- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

Trident Royalties PLC

Purpose Bitcoin ETF

International Graphite

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Funds raised to be used to support work at the Santa Teresa and Barraba Projects including expansion of exploration activities at the Barraba Project to include the historic Murchison Mine area

Highlights

- Placement to raise $1,000,000 to bring in new strategic investors

- Shares to be issued at 2c with a 1 for 2 option at 3c

- Funds raised to be used to support work at the Santa Teresa and Barraba Projects including expansion of exploration activities at the Barraba Project to include the historic Murchison Mine area

Comet Resources Ltd (ASX:CRL) is pleased to announce it has received commitments for a placement of 50,000,000 new fully paid ordinary shares in Comet (Placement Shares) to eligible sophisticated and institutional investors at $0.02 per New Share (the Placement) with a 1 for 2 free attaching option exercisable at $0.03 and expiring 2 years from date of issue (Placement Options).

The Placement will raise $1 million (before costs) and is priced at a 10% discount to the last closing price of Comet shares on 4 February 2021. The Placement brings several new strategic shareholders onto the register of the Company and will provide additional cash resources to support exploration activities at the Company’s projects in Mexico and Australia. This includes an expansion of exploration scope at the Barraba Project in NSW to now include further exploration works at the historic Murchison Mine in addition to planned exploration works at the historic Gulf Creek mine, as well as for working capital purposes.

Comet Managing Director, Matthew O’Kane, commented “With the planned increase in scope of works at the Barraba project to now also include the historic Murchison Mine in addition to the Gulf Creek mine area, we took the opportunity to execute the placement to bring on board some new strategic investors who we feel will provide ongoing benefit via their association with the business moving forward.”

The Placement Shares and Placement Options are intended to be issued under the Company’s capacity pursuant to ASX Listing Rule 7.1 (25,000,000 Placement Options) and 7.1A (50,000,000 Placement Shares). Placement Shares issued under the Placement will rank equally with existing Comet ordinary shares from their date of issue.

Peloton Capital Pty Ltd (Peloton Capital) is engaged as the Lead Manager to the Placement and will receive a distribution fee of 6% on monies raised. The Company will issue Peloton Capital or its nominee, 18.3 million Options at various strike prices. Please refer to the accompanying Appendix 3B for further details.

This announcement has been authorised by the Board of Comet Resources Limited.

For further information please contact:

MATTHEW O’KANE

Managing Director

(08) 6489 1600

comet@cometres.com.au

cometres.com.au

Suite 9, 330 Churchill Avenue Subiaco WA 6008

PO Box 866 Subiaco WA 6904

About Comet Resources

Santa Teresa Gold Project (Mexico)

The Santa Teresa Gold Project is comprised of two mineral claims totalling 202 hectares located in the gold rich El Alamo district, approximately 100 km southeast of Ensenada, Baja California, Mexico; and 250 km southeast of San Diego, California, USA. The Project is prospective for high grade gold. In addition to the two claims of the Project, two additional claims totalling a further 378 hectares in the surrounding El Alamo district are being acquired from EARL.

Barraba Copper Project (NSW)

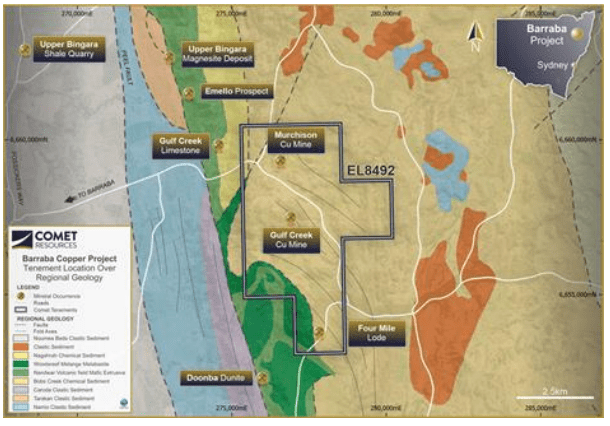

The 2,375ha exploration license that covers the project area, EL8492, is located near the town of Barraba, approximately 550km north of Sydney. It sits along the Peel Fault line and encompasses the historic Gulf Creek and Murchison copper mines. The region is known to host volcanogenic massive sulphide (VMS) style mineralisation containing copper, zinc, lead and precious metals. Historical workings at Gulf Creek produced high-grade copper and zinc for a short period around the turn of the 19th century, and this area will form a key part of the initial exploration focus.

Springdale Graphite Project (WA)

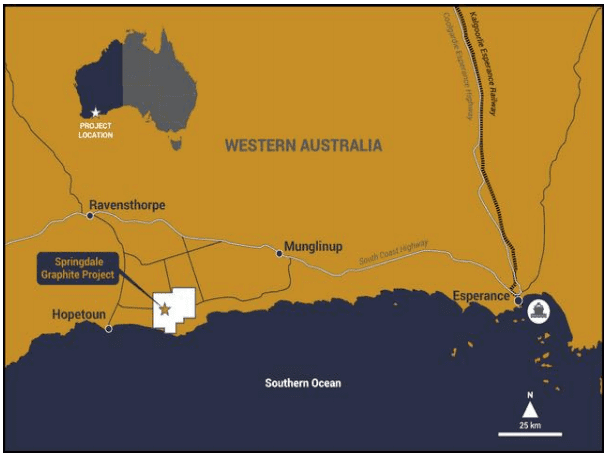

The 100% owned Springdale graphite project is located approximately 30 kilometres east of Hopetoun in south Western Australia. The project is situated on free hold land with good access to infrastructure, being within 150 kilometres of the port at Esperance via sealed roads. The tenements lie within the deformed southern margin of the Yilgarn Craton and constitute part of the Albany-Fraser Orogen. Comet owns 100% of the three tenement’s (E74/562 and E74/612) that make up the Springdale project, with a total land holding of approximately 198 square kilometres.

Forward-Looking Statement

Forward-Looking Statement

This announcement includes forward-looking statements. Forward-looking statements include, but are not limited to, statements concerning Comet Resources Limited’s planned exploration programs, corporate activities and any, and all, statements that are not historical facts. When used in this document, words such as “could,” “plan,” “estimate,” “expect,” “intend,” “may”, “potential,” “should” and similar expressions are forward-looking statements. Comet Resources Limited believes that its forward-looking statements are reasonable; however, forward looking statements involve risks and uncertainties and no assurance can be given that actual future results will be consistent with these forward-looking statements. All figures presented in this document are unaudited and this document does not contain any forecasts of profitability or loss.

No New Information

To the extent that this announcement contains references to prior exploration results and Mineral Resource estimates, which have been cross referenced to previous market announcements made by the Company, unless explicitly stated, no new information is contained. The Company confirms that it is not aware of any new information or data that materially affects the information included in the relevant market announcements and, in the case of estimates of Mineral Resources that all material assumptions and technical parameters underpinning the estimates in the relevant market announcement continue to apply and have not materially changed.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2323.45 | -9.95 | |

| Silver | 27.33 | +0.02 | |

| Copper | 4.46 | -0.05 | |

| Oil | 83.42 | +1.52 | |

| Heating Oil | 2.59 | +0.02 | |

| Natural Gas | 1.84 | +0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.