Copper Mountain Mining Corporation (TSX: CMMC) (ASX: C6C) (the “Company” or “Copper Mountain”) is pleased to announce positive results from 18 drill holes, totalling 6,924 metres, drilled at the New Ingerbelle copper-gold open pit (“New Ingerbelle”), as part of ongoing exploration at the property. The current drill program has encountered long intercepts of high-grade mineralization with continuity, doubling the vertical extent of mineralization below the existing pit. The Company plans to add two more drill rigs to augment the two rigs currently operating on-site as part of the ongoing exploration program. New Ingerbelle is situated one kilometre from the main active mining area of the Copper Mountain Mine, located in southern British Columbia near the town of Princeton.

Highlights

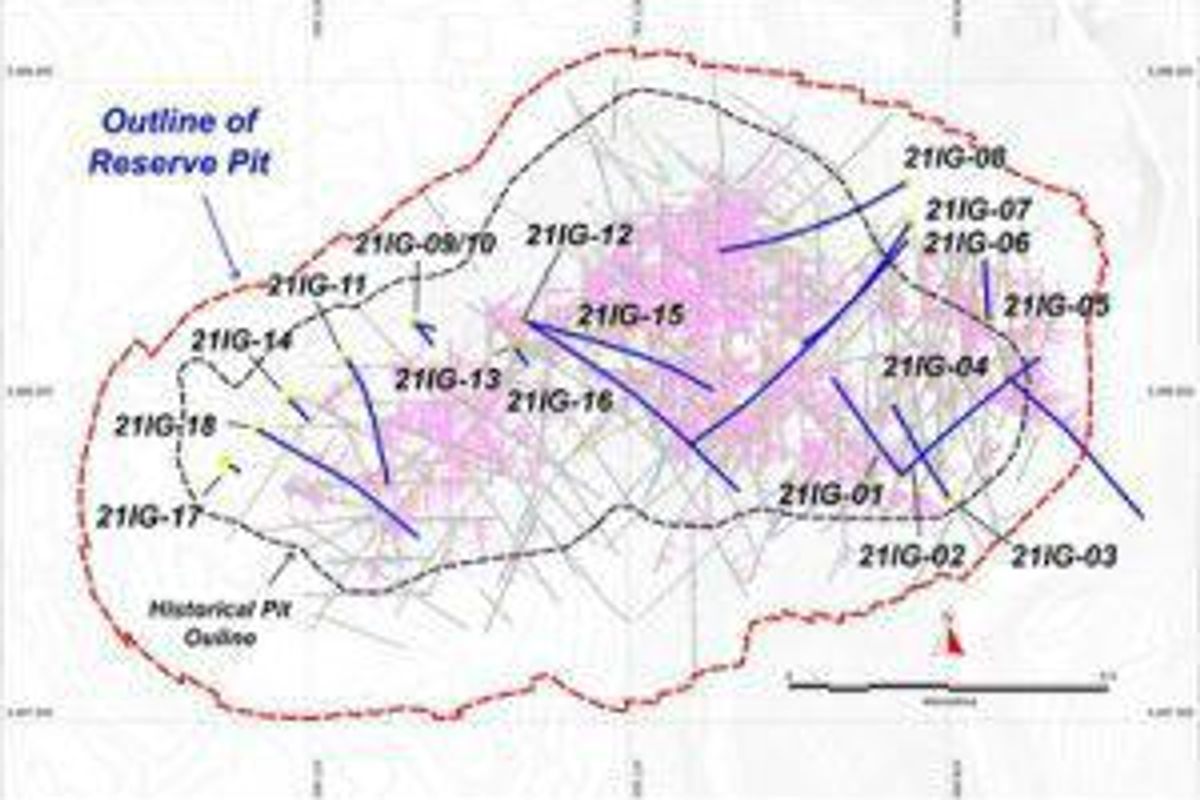

In the section below are highlights from the ongoing drill program. Figures 1 and 2 illustrate a plan view (drill hole location map) and a long section of the program to date. Table 1 has a complete drill hole summary.

- Hole 21IG-01 returned 185 metres of 0.44% CuEq (0.33% Cu, 0.18 g/t Au, 0.41 g/t Ag).

- Includes: 70 metres of 0.60% CuEq (0.45% Cu, 0.26 g/t Au, 0.46 g/t Ag).

- Hole 21IG-02 returned 146 metres of 0.42% CuEq (0.33% Cu, 0.14 g/t Au, 0.52 g/t Ag).

- Hole 21IG-04 returned 234 metres of 0.48% CuEq (0.33% Cu, 0.25 g/t Au, 0.73 g/t Ag).

- Hole 21IG-05 returned 127 metres of 0.42% CuEq (0.31% Cu, 0.19 g/t Au, 0.54 g/t Ag).

- Hole 21IG-06 returned 228 metres of 0.46% CuEq (0.34% Cu, 0.20 g/t Au, 0.68 g/t Ag).

- Includes: 111 metres of 0.62% CuEq (0.46% Cu, 0.25 g/t Au, 0.90 g/t Ag).

- Hole 21IG-11 returned 261 metres of 0.61% CuEq (0.48% Cu, 0.21 g/t Au, 0.45 g/t Ag).

- Hole 21IG-12 returned 359 metres of 0.41% CuEq (0.33% Cu, 0.14 g/t Au, 0.96 g/t Ag).

- Includes: 80 metres of 0.67% CuEq (0.51% Cu, 0.25 g/t Au, 1.52 g/t Ag).

- Hole 21IG-16 returned 186 metres of 0.67% CuEq (0.52% Cu, 0.25 g/t Au, 0.69 g/t Ag).

- Hold 21IG-18 returned 105 metres of 0.50% CuEq (0.40% Cu, 0.17 g/t Au, 0.44 g/t Ag).

“These results confirm our view on New Ingerbelle that there is huge reserve growth potential,” commented Gil Clausen , Copper Mountain’s President and CEO. “The deposit continues to get bigger and better with drilling. We have already doubled the depth of the mineralization and extended it along strike, yet the deposit remains open. The results validate our belief that there is a high potential to substantially increase the Mineral Resources and Mineral Reserves at our BC operation. More drilling remains to be done at New Ingerbelle, the north pit, and the main pit, and the Company plans to continue to drill for the remainder of this year and into 2022.”

The goal of the current drill program is to extend mineralization laterally and to depth and fill gaps within earlier drilling. The New Ingerbelle deposit is a combination of disseminated and fracture-controlled mineralization with strong vertical continuity. The current drill program to date has significantly extended New Ingerbelle mineralization to depth and along strike. Geology, alteration intensity, and copper-to-gold ratios appear to be relatively consistent over the vertical extent of mineralization.

The Company is continuing to drill at New Ingerbelle to define the vertical and lateral extents of the deposit and infill for resource estimation purposes. Copper Mountain aims to add two more drill rigs in the third quarter of 2021 with plans to continue drilling into 2022. The Company plans to incorporate the results of the 2021 drilling into its year-end Mineral Reserves and Mineral Resources update, which will be published in the first quarter of 2022. The Company expects to produce a new “Life of Mine Plan ” for publication in the second quarter of 2022, which will incorporate an updated Mineral Reserves and Mineral Resources estimate based on the complete drill program.

New Ingerbelle is a past-producing open-pit mine discovered and developed in the late 1960s, with mining occurring between 1972 and 1996. Copper Mountain renewed exploration drilling in 2017 and 2018. New Ingerbelle’s Mineral Reserve as at January 1, 2021 is 193 million tonnes grading 0.24% Cu, 0.15 g/t Au and 0.48 g/t Ag (0.33% CuEq) (3) containing 1.0 billion lbs Cu, 920k oz Au and 3.0 million oz Ag (as disclosed in Copper Mountain’s Annual Information Form dated March 29, 2021 , available on SEDAR).

Table 1: Drill Hole Table (1,2)

Hole ID | Azimuth | Dip | Length | From (m) | To (m) | Interval | Cu% | Ag g/t | Au g/t | CuEq% (3) |

21IG-01 | 319.0 | -60.0 | 433.1 | 13.5 | 42.0 | 28.5 | 0.28 | 0.54 | 0.19 | 0.39 |

52.0 | 115.9 | 62.6 | 0.29 | 0.51 | 0.23 | 0.42 | ||||

Incl | 52.0 | 64.0 | 12.0 | 0.42 | 0.67 | 0.26 | 0.58 | |||

189.1 | 381.3 | 184.6 | 0.33 | 0.41 | 0.18 | 0.44 | ||||

Incl | 189.1 | 292.8 | 96.1 | 0.28 | 0.42 | 0.16 | 0.38 | |||

Incl | 311.1 | 381.3 | 70.2 | 0.45 | 0.46 | 0.26 | 0.60 | |||

21IG-02 | 42.0 | -46.0 | 417.6 | 66.0 | 88.4 | 22.4 | 0.38 | 0.43 | 0.25 | 0.53 |

115.8 | 201.2 | 85.3 | 0.20 | 0.40 | 0.13 | 0.27 | ||||

Incl | 115.8 | 152.4 | 36.6 | 0.25 | 0.42 | 0.20 | 0.37 | |||

243.8 | 317.0 | 73.2 | 0.43 | 0.69 | 0.18 | 0.54 | ||||

271.3 | 417.6 | 146.3 | 0.33 | 0.52 | 0.14 | 0.42 | ||||

Incl | 387.1 | 417.6 | 30.5 | 0.37 | 0.52 | 0.17 | 0.47 | |||

21IG-03 | 325.0 | -62.0 | 367.9 | 39.0 | 67.0 | 28.0 | 0.41 | 1.32 | 0.14 | 0.50 |

93.0 | 111.0 | 18.0 | 0.33 | 0.66 | 0.26 | 0.49 | ||||

153.0 | 252.1 | 99.1 | 0.21 | 0.37 | 0.12 | 0.28 | ||||

285.5 | 355.7 | 70.2 | 0.28 | 0.48 | 0.18 | 0.39 | ||||

Incl | 316.1 | 355.7 | 39.6 | 0.31 | 0.51 | 0.20 | 0.43 | |||

21IG-04 | 132.0 | -49.0 | 462.7 | 40.0 | 273.7 | 233.7 | 0.33 | 0.73 | 0.25 | 0.48 |

289.0 | 307.2 | 18.3 | 0.16 | 0.26 | 0.09 | 0.22 | ||||

389.5 | 407.8 | 18.3 | 0.18 | 0.31 | 0.08 | 0.23 | ||||

21IG-05 | 355.0 | -74.0 | 321.0 | 77.0 | 203.9 | 126.9 | 0.31 | 0.54 | 0.19 | 0.42 |

Incl | 77.0 | 119.0 | 42.0 | 0.41 | 0.84 | 0.24 | 0.56 | |||

Incl | 119.0 | 203.9 | 84.9 | 0.25 | 0.40 | 0.16 | 0.35 | |||

21IG-06 | 222.0 | -46.0 | 603.0 | 38.0 | 102.0 | 64.0 | 0.28 | 0.57 | 0.20 | 0.40 |

130.0 | 157.0 | 27.0 | 0.28 | 0.52 | 0.18 | 0.39 | ||||

223.0 | 238.0 | 15.0 | 0.42 | 1.06 | 0.28 | 0.59 | ||||

301.0 | 529.0 | 228.0 | 0.34 | 0.68 | 0.20 | 0.46 | ||||

Incl | 301.0 | 334.0 | 33.0 | 0.39 | 0.74 | 0.26 | 0.55 | |||

Incl | 334.0 | 418.0 | 84.0 | 0.16 | 0.37 | 0.11 | 0.22 | |||

Incl | 418.0 | 529.0 | 111.0 | 0.46 | 0.90 | 0.25 | 0.62 | |||

21IG-07 | 218.0 | -61.0 | 508.4 | 53.0 | 69.0 | 16.0 | 0.34 | 0.78 | 0.14 | 0.43 |

156.0 | 183.0 | 27.0 | 0.21 | 0.46 | 0.15 | 0.30 | ||||

198.0 | 231.0 | 33.0 | 0.24 | 0.43 | 0.20 | 0.36 | ||||

243.0 | 342.0 | 99.0 | 0.26 | 0.51 | 0.11 | 0.33 | ||||

369.0 | 405.0 | 36.0 | 0.20 | 0.29 | 0.17 | 0.31 | ||||

474.0 | 501.0 | 27.0 | 0.15 | 0.23 | 0.09 | 0.20 | ||||

21IG-08 | 242.0 | -57.0 | 552.9 | 398.7 | 551.1 | 152.4 | 0.25 | 0.34 | 0.12 | 0.32 |

21IG-11 | 146.0 | -68.0 | 540.0 | 77.0 | 107.0 | 30.0 | 0.59 | 0.67 | 0.21 | 0.71 |

145.0 | 237.0 | 92.0 | 0.21 | 0.30 | 0.12 | 0.28 | ||||

261.0 | 522.0 | 261.0 | 0.48 | 0.45 | 0.21 | 0.61 | ||||

21IG-12 | 96.0 | -90.0 | 465.2 | 5.3 | 88.0 | 82.7 | 0.24 | 0.55 | 0.11 | 0.30 |

96.0 | 455.0 | 359.0 | 0.33 | 0.96 | 0.14 | 0.41 | ||||

incl | 96.0 | 176.0 | 80.0 | 0.51 | 1.52 | 0.25 | 0.67 | |||

incl | 203.0 | 266.0 | 63.0 | 0.38 | 0.66 | 0.17 | 0.49 | |||

incl | 278.0 | 362.0 | 84.0 | 0.29 | 1.63 | 0.12 | 0.37 | |||

incl | 389.0 | 455.0 | 66.0 | 0.34 | 0.47 | 0.14 | 0.42 | |||

21IG-15 | 146.0 | -53.0 | 732.0 | 12.0 | 40.0 | 14.0 | 0.60 | 1.40 | 0.37 | 0.83 |

52.0 | 74.0 | 11.0 | 0.69 | 1.05 | 0.55 | 1.01 | ||||

82.0 | 96.0 | 14.0 | 0.24 | 0.38 | 0.13 | 0.32 | ||||

156.0 | 171.0 | 15.0 | 0.38 | 0.79 | 0.22 | 0.51 | ||||

222.0 | 234.0 | 12.0 | 0.32 | 0.60 | 0.28 | 0.48 | ||||

261.0 | 414.0 | 153.0 | 0.35 | 0.64 | 0.15 | 0.43 | ||||

456.0 | 552.0 | 96.0 | 0.27 | 0.45 | 0.12 | 0.34 | ||||

648.0 | 708.0 | 60.0 | 0.23 | 0.40 | 0.09 | 0.28 | ||||

21IG-16 | 115.7 | -56.6 | 706.0 | 20.0 | 88.0 | 68.0 | 0.30 | 0.56 | 0.12 | 0.38 |

128.0 | 134.0 | 6.0 | 0.39 | 0.76 | 0.20 | 0.51 | ||||

297.0 | 396.0 | 99.0 | 0.22 | 0.38 | 0.09 | 0.27 | ||||

408.0 | 444.0 | 36.0 | 0.41 | 0.90 | 0.26 | 0.57 | ||||

468.0 | 654.0 | 186.0 | 0.52 | 0.69 | 0.25 | 0.67 | ||||

21IG-18 | 123.0 | -51.0 | 432.0 | 131.0 | 236.0 | 105.0 | 0.40 | 0.44 | 0.17 | 0.50 |

Incl | 131.0 | 164.0 | 33.0 | 0.52 | 0.58 | 0.22 | 0.65 | |||

Incl | 173.0 | 236.0 | 63.0 | 0.39 | 0.42 | 0.16 | 0.48 | |||

245.0 | 269.0 | 24.0 | 0.16 | 0.31 | 0.07 | 0.20 | ||||

281.0 | 299.0 | 18.0 | 0.25 | 0.51 | 0.10 | 0.31 |

Notes: | |

1. | Holes 21IG-09, 21IG-10, 21IG-13, 21IG-14 and 21IG17 were lost due to ground conditions. |

2. | Table shows detailed drill results of intercepts over 0.20% CuEq. |

3. | CuEq calculated from NSR values when using long-term bank consensus metal prices (in US$) of $3.35, $1,599, $21.40 and recoveries of 85%, 71%, 65% for Cu, Au, and Ag, respectively. |

QA/QC and Core Sampling Protocols

Drill core is transported to the secure logging area by geological staff. Sample intervals are marked on the core which is halved by diamond saw. Sample size is usually 2m for HQ and 3m for NQ core diameters. Blanks and field duplicates are inserted into the sample stream and the half core samples are taken to the mine laboratory where samples are dried, crushed, split, and pulverized. The pulverized sample is analyzed by XRF methods, with samples containing greater than 0.4% Cu being re-analyzed by Atomic Adsorption (AA) methods by the mine laboratory which also reports on inserted certified reference standards. Pulps from samples with greater than 0.1% Cu are shipped to an accredited commercial laboratory for Au and Ag analysis (either by Fire assay or AA methods) and every twentieth sample is analyzed for Cu and Ag by ICP multi-element analysis. Such laboratory is independent from Copper Mountain. The drill samples were collected in accordance with accepted industry standards. There are no known issues that would materially affect the accuracy or reliability of the analytical data from the drill program presented herein.

Competent Persons Statement

The information in this report that relates to exploration targets, exploration results, Mineral Resources or ore reserves is based on information compiled by Peter Holbek , B.Sc (Hons), M.Sc. P. Geo. Mr. Holbek is a full time employee of the Company and has sufficient experience which is relevant to the style of mineralization and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Holbek consents to the inclusion in this news release of the matters based on the information in the form and context in which it appears.

Peter Holbek is a qualified person as defined by National Instrument 43-101 (“43-101”) and has reviewed and approved the technical content of this release.

About Copper Mountain Mining Corporation

Copper Mountain’s flagship asset is the 75% owned Copper Mountain Mine located in southern British Columbia near the town of Princeton . The Copper Mountain Mine currently produces approximately 100 million pounds of copper equivalent per year, with average annual production expected to increase to approximately 140 million pounds of copper equivalent. Copper Mountain also has the development-stage Eva Copper Project in Queensland, Australia and an extensive 2,100 km 2 highly prospective land package in the Mount Isa area. Copper Mountain trades on the Toronto Stock Exchange under the symbol “CMMC” and Australian Stock Exchange under the symbol “C6C”.

Additional information is available on the Company’s web page at www.CuMtn.com .

On behalf of the Board of

COPPER MOUNTAIN MINING CORPORATION

“Gil Clausen”

Gil Clausen , P.Eng.

President and Chief Executive Officer

Cautionary Note Regarding Forward-Looking Statements

This news release may contain forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects”, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “occur” or “be achieved”. Forward-looking statements in this news release include statements concerning, among other things: the Company’s intention to add two more drill rigs at New Ingerbelle in the third quarter of 2021; the timing of the Company’s drilling program; the results of the Company’s exploration and development programs; Mineral Resources, Mineral Reserves, realization of Mineral Reserves, and the existence or realization of Mineral Resource estimates; the timing of studies, announcements, and analysis; the potential to add the expected increase in the Company’s average annual production; the Company’s intentions regarding its objectives, goals or future plans; and all other timing, exploration, development, operational, financial, budgetary, economic, legal, social, environmental, regulatory, and political matters that may influence or be influenced by future events or conditions. Forward-looking statements involve risks, uncertainties and other factors that could cause actual results, performance and opportunities to differ materially from those implied by such forward-looking statements. Factors that could cause actual results to differ materially from these forward-looking statements include the successful exploration of the Company’s properties in Canada and Australia , the reliability of the historical data referenced in this press release and risks set out in Copper Mountain’s public documents, including in each management discussion and analysis, filed on SEDAR at www.sedar.com . Although Copper Mountain believes that the information and assumptions used in preparing the forward-looking statements are reasonable, undue reliance should not be placed on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Except where required by applicable law, Copper Mountain disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

This press release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the U.S. Securities and Exchange Commission (“SEC”) set out in the SEC rules that are applicable to domestic United States reporting companies. Consequently, Mineral Reserves and Mineral Resources information included in this press release may not be comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/copper-mountain-announces-continued-positive-drill-results-at-new-ingerbelle-doubles-vertical-extent-of-mineralization-301372144.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/copper-mountain-announces-continued-positive-drill-results-at-new-ingerbelle-doubles-vertical-extent-of-mineralization-301372144.html

SOURCE Copper Mountain Mining Corporation