- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Danakali Executes Mandate for Colluli Debt Financing

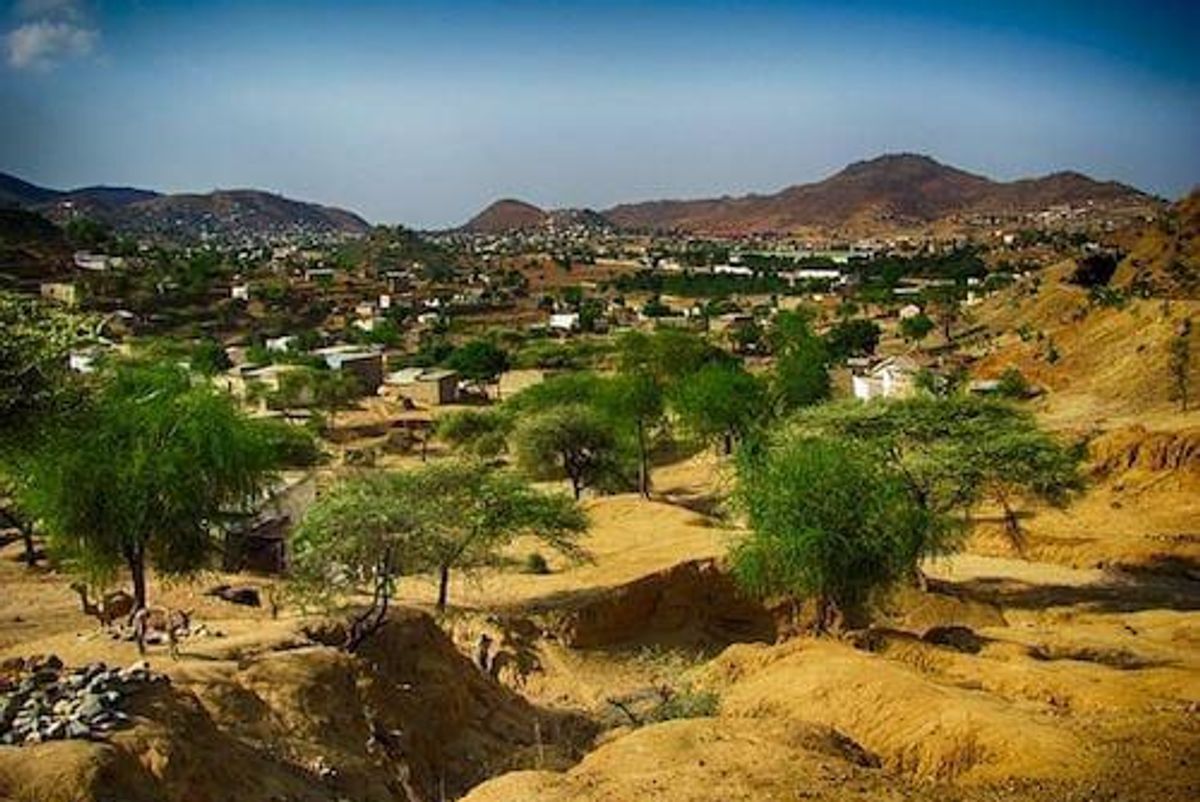

Danakali has executed a US$200-million debt financing mandate to fund construction and development of the Colluli potash project in Eritrea.

Danakali (ASX:DNK,LSE:DNK) has executed a US$200-million debt financing mandate to fund construction and development of its Colluli potash project in Eritrea, East Africa.

African Export-Import Bank and Africa Finance, two African development financial institutions (DFIs), will act as mandated lead arrangers for the debt. According to Danakali, both DFIs were chosen due to their extensive experience with African project financing and the strength of their investor reach.

The mandate’s execution, which comes after the signing of a US$200-million non-binding term sheet, is considered a “critical” milestone for Colluli’s project financing and execution.

“The execution of the mandate represents a significant milestone for the Colluli project funding. We are very pleased to be partnering with strong, experienced African financial institutions,” Danakali CFO Stuart Tarrant said in a Thursday (December 6) release.

He added, “[i]nitial bank due diligence and subsequent negotiations have significantly advanced the project financing process and built on the finalisation of the binding offtake agreement with EuroChem placing [Colluli Mining Share Company (CMSC)] in strong position to advance the Colluli project.”

The Colluli project is a 50/50 joint venture between the Eritrean National Mining and CMSC, the latter of which is a wholly owned subsidiary of Danakali.

Leading fertilizer company EuroChem Group signed a 10-year offtake agreement with CMSC in June for up to 100 percent of Colluli’s sulfate of potash (SOP) output.

Colluli has a 1.1 billion tonne SOP ore reserve, and expects to see annual output of 472,000 tonnes.

Going forward, the mandated lead arrangers will move ahead to credit approval and execution of the syndicated loan facility with CMSC after the remaining due diligence has been finalized and preconditions have been met.

This week’s news from Danakali follows a recent decision by the United Nations (UN) to lift an arms embargo and targeted sanctions on Eritrea that had been in place since December 2009.

While some market watchers have suggested that hesitance about mining in the country likely will not dissipate immediately, Danakali and others agree that the news is good for the East African country.

Danakali Executive Chairman and CMSC Director Seamus Cornelius commented on the decision in a statement and congratulated Eritrean citizens on the achievement.

“Danakali is delighted with the UN’s decision to lift the arms embargo and associated sanctions on Eritrea. This significant step should have a positive impact on foreign investment and enhance international trade opportunities, leading to improved economic outcomes for the people of Eritrea.”

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Olivia Da Silva, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2341.66 | +11.02 | |

| Silver | 27.66 | +0.31 | |

| Copper | 4.60 | +0.07 | |

| Oil | 84.11 | +0.54 | |

| Heating Oil | 2.58 | +0.02 | |

| Natural Gas | 1.59 | -0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

A graduate of Durham College's broadcast journalism program, Olivia has a passion for all things newsworthy. She got her start writing about esports (competitive video games), where she specialized in professional Call of Duty coverage. Since then, Olivia has transitioned into business writing for INN where her beats have included Australian mining and base metals.

Learn about our editorial policies.