TSX: LUN) (Nasdaq Stockholm: LUMI) Lundin Mining Corporation ("Lundin Mining" or the "Company") is pre-announcing certain items impacting the Company's quarterly earnings, adjusted earnings before interest, taxes, depreciation and amortization ("adjusted EBITDA") 1 adjusted earnings 1 and adjusted earnings per share 1 .

Foreign Exchange and Derivatives

Items of significant impact in the first quarter 2024 are expected to include unaudited foreign exchange and trading gains on debt and equity investments supporting the capital funding for the Josemaria Project of approximately $8 million on a pre-tax basis, unaudited realized gains on foreign exchange and diesel derivative contracts of approximately $4 million on a pre-tax basis and unaudited realized gains on foreign exchange of approximately $11 million on a pre-tax basis, primarily relating to payments in Chilean pesos during the quarter.

In the first quarter 2024 the Company is also expected to recognize certain non-cash items that will impact the Company's earnings but not adjusted EBITDA, adjusted earnings or adjusted earnings per share. These include an unaudited non-cash unrealized gain on foreign exchange of approximately $16 million on a pre-tax basis, primarily due to the weakening of the Chilean peso during the quarter, and an unaudited non-cash unrealized loss of approximately $53 million on a pre-tax basis related to the mark-to-market valuation of the Company's unexpired foreign exchange and diesel derivative contracts. Unexpired foreign exchange derivative contracts include zero cost collar contracts of $921 million (equivalent to 898 billion Chilean pesos) entered into during the first quarter 2024 and expiring in the remainder of 2024 through 2026.

Provisional Pricing Adjustments

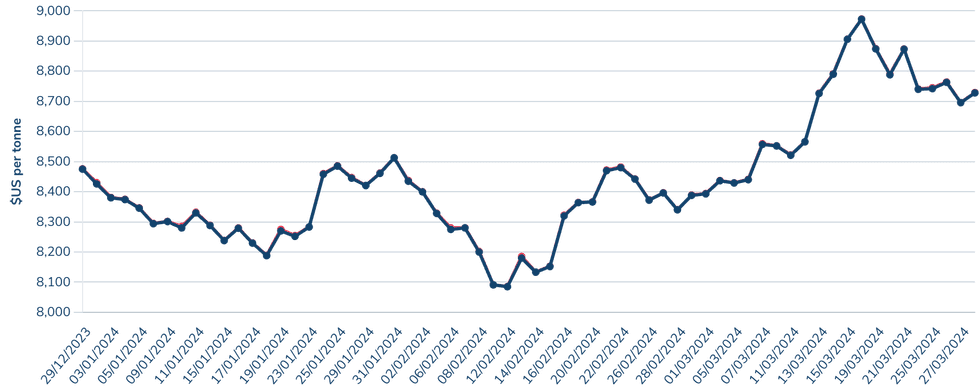

Revenue in the first quarter 2024 is expected to be positively impacted by unaudited provisional pricing adjustments on prior period concentrate sales of approximately $2 million on a pre-tax basis. These adjustments primarily include upward adjustments in relation to copper and nickel sales, partially offset by downward adjustments on molybdenum and zinc sales.

The financial results for the three months ended March 31, 2024 , will be published on Wednesday, May 1, 2024.

About Lundin Mining

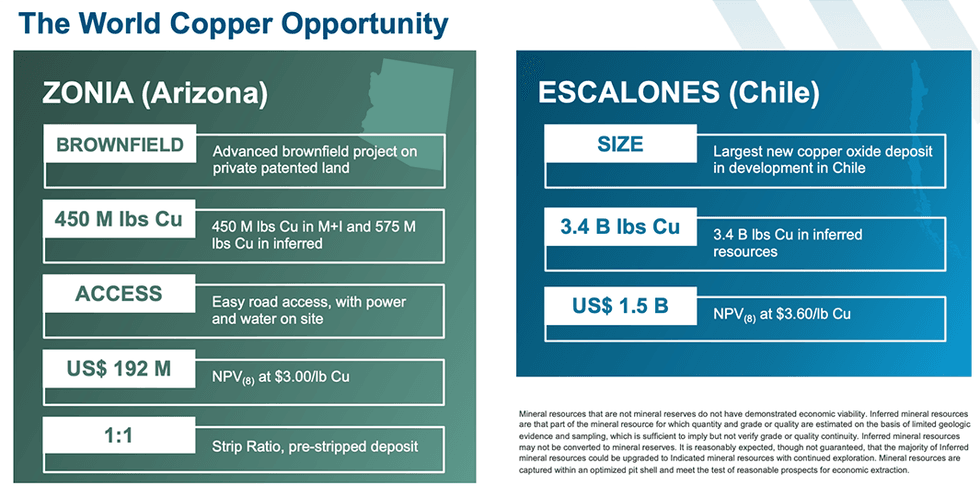

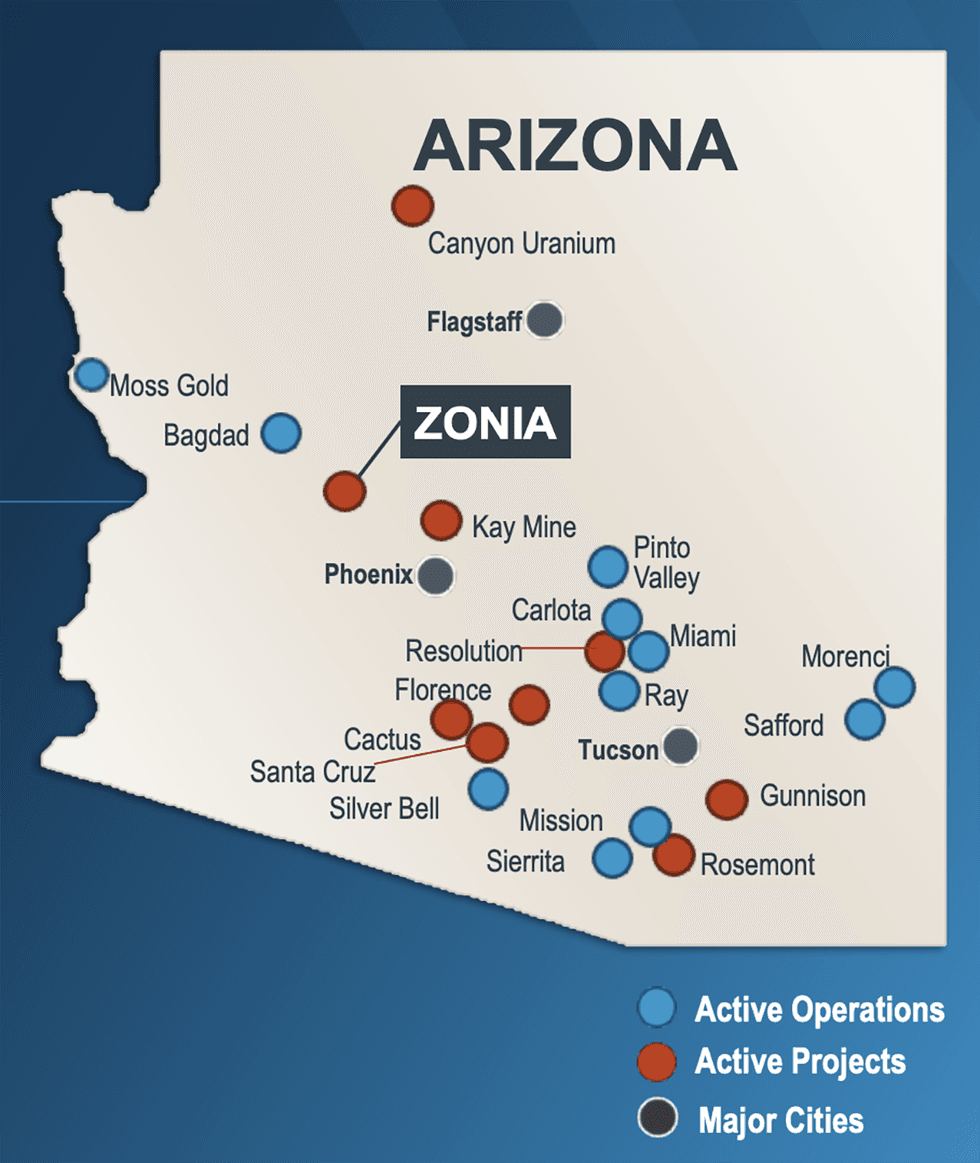

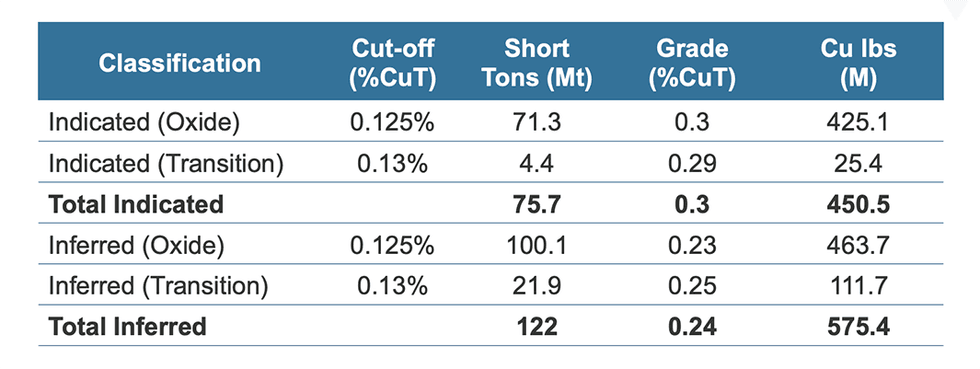

Lundin Mining is a diversified Canadian base metals mining company with operations and projects in Argentina , Brazil , Chile , Portugal , Sweden and the United States of America , primarily producing copper, zinc, gold and nickel.

The information was submitted for publication, through the agency of the contact persons set out below on April 17, 2024 at 14:30 Pacific Time .

__________________________________ |

1 These measures are non-GAAP measures. These performance measures have no standardized meaning within generally accepted accounting principles under International Financial Reporting Standards and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. For additional details please refer to the Company's discussion of non-GAAP and other performance measures in its Management's Discussion and Analysis for the year ended December 31, 2023 which is available on SEDAR+ at www.sedarplus.com . |

Cautionary Statement on Forward-Looking Information

Certain of the statements made and information contained herein is "forward-looking information" within the meaning of applicable Canadian securities laws. All statements other than statements of historical facts included in this document constitute forward-looking information, including but not limited to statements regarding the Company's plans, prospects and business strategies; the Company's guidance on the timing and amount of future production and its expectations regarding the results of operations; expected costs; permitting requirements and timelines; timing and possible outcome of pending litigation; the results of any Preliminary Economic Assessment, Feasibility Study, or Mineral Resource and Mineral Reserve estimations, life of mine estimates, and mine and mine closure plans; anticipated market prices of metals, currency exchange rates, and interest rates; the development and implementation of the Company's Responsible Mining Management System; the Company's ability to comply with contractual and permitting or other regulatory requirements; anticipated exploration and development activities at the Company's projects; the Company's integration of acquisitions and any anticipated benefits thereof; and expectations for other economic, business, and/or competitive factors. Words such as "believe", "expect", "anticipate", "contemplate", "target", "plan", "goal", "aim", "intend", "continue", "budget", "estimate", "may", "will", "can", "could", "should", "schedule" and similar expressions identify forward-looking statements.

Forward-looking information is necessarily based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labour; assumed and future price of copper, nickel, zinc, gold and other metals; anticipated costs; ability to achieve goals; the prompt and effective integration of acquisitions; that the political environment in which the Company operates will continue to support the development and operation of mining projects; and assumptions related to the factors set forth below. While these factors and assumptions are considered reasonable by Lundin Mining as at the date of this document in light of management's experience and perception of current conditions and expected developments, these statements are inherently subject to significant business, economic and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information. Such factors include, but are not limited to: global financial conditions, market volatility and inflation, including pricing and availability of key supplies and services; risks inherent in mining including but not limited to risks to the environment, industrial accidents, catastrophic equipment failures, unusual or unexpected geological formations or unstable ground conditions, and natural phenomena such as earthquakes, flooding or unusually severe weather; uninsurable risks; volatility and fluctuations in metal and commodity demand and prices; significant reliance on assets in Chile ; reputation risks related to negative publicity with respect to the Company or the mining industry in general; delays or the inability to obtain, retain or comply with permits; risks relating to the development of the Josemaria Project; health and safety laws and regulations; risks associated with climate change; risks relating to indebtedness; economic, political and social instability and mining regime changes in the Company's operating jurisdictions, including but not limited to those related to permitting and approvals, nationalization or expropriation without fair compensation, environmental and tailings management, labour, trade relations, and transportation; inability to attract and retain highly skilled employees; risks inherent in and/or associated with operating in foreign countries and emerging markets, including with respect to foreign exchange and capital controls; project financing risks, liquidity risks and limited financial resources; health and safety risks; compliance with environmental, unavailable or inaccessible infrastructure, infrastructure failures, and risks related to ageing infrastructure; changing taxation regimes; the inability to effectively compete in the industry; risks associated with acquisitions and related integration efforts, including the ability to achieve anticipated benefits, unanticipated difficulties or expenditures relating to integration and diversion of management time on integration; risks related to mine closure activities, reclamation obligations, environmental liabilities and closed and historical sites; reliance on key personnel and reporting and oversight systems, as well as third parties and consultants in foreign jurisdictions; information technology and cybersecurity risks; risks associated with the estimation of Mineral Resources and Mineral Reserves and the geology, grade and continuity of mineral deposits including but not limited to models relating thereto; actual ore mined and/or metal recoveries varying from Mineral Resource and Mineral Reserve estimates, estimates of grade, tonnage, dilution, mine plans and metallurgical and other characteristics; ore processing efficiency; community and stakeholder opposition; regulatory investigations, enforcement, sanctions and/or related or other litigation; financial projections, including estimates of future expenditures and cash costs, and estimates of future production may not be reliable; enforcing legal rights in foreign jurisdictions; risks associated with the use of derivatives; risks relating to joint ventures and operations; environmental and regulatory risks associated with the structural stability of waste rock dumps or tailings storage facilities; exchange rate fluctuations; compliance with foreign laws; potential for the allegation of fraud and corruption involving the Company, its customers, suppliers or employees, or the allegation of improper or discriminatory employment practices, or human rights violations; risks relating to dilution; risks relating to payment of dividends; counterparty and customer concentration risks; activist shareholders and proxy solicitation matters; estimation of asset carrying values; relationships with employees and contractors, and the potential for and effects of labour disputes or other unanticipated difficulties with or shortages of labour or interruptions in production; conflicts of interest; existence of significant shareholders; challenges or defects in title; internal controls; risks relating to minor elements contained in concentrate products; the threat associated with outbreaks of viruses and infectious diseases; and other risks and uncertainties, including but not limited to those described in the "Managing Risks" section of the Company's MD&A and the "Risks and Uncertainties" section of the Company's Annual Information Form for the year ended December 31, 2023 , which are available on SEDAR+ at www.sedarplus.com under the Company's profile.

All of the forward-looking statements made in this document are qualified by these cautionary statements. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated, forecast or intended and readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information. Accordingly, there can be no assurance that forward-looking information will prove to be accurate and forward-looking information is not a guarantee of future performance. Readers are advised not to place undue reliance on forward-looking information. The forward-looking information contained herein speaks only as of the date of this document. The Company disclaims any intention or obligation to update or revise forward‐looking information or to explain any material difference between such and subsequent actual events, except as required by applicable law.

SOURCE Lundin Mining Corporation

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/17/c8111.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/17/c8111.html