- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Drilling Commences At Thor ISR Uranium Project

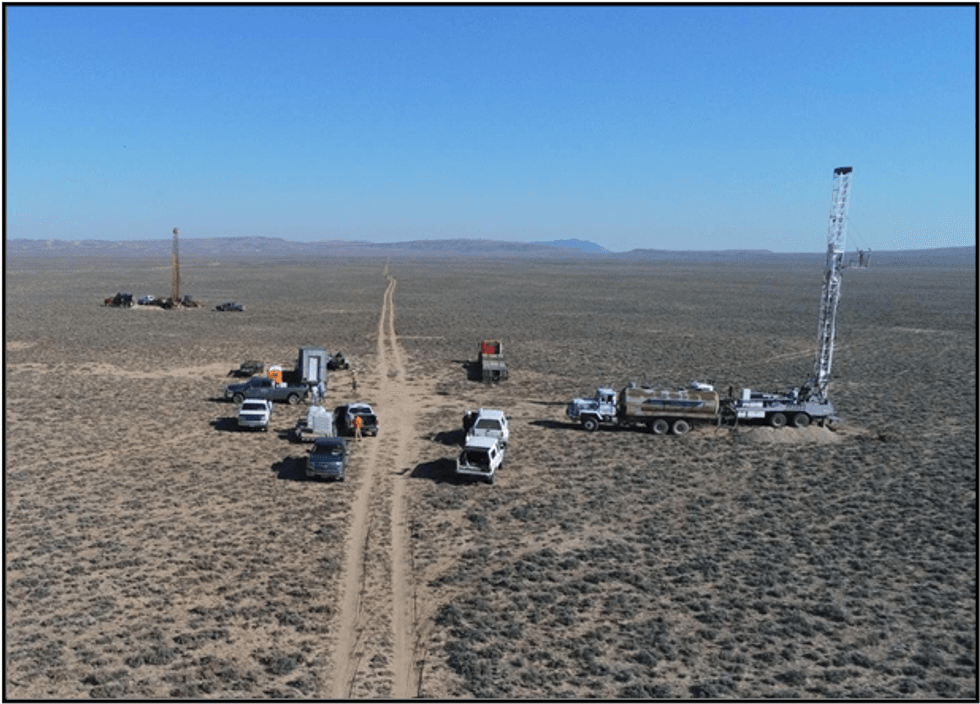

GTI Energy Ltd (GTI or Company) advises that two drill rigs have commenced drilling at the Thor ISR uranium prospect at its Great Divide Basin (GDB) project in Wyoming (Figure 1 & 2).

Highlights

- Two rigs have started drilling at GTI’s Thor ISR uranium prospect

- Drilling is targeting known roll fronts for ISR amenable uranium

- Four holes of ~70 planned holes have been completed to date at Thor

- After drilling at Thor, the rigs will move to Odin, Teebo, Loki & Wicket East

- First results expected within the next 2-3 weeks

- Entire 100,000 ft program expected to finish by the end of 2022

FIGURE 1. MUD ROTARY DRILL RIGS OPERATIONING, THOR ISR URANIUM PROSPECT, GDB WYOMING.

DRILLING AT THOR

Drilling has commenced at the Thor prospect, located adjacent to Ur-Energy Inc’s (URE) 18Mlb Lost Creek uranium deposit and operating ISR uranium processing plant2. Exploration at Thor to date identified mineralisation with economic potential based on widths, grades & depth of mineralisation (ASX release 29 March 2022)1. Four holes have been completed to date of the planned 70-hole (~40,000 ft) campaign to target extensions of 2 miles of mineralised roll front identified from drilling earlier this year. Drilling is focused in the north-east the project, including at the two state leases (Figure 2).

DRILLING AT WICKET EAST

Wicket East lies on the southern boundary of Ur-Energy’s Lost Soldier Deposit (Figure 2). Drilling of up to 20 holes (~20,000ft) at Wicket East seeks to explore a projected mineralised trend extending from the southern boundary of URE’s Lost Soldier property for ~3 miles. This mineralised trend is interpreted from historic drilling information similar to that used at Thor.

DRILLING AT ODIN, LOKI & TEEBO

Odin & Teebo are adjacent to Uranium Energy Corp’s (UEC) Antelope Project. Loki sits south of Antelope & north of URE’s Lost Creek. Drilling of ~40 holes (~40,000 ft) across all 3 prospects will explore ~5 miles of mineralised trends interpreted from the historic information used at Thor.

Click here for the full ASX Release

This article includes content from GTI Energy Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTI Energy Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

GTI Energy

Overview

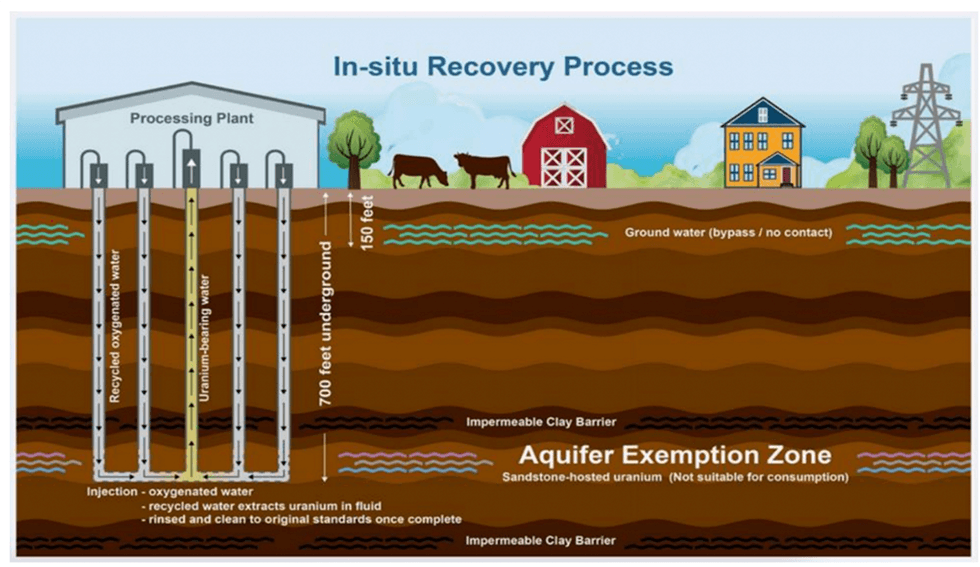

Wyoming has the largest uranium reserves of all the US states and is the home of in-situ recovery (ISR) uranium mining, with experimental ISR mining during the early 1960s and commercial ISR mining starting in 1974. The state is an energy powerhouse in the US, second only to Texas in energy production and accounting for more than 80 percent of the country’s uranium production. It has a production history that dates back to the late 1940s. With a soaring uranium price that passed $90 by the end of 2023, many analysts believe the price will remain on the higher end for years to come.

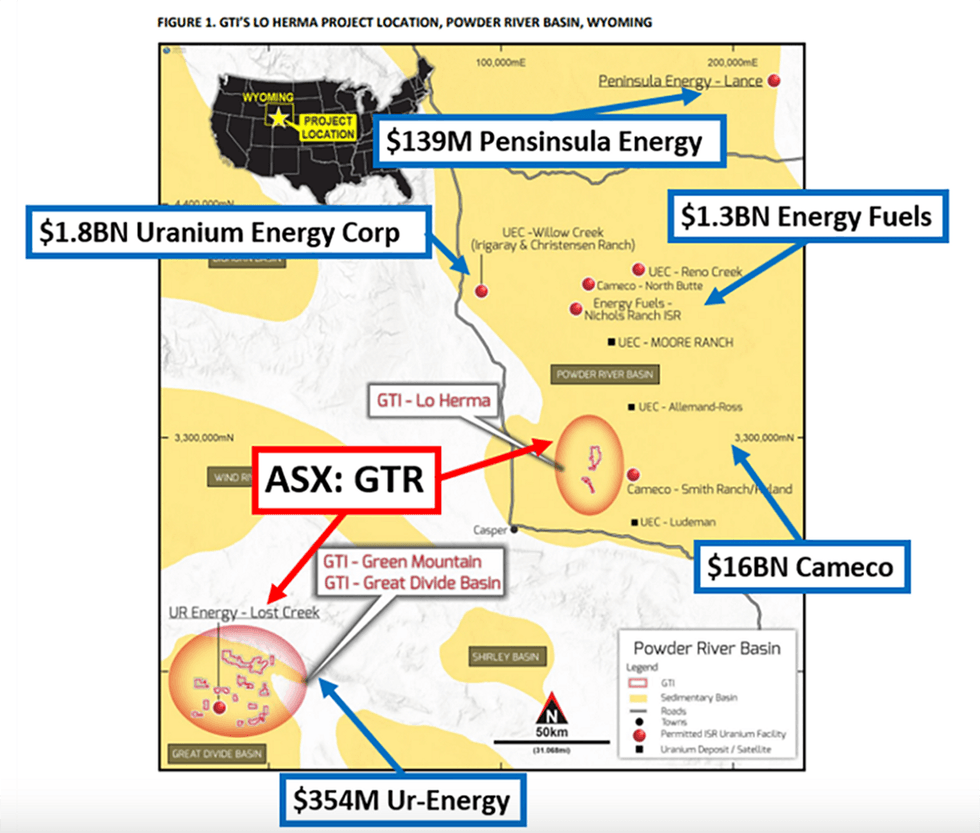

GTI Energy (ASX:GTR, OTCQB:GTRIF) is a mineral exploration company focused on developing a portfolio of attractive uranium projects in the United States. The company now boasts approximately 42,000 acres in the prolific Great Divide and Powder River Basins, which are low-cost ISR uranium-producing districts within 100 miles of each other.

In 2022, the company completed an additional 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Great Divide Basin to 7.5 miles.

The company has also commenced work at its Green Mountain ISR uranium project next to Rio Tinto’s (ASX:RIO) uranium deposits. GTI has historical drill data confirming the presence of uranium mineralised roll fronts on the properties.

The company is led by a highly experienced management and exploration team with an extensive track record in the mineral exploration industry. GTI’s operational team has proven development and engineering expertise with a history of success in ISR uranium deposit discovery in Wyoming.

GTI’s acquisition of Branka Minerals in November 2021 gave the company control of the largest non-US or Canadian-owned uranium exploration landholding in the Great Divide Basin, with approximately 19,500 acres. The landholding included underexplored and highly prospective sandstone-hosted uranium properties which are the company’s Wyoming projects today. This holding then grew with the purchase of the 13,800-acre Green Mountain project in 2022.

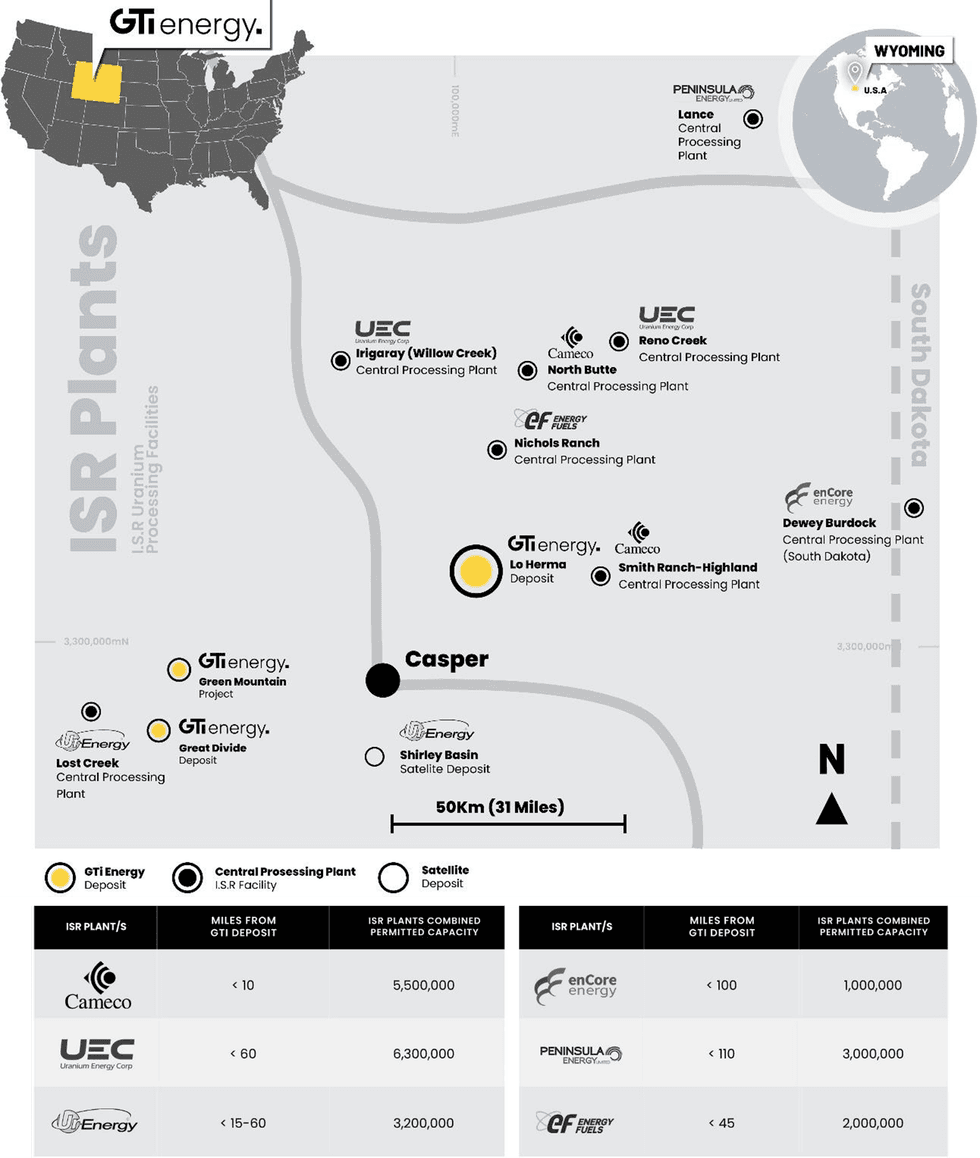

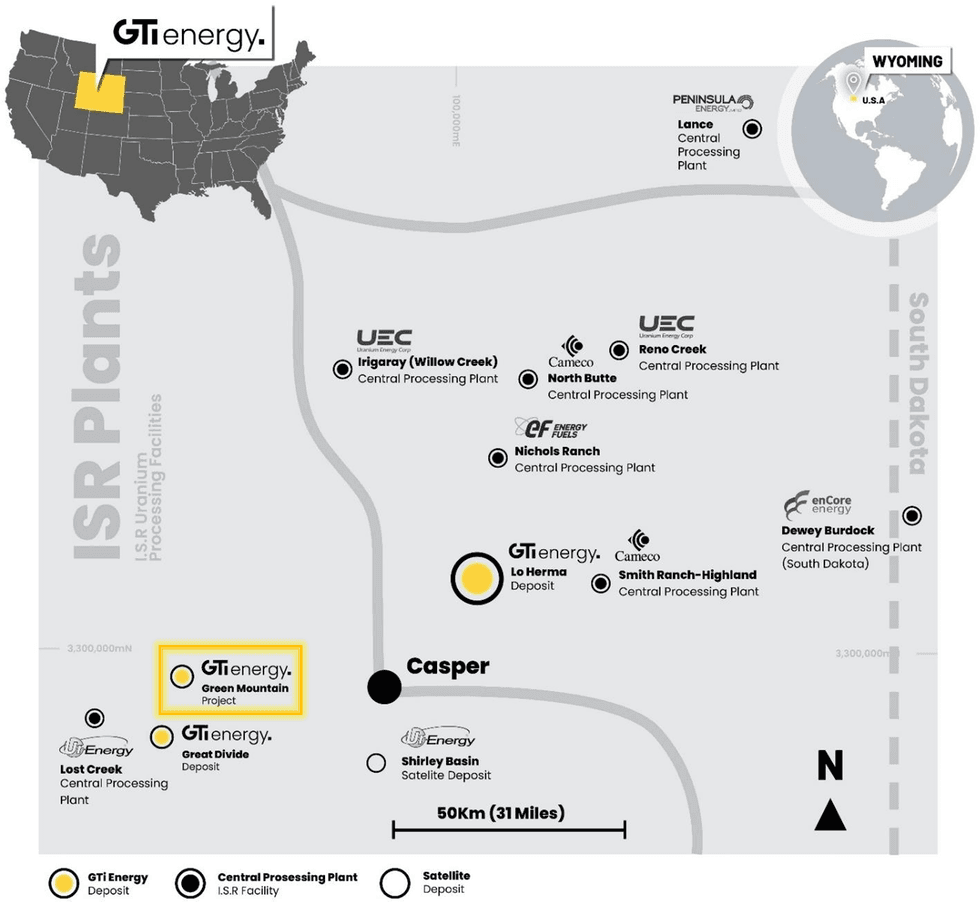

The company further expanded its ISR uranium portfolio in 2023 by acquiring the Lo Herma Project in Wyoming’s prolific Powder River Basin uranium district. The newly staked 13,300 acres of claims are located within 16 kilometers of Cameco’s Smith Ranch-Highland ISR uranium production plant – the largest production site in Wyoming

GTI Energy leverages the strategic positioning of its Wyoming projects, which are located near Ur Energy’s (TSX:URE,NYSE:URG) Lost Creek ISR production plant and the now-rehabilitated historic Rio Tinto Kennecott Sweetwater Mill. The Lost Creek plant is claimed by Ur Energy to be the lowest-cost ISR uranium production plant outside of Kazakhstan.

GTI is committed to strong environmental, social and governance (ESG) initiatives to support the clean energy transition. In November 2021, the company adopted an internationally recognized Environmental, Social and Governance Stakeholder Capitalism Metrics framework, with 21 core metrics and disclosures.

In December 2021, GTI Energy announced it would be transitioning to carbon-neutral operations. The company has subsequently received its carbon neutral certification for its Australian head office and US field operations, through the Australian Government’s Climate Active Program.

GTI Energy is positioned for growth with the pursuit of ISR mining on its Wyoming projects, presenting an opportunity for low operating expenses and capital expenditures with low environmental impact compared to conventional mining. ISR mining supports the company’s goal of low-impact mining and carbon neutrality on its Wyoming projects.

In 2021, the company completed field exploration on its Henry Mountains project in Utah. In the same year, GTI Energy also began a 15,000-meter drill program on its Wyoming projects, concluding the program in early 2022. The drilling confirmed that the targeted ISR-amenable uranium mineralization was present at the Thor project. In 2022, the company completed an additional 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Basin to 7.5 miles.

Company Highlights

- GTI Energy owns multiple promising assets in Wyoming’s prolific and in-situ recovery (ISR) uranium-producing Great Divide and Powder River Basins. Wyoming is the leading US uranium production state and is “uranium-friendly”.

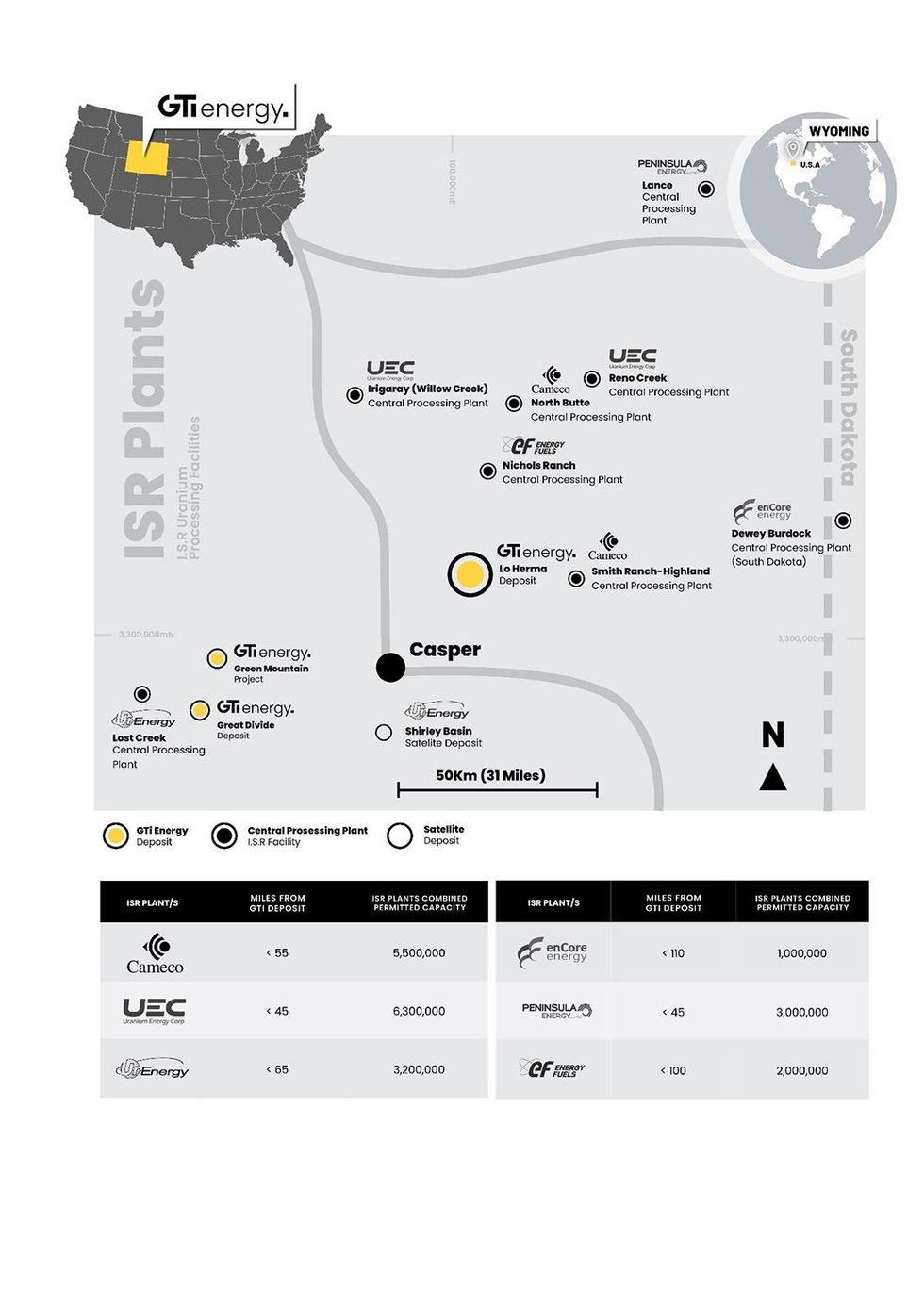

- GTI’s flagship Lo Herma project comprises 13,300 acres of ground in Wyoming within circa 16 kilometers of Cameco’s $16-billion ISR uranium plant (the largest permitted ISR production facility in Wyoming) and 80 kilometers of five permitted ISR uranium production facilities, including UEC’s Christensen Ranch (due to restart in August 2024) and Peninsula Energy’s (ASX:PEN) Lance Project (due to recommence production in late 2024).

- GTI’s Great Divide Basin projects are strategically located near Ur Energy’s (TSX:URE,NYSE:URG) Lost Creek ISR production plant which has re-commenced production.

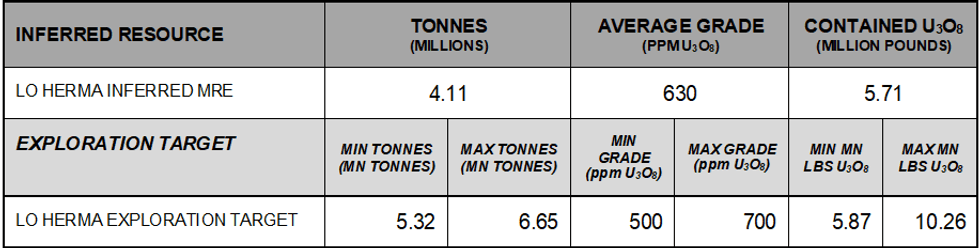

- Maiden uranium resource and updated exploration target at the Lo Herma ISR project delivered an inferred mineral resource estimate of 5.71 Mlbs uranium oxide at an average 630 ppm plus an exploration target of an additional 5.87 to 10.26 Mlbs potential at average grade of 500 to 700 ppm.

- Updated total resources across its Wyoming projects of 7.37 Mlbs plus an exploration target of an additional 11.97 to 19.79 Mlbs potential at average grade of 500 – 700 ppm.

- In early 2022, the company completed a further 103 mud rotary exploration drill holes to increase the total trend length for GTI’s projects in the Great Divide Basin to 7.5 miles.

- In late 2023, GTI completed 26 holes at Lo Herma to verify the historical data base & confirm exploration potential along trend & at depth.

- GTI acquired a 1,771 drill hole data set over Lo Herma with a replacement value of AU$15 million.

- GTI received its carbon neutral certification for its Australian head office and US field operations, through the Australian Government’s Climate Active Program.

- GTI aims to utilize ISR mining at its Wyoming projects, which offers lower environmental impact, lower opex and capex than conventional mining.

- GTI Energy has a highly experienced exploration team including the recent appointment of ISR specialist, Matt Hartmann, with a history of successful uranium discovery in Wyoming.

Key Projects

Wyoming Projects

The Wyoming projects are located in the Powder River & Great Divide Basins in Wyoming and the Henry Mountains (Colorado Plateau) Utah, United States. The Greta Divide Basin projects consist of the Thor, Logray, Loki, Odin, Teebo, Wicket and Green Mountain claims. The approximately 13,000 hectare group of projects is prospective for ISR-amenable sandstone-hosted roll-front uranium. The Wyoming projects are situated 5 to 30 kilometers from Ur-Energy’s Lost Creek ISR plant. The projects are also located near Rio Tinto’s Sweetwater/Kennecott Mill.

GTI Energy’s land holding in the Great Divide Basin was bolstered by the acquisition of the Green Mountain project comprising 5,585 hectares of contiguous ISR uranium exploration claims which abuts the Rio Tinto claims at Green Mountain. Historical drill data and geophysics confirms the presence of major uranium mineralisation at the projects.

Initial drilling at Lo Herma commenced in November 2023 and was completed in December with 26 drill holes successfully verifying the historical Lo Herma drill hole database. A drilling permit amendment is currently in progress aiming to optimise follow-up drilling, increase the total number of drill holes, and construct monitoring wells for groundwater data collection. Drilling is expected to resume by July 2024 with an enlarged program, and the mineral resource estimate and exploration targets are expected to be updated in the fourth quarter of 2024.

The company began initial exploration on Thor in 2021, and in 2022, it completed an additional 103 mud rotary exploration drill holes. The drilling of 70 holes was previously reported at the Thor prospect and an additional 33 holes combined have now been completed at the Odin, Teebo and Loki prospects. These 33 holes have discovered an additional combined 4.26 kilometers of ISR amenable uranium mineralised roll front trends increasing the total trend length for GTI’s projects in the Basin to 12.07 kilometers.

In February 2023, GTI Energy secured, by staking, approximately 3,500 hectares of unpatented mineral lode claims known as the Lo Herma project, about 16 kilometers from Cameco’s Smith Ranch-Highland ISR Uranium facility and Energy Fuels Nichols Ranch ISR plant. Lo Herma also lies within 97 kilometers of the companies leading the restart of uranium production in the USA, including Uranium Energy, Ur-Energy, Energy Fuels, Encore Energy and Peninsula Energy.

The company subsequently, secured a material historical data package for the project, which allowed GTI Energy to report a maiden uranium resource and exploration target update at the Lo Herma ISR project, including a cut-off grade of 200 parts per million (ppm) uranium oxide and a minimum grade thickness (GT) of 0.2 per mineralised horizon as 4.12 million tonnes of mineralisation at an average grade of 630 ppm uranium oxide for 5.71 million pounds (Mlbs) of uranium oxide contained metal. The inferred mineral resource estimate is 5.71 Mlbs uranium oxide at an average of 630 ppm.

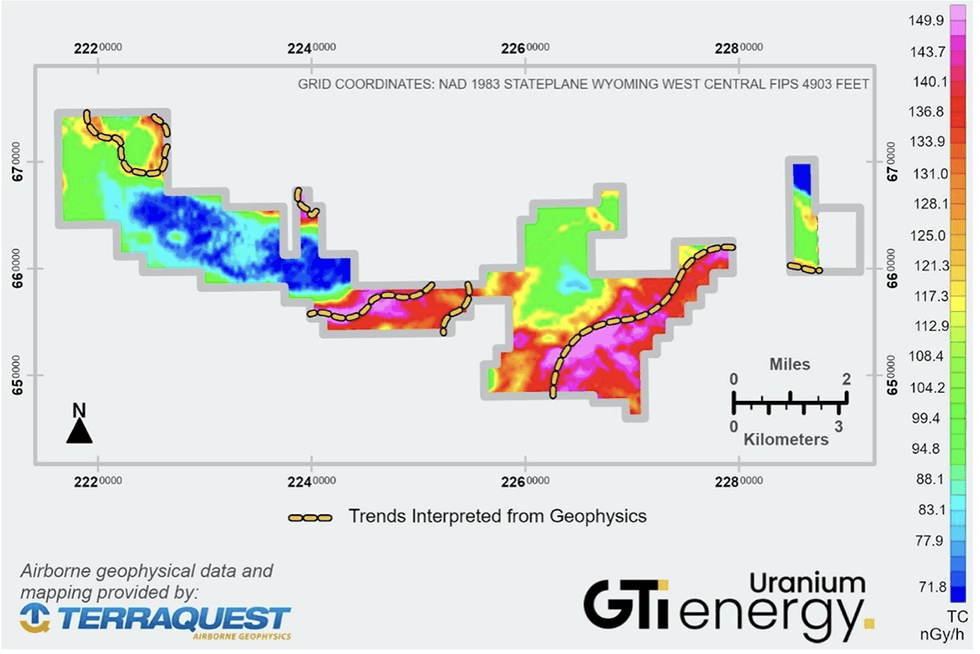

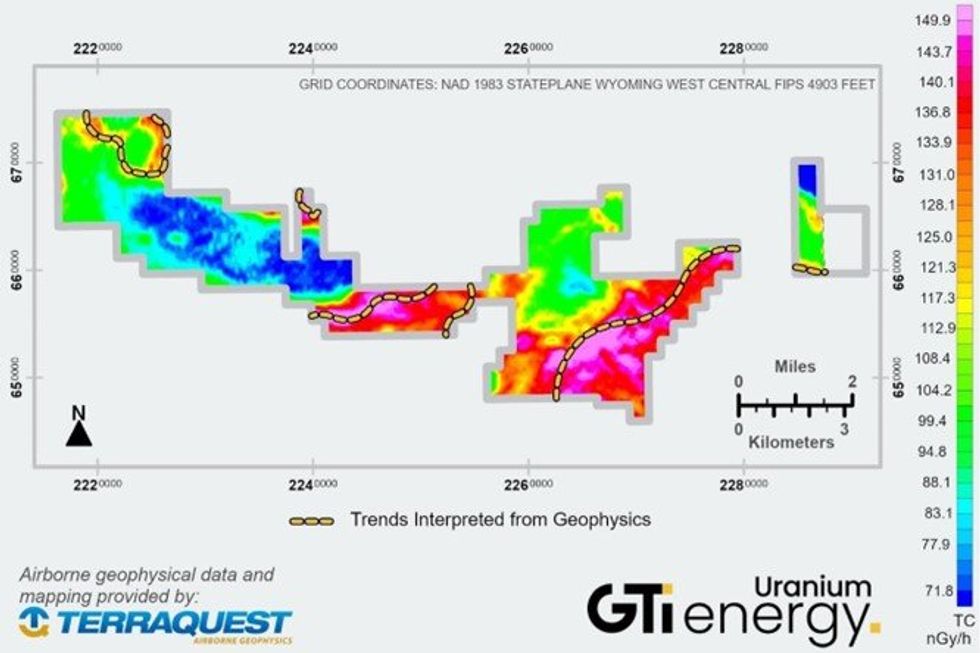

The company also completed collection of aerial geophysical data at its Lo Herma, Green Mountain and Loki West ISR uranium exploration projects in Wyoming. The survey was conducted using a twin-engine aircraft loaded with a suite of sensors that provide detailed radiometric, magnetic and electromagnetic data, allowing for correlation between the three products.

The airborne geophysical survey at its Green Mountain project consequently updated its drill plan with 16 potential drill holes. The permit application process is underway for the 2024 drill program which aims to test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted mineralised regions as determined from the airborne geophysical survey.

Henry Mountains Uranium Project

GTI’s uranium/vanadium projects in Utah are considered suitable for conventional mining and are located on the east flank of the Henry Mountains, covering 3,860 acres. The permits host historical production, open underground workings and have an exploration permit in place. The projects saw significant work from 2019 to 2021 including two drill programs totaling 52 drill holes and geophysical logging of an additional 76 historical drill holes. GTI subsequently elected to prioritise work at its newly acquired Wyoming ISR projects until such time as activity and investment in the region improves. The company’s projects lie within ~100 miles of Energy Fuels’ (NYSE American: UUUU) (TSX: EFR) White Mesa Mill and within a few miles of Anfield Energy’s (TSX.V: AEC) Shootaring (Ticaboo) mill site. The owners of both of these mills are actively pursuing mill re-starts.

In addition, Western Uranium & Vanadium (CSE:WUC) (OTCQX:WSTRF) has announced the purchase of a mill site in Green River Utah and work to design and permit the facility for processing uranium and vanadium. The plant, which will be located ~80 miles from GTI’s projects, is intended to process feed from Western's recently restarted Sunday Mine Complex over 160 miles away. Western advised of a mine operations restart at Sunday in February 2024. Western stated its new "mineral processing plant" will recover uranium, vanadium and cobalt from ore from Western's mines and that produced by other miners. Western said, on February 13, 2024, it expects the plant to be licensed and constructed for annual production of 1 million pounds U3O8 and 6 million pounds of V2O5, with initial production in 2025.

Based on the renewed interest in exploration, mining, and processing of uranium ore in this region, GTI is currently evaluating potential paths for further exploration, resource development, or other value creating activities with its Utah projects.

Management Team

Nathan Lude - Non-executive Chairman

Nathan Lude has broad experience working in the asset and fund management, mining, and energy industries. Lude is the founding director of Advantage Management, a corporate advisory firm. Lude has previously held directorships with ASX-listed mining companies.

Currently, he is the executive director of ASX-listed Hartshead Resources (ASX:ANA). Lude has grown a large business network across Australia and Asia, establishing strong ties with Australian broking firms, institutions, and Asian investors.

Bruce Lane - Executive Director

Bruce Lane has significant experience with ASX-listed and large industrial companies. Lane has held management positions in many global blue-chip companies as well as resource companies and startups in New Zealand, Europe and Australia. He holds a master’s degree from London Business School and is a graduate member of the Australian Institute of Company Directors. Lane has led a number of successful acquisitions, fund raising and exploration programs of uranium and other minerals projects during the last 15 years most notably with ASX listed companies Atom Energy Ltd & Stonehenge Metals Ltd & Fenix Resources Ltd (FEX).

James (Jim) Baughman - Executive Director

James Baughman is a highly experienced Wyoming uranium geologist and corporate executive who will help guide the company’s technical and commercial activities in the US. Baughman is the former president and CEO of High Plains Uranium (sold for US$55 million in 2006 to Uranium One) and Cyclone Uranium.

Baughman has more than 30 years of experience advancing minerals projects from grassroots to advanced stage. He has held senior positions (i.e., chief geologist, chairman, president, acting CFO, COO) in private and publicly traded mining & mineral exploration companies during his 30-year career.

He is a registered member of the Society of Mining, Metallurgy, Exploration and a member of the Society of Economic Geologists with a BSc in geology (1983 University of Wyoming) and is a registered professional geologist (P. Geo State of Wyoming). Baughman is a registered member of the Society of Mining, Metallurgy, and Exploration (SME) and a qualified person (QP) on the Toronto Stock Exchange (TSX) and Australian Stock Exchange (ASX).

Petar Tomasevic - Non-executive Director

Petar Tomasevic is the managing director of Vert Capital, a financial services company specializing in mineral acquisition and asset implementation. He has worked with several ASX-listed companies in marketing and investor relations roles. Tomasevic is fluent in five languages. He is currently appointed as a French and Balkans language specialist to assist in project evaluation for ASX-listed junior explorers. Most recently, he was a director at Fenix Resources (ASX:FEX), which is now moving into the production phase. He was involved in the company’s restructuring when it was known as Emergent Resources. Tomasevic was also involved in the company’s Iron Ridge asset acquisition, the RTO financing, and the development phase of Fenix’s Iron Ridge project.

Matt Hartmann - President of US Operations

Matt Hartmann is an executive and technical leader with more than 20 years of international experience and substantial uranium exploration and project development experience. He first entered into the uranium mining space in 2005 and followed a career path that has included senior technical roles with Strathmore Minerals and Uranium Resources. He is also a former principal consultant at SRK Consulting where he provided advisory services to explorers, producers and prospective uranium investors. Hartmann’s ISR uranium experience has brought him through the entire cycle of the business, from exploration, project studies and development, to production and well field reclamation. He has provided technical and managerial expertise to a large number of uranium ISR projects across the US including, Smith Ranch – Highland ISR Uranium Mine (Cameco), Rosita ISR Uranium Central Processing Plant and Wellfield (currently held by enCore Energy), the Churchrock ISR Uranium project (currently held by Laramide Resources), and the Dewey-Burdock ISR Uranium project (currently held by enCore Energy).

Matthew Foy - Company Secretary

Matthew Foy is an active member of the WA State Governance Council of the Governance Institute Australia. Foy has more than 14 years of experience in facilitating ASX-listing rule compliance. His core competencies are in the secretarial, operational, and governance disciplines for publicly listed companies. Foy has a working knowledge of the Australian Securities and Investments Commission and Australia Stock Exchange reporting. He has document drafting skills that provide the basis for valuable contributions to the boards on which he serves.

Activity Update – Lo Herma & Green Mountain Drill Permitting on Track

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that planning for the 2024 field season in Wyoming has progressed well and permitting is on track to facilitate drilling during Q3.

Highlights

- Lo Herma drilling permit amendment in progress to optimise follow-up drilling, increase total number of drill holes, and construct monitoring wells for groundwater data collection – drilling is scheduled for Q3 2024

- Lo Herma Mineral Resource Estimate & Exploration Target to be updated in Q4 2024

- Green Mountain maiden drilling planned for 2024 with permitting underway

- Utah uranium/vanadium projects under evaluation to determine potential paths for renewed exploration, resource development or other value creating activities

LO HERMA PROJECT: 2024 DRILLING PERMIT AMENDMENT

42 drill holes remain permitted and undrilled at Lo Herma, however a review of the drilling conducted during December 2023 has helped the Company to refine and expand the planned 2024 drilling program to include 71 drill hole locations and construction of up to 5 groundwater monitoring wells. This next phase of exploration at Lo Herma will be focused on expanding the resource areas and where possible, upgrading the current mineral resource classification. Collection of important data including, hydrogeologic parameters of the mineralised aquifers and collection of rock core samples for metallurgical testing will be also prioritised.

GTI intends to mobilise drilling rigs to Lo Herma as soon as the activity is fully permitted, and environmental clearances are finalised. At this time, GTI anticipates that drilling will commence at Lo Herma during July 2024.

Following completion of the 2024 drill program at Lo Herma, GTI intends to publish an updated mineral resource estimate and exploration target range for the project. The Company expects that the updated mineral resource estimate will support near-term development of a Scoping Study to demonstrate the economic potential of the project.

The most recent drill results from Lo Herma and a summary of the project geology can be found in the Company’s 20 December 2023 news release.

GREEN MOUNTAIN PROJECT: DRILLING PERMIT

As previously advised on 21 November 2023, the Company completed an airborne geophysical survey at its Green Mountain Project to help refine a previously planned (but not permitted) drilling program. The now updated drilling plan includes 16 potential drill holes targeting 12 Miles of anomalous radiometric signature (Figure 1) which has been correlated with historical Kerr McGee drill holes maps.

A conceptual universe of 50 drill holes was initially developed with specific drill hole locations and access routes selected in consideration of site-specific topography and environmental considerations – the GTI technical team has now finalised this drill plan, selecting 16 drill holes that will be permitted for the 2024 drilling season should funding and weather conditions allow. The planned drill program will test the validity of the historical Kerr McGee drill hole maps, as well as the interpreted mineralised regions as determined from the airborne geophysical survey.

A “Class I Cultural Resource Report” and site Environmental Review have been completed with both of these studies incorporated into the planning of the drill program. Final on-site review of access will be completed as weather allows after which the Company will file the Drilling Notification. GTI will make a final decision to proceed once reclamation bonding is approved by Wyoming’s DEQ & the Federal BLM.

GREEN MOUNTAIN PROJECT: GEOLOGIC SETTING AND MINERALISATION

The Green Mountain Project is located along the northeastern flank of the Great Divide Basin (GDB). The GDB consists of up to 25,000 feet of Mesozoic to Quaternary sediments and along with the Washaki Basin to the southwest, comprise the greater Green River Basin which occupies much of southwestern Wyoming. The Great Divide basin is structurally bounded by uplifted and fault displaced Precambrian rocks, creating an internally drained and isolated hydrogeologic basin.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTI Activities Report, December Quarter 2023

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to report on its activities during the December quarter.

- Initial 26-hole drilling program completed on time & on budget at Lo Herma

- Results verified the historical Lo Herma drill hole database

- Lo Herma exploration potential confirmed along trend in the Wasatch Formation and at depth in the Fort Union Formation

- 28 new claims staked at Lo Herma show promising exploration potential in the deeper Fort Union Formation which Cameco produces from ~10 miles east.

- Positive results from airborne Magnetic & Radiometric Survey at Green Mountain

- 12 miles (19km) of anomalous uranium trends interpreted from airborne survey

- 6 prominent uranium anomalies identified across the Green Mountain Project

- 28 additional claims staked at Green Mountain, based on results of the geophysical surveys, bringing the total holdings to 697 claims for ~14,000 acres

- Matt Hartmann appointed President US Operations with over 20 years of global mineral exploration, project development & commercial experience with significant track record in ISR uranium through the entire project life-cycle

- Planning underway for 2024 expanded drill program at Lo Herma

During the quarter the Company advised that the initial drilling program had been completed at its 100% owned Lo Herma ISR Uranium Project (Lo Herma), located in Wyoming’s prolific Powder River Basin (Figures 1 & 2). Twenty-six (26) drillholes were advanced, totalling 4,250m (14,000 ft), with operations finalised on 11 December 2023 having been completed on time and on budget.

This initial drill program successfully validated the historical data package, used in preparing the Mineral Resource Estimate (MRE) for Lo Herma, through comparative analysis of stratigraphy & mineralised intercepts from new drill holes collocated with historical drill holes. Additional drill hole locations tested extensions of known mineralised trends and informed on redox conditions across several host sands to help refine and develop an expanded drill program planned at Lo Herma for 2024. These exploration holes confirmed the previously interpreted exploration potential at Lo Herma.

In addition, the Lo Herma land package was expanded through staking of 28 additional claims in December to cover extensions of interpreted trends as defined by the acquired historical data package. The historical data package includes several drill holes within the 28 new claims which contain mineralisation in a deeper Fort Union formation host sand. GTI is currently evaluating how the new claims and data impact the exploration target for the property and 2024 drill plans.

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and within ~60 miles of five (5) permitted ISR uranium production facilities. Facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities & Energy Fuels Nichols Ranch ISR plant. The PRB has extensive ISR production history with numerous ISR uranium resources, central processing plants (CPP) & satellite deposits (Figure 1).

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

President of US Operations Appointed

GTI Energy Ltd (ASX: GTR) (GTI or Company) is delighted to advise that experienced Denver based ISR uranium technical and executive leader, Mr Matt Hartmann has joined GTI in the role of President US Operations, to oversee the Company’s technical and commercial activities in the US.

Highlights

- 20+ years of global mineral exploration, project development & commercial experience, incl a significant track record in ISR uranium through the entire project life cycle

- Uranium experience includes senior technical roles with Uranium Resources Inc. and Strathmore Minerals Corp, and industry consultant as a Principal with SRK. Most recently he was V.P. Technical Services for Sweetwater Royalties LLC, the largest private landowner in Wyoming

- Previously provided technical & managerial expertise to several ISR uranium projects including, Cameco’s Smith Ranch–Highland, Encore’s Rosita central processing plant & wellfield, Laramide’s Churchrock and Encore’s Dewey-Burdock

- Matt adds increased commercial & technical leadership of GTI’s interests in the US which will allow the company to more aggressively pursue its project development and commercialisation plans including strategic partnership opportunities

Matt Hartmann commented“I’m excited to be joining GTI to lead the company’s US operations. Activity in the uranium sector has increased significantly over the past year and the US is poised to return to meaningful uranium production in the near-term. GTI’s projects are extremely well located within 100 miles of 7 permitted ISR uranium facilities in Wyoming which is a very supportive state with a long history of uranium production. Over the past three years GTI has established itself in Wyoming and has assembled a portfolio of compelling uranium projects that would suggest the company is undervalued in the current US$100 per pound uranium market. I look forward to further developing GTI’s assets in the US & advancing the Lo Herma project towards a preliminary economic assessment.”

GTI Executive Director & CEO Bruce Lane commented“We are very pleased that Matt has agreed to join the team after having worked with us in the past. Matts skills and experience, particularly with ISR uranium in Wyoming, are a great fit for GTI as we look to accelerate the growth and development of our Wyoming ISR uranium resources. I have no doubt that Matt’s experience, skills and network in both the technical and commercial arenas will contribute very positively to our efforts to grow GTI into a significant US uranium company.”

MATT HARTMANN – EXPERIENCE SUMMARY

Mr. Hartmann is an executive and technical leader with 20+ years of international experience and substantial uranium exploration and project development experience. He first entered into the uranium mining space in 2005, and followed a career path that has included senior technical roles with Strathmore Minerals Corp. and Uranium Resources Inc. He is also a former Principal Consultant at SRK Consulting where he provided advisory services to explorers, producers & prospective uranium investors.

Mr. Hartmann’s ISR uranium experience has brought him through the entire cycle of the business, from exploration, project studies and development, through production and well field reclamation. He has provided technical and managerial expertise to a large number of uranium ISR projects across the US including, Smith Ranch – Highland ISR Uranium Mine (Cameco), Rosita ISR Uranium Central Processing Plant and Wellfield (currently held by enCore Energy), the Churchrock ISR Uranium Project (currently held by Laramide Resources), and the Dewey-Burdock ISR Uranium Project (currently held by enCore Energy).

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Drilling Successfully Verifies Historical Data & Confirms Exploration Potential at Lo Herma ISR Uranium Project

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise that the initial drilling program has been completed at its 100% owned Lo Herma ISR Uranium Project (Lo Herma), located in Wyoming’s prolific Powder River Basin (Figures 1 & 2). Twenty-six (26) drillholes were advanced, totalling 4,250m (14,000 ft), with operations finalised on 11 December 2023.

- Initial 26-hole drilling program completed on time & on budget at Lo Herma

- Results have successfully verified the historical Lo Herma drill hole database

- Exploration potential confirmed along trend in the Wasatch Formation and at depth in the Fort Union Formation

- New claims staked at Lo Herma show promising exploration potential in the deeper Fort Union Formation which Cameco produces from ~10 miles east.

- Planning in progress for expanded 2024 drill program targeting resource expansion, upgrade of current resource classification & hydrogeologic data collection

This initial drill program successfully validated the historical data package, used in preparing the Mineral Resource Estimate (MRE) for Lo Herma, through comparative analysis of stratigraphy & mineralised intercepts from new drill holes collocated with historical drill holes. Additional drill hole locations tested extensions of known mineralised trends and informed on redox conditions across several host sands to help refine and develop an expanded drill program planned at Lo Herma for 2024. These exploration holes confirmed the previously interpreted exploration potential at Lo Herma.

In addition, the Lo Herma land package was expanded through staking of 28 additional claims in December to cover extensions of interpreted trends as defined by the acquired historical data package. The historical data package includes several drill holes within the 28 new claims which contain mineralisation in a deeper Fort Union formation host sand. GTI is currently evaluating how the new claims and data impact the exploration target for the property and 2024 drill plans.

GTI Executive Director & CEO Bruce Lane commented“We are very pleased that initial drilling has successfully verified the large body of historical data used to prepare the Lo Herma JORC inferred resource. In addition, the drilling confirmed exploration potential along trend in the Wasatch formation and at depth in the Fort Union formation. The program was completed on time & budget with the data generated to be used to refine follow-up drilling in 2024. The drilling in 2024 is expected to upgrade the category of portions of the mineral resource & ultimately support a preliminary economic assessment for the project.”

LO HERMA URANIUM PROJECT – LOCATION & BACKGROUND

The Lo Herma ISR Uranium Project (Lo Herma) is located in Converse County, Powder River Basin (PRB), Wyoming (WY). The Project lies approximately 15 miles north of the town of Glenrock and close to seven (7) permitted ISR uranium production facilities. These facilities include UEC’s Willow Creek (Irigaray & Christensen Ranch) & Reno Creek ISR plants, Cameco’s Smith Ranch-Highland ISR facilities and Energy Fuels Nichols Ranch ISR plant (Figure 1). The Powder River Basin has extensive ISR uranium production history with numerous defined ISR uranium resources, central processing plants (CPP) & satellite deposits (Figure 1). The Powder River Basin has been the backbone of Wyoming U3O8 production since the 1970s.

As reported to ASX on 14 March 2023, a comprehensive historical data package, with an estimated replacement value of ~$15m, was purchased for the Lo Herma project in March of 2023. The data package includes original drill data for roughly 1,771 drill holes, from the 1970’s and 1980’s, pertaining to the Lo Herma region.

A total of 1,391 original drill hole logs were digitised for gamma count per second (CPS) data and converted to eU3O8% grades. 833 of these drill holes were located on GTI’s land position & used to prepare the MRE. 21 additional drill holes are located in the newly claimed area in Section 4 of Township 36N, Range 75W. Along with the 26 drill holes completed in this initial program, GTI now holds data from 880 drill holes within the current Lo Herma mineral holdings.

An initial Exploration Target for the Lo Herma project was previously announced to the ASX on 4 April 2023. An additional data package containing previously unavailable drill maps with geologically interpreted redox trends was subsequently secured by GTI as announced to the ASX on 27 June 2023 (refer to Table 1). Additional redox trends can now be interpolated based on the recent drilling and acquisition of the newly located mineral claims, however the Exploration Target has not been updated. GTI plans to update the mineral resource and exploration target estimates following execution of planned & permitted drilling during 2024.

DRILLING RESULTS

The initial drilling program was completed 11 December 2023, with 26 mud rotary drill holes totalling 4,250m (14,000 ft). The drill targets were designed for verification of the historical drilling data, to test extensions of the mineralised redox trends, and explore the stratigraphic and oxidation conditions of the host sands in underexplored portions of the Lo Herma property.

Of 26 holes drilled, 6 holes met the minimum grade cutoff of 200 ppm eU3O8 & the total hole grade-thickness (GT) target of minimum 0.2 GT. Two drill holes met the minimum grade cutoff, but not the minimum GT. Fourteen (14) drill holes demonstrated trace mineralization but did not meet the grade cutoff. Four (4) drill holes were barren of any indication of mineralization. The best mineralized intercept was encountered in hole LH-23-006, with 19.0 feet with an average of 390 ppm eU3O8 for a total intercept grade-thickness of 0.741. The highest-grade intercept was encountered in hole LH-23-025, with 3.5 feet with an average of 800 ppm eU3O8, containing an internal 0.5 ft (~15 cm) interval of 1,890 ppm eU3O8.

Uranium assay values were obtained by probing the drill holes with a wireline geophysical sonde which includes a calibrated gamma detector, spontaneous potential, resistivity, and downhole drift detectors. The gamma detector senses natural gamma radiation emanations from the rock formations intercepted by the drill hole. The gamma levels are recorded on the geophysical logs. Using calibration, correction, and conversion factors, the measured gamma radiation is converted to an equivalent uranium ore grade (eU3O8) and compiled into uranium intercepts based on a minimum cutoff grade of 200 ppm eU3O8 in half-foot intervals. This is the industry standard method for uranium exploration in the US and is discussed in further detail in the JORC tables. The reader is cautioned that the reported uranium grades may not reflect actual uranium concentrations due to the potential for disequilibrium between uranium and its gamma emitting daughter products.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Green Mountain Geophysics Reveals 12 Miles of New Radiometric Anomalies Indicative of Uranium Trends

GTI Energy Ltd (ASX: GTR) (GTI or Company) is pleased to advise of positive results from the recently completed airborne radiometric and magnetic survey completed at its 100% owned Green Mountain Project (Project) located in Wyoming’s prolific Crooks Gap/Green Mountain/Great Divide Basin uranium production district.

- Positive results from recent airborne Magnetic & Radiometric Survey

- 12 miles (19km) of anomalous uranium trends interpreted from airborne survey

- 6 prominent uranium anomalies were identified across the Project

- Anomalies correlate with historically identified drill holes, interpreted trends, areas of past mining and/or known mineralisation

- 28 additional claims staked, based on results of the geophysical surveys, bringing the total holdings to 697 mining claims comprising circa 14,000 acres

- Next steps: Planning & permitting for follow up drilling

GTI Executive Director Bruce Lane commented“The aerial geophysical survey has provided us with clear direction as to where to drill at Green Mountain. We have been able to utilise the historical drilling and geological information completed by Kerr McGee Corporation, Wold Nuclear and others during the 1970’s and 1980’s to help interpret and extrapolate significant additional anomalous uranium trends, particularly within the eastern part of the extensive Green Mountain land position. The land package is surrounded by significant uranium deposits and resources owned by Rio Tinto, Energy Fuels, Ur Energy & UEC, so we know we are in an area with real potential. Our next step is to progress work on refining drill targets and permitting”.

GTI’s 100% owned Green Mountain ISR Uranium Project (Green Mountain) is located in Sweetwater County, Great Divide Basin (GDB), Wyoming (WY) within a few miles of GTI’s Great Divide Basin projects and within 60 miles of GTI’s Lo Herma project in Wyoming’s Powder River Basin (Figure 1).

GTI’s Green Mountain Project covers ~14,000 acres (~5,665 hectares) of underexplored mineral lode claims (Claims) and benefits from historical Kerr McGee uranium drilling data and oil-well exploration drill logs which confirm the presence of roll fronts within the Battle Springs formation which hosts neighbouring major uranium deposits.

The Properties are located in the neighbourhood of Energy Fuel’s (EFR) 30Mlb Sheep Mountain deposit, Ur-Energy’s (URE) 14Mlb Lost Soldier ISR deposit, UEC’s (UEC) Antelope deposit & Rio Tinto’s (RIO) Big Eagle (past producing), Jackpot, Desert View, Phase II, & Willow Creek deposits (Figure 2). The Claims lie south of Green Mountain, ~5kms from GTI’s existing Odin claim group & within 15km of GTI’s Thor project where two successful drill programs were completed during 2022.

Click here for the full ASX Release

This article includes content from GTI Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

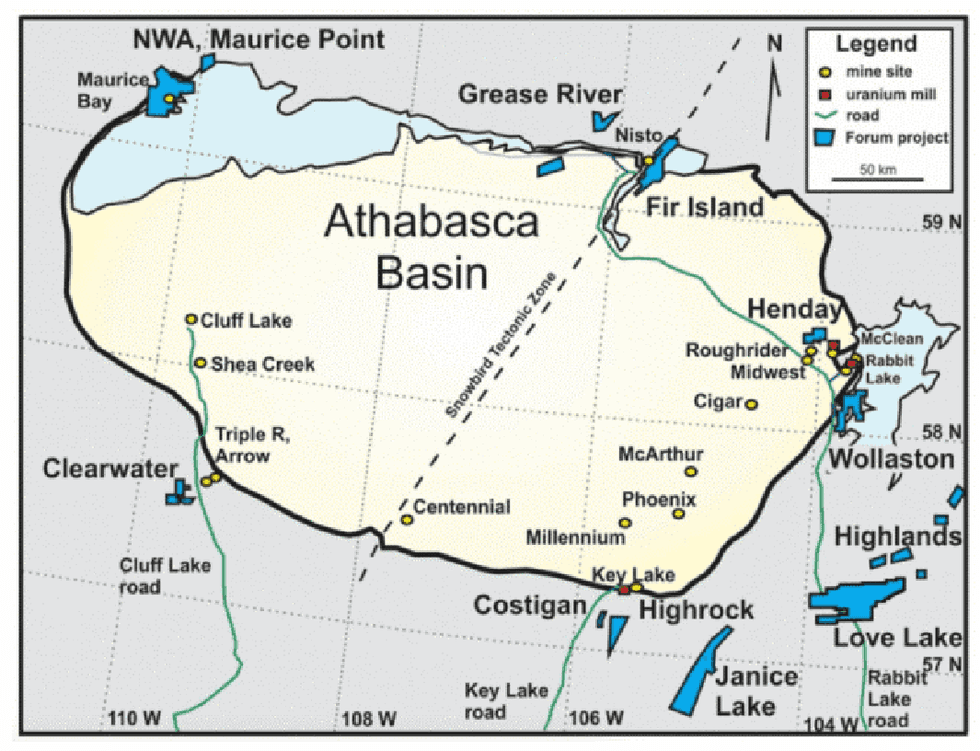

Forum Energy Metals

Overview

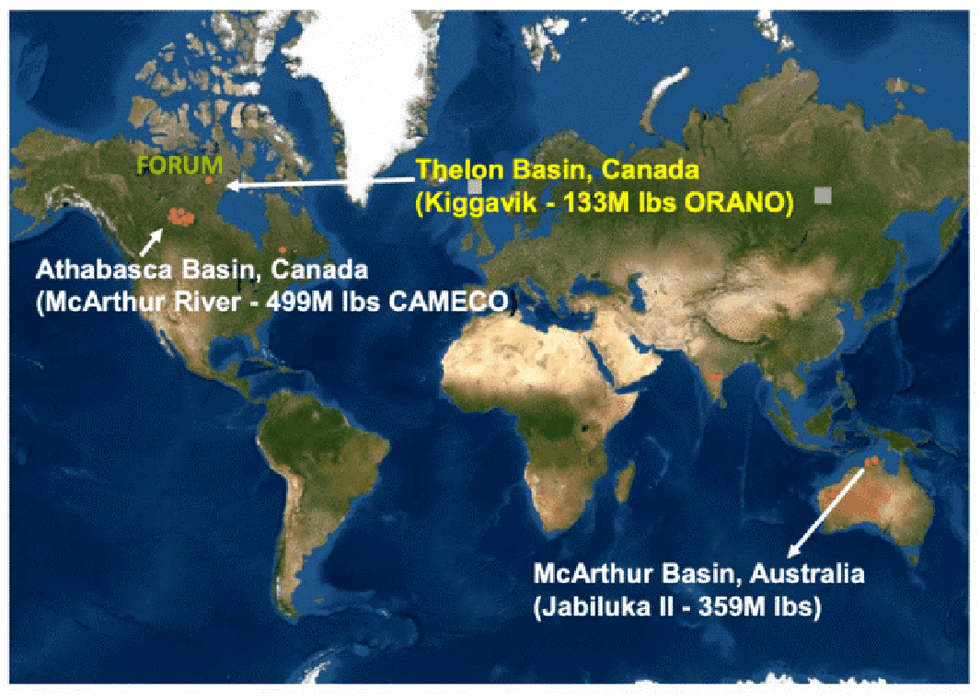

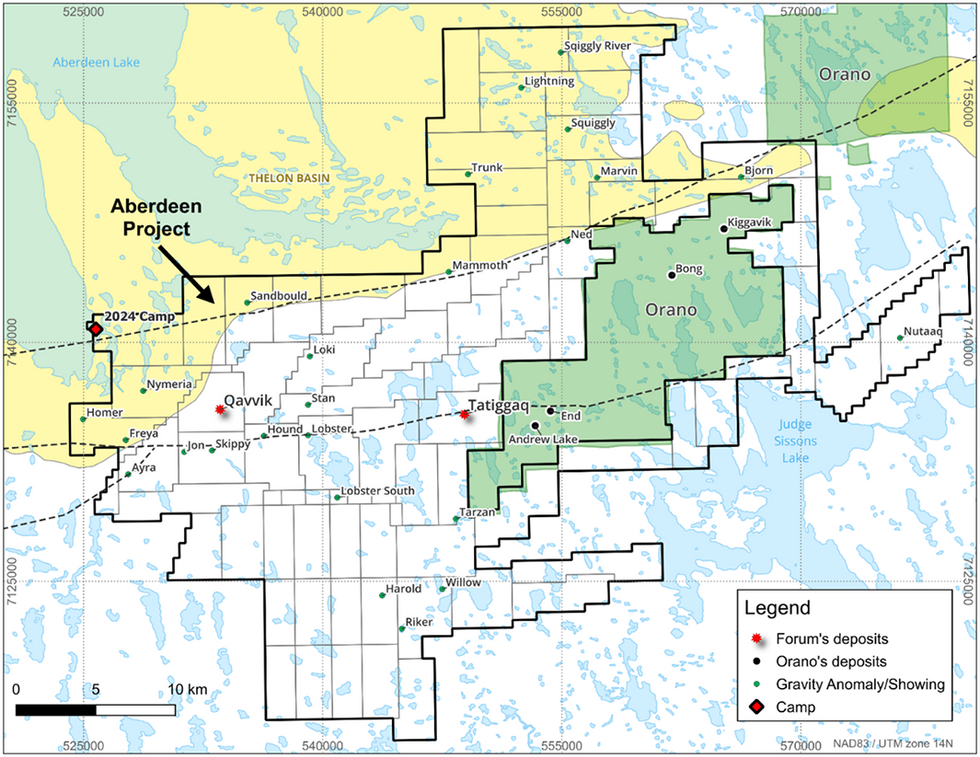

Forum Energy Metals (TSXV: FMC, OTCQB: FDCFF) is an established uranium explorer searching for high-grade deposits in Saskatchewan’s Athabasca Basin and Nunavut’s Thelon Basin. In 2024, the company’s primary focus will be to continue exploring the Aberdeen project in Nunavut, where successful drilling confirmed and expanded high-grade uranium mineralization over significant widths. Nunavut’s underexplored Thelon Basin may be the most prospective region for discovering new, high-grade uranium deposits outside Saskatchewan. With a strong local and regional presence in Saskatchewan, Forum took advantage of weak metals markets to broaden its commodity exposure by adding a diverse portfolio of energy metals exploration projects in the copper, cobalt and nickel space.

Company Highlights

Saskatchewan (Athabasca Basin) and Nunavut (Thelon Basin) Uranium Projects

- Aberdeen Uranium Project (Thelon Basin-Nunavut): Athabasca Basin 2.0?

The Thelon Basin may be the most prospective region in the world for discovering new high-grade uranium deposits outside Saskatchewan’s Athabasca Basin. Both basins exhibit similar geological characteristics.

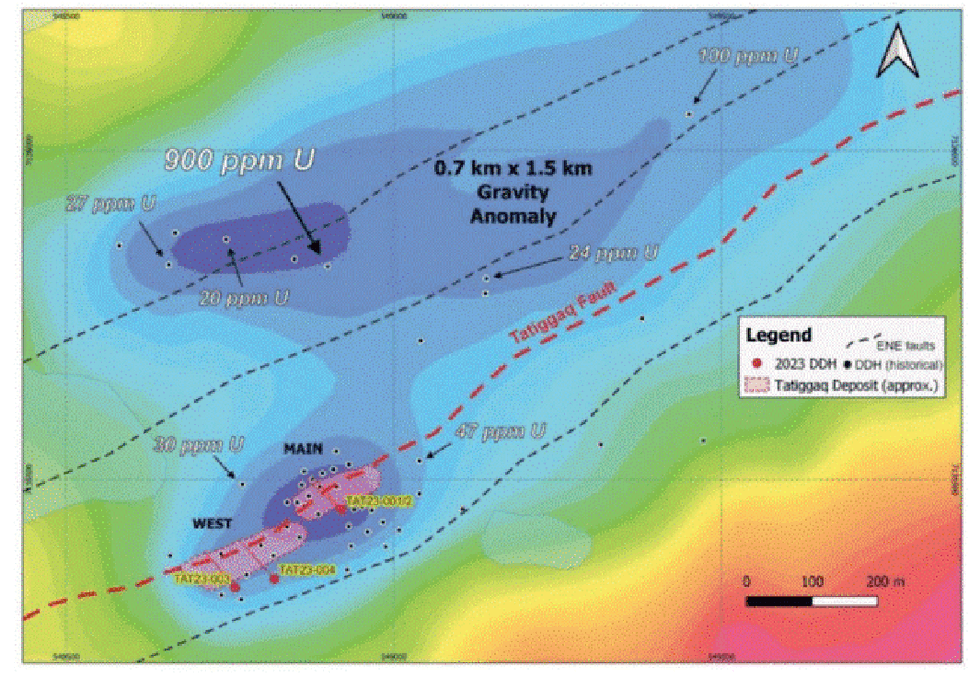

Forum’s Aberdeen Maiden Drill Program Intersects High-grade Uranium

- Between July and August 2023, Forum completed five drill holes totalling 991 meters. The program successfully expanded shallow high-grade uranium mineralization at the primary Tatiggaq Main and West Zones, and confirmed the team’s understanding of the controls of mineralization. Hole TAT23-002 intersected 2.25 percent U3O8 over 11.1 meters at a depth of 148.5 meters in the Main Zone and Hole TAT23-003, a 200-meter step-out to the southwest of the West Zone intersected 0.40 percent U3O8 over 12.8 meters at a depth of 136.8 meters.

- Subsequent to receiving these assay results, Forum completed a $10.4-million brokered private placement, which will enable the company to follow-up with a major 10,000-meter drill program scheduled for the summer of 2024. Drilling will focus on expanding uranium mineralization along strike and at depth. To date, only 200 meters of this 1.5-kilometer-long anomaly has been drill tested.

- Wollaston Uranium: Forum: 100 percent – Located in eastern Athabasca Basin. Limited drilling in 2023 identified elevated uranium and boron values on several geophysical targets on this large property, well located close to the Orano/Denison McClean Lake mill. Forum is reviewing data from its magnetic/electromagnetic survey to plan the next exploration steps.

- Highrock Uranium: Forum: 80 percent, Sassy Gold 20 percent – On trend with Cameco’s past-producing Key Lake Mine.

- Fir Island: Forum: 49 percent, Orano Canada: 51 percent (operator) – Located on the northeastern edge of the Athabasca Basin. Forum is waiting on further exploration plans following Orano’s data review from an extensive resistivity survey.

- Northwest Athabasca Joint Venture: Forum: 39.5 percent, NexGen: 28 percent, Cameco: 20 percent, Orano:12.5 percent – Future winter drilling subject to agreement among the partners. The project hosts the historical 1.5-million-lb Maurice Bay deposit grading 0.6 percent uranium oxide to a depth of 50 meters (Not NI 43-101 compliant. Sufficient exploration work has not been completed to verify and classify as a current mineral resource, but the estimate is considered relevant and reliable due to extensive exploration work completed by previous operators and sourced from Saskatchewan Industry & Resources Miscellaneous Reports 2003-07).

- Maurice Point: Forum: 100 percent

- Grease River: Forum: 100 percent (Traction Uranium earn-in option) – Forum and Traction recently completed airborne magnetic, electromagnetic (EM) and radiometric surveys over the entire project area to aid structural mapping and help define drill targets. Analysis of the EM data has outlined prospective targets along several conductive trends in the East claim block north of the Grease River shear zone.

- Henday: UEC: 60 percent, Forum: 40 percent – Strategically located along the Midwest/Roughrider trend.

- Costigan: Forum: 100 percent – On trend with Cameco’s past-producing Key Lake mine.

- Clearwater: Forum: 75 percent, Vanadian: 25 percent – Located in the Patterson Lake Corridor, Western Athabasca Basin

Key Projects

Nunavut Uranium Project (Thelon Basin)

Nunavut Uranium: Forum’s Aberdeen project claims comprise ground formerly held by Cameco with discoveries made at Tatiggaq, Qavvik and Ayra. The claims surround Orano’s mining lease, which hosts the Kiggavik uranium deposit.

Previously explored by Cameco between 2005 and 2012, this prospective ground hosts two uranium discoveries made by former Cameco geologist Dr. Rebecca Hunter, who now leads Forum’s team as VP exploration.

Cameco abandoned the claims due to the decade-long period of low uranium prices during the post-Fukushima period, which were later acquired by Forum. Renamed the Aberdeen project, Forum’s claims surround Orano Canada-Denison-UEC’s 133-million-lb Kiggavik uranium deposit.

Dr. Rebecca Hunter spotting drill hole locations. As Forum’s VP exploration, Hunter is managing the Aberdeen uranium exploration project.

Cameco completed 36,000 meters of drilling in 135 drill holes. After reviewing Cameco’s data, Forum’s technical team determined the Tatiggaq deposit to be the primary exploration target. Tatiggaq is found within a large gravity anomaly that remains open along strike for 1.5 kilometers and at depth. Previous drilling by Cameco identified results as high as 2.69 percent U3O8 over 7.9 meters, including 24.8 percent U3O8 over 0.4 meters at a depth of approximately 200 meters.

Examining drill core in the field at the Nunavut camp, August 2023

Forum’s maiden drill program, completed in August 2023, successfully confirmed and expanded high-grade uranium mineralization at the Tatiggaq and West Zones. At Tatiggaq, drilling intersected high-grade near-surface uranium mineralization with TAT23-002 (Main Zone) intersecting 2.25 percent U3O8 over 11.1 meters, while TAT23-003 a 200-meter step-out at the West Zone) intersected 0.40 percent U3O8 over 12.8 meters.

Results from the Ned anomaly, one of over 20 high-grade unconformity-type targets, identified elevated uranium, boron, silver and nickel.

Forum’s Summer 2023 maiden drilling focused on the primary Tatiggaq deposit. Forum has since established new drill targets over a more than one kilometer east-northeast extension along the Tatiggaq fault zone following the processing of geophysical data from its recent ambient noise tomography survey. An extensive 10,000-meter summer 2024 drilling program has been announced.

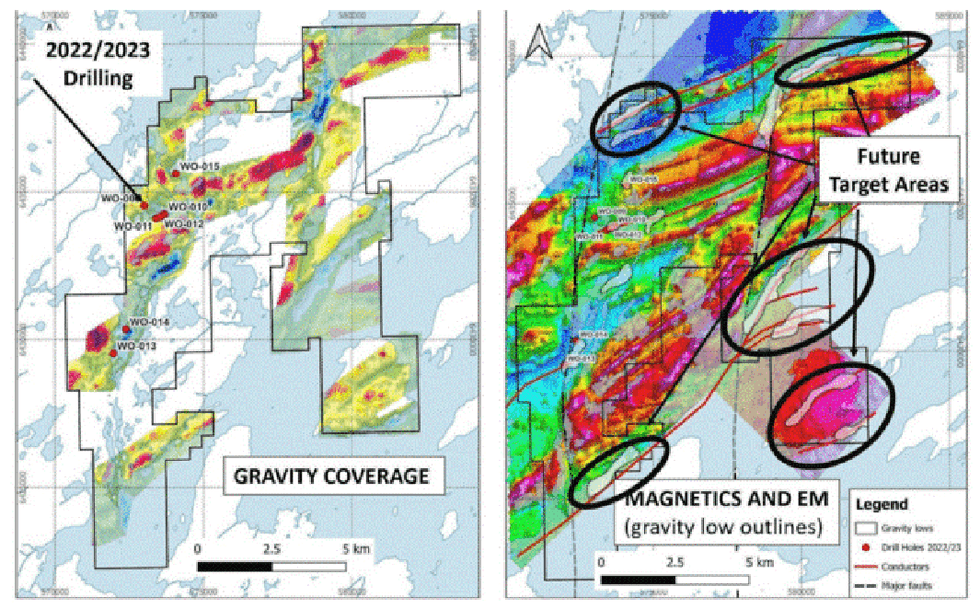

Wollaston Uranium Project

The property is located within 10 kilometers of Cameco’s Rabbit Lake uranium mill and 30 kilometers of Orano/Denison’s McClean Lake uranium mill. Its successful winter 2022 drilling program discovered anomalous uranium in all four holes at the Gizmo target. Forum recently received results of an airborne electromagnetic (EM) and magnetic survey to augment structural interpretations and precisely locate the EM conductors. The following maps show these results and identify new target areas for diamond drilling.

New Gravity Trends and Future Target Areas

Energy Metals Projects

- Janice Lake Copper (Forum 100 percent): Former partner Rio Tinto spent $14 million in exploration expenditures to earn a 51 percent interest in the project. As of November 2023, Forum revised and completed the acquisition of Rio Tinto’s interest in the project giving Forum 100 percent interest.

- Love Lake Nickel-Copper-PGM Project (Forum 100 percent): Strategically positioned near Forum’s Janice Lake copper project.

- Still Nickel-Copper-Cobalt Project (Forum 100 percent): The 11,411-hectare property surrounds the historic Howard Lake nickel-copper-cobalt deposit located 35 kilometers northwest of La Ronge Saskatchewan. Forum has completed a prospecting and geochemical sampling program, and in Q3 2023, completed electromagnetic and magnetic surveys.

- Fisher Copper Claims (Forum 100 percent): The Fisher property is located 40 kilometers west of Pelican Narrows, Saskatchewan. The property hosts a stratabound, volcanogenic massive sulphide deposit with a historical estimate of 650,000 tons grading 0.5 percent copper and 3 percent zinc (Not NI 43-101 compliant. Sufficient exploration work has not been completed to verify and classify as a current mineral resource, but the estimate is considered relevant and reliable due to extensive exploration work completed by previous operators). Forum’s geological team has identified further targets and completed a prospecting and sampling program.

- Quartz Gulch Cobalt, Idaho, USA (Forum 100 percent): On trend with Jervois Mining’s Idaho Cobalt Project, the only permitted cobalt mine in North America.

Forum’s uranium and energy metal projects in northern Saskatchewan

Management & Advisory Team Members

Richard J. Mazur - President, CEO and Director

Richard Mazur is an executive and geoscientist with over 45 years of Canadian and international experience in the exploration and mining industry as a project geologist, financial analyst and senior executive on uranium, gold, diamonds, base metals and industrial minerals projects. Rick founded Forum in 2004. He is also a director of Big Ridge Gold, Impact Silver and Midnight Sun Mining. Mazur graduated with a B.Sc. in geology from the University of Toronto in 1975 and obtained an MBA from Queen’s University in 1985.

Dr. Rebecca Hunter - Vice-President Exploration

Dr. Rebecca Hunter has over 15 years of experience as a uranium exploration geologist in Saskatchewan and Nunavut. As a project geologist for Cameco from 2005 to 2016, Hunter led the Turaqvik-Aberdeen exploration project, where the high-grade Tatiggaq and Qavvik uranium deposits were discovered nearby to the west of Orano’s (formerly AREVA) Kiggavik uranium project in Nunavut. Hunter completed her PhD at Laurentian University, which focused on the litho-geochemistry, structural geology and uranium mineralization systems of the Tatiggaq-Qavvik uranium trend in the Thelon Basin. She was recently appointed VP Exploration and will continue her work as the lead member of Forum’s Aberdeen uranium project exploration team in the Thelon Basin, a geologic analogue to the prolific Athabasca Basin.

Allison Rippin Armstrong - Vice-President, Nunavut Affairs

Allison Rippin Armstrong is a biologist and environmental scientist with over 25 years experience specializing in Environmental, Social and Governance (ESG) practices across Canada and internationally. Allison’s accomplishments over the years have been recognized on a number of occasions, including being awarded the 2009 Kivalliq Inuit Association Expert Counsel Award and the 2011 Mike Hine Award for her contributions to the mining industry in Nunavut. A long-standing board member of Yukon Women in Mining, past member of the NWT & Nunavut Chamber of Mines, and founding member of the Yukon University Foundation Board, she is also the Board Chair of Tectonic Metals Inc.

As VP Nunavut Affairs, Allison’s focus will be in community, regulatory and government relations in Nunavut Territory.

Dan O’Brien - Chief Financial Officer

Dan O’Brien is a member of the Institute of Chartered Professional Accountants of British Columbia and has over 15 years experience working with public companies in the resource industry. O’Brien is the chief financial officer for a number of publicly listed exploration companies trading on the TSX and TSXV exchanges and was previously a senior manager at a leading Canadian accounting firm where he specialized in the audit of public companies in the mining and resource sector.

Anthony Balme - Director

Anthony Balme is the managing director of Carter Capital and Lymington Underwriting, two private UK investment funds, where he is an active participant in several global base and precious metals resource ventures in North America, Sweden and the DRC.

Paul Dennison - Director

Paul Dennison worked for 27 years in the front end of three leading investment banks: Credit Suisse, Merrill Lynch & Deutsche Bank. His focus was capital markets origination, underwriting, sales and trading in all regions outside the Americas. Thereafter, Dennison managed his own asset management company for 12 years, which was licensed in Singapore, Switzerland and the United States. He is currently based in Zurich and Singapore with his own firm, specializing as an introducing broker, sourcing international investment capital for clients.

Janet Meiklejohn - Director

Janet Meiklejohn is the principal of Emerald Capital, a consulting company providing CFO, strategic, valuation, corporate governance and marketing services to high-growth companies. She was formerly VP of institutional equity sales focused on the mining sector with several Canadian investment banks including Desjardins Securities, National Bank, Salman Partners and Macquarie Capital from 1997 to 2015. Meiklejohn grew up in Saskatchewan and has a close personal interest in the development of the uranium industry in the province.

Larry Okada - Director

Larry Okada is a member of both the Canadian Chartered Professional Accountants and the Washington State Certified Public Accountants Association with over 45 years of experience in providing financial management services to publicly traded companies, with emphasis on junior mineral exploration companies. He holds a B.A. in economics and was in public practice with his own firm of Staley, Okada and Partners and PricewaterhouseCoopers LLP. Okada also serves as chairman of Forum’s Audit Committee.

Michael A. Steeves - Director

Michael A. Steeves has been involved in the mining industry for over 50 years. He has previously held executive positions with Zazu Metals, Glamis Gold, Coeur D’Alene Mines, Homestake Mining and Pegasus Gold. Steeves also worked for several years as a mining analyst. He holds a Master of Science degree in earth sciences from the University of Manitoba and is also a chartered financial analyst.

Brian Christie - Director

Brian Christie’s professional career spans over 45 years as a geologist, securities analyst, and investor relations executive. During his tenure as vice-president investor relations at Agnico Eagle Mines from 2012 to 2022, Agnico Eagle was consistently recognized as having one of the top investor relations programs in Canada. Christie is currently retained by Agnico Eagle as a senior advisor, investor relations. Prior to joining Agnico Eagle, he worked for over 17 years as a precious and base metals analyst with Desjardins Securities, National Bank Financial, Canaccord Capital, and HSBC Securities, in addition to 13 years as a geologist with several mining companies including Homestake, Billiton, Falconbridge Copper, and Newmont. Christie holds a BSc. in geology (University of Toronto) and an MSc. in geology (Queen’s University). He is also a member of the Canadian Investor Relations Institute (CIRI) and the National Investor Relations Institute (NIRI).

Top 5 ASX Uranium Stocks of 2024

Uranium has broken out, with the spot price rising to a 16-year high of US$106 per pound in early 2024. Despite a pullback, uranium prices in April still remain 30 percent higher than last year's average.

Although the market's turnaround has taken time, experts are predicting a bright future as countries around the world pursue clean energy goals. Against that backdrop, some ASX-listed uranium companies have been making moves in 2024.

Below the Investing News Network has listed the top uranium stocks on the ASX by year-to-date gains. Data was gathered using TradingView's stock screener on April 10, 2024, and all companies included had market caps above AU$50 million at the time. Read on to learn more about these firms and what they've been up to so far this year.

1. Paladin Energy (ASX:PDN)

Year-to-date gain: 56.12 percent; market cap: AU$4.54 billion; current share price: AU$1.53

Paladin Energy owns a 75 percent stake in the active Langer Heinrich uranium mine in Namibia, and also has an exploration portfolio that spans both Canada and Australia.

First brought into production in 2006, operations at Langer Heinrich were suspended in 2018 as ultra-low uranium prices averaging US$24 per pound U3O8 made the mine uneconomical. The dramatic rebound in the uranium market over the past year prompted Paladin to return Langer Heinrich to commercial production in April 2024.

Shares in company reached AU$1.53, its highest point of 2024 so far, on April 9. This is up by more than 56 percent since the start of the year, and up nearly 300 percent since hitting a yearly low of AU$0.515 in May 2023.

2. Lotus Resources (ASX:LOT)

Year-to-date gain: gain 45.95 percent; market cap: AU$1.24 billion; current share price: AU$0.42

Lotus Resources is another ASX-listed uranium miner working to revive operations at a former mine. The company’s flagship asset is the Kayelekera uranium mine in Malawi, which it acquired from Paladin Energy in 2020.

Kayelekera has been on care and maintenance since 2014 due to the years-long low price environment for the nuclear fuel. In August 2022, Lotus completed a definitive feasibility study for restarting the mine, which it is targeting for Q4 2025.

Last November, Lotus completed a merger with A-Cap Energy, adding the Letlhakane uranium project in Botswana to its portfolio. The company’s plans for the project in 2024 include fast-tracking delivery of a scoping study through the completion of infill drilling aimed at optimizing the mine plan and upgrading the mineral resource estimate.

Shares of Lotus Resources reached a year-to-date high of AU$0.44 on March 21.

3. Bannerman Energy (ASX:BMN)

Year-to-date gain: 44.19 percent; market cap: AU$596.08 million; current share price: AU$3.85

Uranium development company Bannerman Energy has honed its efforts on its Namibia-based Etango uranium project, which it says is one of the world’s largest undeveloped uranium assets. The company has been moving forward at Etango for 15 years and is currently targeting a final investment decision for this year.

Bannerman's latest news on its progress at Etango came on March 18 with the announcement that the company has completed a scoping study on the viability of expanding or extending the base case 8 million tonnes per annum of production outlined in the definitive feasibility study completed in December 2022. In addition, the company is currently advancing Front End Engineering and Design, offtake marketing and strategic financing workstreams.

Bannerman's share price reached AU$4.00, its highest point of 2024 so far, on April 8.

4. Deep Yellow (ASX:DYL)

Year-to-date gain: 31.46 percent; market cap: AU$1.22 billion; current share price: AU$1.40

Deep Yellow's portfolio of uranium assets spans Namibia and Australia, with its two most advanced projects being Tumas and Mulga Rock. The former is located in Namibia, while the latter is in Western Australia; according to the company, together they have a potential production capacity of over 7 million pounds per year of U3O8.

Deep Yellow released a definitive feasibility study (DFS) for Tumas in early February 2023, outlining output of 3.6 million pounds of U3O8 annually along with 1.15 million pounds of V2O5. The property's mine life is set at 22.25 years, but additional resources could increase it to over 30 years. In December, Deep Yellow did a review of the DFS, updating costs and forecast financial outcomes to reflect the more settled economic environment. Tumas received a mining licence from the Namibian government that same month. The company is targeting late Q3 2024 for a final investment decision.

In terms of Mulga Rock, the company has been working on an evaluation program geared at boosting the project's value by looking at its critical minerals potential. In late February 2024, the company updated the mineral resource estimate for the Ambassador and Princess deposits, resulting in a 26 percent increase in the project's total contained uranium and justifying an update to the DFS. Deep Yellow expects to start a revised DFS for Mulga Rock in Q2 2024.

Shares of Deep Yellow reached their 2024 peak on February 2, coming in at AU$1.76.

5. Boss Energy (ASX:BOE)

Year-to-date gain: 20.1 percent; market cap: AU$2.01 billion; current share price: AU$4.84

Boss Energy is focused on restarting its fully permitted Honeymoon uranium mine in South Australia. Production at the asset was suspended in 2013 due to low prices, but the company is now looking to bring it back online to take advantage of uranium's move upward. A JORC-compliant resource for the Honeymoon restart area stands at 36 million pounds of U3O8, and the property's mine life is estimated at over 10 years with output of 2.45 million pounds of U3O8 annually.

News throughout the past year was focused on activities geared at bringing Honeymoon back online, and Boss ultimately started mining operations at Honeymoon back up again in mid-October 2023. The same month, Boss and Coda Minerals (ASX:COD) were awarded four exploration tenements under a mineral rights sharing arrangement. The tenements make up the Kinloch project, which is located 130 kilometres south of Honeymoon.

Boss signed its first binding sales contract for production from Honeymoon in late December 2023. It will sell 1 million pounds of uranium to a US utility for seven years starting in 2025 and ending in 2031.

Then, in late February of this year, Boss announced the completion of a transaction that it said will make it a multi-mine uranium producer in the first half of 2024 — it entered into an agreement to acquire a 30 percent stake in enCore Energy's (TSXV:EU,NASDAQ:EU) Alta Mesa in-situ recovery project in Texas. In mid-March enCore announced its highest grade drill results to date at Alta Mesa, and reported that "at the Alta Mesa Uranium CPP, enCore has met most of the key objectives for the refurbishment of the processing circuits necessary for the planned early 2024 restart."

Boss Energy's share price reached its highest point of the year so far on February 2, when it hit AU$6.11.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Top 10 Uranium-producing Countries (Updated 2024)

Output from the top uranium-producing countries rose steadily for a decade, peaking at 63,207 metric tons (MT) in 2016. However, global uranium production has noticeably declined in the years since then.

Decreased numbers across the world are related to the persistently low spot prices the uranium market has experienced in the wake of the Fukushima disaster; COVID-19 and Russia's war against Ukraine have also had an impact on output.

Now uranium prices have begun to rebound significantly, buoyed by increasingly positive sentiment about the role of nuclear power in the energy transition, and investment demand via new uranium-based funds.

Currently 10 percent of the world’s electricity is generated by nuclear energy, and that number is expected to grow. Looking forward, analysts are calling for a sustained bull market in uranium. In early 2024, prices surged to a 16 year high of more than US$100 per pound, and although they have slipped slightly since then, industry insiders remain optimistic.

Due to its significance in energy generation, it’s important to know where uranium is mined and which nations are the largest uranium-producing countries. Kazakhstan is the leader by a long shot, and has been since 2009. In 2022 — the last year for which data is available — it was followed by Canada and Namibia in second and third place, respectively.

For investors interested in following the uranium space, having familiarity with these uranium production hotspots is essential. Read on to get a closer look at 2022’s largest uranium-producing countries. All statistics are from the World Nuclear Association’s most recent report on uranium mine production.

1. Kazakhstan

Mine production: 21,227 MT

As mentioned, Kazakhstan had the highest uranium production in the world in 2022. In fact, the country’s total output of 21,227 MT accounted for an impressive 43 percent of global uranium supply.

When last recorded in 2021, Kazakhstan had 815,200 MT of known recoverable uranium resources, second only to Australia. Most of the uranium in the country is mined via an in-situ leaching process.

Kazataprom (LSE:KAP,OTC Pink:NATKY), the country’s national uranium miner, is the world’s largest producer, with projects and partnerships in various jurisdictions. News that the top uranium producer may miss its production targets for 2024 and 2025 was a large contributor to uranium prices breaking through the US$100 level this year.

2. Canada

Mine production: 7,351 MT

Canada’s uranium output has fallen dramatically since hitting a peak of 14,039 MT in 2016. After producing 6,938 MT of yellowcake in 2019, Canadian uranium production sank to 3,885 MT in 2020 as the COVID-19 pandemic led to operational shutdowns. However, uranium production in the country began to rebound in 2022.

Saskatchewan’s Cigar Lake and McArthur River are considered the world’s two top uranium mines. Both properties are operated by sector major Cameco (TSX:CCO,NYSE:CCJ). Cameco made the decision to shutter operations at the McArthur River mine in 2018, but returned to normal operations in November 2022.

In 2023, Cameco produced 17.6 million pounds of uranium, which was below its originally planned production of 20.3 million pounds for the year. The company has set its guidance at 22.4 million pounds for 2024.

Uranium exploration is also prevalent in Canada, with the majority occurring in the uranium-rich Athabasca Basin. That area of Saskatchewan is world renowned for its high-quality uranium deposits and friendly mining attitude. The province’s long history with the uranium industry has helped to assert it as an international leader in the sector.

3. Namibia

Mine production: 5,613 MT

Namibia’s uranium production has been steadily increasing after falling to 2,993 MT in 2015.

In fact, the African nation overtook longtime frontrunner Canada to become the third largest uranium-producing country in 2020, and went on to surpass Australia for the second top spot in 2021. Although Namibia slipped back below Canada in 2022, its output for the year was only down by 140 MT from 2021.

The country is home to two uranium mines that are capable of producing 10 percent of the world’s output. Paladin Energy (ASX:PDN,OTCQX:PALAF) owns the Langer Heinrich mine, while large miner Rio Tinto (NYSE:RIO,ASX:RIO,LSE:RIO) sold its majority share of the Rössing mine to China National Uranium in 2019.

In 2017, Paladin took Langer Heinrich offline due to weak uranium prices; however, improved uranium prices over the past few years prompted the uranium miner to ramp up restart efforts. At the close of 2024's first quarter, Langer Heinrich achieved commercial production once again.

4. Australia

Mine production: 4,087 MT

Australia’s uranium production decreased significantly in 2021 to 4,192 MT, down from 2020’s 6,203 MT; it fell further in 2022 to hit 4,087 MT. The island nation holds 28 percent of the world’s known recoverable uranium resources.

Uranium mining is a contentious and often political issue in Australia. While the country permits some uranium-mining activity, it is opposed to using nuclear energy — at least for now. "Australia uses no nuclear power, but with high reliance on coal any likely carbon constraints on electricity generation will make it a strong possibility,” according to the World Nuclear Association. “Australia has a significant infrastructure to support any future nuclear power program.”

Australia is home to three operating uranium mines, including the largest-known deposit of uranium in the world, BHP's (NYSE:BHP,ASX:BHP,LSE:BHP) Olympic Dam. Although uranium is only produced as a by-product at Olympic Dam, its high output of the metal makes it the fourth largest uranium-producing mine in the world. In BHP's 2023 fiscal year, uranium output from the Olympic Dam operation totaled 3.4 million MT of uranium oxide concentrate, an increase of 1.03 million MT from the previous year's production.

5. Uzbekistan

Mine production: 3,300 MT

In 2020, with an estimated 3,500 MT of output, Uzbekistan became one of the top five uranium-producing countries. Domestic uranium production had been gradually increasing in the Central Asian nation since 2016. Previously seventh in terms of global uranium output, it is expanding production via Japanese and Chinese joint ventures. However, for 2022, the country's uranium output was down by 200 MT to 3,300 MT.

Navoi Mining & Metallurgy Combinat is part of state holding company Kyzylkumredmetzoloto, and handles all the mining and processing of domestic uranium supply. The nation's uranium largess continues to attract foreign investment; strategic partnerships with French uranium miner Orano and state-run China Nuclear Uranium were announced in November 2023 and March 2024, respectively.

6. Russia

Mine production: 2,508 MT

Russia was in sixth place in terms of uranium production in 2022. Output has been relatively steady in the country since 2011, usually coming in around the 2,800 to 3,000 MT range.

Experts had been expecting the country to increase its production in the coming years to meet its energy needs, as well as growing uranium demand around the world. But in 2021, uranium production in the country dropped by 211 MT from the previous year to 2,635 MT; it fell further by another 127 MT to reach 2,508 MT in 2022.

In terms of domestic production, Rosatom, a subsidiary of ARMZ Uranium Holding, owns the country’s Priargunsky mine and is working on developing the Vershinnoye deposit in Southern Siberia through a subsidiary. In 2023, Russia surpassed its uranium production target, producing 90 MT more than expected. Rosatom is developing new mines, including Mine No. 6, which is slated to begin uranium production in 2028.

Russian uranium has been an area of controversy in recent years, with the US initiating a Section 232 investigation around the security of uranium imports from the country in 2018. More recently, Russia's ongoing war in Ukraine has prompted countries around the world to look more closely at their nuclear supply chains.

7. Niger

Mine production: 2,020 MT

Niger’s uranium production has declined year-on-year over the past decade, with output totaling 2,020 MT in 2022. The African nation has two uranium mines in production, SOMAIR and COMINAK, which account for 5 percent of the world’s uranium production. Both projects are operated by subsidiaries of Orano, a private uranium miner.

Niger is also home to the flagship project of explorer GoviEx Uranium (TSXV:GXU,OTCQB:GVXXF). The company is presently developing its Madaouela asset, as well as projects in Zambia and Mali. Global Atomic (TSX:GLO,OTCQX:GLATF) is developing its Dasa project in the country, and expects to commission its processing plant by early 2026.

A recent military coup in the African nation has sparked uranium supply concerns, as Niger accounts for 15 percent of France's uranium needs and one-fifth of EU imports. In January 2024, the Nigerian government, now under a military junta, announced it intends to overhaul the nation's mining industry. It has temporarily halted the granting of new mining licenses and will be considering reforms to existing mining licenses in order to increase state profits.

8. China

Mine production: 1,700 MT

China’s uranium production rose from 885 MT in 2011 to 1,885 MT in 2018, and held steady at that level until falling to 1,600 MT in 2021. The country's uranium output grew by 100 MT to hit 1,700 MT in 2022.

China General Nuclear Power, the country’s sole domestic uranium supplier, is looking to expand nuclear fuel supply deals with Kazakhstan, Uzbekistan and additional foreign uranium companies.

China’s goal is to supply one-third of its nuclear fuel cycle with uranium from domestic producers, obtain one-third through foreign equity in mines and joint ventures overseas and purchase one-third on the open uranium market. China is also a leader in nuclear energy; Mainland China has 55 nuclear reactors with 27 in construction.

9. India

Mine production: 600 MT

India produced 600 MT of uranium in 2022, on par with output in 2021.

India currently has 23 operating nuclear reactors with another seven under construction. “The Indian government is committed to growing its nuclear power capacity as part of its massive infrastructure development programme,” as per the World Nuclear Association. “The government has set ambitious targets to grow nuclear capacity.”

10. South Africa

Mine production: 200 MT

South Africa is another uranium-producing country that has seen its output decline over the past decade — the nation's uranium output peaked at 573 MT in 2014. Nonetheless, South Africa surpassed Ukraine's production (curbed by Russia's invasion) in 2022 to become the 10th top uranium producer globally.

South Africa holds 5 percent of the world’s known uranium resources, taking the sixth spot on that list.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Blue Sky Uranium Announces Non-Brokered Private Placement

Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2), ("Blue Sky" or the "Company") is pleased to announce a non-brokered private placement for the sale of up to 16,666,667 units of the Company (each, a "Unit") at a price of C$0.06 per Unit (the "Offering Price") for aggregate gross proceeds of C$1,000,000 (the "Offering"). Red Cloud Securities Inc. will be acting as a finder in connection with the Offering.

Each Unit will consist of one common share in the capital of the Company (each, a "Common Share") and one transferrable Common Share purchase warrant (each, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one additional Common Share (each, a "Warrant Share") at an exercise price of C$0.09 per Warrant Share for a period of two (2) years following the issue date of the Unit.