- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Galena Mining Ltd. (“Galena” or the “Company”) (ASX: G1A) announces the fifth and final batch of assay results from the now completed 2020 Abra Drilling Program at the Abra Base Metals Project (“Abra” or the “Project”).

Highlights:

- Three additional drill-holes showing cumulative lead-silver intersections >50m (AB183A, AB192 and AB200A), including

- AB200A recorded the longest cumulative +5% lead grade intersections ever observed at Abra at 103m

- Outstanding lead-silver intersections in this announcement continue to confirm wide, high-grade mineralised zones:

- AB200A:

- 22.5m at 9.0% lead and 17g/t silver from 301.0m

- 14.9m at 12.3% lead and 15g/t silver from 391.7m

- 40.9m at 7.6% lead and 14g/t silver from 425.0m

- AB184 – 27.9m at 8.6% lead and 16g/t silver from 378.4m o AB176:

- 22.5m at 9.0% lead and 17g/t silver from 301.0m

- 14.9m at 12.3% lead and 15g/t silver from 391.7m

- 40.9m at 7.6% lead and 14g/t silver from 425.0m

- 15.9m at 11.8% lead and 28g/t silver from 378.9m

- 13.5m at 7.7% lead and 22g/t silver from 398.9m

- AB183A:

- 13.1m at 8.2% lead and 35g/t silver from 291.1m

- 21.2m at 8.5% lead and 19g/t silver from 307.8m

- 10.8m at 13.3% lead and 19g/t silver from 369.4m

- AB185 – 13.6m at 11.3% lead and 27g/t silver from 352.4m

- AB177 – 19.9m at 6.9% lead and 13g/t silver from 287.2m

- AB198 – 11.9m at 10.2% lead and 48g/t silver from 271.8m

- AB181 – 17.3m at 7.0% lead and 22g/t silver from 276.4m

- AB191 – 11.6m at 9.6% lead and 16g/t silver from 411.4m

- AB200A:

- 43 (75%) of the 57 drill-holes drilled in the 2020 Abra Drilling Program exceeded or met grade and thickness expectations compared to the October 2019 Resource model

- Eight holes from the program showed cumulative down-hole significant (+5% lead) lead-silver intersections >50m, including AB147, Abra’s ‘best hole ever’

- Optiro are well advanced in preparing an updated Mineral Resource estimate, which is expected to be completed in the coming weeks

Galena Mining Ltd. (“Galena” or the “Company”) (ASX: G1A) announces the fifth and final batch of assay results from the now completed 2020 Abra Drilling Program at the Abra Base Metals Project (“Abra” or the “Project”).

Managing Director, Alex Molyneux commented, “With these being the final assays from the 2020 Abra Drilling Program, we’re already quite advanced on an updated Mineral Resource estimate for the Project. Furthermore, I believe the success of this program in defining and extending the shallow, metal rich zone on the north-eastern side of the orebody will present well for mine plan optimisation opportunities.”

He went on to say, “We also thank the Bureau Veritas team in Perth for their diligence in successfully delivering over 10,000 individual sample assays, including over the Christmas period under some difficult operating conditions with Covid restrictions.”

2020 ABRA DRILLING PROGRAM

This announcement concludes the release of all assay results for the 57 drill-holes successfully completed during the 2020 Abra Drilling Program.

This release includes assays from 22 drill-holes (AB176, AB177, AB180W1 to AB194, and AB196 to AB200A). The assay results for the first 35 drill-holes (AB144 to AB175, and AB178 to AB179, and AB195) were announced on 19 October 2020, 18 November 2020, 22 January 2021 and 22 February 2021.

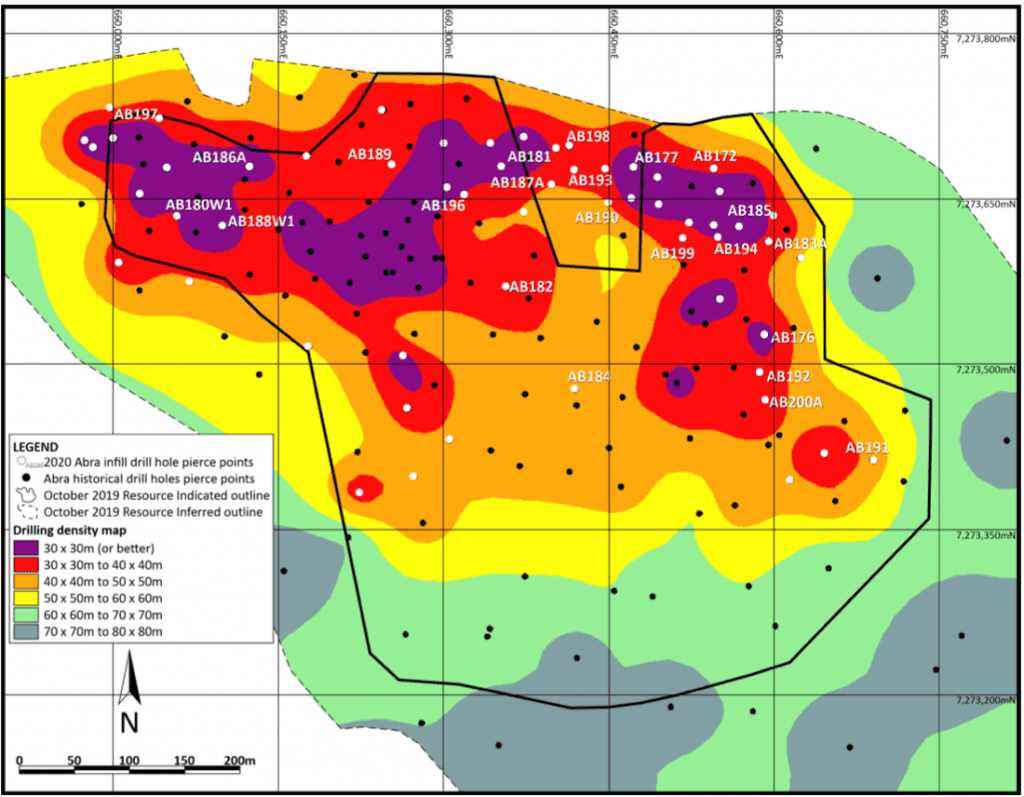

The program was initially planned to consist of approximately 15,000 metres to 18,000 metres of drilling, with three objectives: lead-silver orebody infill; drilling into selected prospective ‘metal rich’ zones for potential life of mine plan optimisation; and gold-copper exploration (see Galena ASX announcement of 4 August 2020). However, drill-hole AB147 (reported on 19 October 2020) encountered 86.1 metres of combined down-hole cumulative thickness of significant intersections and was considered to be the best high-grade lead-silver drill-hole in Abra’s history. AB147 was successful in confiriming a ‘metal rich’ zone not currently in the early years of the mine plan used for the Feasibility Study, in this case a relatively shallow zone on the northeastern limb of the Indicated portion of Abra’s Mineral Resource. An additional 16 drill-holes were added to the 2020 Abra Drilling Program in the area around AB147 with the aim to define the zone with 30 metre by 30 metre and better drill-hole spacing to enable its inclusion in detailed mine planning for the early years of an updated mine plan. The added drill-holes cover an area approximately 100 metres (north-south) by 200 metres (east-west), extending outside of the Indicated Resource area modelled for the Apron Zones 101 and 102 lode in the October 2019 Resource, into the Inferred area between the two northern limbs of the Indicated Resource boundary (see Figure 1 below).

Of the sixteen drill-holes added to the drilling program, the assay results for nine are being reported in this ASX announcement (AB177, AB183A, AB185, AB187A, AB190, AB193, AB194, AB198 and AB199). These holes continued to show strong cumulative down-hole thicknesses of significant lead-silver intersections as has been observed in prior holes reported in the vicinity. Drill-holes AB183A and AB177 respectively encountered 50.1 metres and 46.9 metres of combined down-hole cumulative thickness of significant intersections.

Towards the end of the 2020 Abra Drilling Program, two drill-holes being reported in this announcement (AB200A and AB192) were drilled to target another potential metal rich zone towards the south and on the eastern margin of the deposit. These drill-holes were highly successful, with some of the strongest cumulative down-hole thicknesses of significant lead- silver intersections observed to date at Abra. Drill-holes AB200A and AB192 respectively.

Click here to connect with Galena Mining Ltd. (ASX: G1A) for an Investor Presentation.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2383.42 | +1.62 | |

| Silver | 28.12 | -0.77 | |

| Copper | 4.33 | 0.00 | |

| Oil | 85.37 | +0.01 | |

| Heating Oil | 2.66 | 0.00 | |

| Natural Gas | 1.68 | -0.05 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.