- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Element79 Gold Corp.

Far Northern Resources

Brunswick Exploration

Osisko Metals

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Comet Resources: Capital Raising of $650,000 closed and Barraba Copper Project Acquisition Completed

Comet Resources Ltd (ASX:CRL) received subscriptions for $650,000 under a placement of 65,000,000 fully paid ordinary shares.

Highlights:

• Comet has successfully closed a placement of $650,000 at $0.01 per Share, re- affirming support for the Barraba Copper Project

• Barraba Copper Project acquisition now completed under amended terms that includes a reduction in consideration Shares from $450K to $200K

• Comet continues to see strong outlook for copper as the COVID-19 crisis passes

• Initial Barraba Project drilling program to commence once current travel restrictions are eased

Comet Resources Ltd (Comet or the Company) (ASX:CRL) is pleased to advise that it has received subscriptions for $650,000 under a placement (Placement) of 65,000,000 fully paid ordinary shares (Shares) in the capital of the Company, together with one free attaching option (exercisable at $0.02 on or before 30 June 2021) for each Share issued, to support the acquisition of the Barraba Copper Project in NSW (Acquisition) and initial project works.

A portion of the Placement will be conducted under the Company’s current placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A through the issue of 54,000,000 Shares at a price of $0.01 per Share (satisfying the minimum pricing condition under ASX Listing Rule 7.1A.3) with the balance of 11,000,0000 Shares under the Placement to be issued following receipt of shareholder approval. A Notice of General Meeting will be lodged in due course, seeking shareholder approval for the issue of Placement Shares in excess of the Company’s current 7.1 and 7.1A capacity, as well as for the free attaching 1 for 1 Placement options expiring 30 June 2021 and exercisable at $0.02. This capital raise replaces the previously announced capital raise at $0.025 per Share (ASX 18 February 2020) which has now been withdrawn.

Comet Managing Director, Matthew O’Kane, commented” “I’m very pleased that we have been able to work with our advisors and the vendors of the Barraba Project to come up with terms that enable us to continue with the acquisition and proceed with a placement that is sized to reflect current market conditions. I am now looking forward to the initial field exploration program at Barraba as soon as logistical and regulatory conditions permit.”

Comet believes that copper is set to see an increase in demand due to the global efforts to reduce emissions from the transport network and also from generation of renewable electricity. Copper is not only an important part the batteries used in BEVs, but is also used extensively in the electric motors that drive the wheels of BEVs, and is also used intensively in the generation of electricity from renewables, such as solar and wind. There is also significant potential for post Covid-19 fiscal spending initiatives by governments to provide further demand for copper.

The Barraba Copper Project has never been systematically tested by modern exploration techniques. The initial exploration program will include drill testing of areas below the historically identified deposits, plus high-level exploration targets delineated by an induced polarisation (IP) survey of parts of the license area that were never followed up. To complement the drill testing we will also complete downhole geophysics with the aim of providing additional information about potential parallel and blind lodes, in addition to the known historical lodes. As volcanogenic massive sulphide (VMS) deposits often occur in clusters, we are excited about the potential for new discoveries on the Barraba Copper Project though new exploration works and testing the extent of the previously discovered and partially mined lodes.

The key terms of the acquisition of the Barraba Copper Project which were announced to the market in the Company’s press release on 23 January 2020 have been varied as follows:

(a) the Cash Consideration of $150,000 payable by the Company shall be paid as follows: (i) $50,000 on execution of the Agreement (which amount has now been paid);

(ii) $50,000 on execution of the variation deed (which amount has now been paid); and

(iii) $50,000 on the date that is 6 months following the date of the variation deed, being 15 October 2020;

(b) the $450,000 aggregate value of the Consideration Shares to be issued by the Company shall be reduced to $200,000 at a deemed issue price of $0.01 per Share, which will be issued out of the Company’s placement capacity under ASX Listing Rule 7.1;

(c) the quantum of the capital raising required in order to satisfy the condition precedent to completion of the Acquisition is reduced from $2,000,000 to $500,000, which will be satisfied upon completion of the Placement;

(d) the Company’s entitlement to buy down the 2% net smelter return royalty has been removed from the Agreement; and

(e) the End Date for satisfaction of the Conditions has been extended from 30 March 2020 to 30 June 2020.

Summary of the Capital Raising:

Under the terms of the offer the Company has received firm commitments for the issuance of 65,000,000 Shares at a subscription price of $0.01 per Share. The Company will also issue subscribers one unlisted option with a strike price of $0.02 and an expiry of 30 June 2021 for each Share issued under the offer.

Shares issued pursuant to the capital raising will first be issued pro-rata to subscribers from the Company’s available 7.1 and 7.1A capacity, with the balance of the Shares to be issued as well as the free attaching placement options being subject to shareholder approval. The Company expects to lodge the notice of general meeting shortly.

Summary of the Barraba Copper Project

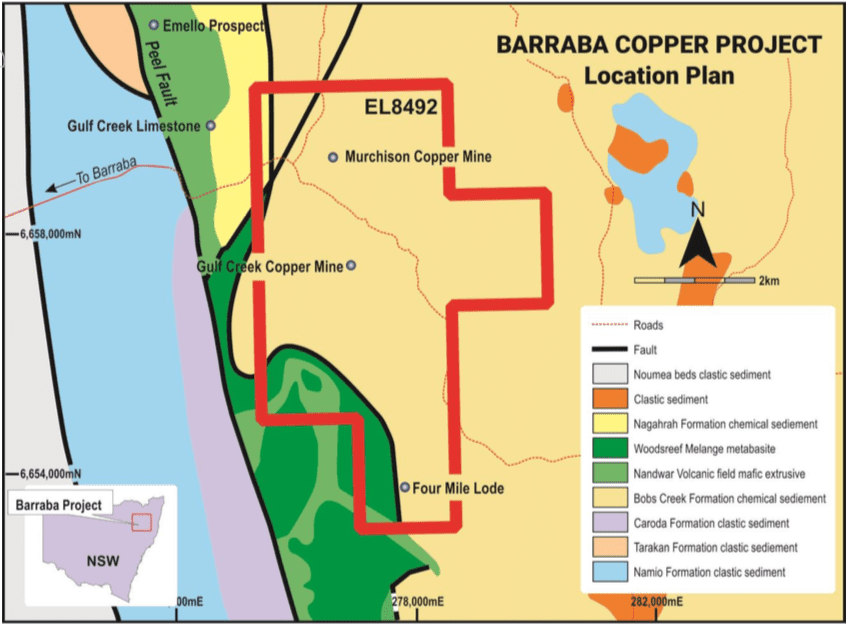

The 2,375ha exploration license that covers the project area, EL8492, is located near the town of Barraba, approximately 550km north of Sydney. It sits along the Peel Fault line and encompasses the historic Gulf Creek and Murchison copper mines. The region is known to host VMS style mineralisation containing copper, zinc, lead and precious metals. Historical workings at Gulf Creek produced high-grade copper and zinc for a short period around the turn of the 19th century, and this area will form a key part of the initial exploration focus.

Empire Capital Partners Pty Ltd have been engaged as the lead manager to the offer and will receive a distribution fee of 6% on monies raised and a $35,000 lead manager fee. Subject to shareholder approval, the Company will issue Empire, a number of Options that is equal to 6% of the Options to be issued under the Barraba Capital Raising on the same terms and conditions (being, 3,900,000 Options on 65,000,000 Options to be issued under the Barraba Capital Raising).

Latest News

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2309.38 | -5.75 | |

| Silver | 27.35 | +0.10 | |

| Copper | 4.54 | 0.00 | |

| Oil | 79.25 | +0.26 | |

| Heating Oil | 2.48 | +0.01 | |

| Natural Gas | 2.18 | -0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.