- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Charger’s $5.5M Placement Strongly Supported

Charger Metals NL (ASX: CHR, “Charger” or the “Company”) is pleased to announce that it has received firm commitments to raise A$5.5 million (before costs) in new equity via a strongly supported share placement to institutional, sophisticated and professional investors (“Placement”). The Placement will comprise the issue of 11 million new shares in the Company (“New Shares”) at an issue price of A$0.50 per New Share and represents a 5% discount to the Company’s 15-day volume weighted average price (VWAP) of existing ordinary shares (“Ordinary Shares”).

Charger proposes to use funds from the Placement (after administration costs) predominantly on exploration activities including drilling to advance the Company’s Bynoe and Lake Johnston Lithium Projects.

Commenting on the completion of the Placement, Managing Director David Crook said:

“Weareverypleasedwiththestronglevel of demand shown for our capital raising from existing sophisticated and institutional shareholders from Australia and abroad.

“The lithium market is currently strong, reflecting the improved understanding of the critical rolelithiumbatteriesaretoplayintheenergymixforaNetZeroEmissionworld. Increasing demand for primary supply into the lithium market should continue to underpin projects, such as Charger’s Bynoe and Lake Johnson Lithium Projects, and the funds raised will allow us to aggressively drill both these highly prospective lithium projects.”

Prenzler Group acted as Lead Manager to the Placement. Under the terms of their mandate, Prenzler will receive a 2% management fee and a 4% selling fee on the gross proceeds of the Placement.

The Placement Shares will fall within the Company’s placement capacity under ASX Listing Rules

7.1 and 7.1A. 6 million Placement Shares will be issued under the Company’s LR 7.1 capacity

and 5 million Placement Shares will be issued under the Company’s LR7.1A capacity.

The Placement Shares are expected to be issued on 23 September 2022, with quotation on the ASX expected to take place on 26 September 2022. The Placement Shares will rank equally with existing fully paid Ordinary Shares.

Click here for the full ASX Release

This article includes content from Charger Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities and Cash Flow Report for the Quarter Ended 31 March 2024

Atlantic Lithium looks ahead to major near-term value-drivers as it advances the Ewoyaa Lithium Project towards shovel-readiness

The Board of Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF, “Atlantic Lithium” or the “Company”), the African-focused lithium exploration and development company targeting to deliver Ghana’s first lithium mine, is pleased to announce its Quarterly Activities and Cash Flow Report for the period ended 31 March 2024.

Highlights from the Reporting Period:

Project Development:

- Overwhelmingly strong local community support demonstrated at the Environmental Protection Agency (“EPA”) Scoping Public Hearing in respect of the Company’s Ewoyaa Lithium Project (“Ewoyaa” or “the Project”) in Ghana.

- Completion and submission of Ewoyaa Feldspar Study and Downstream Conversion Study to Ghana’s Minerals Commission, as agreed under the terms of the grant of the Mining Lease for the Project.

- Engagement with industry-leading engineering firms with proven experience in Ghana ahead of tender process for the award of the Engineering, Procurement, and Construction Management (“EPCM”) contract.

- Further key strategic appointments in support of mine development.

Exploration:

- Assay results received for a total of 9,734m of drilling completed in 2023 over the new Dog-Leg target, Okwesi, Anokyi and Ewoyaa South-2 deposits, which sit outside of the current JORC (2012) compliant 35.3Mt @ 1.25% Li2O Mineral Resource Estimate (“MRE”)1 for the Project.

- Results reported during the period represent the final results for the 2023 drilling season, with a total of 25,898m drilled throughout the year.

- Multiple high-grade and broad drill intersections reported in results, including at Dog-Leg, where drilling intersected a shallow-dipping, near surface mineralised pegmatite body with true thicknesses of up to 35m.

- Highlight intersections include 69m at 1.25% Li2O from 45m and 83m at 1% Li2O from 36m at Dog-Leg.

- Completion of reverse circulation (“RC”) and diamond core (“DD”) resource growth drilling at the Dog-Leg target, with assays pending.

- Results of drilling completed in 2023 and results pending for 2024 to be incorporated into a MRE upgrade, targeted during H2 2024.

- Completion of 3,177m of plant site sterilisation drilling, with no mineralisation intersected, providing confidence in the proposed plant site location.

- Final approval received to commence field work at the newly-granted Senya Beraku prospecting licence.

- Promotion of Exploration Manager Iwan Williams to General Manager, Exploration and Country Manager Abdul Razak to Exploration Manager, Ghana following the decision of Head of Business Development & Chief Geologist Len Kolff to step down from his roles at the Company.

- Changes to the exploration team focused on enabling the advancement of the Company’s exploration asset pipeline and the evaluation of new value-accretive opportunities to ensure the long-term growth of the Company.

Corporate:

- Completion of the Minerals Income Investment Fund of Ghana’s (“MIIF”) Subscription for 19,245,574 Atlantic Lithium shares for a value of US$5m, representing Stage 1 of MIIF’s agreed total US$32.9 million Strategic Investment to expedite the development of the Project towards production.

- Strong interest for spodumene concentrate to be produced at Ewoyaa continues to be demonstrated from a range of industry players around the world through the Company’s ongoing competitive offtake partnering process to secure funding for a portion of the remaining 50% available feedstock from Ewoyaa.

- Formal bids from remaining interested parties expected to be received in the coming weeks ahead of final negotiations.

- Purchase of 24.3m Atlantic Lithium shares at a premium by major shareholder Assore International Holdings (“Assore”) from strategic funding partner Piedmont Lithium Inc. (NASDAQ: PLL; ASX: PLL, “Piedmont”).

- Further purchase of the Company’s shares from members of the Company’s senior leadership team, equating to a total value of A$5,192,393 (£2,794,015) since March 2023.

“With our sights firmly set on breaking ground at the Ewoyaa Lithium Project later this year, Atlantic Lithium remains fully focused on activities that de-risk the Project and move Ewoyaa closer to shovel-readiness.

“Key to achieving this milestone is the success of the ongoing permitting process, which is advancing as anticipated. We are proud to note the overwhelming support of our local communities, who, as demonstrated during the recent EPA Scoping Public Hearing, are eager to see Ewoyaa deliver the generational benefits expected to be brought about from lithium production in their municipality.

“Following the completion of its US$5m investment in the Company, we are delighted to welcome the Minerals Income Investment Fund of Ghana to the Atlantic Lithium share register as a highly valued local stakeholder and key funding partner. MIIF’s subscription represents the first stage of its planned US$32.9m total investment, expected to expedite the development of the Project. We continue to work closely with MIIF to complete the remainder of its planned Project- level investment in due course.

“Significant work in respect of the agreed terms of the grant of the Mining Lease for the Project has also been completed during the period. Both the Feldspar Study and Downstream Study have been finalised and submitted to the Minerals Commission, and we are working with the Ghana Stock Exchange and associated parties to enable our listing on the GSE as soon as possible.

“Concurrent to these, we continue to enhance the value of the Project; both through drilling completed in 2023 and planned for the remainder of 2024. Drilling completed in 2023 has delivered encouraging results, including new targets for follow-on work, to be undertaken in H2 2024. We look forward to incorporating the 2023 results and results to be received from drilling planned for H2 2024 into a MRE update later this year.

“I would like to congratulate Iwan Williams and Abdul Razak on their promotions, to General Manager, Exploration and Exploration Manager, Ghana, respectively, following Len’s decision to step down from his roles at the Company. Iwan and Razak have led the Company’s exploration activities alongside Len since before the delivery of the Maiden MRE at Ewoyaa in 2020, and are, therefore, well-credentialled to lead the Company’s exploration efforts, focused primarily on advancing our current portfolio of assets in West Africa, as well as assessing new opportunities in Ghana and elsewhere.

“On behalf of the Board, I would also like to thank Len for his significant contributions to the leadership of the Company throughout his nine years with Atlantic Lithium. His expertise has been fundamental to getting us to where we are today, notably his role in the discovery of the Project and for stepping up to assume the role of Interim Chief Executive Officer following the untimely passing of the Company’s founder, Vincent Mascolo. I wish him every success in his future endeavours.

“Looking forward, we have a number of other major catalysts in the months ahead of us. These include the conclusion of the competitive offiake partnering process for a portion of Ewoyaa’s remaining offiake available, which will serve as a major funding milestone for the Company, the ratification of the Mining Lease by parliament and, in line with the ongoing permitting process, the grant of the final permits; namely the EPA Permit and Mine Operating Permit, which are required by the Company to enable the commencement of construction at Ewoyaa.

“We look forward to updating the market on our progress in due course.”

Click here for the full ASX Release

This article includes content from Atlantic Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Forward Water Technologies

Overview

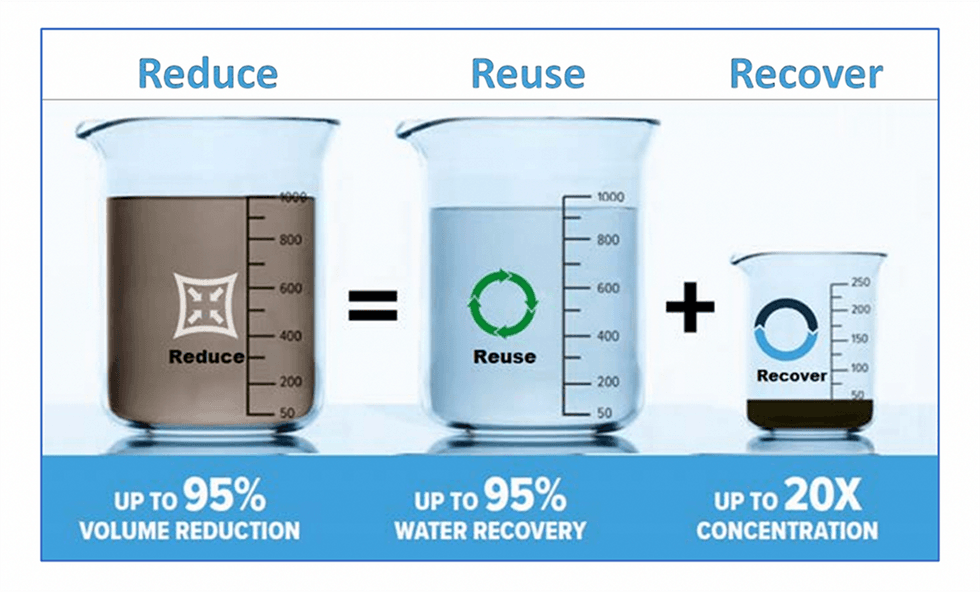

Forward Water Technologies (TSXV:FWTC) is helping lithium mining companies and other industries reduce their environmental impact through its innovative wastewater treatment technology that enables industrial operations to reduce liquid waste volume by up to 95 percent.

Environmental, social and governance (ESG) ratings continue to be a key business strategy for organizations as they impact public perception and partnership possibilities. For water-intensive industries, such as mining, sustainable wastewater management is critical.

Transformative wastewater technologies are critical for both businesses and the world’s population. In fact, unless sufficient progress is achieved, UNICEF and WHO estimate that 1.6 billion people will be without access to safe drinking water by 2030, and 2.8 billion will be without access to safe sanitation and hygiene. Water treatment technologies can disrupt current trends and improve global access to safe drinking water.

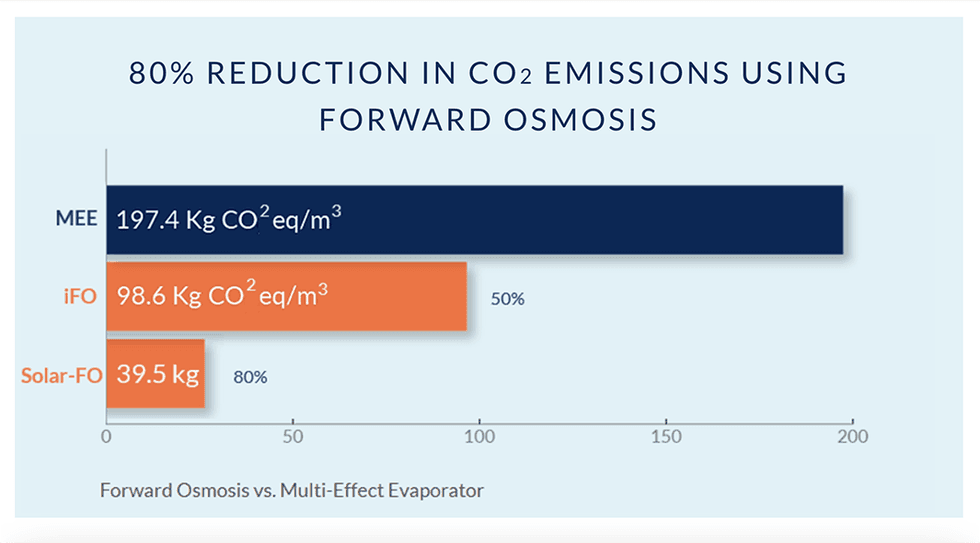

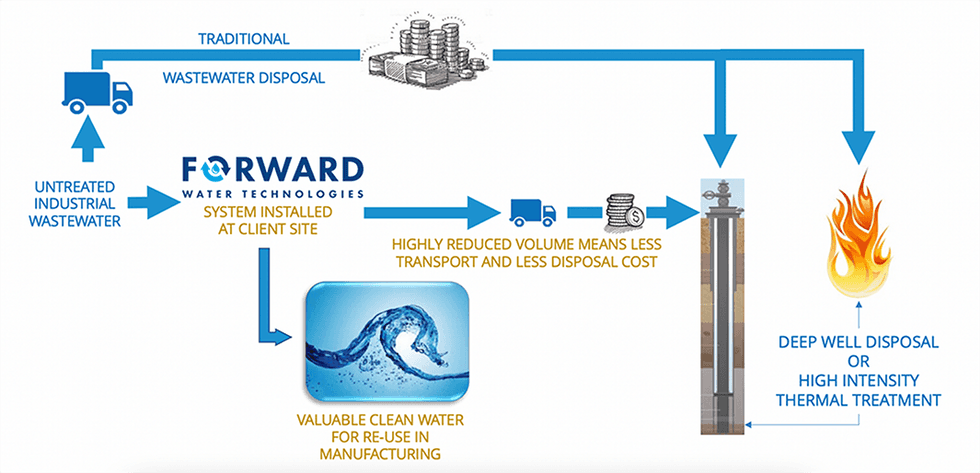

Through its Forward Osmosis (FO) technology, Forward Water is providing an environmentally friendly alternative to traditional wastewater disposal. Traditionally, wastewater disposal requires transporting untreated wastewater for deep well disposal or high-intensity thermal treatment.

Forward Water’s FO system is installed at the client site, and wastewater is treated to reduce waste volume and produce valuable clean water for reuse in the manufacturing process. Then, the significantly reduced volume of wastewater is transported and disposed of, significantly saving on transportation and disposal costs.

The FO technology targets three massive sectors: industrial wastewater, mining and food manufacturing. Forward Water’s unique and patented FO technology achieves high-rate water extraction within a low-energy continuous process. The process reduces waste and allows up to 95 percent water recovery, ready for reuse.

Forward Water’s Li-FO™ technology is ideal for lithium-brine mining operations, allowing mines to “fine tune” brine sources to improve concentration by up to 20 times. This results in improved recovery and makes lower-concentration brines economically viable. Forward Water is currently embarking on an early development testing project to further evaluate and refine the technology’s viability in lithium mining.

In 2023, the company’s wholly owned subsidiary, Forward Water Technologies Inc., licensed specific intellectual property from FUJIFILM Corporation to solidify the protection of its water treatment technology platform.

CleanTech Lithium (AIM:CTL,Frankfurt:T2N,OTC:CTLHF) has contracted FWT to provide advisory services for the support and development of CleanTech Lithium's direct lithium extraction (DLE) process in Chile. The collaboration will use FWT’s industrial forward osmosis system in the hyper-concentrating of CleanTech Lithium's eluate and its conversion into battery-grade lithium carbonate through Conductive Energy's DLE process.

Howie Honeyman, CEO, explained in an interview how the company’s technology can improve lithium mining operations. “A lot of lithium being mined today around the world is coming from underground aquifers that store the lithium brine. The challenge is that the lithium is surrounded by other minerals and salts, requiring chemical ‘tweezers’ to pluck out that lithium. What we can do is, at multiple places in that process, we can concentrate that lithium-containing water stream, which makes it far easier for these miners to handle the volumes they need to extract that lithium.”

An experienced management team with technical expertise leads the company towards further refining and deploying its technology. The team includes experts in materials science, chemistry and engineering. Additional experts in corporate administration and financing round out the leadership team to lead the company toward its goals.

Company Highlights

- Forward Water Technologies has developed a patented wastewater treatment technology that reduces wastewater volume and improves reusability across multiple industries, including mining and food manufacturing.

- The company’s Forward Osmosis (FO) technology disrupts the traditional method of wastewater disposal by reducing the amount of waste that must be transported and disposed of, directly reducing costs.

- The FO technology also improves water reusability by up to 95 percent, reducing the expense of importing water for industrial processes.

- The Forward Water Technologies Li-FO™ process is applicable in the lithium mining sector by improving concentration by up to 20 times, allowing organizations to improve extraction efficiency.

- The company has partnered with a lithium-brine extraction operation to evaluate its Li-FO™ technology.

- Forward Water Technologies is in early negotiations to deliver an FWTC forward osmosis pilot system on-site in Chile to support a customer's lithium extraction process.

- Forward Water Technologies has licensed specific intellectual property from FUJIFILM Corporation to solidify the protection of its water treatment technology platform.

- The company has been contracted by CleanTech Lithium to provide advisory services for the support and development of CleanTech Lithium's direct lithium extraction processes in Chile.

- An experienced management team with a blend of relevant technical expertise leads the company toward refining and marketing its technology.

Key Project

Forward Osmosis Water Treatment

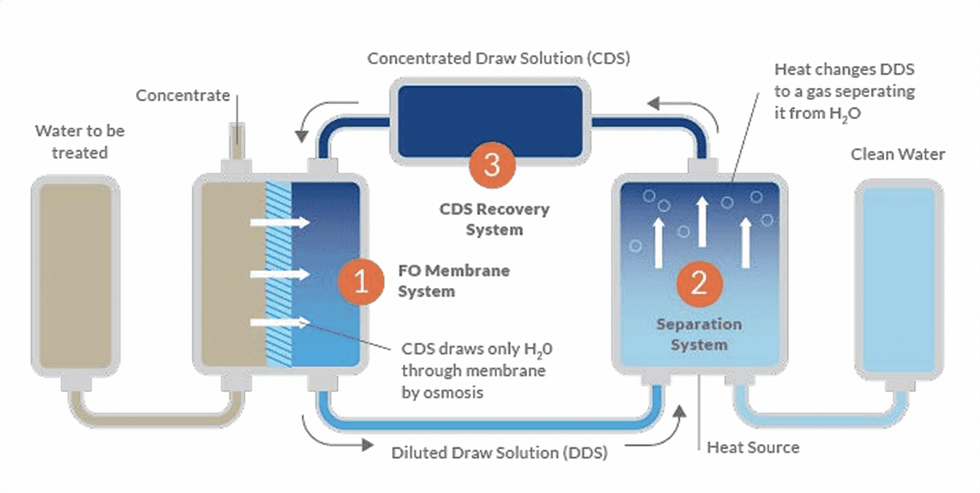

Forward Osmosis is a naturally occurring process in which water is spontaneously drawn across a membrane when one solution is higher in salt concentration than the other. The difference in salinity, known as the osmotic gradient, creates a low-energy water treatment process.

Forward Water Technologies has leveraged the naturally occurring process to innovate its patented, three-step FO technology, enabling a 95 percent wastewater reduction and 95 percent water recovery.

Project Highlights:

- Patented Three-Step Process: Forward Water Technologies FO process achieves low-energy and high-rate water extraction with a unique three-step design:

- Water Extraction: Water is drawn across the FO membrane into a salt draw solution. The combination of the patented draw solution and unique membrane “locks” the draw solution on one side of the membrane, creating a true closed-loop process.

- Water/Salt Separation: Next, a switchable water salt (SWS) achieves water/salt separation as low-grade heat is applied, and it phases from liquid to gas. As the gas leaves the solution, clean water is left behind. The energy necessary for this step is often found in many facilities in the form of waste heat.

- Salt Draw Reconcentration: Finally, as the gas leaves the solution, it is captured within the closed-loop system and is passively cooled, causing it to phase back into liquid form as an SWS. The SWS liquid is collected and recycled back to the front of the membranes in the water extraction step, creating a continuous process.

- Widely Applicable Water Treatment: The low-energy process allows organizations across several industries to improve water reclamation and reduce wastewater by up to 95 percent. Additionally, the process allows for up to 20 times concentration, making the process amenable to lithium-brine extraction and other potential applications.

- Significant Cost Savings: The primary value proposition for the FO process is cost reduction in wastewater transportation and disposal. With the process in place, more water is reclaimed for reuse in manufacturing, which reduces the raw volume of wastewater that must be transported and disposed of.

Management Team

Howie Honeyman - Chief Executive Officer and President

Dr. Howie Honeyman has 20 years of experience commercializing new technologies at Xerox, Cabot, E Ink, Natrix Separations and as former CTO of GreenCentre Canada. Honeyman commercialized high-capacity, high-throughput membranes for bioprocessing as SVP of Natrix Separations, which has since been acquired by Millipore-Sigma. Since 2015, Honeyman has been leading Forward Water to become a premier wastewater treatment solution. Honeyman is also an inventor of record on over 50 US patents and holds a PhD in chemistry from the University of Toronto.

Michael Willetts - Chief Financial Officer

Michael Willetts has over 25 years in financial leadership roles primarily in manufacturing, from large multinational businesses to startups, both public and private. He previously worked as an engineer in the automotive industry before entering into finance at Ford Motor Company. Willets went on to progressively larger finance roles in several international automotive suppliers (Textron, GKN, DSM) and Canadian manufacturers (Armtec, Stronach International, AirBoss of America). Willetts is currently providing fractional CFO services through WD Numeric Corporate Services in the manufacturing, SaaS and cannabis industries. Willetts graduated with a BASc, BComm and MBA from the University of Windsor.

Wayne Maddever - Chief Operating Officer

Dr. Wayne Maddever received his Ph.D. in materials science engineering from the University of Toronto. Since 1985, he has held senior executive management positions with technically based businesses in start-up, turnaround or acquisition situations where his skills in change management have brought considerable success in the commercialization of new technologies. His experience in both private and public companies, domestically and internationally, spans a broad variety of industries, including bio and advanced materials, precision manufacturing, recycling, waste-to-energy and medical devices. He holds a number of patents in several fields. He is a fellow of the Canadian Academy of Engineering. In addition to his duties as COO of Forward Water, he is currently portfolio manager at Bioindustrial Innovation Canada, one of the major shareholders of Forward Water.

Grant Thornley - VP Engineering Solution Sales

Grant Thornley is a business strategist with more than 25 years of experience. He has developed and grown international water/wastewater markets through innovative growth hacking techniques and processes, synergized with product development and positioning, data analytics and acceleration of go-to-market strategies through alliances and partnerships. Having expertise in chemical, mechanical and biological treatment processes as well as designing hundreds of municipal and industrial applications, Thornley brings a knowledge-to-action approach to helping clients solve problems and realize new opportunities in water reuse, energy conservation and CO2 reduction.

Leonard Seed - Director of Engineering & Operations

Leonard Seed has over 18 years of experience developing and commercializing new water and wastewater treatment technologies, primarily in a start-up environment. Seed is named as an inventor on over seven patents and has authored several publications. Seed is a professional engineer and has an MSc in environmental engineering from the University of Guelph. Leonard holds inventorship on seven US patents and is an instructor at Mohawk College teaching aspects of water treatment technologies and leading research efforts on forward osmosis.

Philip Jessop - Executive Research Director

Dr. Philip Jessop is a professor and Canada Research Chair of Green Chemistry at the Department of Chemistry, Queen’s University in Kingston, Ontario. He also serves as the technical director of GreenCentre Canada and executive research director at Forward Water Technologies. After his Ph.D. (British Columbia, 1991) and a postdoctoral appointment (Toronto, 1992), he became a contract researcher in Japan working for R. Noyori (Nobel Prize 2001). As a professor at the University of California-Davis (1996-2003) and since then at Queen’s, he has studied green solvents and the chemistry of carbon dioxide. Distinctions include the NSERC Polanyi Award (2008), Killam Research Fellowship (2010), Canadian Green Chemistry & Engineering Award (2012), Eni Award (2013), Fellowship in the Royal Society of Canada (2013), a Canada Research Chair Tier 1 (2013 to 2020), and the NSERC Brockhouse Prize (2019). He serves as chair of the editorial board for the journal Green Chemistry, has chaired three international conferences, and helped create GreenCentre Canada, a national center of excellence for the commercialization of green chemistry technologies. Forward Water is a spin-off company based on Dr. Jessop’s switchable solvents.

Board Changes

Mr. Sondergaard's appointment to the Board follows his recent appointment as Country Manager for Canada, delivering on White Cliff's stated objective of building a first class operations team. Eric brings over 20 years of operational experience in the mining industry, including significant expertise in frontier exploration and project management. Notably, he played a pivotal role in the identification of key projects recently acquired by the Company and is an expert in remote project development, logistics and has a proven track record of creating value for shareholders.

In conjunction with Mr. Sondergaard's appointment, White Cliff Minerals also announces the retirement of Mr. Ed Mead (“Ed”) from the Board of Directors effective immediately however will continue to provide, as required, consulting services to the Company in relation to its Australian portfolio. The Company would like to thank Ed for his invaluable contribution throughout this transition phase. As part of this ongoing support, and in recognition of the valuable contribution to the formation of the newly focussed and revitalised White Cliff Minerals Ltd, Ed will maintain his full allocation of the Tranche A incentive scheme with the balance becoming void as per the terms and conditions of the incentive scheme itself.

As part of the Board restructure, Troy Whitaker will move to the role of Managing Director of the Company. The remuneration for both Eric and Troy remain unchanged.

Commenting on these developments, White Cliff Chairman, Roderick McIllree, stated: "The changes required to facilitate the change of strategic direction are now complete. We are delighted to welcome someone of Eric’s calibre with a proven track record to the Board. His involvement will be critical as the Company prepares for its maiden field campaign. We also extend our sincere thanks to Ed Mead for his dedication and service to the Company and wish him the best for his future endeavours."

Click here for the full ASX Release

This article includes content from White Cliff Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities Report for the Period Ended 31 March 2024

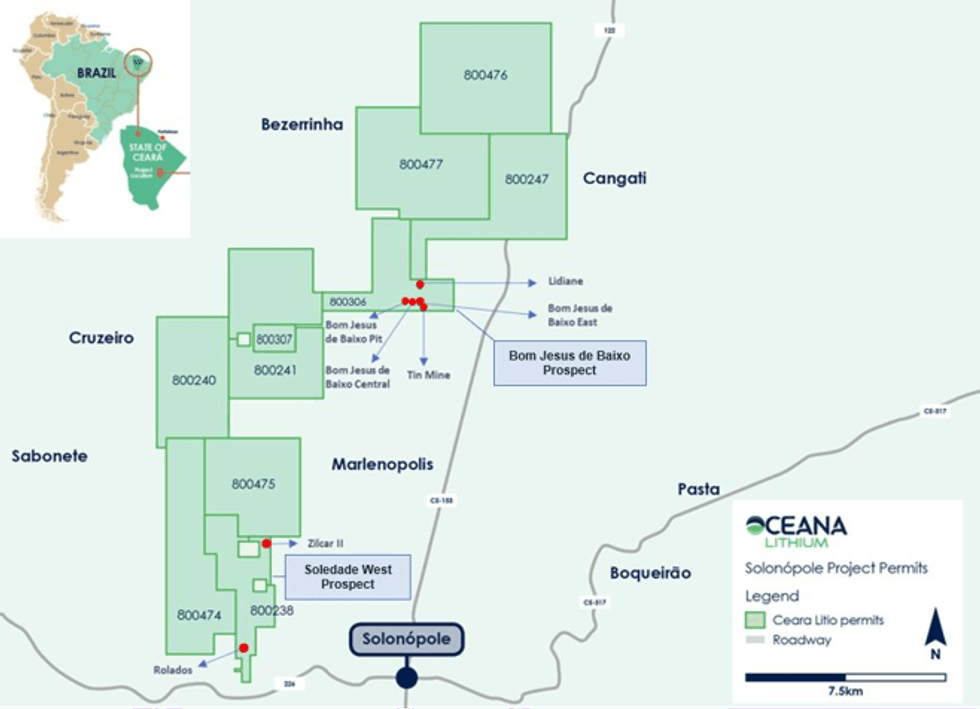

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to present its activities report for the March 2024 quarter.

Highlights

Solonópole Project, Ceará, Brazil

- Anomalous lithium values above 100 ppm (and up to 631 ppm) found in 383 soil samples within existing and new target areas.

- Integration and interpretation of these soil sample results with data from geophysics, geological mapping (138 line-km), trenching and RC drilling (~2,000m) further enhance prospectivity of existing and new targets.

- Combined datasets confirmed several swarms of pegmatite bodies striking in a NE-SW and E-W directions and identified new high priority areas.

- Nira interpreted to be the most prospective new target, with 180 soil samples of >100 ppm Li and as high as 524 ppm Li covering an area of at least 1km2.

- Nira also features 17 pegmatite outcrops with average widths of up to 30 meters and strike lengths from 200m to 600m.

- Planning for the next follow-up drilling campaign is underway.

Napperby Project, Northern Territory, Australia

- Oceana’s Napperby Project covers some of Arunta Province’s hottest granites plutons, the Wangala Granite (uranium) and Ennugan Mountains Granite (uranium/thorium).

- Both granite plutons show outstanding uranium/thorium ratios and are almost fully encapsulated within Napperby’s EL32836 and ELA32841.

- Follow-up exploration activities will target uranium and Rare Earth Elements (REEs) in parallel with Lithium-Caesium-Tantalum (LCT) pegmatites.

Corporate

- Experienced geologist and mining executive, Aidan Platel, appointed as non- executive director.

- Brazilian-based geologist, Mike Sousa, appointed as Exploration Manager and Competent Person.

- The Company remains well-funded with cash at 31 March of ~$2.67m.

Solonópole Project, Ceará State, Brazil

The Solonópole Project area is located in the state of Ceará, north-eastern Brazil and consists of ten (10) exploration permits covering approximately 124km2 (Figure 1), owned by Oceana’s subsidiary Ceará Litio. The project is approximately three to four hours by road from the state capital Fortaleza and deep-water port of Pecém, and is well serviced by sealed highways and high voltage electricity.

Large-Scale Soil Sampling and Geological Mapping at Solonópole Lithium Project

The large-scale infill soil sampling program that commenced in March 2023 continued over the project area (Figure 2). The optimized sampling grids are along 200m spaced lines with 25m sampling stations, aligned north south to cut across all typical pegmatite strike directions in this area.

As at 31 March 2024, over 10,300 soil samples had been collected from Solonópole and 8,741 soil samples had been analysed by X-Ray Fluorescence (XRF) for Lithium-Caesium-Tantalum (LCT) pathfinders, of which 1,908 soil samples have lab results validated by Oceana´s internal QA/QC. Anomalous lithium values above 100 ppm and up to 631 ppm were found in 383 soil samples within existing and new target areas.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

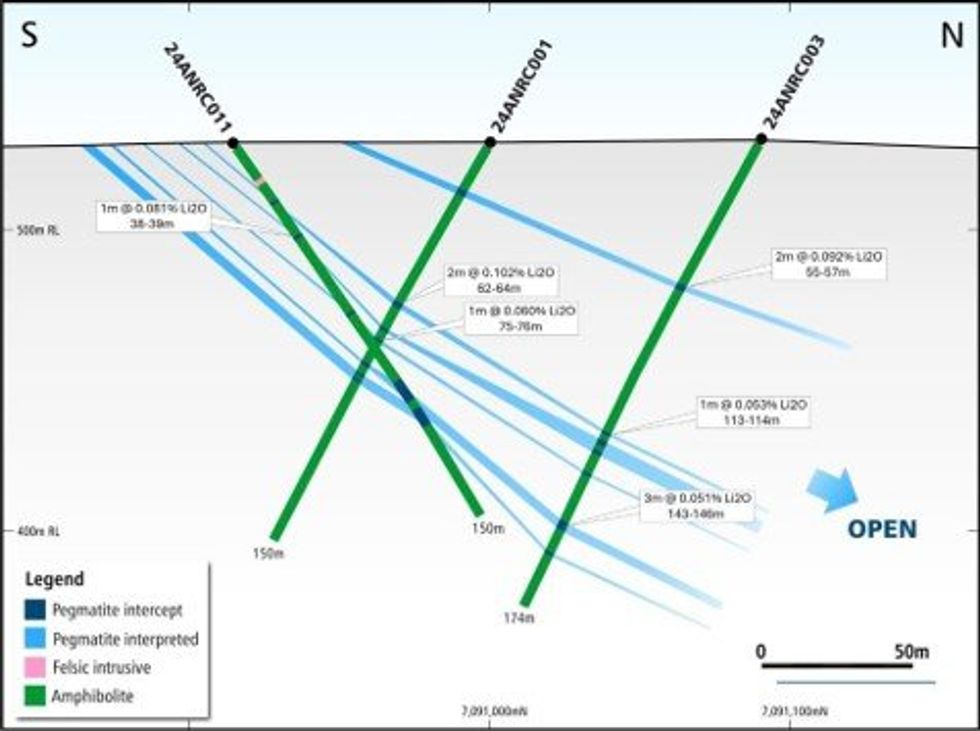

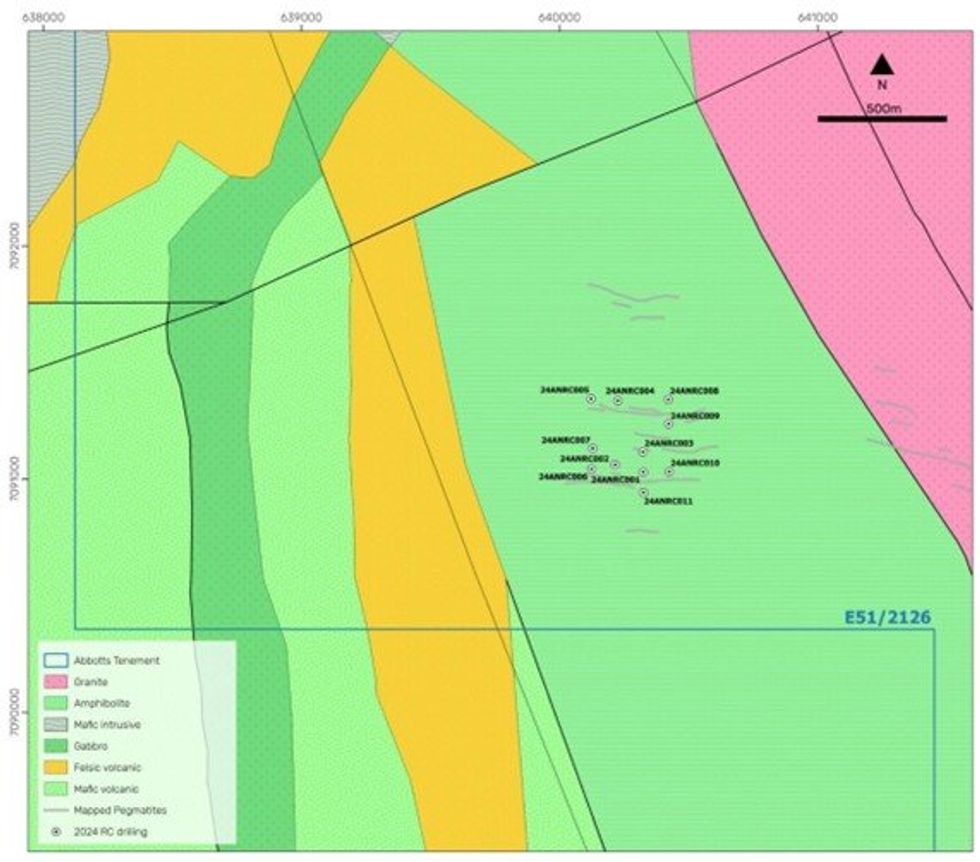

Results From First Drilling at Abbotts North Confirm LCT System

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) advises that results have been received from the first drilling program at Abbotts North located 35km north of Meekatharra, Western Australia. The results show elevated lithium across the stacked pegmatites of up to 0.41% Li2O (24ANR007), confirming the continuation of the LCT system down depth and along strike.

HIGHLIGHTS

- Assay results from Abbotts North confirm continuation of LCT system

- Focus shifts to targets identified to the north and east of previous drilling

- Field work over these newly identified areas has commenced

- Premier1 is fully funded for second phase exploration in these areas

A total of 11 RC holes for 1,623m were drilled to test the main outcropping pegmatites at the Buttamiah Prospect. Additional studies of the outcropping pegmatites in the larger Buttamiah Prospect area including fractionation vectoring using K/Rb ratios suggest the core of the system to be located to the east of the previous drilling.

In addition, the data indicate that LCT pegmatites occur within the granites to the north of the drill area. Further mapping and sampling of pegmatites in these areas as well as over the remaining tenement package has commenced. Focus is to delineate drill targets of higher grades and greater thickness that have the potential to form a significant lithium deposit within the existing LCT system.

Premier1 is fully funded for any subsequent phase two drilling program.

Significant intercepts from RC drilling undertaken on the Abbotts North project in February 2024 are shown in Table 1a. Drill collar details are shown in Table 1b.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Analyst Firm Targets Share Price Upside for Lithium Universe as Refinery Plans Ramp Up

Description:

Australian investment research firm East Coast Research is estimating a more than 150 percent upside in the share price of Lithium Universe (ASX:LU7) over 12 months, from its current price of $0.21 per share to about $0.53 per share.

“Drawing on its expertise, LU7’s Dream Team is working on closing the massive gap in downstream lithium processing in North America by building a 16,000 tpa lithium carbonate refinery in Quebec, for which the company is rapidly completing a DFS (definitive feasibility study,” said East Coast Research analyst Behzad Golmohammadi in his report.

Led by lithium pioneer Iggy Tan, Lithium Universe has assembled a team of lithium industry experts that can deliver on the company’s goal to strengthen North America’s lithium supply chain. Through this expertise, Lithium Universe aims to close a widening lithium processing gap in North America, through a planned 16,000-tpa lithium carbonate refinery in Quebec, Canada, the analyst report cited. Lithium Universe is currently undertaking a definitive feasibility study for the processing plant.

China currently controls around 60 percent of the global lithium refining capacity for batteries, a huge driver for North American efforts to a lithium supply chain for the region.

“Western governments have come up with policies and strategic plans to support the expansion of their lithium refining capacities. However, the biggest challenge here is a lack of expertise that has led to a series of recent failures and delayed startups in the sector. This is where LU7’s Dream Team shines with its proven track record of successfully constructing and commissioning such projects,” the analyst report said.

Report highlights:

- Lithium Universe’s “dream team” of lithium industry experts led by Iggy Tan is working on closing the massive gap in downstream lithium processing in North America by building a 16,000 tpa lithium carbonate refinery in Quebec, Canada, for which the company is rapidly completing a definitive feasibility study.

- Lithium Universe plans to replicate the Jiangsu Lithium Carbonate Refinery, using the same engineering manager (Hatch) and the key executives who built the world-class Jiangsu Refinery.

- China’s dominance in the global lithium supply chain has pushed governments in North America to develop and strengthen a secure supply chain outside China, with strategic support for projects that expand North America’s lithium refining capacity.

- East Coast Research has valued Lithium Univers at AU$0.047 per share in a base-case scenario and AU$0.058 per share in a bull-case scenario, solely based on the Quebec lithium carbonate refinery project, and excluding the company’s prospective exploration assets or its spodumene concentrator project in Quebec.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.