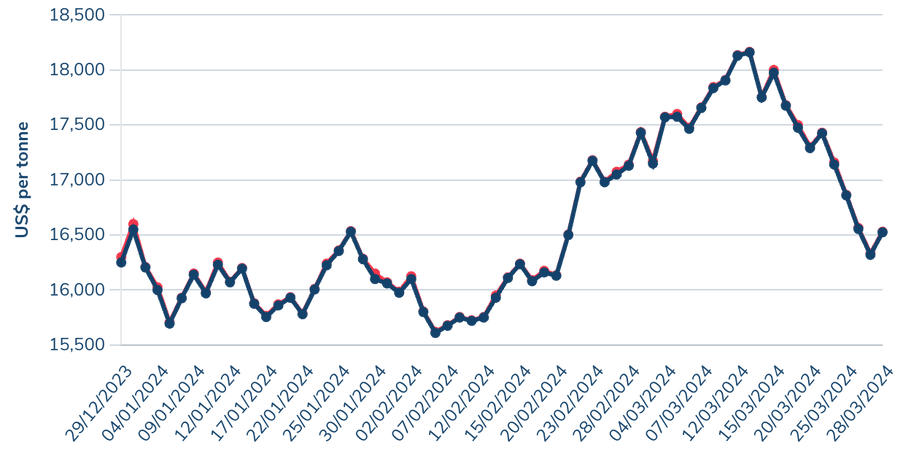

With the first quarter in the books, that story seems to largely be playing out. After opening the year at US$16,600 per metric ton (MT) on January 2, nickel was stable during January and February. However, March brought volatility to the sector, with strong gains pushing the base metal to a quarterly high of US$18,165 on March 13.

Nickel's price rise failed to hold, and it once again dropped below the US$17,000 mark by the end of the month. Ultimately, the metal fell to US$16,565 on March 28, resulting in a slight loss for the quarter.

Indonesian supply dampens nickel prices

Lackluster pricing in the nickel market is largely the result of the metal's ongoing oversupply position.

The largest factor is elevated production from Indonesia, which is the top producer of the metal by far. The country produced 1.8 million MT of nickel in 2023, according to the US Geological Survey, representing half of global supply.

Indonesia's output has climbed exponentially over the past decade, and has been exacerbated by government initiatives that placed strict limits on the export of raw materials to encourage investment in production and refinement.

In an email to the Investing News Network (INN), Exploration Insights Editor Joe Mazumdar wrote, “The growth in electric vehicle (EV) production and the escalating demand for nickel in batteries prompted the Indonesian government to mandate increased local refining and manufacturing capacity from companies operating in the country.”

Despite the lower quality of material coming from Indonesia, the investment was made to shore up supply lines for Chinese battery makers and was earmarked for EV production. However, EV demand has waned through 2023 and into 2024 due to high interest rates, range anxiety and charging capacity, increasing nickel stockpiles.

A report on the nickel market provided by Jason Sappor, senior analyst with the metals and mining research team at S&P Global Commodity Insights, shows that short positions began to accumulate through February and early March on speculation that Indonesian producers were cutting operating rates due to a lack of raw material from mines.

The lack of mined nickel, which helped push prices up, was caused by delays from a new government approval process for mining output quotas that was implemented by Indonesia in September 2023. The new system will allow mining companies to apply for approvals every three years instead of every year. However, the implementation has been slow, and faced further delays while the country went through general elections.

The nickel market found additional support on speculation that the US government was eyeing sanctions on nickel supply out of Russia. Base metals were ultimately not included in the late February sanctions, and prices for the metal began to decline through the end of March as Indonesian quota approvals accelerated.

Western nickel producers cut output on low prices

According to Macquarie Capital data provided by Mazumdar, 35 percent of nickel production is unprofitable at prices below US$18,000, with that number jumping to 75 percent at the US$15,000 level.

Mazumdar indicated that nickel pricing challenges have led to cuts from Australian producers like First Quantum Minerals (TSX:FM,OTC Pink:FQVLF) and Wyloo Metals, which both announced the suspension of their respective Ravensthorpe and Kambalda nickel-mining operations. Additionally, major Australian nickel producer BHP (ASX:BHP,NYSE:BHP,LSE:BHP) is considering cuts of its own.

Nickel price, Q1 2024.

Chart via the London Metal Exchange.

Meanwhile, the nickel industry in French territory New Caledonia is facing severe difficulties due to faltering prices.

The French government has been in talks with Glencore (LSE:GLEN,OTC Pink:GLCNF), Eramet (EPA:ERA) and raw materials trader Trafigura, which have significant stakes in nickel producers in the country, and has offered a 200 million euro bailout package for the nation's nickel industry. The French government set a March 28 deadline for New Caledonia to agree to its rescue package, but a decision had not yet been reached as of April 11.

Earlier this year, Glencore announced plans to shutter and search for a buyer for its New Caledonia-based Koniambo Nickel operation, which it said has yet to turn a profit and is unsustainable even with government assistance.

For its part, Trafigura has declined to contribute bailout capital for its 19 percent stake in Prony Resources Nouvelle-Caledonie and its Goro mine in the territory, which is forcing Prony to find a new investor before it will be able to secure government funding. On April 10, Eramet reached its own deal with France for its subsidiary SLN’s nickel operations in New Caledonia; the transaction will see the company extend financial guarantees to SLN.

The situation has exacerbated tensions over New Caledonia's independence from France, with opponents of the agreement arguing it risks the territory's sovereignty and that the mining companies aren’t contributing enough to bailing out the mines, which employ thousands. Reports on April 10 indicate that protests have turned violent.

While cuts from Australian and New Caledonian miners aren’t expected to shift the market away from its surplus position, Mazumdar expects it will help to maintain some price stability in the market.

“The most recent forecast projects demand (7 percent CAGR) will grow at a slower pace than supply (8 percent CAGR) over the next several years, which should generate more market surpluses,” he said.

Miners seek "green nickel" premium for western products

In an email to INN, Ewa Manthey, commodities strategist at financial services provider ING, suggested western nickel producers are in a challenging position, even as they make cuts to production.

“The recent supply curtailments also limit the supply alternatives to the dominance of Indonesia, where the majority of production is backed by Chinese investment. This comes at a time when the US and the EU are looking to reduce their dependence on third countries to access critical raw materials, including nickel,” she said.

This was affirmed by Mazumdar, who said the US is working to combat the situation through a series of subsidies designed to encourage western producers and aid in the development of new critical minerals projects.

“The US Inflation Reduction Act promotes via subsidies sourcing of critical minerals and EV parts from countries with which it has a free trade agreement or a bilateral agreement. Indonesia and China do not have free trade agreements with the US,” he said. Mazumdar went on to suggest that the biggest benefactors of this plan will be Australia and Canada, but noted that with prices remaining depressed, multibillion-dollar projects will struggle to get off the ground.

Western producer shope their material may eventually see a "green nickel" premium that plays into their focus on ESG. However, this idea hasn’t gained much traction. The London Metal Exchange (LME) believes the green nickel market is too small to warrant its own futures contract, and Mazumdar said much the same. “There is little evidence that a premium for ‘green nickel’ producers or developers has much momentum, although an operation with low carbon emissions may have a better chance of getting funding from institutional investors in western countries,” he noted.

Even though there might not be much interest in green nickel on the LME, there are vocal proponents, including Wyloo’s CEO, Luca Giacovazzi. He sees the premium as being essential for the industry, and has said participants should be looking for a new marketplace if the LME is unwilling to pursue a separate listing for green nickel.

The calls for a premium have largely come from western producers that incur higher labor and production costs to meet ESG initiatives, which is happening less amongst their counterparts in China, Indonesia and Russia.

Western producers were caught off guard early in March as PT CNGR Ding Xing New Energy, a joint venture between China’s CNGR Advanced Material (SHA:300919) and Indonesia’s Rigqueza International, applied to be listed as a “good delivery brand” on the LME. The designation would allow the company, which produces Class 1 nickel, to be recognized as meeting responsible sourcing guidelines set by the LME.

If it is approved, which is considered likely, the company would be the first Indonesian firm to be represented on the LME. There has been pushback from western miners on the basis of ESG and responsible resourcing challenges.

Investor takeaway

As the nickel market faces strong production from Indonesia, experts expect more of the same for prices.

“Looking ahead, we believe nickel prices are likely to remain under pressure, at least in the near term, amid a weak macro picture and a sustained market surplus,” Manthey said. The continued surplus may provide some opportunities for investors looking to get into a critical minerals play at a lower cost, but a reversal may take some time.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Top 3 Canadian Nickel Stocks

Which Canadian nickel companies are up the most so far in 2024? The Investing News Network looks at the top-gaining nickel stocks this year.

Nickel has been trending down since early 2023, and bearish sentiment still pervades the market in 2024 even though prices for the base metal tacked upward in mid-March and early April.

Supply is expected to outflank demand over the short term, but the longer-term outlook for the metal is strong. Speaking to the Investing News Network (INN), analysts shared their thoughts on the biggest nickel trends to watch for in 2024, and what they think will affect the market moving forward. They discussed factors such as oversupply, weaker-than-expected demand from China and doubts about the London Metal Exchange after it suspended trading last year.

Demand from the electric vehicle industry is one reason nickel's future looks bright further into the future.

“Global nickel consumption is expected to increase due to recovery of the stainless steel sector and increased usage of nickel in electric vehicle batteries. Batteries now account for almost 17 percent of total nickel demand, behind stainless steel," Ewa Manthey, commodities strategist at financial services firm ING, told INN in the lead-up to 2024. “The metal’s appeal to investors as a key green metal will support higher prices in the longer term."

Below INN has listed the top nickel stocks on the TSXV by share price performance so far this year. TSX and CSE stocks were considered, but didn't make the cut. All year-to-date and share price data was obtained on April 3, 2024, using TradingView’s stock screener. The top nickel stocks listed had market caps above C$10 million at that time.

1. EV Nickel (TSXV:EVNI)

Press Releases Company ProfileYear-to-date gain: 106.67 percent; market cap: C$38.84 million; current share price: C$0.62

EV Nickel’s primary project is the 30,000 hectare Shaw Dome asset in Ontario. It includes the high-grade W4 deposit, which has a resource of 2 million metric tons at 0.98 percent nickel for 43.3 million pounds of Class 1 nickel across the measured, indicated and inferred categories. Shaw Dome also holds the large-scale CarLang A zone, which has a resource of 1 billion metric tons at 0.24 percent nickel for 5.3 billion pounds of Class 1 nickel across the indicated and inferred categories.

EV Nickel is also working on integrating carbon capture and storage technology for large-scale clean nickel production, and has procured funding from the Canadian government and Ontario's provincial government. In late 2023, the company announced it was moving its carbon capture research and development to the pilot plant stage.

The company's only news so far in 2024 has been the announcement, upsizing and closure of a flow-through financing. Ultimately EV Nickel raised C$5.12 million to fund the development of its high-grade large-scale nickel resources.

The Canadian nickel exploration company's share price started off the year at C$0.30 before steadily climbing to reach a year-to-date high of C$0.73 on March 3.

2. Canada Nickel (TSXV:CNC)

Press Releases Company ProfileYear-to-date gain: 15.2 percent; market cap: C$249.55 million; current share price: C$1.44

Canada Nickel Company has honed its efforts on its wholly owned flagship Crawford nickel sulfide project in Ontario’s productive Timmins Mining Camp. A bankable feasibility study for the asset demonstrates a large-scale nickel deposit with a mine life of 41 years, an after-tax net present value of US$2.5 billion and an internal rate of return of 17.1 percent. The company has said it is targeting both the electric vehicle and stainless steel markets.

A few big-name companies hold significant ownership positions in Canada Nickel, including Agnico Eagle Mines (TSX:AEM,NYSE:AEM), which holds an 11 percent stake, and Anglo American (LSE:AAL,OTCQX:AAUKF), which has a 7.6 percent stake. In February of this year, battery and electronic materials manufacturer Samsung SDI (KRX:006400) made an equity investment of US$18.5 million for an 8.7 percent ownership stake in the company.

Canada Nickel’s share price started 2024 at C$1.40 before jumping to a year-to-date high of C$2.24 on January 16.

In early February, the company shared that its wholly owned subsidiary, NetZero Metals, is planning to develop a nickel-processing facility and stainless steel and alloy production facility in the Timmins Nickel District. Canada Nickel’s share price had slid to C$1.35 on February 5 before rising up to C$1.46 on February 9 following the news.

Later in the month, Canada Nickel shared successful results from initial infill drilling at its 100 percent owned Bannockburn property, and announced a new discovery at the Mann property. Mann is a joint venture with Noble Mineral Exploration (TSXV:NOB,OTCQB:NLPXF) in which Canada Nickel can earn an 80 percent interest.

3. Sama Resources (TSXV:SME)

Press Releases Company ProfileYear-to-date gain: 10 percent; market cap: C$26.41 million; current share price: C$0.11

Sama Resources’ focus is the Samapleu nickel, copper and platinum-group metals (PGMs) project in Côte d’Ivoire, West Africa, which includes the Samapleu and Grata deposits. Samapleu is a joint venture between Sama (70 percent) and Ivanhoe Electric (30 percent); Ivanhoe Electric, which is backed by Robert Friedland, recently earned the option to acquire a 60 percent interest in the project with the completion of a new preliminary economic assessment.

In the first few weeks of the year, Sama has already dropped a few press releases. The company shared highlights from its ongoing 3,800 meter winter drilling program at the Yepleu prospect. Importantly, the work has confirmed that newly discovered nickel-copper-PGMs mineralization measures 500 by 400 meters, is near surface and open in all directions. Drill results from the program so far include hole S-349, which intersected 53 meters of combined mineralization layers grading 0.29 percent nickel, including 2.6 meters at 1.31 percent nickel and 0.95 percent copper.

Sama’s share price started off the year at C$0.11 before jumping to a year-to-date high of C$0.14 on February 12.

FAQs for nickel investing

How to invest in nickel?

There are a variety of ways to invest in nickel, but stocks and exchange-traded products are the most common. Nickel-focused companies can be found globally on various exchanges, and through the use of a broker or a service such as an app, investors can purchase companies and products that match their investing outlook.

Before buying a nickel stock, potential investors should take time to research the companies they’re considering; they should also decide how many shares will be purchased, and what price they are willing to pay. With many options on the market, it's critical to complete due diligence before making any investment decisions.

Nickel stocks like those mentioned above could be a good option for investors interested in the space. Experienced investors can also look at nickel futures.

What is nickel used for?

Nickel has a variety of applications. Its main use is an alloy material for products such as stainless steel, and it is also used for plating metals to reduce corrosion. It is used in coins as well, such as the 5 cent nickel in the US and Canada; the US nickel is made up of 25 percent nickel and 75 percent copper, while Canada's nickel has nickel plating that makes up 2 percent of its composition.

Nickel's up-and-coming use is in electric vehicles as a component of certain lithium-ion battery compositions, and it has gotten extra attention because of that purpose.

Where is nickel mined?

The world's top nickel-producing countries are primarily in Asia: Indonesia, the Philippines and New Caledonia make up the top three. Rounding out the top five are Russia and Canada. Indonesia's production stands far ahead of the rest of the pack, with 2023 output of 1.8 million MT compared to the Philippines' 400,000 MT and New Caledonia's 230,000 MT.

Significant nickel miners include Norilsk Nickel (OTC Pink:NILSY,MCX:GMKN), Nickel Asia, BHP Group (NYSE:BHP,ASX:BHP,LSE:BHP) and Glencore (LSE:GLEN,OTC Pink:GLCNF).

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Canada Nickel and Noble Mineral Exploration are clients of the Investing News Network. This article is not paid-for content.

FPX Nickel

Overview

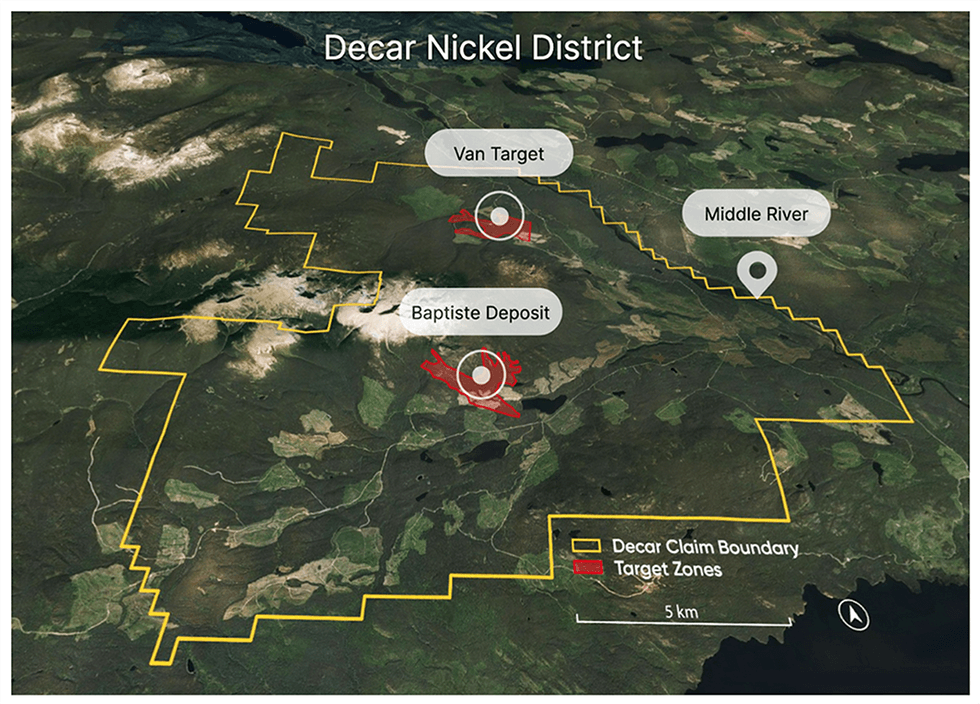

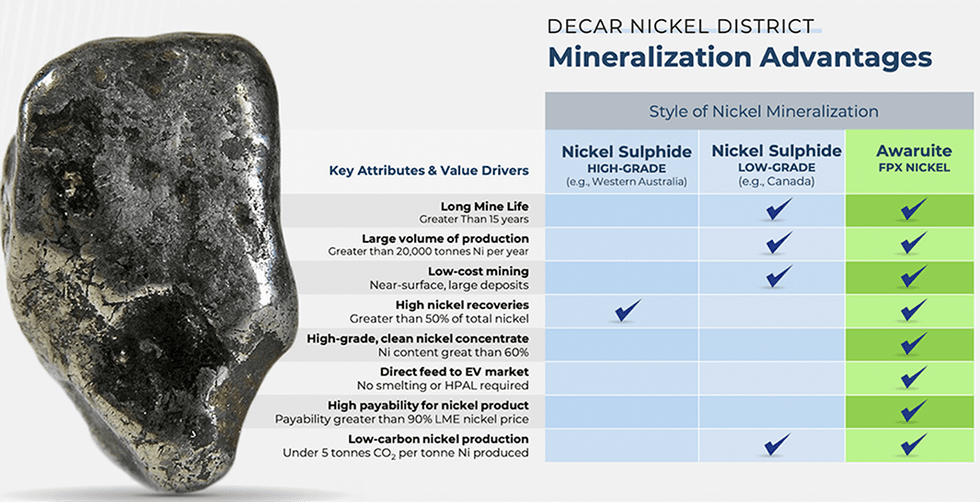

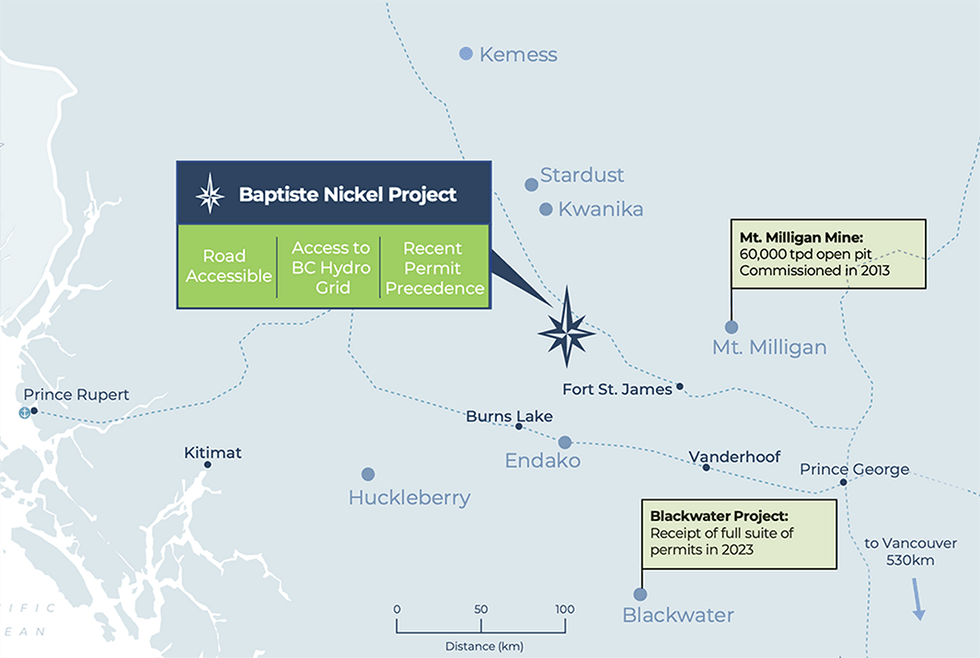

FPX Nickel (TSXV:FPX,OTXQB:FPOCF) is an exploration and development company focused on its advanced-development-stage Tier 1 Baptiste project in the Decar Nickel District in central British Columbia. The project has the potential to supply high-concentration nickel and cobalt sulfates suitable for the growing electric vehicle battery industry, as well as more traditional markets for nickel, such as stainless steel.

Nickel plays a vital role in electric vehicle (EV) and battery manufacturing, a sector that sees rapid expansion year after year. Market research projects a growing nickel demand for EVs to reach 1.3 million metric tonnes per annum by 2030, as nickel content in electric vehicles increases to over 40 kilograms per car battery.

Despite its significant role in powering a global shift to greener energies, analysts also project an undersupply of nickel for the next several years due to decreasing production and a lack of new active mines. Mining companies advancing high-margin nickel projects offer investors exposure to a market with great economic growth and success potential.

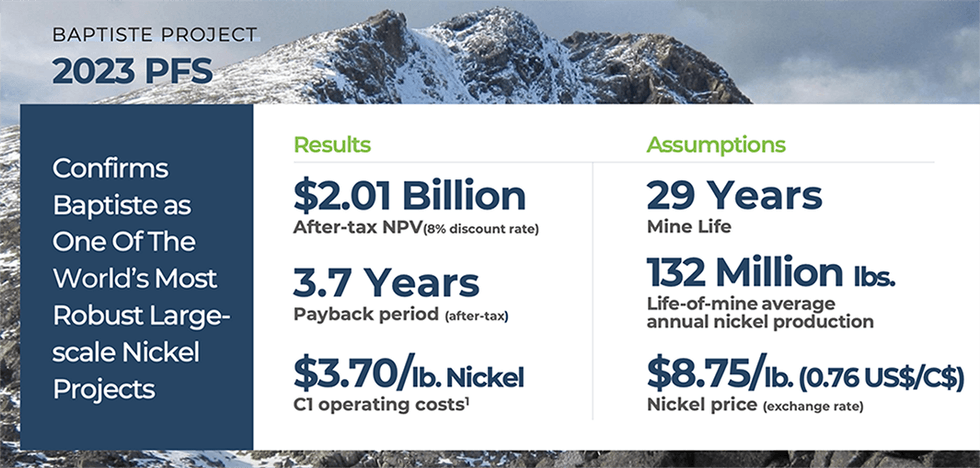

FPX Nickel’s Baptiste project leverages a 2023 preliminary feasibility study( PFS) and an updated mineral resource estimate that includes total nickel and potential by-product elements, cobalt and iron.

The PFS for Baptiste indicated an after-tax NPV of $2.01 billion and an IRR of 18.6 percent at $8.75-pound nickel for a 29-year mine life producing an average of 59,100 tons per year.

The positive geological interpretation of the Van target at the Decar Nickel District offers further blue-sky potential for the Baptiste project, potentially mimicking the successes of its geographic neighbors, such as New Gold’s (TSX:NGD,NYSEMKT:NGD) C$1.8 billion Blackwater Gold open-pit project.

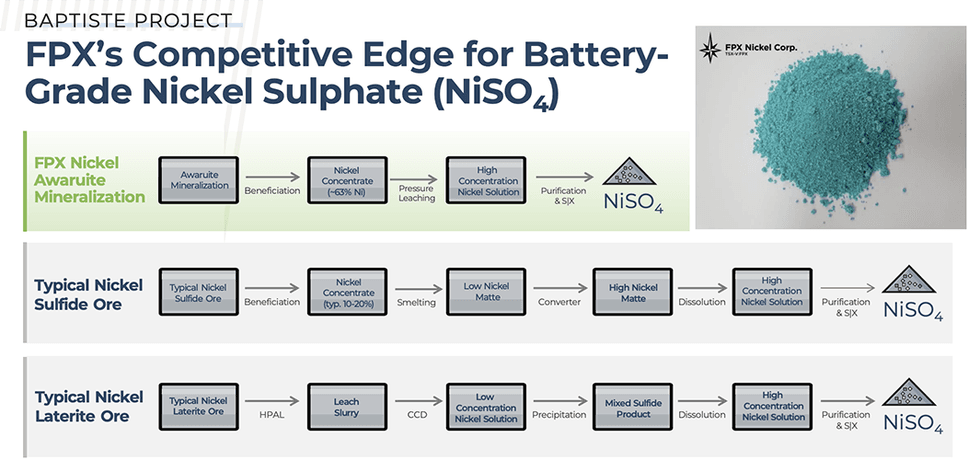

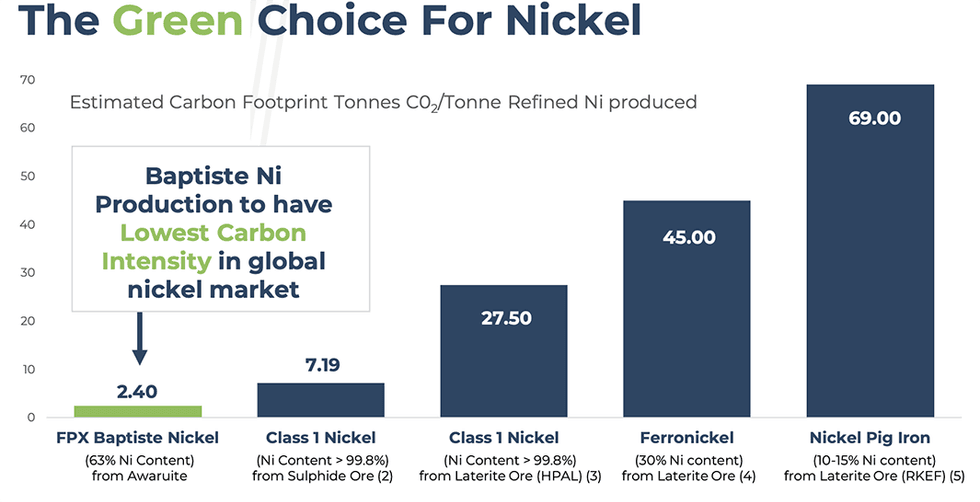

The Baptiste project presents FPX Nickel with the potential to produce refined nickel at a significantly lower carbon footprint than other sources of production in the global nickel industry. Recent leach testing of awaruite nickel concentrates produced from Baptiste achieved nickel recoveries of 98.8 percent to 99.5 percent in producing a high-purity chemical solution containing 69.4 to 70.1 g/L nickel.

In keeping with FPX Nickel’s aim to build a carbon-neutral mining operation at the Baptiste project, the company co-founded a multi-university research program to study carbon capture and storage at mining sites. The program is in collaboration with Anglo-American majority-owned (LSE:AAL,OTCQX:AAUKF) DeBeers, and the Government of Canada.

Hydrometallurgical testing conducted by FPX Nickel for the production of battery-grade nickel sulphate has produced sufficient high-grade (> 65 percent nickel) awaruite concentrate. This large-scale pilot test work validates the processing strategy for Baptiste, leveraging awaruite's ferromagnetism, high density, active surface properties, and very high nickel content.

Baptiste’s awaruite mineralization promotes a simple three-stage process. It has the potential to be more efficient than the typical five-stage process required to convert sulphide and laterite ores into nickel sulphate. Rapid nickel extraction of more than 98 percent in 60 minutes is achieved under mild pressure leaching conditions with significantly lower equipment size/risk, power consumption, pressure and temperature requirements than typical high-pressure acid leach (HPAL) operations.

In January 2024, FPX Nickel closed a C$14.4 million strategic equity investment from Sumitomo Metal Mining. Net proceeds of the private placement will be used to fund exploration and development activities at its Baptiste nickel project, and continue ongoing environmental baseline activities, feasibility study readiness activities, and general corporate and administrative purposes.

FPX Nickel’s wholly owned subsidiary CO2 Lock, specializing in carbon capture and storage (CCS) via permanent mineralization, has completed a comprehensive field program at its SAM site in central British Columbia including the first-ever successful injection of CO2 into a brucite-rich ultramafic mineral project. This achievement marks a significant milestone in the development of CO2 Lock's innovative in-situ CO2 mineralization technology.

FPX Nickel’s management team consists of highly experienced capital markets and mining professionals, including Canadian Mining Hall of Fame member Dr. Peter Bradshaw, and veteran geologist Rob Pease.

Company Highlights

- FPX Nickel is a Canadian resource company focused on exploring and developing its wholly owned advanced-development-stage Baptiste nickel project in the Decar Nickel District, central British Columbia.

- The company favorably leverages low-cost operation and mining best practices. It is advancing one of the few major nickel deposits in the mining-friendly jurisdiction of British Columbia.

- The Baptiste property hosts high-grade nickel mineralization with low impurities and little to no sulfides. This production-quality asset has potential applications for direct feed to the stainless steel or the electric vehicle battery market, with high projected recoveries and low estimated operating cost.

- FPX Nickel operates a tight share structure consisting largely of management (which holds 14 percent of the company’s shares) and three large corporate strategic investors (which collectively hold 30 percent of the company).

- Baptiste offers a tremendous opportunity for lowering the carbon footprint of nickel.

- Preliminary feasibility study for Baptiste indicated an after-tax NPV of $2.01 billion and IRR of 18.6 percent at $ 8.75-pound nickel for a 29-year mine life producing an average of 59,100 tonnes per year of nickel.

- In early 2024, FPX Nickel closed a C$14.4 million in private placement financing from Sumitomo Metal Mining Canada (SMCL), a wholly owned subsidiary of Sumitomo Metal Mining (TSE:5713)

Key Project

Decar Nickel District - Baptiste Project

The Decar Nickel District covers 245 square kilometers and is 80 kilometers west of the Mt. Milligan mine, central British Columbia. The property hosts the highly prospective Baptiste nickel project, which has the potential to become the world’s best development-stage nickel project. The asset is accessible via logging and paved road, with railway and hydropower nearby.

Baptiste hosts nickel-iron alloy mineralization, bulk-tonnage potential and open-pit nickel mining possibilities across its four primary targets. Exploration has also indicated resources at an average grade of 0.123 percent DTR nickel for 2.3 million tons and 391 million tonnes of inferred resources with an average grade of 0.115 percent DTR nickel.

In September 2022, the company completed a 2,504-meter step-out drilling program at its Van target in the Decar Nickel District. The completed holes stepped out aggressively from the initial discovery area, testing the potential for nickel mineralization up to 1 kilometer west of the holes drilled in 2021.

Baptiste Project 2023 PFS

In 2023, the company released the preliminary feasibility study results for the Baptiste nickel project indicating an average production of 59,100 tons of nickel per year in concentrate over a 29-year mine life. The project will be developed in a phased approach, with an initial mill throughput rate of 108,000 tons per day (Phase 1), followed by an expansion to 162,000 tons per day (Phase 2).

FPX Nickel signed a non-binding memorandum of understanding with Japan Organization for Metals and Energy Security (JOGMEC) and the Prime Planet Energy & Solutions (PPES) joint venture between Toyota Motor Company and Panasonic, setting out a framework for FPX and PPES to explore collaborative opportunities for the vertical integration of nickel production at the Baptiste project and the production of nickel sulphate and cathode active materials for the PPES supply chain.

Management Team

Martin Turenne - President, CEO and Director

Martin Turenne is a senior executive with over 15 years of experience in the commodities industry, including over five years in the mining industry. He has extensive leadership experience in strategic management, fundraising, economic analysis, financial reporting, regulatory compliance and corporate tax. Turenne formerly served as CFO of First Point Minerals Corp. from 2012 to 2015 and in positions at KPMG LLP and Methanex Corporation. He is a member of the Canadian Institute of Chartered Accountants.

Andrew Osterloh - Vice-president, Projects

With more than 20 years in the industry, Andrew Osterloh is experienced in process engineering, plant metallurgy and project management. He was formerly the project director and head of studies for Fluor Canada, leading feasibility study work for large base metal assets. He was formerly project director and manager of studies for Fluor Canada, where he led feasibility studies for several large base metal assets in the Americas for Glencore, Freeport-McMoRan, Teck and Newmont. Osterloh is a member of the Association of Professional Engineers of British Columbia and holds a Bachelor of Applied Science in mineral process engineering from the University of British Columbia.

Felicia de la Paz - Chief Financial Officer and Corporate Secretary

Felicia de la started her professional career with KPMG LLP's audit practice in Vancouver, culminating with her role as a senior manager leading large teams in the execution of audit engagements for a variety of large and complex organizations across multiple industries. After joining Equinox Gold as the corporate controller in 2017, she was part of a core financial leadership team overseeing corporate accounting, financial reporting and system development, managing the successful integration of several new acquisitions across multiple jurisdictions, including both operating mines and large-scale development projects. She acted as the vice-president of finance for Vida Carbon, a carbon royalty and streaming company, and has more recently been providing financial and systems advisory services to public companies in the mining sector. She is a chartered professional accountant and holds a Bachelor of Commerce (Honours) from the University of British Columbia.

Dr. Peter M. D. Bradshaw - Chairman

Dr. Peter Bradshaw is a geologist with more than 45 years of international mineral exploration experience in over 30 countries with Barringer Research, Placer Dome, and Orvana Minerals. He is a member of the Canadian Mining Hall of Fame. Bradshaw’s key discoveries and project involvement include Porgera Gold Mine, Papua New Guinea; Kidston Gold Mine, Queensland, Australia; Misima Gold Mine, Papua New Guinea; Big Bell Gold Mine, Western Australia; Omai Gold Mine, Guyana; Decar Nickel Project, British Columbia, Canada; director of Aquila Resources; co-founder and first chairman of the Mineral Deposit Research Unit, University of British Columbia.

Rob Pease - Director

Rob Pease is a geologist with more than 30 years of experience in exploration, mine development and construction. He is the former CEO of Terrane Metals, acquired by Thompson Creek for C$650 million. Pease was also the former director of Richfield Ventures, acquired by New Gold for C$500 million. He is a director of Pure Gold Mining Inc. and Liberty Gold.

William H. Myckatyn - Director

William Myckatyn is a mining engineer with more than 34 years of experience in the mining industry. Myckatyn is the founder and CEO of Quadra Mining Ltd. He served as chairman and subsequently co-chairman of Quadra FNX Mining until its takeover in 2012. Prior to this, Myckatyn was chairman, president and CEO of Dayton Mining Corp., where he led the restructuring and merger with Pacific Rim Mining Corp. He was the former president and CEO of Princeton Mining and Gibraltar Mines Ltd. For over 17 years, he worked for various operations controlled by Placer Dome Inc. and its associated predecessor companies, including four separate mines in Australia and the Philippines. He is a director of San Marco Resources and OceanaGold.

Peter Marshall - Director

Peter Marshall is a mining engineer with 30 years of experience in mine development and construction. Marshall was formerly VP of project development at New Gold and SVP project development at Terrane Metals. He has extensive mine development experience in central British Columbia, including completing the Blackwater gold project feasibility study and development, and early construction of Mt. Milligan copper-gold mine, acquired by Thompson Creek for C$650 million in 2010.

James S. Gilbert, - Director

James Gilbert has more than 30 years of investment and transaction execution experience, with more than 20 years focused on the international mining and metals industry. Gilbert held senior management positions with Rothschild, Gerald Metals Inc. and Minera S.A., a private mining investment company. His experience covers mergers and acquisitions, debt and equity financing, off-take and specialty refining agreements, joint venture negotiations and strategic marketing. He was formerly director of AQM Copper Inc., acquired by Teck Resources in 2016.

Anne Currie - Director

Anne Currie is a recognized leader in the permitting of major Canadian mining projects, with over 30 years of experience in the private and public sector, including as a former senior partner with leading global consultancy Environmental Resources Management. She was British Columbia's chief gold commissioner, the chief regulatory authority for the Mineral Tenure Act., and has an exceptional track record in steering the environmental assessment and permitting processes for major mining projects in British Columbia, including for the KSM, Brucejack, Kemess Underground and Blackwater projects.

Kim Baird - Director

Kim Baird is an accomplished leader and strategic advisor working with indigenous communities, governments, businesses and other organizations. In her prior role as the elected chief of the Tsawwassen First Nation, she negotiated and implemented British Columbia's first modern urban treaty, establishing for the Tsawwassen People ownership and governance over their land and resources.

Dan Apai - Engineering Manager

Dan Apai has over twenty years of mining industry experience in civil engineering and engineering management over a diverse range of projects. In his previous role as a principal civil engineer for Fluor Canada, he led the study and detailed engineering works for numerous large-scale mining projects for clients including Teck, Newmont, BHP, First Quantum, Glencore, Josemaria Resources and Newcrest. Apai's technical expertise includes site layout, earthworks, water management, linear facilities (i.e., roads, powerlines, pipelines), and water supply systems – all elements that strongly influence the capital intensity, permitability, and operability of mining projects. Apai is a member of the Association of Professional Engineers of British Columbia and holds a Bachelor of Engineering from the University of Western Australia.

Tim Bekhuys - SVP, Sustainability and External Relations

Tim Bekhuys is a senior mining executive with over 40 years’ experience in community engagement, environmental assessment and permitting. He was formerly VP environment, health, safety and sustainability for SSR Mining, where he led all aspects of sustainability reporting, environmental assessment and permitting activities. He also previously acted as director of environment and sustainability for New Gold, where he successfully led the government, permitting, Indigenous and community relations programs for the Blackwater project in central B.C. Bekhuys was a former member of the boards of directors of the Association for Mineral Exploration British Columbia, the Mining Association of British Columbia, and the Mining Association of Canada.

Keith Patterson - Vice-president, Generative Exploration

Keith Patterson is a senior geologist with over 25 years’ experience in greenfield exploration throughout North America, South America, Europe and Asia. He was formerly director of project generation and greenfield strategy with Eldorado Gold where he managed global exploration and project generation. Patterson acted as vice-president of exploration for Jinshan Gold Mines where he was responsible for the execution of exploration programs and project evaluations in China. He is a registered professional geoscientist with the Engineers and Geoscientists of British Columbia and holds a Master of Geological Sciences and a Bachelor of Geological Engineering, both from the University of British Columbia.

Q1 2024 Quarterly Report

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to provide its Appendix 5B cash flow statement for the quarter ended 31 March 2024, along with the following operational summary.

Quarter Highlights

- 33 holes for 7,014 metres of diamond drilling completed at Horden Lake.

- Program targeted grade and tonnage opportunities within the 412 kt CuEq (27.8mt at 1.5% CuEq) Indicated and Inferred Resource1.

- Logging and assay in progress. First assay results will be progressively released during Q2 2024.

- Downhole geophysics program to highlight resource growth potential around the defined Resource, which is open down-plunge.

- BAGB Magnetotelluric “MT” geophysical survey interpretation, with results released post reporting period.

- Large magnetic anomalies outlined on a newly mapped prospective contact, which hosts the historical high-grade discoveries ‘Alotta’ and ‘Midrim’.

- $2.85m cash balance and consistent news-flow is expected as the Company executes its work programs across its properties.

Managing Director Ivan Fairhall said: “Having joined Pivotal Metals in September, I’m very pleased to present my first full Quarterly Report which outlines significant progress on all aspects of our exploration endeavours.

The importance of drilling at Horden Lake cannot be understated. We have a clear strategy to add value to the asset de-risk and show the growth potential of this already significant 412kt CuEq indicated and inferred Cu-Ni-PGM resource. Investors will now benefit from considerable newsflow off the back of work completed to date. We are also highly enthused by the BAGB results which fully support our geological model and provide exciting targets of scale for future drilling.

With a cash boost late last year, clean balance sheet, and two very exciting exploration and development projects, the Board and I are looking forward to delivering a full operational and news schedule to all shareholders over the coming months.”

OPERATIONAL UPDATE

HORDEN LAKE PROJECT