- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Critical Resources

High-grade Lithium Portfolio, in a Tier 1 Location, Aligned with the World’s Green Energy Transition

Company Highlights

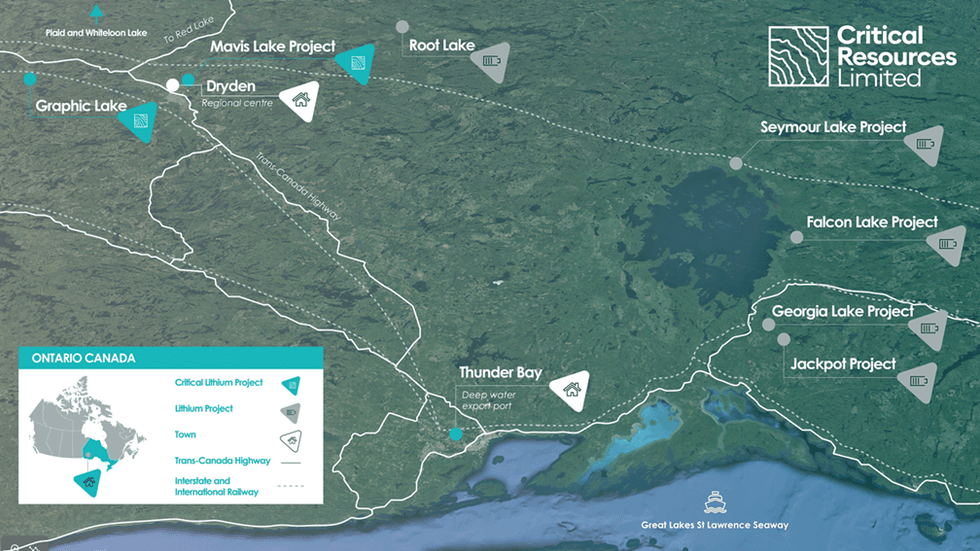

- Critical Resources is an exploration and development company, focused on lithium and critical minerals, with primary assets in Ontario Canada.

- The company has a suite of lithium projects in Ontario, Canada, with access to an experienced local workforce and essential transport and energy infrastructure and direct access to the growing North American electric vehicle industry.

- The Company’s key focus is advancing its Flagship Mavis Lake Lithium Project.

- The Company completed a strategic acquisition of the Gullwing-Tot Lakes property from Power Metals (TSXV:PWM) in December 2022, significantly expanding the exploration area and growth potential of Mavis Lake (Mavis Lake and Gullwing/Tot claims for one single contiguous project area).

- Following the completion of a highly successful 19,500-meter drilling program in 2022, a further 20,000-meter drill campaign commenced in 2023 to define further mineralization ahead of the release of Mavis Lake’s maiden mineral resource estimate

- Technical scoping/feasibility studies commenced late last year, mapping the pathway for development, construction and into production

- A highly capable, proven and motivated management team with diverse experience in natural resources, technical project delivery, and commercial and corporate finance.

Overview

Critical Resources (ASX:CRR) is an Australia-based critical minerals company, focused on unlocking value from high-quality assets to meet the growing and unprecedented global demand for clean energy solutions. As an explorer and developer of critical minerals projects, the company is entrenched in the global movement of electrification and a decarbonised future.

As the world’s transition to net-zero emissions gathers pace, Critical Resources’ Mavis Lake Lithium Project in Canada is being developed in lockstep with North America’s rapidly expanding electric vehicle market and broader green economy ambitions.

More than 300 million electric vehicles (EVs) are predicted to be on the road by 2040 and the global green technology/sustainability market is expected to reach US$74.64 billion by 2030, growing at a CAGR of almost 22 per cent in the decade to 2030.

Critical Resources is focused on the commercial development of quality assets in top tier mining jurisdictions, aimed at delivering shareholder value by providing the essential minerals for the world’s fundamental shift towards a clean energy future. The immediate priority is exploration and development of the company’s lithium hard-rock holdings in Canada, specifically the highly prospective Mavis Lake Lithium Project in Ontario.

As the company transitions from lithium explorer to lithium project developer, a dual development strategy is being adopted. The Company will continue its resource growth and expanding on the maiden Mineral Resource Estimate via continued drilling in 2023 and 2024. In parallel, the Company is accelerating its technical and environmental studies that will underpin the pathway to production.

The company’s approach in Canada has been to target ground with the potential for high-grade lithium mineralisation and in close proximity to:

- Established transport and energy

infrastructure and workforce required for future construction, mining and

production phases; and

- Potential end-use partners such as emerging battery manufacturers based in Canada and the United States.

An experienced management team leads Critical Resources, equipped with the corporate, technical and commercial expertise and vision to unlock value and fully realise the potential of priority assets, for the long-term benefit of shareholders.

Company Highlights

- Critical Resources is an exploration and development company, focused on lithium and critical minerals, with primary assets in Ontario Canada.

- The company has a suite of lithium projects in Ontario, Canada, with access to an experienced local workforce and essential transport and energy infrastructure and direct access to the growing North American electric vehicle industry.

- The Company’s key focus is advancing its Flagship Mavis Lake Lithium Project.

- The Company completed a strategic acquisition of the Gullwing-Tot Lakes property from Power Metals (TSXV:PWM) in December 2022, significantly expanding the exploration area and growth potential of Mavis Lake (Mavis Lake and Gullwing/Tot claims for one single contiguous project area).

- Following the completion of a highly successful 19,500-meter drilling program in 2022, a further 20,000-meter drill campaign commenced in 2023 to define further mineralization ahead of the release of Mavis Lake’s maiden mineral resource estimate

- Technical scoping/feasibility studies commenced late last year, mapping the pathway for development, construction and into production

- A highly capable, proven and motivated management team with diverse experience in natural resources, technical project delivery, and commercial and corporate finance.

Get access to more exclusive Battery Metals Investing Stock profiles here

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.