- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Eclipse Commences Trading on Frankfurt Stock Exchange

Eclipse Metals Ltd (ASX: EPM) (Eclipse or the Company) is pleased to announce it has commenced trading on Frankfurt Stock Exchange under the ticker [FSE: 9EU].

Highlights

- Dual listing in Frankfurt supports Eclipse’s strategy of broadening overseas investor base to engage with European investors and stakeholders

- Facilitates access for retail investors from European and Scandinavian countries

- Promotes corporat profile in Europe and trading liquidity

- Enhances ability to engage with large and sophisticated investors in Europe

- Australian Securities Exchange (ASX) will continue to be Eclipse’s primary exchange.

Eclipse has appointed Frankfurt-based DGWA, the German Institute for Asset and Equity Allocation and Valuation (Deutsche Gesellschaft für Wertpapieranalyse GmbH) as its investor relations and corporate advisor in Europe.

Frankfurt Stock Exchange is the largest of Germany’s trading exchanges and the second largest stock exchange in Europe.

DGWA will assist Eclipse to engage with retail, institutional and large private investors in the German speaking DACH region (Germany, Austria, and Switzerland) with a population of close to 100 million people, as well as the rest of Europe and the United Kingdom.

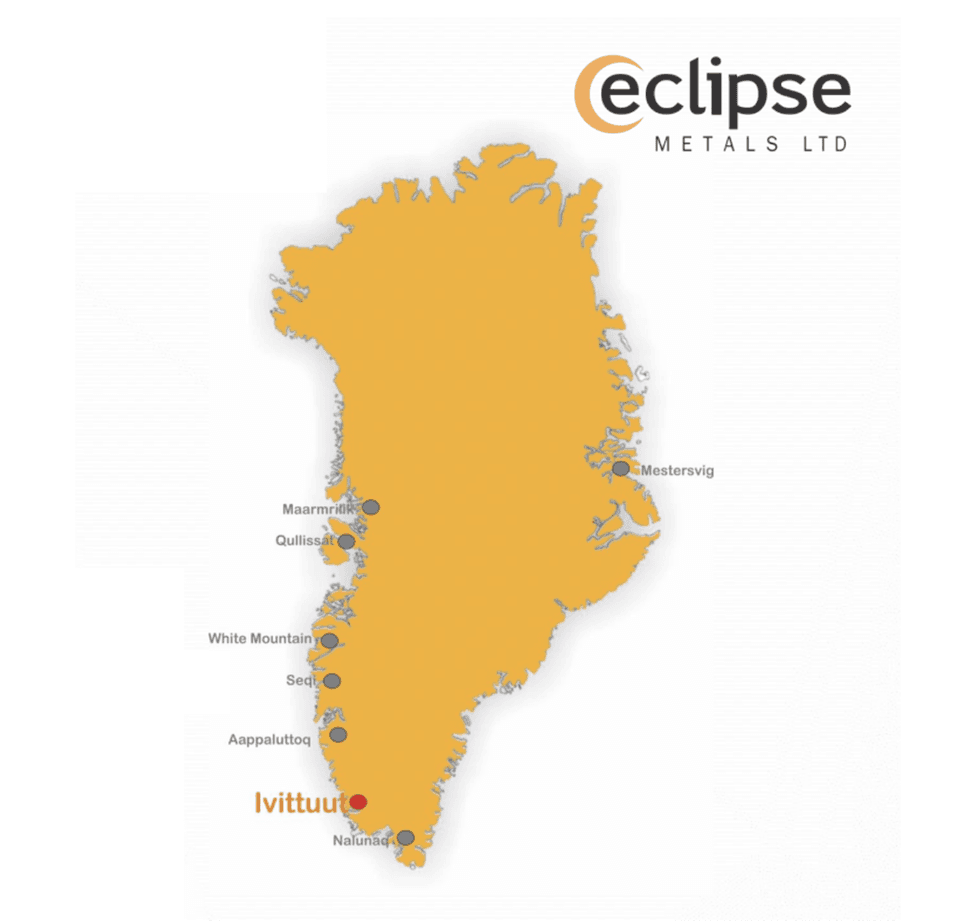

DGWA will assist Eclipse with expanding its European profile for investor and stakeholder awareness of the Company’s activities at its Ivigtût project in Greenland.

Eclipse Metals Executive Chairman Carl Popal said: “Eclipse Metals has attracted considerable interest from investors outside Australia and in particular Scandinavian regions where there is an awareness of the Company’s projects. Greenland hosts a quarter of the world’s rare earth minerals in a favourable mining jurisdiction, and we expect increased interest from European investors, stakeholders and OEMs as project development work continues.”

DGWA CEO Stefan Müller said, “We are excited to be partnering with Eclipse Metals in Europe. The Company is at a pivotal stage with the recent announcement of rare earth element (REE) results from the Ivigtût and Grønnedal targets in Greenland. The interest from European investors in Companies with REE projects in Tier 1 jurisdictions such as Greenland is particularly strong. We will further assist the Company with memberships and engagement with relevant European organisations and stakeholders.”

Click here for the full ASX Release

This article includes content from Eclipse Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Eclipse Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Eclipse Metals

Overview

Eclipse Metals Ltd. (ASX:EPM) is an exploration and mining development company focusing on multi-commodity assets that support the world’s decarbonization goals. The company has a robust portfolio of projects in Australia and Greenland targeting crucial minerals, including rare earth elements (REEs), lithium, zinc, manganese, high-purity quartz, gold, copper, vanadium and uranium.

Governments worldwide have set ambitious goals to reach net-zero emissions in the coming decades, highlighting miners that supply the critical minerals required for low-carbon technologies, which is expected to consume a growing percentage of the world’s total mineral production, with vital elements growing by over 100 percent by 2050, according to the World Bank.

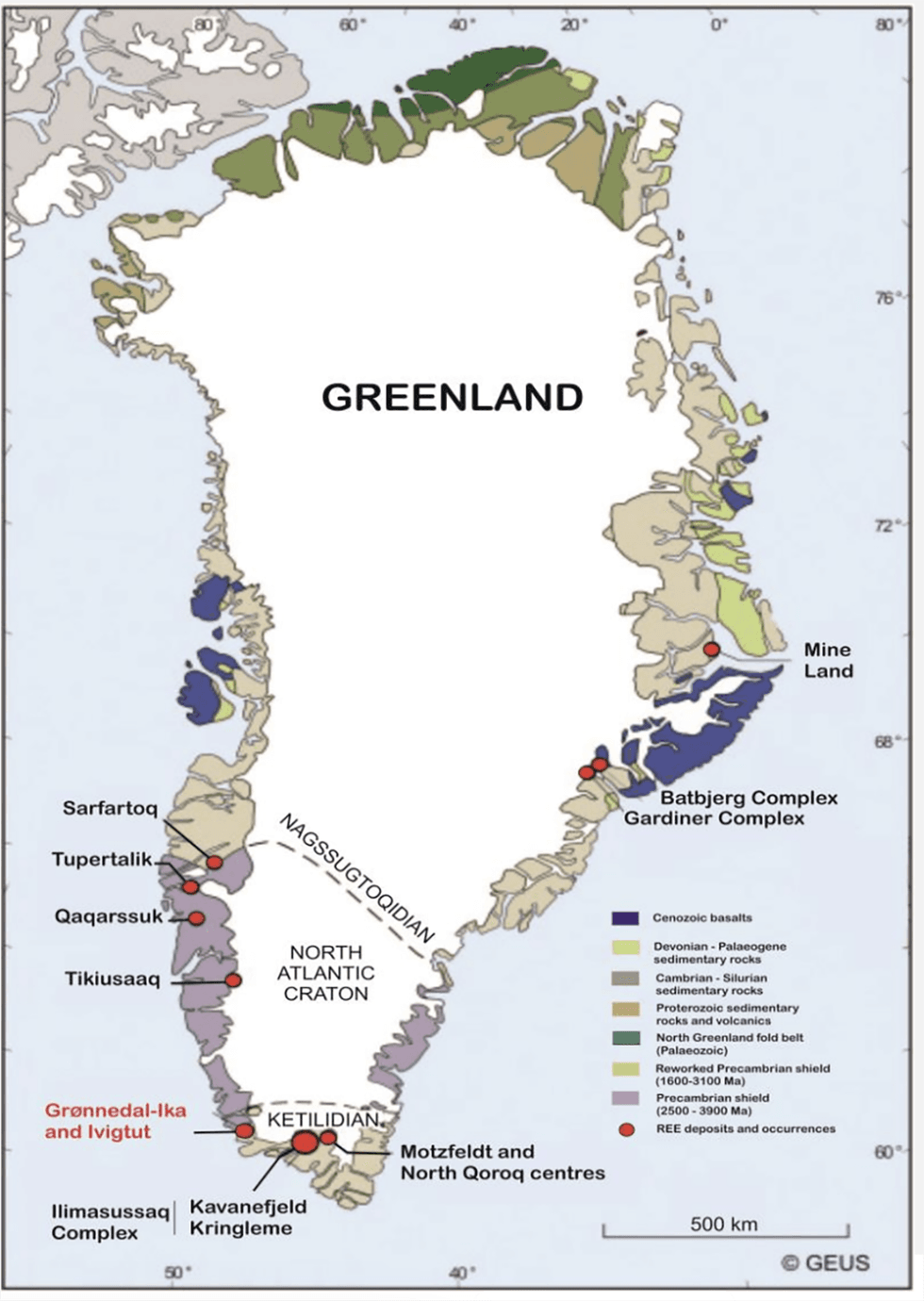

Greenland REE deposits

Eclipse Metal’s flagship asset in Greenland, the Ivigtût project, contains known REE mineralization, industrial minerals and lithium potential.

Multiple academic research and significant rare earths results obtained by Eclipse Metals to date imply that the Grønnedal prospect (located 10 kilometers northeast of Ivigtût) has the potential to contain significant rare earth mineralization. This presence is consistent with other rare earth-bearing carbonatite-syenite intrusive complexes and has elevated ratios in praseodymium (Pr), neodymium (Nd), with enriched in dysprosium (Dy),

zirconium (Zr) and niobium (Nb) — elements that are crucial in the global journey toward a low-carbon, net-zero-emission future. As a mining-friendly jurisdiction, Greenland has an established infrastructure, reducing future development costs.

Additionally, the Ivigtût project contains a high-grade quartz body, a required material for high-end electronics and semiconductors. Eclipse Metals has begun its initial exploration drilling campaign and developed the project’s environmental impact assessment.

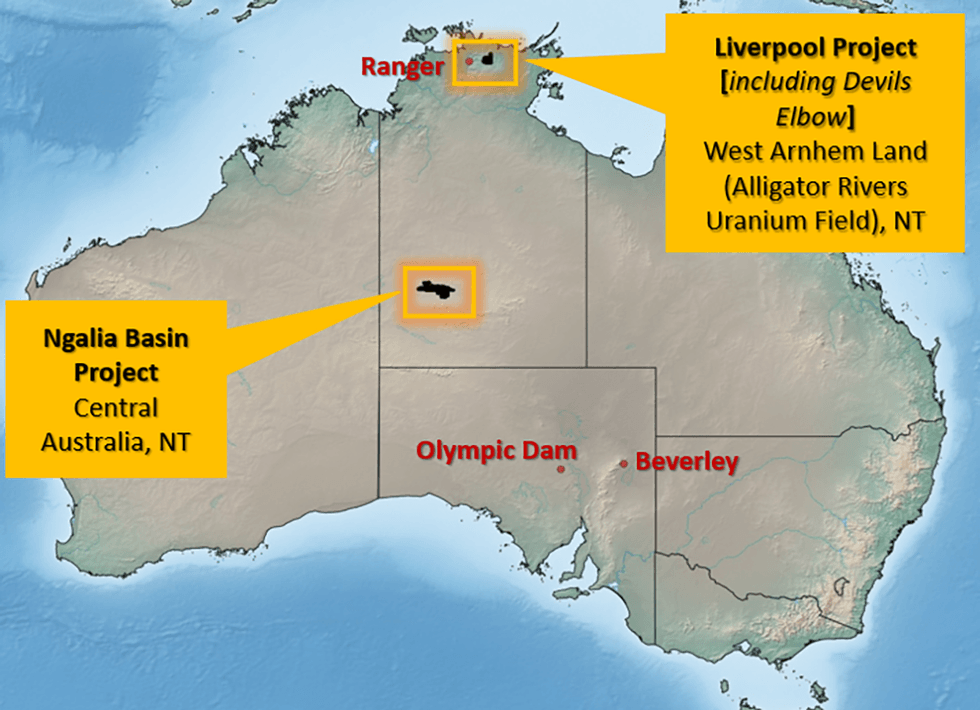

Eclipse Metals’ portfolio also includes Australian assets targeting uranium, copper and manganese as part of the company’s mission to support decarbonization. Its Northern Territory and Queensland assets allow the company to capitalize on existing infrastructure and mining-friendly local governments. The company’s uranium assets are in close proximity to other world-class deposits, allowing Eclipse to benefit from existing infrastructure and community support.

A sound management team with decades of experience in the natural resource industry leads Eclipse Metals. The team’s breadth of expertise includes mineral exploration, geology, corporate administration, metallurgy and international trade, creating confidence in the company’s ability to capitalize on its assets.

Company Highlights

- Eclipse Metals is an exploration and mining development company with assets in Greenland and Australia, supporting the world’s decarbonization goals.

- The company’s flagship Ivigtût multi-commodity asset in Greenland exposes the company to REEs, high-purity quartz, and other industrial metals required for emerging technologies.

- Greenland is a mining-friendly yet underexplored jurisdiction, creating tremendous opportunities for the company.

- Eclipse Metals’ portfolio of assets in Australia includes projects in Queensland and the Northern Territory in world-class mining jurisdictions.

- The company has begun its initial exploratory drilling campaign in Greenland and is progressing on the project’s environmental impact assessment for the mining license.

- An experienced management team leads Eclipse Metals with decades of experience in the mining industry.

Key Projects

Ivigtût Multi-commodity Project

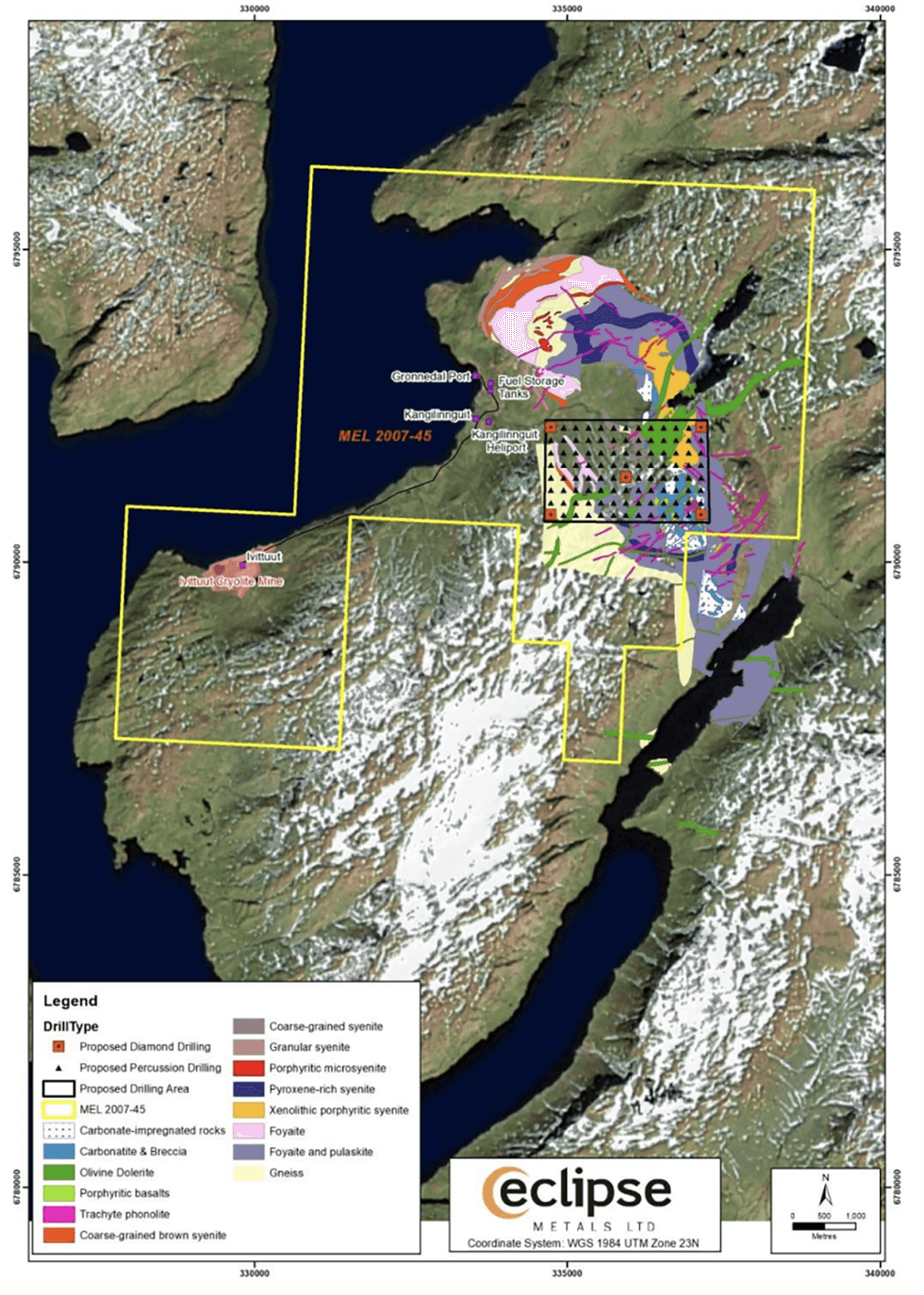

The flagship Ivigtût project has a 120-year mining history, having produced 3.8 million tons of cryolite to support aluminum production. The settlement of Kangilinnguit (Grønnedal) approximately 5.5 kilometers to the northeast of Ivigtut provides access to an existing port. In addition, the project is close to existing infrastructure, including a power station, wharf and heliport, which minimizes future development costs.

Project Highlights:

- A Multi-commodity Project: The asset is known to host REEs and undiscovered polymetallic potential. In addition to REEs, the project contains other minerals, which include:

- Cryolite

- Fluorite

- High silica-grade quartz (99.9 percent SiO2)

- Zinc

- Iron

- Lithium

- Rich Exploration Potential: The asset’s area includes a source of carbonatite minerals and REEs, with deposits occurring in the project area that offers additional exploration opportunities to expand known resources. Eclipse Metals is presently strategically exploring the asset, with a drill program, planned pit dewatering, and sampling of 19,000 meters of historical drill cores.

- High-grade Quartz Opportunity: High-grade quartz is necessary to produce photovoltaic products, such as semiconductors and other high-end electronics. The asset contains over 5 million tonnes of quartz mineralization with up to 99.99 percent silica grade.

The company completed scoping phase reports of social and environmental impact assessments for its Ivigtût project with the assistance of Danish consultancy, COWI. The reports are integral to applying to Greenland’s Mineral Licence and Safety Authority for a mining license.

Eclipse also completed its maiden percussion drilling and trench sampling program at the Ivigtût mine site and Grønnedal carbonatite complex.

MEL2007-45 Location map and exploration drill targets

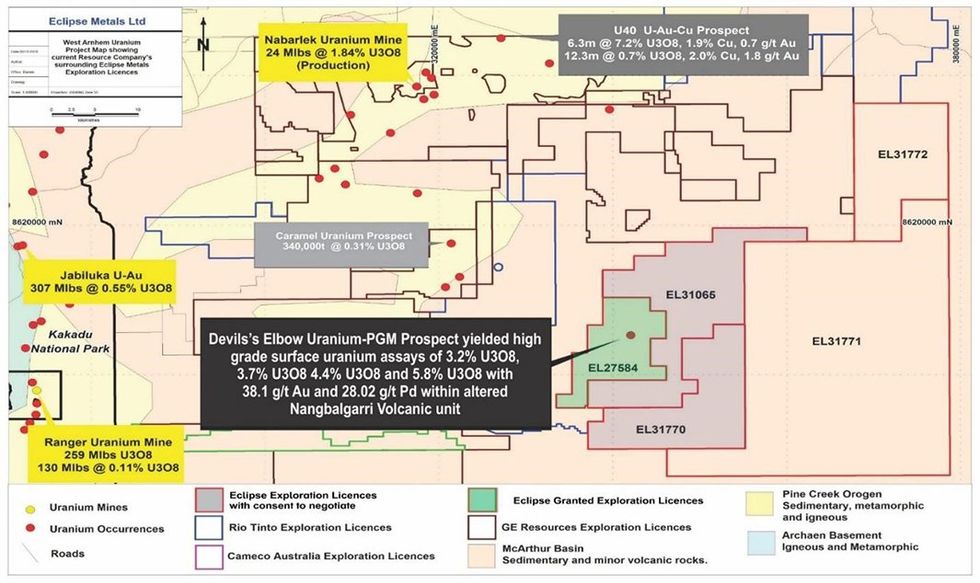

Northern Territory Uranium projects

Liverpool Uranium Project

The Liverpool project comprises five exploration licenses totalling 1,464 square kilometers in the Northern Territory, a proven uranium district. The advanced exploration target contains multiple drill-ready targets.

Project Highlights:

- Nearby World-class Deposits: The Devil’s Elbow prospect within the asset is near several world-class deposits, including:

- Ranger 1 No 1: 0.34 percent uranium

- Ranger 1 No 3: 0.17 percent uranium

- Nabarlek: 1.95 percent uranium

- Jabiluka 1: 0.25 percent uranium

Encouraging Sample Results:

- Samples from shallow trenching yielded high-grade uranium assays including 3.2 percent uranium oxide, 3.7 percent uranium oxide, 4.40 percent uranium oxide, and 5.8 percent uranium oxide, with 38.1 g/t gold and 28.02 g/t palladium, related to fractures within altered amygdaloidal basalt of the Nungbalgarri Volcanics.

- Samples from the radioactive volcanic boulders returned assays of up to 1,720 ppm uranium (0.17 percent uranium), 1,210 ppm uranium (0.12 percent uranium) and a peak value of 3,300 ppm uranium (0.33 percent uranium).

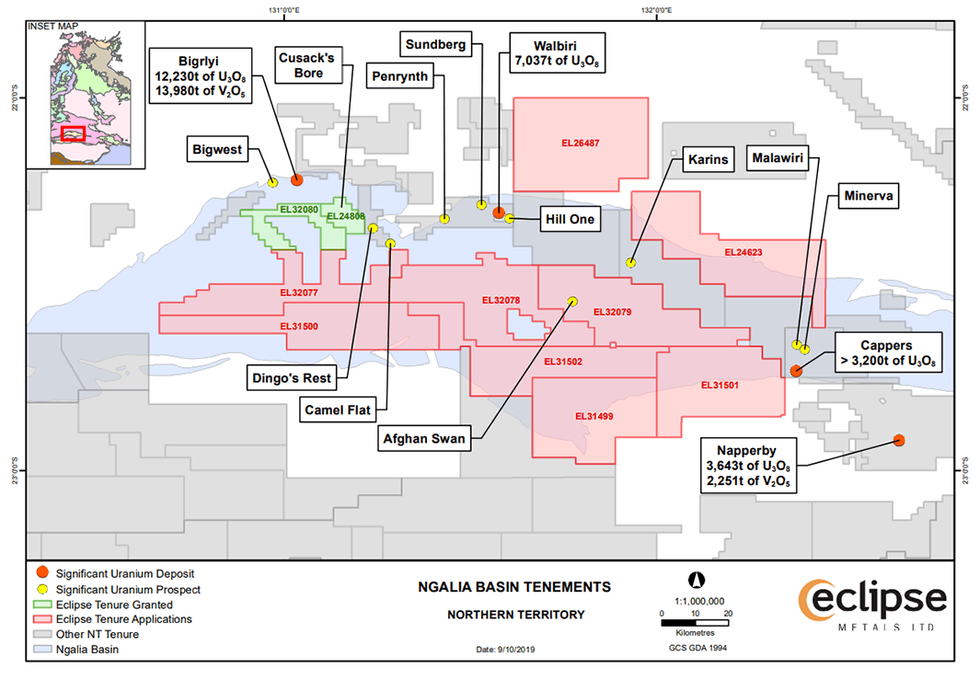

Ngalia Basin Uranium Project

As Eclipse Metals’ second Northern Territory project, the Ngalia Basin project comprises eight exploration licenses totaling 7,280 square kilometers.

Project Highlights:

- Drill-ready Targets Identified: The company has identified two high-priority drill-ready targets within granted tenements.

- Benefitting from Previous Explorers: The asset’s previous explorers discovered anomalous uranium values, streamlining Eclipse’s exploration program and creating a clear progression path.

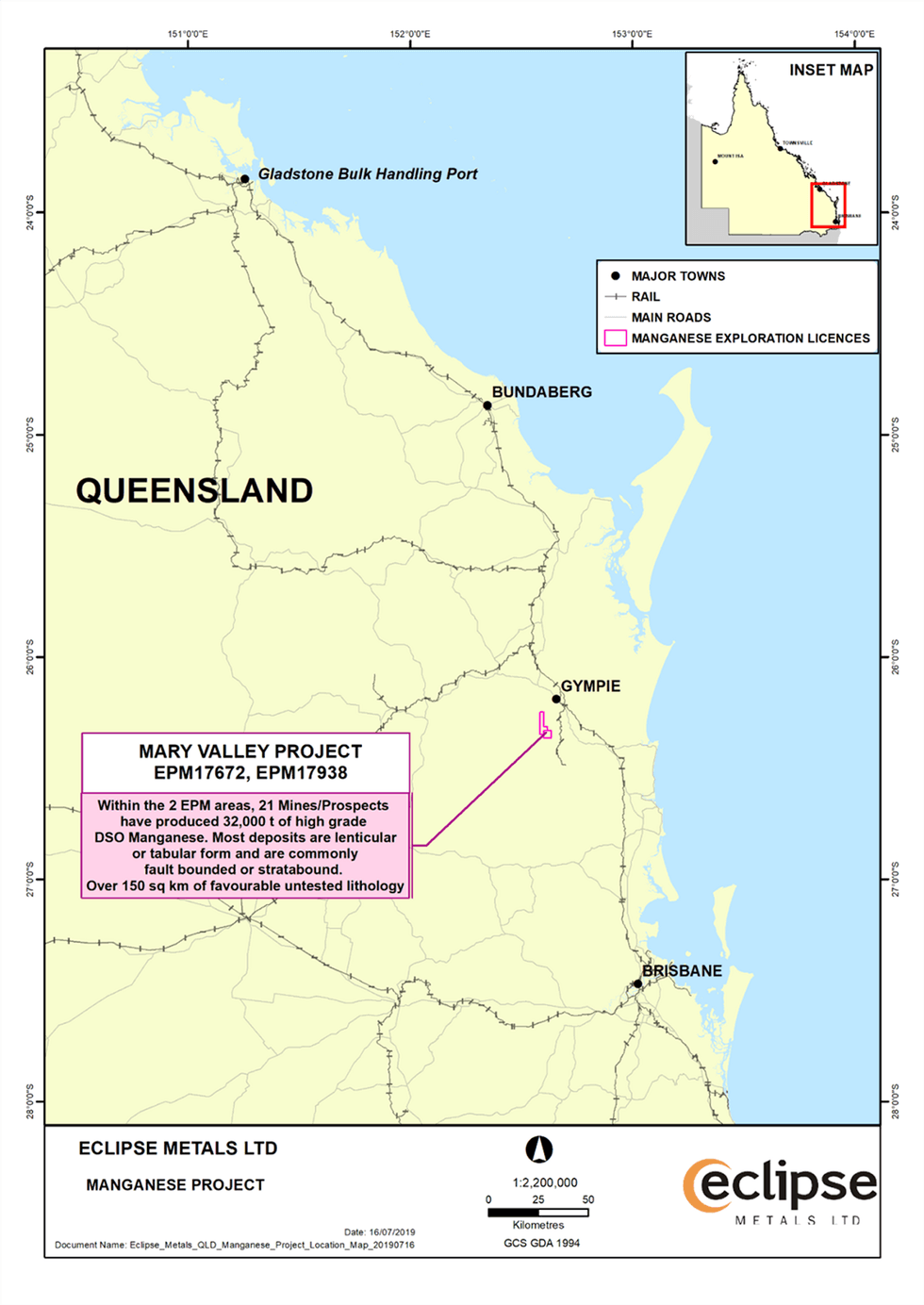

Mary Valley Manganese Project

The company’s Queensland project covers 35 square kilometers and is 16 kilometers southwest of Gympie Township. The Mary Valley hosts historic mines, such as Amamoor, which produced roughly 20,000 tonnes at 51 percent manganese. In addition, existing road and power infrastructure significantly reduce future development costs.

Project Highlights:

- Promising Historical Results: Drill results from the previous explorer include:

- 2018 drilling: 3.2 meters at 59.8 percent manganese dioxide

- 2020 shallow drilling: 3.5 meters at 24.9 percent manganese dioxide from the surface

- High-grade Manganese Potential: As an essential component in lithium-ion batteries, high-grade manganese is growing in demand. The Mary Valley deposit may support mill feed for a beneficiation plant capable of producing marketable, high-grade manganese.

- Encouraging Intersection: Previous diamond drill holes produced encouraging results, including:

- ADD 006 – 8.8 to 12 meters manganese oxide = 59.8 percent

- ADD 007 – 14.9 to 17.3 meters manganese oxide = 26.3 percent

- ADD 010 – 0.0 to 5.0 meters manganese oxide = 16.8 percent

Rock Hill Copper Project

The Northern Territory Rock Hill copper project contains encouraging copper-silver mineralization. Eclipse Metals plans to conduct airborne electromagnetic surveys and reverse circulation drilling over the mineralized zones, followed by diamond drilling. The potential mineralized corridor extends for over 10 kilometers.

Project Highlights:

- Promising Historical Results: Historical results indicate upside potential including:

- 3.0 meters at 1,420 g/t silver from 6.1 meters

- 11.6 meters at 0.43 percent copper from 58.2 meters

- 0.3 meters at 4.6 percent copper and 10 g/t silver

- 0.3 meters at 10.20 percent copper, 27 g/t silver

Management Team

Carl Popal - Executive Chairman

Carl Popal has more than 20 years of entrepreneurial experience covering a diverse range of commodities trading, corporate management, minerals exploration, asset management and construction, to name some. Previously, Popal was chief executive director of ASX-listed company Paynes Find Gold Ltd. He is the managing director of Ghan Resources Pty Ltd and Popal Enterprise Pty Ltd. Since 2001, Popal has managed several entities conducting international trading. He has more than 12 years’ experience in property development and has managed various commercial dealings within a network of companies around the world including in India, China and Malaysia.

Rodney Dale - Non-executive Director

Rodney Dale holds a Fellowship Diploma in geology from the Royal Melbourne Institute of Technology and is a Fellow of the Australasian Institute of Mining and Metallurgy. His experience covers more than 60 years, working in many parts of Australia, Indonesia and Africa on gold, tin, wolfram, base metals and industrial mineral exploration and mining, including trial mining and export of high-grade quartz. He has worked in and managed small gold mines in Western Australia. Since 1970, Dale has been an independent geological consultant with three periods as a director of ASX-listed companies. More recently, he has been involved with the assessment of iron ore projects in Australia, South America, India, China and Africa.

Oliver Kreuzer - Non-executive Director

Dr. Oliver Kreuzer is a registered professional geoscientist and company director with a broad skill set in structural, generative and corporate geology honed within more than a 20-year career in applied research and mineral exploration across a wide range of gold, base, energy and battery metals projects worldwide. His generative work laid the foundations for several new company floats, project acquisitions and new discoveries. Kreuzer is currently a non-executive director of ASX-listed exploration companies 92 Energy Ltd and NickelX Ltd.

Ibrar Idrees – Non-executive Director

Ibrar Idrees has a Bachelor of Commerce (majoring in Accounting and Finance) from Deakin University and has over 10 years of professional and corporate experience gained in a diverse range of industries in Australia and South Asia. Idrees, a practicing accountant, has worked in a variety of business development and financial positions in small and large companies.

Sebastian Andre - Company Secretary

Sebastian Andre is a chartered secretary with over 14 years of experience in corporate advisory, governance, compliance, and risk services. Andre has previously acted as an adviser at the ASX and has a thorough understanding of the ASX listing rules. He holds qualifications in accounting, finance and corporate governance and is a member of the Governance Institute of Australia

Ionicre Raises $5.5 Million in a Placement

The Board of Ionic Rare Earths Limited (ASX: IXR) (“IonicRE” or “the Company”) announces it has received firm commitments to raise $5.5 million (before costs) by way of a share placement of approximately 423 million shares at $0.013 per share (“Placement”). The Placement was strongly supported by both key existing shareholders.

- IonicRE has received firm commitments to raise $5.5 million (before costs) in a Placement;

- Placement includes participation of $0.5 million from IonicRE Executive Chairman Mr Brett Lynch, further to his recent $1.5 million investment on joining the Company in January 2024;

- Funds raised will support:

- Advancing Ionic Technologies’ magnet recycling technology and enhancements to its Magnet Recycling Demonstration Plant, currently producing separated magnet rare earth oxides (REOs) in Belfast, UK, along with the completion of a Feasibility Study for a full-scale plant, expected mid 2024; and

- Advancing offtake and financing discussions presently underway at the Makuutu Ionic Adsorption Rare Earths Project, where the demonstration plant at site is producing mixed rare earth carbonate (MREC) which will be evaluated by several parties to advance offtake negotiations.

Managing Director Tim Harrison commented,“We have received such a significant amount of interest from various magnet manufacturers, alloy makers and OEM’s who are interested in utilising our world-class magnet rare-earth recycling technology for access to secure, sustainable, and traceable rare earth supply. Demand at our operational demonstration plant in Belfast is now full for the next 18 months with potential partner trials advancing to plan.”

“Further, our upstream project, the Makuutu Rare Earth Project, is also advancing well with several offtake negotiations with partners who will be evaluating our MREC being produced at the Makuutu demonstration plant. We are on the verge of a tangible increase in shareholder value. We greatly appreciate the support of existing shareholders with funding this placement.”

Placement Details

The Company has received binding commitments from existing sophisticated investors to raise $5.5 million (before costs) through the issue of 423,076,923 fully paid ordinary shares (“Shares”) at an issue price of $0.013 per Share (“Placement”). Participants will receive 3 free attaching unlisted options for every 4 shares issued with an exercise price of $0.02 (being a 54% premium to the issue price of Shares under the Placement) and a 4-year term which will see 317,307,690 unlisted options (“Options”). 216,967,454 free attaching unlisted Options will be issued utilising the Company’s existing placement capacity pursuant to Listing Rule 7.1, with the balance to be issued subject to shareholder approval.

The issue price under the Placement represents a 25.3% discount to the volume weighted average price ("VWAP") of IonicRE shares over the past 10 trading days. Shares issued under the Placement will be issued utilising the Company’s existing placement capacity pursuant to Listing Rule 7.1 and are expected to be issued on or about Wednesday, 1 May 2024. The Shares issued under the Placement will rank equally with IonicRE’s existing Shares quoted on the ASX.

Mr. Brett Lynch, IonicRE’s Executive Chairman, will subscribe for 38,461,539 Shares ($500,000) under the Placement plus 28,846,154 free attaching Options with an exercise price of $0.02 and a 4-year term, subject to receiving approval at a general meeting of shareholders to be held this quarter. This is in addition to Mr Lynch’s $1.5 million equity investment in January 2024 when he joined the Board of the Company.

Canaccord Genuity (Australia) Limited and MST Financial Services Pty Limited acted as Joint Lead Managers to the Placement, with Canaccord acting exclusively as Global Coordinator and Sole Bookrunner (Global Coordinator) to the offer.

Use of Funds

It is the intention of the Company to use the funds raised under the Placement to advance the commercial partnership negotiations, magnet recycling demonstration plant enhancements and the completion of the feasibility study at Ionic Technologies, plus activity at the Makuutu demonstration plant tied to offtake negotiations and working capital.

The Joint Lead Managers will be entitled to receive a fee equal to 6% of the Placement proceeds, excluding the amount subscribed by Mr. Brett Lynch. Subject to shareholder approval, the Company proposes to issue 20 million unlisted options to the Joint Lead Managers with an exercise price of $0.02 and expiring 4 years after the date the options are issued.

All amounts are in Australian dollars unless otherwise specified.

Nothing contained in this announcement constitutes investment, legal, tax or other advice. Investors should seek appropriate professional advice before making any investment decision.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ChemX Materials: Developing Innovative Processing Technology to Produce High Purity Alumina

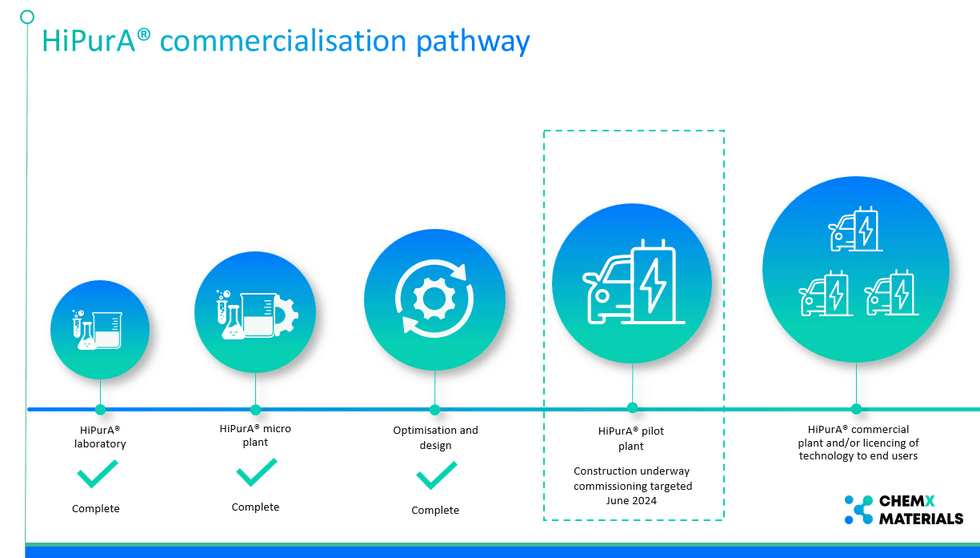

ChemX Materials (ASX:CMX) develops innovative processing technology to produce high purity alumina for advanced technology and clean energy applications. The company's 100 percent owned, Australian patented HiPurA® process technology offers a low cost and energy intensity production method to produce high purity alumina (HPA).

HPA is used in advanced technology and clean energy applications including lithium-ion batteries, LEDs, semiconductors and synthetic sapphires. Synthetic sapphires are critical in the production of applications such as smart watches, iPhones and laptop screens.

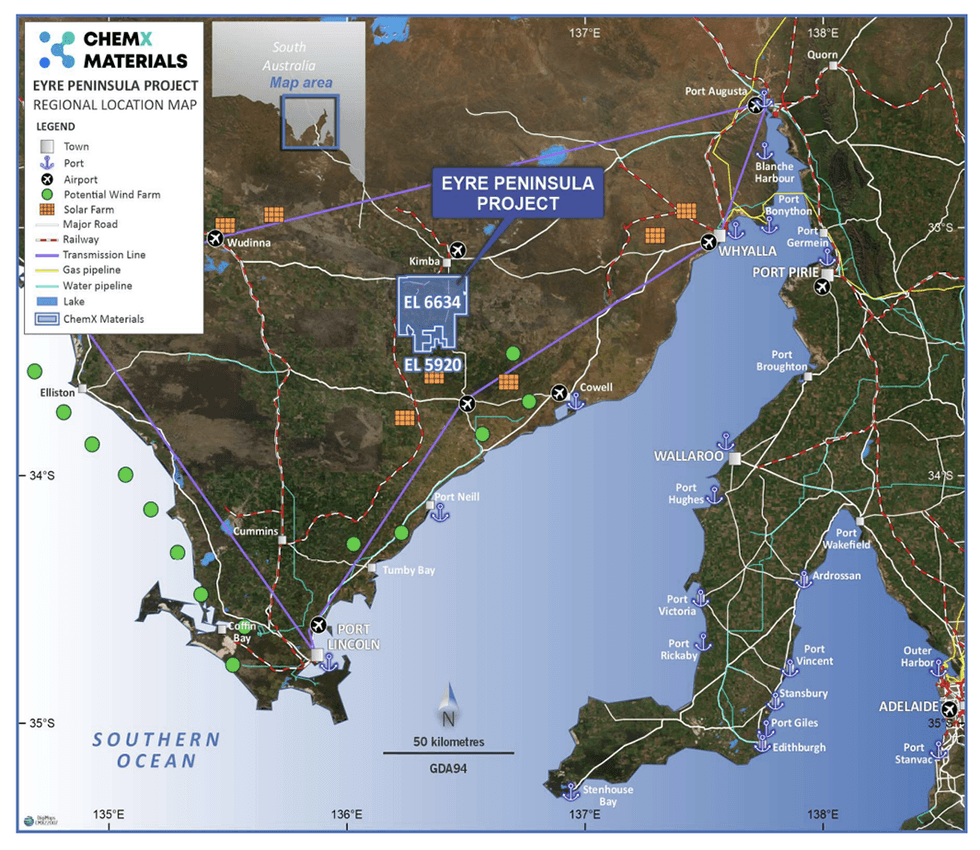

ChemX Materials is also developing a high purity manganese project. The Jamieson Tank project is located on two exploration tenements, EL 5920 and EL 6634 in the Eyre Peninsula in South Australia. These tenements collectively cover an area of 718 km2.

ChemX Materials completed a 94-hole drill program at the Jamieson Tank project, totaling 6,164 metres and released its maiden Mineral Resource Estimate in September 2023. The Mineral Resource Estimate reported 13.1 Mt at 5.7 percent manganese, with 21 percent classified as Indicated and 79 percent classified as Inferred.

Company Highlights

- ChemX Materials Limited (ChemX Materials) is an Australian company developing an innovative, processing technology to produce high-purity alumina (HPA), this process is called HiPurA®.

- ChemX Materials owns 100 percent of HiPurA® and was granted an Australian patent for this technology in January 2024.

- High purity alumina is used in advanced technology and clean energy applications including lithium-ion batteries, LEDs, semiconductors, smart watches and iPhones.

- The HiPurA® process is modular, scalable and uses a readily available aluminous chemical as its feedstock, therefore is not reliant on mine production offtake, all of which enable the technology to be deployed close to end users' manufacturing operations.

- ChemX Materials has proven HiPurA® can produce above 4N (99.99 percent) high purity alumina at micro plant scale. This testwork indicates HiPurA® is low in cost and energy intensity.

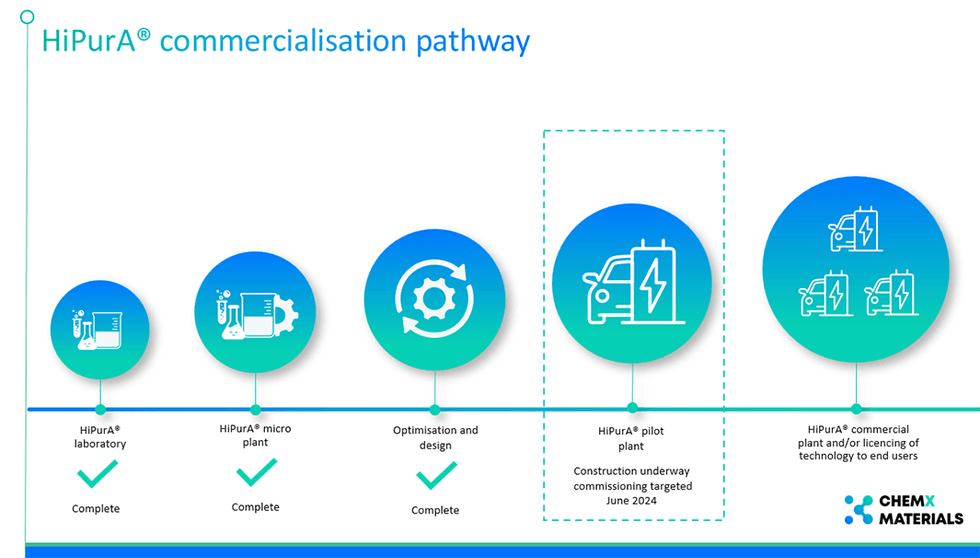

- ChemX Materials is constructing a pilot plant to demonstrate HiPurA® can work at scale, which is the next step towards commercialisation. The pilot plant construction is underway and on track for commissioning in June 2024.

This ChemX Materials profile is part of a paid investor education campaign.*

Click here to connect with ChemX Materials (ASX:CMX) to receive an Investor Presentation

Massive Maiden Mineral Resource Estimate >1B Tonnes for EMA Rare Earth Project

Brazilian Critical Minerals Limited (ASX: BCM) (“BCM” or the “Company”) is pleased to announce a maiden Mineral Resource Estimate (MRE) for the Ema and Ema East projects (collectively Ema), forming part of the Company´s wholly owned REE projects, Apuí, Amazon, Brazil (Table 2) at a cut-off of 500ppm the Inferred Mineral Resource Estimate contains 1,017Mt @ 793 ppm TREO.

Highlights

- JORC 2012 compliant Inferred Mineral Resource Estimate (MRE) of 1.02Bt @ 793ppm TREO, including a higher-grade portion of 331Mt @ 977ppm TREO

- Places Ema as one of the largest1 tonnage fully ionic clay, rare earth deposits in the world

- High magnetic REO (Nd, Pr, Dy, Tb) element proportion of 27 – 31% of basket positioning it as one of Brazil’s most enriched MREO deposits

- MRE developed from only 46% of the available area at Ema, with 107km2 available for further exploration

- The mineralisation is close to surface, amenable to low-cost open pit mining methods and remains open at depth and to the east and west

- Drilling program is now being designed to convert MRE from Inferred to Indicated and Measured categories

MRE when coupled with previously announced1 world class metallurgical testwork recovery results of the magnetic rare earth oxides (MREO), as listed below, confirm the following:

- 10 metres @ 76% Nd, 74% Pr, 47% Dy and 54% Tb from 10m (EMA-TR-101)

- 6 metres @ 66% Nd, 61% Pr, 56% Dy and 83% Tb from 10m (EML-TR-059)

- 13 metres @ 71% Nd, 62% Pr, 45% Dy and 52% Tb from 5m (TR-071)

- 5 metres @ 66% Nd, 66% Pr, 52% Dy and 55% Tb from 12m (TR-059)

- 10 metres @ 65% Nd, 61% Pr, 43% Dy and 50% Tb from 10m (TR-110)

- Ema is a fully ionic clay rare earth deposit – there is currently zero drilling into fresh rock

- Is amenable to a low cost REE metal recovery process – low reagent usage, high impurity removal in final product

- Recoveries achieved using standard weak ammonium sulphate leaching solution, pH 4, at ambient temperatures over low leach times of only 30 minutes duration

- Results demonstrate mineralisation is suited to low-cost processing through conventional processing facilities commonly used in China

Andrew Reid, Managing Director, commented:

“Today’s announcement is very important for the Company and our shareholders as it now sets us on a path towards development. This result places Ema as one of the largest ionic rare earths deposits in the world. The team has done a tremendous job in getting such a large MRE defined in less than 1 year, which now confirms the immense potential of the Ema project in Brazil.

Not only do we have a massive mineral resource of >1 billion tonnes but also significantly we have >300 million tonnes at grades close to 1,000ppm which will assist in generating positive financial cash flow models.

Opportunities to increase both grade and tonnage remain high due to the extremely conservative global specific gravity (SG) of 1.34 which was applied to the estimated volumes. Additional deeper, less weathered samples from the higher-grade horizon is expected to result in significantly higher sg’s.

With only 46% of the total area drilled, the team is confident of increasing not only tonnages but believes the opportunities to also increase the grade are well founded and will be tested through the next round of drilling commencing over the coming months. BCM is now well on its way to establishing the Company as a global rare earths leader.”

Click here for the full ASX Release

This article includes content from Brazilian Critical Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ChemX Materials

Overview

ChemX Materials (ASX:CMX) is a critical materials company developing innovative processing technology to produce high purity alumina for advanced technology and clean energy applications.

ChemX Materials’ 100 percent owned, Australian patented HiPurA® process technology offers a low cost and energy intensity production method to produce high purity alumina (HPA).

HPA is used in advanced technology and clean energy applications including lithium-ion batteries, LEDs, semiconductors and synthetic sapphires. Synthetic sapphires are critical in the production of applications such as smart watches, iPhones and laptop screens.

Company Highlights

- ChemX Materials Limited (ChemX Materials) is an Australian company developing an innovative, processing technology to produce high-purity alumina (HPA), this process is called HiPurA®.

- ChemX Materials owns 100 percent of HiPurA® and was granted an Australian patent for this technology in January 2024.

- High purity alumina is used in advanced technology and clean energy applications including lithium-ion batteries, LEDs, semiconductors, smart watches and iPhones.

- The HiPurA® process is modular, scalable and uses a readily available aluminous chemical as its feedstock, therefore is not reliant on mine production offtake, all of which enable the technology to be deployed close to end users' manufacturing operations.

- ChemX Materials has proven HiPurA® can produce above 4N (99.99 percent) high purity alumina at micro plant scale. This testwork indicates HiPurA® is low in cost and energy intensity.

- ChemX Materials is constructing a pilot plant to demonstrate HiPurA® can work at scale, which is the next step towards commercialisation. The pilot plant construction is underway and on track for commissioning in June 2024.

Key Business Segments

High Purity Alumina Processing Technology - HiPurA®

ChemX Materials is developing an innovative processing technology to produce high-purity alumina (HPA). This process is called HiPurA®. ChemX Materials owns 100 percent and holds an Australian patent for HiPurA®. ChemX Materials has proven HiPurA® can produce above 4N (99.99 percent) pure HPA at micro plant scale. This test work has also demonstrated that HiPurA® is superior compared to alternative technologies, offering several advantages, including:

- Lower costs – both capital and operating.

- Independent feedstock - – process is not tied to mine production and uses a readily available aluminous industrial chemical.

- Easily scalable – production output can increase based on demand.

- Modular – can be built near end users’ manufacturing operations.

- Optionality – patented technology can be licenced to end users.

- Lower carbon footprint – technology is not energy intensive.

HPA has several applications, the most important being lithium-ion batteries used in electric vehicles (EVs) and energy storage applications. HPA is used in the coating of the battery separator to enhance safety and performance. The outlook for EVs is very promising. With the adoption of EVs growing rapidly year on year as governments across the globe deploy domestic incentives and regulations to reduce the use of internal combustion engines to meet net zero targets.

HPA is also a key in the production of synthetic sapphire, which is used in LEDs, semiconductors, lasers, optical lenses and medical devices.

ChemX Materials has proven its HiPurA® technology can achieve above 99.99 percent (4N) HPA purity at micro plant scale. Following the technical success of the micro plant, ChemX Materials is constructing a 24 tpa pilot plant in Western Australia. The pilot plant is expected to be operational in June 2024.

In January 2024, ChemX Materials was granted an Australian Patent for its innovative HiPurA® technology. Based on the success of the Australian patent, it is anticipated that ChemX Materials will be afforded similar protections in other international jurisdictions. The patent is important as it provides intellectual property protection as ChemX Materials seeks to commercialise the technology globally.

HPA production from the pilot plant will be used for customer qualification and marketing purposes. ChemX Materials is actively pursuing commercial opportunities globally. Commercialisation options include:

- Build, own, operate a commercial scale plant to sell high purity alumina to end users.

- Licence the HiPurA® technology for deployment at end users’ manufacturing locations.

High Purity Manganese Project

ChemX Materials is developing a high purity manganese project. The Jamieson Tank project is located on two exploration tenements, EL 5920 and EL 6634 in the Eyre Peninsula in South Australia. These tenements collectively cover an area of 718 km2.

ChemX Materials completed a 94-hole drill program at the Jamieson Tank project, totaling 6,164 metres and released its maiden Mineral Resource Estimate in September 2023. The Mineral Resource Estimate reported 13.1 Mt at 5.7 percent manganese, with 21 percent classified as Indicated and 79 percent classified as Inferred.

High purity manganese has essential applications in lithium-ion batteries as a cathode material. Manganese provides energy density, stability and lower costs and is a critical material for modern battery chemistries. As the world pursues decarbonisation it is forecasted that the demand for manganese will grow.

With the objective of the United States Inflation Reduction Act (IRA) to reduce its reliance on Chinese sources of critical minerals, by 2025, the Jamieson Tank project is an important prospect. China currently supplies around 95 percent of the global manganese sulphate.

The South Australian jurisdiction offers excellent infrastructure. The Jamieson Tank project is in a province that is characterised by rapidly growing renewable energy infrastructure (wind, solar and hydrogen) and access to a local skilled workforce. The Jamieson Tank project is accessible by road, approximately 160 kms from the port of Whyalla and near a major regional airport.

The tenements in which the Jamieson Tank project is located also host kaolin and rare earth elements (REE) deposits. The area has historically been well known and explored for its potential for kaolin. The Kelly Tank exploration target is estimated to be 55 - 130 Mt of extractable kaolin.

In 2022, ChemX Materials undertook a drilling program and identified REE hosted within the kaolin throughout the tenements. The drilling program intersected high-grade REE mineralisation with intervals of up to 5 metres @2,468 parts per million total rare earth oxides from 7 metres. Importantly, it remains open in various directions, providing potential exploration upside for future drill programs.

Management Team

Peter Lee – Chief Executive Officer

20+ years’ experience across mining, metals processing and chemical industries within Canada and Australia. Lee has held technical leadership roles with companies including Rio Tinto, BHP, Roy Hill and WSPGolder. He is an expert in refining and electrochemical processes and a registered P. Eng Engineers and Geoscientists of British Columbia, Canada, and a member of AusIMM and AICD.

Warrick Hazeldine – Non-executive Chair

Warrick Haseldine has more than 20 years of experience across capital markets and strategic communications with a focus on battery materials. He is the co-founder of advisory firm Cannings Purple, and former chair and non-executive director of Global Lithium Resources Ltd (ASX:GL1). Hazeldine is currently a director of Surfing WA, advisory board member of Curtin University, and a non-executive director of Purple.

Stephen Strubel – Executive Director and Company Secretary

Stephen Strubel is the company founder with 20 years’ experience in finance and corporate governance. Struber held a senior leadership role with Patersons Securities and has been a director and company secretary for ASX-listed companies. He holds a bachelor’s degree in banking and international trade from Victoria University and an MBA from the Australian Institute of Business.

Alwyn Vorster – Non-executive Director

Alwyn Vorster has 30+ years’ experience in the resources industry, spanning several commodities including rare earths, iron ore, bauxite, potash and salt. Vorster has several senior leadership positions including chief executive officer of Hastings (ASX:HAS) and managing director of BCI Minerals (ASX:BCI) and Iron Ore Holdings (ASX:IOH). Vorster is currently non-executive director of Lindian Resources (ASX:LIN) and Arrow Minerals (ASX:AMD).

Rock Chips of up to 3.22% TREO Identified in Newly Granted Machinga Licence

Heavy rare earths (HREE) and Niobium (Nb) explorer DY6 Metals Ltd (ASX: DY6) (“DY6”, “the Company”) is pleased to announce the receipt of the assay results for the second comprehensive reconnaissance rock chip and soil sampling program completed at Machinga Main Licence Area Anomaly (Figure 1).

HIGHLIGHTS

- Sampling program consisting of a total of 727 rock chips and soil samples recently completed into recently granted licence area at Machinga

- Full assay results received from soil and rock chip sampling program at Machinga:

- 305 soil samples were taken on a 200m x 100m grid

- Assays returned up to 0.49%TREO

- 21% of all soil samples returned >1000ppm (>0.1%) TREO

- 422 rock chip samples were taken on a nominal 50 x 50m grid

- Assays returned up to 3.22% TREO, with 5 samples returning 1%+ TREO

- Rock chips also returned up to 0.75% Nb2O5

- 305 soil samples were taken on a 200m x 100m grid

- Two anomalies west of the main road of the newly granted licence show a much more continuous character of higher TREO results - highlighting the scale potential of REE mineralisation in this new area of the licence

- Assays will assist in refining targets ahead of next phase of drilling at Machinga

Machinga Soil and Rock Chip Sampling Program

Following on from the DDH assays reported in December 2023, DY6 conducted a comprehensive geochemical sampling over the Machinga exploration licences (EL0705/EL0529) initially, targeting the western side of the maiden drilling in Area 1 and 2 in licence EL0529 before moving to the anomalous soil responses in the southern region of Machinga main (EL0705) (Figure 1). The program consisted of a total of 727 samples which included 422 rock chips and 305 soils. The full list of assay results is included in Table 1.

Geochemical sampling was extended into the new licence and over the anomalous southern region covering and area of approximately 3000m x 2000m along a NW-SE strike direction. A previously reported extensive uranium radiometric anomaly, which spans over 7km along the same geological unit (refer ASX release dated 6 July 2023) is being targeted by the Company.

Click here for the full ASX Release

This article includes content from DY6 Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Rare Earth Elements Prices 101 (Updated 2024)

From electric vehicles and wind turbines to water treatment and nuclear power, rare earth elements (REE) are critical for many of the technologies necessary for a cleaner, greener economy and world. However, understanding pricing for these commodities can be tricky.

There are 17 rare earth minerals in all, and each is classified under different groups — typically light rare earths and heavy rare earths. Prices are available for multiple individual and mixed products, including for the rare earths used in permanent rare earth magnets, so it can all seem a bit overwhelming.

“The supply chain for rare earth materials and permanent magnets is complex, regionally concentrated and marked by a lack of transparent pricing,” according to international price reporting agency Fastmarkets. “This can lead to unpredictable costs, budgeting difficulties and supply insecurity. Geopolitical tensions further add to this uncertainty.”

Read on for a short introduction to the rare earth elements market and prices.

What is China's role in rare earths pricing?

First and foremost, it’s important to know that China is the main driver when it comes to REE prices and the rare earths market as a whole. The country is the world’s leading rare earths producer by a wide margin, and despite efforts elsewhere also controls about 87 percent of global rare earths refining capacity.

China has such a monopoly on the sector that REE prices spiked in 2010 and 2011 when the country cut exports. That sparked a boom for rare earths companies and mining projects around the world, as they sought to create reliable sources of rare earths supply outside of China. However, many failed to thrive when REE prices fell again.

In 2014, the World Trade Organization ruled against Chinese export quotas for rare earths, and China removed its industry caps in January 2015. The country also eliminated its export tariffs for rare earths in May 2015, leading to a further fall in REE prices. More recently, it banned the export of technology to make rare earth magnets.

The ongoing trade war between the US and China adds a layer of complication to the rare earth metals sector. Recognizing China's key place in the market, the US is undertaking various efforts to build its own supply.

In February 2021, US President Joe Biden signed an executive order aimed at reviewing shortcomings in the nation's domestic supply chains for rare earths, medical devices, computer chips and other critical resources. The next month, the US Department of Energy announced a US$30 million initiative to research and secure domestic supply chains for rare earths, along with battery metals such as cobalt and lithium.

In June 2022, Biden went even further, invoking the Defense Product Act to increase the domestic production of critical minerals such as rare earths, as well as to fund feasibility studies and expand existing resources. Furthermore, in September 2022, the Biden government announced US$156 million in funding to support the creation of "first-of-a-kind facility to extract and separate REEs and critical minerals from unconventional sources like mining waste."

Later, in July 2023, the Department of Energy put up US$32 million to build facilities for the production of REEs and other critical minerals from domestic coal-based resources.

Even with these efforts, China remains the heavyweight for now, so it’s important that investors interested in the rare earths space keep track of what the country is up to in terms of production.

Where to find rare earths prices?

Unlike prices for gold and silver, rare earth elements prices are hard to come by, as there is no widely used public exchange for rare earths. Firms such as Fastmarkets put out regular price assessments based on surveys of traders, consumers and other market participants; this information is available for a fee.

Price forecasts and other information can also be found via analyst firms and pricing forums such as Adamas Intelligence, Argus Media, Technology Metals Research and Asian Metal.

Which rare earths are the most important?

Rare earths are used in a range of different technologies, and demand is higher for some than others. They can be divided into “heavy” and “light” categories based on atomic weight, with heavy often being more sought after.

That said, light rare earths can be important too. Neodymium and praseodymium, used in rare earth magnets, fall into the light category. These and other elements used in rare earth permanent magnets, such as dysprosium, can be quite expensive. Neodymium and praseodymium have also been in the spotlight due to electric vehicles.

The concentration of different rare earths varies within each given deposit, but usually a deposit is dominated by either heavy or light rare earths, with some elements being much more abundant. Cerium, for example, is the most abundant rare earth, and is more plentiful in the Earth’s crust than copper.

Both cerium and lanthanum, used in things such as alloys in steelmaking and industrial catalysts, are oversupplied. As a result, they are priced quite a bit lower than most rare earth magnet materials.

Another group of rare earths to consider is those used in phosphors, or phosphorescent materials, which are the active component that adds color in fluorescent light bulbs and other lighting applications. Yttrium is fairly inexpensive when compared to more rare and therefore more expensive metals such as europium and terbium.

Rare earth concentrates and pricing

Think rare earths are easy to separate? Think again.

As mentioned, rare earths deposits contain various types of rare earths, not to mention a range of other impurities such as uranium and thorium, which can be troublesome to dispose of. The separation process can be difficult and lengthy, and so far separators outside of China have not managed to undercut producers within the country.

The best-known producer of separated rare earths outside of China is Lynas Rare Earths (ASX:LYC,OTC Pink:LYSCF), which owns and operates the Mount Weld mine in Western Australia and a separation facility in Malaysia. In 2023, Lynas received a US$258 million contract from the US Department of Defense to build a rare earths separation facility in Texas.

At the moment, California's Mountain Pass operation, owned by MP Materials (NYSE:MP), is the only working US rare earths mine and processing facility. The facility, which has a storied history, produces high-purity separated rare earth oxides, including lanthanum, cerium and neodymium-praseodymium oxide.

Other big companies developing REE separation operations include Energy Fuels (TSX:EFR,NYSEAMERICAN:UUUU). In Utah, the firm is completing Phase 1 REE separation infrastructure at its White Mesa mill, which will result in separated neodymium-praseodymium capacity of 800 to 1,000 metric tons per year.

According to Adamas Intelligence, "Elsewhere, projects across Sweden, South Africa, Australia and other countries aim to extract rare earths from mine waste and byproducts that could supply 8% of global demand successful."

It’s important to keep in mind that rare earths within a mixed concentrate won’t fetch as high a price as those that are already separated. When looking at technical reports from junior miners, be sure to check that companies have accounted for this discount when calculating their rare earths basket price, which is the price for all the rare earths bundled into a single number based on the distribution of different rare earths within the deposit.

This is an updated version of an article originally published by the Investing News Network in 2015.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Energy Fuels is a client of the Investing News Network. This article is not paid-for content.

Latest News

Eclipse Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.