- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Definitive Feasibility Study Project Update

Staged Project Development and Mine Throughput Optimisation Ewoyaa Lithium Project, Ghana

The following planned developments to the Project result from the Company's increased Mineral Resource Estimate1 ("MRE") to 35.3 Mt @ 1.25% Li2O, announced on 1 February 2023, and ongoing work to optimise the Project's processes.

Figures, Tables and Appendixes referred to in this release can be viewed in the PDF version available via this link:

https://www.rns-pdf.londonstockexchange.com/rns/8379T_1-2023-3-22.pdf

HIGHLIGHTS:

- Staged developments to increase metal recovery and improve plant efficiency:

- Stage 1 - DFS Project Development, comprising:

- Crushing and screening to three size fractions (from 1-10mm) in order to improve cyclone performance.

- Retain sales of natural occurring fines as a direct shipping ore ("DSO") by-product.

- Model various mine throughput scenarios to optimise Project outcomes.

- Stage 2 - Scoping Studies, comprising of three separate value-adding streams:

- Evaluation of early lithium spodumene concentrate ("SC6") production opportunities through the rapid deployment of Modular Dense Media Separation ("DMS") units to capitalise on the current SC6 price environment.

- Later-stage beneficiation of natural occurring fines to SC6.

- Production of feldspar by-product to reduce waste and to supply Ghana's growing ceramics industry.

- Stage 1 - DFS Project Development, comprising:

- Study to consider various mine throughput scenarios for the Project driven by the MRE1 upgrade to 35.3 Mt @ 1.25% Li2O.

- Work ongoing to further optimise the Project's processes and economics.

- The PFS1 delivers exceptional financial outcomes for a 2.0Mtpa throughput operation, producing an average c. 255,000tpa SC6 over a 12.5-year mine life, based on the previous 30.1 Mt at 1.26% Li2O MRE:

- LOM revenues exceeding US$4.84bn, Post-tax NPV8 of US$1.33bn, IRR of 224% over 12.5 years.

- US$125m capital cost with industry-leading payback period of <5 months.

- Maiden Ore Reserve of 18.9 Mt at 1.24% Li2O declared, demonstrating sound resources to reserve conversion.

- Conventional DMS processing facility.

- Front-End Engineering Design ("FEED") and DFS for the Project progressing well; DFS remains on track for Q2 2023:

- DFS to incorporate increased 35.3 Mt @ 1.25% Li2O MRE1 and is expected to significantly enhance the Project's economics.

Commenting on the Company's latest progress, Keith Muller, Chief Operating Officer of Atlantic Lithium, said:

"Since commencing at Atlantic Lithium, the team has been working hard to assess all opportunities to enhance the Project's processes and potential economics. Alongside the increased MRE, the staged project development plan will focus on improved plant efficiency and increased metal recovery.

"The DFS will be based on a flow sheet that encompasses a crushing and screening process that produces three distinct size fractions, with a maximum size of 10mm. Utilising three different size fractions significantly improves cyclone performance as they operate more efficiently within a narrower size range. This optimisation leads to better metal recoveries in the processing plant, which is one of our key focus areas.

"Separate to the delivery of the DFS, we will be conducting initial studies on the use of Modular DMS units, to potentially shorten the timeline to initial production against a backdrop of current buoyant lithium pricing. We will also focus on the beneficiation of middlings, which will enable us to further enhance the final quantities of SC6 produced.

"Ghana has an existing market for the raw materials required for its ceramics industry; the Company intends to evaluate the potential to supply feldspar, another by-product of production, to the Ghanaian market. This initiative could make Ewoyaa a significant source of domestically produced feldspar. Our evaluation will ensure the most efficient utilisation of resources and contribute to the growth of both the Company and Ghana's ceramics industry.

"Work on the Front-End Engineering Design and Definitive Feasibility Study for Ewoyaa is progressing well, with the Company continuously assessing opportunities to enhance the Project's economics. The DFS, targeted for completion in Q2, will incorporate the latest upgraded Mineral Resource Estimate to 35.3 Mt @ 1.25% Li2O and will model various throughput scenarios to optimise Project outcomes.

"In addition to the progress on the FEED and DFS, an update on the Stage 2 Scoping Studies will also be provided. Collectively, these updates will contribute to a more comprehensive understanding of the Project's potential, allowing the Company to make well-informed decisions and ensure the Project's long-term success, as well as maximising returns for the Company's shareholders.

"With numerous positive milestones ahead, we expect 2023 to be a year in which we realise some of the significant value potential available to the Company. We look forward to providing further updates in due course."

The Company outlines the following steps in the planned development of the Project towards production.

Planned Stage 1 - DFS and Project Development

Results from the heavy liquid separation ("HLS") testwork series (refer to the PFS announcement of 22 September 2022) confirmed that crushing to an all-in top-size of 6.3 mm would produce superior results and that a simple gravity-only DMS would be suitable for the plant. However, crushing to one size limits the potential throughput of the plant. Further testwork has indicated that crushing and screening to three sizes, ranging from 1-10mm would maximise metal recovery and grade at the Project. This optimisation will lead to better metal recoveries in the processing plant.

Figure 1:Ewoyaa flowsheet

The Ewoyaa flowsheet provides for the extraction of natural occurring fines, which still hold a relatively high head grade and metal credits. The natural occurring fines hold approximately 5% of the metal units reporting to the plant. The secondary cyclone 'rejects' or 'floats' produced through DMS at the Project have a relatively high grade, accounting for approximately 7% of the metal reporting to the plant. When combined with the natural occurring fines, this material is ideal for sale as a low-grade product, with a lithium content in the range of 1-1.2%.

As part of the Stage 2 Scoping Studies below, the Company will investigate the potential to beneficiate this material through a middlings beneficiation process, which could further improve value.

The Company will study various mine throughput scenarios for the DFS in line with the increased Mineral Resource Estimate1 ("MRE") of 35.3 Mt @ 1.25% Li2O.

The exploration of additional processing and throughput options demonstrates the Company's commitment to resource optimisation and value maximisation for the Project, ultimately benefiting its stakeholders and contributing to the Company's growth.

Stage 2 - Scoping Studies

Separate to the delivery of the DFS, the Company is investigating three study streams, including the evaluation of early SC6 production opportunities, the beneficiation of middlings to produce SC6 and the production of commercial quantities of feldspar by-product to reduce waste at the Project site and to supply Ghana's growing ceramics industry.

As part of the development of the Project, the Company intends to conduct a study to evaluate the potential for early SC6 production through the deployment of Modular DMS units. The Company believes that the Modular DMS units can be easily installed, enabling earlier production in the current high lithium price environment.

The Company also intends to conduct a study to undergo beneficiation of middlings, which is a combination of naturally occurring fines produced and secondary floats from the cyclone process, which have consistently delivered lithium grades similar to the MRE. By optimising the processing of middlings, the Company aims to enhance SC6 production, adding value to the overall production process.

As detailed in the PFS1, the Company believes that commercial quantities of feldspar may be produced from the plant - feldspar being defined as aluminosilicates containing a combined alkali content (Na2O + K2O) of greater than 10%. Ghana currently imports feldspar to supply its ceramics industry. The Company intends to evaluate the route to market of the feldspar produced as a by-product at Ewoyaa which could significantly enhance Ghana's ceramics industry. There is interest in Ghana to set up processing of the feldspar and this option is also being considered by the Company.

Simultaneously, work on the FEED and DFS is progressing well. The DFS is intended to be delivered in Q2 and will incorporate the upgraded MRE1 of 35.3 Mt @ 1.25% Li2O, expected to deliver enhanced economics for the Project.

End note:

[1]Ore Reserves, Mineral Resources and Production Targets

The information in this announcement that relates to production targets and Ore Reserves is extracted from the announcement dated 23 September 2022. The information in relation to Mineral Resources of 35.3 Mt @ 1.25% Li2O for the Project is extracted from the announcement dated 1 February 2023. The MRE includes a total of 3.5 Mt @ 1.37% Li2O in the Measured category, 24.5 Mt @ 1.25% Li2O in the Indicated category and 7.4 Mt @ 1.16% Li2O in the Inferred category. The Company confirms that all material assumptions and technical parameters underpinning the production targets, Mineral Resources and Ore Reserve estimates in the Announcements continue to apply and have not materially changed and it is not aware of any new information or data that materially affects the information included in the Announcements.

This announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with the Company's obligations under Article 17 of MAR.

For any further information, please contact:

Atlantic Lithium Limited Neil Herbert (Executive Chairman) Amanda Harsas (Finance Director and Company Secretary) IR@atlanticlithium.com.au | Tel: +61 2 8072 0640 |

SP Angel Corporate Finance LLP Nominated Adviser Jeff Keating Charlie Bouverat | Tel: +44 (0)20 3470 0470 |

Canaccord Genuity Limited Joint Company Broker Raj Khatri James Asensio Harry Rees | Tel: +44 (0) 20 7523 4500 |

Liberum Capital Limited Joint Company Broker Scott Mathieson Edward Thomas Kane Collings | Tel: +44 (0) 20 3100 2000 |

Yellow Jersey PR Limited Charles Goodwin Bessie Elliot | Tel: +44 (0)20 3004 9512 |

Notes to Editors:

About Atlantic Lithium

Atlantic Lithium is an AIM and ASX-listed lithium company advancing a portfolio of lithium projects in Ghana and Côte d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is a significant lithium spodumene pegmatite discovery on track to become Ghana's first lithium-producing mine. The Company signed a funding agreement with Piedmont Lithium Inc. for US$103m towards the development of the Ewoyaa Project. Based on the Pre-Feasibility Study, the Ewoyaa Project has indicated Life of Mine revenues exceeding US$4.84bn, producing a spodumene concentrate via simple gravity only process flowsheet.

Atlantic Lithium holds560km2 & 774km2 oftenure across Ghana and Côte d'Ivoire respectively, comprising significantly under-explored, highly prospective licences.

Atlantic Lithium Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Atlantic Lithium

Overview

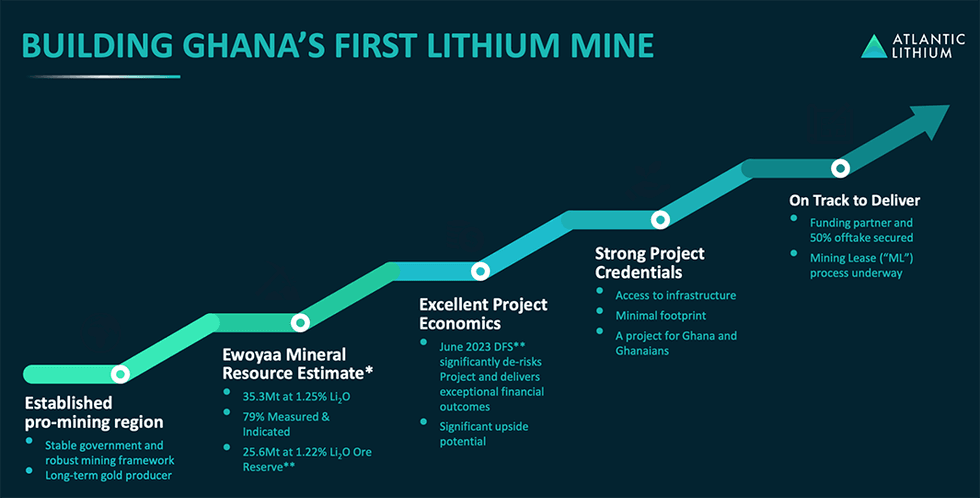

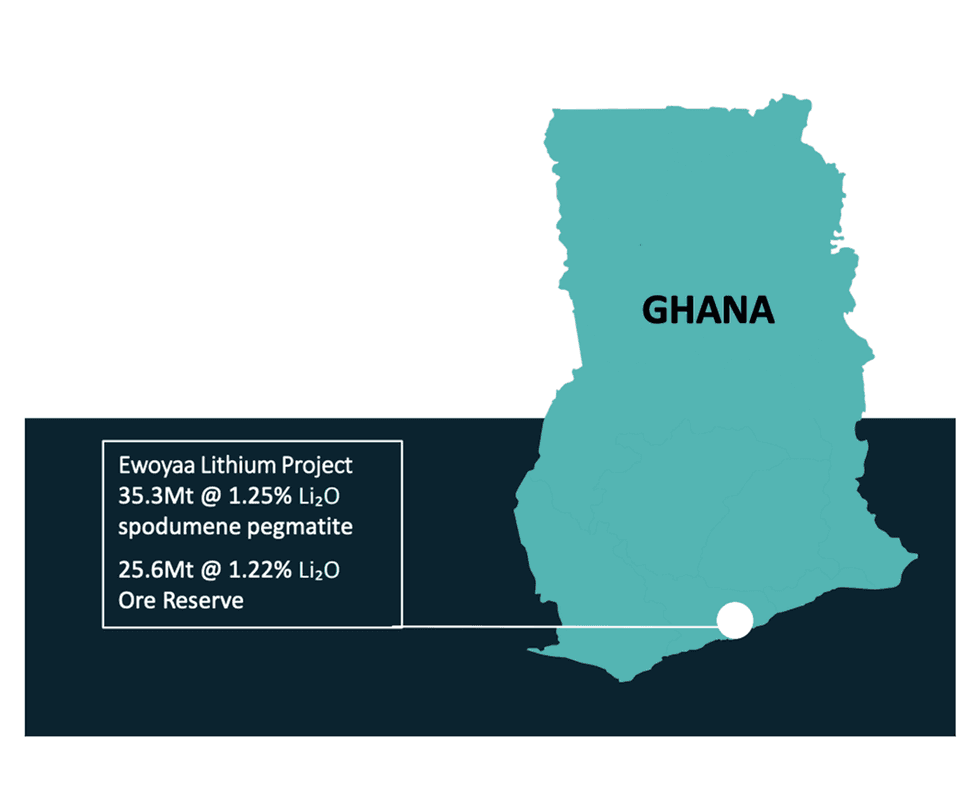

Despite its long mining history, favourable regulatory climate and stable political backdrop, Ghana remains largely overlooked as an investment jurisdiction for battery metals. Situated on the West African coast, the country boasts a strong strategic location and abundance of mineral wealth.

In 2023, the country reclaimed its title as Africa's number one producer of gold. And gold isn't the only precious metal to be found in the country. Ghana is also home to significant lithium reserves, with c. 180,000 tonnes of estimated resources.

Located between Europe, the United States and China, Ghana is perfectly positioned to serve as an important hub for the global supply of the battery metal.

Australian lithium exploration and development company Atlantic Lithium (ASX:A11, AIM:ALL, OTCQX:ALLIF) intends to leverage this opportunity through its flagship Ewoyaa project, set to become Ghana’s first lithium-producing mine. Atlantic intends to produce spodumene concentrate capable of conversion to lithium hydroxide and carbonate for use in electric vehicle batteries, helping drive the transition to decarbonisation.

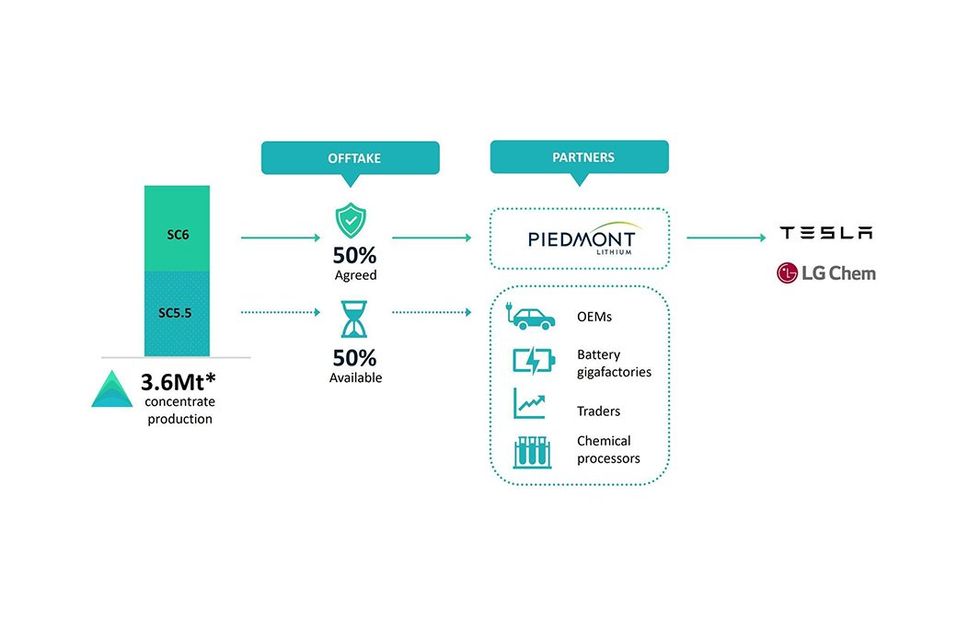

A definitive feasibility study (DFS) released in June 2023 shows that, considering its current 35.3 million tons (Mt) @ 1.22 percent lithium oxide JORC Mineral Resource Estimate and conservative life-of-mine concentrate pricing of US$1,587/t, FOB Ghana Port, Ewoyaa has demonstrable economic viability, low capital intensity and excellent profitability. Through simple open-pit mining, three-stage crushing and conventional Dense Media Separation (DMS) processing, the DFS outlines the production of 3.6 Mt of spodumene concentrate over a 12-year mine life, delivering US$6.6 billion life-of-mine revenues, a post-tax NPV8 of US$1.5 billion and an internal rate of return of 105 percent.

Atlantic Lithium intends to deploy a Modular DMS plant ahead of commencing operations at the large-scale main plant to generate early revenue, which will reduce the peak funding requirement of the main plant. The project is expected to deliver first spodumene production as early as April 2025.

The development of the project is co-funded under an agreement with NASDAQ and ASX-listed Piedmont Lithium (ASX:PLL), with Piedmont expected to fund c. 70 percent of the US$185 million total capex. In accordance with the agreement, Piedmont is funding US$17 million towards studies and exploration and an initial US$70 million towards the total capex. Costs are split equally between Atlantic Lithium and Piedmont thereafter.

In return, Piedmont will receive 50 percent of the spodumene concentrate produced at Ewoyaa, providing a route to consumers through several major battery manufacturers, including Tesla. With 50 percent of its offtake still available, Atlantic Lithium is one of very few near-term spodumene concentrate producers with uncommitted offtake.

Already the largest taxpayer and employer in Ghana’s Central Region, Atlantic Lithium is expected to provide direct employment to roughly 800 personnel at Ewoyaa and, through its community development fund whereby 1 percent of retained earnings will be allocated to local initiatives, will deliver long-lasting benefits to the region and to Ghana.

Atlantic Lithium also has the potential to capitalise upon considerable additional upside across its extensive exploration portfolio — potential it intends to leverage to the fullest as it becomes an early mover in West African lithium production.

Company Highlights

- A mining and exploration company operating in West Africa, Atlantic Lithium is set to deliver Ghana’s first lithium-producing mine with its flagship Ewoyaa Lithium Project.

- Ghana is a well-established mining region with access to reliable, existing infrastructure and a significant mining workforce. There are currently 16 operating mines in the country.

- There is significant government interest in getting Ewoyaa operational to diversify the country’s production from gold.

- Atlantic Lithium is already the leading taxpayer and employer in the region and, through Ewoyaa, expects to bring significant business and development locally.

- The June 2023 definitive feasibility study proves Ewoyaa to be a financially viable, major near-term lithium-producing asset.

- The project is co-funded under an agreement with Piedmont Lithium.

- With 50 percent of offtake still uncommitted, the company is one of few near-term spodumene producers with offtake available.

- Situated on the West African coast, Atlantic Lithium is well-positioned to serve the global electric vehicle markets.

Key Assets

Ewoyaa

Set to be Ghana's first lithium-producing mine, Atlantic Lithium's flagship Ewoyaa Project is situated within 110 kilometres of Takoradi Port and 100 kilometres of Accra, with access to excellent infrastructure and a skilled local workforce. A definitive feasibility study (DFS) released in June 2023 confirmed the project's economic viability and profitability potential, indicating a 3.6-Mt spodumene concentrate production over the mine's 12-year projected life.

Atlantic Lithium is currently in the process of securing a mining lease for the project, which will enable the commencement of the permitting process. Through the deployment of a Modular DMS plant, which will process 450,000 tons of ore as the main 2.7-Mt processing plant is being constructed, the mine is expected to deliver first production in 2025.

Highlights:

- Promising DFS Results: Atlantic Lithium's recent DFS reaffirmed Ewoyaa as an industry-leading asset with low capital intensity and excellent profitability. Highlights include:

- Estimated 12-year life of mine, producing 3.6 Mt spodumene concentrate.

- 365 ktpa steady state production

- Average LOM EBITDA of US$316 million per annum

- NPV of US$1.5 billion

- Free cash flow of US$2.4 billion from life-of-mine revenues of US$6.6 billion

- Modest $185 million capital cost

- Payback within 19 months.

- Favourable Location: The project's starter pits are positioned within one kilometre of its processing plant. Additionally, Ewoyaa has access to reliable existing infrastructure, located within 800 metres from the N1 highway and adjacent to grid power.

- Promising Reserves: Ewoyaa's current mineral resource estimate is 35.3 Mt at 1.25 percent lithium oxide, with ore reserves of 25.6 Mt at 1.22 percent lithium oxide.

- Potential for Further Exploration: There remains significant exploration potential, with only 15 square kilometres of Atlantic Lithium's entire tenure having been drilled to date.

- Strong Partnerships: Atlantic Lithium has a 50-percent offtake deal with Piedmont Lithium, which itself has offtake agreements with both Tesla and LG Chem.

- Positive Presence: Atlantic Lithium will generate significant economic benefits to the region. Once operational, the project is expected to employ roughly 800 personnel.

Côte d'Ivoire

Atlantic Lithium currently has two applications pending for an area of roughly 774 square kilometres in the West African country of Côte d'Ivoire. The underexplored yet highly prospective region is known to be underlain by prolific birimian greenstone belts, characterised by fractionated granitic intrusive centres with lithium and colombite-tantalum occurrences and outcropping pegmatites. The area is also incredibly well-served, with extensive road infrastructure, well-established cellular network and high-voltage transmission line within roughly 100 kilometres of the country's capital, Abidjan.

Management Team

Neil Herbert - Executive Chairman

Neil Herbert is a fellow of the Association of Chartered Certified Accountants and has over 30 years of experience in finance. He has been involved in growing mining and oil and gas companies both as an executive and as an investor for over 25 years. Until May 2013, he was co-chairman and managing director of AIM-quoted Polo Resources, a natural resources investment company.

Prior to this, Herbert was a director of resource investment company Galahad Gold, after which he became finance director of its most successful investment, the start-up uranium company UraMin, from 2005 to 2007. During this period, he worked to float the company on AIM and the Toronto Stock Exchange in 2006, raise US$400 million in equity financing and negotiate the sale of the group for US$2.5 billion.

Herbert has held board positions at a number of resource companies where he has been involved in managing numerous acquisitions, disposals, stock market listings and fundraisings. He holds a joint honours degree in economics and economic history from the University of Leicester.

Keith Muller - Chief Executive Officer

Keith Muller is a mining engineer with over 20 years of operational and leadership experience across domestic and international mining, including in the lithium sector. He has a strong operational background in hard rock lithium mining and processing, particularly in DMS spodumene processing. Before joining Atlantic Lithium, he held roles as both a business leader and general manager at Allkem, where he worked on the Mt Cattlin lithium mine in Western Australia.

Prior to that, Muller served as operations manager and senior mining engineer at Simec. He holds a Master of Mining Engineering from the University of New South Wales and a Bachelor of Engineering from the University of Pretoria. He is also a member of the Australian Institute of Mining and Metallurgy, the Board of Professional Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas - Finance Director and Company Secretary

Amanda Harsas is a senior finance executive with a demonstrable track record and over 25 years’ experience in strategic finance, business transformation, commercial finance, customer and supplier negotiations and capital management. Prior to joining Atlantic Lithium, she worked across several sectors including healthcare, insurance, retail and professional services. Harsas is a chartered accountant, holds a Bachelor of Business and has international experience in Asia, Europe and the US.

Len Kolff - Head of Business Development and Chief Geologist

Len Kolff has over 25 years of mining industry experience in the major and junior resources sector. With a proven track record in deposit discovery and a particular focus on Africa, Kolff most recently worked in West Africa and was instrumental in the discovery and evaluation of the company’s Ewoyaa Lithium Project in Ghana, as well as the discovery and evaluation of the Mofe Creek iron ore project in Liberia. Prior to this, he worked at Rio Tinto with a focus on Africa, including the Simandou iron ore project in Guinea and the Northparkes Copper-Gold mine in Australia.

Kolff holds a Master of Economic Geology from CODES, University of Tasmania and a Bachelor of Science (Honours) degree from the Royal School of Mines, Imperial College, London.

Patrick Brindle - Non-executive Director

Patrick Brindle currently serves as executive vice-president and chief operating officer at Piedmont Lithium. He joined Piedmont in January 2018. Prior to this, he held roles as vice-president of project management and subsequently as chief development officer.

Brindle has more than 20 years' experience in senior management and engineering roles and has completed EPC projects in diverse jurisdictions including the United States, Canada, China, Mongolia, Australia and Brazil. Before joining Piedmont, he was vice-president of engineering for DRA Taggart, a subsidiary of DRA Global, an engineering firm specialising in project delivery of mining and mineral processing projects globally.

Kieran Daly - Non-executive Director

Kieran Daly is the executive of growth and strategic development at Assore. He holds a BSc Mining Engineering from Camborne School of Mines (1991) and an MBA from Wits Business School (2001) and worked in investment banking/equity research for more than 10 years at UBS, Macquarie and Investec prior to joining Assore in 2018.

Daly spent the first 15 years of his mining career at Anglo American’s coal division (Anglo Coal) in a number of international roles including operations, sales and marketing, strategy and business development. Among his key roles were leading and developing Anglo Coal's marketing efforts in Asia and to steel industry customers globally. He was also the global head of strategy for Anglo Coal immediately prior to leaving Anglo in 2007.

Christelle Van Der Merwe - Non-executive Director

Christelle Van Der Merwe is a mining geologist responsible for the mining-related geology and resources of Assore’s subsidiary companies (comprising the pyrophyllite and chromite mines) and is also concerned with the company's iron and manganese mines. She has been the Assore group geologist since 2013 and involved with strategic and resource investment decisions of the company. Van Der Merwe is a member of SACNASP and the GSSA.

Jonathan Henry - Independent Non-executive Director

Jonathan Henry is a senior executive with significant, global listed company experience, primarily in the mining industry, having held various leadership and board roles for nearly two decades. Henry is currently the non-executive chair of Toronto Venture Exchange-listed (TSX-V) Giyani Metals. He has been heavily involved in the strategic management and leadership of projects toward production, commercialisation and, ultimately, the realisation of shareholder value. He has gained significant experience working across capital markets, business development, project financing, key stakeholder engagement (including public and investor relations), and the reporting and implementation of ESG-focused initiatives.

Henry was the executive chair and non-executive director at Euronext Growth and AIM-listed Ormonde Mining, non-executive director at TSX-V-listed Ashanti Gold, president, director and CEO at TSX-listed Gabriel Resources and various roles, including CEO and managing director, at London and Oslo Stock Exchange-listed Avocet Mining PLC.

Aaron Maurer – Head of Operational Readiness

Aaron Maurer is a senior-level business executive with over 25 years’ international multi-commodity mining experience, overseeing strategic, operational and financial performance. Over his career, he has held several engineering, production, operational and senior executive roles. Before joining Atlantic Lithium, he served as executive general manager - operations at Minerals Resources, where he oversaw the Mt Marion Lithium mine and three iron ore mines in Western Australia. He was previously the managing director and CEO of PVW Resources and general manager (site senior executive) at Peabody Energy Australia.

His significant expertise spans the development and implementation of safety and cost-saving initiatives, change management, strategic planning, business development and employee development. Maurer holds a Master in Corporate Finance and a Bachelor of Engineering (Mining).

Roux Terblanche - Project Manager

Roux Terblanche is a mineral resource project delivery specialist with proven African and Australian experience working for owners, EPCMs, consultants and contractors. He has a wide range of commodity experiences, including lithium, gold, copper, diamonds and platinum. He has proven to add value and deliver projects safely, on time and within budget.

Terblanche has worked in the UAE and across Africa, including Ghana, the DRC, Burkina Faso, Zambia, Rwanda, Botswana and Senegal. He was instrumental in increasing the operating footprint of an international construction company across Africa and was integral to the building of the Akyem, Tarkwa Phase 4 and Chirano mines in Ghana.

Terblanche holds a national diploma in mechanical engineering, a diploma in project management and a Bachelor of Commerce from the University of South Africa.

Iwan Williams - Exploration Manager

Iwan Williams is an exploration geologist with over 20 years' experience across a broad range of commodities, principally iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE's, nickel and other base metals, as well as chromitite, phosphates, coal and diamond.

Williams has extensive southern and west African experience and has worked in Central and South America. His experience includes all aspects of exploration management, project generation, opportunity reviews, due diligence and mine geology. He has extensive studies experience having participated in the delivery of multiple project studies including resource, mine design criteria, baseline environmental and social studies and metallurgical test-work programmes. He is very familiar with working in Africa having spent 23 years of his 28-year geological career in Africa. Williams is a graduate of the University of Liverpool.

Abdul Razak - Country Manager

Abdul Razak has extensive exploration, resource evaluation and project management experience throughout West Africa with a strong focus on data-rich environments. He has extensive gold experience having worked throughout Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, as well as international exploration and resource evaluation experience in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an integral member of the team, managing all site activities including drilling, laboratory, local teams, geotech and hydro, community consultations and stakeholder engagements and was instrumental in establishment of the current development team and defining Ghana’s maiden lithium resource estimate. He is based at the project site in Ghana.

Lithium Universe Limited (ASX: LU7) – Trading Halt

Description

The securities of Lithium Universe Limited (‘LU7’) will be placed in trading halt at the request of LU7, pending it releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of the commencement of normal trading on Monday, 29 April 2024 or when the announcement is released to the market.

This article includes content from Lithium Universe Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities and Cash Flow Report for the Quarter Ended 31 March 2024

Atlantic Lithium looks ahead to major near-term value-drivers as it advances the Ewoyaa Lithium Project towards shovel-readiness

The Board of Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF, “Atlantic Lithium” or the “Company”), the African-focused lithium exploration and development company targeting to deliver Ghana’s first lithium mine, is pleased to announce its Quarterly Activities and Cash Flow Report for the period ended 31 March 2024.

Highlights from the Reporting Period:

Project Development:

- Overwhelmingly strong local community support demonstrated at the Environmental Protection Agency (“EPA”) Scoping Public Hearing in respect of the Company’s Ewoyaa Lithium Project (“Ewoyaa” or “the Project”) in Ghana.

- Completion and submission of Ewoyaa Feldspar Study and Downstream Conversion Study to Ghana’s Minerals Commission, as agreed under the terms of the grant of the Mining Lease for the Project.

- Engagement with industry-leading engineering firms with proven experience in Ghana ahead of tender process for the award of the Engineering, Procurement, and Construction Management (“EPCM”) contract.

- Further key strategic appointments in support of mine development.

Exploration:

- Assay results received for a total of 9,734m of drilling completed in 2023 over the new Dog-Leg target, Okwesi, Anokyi and Ewoyaa South-2 deposits, which sit outside of the current JORC (2012) compliant 35.3Mt @ 1.25% Li2O Mineral Resource Estimate (“MRE”)1 for the Project.

- Results reported during the period represent the final results for the 2023 drilling season, with a total of 25,898m drilled throughout the year.

- Multiple high-grade and broad drill intersections reported in results, including at Dog-Leg, where drilling intersected a shallow-dipping, near surface mineralised pegmatite body with true thicknesses of up to 35m.

- Highlight intersections include 69m at 1.25% Li2O from 45m and 83m at 1% Li2O from 36m at Dog-Leg.

- Completion of reverse circulation (“RC”) and diamond core (“DD”) resource growth drilling at the Dog-Leg target, with assays pending.

- Results of drilling completed in 2023 and results pending for 2024 to be incorporated into a MRE upgrade, targeted during H2 2024.

- Completion of 3,177m of plant site sterilisation drilling, with no mineralisation intersected, providing confidence in the proposed plant site location.

- Final approval received to commence field work at the newly-granted Senya Beraku prospecting licence.

- Promotion of Exploration Manager Iwan Williams to General Manager, Exploration and Country Manager Abdul Razak to Exploration Manager, Ghana following the decision of Head of Business Development & Chief Geologist Len Kolff to step down from his roles at the Company.

- Changes to the exploration team focused on enabling the advancement of the Company’s exploration asset pipeline and the evaluation of new value-accretive opportunities to ensure the long-term growth of the Company.

Corporate:

- Completion of the Minerals Income Investment Fund of Ghana’s (“MIIF”) Subscription for 19,245,574 Atlantic Lithium shares for a value of US$5m, representing Stage 1 of MIIF’s agreed total US$32.9 million Strategic Investment to expedite the development of the Project towards production.

- Strong interest for spodumene concentrate to be produced at Ewoyaa continues to be demonstrated from a range of industry players around the world through the Company’s ongoing competitive offtake partnering process to secure funding for a portion of the remaining 50% available feedstock from Ewoyaa.

- Formal bids from remaining interested parties expected to be received in the coming weeks ahead of final negotiations.

- Purchase of 24.3m Atlantic Lithium shares at a premium by major shareholder Assore International Holdings (“Assore”) from strategic funding partner Piedmont Lithium Inc. (NASDAQ: PLL; ASX: PLL, “Piedmont”).

- Further purchase of the Company’s shares from members of the Company’s senior leadership team, equating to a total value of A$5,192,393 (£2,794,015) since March 2023.

“With our sights firmly set on breaking ground at the Ewoyaa Lithium Project later this year, Atlantic Lithium remains fully focused on activities that de-risk the Project and move Ewoyaa closer to shovel-readiness.

“Key to achieving this milestone is the success of the ongoing permitting process, which is advancing as anticipated. We are proud to note the overwhelming support of our local communities, who, as demonstrated during the recent EPA Scoping Public Hearing, are eager to see Ewoyaa deliver the generational benefits expected to be brought about from lithium production in their municipality.

“Following the completion of its US$5m investment in the Company, we are delighted to welcome the Minerals Income Investment Fund of Ghana to the Atlantic Lithium share register as a highly valued local stakeholder and key funding partner. MIIF’s subscription represents the first stage of its planned US$32.9m total investment, expected to expedite the development of the Project. We continue to work closely with MIIF to complete the remainder of its planned Project- level investment in due course.

“Significant work in respect of the agreed terms of the grant of the Mining Lease for the Project has also been completed during the period. Both the Feldspar Study and Downstream Study have been finalised and submitted to the Minerals Commission, and we are working with the Ghana Stock Exchange and associated parties to enable our listing on the GSE as soon as possible.

“Concurrent to these, we continue to enhance the value of the Project; both through drilling completed in 2023 and planned for the remainder of 2024. Drilling completed in 2023 has delivered encouraging results, including new targets for follow-on work, to be undertaken in H2 2024. We look forward to incorporating the 2023 results and results to be received from drilling planned for H2 2024 into a MRE update later this year.

“I would like to congratulate Iwan Williams and Abdul Razak on their promotions, to General Manager, Exploration and Exploration Manager, Ghana, respectively, following Len’s decision to step down from his roles at the Company. Iwan and Razak have led the Company’s exploration activities alongside Len since before the delivery of the Maiden MRE at Ewoyaa in 2020, and are, therefore, well-credentialled to lead the Company’s exploration efforts, focused primarily on advancing our current portfolio of assets in West Africa, as well as assessing new opportunities in Ghana and elsewhere.

“On behalf of the Board, I would also like to thank Len for his significant contributions to the leadership of the Company throughout his nine years with Atlantic Lithium. His expertise has been fundamental to getting us to where we are today, notably his role in the discovery of the Project and for stepping up to assume the role of Interim Chief Executive Officer following the untimely passing of the Company’s founder, Vincent Mascolo. I wish him every success in his future endeavours.

“Looking forward, we have a number of other major catalysts in the months ahead of us. These include the conclusion of the competitive offiake partnering process for a portion of Ewoyaa’s remaining offiake available, which will serve as a major funding milestone for the Company, the ratification of the Mining Lease by parliament and, in line with the ongoing permitting process, the grant of the final permits; namely the EPA Permit and Mine Operating Permit, which are required by the Company to enable the commencement of construction at Ewoyaa.

“We look forward to updating the market on our progress in due course.”

Click here for the full ASX Release

This article includes content from Atlantic Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Forward Water Technologies

Overview

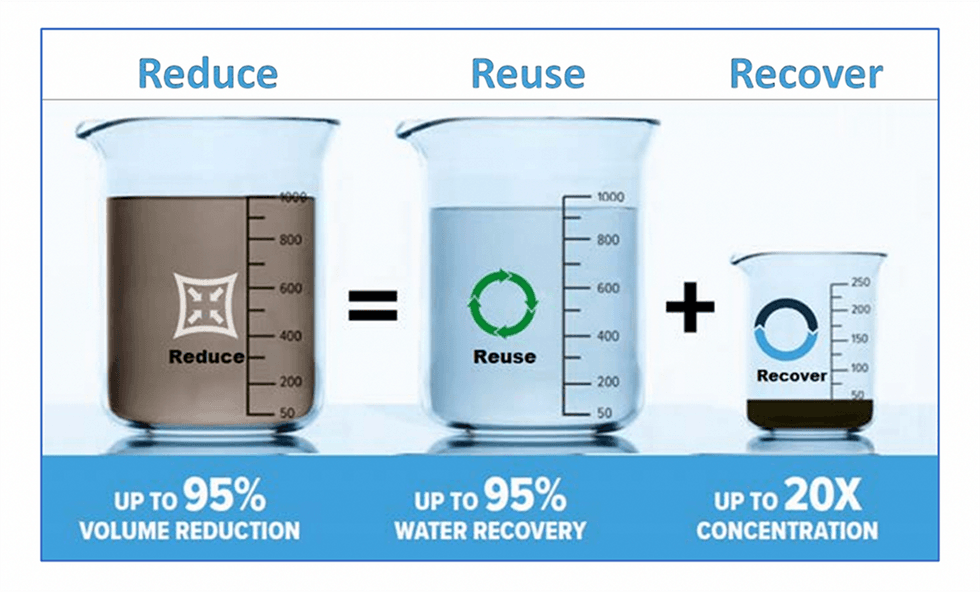

Forward Water Technologies (TSXV:FWTC) is helping lithium mining companies and other industries reduce their environmental impact through its innovative wastewater treatment technology that enables industrial operations to reduce liquid waste volume by up to 95 percent.

Environmental, social and governance (ESG) ratings continue to be a key business strategy for organizations as they impact public perception and partnership possibilities. For water-intensive industries, such as mining, sustainable wastewater management is critical.

Transformative wastewater technologies are critical for both businesses and the world’s population. In fact, unless sufficient progress is achieved, UNICEF and WHO estimate that 1.6 billion people will be without access to safe drinking water by 2030, and 2.8 billion will be without access to safe sanitation and hygiene. Water treatment technologies can disrupt current trends and improve global access to safe drinking water.

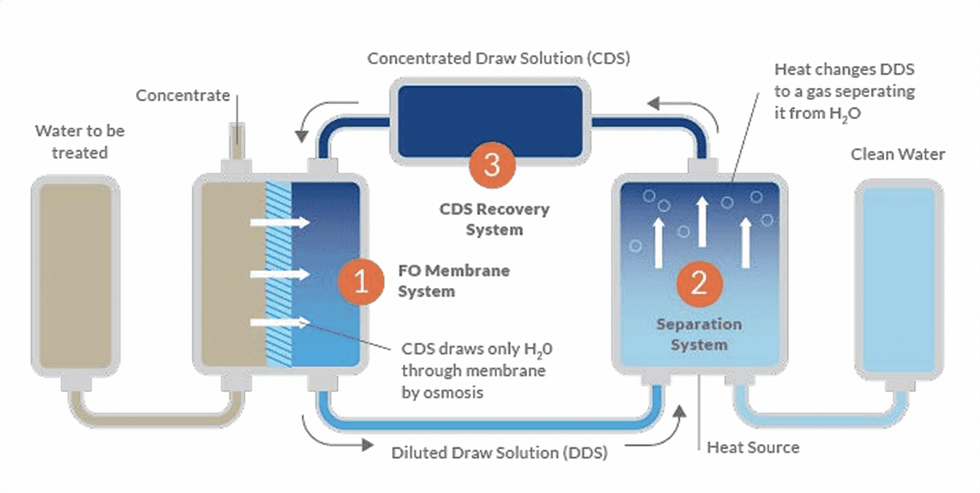

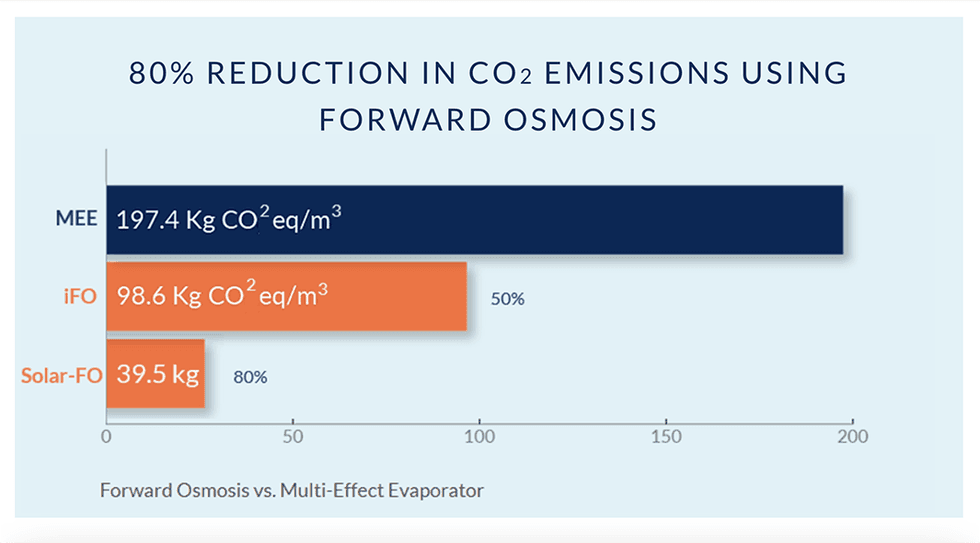

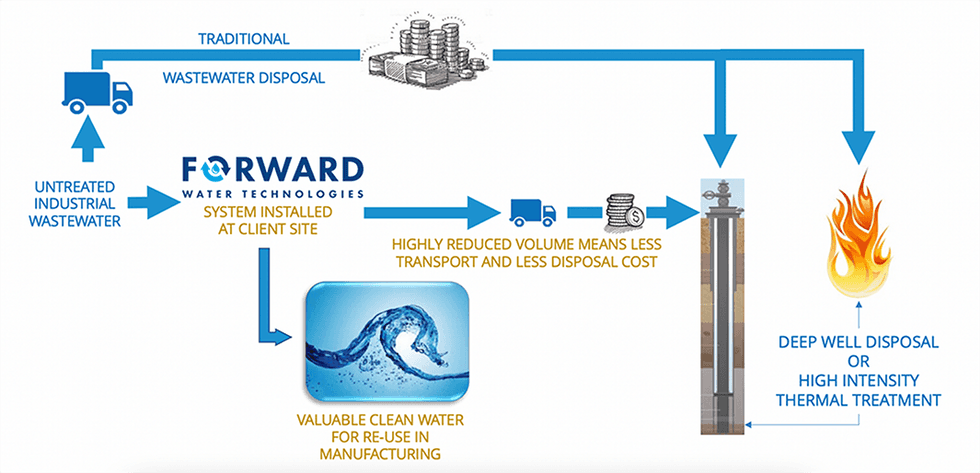

Through its Forward Osmosis (FO) technology, Forward Water is providing an environmentally friendly alternative to traditional wastewater disposal. Traditionally, wastewater disposal requires transporting untreated wastewater for deep well disposal or high-intensity thermal treatment.

Forward Water’s FO system is installed at the client site, and wastewater is treated to reduce waste volume and produce valuable clean water for reuse in the manufacturing process. Then, the significantly reduced volume of wastewater is transported and disposed of, significantly saving on transportation and disposal costs.

The FO technology targets three massive sectors: industrial wastewater, mining and food manufacturing. Forward Water’s unique and patented FO technology achieves high-rate water extraction within a low-energy continuous process. The process reduces waste and allows up to 95 percent water recovery, ready for reuse.

Forward Water’s Li-FO™ technology is ideal for lithium-brine mining operations, allowing mines to “fine tune” brine sources to improve concentration by up to 20 times. This results in improved recovery and makes lower-concentration brines economically viable. Forward Water is currently embarking on an early development testing project to further evaluate and refine the technology’s viability in lithium mining.

In 2023, the company’s wholly owned subsidiary, Forward Water Technologies Inc., licensed specific intellectual property from FUJIFILM Corporation to solidify the protection of its water treatment technology platform.

CleanTech Lithium (AIM:CTL,Frankfurt:T2N,OTC:CTLHF) has contracted FWT to provide advisory services for the support and development of CleanTech Lithium's direct lithium extraction (DLE) process in Chile. The collaboration will use FWT’s industrial forward osmosis system in the hyper-concentrating of CleanTech Lithium's eluate and its conversion into battery-grade lithium carbonate through Conductive Energy's DLE process.

Howie Honeyman, CEO, explained in an interview how the company’s technology can improve lithium mining operations. “A lot of lithium being mined today around the world is coming from underground aquifers that store the lithium brine. The challenge is that the lithium is surrounded by other minerals and salts, requiring chemical ‘tweezers’ to pluck out that lithium. What we can do is, at multiple places in that process, we can concentrate that lithium-containing water stream, which makes it far easier for these miners to handle the volumes they need to extract that lithium.”

An experienced management team with technical expertise leads the company towards further refining and deploying its technology. The team includes experts in materials science, chemistry and engineering. Additional experts in corporate administration and financing round out the leadership team to lead the company toward its goals.

Company Highlights

- Forward Water Technologies has developed a patented wastewater treatment technology that reduces wastewater volume and improves reusability across multiple industries, including mining and food manufacturing.

- The company’s Forward Osmosis (FO) technology disrupts the traditional method of wastewater disposal by reducing the amount of waste that must be transported and disposed of, directly reducing costs.

- The FO technology also improves water reusability by up to 95 percent, reducing the expense of importing water for industrial processes.

- The Forward Water Technologies Li-FO™ process is applicable in the lithium mining sector by improving concentration by up to 20 times, allowing organizations to improve extraction efficiency.

- The company has partnered with a lithium-brine extraction operation to evaluate its Li-FO™ technology.

- Forward Water Technologies is in early negotiations to deliver an FWTC forward osmosis pilot system on-site in Chile to support a customer's lithium extraction process.

- Forward Water Technologies has licensed specific intellectual property from FUJIFILM Corporation to solidify the protection of its water treatment technology platform.

- The company has been contracted by CleanTech Lithium to provide advisory services for the support and development of CleanTech Lithium's direct lithium extraction processes in Chile.

- An experienced management team with a blend of relevant technical expertise leads the company toward refining and marketing its technology.

Key Project

Forward Osmosis Water Treatment

Forward Osmosis is a naturally occurring process in which water is spontaneously drawn across a membrane when one solution is higher in salt concentration than the other. The difference in salinity, known as the osmotic gradient, creates a low-energy water treatment process.

Forward Water Technologies has leveraged the naturally occurring process to innovate its patented, three-step FO technology, enabling a 95 percent wastewater reduction and 95 percent water recovery.

Project Highlights:

- Patented Three-Step Process: Forward Water Technologies FO process achieves low-energy and high-rate water extraction with a unique three-step design:

- Water Extraction: Water is drawn across the FO membrane into a salt draw solution. The combination of the patented draw solution and unique membrane “locks” the draw solution on one side of the membrane, creating a true closed-loop process.

- Water/Salt Separation: Next, a switchable water salt (SWS) achieves water/salt separation as low-grade heat is applied, and it phases from liquid to gas. As the gas leaves the solution, clean water is left behind. The energy necessary for this step is often found in many facilities in the form of waste heat.

- Salt Draw Reconcentration: Finally, as the gas leaves the solution, it is captured within the closed-loop system and is passively cooled, causing it to phase back into liquid form as an SWS. The SWS liquid is collected and recycled back to the front of the membranes in the water extraction step, creating a continuous process.

- Widely Applicable Water Treatment: The low-energy process allows organizations across several industries to improve water reclamation and reduce wastewater by up to 95 percent. Additionally, the process allows for up to 20 times concentration, making the process amenable to lithium-brine extraction and other potential applications.

- Significant Cost Savings: The primary value proposition for the FO process is cost reduction in wastewater transportation and disposal. With the process in place, more water is reclaimed for reuse in manufacturing, which reduces the raw volume of wastewater that must be transported and disposed of.

Management Team

Howie Honeyman - Chief Executive Officer and President

Dr. Howie Honeyman has 20 years of experience commercializing new technologies at Xerox, Cabot, E Ink, Natrix Separations and as former CTO of GreenCentre Canada. Honeyman commercialized high-capacity, high-throughput membranes for bioprocessing as SVP of Natrix Separations, which has since been acquired by Millipore-Sigma. Since 2015, Honeyman has been leading Forward Water to become a premier wastewater treatment solution. Honeyman is also an inventor of record on over 50 US patents and holds a PhD in chemistry from the University of Toronto.

Michael Willetts - Chief Financial Officer

Michael Willetts has over 25 years in financial leadership roles primarily in manufacturing, from large multinational businesses to startups, both public and private. He previously worked as an engineer in the automotive industry before entering into finance at Ford Motor Company. Willets went on to progressively larger finance roles in several international automotive suppliers (Textron, GKN, DSM) and Canadian manufacturers (Armtec, Stronach International, AirBoss of America). Willetts is currently providing fractional CFO services through WD Numeric Corporate Services in the manufacturing, SaaS and cannabis industries. Willetts graduated with a BASc, BComm and MBA from the University of Windsor.

Wayne Maddever - Chief Operating Officer

Dr. Wayne Maddever received his Ph.D. in materials science engineering from the University of Toronto. Since 1985, he has held senior executive management positions with technically based businesses in start-up, turnaround or acquisition situations where his skills in change management have brought considerable success in the commercialization of new technologies. His experience in both private and public companies, domestically and internationally, spans a broad variety of industries, including bio and advanced materials, precision manufacturing, recycling, waste-to-energy and medical devices. He holds a number of patents in several fields. He is a fellow of the Canadian Academy of Engineering. In addition to his duties as COO of Forward Water, he is currently portfolio manager at Bioindustrial Innovation Canada, one of the major shareholders of Forward Water.

Grant Thornley - VP Engineering Solution Sales

Grant Thornley is a business strategist with more than 25 years of experience. He has developed and grown international water/wastewater markets through innovative growth hacking techniques and processes, synergized with product development and positioning, data analytics and acceleration of go-to-market strategies through alliances and partnerships. Having expertise in chemical, mechanical and biological treatment processes as well as designing hundreds of municipal and industrial applications, Thornley brings a knowledge-to-action approach to helping clients solve problems and realize new opportunities in water reuse, energy conservation and CO2 reduction.

Leonard Seed - Director of Engineering & Operations

Leonard Seed has over 18 years of experience developing and commercializing new water and wastewater treatment technologies, primarily in a start-up environment. Seed is named as an inventor on over seven patents and has authored several publications. Seed is a professional engineer and has an MSc in environmental engineering from the University of Guelph. Leonard holds inventorship on seven US patents and is an instructor at Mohawk College teaching aspects of water treatment technologies and leading research efforts on forward osmosis.

Philip Jessop - Executive Research Director

Dr. Philip Jessop is a professor and Canada Research Chair of Green Chemistry at the Department of Chemistry, Queen’s University in Kingston, Ontario. He also serves as the technical director of GreenCentre Canada and executive research director at Forward Water Technologies. After his Ph.D. (British Columbia, 1991) and a postdoctoral appointment (Toronto, 1992), he became a contract researcher in Japan working for R. Noyori (Nobel Prize 2001). As a professor at the University of California-Davis (1996-2003) and since then at Queen’s, he has studied green solvents and the chemistry of carbon dioxide. Distinctions include the NSERC Polanyi Award (2008), Killam Research Fellowship (2010), Canadian Green Chemistry & Engineering Award (2012), Eni Award (2013), Fellowship in the Royal Society of Canada (2013), a Canada Research Chair Tier 1 (2013 to 2020), and the NSERC Brockhouse Prize (2019). He serves as chair of the editorial board for the journal Green Chemistry, has chaired three international conferences, and helped create GreenCentre Canada, a national center of excellence for the commercialization of green chemistry technologies. Forward Water is a spin-off company based on Dr. Jessop’s switchable solvents.

Board Changes

Mr. Sondergaard's appointment to the Board follows his recent appointment as Country Manager for Canada, delivering on White Cliff's stated objective of building a first class operations team. Eric brings over 20 years of operational experience in the mining industry, including significant expertise in frontier exploration and project management. Notably, he played a pivotal role in the identification of key projects recently acquired by the Company and is an expert in remote project development, logistics and has a proven track record of creating value for shareholders.

In conjunction with Mr. Sondergaard's appointment, White Cliff Minerals also announces the retirement of Mr. Ed Mead (“Ed”) from the Board of Directors effective immediately however will continue to provide, as required, consulting services to the Company in relation to its Australian portfolio. The Company would like to thank Ed for his invaluable contribution throughout this transition phase. As part of this ongoing support, and in recognition of the valuable contribution to the formation of the newly focussed and revitalised White Cliff Minerals Ltd, Ed will maintain his full allocation of the Tranche A incentive scheme with the balance becoming void as per the terms and conditions of the incentive scheme itself.

As part of the Board restructure, Troy Whitaker will move to the role of Managing Director of the Company. The remuneration for both Eric and Troy remain unchanged.

Commenting on these developments, White Cliff Chairman, Roderick McIllree, stated: "The changes required to facilitate the change of strategic direction are now complete. We are delighted to welcome someone of Eric’s calibre with a proven track record to the Board. His involvement will be critical as the Company prepares for its maiden field campaign. We also extend our sincere thanks to Ed Mead for his dedication and service to the Company and wish him the best for his future endeavours."

Click here for the full ASX Release

This article includes content from White Cliff Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities Report for the Period Ended 31 March 2024

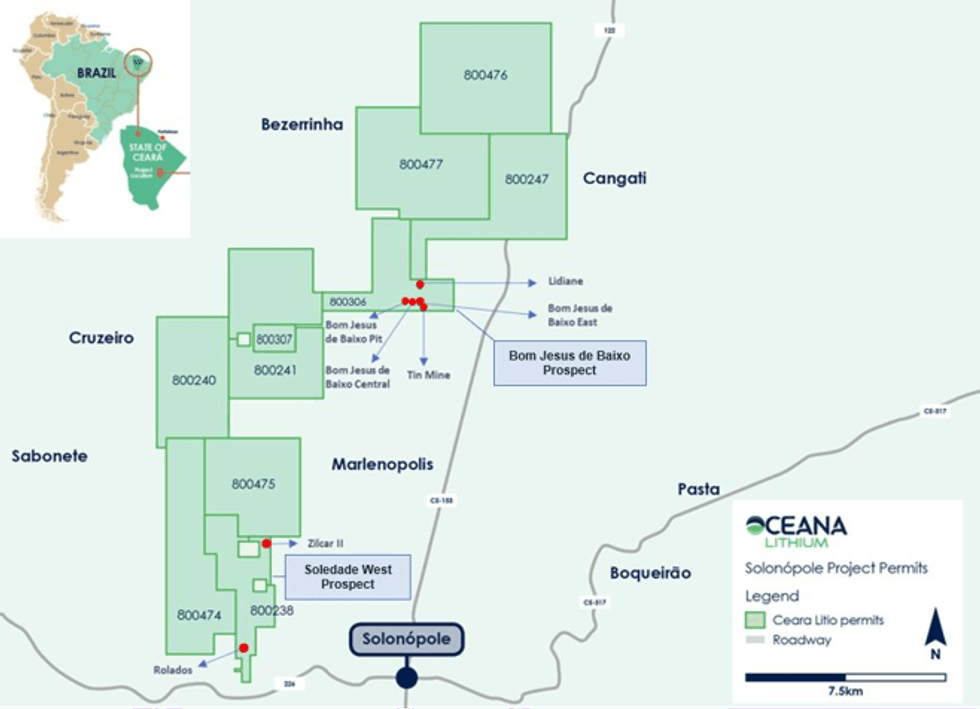

Oceana Lithium Limited (ASX: OCN, “Oceana” or “the Company”) is pleased to present its activities report for the March 2024 quarter.

Highlights

Solonópole Project, Ceará, Brazil

- Anomalous lithium values above 100 ppm (and up to 631 ppm) found in 383 soil samples within existing and new target areas.

- Integration and interpretation of these soil sample results with data from geophysics, geological mapping (138 line-km), trenching and RC drilling (~2,000m) further enhance prospectivity of existing and new targets.

- Combined datasets confirmed several swarms of pegmatite bodies striking in a NE-SW and E-W directions and identified new high priority areas.

- Nira interpreted to be the most prospective new target, with 180 soil samples of >100 ppm Li and as high as 524 ppm Li covering an area of at least 1km2.

- Nira also features 17 pegmatite outcrops with average widths of up to 30 meters and strike lengths from 200m to 600m.

- Planning for the next follow-up drilling campaign is underway.

Napperby Project, Northern Territory, Australia

- Oceana’s Napperby Project covers some of Arunta Province’s hottest granites plutons, the Wangala Granite (uranium) and Ennugan Mountains Granite (uranium/thorium).

- Both granite plutons show outstanding uranium/thorium ratios and are almost fully encapsulated within Napperby’s EL32836 and ELA32841.

- Follow-up exploration activities will target uranium and Rare Earth Elements (REEs) in parallel with Lithium-Caesium-Tantalum (LCT) pegmatites.

Corporate

- Experienced geologist and mining executive, Aidan Platel, appointed as non- executive director.

- Brazilian-based geologist, Mike Sousa, appointed as Exploration Manager and Competent Person.

- The Company remains well-funded with cash at 31 March of ~$2.67m.

Solonópole Project, Ceará State, Brazil

The Solonópole Project area is located in the state of Ceará, north-eastern Brazil and consists of ten (10) exploration permits covering approximately 124km2 (Figure 1), owned by Oceana’s subsidiary Ceará Litio. The project is approximately three to four hours by road from the state capital Fortaleza and deep-water port of Pecém, and is well serviced by sealed highways and high voltage electricity.

Large-Scale Soil Sampling and Geological Mapping at Solonópole Lithium Project

The large-scale infill soil sampling program that commenced in March 2023 continued over the project area (Figure 2). The optimized sampling grids are along 200m spaced lines with 25m sampling stations, aligned north south to cut across all typical pegmatite strike directions in this area.

As at 31 March 2024, over 10,300 soil samples had been collected from Solonópole and 8,741 soil samples had been analysed by X-Ray Fluorescence (XRF) for Lithium-Caesium-Tantalum (LCT) pathfinders, of which 1,908 soil samples have lab results validated by Oceana´s internal QA/QC. Anomalous lithium values above 100 ppm and up to 631 ppm were found in 383 soil samples within existing and new target areas.

Click here for the full ASX Release

This article includes content from Oceana Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

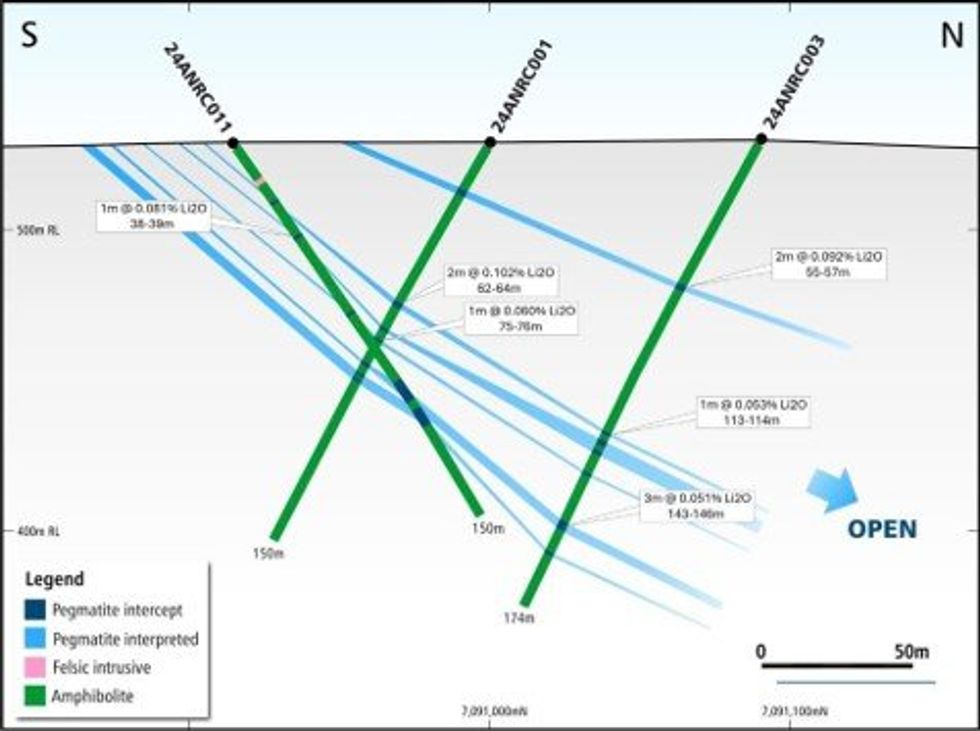

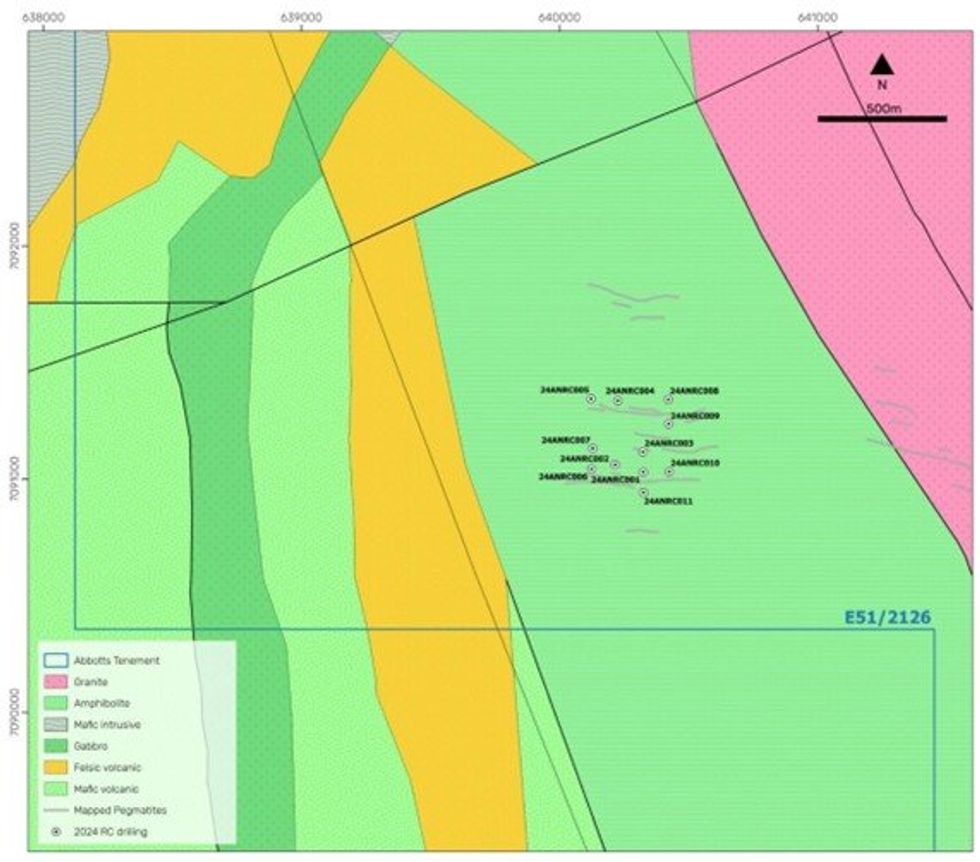

Results From First Drilling at Abbotts North Confirm LCT System

Premier1 Lithium Limited (ASX:PLC) (“Premier1” or the “Company”) advises that results have been received from the first drilling program at Abbotts North located 35km north of Meekatharra, Western Australia. The results show elevated lithium across the stacked pegmatites of up to 0.41% Li2O (24ANR007), confirming the continuation of the LCT system down depth and along strike.

HIGHLIGHTS

- Assay results from Abbotts North confirm continuation of LCT system

- Focus shifts to targets identified to the north and east of previous drilling

- Field work over these newly identified areas has commenced

- Premier1 is fully funded for second phase exploration in these areas

A total of 11 RC holes for 1,623m were drilled to test the main outcropping pegmatites at the Buttamiah Prospect. Additional studies of the outcropping pegmatites in the larger Buttamiah Prospect area including fractionation vectoring using K/Rb ratios suggest the core of the system to be located to the east of the previous drilling.

In addition, the data indicate that LCT pegmatites occur within the granites to the north of the drill area. Further mapping and sampling of pegmatites in these areas as well as over the remaining tenement package has commenced. Focus is to delineate drill targets of higher grades and greater thickness that have the potential to form a significant lithium deposit within the existing LCT system.

Premier1 is fully funded for any subsequent phase two drilling program.

Significant intercepts from RC drilling undertaken on the Abbotts North project in February 2024 are shown in Table 1a. Drill collar details are shown in Table 1b.

Click here for the full ASX Release

This article includes content from Premier1 Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Atlantic Lithium Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.