Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce that it has entered into binding agreements for a US$15m (A$22.1m) private placement of unsecured convertible debentures (the "Debentures") with Queen's Road Capital Investment Ltd ("QRC"). The Debentures are convertible into fully paid ordinary shares in CEL ("Shares") at a price of $0.25, a 30% premium to the 5-day volume weighted average price (“VWAP”) prior to 2 September 2022. Additionally, the Company's largest institutional shareholder has committed to invest pro-rata to its 12% shareholding via a $2.6m placement at 5-day VWAP, increasing combined funds raise to $24.7m from two parties.

Highlights

- Queen's Road Capital to invest US$15m (~A$22.1m1) via unsecured Convertible Debentures

- Debentures convert into CEL shares at a price of $0.25 - a 30% premium to 5-day VWAP2

- QRC is well known as a long-term resource investor with a track record of successful investments

- Additionally, CEL's largest shareholder commits to a $2.6m investment pro-rata to its 12% shareholding

- The combined $24.7m funding, which is expected to close on September 14, allows CEL to complete:

- a Scoping Study for the Hualilan Gold Project to be based on an updated Mineral Resource Estimate (“MRE”) incorporating the recently completed 204,000 metre drill program

- 50,000 metres additional drilling at Hualilan which will likely result in a further MRE update

- an additional 25,000 metres drilling at the El Guaybo Project in Ecuador designed to allow the reporting of a maiden MRE on the main GY-A discovery zone at the El Guaybo Project, Ecuador

- an additional $2.6m discretionary spending which is yet to be allocated

QRC is a leading resource-focused investment company based in Hong Kong and listed on the main board of the Toronto Stock Exchange ("TSX"). QRC acquires and hold securities for long-term capital appreciation, with a focus on convertible debt securities and resource projects in advanced development or production located in safe jurisdictions.

The funding allows the completion of several important and value accretive milestones including; an updated Mineral Resource Estimate and Scoping Study at Hualilan; an additional 50,000m of drilling at Hualilan; and an additional 25,000m drilling and a maiden Mineral Resource Estimate at El Guaybo in Ecuador. Importantly, the pro-rata at market participation of CEL's largest shareholder provides discretionary expenditure of $2.6m which, is yet to be allocated, and extends CEL's runway into 2024.

Commenting on the investment CEL Managing Director, Mr Kris Knauer, said

"I am delighted to have QRC make an investment in CEL. QRC is a recognised long-term investor with a track record of successful investments in the resource sector. QRC undertook extensive due diligence including a Hualilan site visit and their investment is an endorsement of CEL's progress and potential. Our largest shareholder has been an active buyer on market and their pro-rata participation increases the amount raised to almost $25 million and extends our runway well into 2024.

CEL is now funded to deliver on several important milestones including an updated Mineral Resource Estimate and Scoping Study at Hualilan, plus a maiden Mineral Resource Estimate at El Guaybo. The additional 50,000 metres drilling at Hualilan will double the drill metres in the current resource estimate.

It is a great outcome to achieve the funding required to complete this series of significant and value accretive milestones from a two long term investors, at a significant premium to a traditional placement and the current market price."

Terms of the Debentures

The Company and QRC have entered into a binding Debenture Agreement (the "Agreement") with the Debentures convertible at the holder's option into Shares at a conversion price of A$0.25, representing a 30% premium to the 5-day VWAP of Shares on the Australian Securities Exchange (“ASX”) prior to 2 September 2022.

The Agreement is subject to a condition precedent that a material adverse event has not occurred in respect of the Company's Hualilan Gold Project prior to settlement, however, is not otherwise subject to any other conditions precedent and is expected to close on or around 14 September 2022, with the full US$15 million payable to the Company on closing. The Debentures will be issued pursuant to the Company's 15% placement capacity under ASX Listing Rule 7.1. Following entry into the Agreement, the Company intends to seek the approval of its shareholders (Shareholders), at the Company’s Annual General Meeting in November 2022 (AGM), for the ratification of the Debentures (and all interest accruing thereunder) for the purpose of ASX Listing Rule 7.4 (Debenture Resolution).

The Debentures are unsecured with a coupon (interest) rate of 9% (7% payable in cash and 2% payable in either cash or Shares, at QRC's election) payable quarterly in arrears. The Share price used to calculate the number of Shares to be issued for the interest component payable in Shares is the to 20 day VWAP ending three trading days prior to the interest being payable. The debentures will have a four-year term from closing and will be repayable by the Company upon expiry of that period to the extent not otherwise converted earlier into Shares. The Debentures are expected to be refinanced as part of the development funding for the Hualilan Gold Project should they not be converted.

Upon closing, the Company will pay to QRC an establishment fee equal to 3% of the principal amount of the Debentures in cash or shares. QRC has notified the Company that is has elected for the establishment fee to be paid in Shares which will be issued at the same price of $0.19 as the At Market Placement. These shares will be issued under the Company's LR7.1 placement capacity.

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

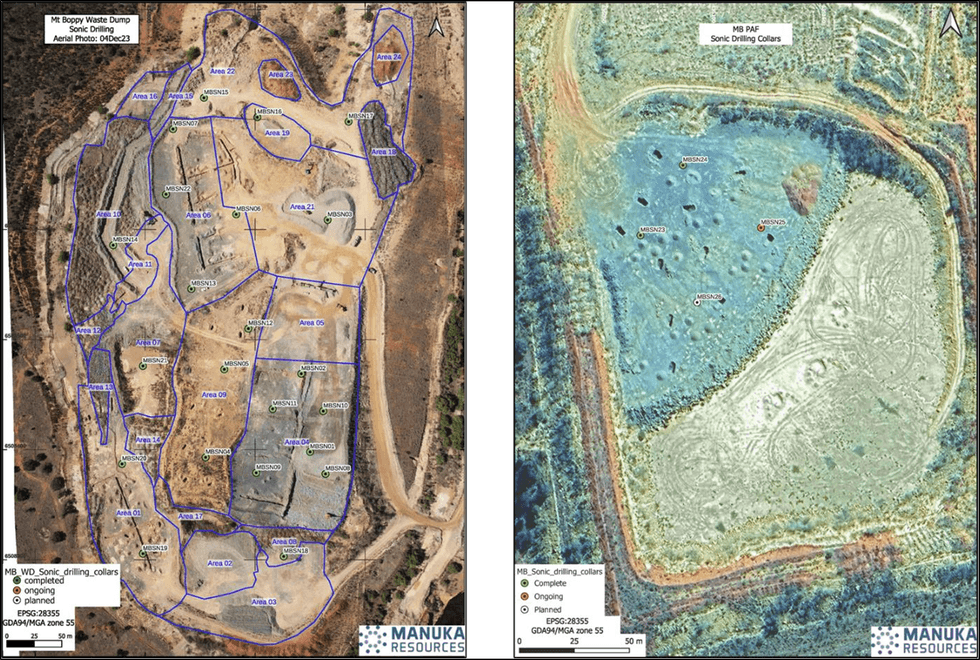

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

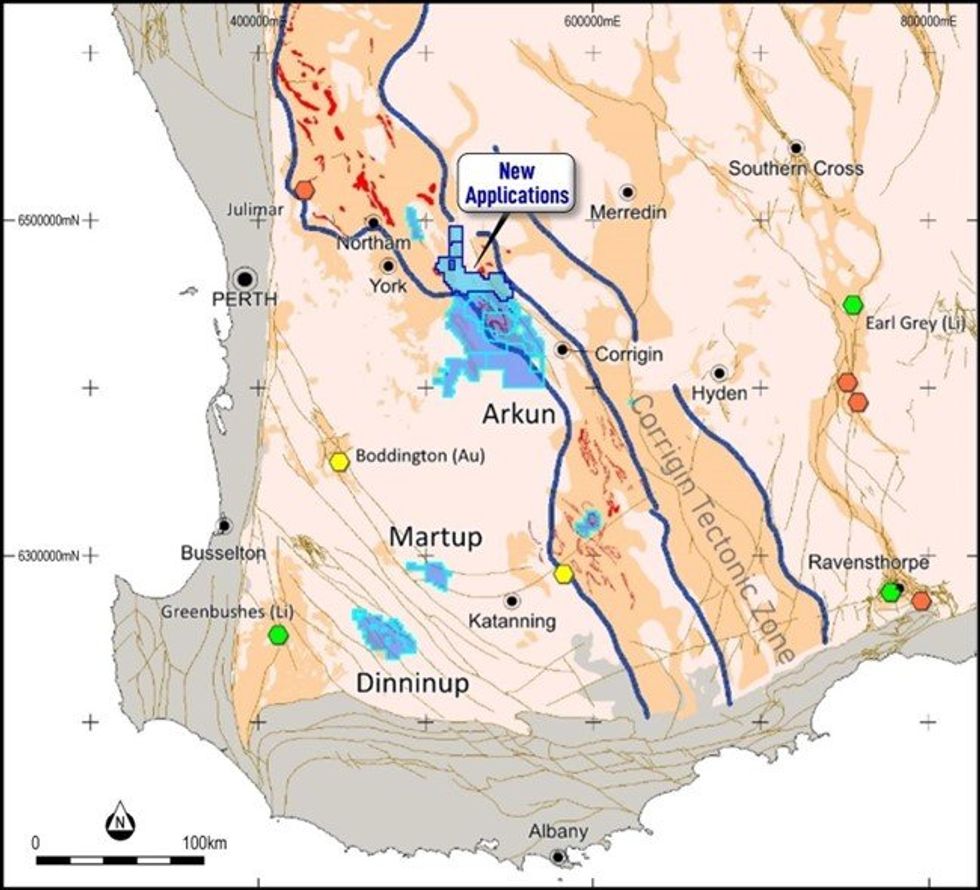

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow.

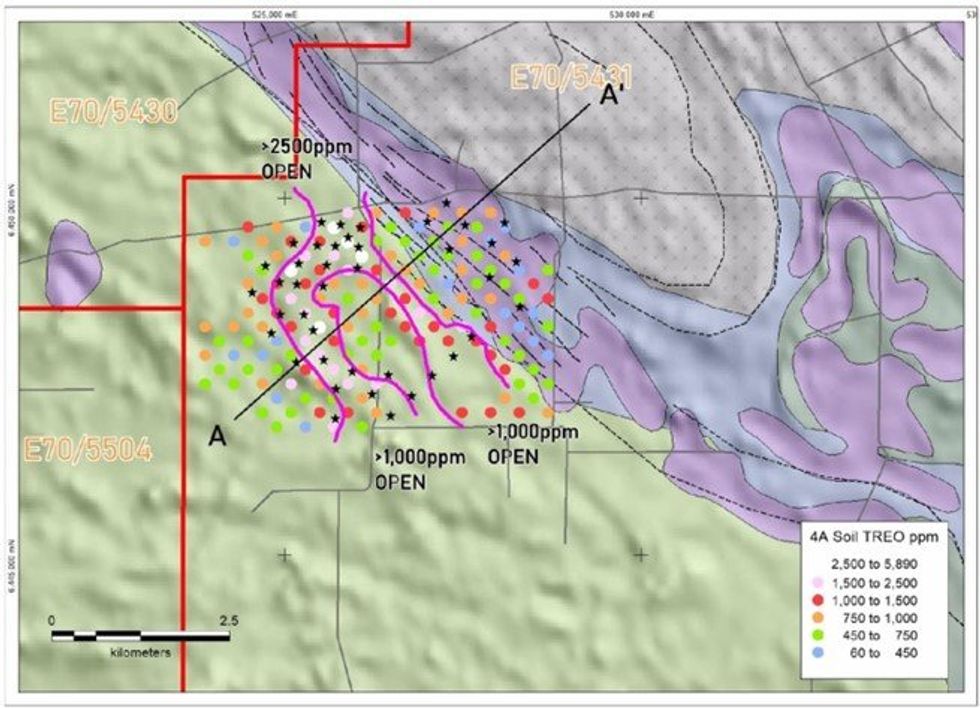

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow. Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

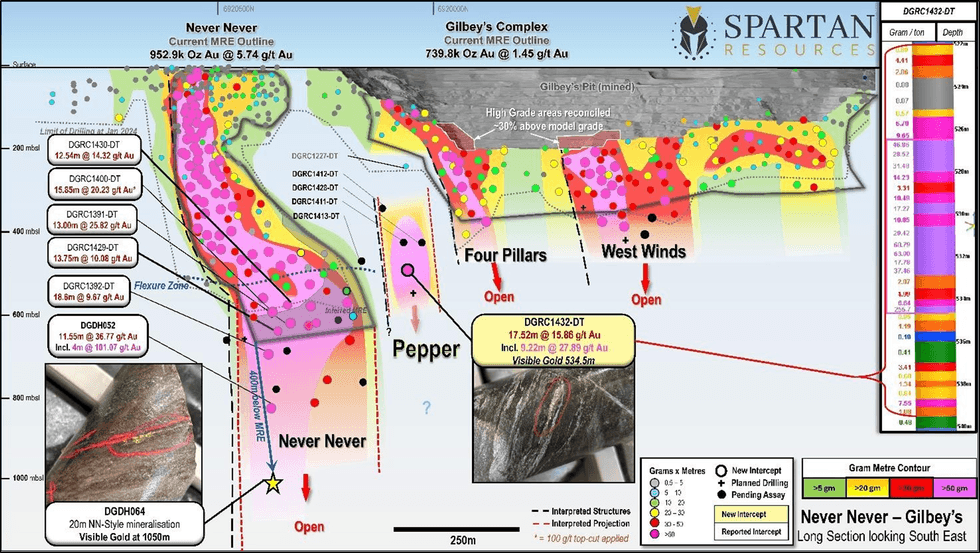

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending).

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending). Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept

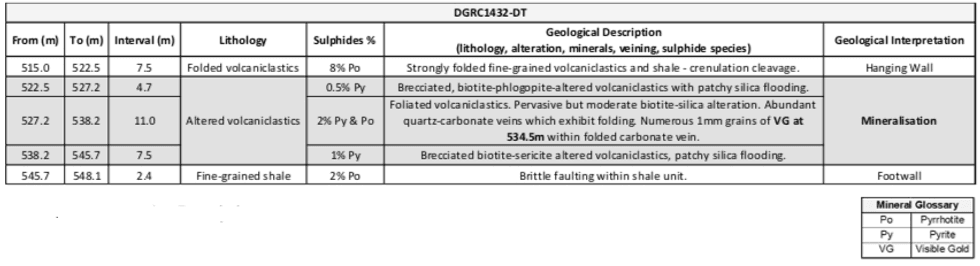

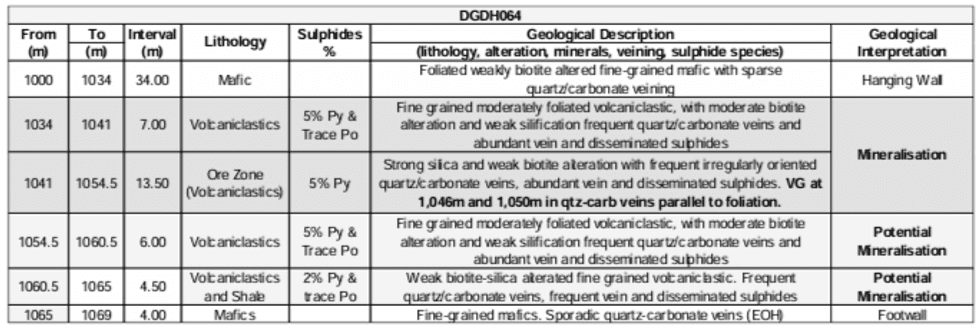

Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)

Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)

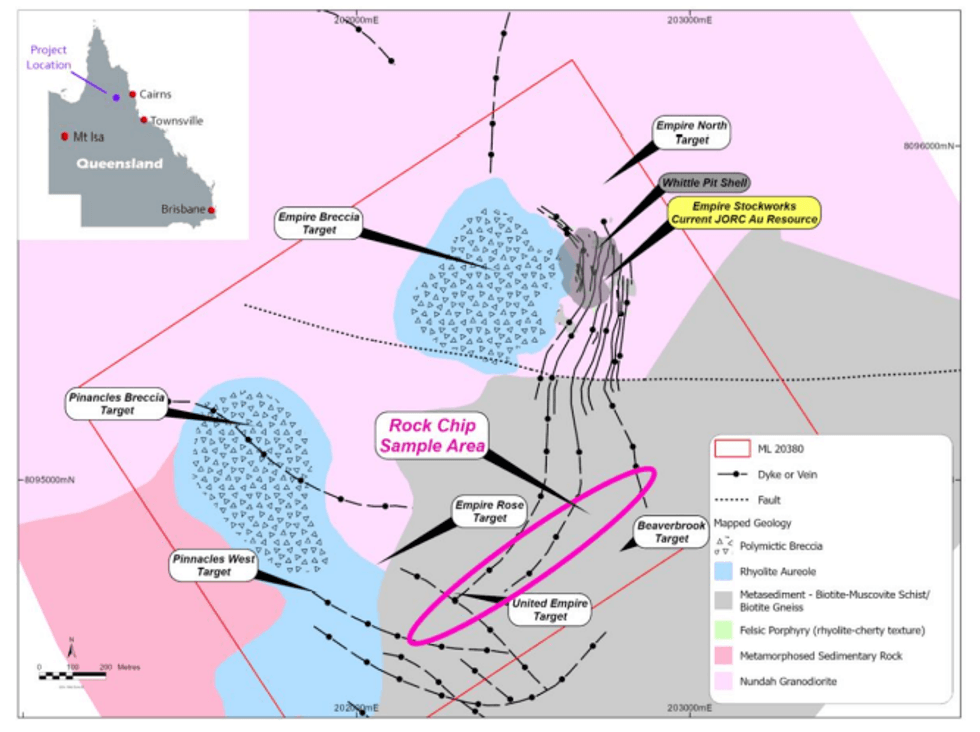

Figure 1 Empire Mining Lease - Location of Empire Stock Work, Pinnacle & United Empire.

Figure 1 Empire Mining Lease - Location of Empire Stock Work, Pinnacle & United Empire.