- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Final Priority Drill Targets Selected For Cluff Lake Uranium Project Field Season

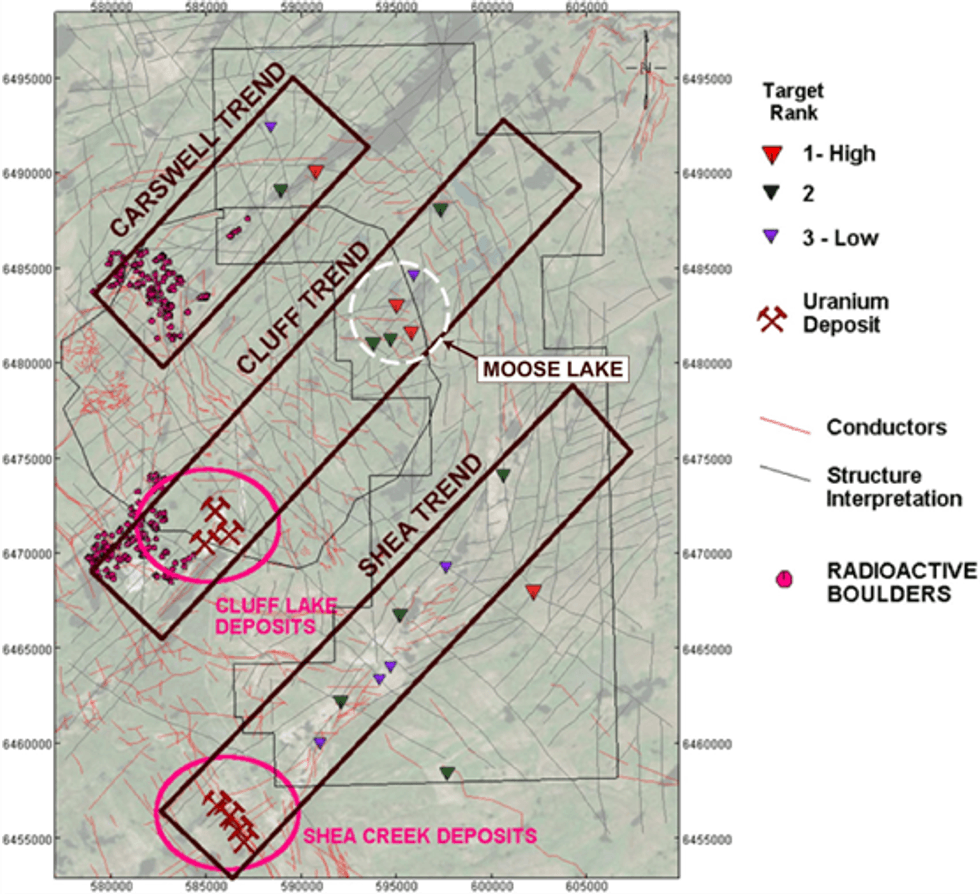

Valor Resources Limited(Valor) or (the Company) (ASX: VAL) is pleased to advise that it has confirmed several priority drill targets for the upcoming 2023 field season at the Cluff Lake Uranium Project, located 7km east of the Cluff Lake Uranium deposits on the western flank of Canada’s world-class Athabasca Basin (Figure 2).

HIGHLIGHTS

- Four priority targets identified at the Cluff Lake Uranium Project in Canada’s Athabasca Basin following a comprehensive review of all available exploration data, including data obtained from the extensive airborne gravity survey completed last year.

- Two of the targets located at the Moose Lake prospect are prioritised for drill testing.

- Structural interpretation combined with geophysical inversion models, all available surface geochemistry and drill-hole information have been used to rank and prioritise the targets for basement-hosted and unconformity-type uranium deposits.

- The depth to the top of the Athabasca Basin/basement unconformity has been derived from historical airborne EM (MEGATEM) magnetic and drilling data, as well as Valor’s 2022 airborne gravity gradiometry (AGG) survey data.

- Exceptionally high-grade rare earth element (REE) assays of up to 9.15% TREO1 returned from on- ground field checking of targets and surface sampling of historic trenches at the Moose Lake prospect.

- The Cluff Lake Project is located 7km east of Orano’s Cluff Lake Mine, which produced 62.5Mlbs @ 0.92% U3O8 and 5km from Orano’s/UEX’s Shea Creek deposits, which combine to form one of the largest undeveloped uranium resources in the Athabasca Basin.

- Follow-up field program proposed including radon surveys over targets before drilling later in 2023.

The targets have been refined following the interpretation of new airborne gravity gradiometry (AGG) and magnetic data, re-processing of historical airborne EM data (MEGATEM) and initial fieldwork at the Cluff Lake Project.

An earlier review of historic exploration data from the Cluff Lake area identified seven prospective targets from geological mapping, surface sampling, diamond drilling and re-processed historical geophysical data. The results of this review were reported on 7th June 2022 in the ASX announcement titled “Highly prospective Uranium targets identified at Cluff Lake Project near historical uranium mine”.

Subsequent to that, the Company completed an airborne gravity gradiometry survey in June 2022 and, following an interpretation of these and other data, high-priority targets have been defined (Figure 1).

The airborne gravity survey was designed to identify gravity lows which can be caused by clay alteration of the host rock, potentially due to hydrothermal fluids associated with unconformity uranium deposits (see Figure 3).

Click here for the full ASX Release

This article includes content from Valor Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Shareholders Approve Firetail Resources’ Acquisition of Peruvian Assets

Firetail received strong shareholder approval with 88 percent of votes in favor of the transaction

Firetail Resources (ASX:FTL) shareholders have approved the acquisition of up to 80 percent interest in Valor Resources’ (ASX:VAL) Picha and Charaque projects in Peru, according to an article published by The West Australian.

About 88 percent of Firetail’s shareholders voted in favour of the transaction, which is set to be completed in the first week of September 2023. The deal involves Firetail issuing an upfront payment of $550,000, 15 million shares and 20 million performance rights. In return, Valor will transfer 80 percent of the issued share capital of Kiwanda S.A.C, Valor’s wholly owned subsidiary which holds the mining concessions for the Peruvian assets.

The article also noted that Valor shall maintain a 20.58 percent stake in Firetail and a 20 percent interest in the acquired assets.

Firetail is advancing its drill planning for the Picha copper project in Peru with regulatory approvals already in place allowing up to 120 drill holes comprising up to 40 drill platforms with three holes per platform.

To read the full article, click here.

Click here to connect with Firetail Resources (ASX:FTL) for an Investor Presentation.

Top 5 ASX Uranium Stocks of 2024

Uranium has broken out, with the spot price rising to a 16-year high of US$106 per pound in early 2024. Despite a pullback, uranium prices in April still remain 30 percent higher than last year's average.

Although the market's turnaround has taken time, experts are predicting a bright future as countries around the world pursue clean energy goals. Against that backdrop, some ASX-listed uranium companies have been making moves in 2024.

Below the Investing News Network has listed the top uranium stocks on the ASX by year-to-date gains. Data was gathered using TradingView's stock screener on April 10, 2024, and all companies included had market caps above AU$50 million at the time. Read on to learn more about these firms and what they've been up to so far this year.

1. Paladin Energy (ASX:PDN)

Year-to-date gain: 56.12 percent; market cap: AU$4.54 billion; current share price: AU$1.53

Paladin Energy owns a 75 percent stake in the active Langer Heinrich uranium mine in Namibia, and also has an exploration portfolio that spans both Canada and Australia.

First brought into production in 2006, operations at Langer Heinrich were suspended in 2018 as ultra-low uranium prices averaging US$24 per pound U3O8 made the mine uneconomical. The dramatic rebound in the uranium market over the past year prompted Paladin to return Langer Heinrich to commercial production in April 2024.

Shares in company reached AU$1.53, its highest point of 2024 so far, on April 9. This is up by more than 56 percent since the start of the year, and up nearly 300 percent since hitting a yearly low of AU$0.515 in May 2023.

2. Lotus Resources (ASX:LOT)

Year-to-date gain: gain 45.95 percent; market cap: AU$1.24 billion; current share price: AU$0.42

Lotus Resources is another ASX-listed uranium miner working to revive operations at a former mine. The company’s flagship asset is the Kayelekera uranium mine in Malawi, which it acquired from Paladin Energy in 2020.

Kayelekera has been on care and maintenance since 2014 due to the years-long low price environment for the nuclear fuel. In August 2022, Lotus completed a definitive feasibility study for restarting the mine, which it is targeting for Q4 2025.

Last November, Lotus completed a merger with A-Cap Energy, adding the Letlhakane uranium project in Botswana to its portfolio. The company’s plans for the project in 2024 include fast-tracking delivery of a scoping study through the completion of infill drilling aimed at optimizing the mine plan and upgrading the mineral resource estimate.

Shares of Lotus Resources reached a year-to-date high of AU$0.44 on March 21.

3. Bannerman Energy (ASX:BMN)

Year-to-date gain: 44.19 percent; market cap: AU$596.08 million; current share price: AU$3.85

Uranium development company Bannerman Energy has honed its efforts on its Namibia-based Etango uranium project, which it says is one of the world’s largest undeveloped uranium assets. The company has been moving forward at Etango for 15 years and is currently targeting a final investment decision for this year.

Bannerman's latest news on its progress at Etango came on March 18 with the announcement that the company has completed a scoping study on the viability of expanding or extending the base case 8 million tonnes per annum of production outlined in the definitive feasibility study completed in December 2022. In addition, the company is currently advancing Front End Engineering and Design, offtake marketing and strategic financing workstreams.

Bannerman's share price reached AU$4.00, its highest point of 2024 so far, on April 8.

4. Deep Yellow (ASX:DYL)

Year-to-date gain: 31.46 percent; market cap: AU$1.22 billion; current share price: AU$1.40

Deep Yellow's portfolio of uranium assets spans Namibia and Australia, with its two most advanced projects being Tumas and Mulga Rock. The former is located in Namibia, while the latter is in Western Australia; according to the company, together they have a potential production capacity of over 7 million pounds per year of U3O8.

Deep Yellow released a definitive feasibility study (DFS) for Tumas in early February 2023, outlining output of 3.6 million pounds of U3O8 annually along with 1.15 million pounds of V2O5. The property's mine life is set at 22.25 years, but additional resources could increase it to over 30 years. In December, Deep Yellow did a review of the DFS, updating costs and forecast financial outcomes to reflect the more settled economic environment. Tumas received a mining licence from the Namibian government that same month. The company is targeting late Q3 2024 for a final investment decision.

In terms of Mulga Rock, the company has been working on an evaluation program geared at boosting the project's value by looking at its critical minerals potential. In late February 2024, the company updated the mineral resource estimate for the Ambassador and Princess deposits, resulting in a 26 percent increase in the project's total contained uranium and justifying an update to the DFS. Deep Yellow expects to start a revised DFS for Mulga Rock in Q2 2024.

Shares of Deep Yellow reached their 2024 peak on February 2, coming in at AU$1.76.

5. Boss Energy (ASX:BOE)

Year-to-date gain: 20.1 percent; market cap: AU$2.01 billion; current share price: AU$4.84

Boss Energy is focused on restarting its fully permitted Honeymoon uranium mine in South Australia. Production at the asset was suspended in 2013 due to low prices, but the company is now looking to bring it back online to take advantage of uranium's move upward. A JORC-compliant resource for the Honeymoon restart area stands at 36 million pounds of U3O8, and the property's mine life is estimated at over 10 years with output of 2.45 million pounds of U3O8 annually.

News throughout the past year was focused on activities geared at bringing Honeymoon back online, and Boss ultimately started mining operations at Honeymoon back up again in mid-October 2023. The same month, Boss and Coda Minerals (ASX:COD) were awarded four exploration tenements under a mineral rights sharing arrangement. The tenements make up the Kinloch project, which is located 130 kilometres south of Honeymoon.

Boss signed its first binding sales contract for production from Honeymoon in late December 2023. It will sell 1 million pounds of uranium to a US utility for seven years starting in 2025 and ending in 2031.

Then, in late February of this year, Boss announced the completion of a transaction that it said will make it a multi-mine uranium producer in the first half of 2024 — it entered into an agreement to acquire a 30 percent stake in enCore Energy's (TSXV:EU,NASDAQ:EU) Alta Mesa in-situ recovery project in Texas. In mid-March enCore announced its highest grade drill results to date at Alta Mesa, and reported that "at the Alta Mesa Uranium CPP, enCore has met most of the key objectives for the refurbishment of the processing circuits necessary for the planned early 2024 restart."

Boss Energy's share price reached its highest point of the year so far on February 2, when it hit AU$6.11.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Top 10 Uranium-producing Countries (Updated 2024)

Output from the top uranium-producing countries rose steadily for a decade, peaking at 63,207 metric tons (MT) in 2016. However, global uranium production has noticeably declined in the years since then.

Decreased numbers across the world are related to the persistently low spot prices the uranium market has experienced in the wake of the Fukushima disaster; COVID-19 and Russia's war against Ukraine have also had an impact on output.

Now uranium prices have begun to rebound significantly, buoyed by increasingly positive sentiment about the role of nuclear power in the energy transition, and investment demand via new uranium-based funds.

Currently 10 percent of the world’s electricity is generated by nuclear energy, and that number is expected to grow. Looking forward, analysts are calling for a sustained bull market in uranium. In early 2024, prices surged to a 16 year high of more than US$100 per pound, and although they have slipped slightly since then, industry insiders remain optimistic.

Due to its significance in energy generation, it’s important to know where uranium is mined and which nations are the largest uranium-producing countries. Kazakhstan is the leader by a long shot, and has been since 2009. In 2022 — the last year for which data is available — it was followed by Canada and Namibia in second and third place, respectively.

For investors interested in following the uranium space, having familiarity with these uranium production hotspots is essential. Read on to get a closer look at 2022’s largest uranium-producing countries. All statistics are from the World Nuclear Association’s most recent report on uranium mine production.

1. Kazakhstan

Mine production: 21,227 MT

As mentioned, Kazakhstan had the highest uranium production in the world in 2022. In fact, the country’s total output of 21,227 MT accounted for an impressive 43 percent of global uranium supply.

When last recorded in 2021, Kazakhstan had 815,200 MT of known recoverable uranium resources, second only to Australia. Most of the uranium in the country is mined via an in-situ leaching process.

Kazataprom (LSE:KAP,OTC Pink:NATKY), the country’s national uranium miner, is the world’s largest producer, with projects and partnerships in various jurisdictions. News that the top uranium producer may miss its production targets for 2024 and 2025 was a large contributor to uranium prices breaking through the US$100 level this year.

2. Canada

Mine production: 7,351 MT

Canada’s uranium output has fallen dramatically since hitting a peak of 14,039 MT in 2016. After producing 6,938 MT of yellowcake in 2019, Canadian uranium production sank to 3,885 MT in 2020 as the COVID-19 pandemic led to operational shutdowns. However, uranium production in the country began to rebound in 2022.

Saskatchewan’s Cigar Lake and McArthur River are considered the world’s two top uranium mines. Both properties are operated by sector major Cameco (TSX:CCO,NYSE:CCJ). Cameco made the decision to shutter operations at the McArthur River mine in 2018, but returned to normal operations in November 2022.

In 2023, Cameco produced 17.6 million pounds of uranium, which was below its originally planned production of 20.3 million pounds for the year. The company has set its guidance at 22.4 million pounds for 2024.

Uranium exploration is also prevalent in Canada, with the majority occurring in the uranium-rich Athabasca Basin. That area of Saskatchewan is world renowned for its high-quality uranium deposits and friendly mining attitude. The province’s long history with the uranium industry has helped to assert it as an international leader in the sector.

3. Namibia

Mine production: 5,613 MT

Namibia’s uranium production has been steadily increasing after falling to 2,993 MT in 2015.

In fact, the African nation overtook longtime frontrunner Canada to become the third largest uranium-producing country in 2020, and went on to surpass Australia for the second top spot in 2021. Although Namibia slipped back below Canada in 2022, its output for the year was only down by 140 MT from 2021.

The country is home to two uranium mines that are capable of producing 10 percent of the world’s output. Paladin Energy (ASX:PDN,OTCQX:PALAF) owns the Langer Heinrich mine, while large miner Rio Tinto (NYSE:RIO,ASX:RIO,LSE:RIO) sold its majority share of the Rössing mine to China National Uranium in 2019.

In 2017, Paladin took Langer Heinrich offline due to weak uranium prices; however, improved uranium prices over the past few years prompted the uranium miner to ramp up restart efforts. At the close of 2024's first quarter, Langer Heinrich achieved commercial production once again.

4. Australia

Mine production: 4,087 MT

Australia’s uranium production decreased significantly in 2021 to 4,192 MT, down from 2020’s 6,203 MT; it fell further in 2022 to hit 4,087 MT. The island nation holds 28 percent of the world’s known recoverable uranium resources.

Uranium mining is a contentious and often political issue in Australia. While the country permits some uranium-mining activity, it is opposed to using nuclear energy — at least for now. "Australia uses no nuclear power, but with high reliance on coal any likely carbon constraints on electricity generation will make it a strong possibility,” according to the World Nuclear Association. “Australia has a significant infrastructure to support any future nuclear power program.”

Australia is home to three operating uranium mines, including the largest-known deposit of uranium in the world, BHP's (NYSE:BHP,ASX:BHP,LSE:BHP) Olympic Dam. Although uranium is only produced as a by-product at Olympic Dam, its high output of the metal makes it the fourth largest uranium-producing mine in the world. In BHP's 2023 fiscal year, uranium output from the Olympic Dam operation totaled 3.4 million MT of uranium oxide concentrate, an increase of 1.03 million MT from the previous year's production.

5. Uzbekistan

Mine production: 3,300 MT

In 2020, with an estimated 3,500 MT of output, Uzbekistan became one of the top five uranium-producing countries. Domestic uranium production had been gradually increasing in the Central Asian nation since 2016. Previously seventh in terms of global uranium output, it is expanding production via Japanese and Chinese joint ventures. However, for 2022, the country's uranium output was down by 200 MT to 3,300 MT.

Navoi Mining & Metallurgy Combinat is part of state holding company Kyzylkumredmetzoloto, and handles all the mining and processing of domestic uranium supply. The nation's uranium largess continues to attract foreign investment; strategic partnerships with French uranium miner Orano and state-run China Nuclear Uranium were announced in November 2023 and March 2024, respectively.

6. Russia

Mine production: 2,508 MT

Russia was in sixth place in terms of uranium production in 2022. Output has been relatively steady in the country since 2011, usually coming in around the 2,800 to 3,000 MT range.

Experts had been expecting the country to increase its production in the coming years to meet its energy needs, as well as growing uranium demand around the world. But in 2021, uranium production in the country dropped by 211 MT from the previous year to 2,635 MT; it fell further by another 127 MT to reach 2,508 MT in 2022.

In terms of domestic production, Rosatom, a subsidiary of ARMZ Uranium Holding, owns the country’s Priargunsky mine and is working on developing the Vershinnoye deposit in Southern Siberia through a subsidiary. In 2023, Russia surpassed its uranium production target, producing 90 MT more than expected. Rosatom is developing new mines, including Mine No. 6, which is slated to begin uranium production in 2028.

Russian uranium has been an area of controversy in recent years, with the US initiating a Section 232 investigation around the security of uranium imports from the country in 2018. More recently, Russia's ongoing war in Ukraine has prompted countries around the world to look more closely at their nuclear supply chains.

7. Niger

Mine production: 2,020 MT

Niger’s uranium production has declined year-on-year over the past decade, with output totaling 2,020 MT in 2022. The African nation has two uranium mines in production, SOMAIR and COMINAK, which account for 5 percent of the world’s uranium production. Both projects are operated by subsidiaries of Orano, a private uranium miner.

Niger is also home to the flagship project of explorer GoviEx Uranium (TSXV:GXU,OTCQB:GVXXF). The company is presently developing its Madaouela asset, as well as projects in Zambia and Mali. Global Atomic (TSX:GLO,OTCQX:GLATF) is developing its Dasa project in the country, and expects to commission its processing plant by early 2026.

A recent military coup in the African nation has sparked uranium supply concerns, as Niger accounts for 15 percent of France's uranium needs and one-fifth of EU imports. In January 2024, the Nigerian government, now under a military junta, announced it intends to overhaul the nation's mining industry. It has temporarily halted the granting of new mining licenses and will be considering reforms to existing mining licenses in order to increase state profits.

8. China

Mine production: 1,700 MT

China’s uranium production rose from 885 MT in 2011 to 1,885 MT in 2018, and held steady at that level until falling to 1,600 MT in 2021. The country's uranium output grew by 100 MT to hit 1,700 MT in 2022.

China General Nuclear Power, the country’s sole domestic uranium supplier, is looking to expand nuclear fuel supply deals with Kazakhstan, Uzbekistan and additional foreign uranium companies.

China’s goal is to supply one-third of its nuclear fuel cycle with uranium from domestic producers, obtain one-third through foreign equity in mines and joint ventures overseas and purchase one-third on the open uranium market. China is also a leader in nuclear energy; Mainland China has 55 nuclear reactors with 27 in construction.

9. India

Mine production: 600 MT

India produced 600 MT of uranium in 2022, on par with output in 2021.

India currently has 23 operating nuclear reactors with another seven under construction. “The Indian government is committed to growing its nuclear power capacity as part of its massive infrastructure development programme,” as per the World Nuclear Association. “The government has set ambitious targets to grow nuclear capacity.”

10. South Africa

Mine production: 200 MT

South Africa is another uranium-producing country that has seen its output decline over the past decade — the nation's uranium output peaked at 573 MT in 2014. Nonetheless, South Africa surpassed Ukraine's production (curbed by Russia's invasion) in 2022 to become the 10th top uranium producer globally.

South Africa holds 5 percent of the world’s known uranium resources, taking the sixth spot on that list.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Blue Sky Uranium Announces Non-Brokered Private Placement

Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2), ("Blue Sky" or the "Company") is pleased to announce a non-brokered private placement for the sale of up to 16,666,667 units of the Company (each, a "Unit") at a price of C$0.06 per Unit (the "Offering Price") for aggregate gross proceeds of C$1,000,000 (the "Offering"). Red Cloud Securities Inc. will be acting as a finder in connection with the Offering.

Each Unit will consist of one common share in the capital of the Company (each, a "Common Share") and one transferrable Common Share purchase warrant (each, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one additional Common Share (each, a "Warrant Share") at an exercise price of C$0.09 per Warrant Share for a period of two (2) years following the issue date of the Unit.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 – Prospectus Exemptions ("NI 45-106"), the Units will be offered for sale to purchasers resident in Canada other than Quebec and in certain offshore jurisdictions pursuant to the listed issuer financing exemption under Part 5A of NI 45-106 (the "Listed Issuer Financing Exemption"). The Units may also be sold in certain other jurisdictions pursuant to applicable securities laws. The Common Shares issuable from the sale of Units sold under the Listed Issuer Financing Exemption are expected to be immediately freely tradeable under applicable Canadian securities legislation if sold to purchasers resident in Canada, subject to any hold period imposed by the TSX Venture Exchange (the "Exchange") on the securities issued to certain purchasers. There is an offering document relating to the Offering that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at www.blueskyuranium.com. Prospective investors should read this offering document before making an investment decision.

Closing of the Offering is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including but not limited to, the approval of the Exchange. Directors, officers and employees of the Company may participate in a portion of the Offering and any securities issued to such directors and officers are subject to the Exchange's four-month hold period. A commission may be paid to arm's length finders on a portion of the Offering. The Company intends to use the proceeds of the Offering for exploration programs on the Company's projects in Argentina and for general working capital.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws, and accordingly, may not be offered or sold within the United States except in compliance with the registration requirements of the 1933 Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction.

About Blue Sky Uranium Corp.

Blue Sky Uranium Corp. is a leader in uranium discovery in Argentina. The Company's objective is to deliver exceptional returns to shareholders by rapidly advancing a portfolio of surficial uranium deposits into low-cost producers, while respecting the environment, the communities, and the cultures in all the areas in which we work. Blue Sky has the exclusive right to properties in two provinces in Argentina. The Company's flagship Amarillo Grande Project was an in-house discovery of a new district that has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier. The Company is a member of the Grosso Group, a resource management group that has pioneered exploration in Argentina since 1993.

ON BEHALF OF THE BOARD

"Nikolaos Cacos"

______________________________________

Nikolaos Cacos, President, CEO and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. All statements, other than statements of historical fact, that address activities, events or developments the Company believes, expects or anticipates will or may occur in the future, including, without limitation, statements about the closing of the Offering, the participation by insiders in the Offering, finder's fees, and the use of proceeds; the Company's plans for its mineral properties; the Company's business strategy, plans and outlooks; the future financial or operating performance of the Company; and future exploration and operating plans are forward-looking statements. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: the impact of COVID-19; risks and uncertainties related to the ability to obtain necessary approvals, including Exchange approval for the closing of the Offering, the ability to obtain, amend, or maintain licenses, permits, or surface rights; risks associated with technical difficulties in connection with mining activities; and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations. Actual results may differ materially from those currently anticipated in such statements. Readers are encouraged to refer to the Company's public disclosure documents for a more detailed discussion of factors that may impact expected future results. Any forward-looking statement speaks only as of the date on which it is made and the Company undertakes no obligation to publicly update or revise any forward-looking statements, unless required pursuant to applicable laws.

Tisdale Clean Energy Appoints Jordan Trimble to Advisory Board

TISDALE CLEAN ENERGY CORP. (“ Tisdale ” or the “ Company ”) (TSX.V: TCEC, OTCQB: TCEFF , FSE: T1KC ) , is pleased to announce the appointment of Jordan Trimble to its newly constituted Advisory Board.

Mr. Trimble is the President and CEO of Skyharbour Resources, a uranium explorer and prospect generator in the Athabasca Basin and Tisdale’s project partner at the South Falcon East Project. He brings significant experience in the uranium sector and will provide vital insight to the Company in his advisory role.

“I’ve known and worked with Jordan for over a decade now, and I’m very happy we’re able to bring him on as a key advisor to Tisdale,” said Alex Klenman, CEO of Tisdale. “As we develop the South Falcon East project and grow the Company, Jordan’s knowledge of the Athabasca Basin combined with his deep understanding of the uranium sector as a whole will have a positive impact on our ability to grow the Company,” continued Mr. Klenman.

“With Skyharbour as a project partner at South Falcon East, and with Tisdale recently commencing their inaugural exploration programs at the project, I am happy to join Tisdale as an advisor,” said Mr. Trimble. The South Falcon East project is an advanced-stage exploration asset that hosts a near-surface uranium resource with strong expansion potential as well as robust discovery upside potential regionally on the property. Skyharbour as a large shareholder of Tisdale is excited for the company to unlock further value at the project.”

Jordan Trimble is the President and Chief Executive Officer as well as a Director of Skyharbour Resources Ltd. Under his leadership Skyharbour has grown from a $2 million shell company to a $90 million market cap as a leading exploration company in the Athabasca Basin. Skyharbour is advancing numerous projects including its co-flagship Moore and Russell Lake uranium projects, and it has a portfolio of over 587,000 hectares of mineral claims across 29 projects.

Through his career Mr. Trimble has founded and helped manage several public and private companies having worked in the resource industry in various roles specializing in management, corporate finance and strategy, shareholder communications, business development and capital raising. He is a frequent speaker at resource and mining conferences globally and has appeared on various media outlets including BNN and the Financial Post. Mr. Trimble holds a Bachelor of Science Degree with a Minor in Commerce from the University of British Columbia, and he is a CFA® Charterholder and served a full term as a Director of the CFA Society Vancouver.

ON BEHALF OF THE BOARD OF TISDALE CLEAN ENERGY CORP.

“Alex Klenman”

Alex Klenman, CEO

For further information please contact:

Alex Klenman, CEO

Tel: 604-970-4330

Tisdale Clean Energy Corp

Suite 2200, HSBC Building, 885 West Georgia St.

Vancouver, BC V6C 3E8 Canada

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

Victory Announces Private Placements

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Victory Battery Metals Corp. (CSE:VR)(FRA:VR6) (OTC PINK:VRCFF) ("Victory" or the "Company") announces today that it will undertake a non-brokered private placement of up to $500,000 by the issuance of 10,000,000 units at $0.05, each unit consisting of one share and one half a warrant. Each whole warrant entitles the holder to additional share for 2 years at a price of $0.10.

In connection with the Offering, the Company may pay finder's fees in cash or securities or a combination of both, as permitted by the policies of the Canadian Securities Exchange (the "CSE") and applicable securities laws. The common shares and warrants comprising the Units will be subject to a four-month and one-day hold period.

The Company intends to use the net proceeds of the offering for working capital requirements and other general corporate purposes.

About Victory Battery Metals

Victory is a publicly traded diversified investment corporation with mineral interests in North America. The Company's head office is located at 1780-355 Burrard Street, Vancouver, BC, V6C 2C8, and its Common Shares are currently listed on the CSE.

Cautionary Statement Regarding Forward-Looking Information

Statements in this press release regarding the Company which are not historical facts are "forward-looking statements" that involve risks and uncertainties. Such forward-looking information can be generally identified by terms such as "may", "expect", "estimate", "anticipate", "intend", "believe", and "continue" or the negative thereof or similar variations. Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties. The Company provides forward-looking statements for the purpose of conveying information about current expectations and plans relating to the future, and readers are cautioned that such forward-looking statements may not be appropriate for other purposes. By its nature, this forward-looking information is subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions may not prove to be accurate, that assumptions may not be correct, and that objectives, strategic goals and priorities may not be achieved. These risks and uncertainties include but are not limited to those identified and reported under the Company's disclosure documents available on its SEDAR+ profile at www.sedarplus.com.

Contact Information

For further information, please contact:

Mark Ireton, President

Phone: +1 (236) 317-2822 or toll-free +1 (855) 665-GOLD (4653)

E-mail: info@victorybatterymetals.com

www.victorybatterymetals.com

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this press release.

Toro Energy

Overview

Countries worldwide are working towards decarbonization and paying more attention to clean energy sources. About 10 percent of the world's electricity is produced from 440 power reactors, and more countries like Japan, Germany, the UK and the US are revitalizing their nuclear energy capacities to reduce fossil fuel production while improving energy security.

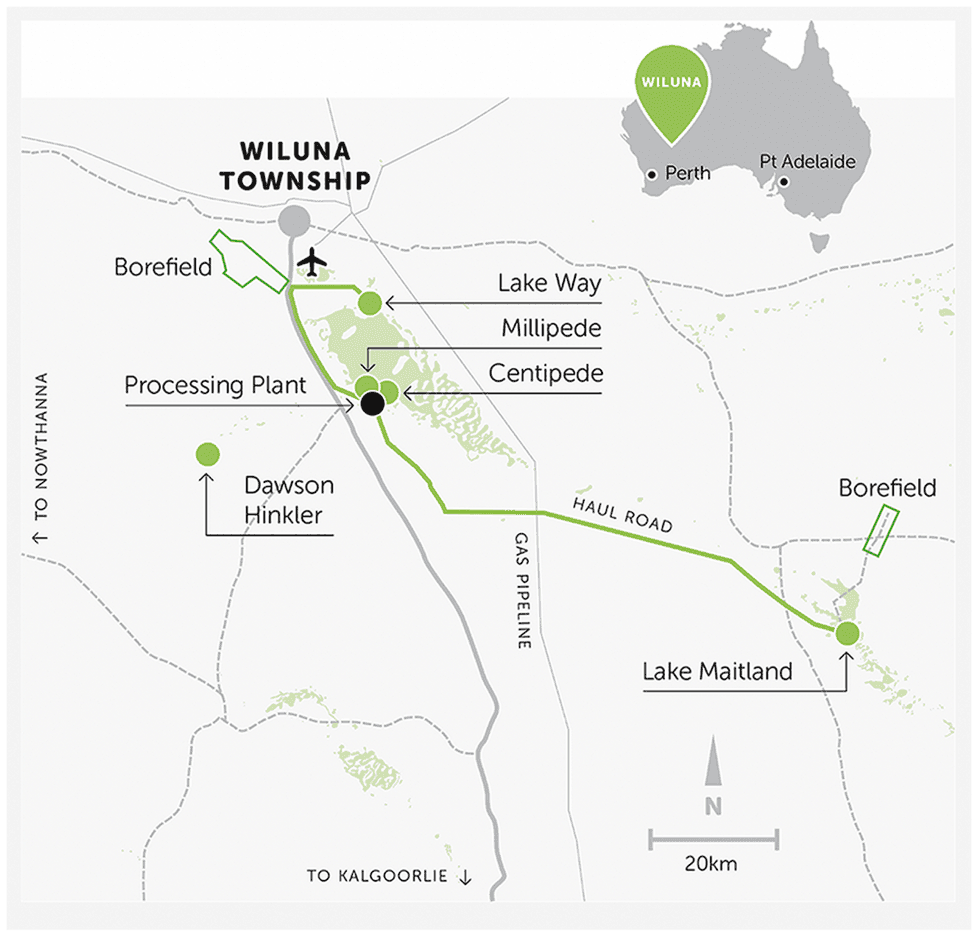

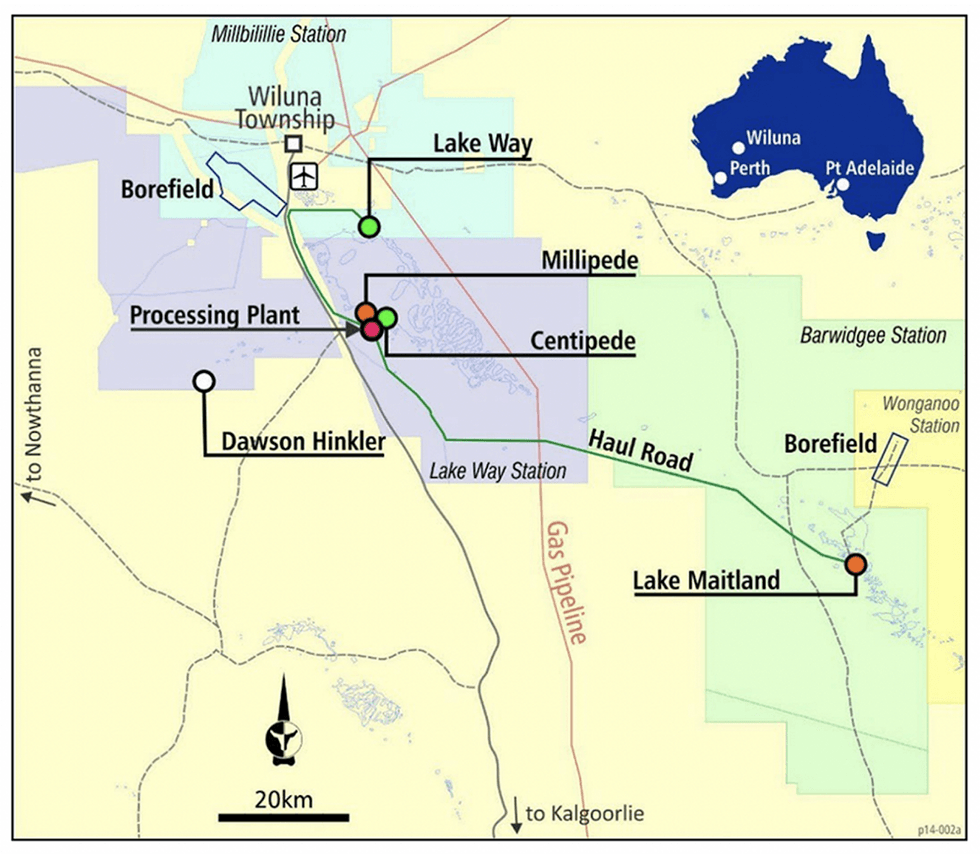

Australia produces 12 percent of the world’s uranium, behind Canada (13 percent) and Kazakhstan (43 percent). It is also home to the Wiluna uranium project, a well-established uranium resource, which is also the flagship asset of Toro Energy (ASX:TOE), a uranium exploration and development mining company that actively seeks to uncover value from other commodities in its existing highly prospective project ground.

Toro holds JORC-compliant uranium resources of 90.9 million pounds (Mlbs) uranium oxide (U3O8), at a 200 parts per million (ppm) U3O8 cut-off, across its Western Australia uranium projects, of which 84 Mlbs are proximally located within the northern goldfields region.

The 100-percent-owned Wiluna uranium project includes four key deposits – Lake Maitland, Centipede, Millipede and Lake Way – and offers significant uranium exposure of 52 million tons (Mt) @ 548 ppm for 62.7 Mlbs U3O8, at 200 ppm cut-off (JORC 2012). It is located only 30 kilometers southwest of Wiluna in Central Western Australia.

The Wiluna uranium project has received state and federal approval (subject to required amendments) and has been granted mining leases.

Considerable research over recent years has identified processing redesign opportunities from unique geological attributes within the uranium deposits, but particularly at Lake Maitland, as well as the ability to extract the inherent vanadium held within the uranium ‘ore’ for a vanadium by-product. Within the uranium mineralization envelope, the Wiluna project is estimated to contain 68.3 Mlbs of vanadium oxide (V2O5), inferred at 200 ppm V2O5 cut-off (JORC 2012).

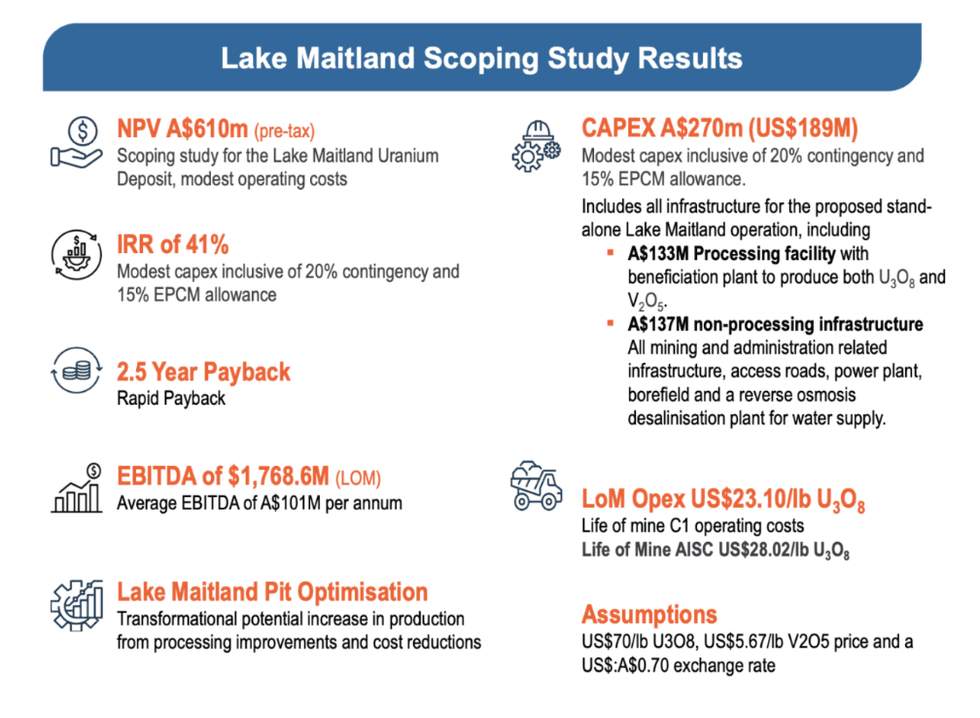

The unique geology of the Lake Maitland deposit and the processing redesign have allowed for a mining and processing option exclusively for Lake Maitland, that could be economic on its own or be the economic spearhead of a longer-term, larger Wiluna mining operation (dependent on market conditions and approvals). The stand-alone Lake Maitland option, aided by the economic efficiency of the new processing design, results in a transformational potential increase in production from the Lake Maitland deposit.

The scoping study for the stand-alone Lake Maitland uranium-vanadium operation option shows potential for exceptional financial returns with a pre-tax NPV of AU$610 million, a short payback period of 2.5 years, 41 percent internal rate of return, and low capital operating cost estimates (assuming an AU$/US$ exchange rate of 0.7 and US$70/lb U3O8 price and US$5.67/lb V2O5 price) after producing 22.8 Mlbs of U3O8 and 11.9 Mlbs of V2O5.

The Lake Maitland pit optimisation successfully increased potential production by 8Mlbs U3O8 and 11.9Mlbs V2O5 based on these assumptions.

The design phase of Toro Energy’s beneficiation and hydrometallurgical pilot plant is on track and in line with plans to begin operations in the second half of 2024. The pilot plant will test the improved beneficiation and hydrometallurgical circuit developed by Toro from bench scale research at a closer-to-production scale and as single streams. It will also test potential ore from the three uranium-vanadium deposits that Toro believes will make up an extended Lake Maitland operation – these include Lake Maitland, Lake Way and Centipede-Millipede.

The company will commence a large sonic core drill program to provide bulk, but targeted potential ore, for the upcoming pilot plant program.

Toro Energy has also recently initiated a refresh and update of its Lake Maitland scoping study using the latest, more favourable commodity pricing and exchange rate guidance.

The Lake Maitland deposit is part of a joint venture partnership with two reputable Japanese corporations, Japan Australia Uranium Resource Development. (JAURD) and Itochu.

Toro has been actively evaluating the prospectivity of its Wiluna asset portfolio for minerals other than uranium, including nickel and gold.

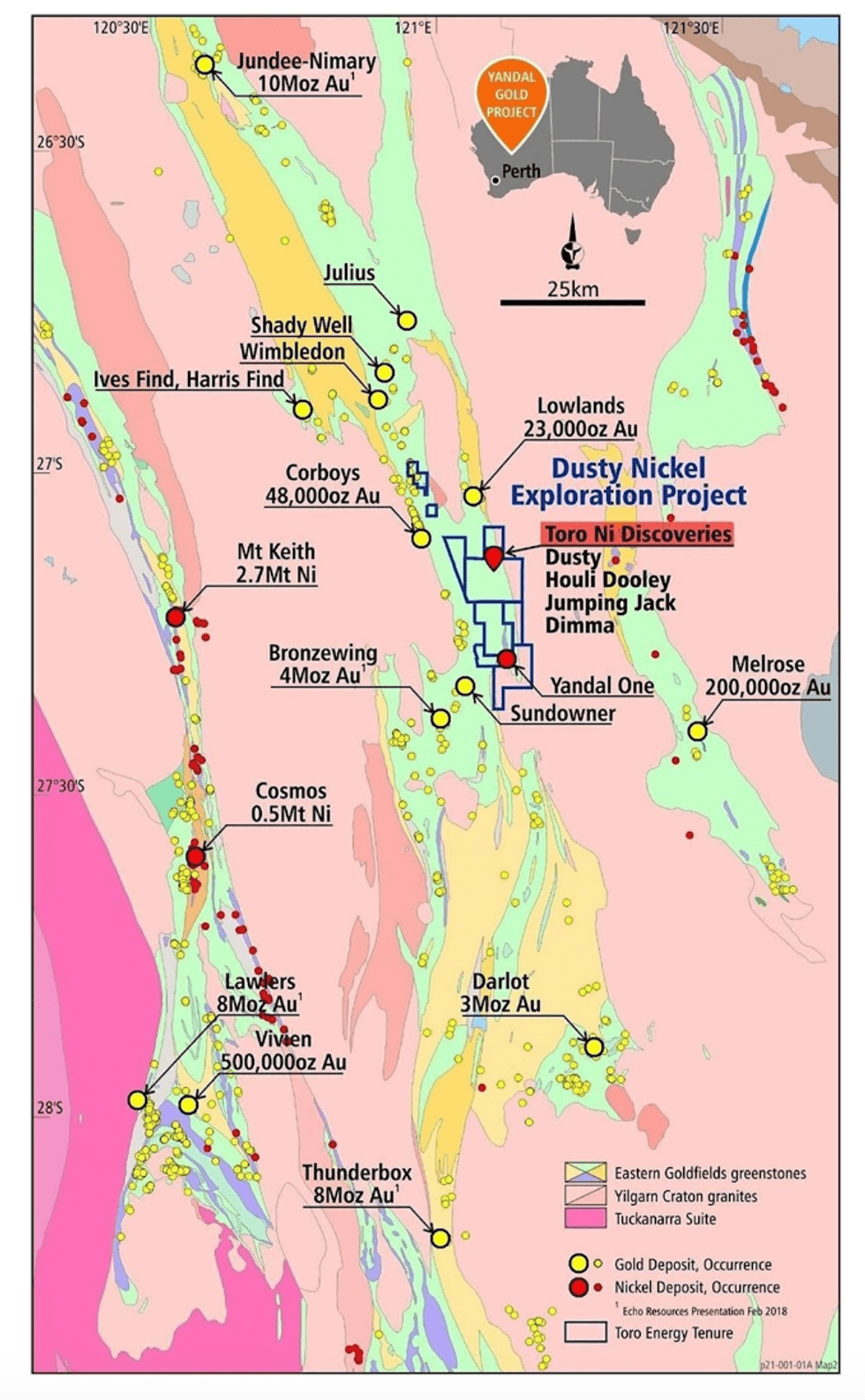

Toro’s Dusty nickel project is located on the northern, eastern and southern shores of Lake Maitland and the Lake Maitland uranium deposit and is focused on two main target areas: Dusty and Yandal One. These properties will be the subject of a proposed demerger, following Toro’s recent strategic review of its non-core assets and future plans to solely focus on its uranium development opportunities and its flagship Wiluna project.

Toro Energy’s management team and board of directors have extensive experience in the mining industry, with combined expertise that includes working at major mining houses, exploration companies, uranium mining operations, corporate financing and government and community relations.

Company Highlights

- Toro Energy is a well-established Western Australian uranium exploration and development company that actively seeks to uncover value from other commodities in existing highly prospective ground.

- Toro holds JORC-compliant uranium resources of 90.9 Mlbs U3O8 across its Western Australia uranium projects, of which 84 Mlbs is proximally located within the northern goldfields.

- Toro’s 100-percent-owned flagship Wiluna uranium project, located 30 kilometers southwest of Wiluna in Central Western Australia, contains 62.7 Mlbs of U3O8 at an average grade of 548 ppm over four deposits: Lake Maitland, Centipede, Millipede and Lake Way.

- The company has defined a significant maiden inferred vanadium resource of 68.3 Mlbs of V2O5 inside the uranium mineralisation envelope.

- Scoping Study completed for a stand-alone Lake Maitland Uranium-Vanadium operation shows potential for exceptional financial returns.

- In addition to its flagship uranium project, Toro’s strategic evaluation of the Lake Maitland tenure has resulted in the discovery of massive nickel sulphide and vein-hosted gold, which include the Dusty Nickel Project and the Yandal Gold Project.

- Following a recent strategic review, Toro is considering to solely focus on its uranium development opportunities and demerge its portfolio of non-core projects, including the nickel, gold and base metal assets in Western Australia.

- The company is led by a management team and board of directors with direct experience in the uranium exploration and mining as well as base metal exploration industry.

Key Projects

Wiluna Uranium Project

Toro Energy’s flagship asset is located only 30 kilometers from the town of Wiluna in the northern goldfields region within central Western Australia. The Wiluna project contains 62.7 Mlbs of U3O8 (at a 200 ppm U3O8 cut-off) over four deposits: Centipede, Millipede, Lake Way and Lake Maitland. The asset has been de-risked and optimized to improve yield and has successfully incorporated the processing of a vanadium resource as a by-product. A scoping study was completed for a stand-alone Lake Maitland uranium-vanadium operation.

Project Highlights:

- De-risked Uranium Project: Toro Energy has de-risked the Wiluna uranium asset by:

- Obtaining state and federal environmental approvals. Retrospective amendment to substantial commencement date condition will be required as well as amendment to mining proposal required as a result of further studies which significantly enhanced the project (refer below)

- Securing mining leases

- Identifying a simple yet effective mining process

- Drilling out the uranium resources so that the project’s JORC 2012-compliant 52 Mt at 548 ppm for 62.7 Mlbs of U3O8 (at a 200 ppm U3O8 cut-off) have a 96.3 percent measured and indicated status (JORC 2012)

- Extensive laboratory testing of a new and efficient beneficiation and processing technique inclusive of the extraction of vanadium for a valuable by-product.

- Uranium Exploration assets: Toro also owns 100 percent of three other exploration projects in Western Australia that have a total uranium resource of 28.2 Mlbs at Nowthanna, Dawson Hinkler and Theseus.

- Lake Maitland Pit Expansion: A 2022 pit expansion campaign, based on the new beneficiation and processing flow sheet and a stand-alone Lake Maitland mining operation, increased the potential of uranium ore and the asset by US$608 million in potential gross product value.

- Scoping study at proposed Lake Maitland Uranium-Vanadium Operation: Conducted by mining engineers at SRK Consulting Australasia, and metallurgical and processing engineers at Strategic Metallurgy, the scoping study results highlight the project’s potential for robust financial returns (assumes a US$70/lb U3O8, US$5.67/lb V2O5 price and a US$: AU$0.70 exchange rate).

- Scoping Study Financial Metrics Refresh: A refresh of the scoping study is underway to incorporate current financial metrics and improved uranium pricing.

- Further Expansion of Scoping Study: to incorporate amenable ore from Toro’s Lake Way and Centipede-Millipede uranium deposits into the proposed processing operation at Lake Maitland.

- Expanded Resource at Lake Way and Centipede-Millipede deposits: Expansion of the stated U3O8 and V2O5 resources at both the Centipede-Millipede and Lake Way uranium-vanadium deposits was conducted by reducing the stated U3O8 and V2O5 resource cut-off grades to 100 ppm (from 200 ppm):

- The stated Centipede-Millipede U3O8 resource expands by 25 percent or 5.98 Mlbs to 29.95 Mlbs contained U3O8, with a reduction in average grade to 351 ppm U3O8.

- The stated Lake Way U3O8 resource expands by 15 percent or 1.79 Mlbs to 14.12 Mlbs contained U3O8, with a reduction in average grade to 406 ppm U3O8.

- The stated Centipede-Millipede V2O5 resource expands by 17 percent or 6.6 Mlbs to 45.2 Mlbs contained V2O5, with a reduction in average grade to 281 ppm V2O5.

- The stated Lake Way V2O5 resource expands by 9.5 percent or 1.1 Mlbs to 12.7 Mlbs contained V2O5, with a reduction in average grade to 307 ppm V2O5.

- The Lake Maitland deposit will be re-estimated to better define the resource at the new cut-off grade before restating the resource and re-calculating the total Wiluna Project resources at the new cut-off grades of 100ppm.

- Pilot Plant Design Commissioned: A detailed pilot plant design is being undertaken to further assess the new processing flowsheet for Lake Maitland at a closer to ‘operational’ scale. The pilot plant design is on track incorporating all aspects of both uranium and vanadium production. A sonic core drilling program will commence to deliver potential ore to the pilot plant currently in design for Wiluna.

- Robust Local Infrastructure: The assets are within an established mining center, which means much of the required infrastructure is readily available. The project has access to power and water, which reduces initial development costs.

- Joint Venture Partnership: Toro Energy has entered into a joint venture partnership with JAURD and Itochu for its Lake Maitland deposit. Both corporations have the right, but not the obligation, to earn a combined 35 percent interest in the project upon contributing US$39.6 million, and an additional proportionate share of expenditure thereafter, once a positive final investment decision has been made based on a definitive feasibility study.

The Dusty Nickel Project – Discoveries of Massive Nickel Sulphide

Toro’s Lake Maitland tenure is located in the Yandal Greenstone Belt within the Yilgarn Craton of Western Australia, a gold district within a world-class gold and nickel province. With little exploration for non-uranium minerals ever conducted on the properties, Toro considers the project area highly prospective for nickel, gold and base metals.

In 2020, Toro made a blind discovery of massive and semi-massive nickel sulphides associated with the base of a 7.5-kilometer unbroken length of previously unknown komatiite (Dusty komatiite) – arguably the first massive nickel sulphides discovered in the Yandal Greenstone Belt, which is located 50 kilometers east of the world-class Mt. Keith nickel deposit. The Dusty nickel project is located near the Lake Maitland uranium deposit and contains two key target areas: Dusty and Yandal One.

Continued exploration and diamond drilling on the project has resulted in four discoveries of massive/semi-massive nickel sulphide zones to date with only 4.5 kilometers tested so far at a single depth along a 7.5-kilometer komatiite magnetic trend. Only limited testing for massive nickel sulphides has been undertaken to date of an approximately 15-kilometer strike length of known komatite - ultramafic target rock. With such limited drilling on the Lake Maitland tenure, it is yet to be known whether other similar magnetic anomalies are also komatiite-ultramafic rock and how much more rock is prospective for massive nickel sulphides on Toro’s 100-percent-owned Dusty nickel project.

Project Highlights:

- Four zones of massive nickel sulphide discovered: Toro has discovered four zones of massive and semi-massive nickel sulphides: Dusty, Houli Dooley, Jumping Jack and Dimma. Significant diamond drill results from these discoveries to date include:

- DUSTY

- 9 meters at 2.07 percent nickel from 250.9 meters downhole (TED07) including:

- 2.0 meter at 4.01 percent nickel from 250.9 meters downhole; and

- 2.0 meters at 3.85 percent nickel from 255.5 meters downhole.

- 2.6 meters at 3.45 percent nickel from 184.5 meters downhole (TED04).

- 7.2 meters at 1.05 percent nickel and 0.26 percent copper from 252 meters downhole (TED22).

- 9 meters at 2.07 percent nickel from 250.9 meters downhole (TED07) including:

- HOULI DOOLEY

- 3.05 meters at 1.59 percent nickel from 297.75 meters downhole (TED14).

- JUMPING JACK

- 3.45 meters at 1.42 percent nickel from 240.2 meters downhole (TED37).

- 2.44 meters at 1.16 percent nickel from 231.6 meters downhole (TED38).

- DIMMA

- 4.31 meters at 1.16 percent Ni from 243.3 meters downhole (TED41).

- 3.13 meters at 1.42 percent Ni from 314 meters downhole (TED42).

- 4.6 meters at 1.61 percent Ni from 194.2 meters downhole, including 3m at 1.09 percent Ni from 166 meters downhole (TED54).

- 2.1 meters at 1.83 percent Ni from 147.1 meters downhole (TED55).

- DUSTY

- Yandal OneTarget Area: The Yandal One Target Area is located some 17 kilometers south of the Dusty discoveries and with limited drilling, Toro has proven the existence of another komatiite with the potential to host massive nickel sulphide.

Toro Yandal Gold Project

The Lake Maitland tenure is located only 20 kilometers northeast of the world-class Bronzewing and Mt McClure gold mines within the same Greenstone Belt, the Yandal, within one of the most famous gold provinces in the world, the Yilgarn Craton.

Early exploration by Toro at the Golden Ways target area in the north of the project has uncovered surface rock chip samples of up to 70 g/t gold and significant drilling results, including:

- 5 meters at 4.4 g/t from 22 meters (TERC24)

- Including 2 meters at 9.93 g/t from 22 meters

- 4 meters at 3.3 g/t from 28 meters (TERC25)

- Including 1 meter at 10.9 g/t from 28 meters

- 2 meters at 3.79 g/t from 10 meters (TERC38)

- Including 1 meters at 7.33 g/t from 10 meters

- 3 meters at 1.41 g/t from 9 meters (TERC36)

- Including 1 meters at 2.76 g/t from 10 meters

Management Team

Richard Homsany - Executive Chairman

Richard Homsany has extensive experience in the resources industry, having been the executive vice-president for Australia of TSX-listed Mega Uranium since April 2010. He has worked for North Ltd, an ASX top 50-listed internationally diversified resources company in operations, risk management and corporate, before its takeover by Rio Tinto.

Homsany is an experienced corporate lawyer and certified practicing accountant (CPA) advising numerous clients in the energy and resources sector, including publicly listed companies. He was corporate partner at international law firm DLA Phillips Fox (now DLA Piper), where he advised clients on a range of transactions and matters including capital raising, IPOs, stock exchange listing, mergers and acquisitions, finance, joint ventures, divestments and governance.

He is a fellow of the Financial Services Institute of Australasia (FINSIA) and a member of the Australian Institute of Company Directors. He has a commerce degree and honors degree in law from the University of Western Australia, and a graduate diploma in finance and investment from FINSIA (State Dux).

Homsany has significant board experience with publicly listed companies in Australia and Canada. He is the chairman of ASX-listed copper explorer Redstone Resources. and TSXV-listed iron ore and gold explorer Central Iron Ore Limited. Homsany is currently the chairman of the Health Insurance Fund of Australia Limited.

Michel Marier - Non-executive Director

Michel Marier joined Sentient in 2009 as an investment manager. Before joining Sentient, Marier worked eight years in the private equity division of la Caisse de dépôt et placement du Québec. Marier holds a master’s degree in finance from HEC Montreal and is a CFA charter holder.

Richard Patricio - Non-executive Director

Richard Patricio is the CEO and president of Mega Uranium, a uranium-focused investment and development company with assets in Canada and Australia.

In addition to his legal and corporate experience, Patricio has built a number of mining companies with global operations. He holds senior officer and director positions in several junior mining companies listed on the TSX, TSX Venture, AIM and NASDAQ exchanges. He is currently also a director of NexGen Energy (TSE:NXE, Mkt Cap. C$2.7 billion). He previously practiced law at a top-tier law firm in Toronto and worked as an in-house general counsel for a senior TSX-listed company. He received his law degree from Osgoode Hall and was called to the Ontario bar in 2000.

Katherine Garvey - Legal Counsel and Company Secretary

Katherine Garvey is a corporate lawyer who has significant experience in the resources sector. Garvey advises public (both listed and unlisted) and proprietary companies on a variety of corporate and commercial matters including capital raising, finance, acquisitions and disposals, Corporations Act and ASX Listing Rule compliance, corporate governance and company secretarial issues. She has extensive experience drafting and negotiating various corporate and commercial agreements including farm-in agreements, joint ventures, shareholders’ agreements, and business and share sale and purchase agreements.

Garvey is a senior associate at Cardinals Lawyers and Consultants, a corporate and resources law firm in West Perth, and company secretary of the Health Insurance Fund of Australia Limited. Garvey is also legal counsel (Australia) to TSX-listed Mega Uranium, and company secretary to TSXV-listed Central Iron Ore.

Dr. Greg Shirtliff – Geology Manager

Dr. Greg Shirtliff has over 20 years of experience in industry-related geology and geochemistry, including a PhD in mine-related geology and geochemistry from the Australian National University. Since his studies, Dr Shirtliff has spent over 17 years in various roles in the mining and exploration industry ranging from environmental, mine geology, resource development, exploration and management roles in exploration and technical projects inclusive of engineering and metallurgical. His roles have included a number of years at ERA-Rio Tinto’s Ranger Uranium Mine, as the senior geoscientist for Cameco Australasia and more recently as the lead geologist and technical manager for Toro Energy, where he is the exploration and technical lead responsible for increasing the viability of the company’s uranium and mineral resources, developing and directing the company’s uranium and non-uranium exploration strategy, aiding the company technically through EPA approval for a uranium mine, and guiding the engineering and metallurgical through to scoping level economic assessment.

Dr Shirtliff has had recent exploration success at Toro Energy, discovering multiple zones of massive nickel sulphide mineralization along the Dusty Komatiite, arguably the first massive nickel sulphide mineralization discovered in the Yandal Greenstone Belt in Western Australia.

Dr Shirtliff holds directorships on privately owned consultancy and prospecting companies and is a long-standing member of the Australian Institute of Mining and Metallurgy and the internationally recognized Society of Economic Geologists.

Marc Boudames - Financial Controller

Marc Boudames is experienced in statutory financial reporting, taxation, ERP systems, business analytics, corporate transactions, due diligence, mergers & acquisitions, finance, joint ventures and divestments. He previously worked at RSM Bird Cameron, as general manager –finance & administration for ASX-listed Redport Ltd and Mega Uranium (Australia), a Canadian TSX-listed mining and equity investment company focused on global uranium properties and multi-mineral exploration. He has worked for multiple companies across various industries, including listed and public companies associated with the mining and oil and gas sectors, such as WesTrac, CB&I and Spotless Group.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.