- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Firebird Raises $3.5m To Accelerate Oakover Development

Firebird Metals Limited (ASX: FRB) (“Firebird” or “the Company”) is pleased to announce that it has received firm commitments to raise $3.5 million (before costs) via a strongly supported placement to sophisticated and professional investors (“Placement”), to accelerate development and exploration activities at its flagship Oakover Manganese Project (“Oakover”).

Highlights

- Firm commitments received for $3.5 million placement

- Firebird Directors have applied for $420,000 in the Placement, subject to shareholder approval

- Placement proceeds to fund completion of infill drilling, metallurgical test work, environmental surveys, ongoing exploration and relevant development studies

- Firebird is now well-funded to accelerate development of the Oakover Manganese Project, following recent completion of a Manganese Concentrate Scoping Study which confirmed the exciting, long-term potential of Oakover as a Manganese hub

Firebird Directors and related parties have applied for $420,000 in the Placement, which will be subject to shareholder approval.

Under the Placement, Firebird will issue 17.5 million new fully paid ordinary shares in the Company (“Shares”) at an issue price of $0.20 per Share, together with one free attaching option (“Placement Options”) for every two Shares issued. The Placement Options will be issued subject to shareholder approval, exercisable at $0.30 each and expire two years from date of issue.

Commenting on the exciting future ahead for Firebird, Managing Director Peter Allen said:

“We are very pleased with the overwhelming level of interest and support from both existing shareholders and new investors and thank them for their support, as we continue to develop and grow our exciting Oakover Manganese Project into Western Australia’s next major Manganese operation.

“Since listing last year, we have been focused on rapidly growing our advanced portfolio, led by Oakover, towards the development phase. We have delivered on this objective, culminating in the completion of the highly impressive Oakover Scoping Study, which clearly showed the excellent, long-term potential of the Project.

“We are now focused on delivering the next 12 months, with a key focus on extending Life-of-Mine at Oakover, commencing and completing key development studies, advancing ESG objectives and adding to our Manganese inventory through targeted exploration across our other projects, starting with Hill 616. Importantly, current and long-term manganese market fundamentals are strong and supported by the growing demand for battery minerals and infrastructure (steel) markets and we are excited by the prospect of Oakover becoming a key supplier to these markets in the coming years.”

Use of Funds

Funds raised from the Placement will be primarily applied towards the following activities at Oakover and across other Projects, including Hill 616:

- Infill drilling;

- Metallurgical test work (Ore Sorting, DMS, Hydrometallurgy);

- Environmental surveys;

- Scoping Study update and Pre-Feasibility study work;

- Mapping and ongoing exploration programs; and

- General working capital purposes

The Placement price of $0.20 represents a 4.8% discount to the last close of price on Friday, 12 August 2022 (A$0.21).

The Placement Shares will be issued across two tranches, as follows:

- 12,900,000 Shares will be issued pursuant to the Company’s existing placement capacity under ASX Listing Rule 7.1 (7,442,500 Shares) and ASX Listing Rule 7.1A (5,457,500 Shares) (Tranche 1); and

- 4,600,000 Shares, including the Director participation Shares, will be subject to shareholder approval (“Tranche 2”) to be sought at a general meeting of shareholders expected to be held in October 2022 (“General Meeting”).

The issue of the 9,250,000 Placement Options will also be subject to Shareholder approval at the General Meeting.

Tranche 1 Shares are expected to settle on Wednesday, 24 August 2022 and will commence trading on the ASX on a normal basis on Thursday, 25 August 2022.

Euroz Hartleys Limited was Lead Manager to the Placement.

In addition to the Placement, Firebird has agreed with consulting group Increva Pty Ltd to receive payment in FRB securities on the same terms as the Placement to a maximum of $200,000 (1,000,000 shares) for specialist technical consulting work in the ongoing studies.

The Company’s shares are expected to resume trading on the ASX from market open today, 17th August 2022.

Click here for the full ASX Release

This article includes content from Firebird Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Firebird Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Firebird Metals

Overview

Firebird Metals (ASX:FRB) is an Australian mining company that’s well-positioned to develop a new manganese mining operation in Western Australia with a strategy to become a global battery cathode producer supporting a rapidly expanding electric vehicle market.

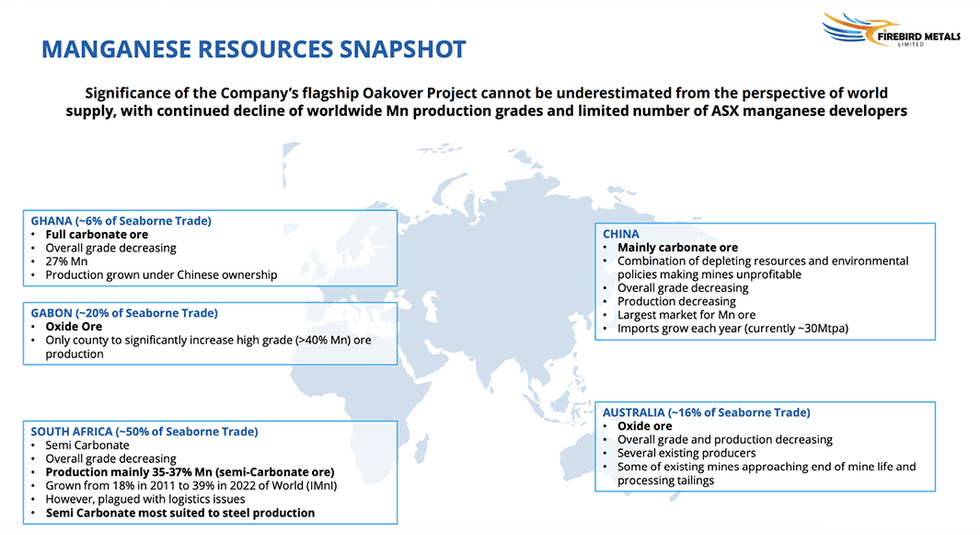

Batteries currently represent the largest non-alloy market for manganese, accounting for roughly 3 percent of global annual manganese consumption. The metal has a long history of being used as a cathode material in batteries, both in its natural form and in the form of electrolytic manganese dioxide. That includes modern lithium-ion batteries, the supply and manufacturing chain for which could potentially grow by over 30 percent annually from now through 2030.

Manganese-rich batteries are increasingly being held up as an alternative to standard lithium-ion batteries, leading to an expected exponential demand for the mineral. Tesla alone has already committed to producing manganese-based batteries for two thirds of its supply, owing to the metal's relative abundance and lower cost compared to nickel and cobalt.

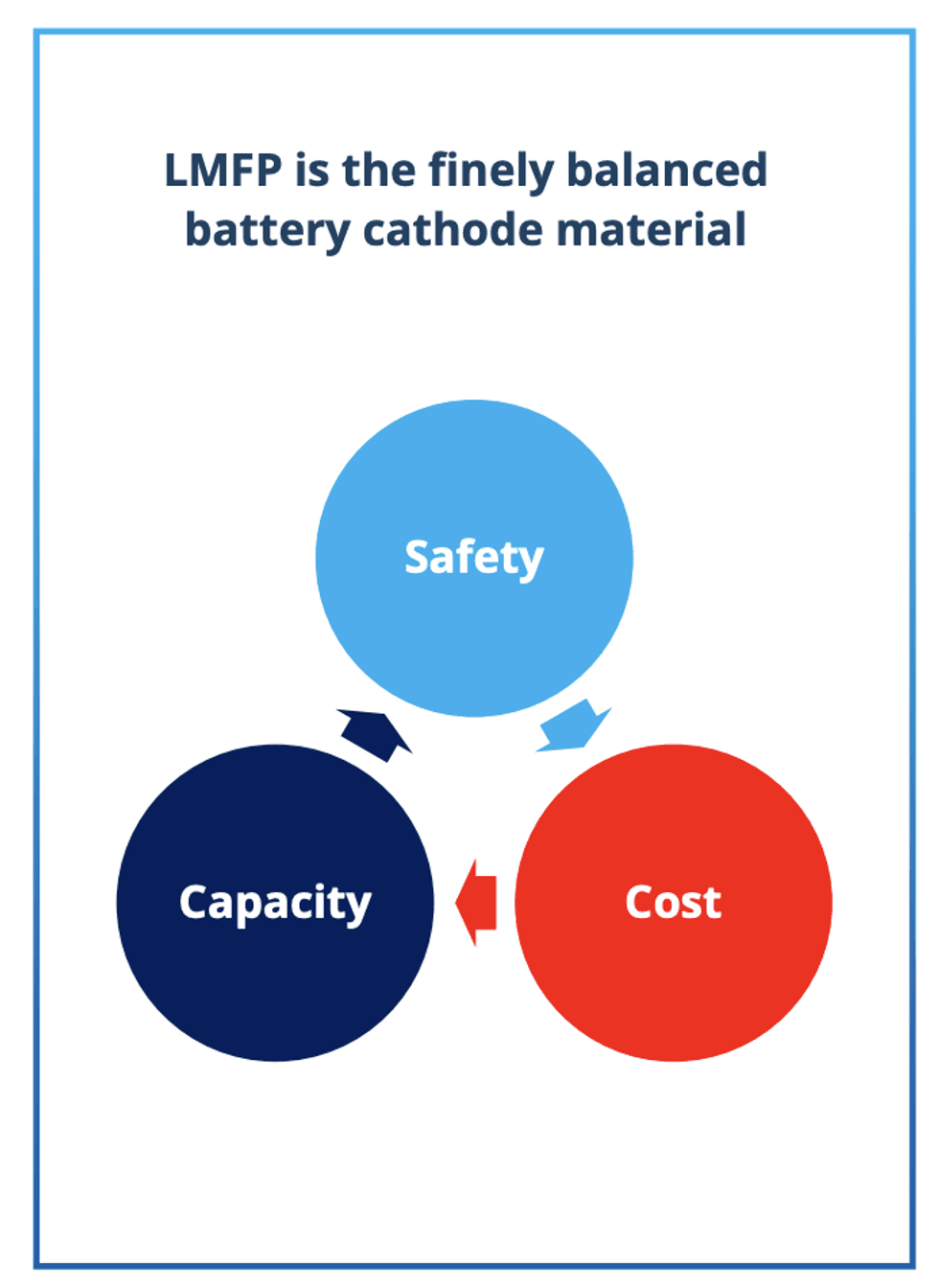

Lithium-iron-phosphate (LFP) represents one of the most prominent phosphate battery configurations. In recent years, however, the business case for using manganese as a cathode material for lithium-ion batteries, known as lithium manganese iron phosphate (LMFP), has become stronger. LMFP not only improves the battery’s energy density, but also increases capacity by up to 20 percent. LMFP batteries also perform better in low-temperature environments.

As LFP rapidly nears its theoretical energy density capacity, the rise of LMFP batteries as a replacement is all but inevitable as the world continues its slow march towards electrification and sustainable energy. Consequently, this means that demand for battery-grade manganese is set to explode in the coming years. And Firebird Metals is more than ready to step in and provide some much-needed supply.

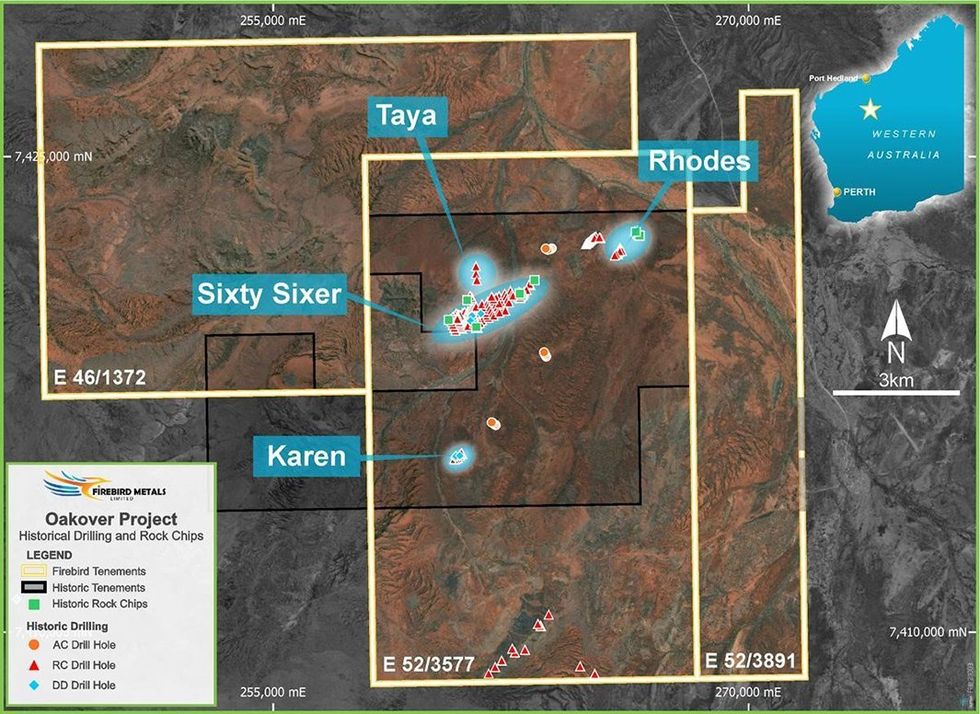

Firebird maintains ownership over a massive manganese resource in Western Australia's Pilbara region in the form of its flagship Oakover project. Characterised by near-surface mineralisation, Oakover houses an estimated 176.65 million tons (Mt) of manganese across several different targets. Because of Oakover's favourable geology, Firebird can potentially leverage Oakover to supply not just the battery market but also multiple other industries, such as steel, all through a low-cost, simple mining operation.

The end result? Significant returns for investors — a projection only further emphasised by the impressive results returned by a recent concentrate scoping study on the project. Firebird maintains several other projects in Australia as well, including the Oakover-like Hill 616 and the exploration-focused Wadanya.

Firebird's long-term strategy reaches far beyond Australia's borders, however. From mining to downstream processing, the company's vision is to become a global cathode producer. For that, Firebird is looking to China, which to date accounts for roughly 90 percent of global manganese sulphate demand.

In early September 2023, the company announced its plans to establish a processing plant in China, noting to investors that an in-house scoping study was already well underway. According to Firebird's managing director Peter Allen, the construction of this plant represents the next phase of major growth for Firebird. As with the rest of Firebird's operations, this new plant will be constructed with the company's ESG methodology front of mind, ensuring transparency and accountability in addition to human welfare, support for local communities and environmental sustainability.

This plan, should it proceed apace, has the potential to make an enormous impact on global manganese supply — all while positioning Firebird as a cost-competitive player in the manganese sulphate market and a promising investment opportunity.

Company Highlights

- An Australian junior exploration company, Firebird Resources is well-positioned to take advantage of the growing demand for manganese as the rapidly expanding electric vehicle market and global electrification continue to ramp up.

- Firebird maintains ownership of a massive manganese resource in Australia with significant growth potential.

- A recent concentrate scoping study confirmed the potential and profitability of the company's flagship project, Oakover, situated in Western Australia's Pilbara region.

- Firebird's long-term goal involves leveraging its manganese resource to position itself as a leading global producer of manganese sulphate for the battery industry.

- The company is currently embarking on a scoping study with plans to build a manganese sulphate plant in China. This will allow it to gain a foothold in the Chinese market, which currently accounts for 90 percent of global manganese sulphate demand.

- This study represents the next phase of major growth for Firebird, and is a significant part of the company's overall strategy to establish itself as a near-term producer of battery-grade high-purity manganese sulphate.

Key Projects

Oakover

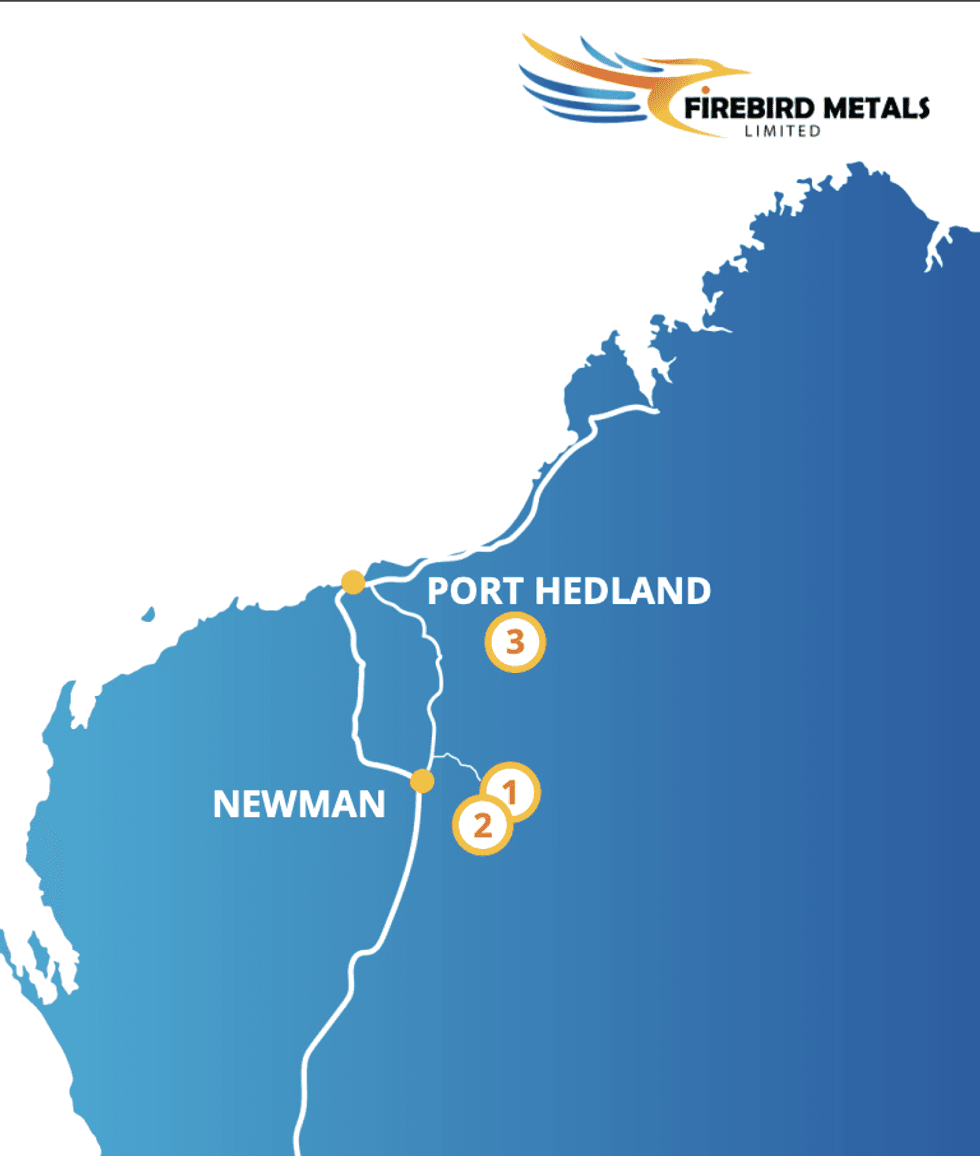

Situated 85 kilometres East of Newman in Western Australia's East Pilbara Manganese Province, Firebird's flagship Oakover project is characterised by favourable near-surface and shallow-dipping mineralisation. The project's favourable geology provides Firebird with multiple processing options, with the company currently targeting production of manganese concentrate and high-purity manganese sulphate. Oakover has, over the course of its history, been subject to extensive modern and historic exploration.

The most recent exploration program, completed by Firebird, resulted in a mineral resource estimate of 176.65 Mt at 9.9 percent manganese, including 105.8Mt at 10.1 percent manganese in the indicated resource category.

Project Highlights:

- Confirmed Potential: Firebird recently achieved a major milestone at Oakover with the completion of a concentrate scoping study which confirmed the project's outstanding long-term potential as a manganese hub. Highlights of the study include:

- Potential 18-year mine life.

- 1.2 Mt per annum with low strip ratio (0.45:1) and mining costs.

- Upfront capital investment of A$124 million with low capex optionality.

- A$741.3 million NPV and IRR of 73.1 percent.

- Indicated material accounts for 99.2 percent of material processed.

- 80 percent uplift in indicated resource at Oakover to 105.8 Mt.

- Metallurgical Results: Firebird has undertaken extensive metallurgical and hydrometallurgical testwork at Oakover, with results providing the company with a high level of confidence in its growth and profit potential. Notable highlights are as follows:

- Achievable 30 to 32 percent manganese concentrate saleable product

- Achievable battery-grade manganese sulphate

- Current Plans: Firebird's concentrate scoping study assessed two production scenarios, each utilising simple processing, crush, screen, scrub and DMS beneficiation. It has chosen to pursue full production from startup with ~4 Mtpa processing and ~1.2 Mtpa of 30 to 32 percent manganese concentrate.

Hill 616

Located 35 kilometres south of the Oakover project, Hill 616 shares highly similar geological characteristics to Firebird's flagship, with shallow, gently dipping geology. Covering approximately 15.7 square kilometres within the Peak Hill Mineral Field, Hill 616 has to date undergone extensive historical drilling, with 116 holes for 4,900 metres over a 2.2-kilometre strike.

This drilling has resulted in an inferred mineral resource of 57.5 Mt at 12.2 percent manganese.

Wandanya

Wandanya is a recently established exploration-focused project situated 50 kilometres southwest of the world-class Woodie Woodie Manganese Mine. Its close proximity to Port Hedland affords it considerable direct shipping ore potential. Rock chip results indicate that Wandanya's deposits are also exceptionally high grade, returning results up to 64.9 percent and 55.2 percent manganese.

Management Team

Evan Cranston — Chairperson

Evan Cranston is an experienced mining executive with a background in corporate and mining law. He is the principal of corporate advisory and administration firm Konkera Corporate and has extensive experience in the areas of equity capital markets, corporate finance, structuring, asset acquisition, corporate governance and external stakeholder relations.

Cranston holds both a Bachelor of Commerce and Bachelor of Laws from the University of Western Australia. He is currently the non-executive chairman of African Gold (ASX:A1G) and Benz Mining (TSXV:BZ, ASX:BNZ).

Peter Allen — Managing Director

Peter Allen is a mining executive with more than 20 years of experience in marketing of manganese, lithium and a range of other commodities. He was previously the managing director of marketing for Consolidated Minerals Limited, which operates Woodie Woodie mine in WA and the Nsuta Manganese mine in Ghana.

Allen assisted manganese-focused explorer Element 25 (ASX:E25) and Gulf Manganese Corporation (ASX:GMC) with PFS and product marketing. More recently, he was the marketing manager for AVZ Minerals (ASX:AVZ), a company focussed on the Manono lithium project.

Wei Li — Executive Director & CFO

Wei Li is a chartered accountant with extensive professional experience across several key sectors which include the resource industry, international trade, capital markets, project management of IPOs and spin-outs, and financial accounting. His experience includes being employed by and acting as director and CFO of several companies, predominantly in the resource sector. Prior to these roles, he managed a private base metal exploration company in the NT of Australia and assisted in commissioning an AU$150-million electrolytic manganese dioxide plant in Hunan China.

Li is currently a non-executive director of Macro Metals.

Ashley Pattison — Non-executive Director

Ashley Pattison brings over 20 years of experience in the resources sector across corporate finance and operational roles. Qualified as chartered accountant, he has extensive experience in operations, finance, strategy and corporate finance. Pattison has been the managing director of a number of listed and private mining companies over the past 10 years and also CEO of a listed mining service company.

Pattinson is currently the executive chairman of PC Gold and a non-executive director of Industrial Minerals (ASX:IND) and Macro Metals.

Brett Grosvenor — Non-executive Director

Brett Grosvenor is an experienced mining executive with over 25 years of experience in the mining and power industries. He holds a dual tertiary qualification in engineering and a master’s in business.

March 2024 Quarterly Report

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to present its Quarterly Activities and Cash Flow Report.

Butcherbird Manganese Operations, Western Australia

- Detailed design, planning and procurement commences for Stage 2 Expansion Project to expand Butcherbird manganese ore production to 1.1 million tonnes per annum in line with a Feasibility Study (FS) completed in January 20241.

- Northern Australia Infrastructure Facility (NAIF) completes a strategic assessment of Butcherbird Stage 2 Expansion Project.

- Expansion Project is now proceeding with the detailed due diligence phase of NAIF’s assessment process.

- Manganese ore prices increasing, potentially in response to the South 32 Limited (S32) production disruption at Groote Eylandt. S32 is now estimating a repair timeline of ~12 months2.

Battery Grade High Purity Manganese (HPMSM) Development – Louisiana, USA

- E25 progresses engineering development, permitting, logistics and project financing via offtake and funding agreements for HPMSM facility in USA.

- Air Permit public meeting successfully completed paving the way for the formal issuance of the permit.

In January 2024, Element 25 Limited (E25, the Company) released a Feasibility Study (FS) on the proposed expansion of its 100%-owned Butcherbird Manganese Operations in Western Australia (WA) to target manganese concentrate production of 1.1 million tonnes per annum (Mtpa). The FS demonstrated strong economics with robust economic returns and rapid capital payback.

Expansion of the processing facility at Butcherbird is an important step in providing feedstock for the Company’s planned battery grade high purity manganese sulphate monohydrate (HPMSM) project to be built in Louisiana, USA in partnership with General Motors LLC and Stellantis NV3.

E25 is now, via a dedicated owners team supported by selected external contractors and consultants, advancing detailed design, planning and procurement activities for the Stage 2 expansion in parallel with financing.

In parallel with expansion activities, the Company suspended Butcherbird’s current production operations, aiming to reduce operational cash outflows and re-focus resources and available cash on implementing the expansion plan outlined in the FS.

50,540mt of manganese concentrate was shipped on 27 January 2024. Approximately 15,000mt of manganese concentrate was subsequently transported to Port Hedland and will form part of a shipment scheduled to be loaded in early May 2024 (estimated). Stockpiles have now been depleted in line with care and maintenance activities on site, with haulage winding back and ultimately ceasing in early March 2024.

The current schedule anticipates operations to recommence in approximately 11 months following project financing being secured, when E25 plans to increase annual production to 1.1 million tonnes per annum of manganese oxide concentrate. Further detail and an updated schedule will be provided as the project team works through front-end engineering and design (FEED) activities.

Northern Australia Infrastructure Facility Strategic Assessment

During the quarter, the Northern Australia Infrastructure Facility (NAIF successfully completed a strategic assessment of the Butcherbird Stage 2 Expansion Project. The Expansion Project is now proceeding to the detailed due diligence phase of the NAIF assessment process.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25 Presents at Paydirt Battery Minerals Conference - April 2024

This presentation contains only a brief overview of Element 25 Limited and its associated entities (“Element 25") and their respective activities and operations. The contents of this presentation, including matters relating to the geology of Element 25's projects, may rely on various assumptions and subjective interpretations which it is not possible to detail in this presentation and which have not been subject to any independent verification.

This presentation contains multiple forward-looking statements. Known and unknown risks and uncertainties, and factors outside of Element 25’s control, may cause the actual results, performance and achievements of Element 25 to differ materially from those expressed or implied in this presentation.

To the maximum extent permitted by law, Element 25 does not warrant the accuracy, currency or completeness of the information in this presentation, nor the future performance of Element 25, and will not be responsible for any loss or damage arising from the use of the information.

The information contained in this presentation is not a substitute for detailed investigation or analysis of any particular issue. Current and potential investors and shareholders should seek independent advice before making any investment decision in regard to Element 25 or its activities.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Butcherbird Expansion Project Advances through NAIF Funding Process

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to advise the Northern Australia Infrastructure Facility (NAIF) has completed a strategic assessment of the Butcherbird Stage 2 Expansion Project (Butcherbird or Project). E25 aims to increase Butcherbird’s annual production to 1.1 million tonnes per annum of manganese oxide concentrate in line with the Feasibility Study (FS) announced in January 20241.

The Expansion Project is now proceeding to the detailed due diligence phase of the NAIF assessment process.

NAIF is a Commonwealth Government financier providing concessional loans for the development of infrastructure projects in northern Australia and the Australian Indian Ocean Territories to deliver economic and social growth2.

Completion of a strategic assessment by NAIF does not represent a formal decision to offer or commit finance. NAIF has not yet made any decision to offer finance or made any commitment to provide any financial support to the Project, and there is no certainty that an agreement will be reached between the parties.

Element 25 Managing Director Justin Brown said: “Our Butcherbird Project hosts a world-class manganese deposit with more than 260Mt in resources, which will has the ability to underpin a long life producing asset3. The results of our Feasibility Study for the Expansion Project1 show the potential for this asset to deliver over 1 million tonnes of manganese concentrate per year to market, generating strong returns for shareholders and providing feedstock for the Company’s planned HPMSM facility in Louisiana. Having NAIF involved in the project is a positive step towards financing its expansion.”

BUTCHERBIRD EXPANSION PROJECT

E25 plans to expand its Butcherbird operations to 1.1Mpta manganese concentrate production using expanded open-cut mining methods, a modified primary comminution circuit and a dense media separation (DMS) back-end solution to optimise grade and recoveries. Expansion would establish Butcherbird as a low-cost Mn operator (estimated US$2.76/dmtu C1 FOB cost1) able to produce at a cost lower than the low manganese sale price points seen within the Mn market. Mineral Resources used to support the Project’s 7.2-year mine life from 2024 to 2031 represents 36.0% of the total mineral resource inventory within the granted mining lease M52/1074.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25 Progresses USA HPMSM Refinery Plans

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to provide an update in relation to it’s planned construction of a high-purity manganese sulphate (HPMSM) refinery in Louisiana USA to supply domestic HPMSM to the US electric vehicle battery industry.

Element 25 Managing Director Justin Brown said: “E25 aims to be a leading source of high quality, vertically integrated, traceable and ESG and IRA-compliant battery material to the global electric vehicle industry. Construction of our HPMSM facility in the USA – the first of its kind there – is a key pillar to the strategic plan which aims to position E25 as the industry leading provider of high quality ethically sourced battery-grade manganese to support global electrification efforts.

Engineering Development

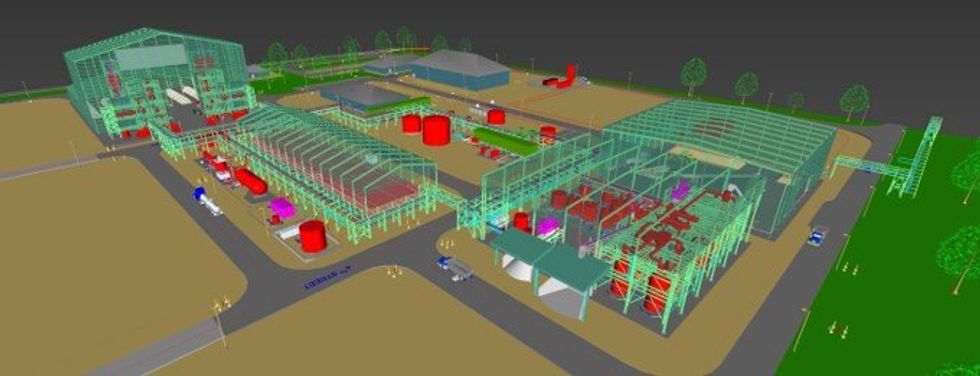

Basic engineering packages for specific sections of the plant are being generated by equipment vendors. Design development of the balance of the processing facility is progressing. The project engineers have developed an initial project execution plan, procurement plan and other foundational elements, which are being reviewed. Project controls are being developed to manage cost and schedule.

Schedule

The project schedule has been developed, incorporating all facets of the project, including engineering, permitting, project financing and construction. Commencement of construction and commissioning are under review pending the execution of binding terms on the project site, in addition to the conclusion of project financing activities and a Final Investment Decision by E25’s Board of Directors to commence construction (FID).

The current schedule development provides for approximately 80 weeks of project build time based on the current critical path, however is being reviewed with the aim of compressing construction timelines.

The current timeline assumes no material interruptions to project development once construction commences due to procurement, procurement delays or weather-related disruptions.

Project Site Selection

Discussions continue with the owners of the preferred project site with the intention of combining land, sulphuric acid and ancillary services into the commercial terms. The principal reagent required by the Element 25 HPMSM process is sulphuric acid, and securing reliable supply at competitive commercial terms is an important aspect of the site selection process. Other considerations include inbound and outbound logistics and site permitting requirements. Site-specific engineering activities are currently paused pending finalisation of these commercial agreements.

Permitting

Air Permit

The air permit is a key requirement to commence facility construction. Any source, including a temporary source, which emits or has the potential to emit any air contaminant (defined as particulate matter, dust, fumes, gas, mist, smoke, or vapour, or any combination thereof produced by the process(es) other than natural) requires an air permit. As part of the permitting process, Element 25 has completed a detailed assessment of expected emissions from the HPMSM refinery and provided this information along with supporting documentation to the Louisiana Department of Environmental Quality (LDEQ).

A draft permit has been issued, and comments have been provided to the regulator. The final stage of the permitting process is a public meeting, currently scheduled to be held on 18 April 2024 to be held in the local community centre close to the proposed project site.

The LDEQ Office of Environmental Services will conduct a public hearing in order to receive comments on the proposed Initial Part 70 Air Operating Permit and the associated Environmental Assessment Statement (EAS) for Element 25 (Louisiana) LLC, being the operator of the site. It is anticipated that the final permit will be issued during May 2024 at the conclusion of this process.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

December 2023 Quarterly Report

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) is pleased to present its Quarterly Activities and Cash Flow Report.

QUARTERLY HIGHLIGHTS

Butcherbird Manganese Operations, Western Australia

- Butcherbird Expansion Feasibility Study targets 1.1 million tonnes per annum (Mtpa) manganese production.

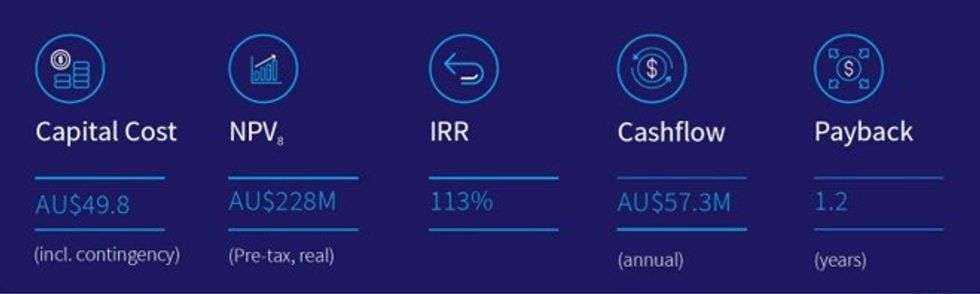

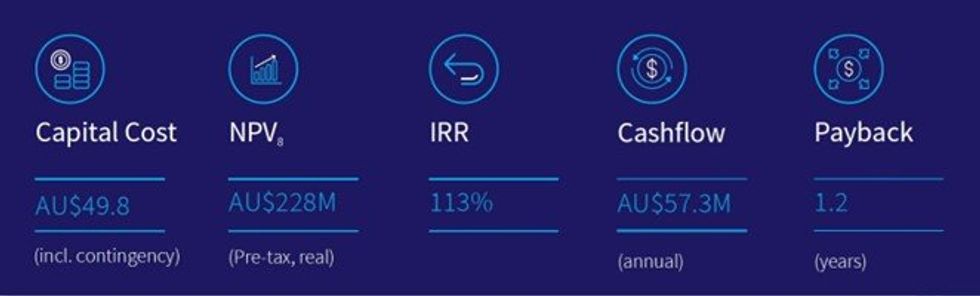

- Study demonstrates strong fundamentals, with robust economic returns and rapid capital payback:

- Expansion envisages expanded open-cut mining methods, modified primary comminution circuit and dense media separation (DMS) back-end solution to optimise grade and recoveries.

- Expanded operation will establish Butcherbird as a low-cost Mn operation with a US$2.76/dmtu C1 FOB cost – which will ensure sustainable profitability at lower manganese prices compared to the current pilot operation.

- Low capital cost of A$49.8M with annual operation cashflow of A$57.3M at full production – payback period of 14 months from start of operations.

- Study used all available Measured and Indicated Resources within the mine plan to support a 7.2-year mine life – which represents 36% of the total mineral resource inventory within granted mining lease M52/1074.

- E25 plans to undertake infill drilling in areas containing Inferred Resources, outside the current mine plan, within the next 12 months targeting an additional 20-25 years of mine reserves at the proposed production levels.

- E25 approved for US$57 million of tax incentives under Louisiana State’s Industrial Tax Exempt Program (ITEP).

- Two key international patents lodged under the Patent Co-Operation Treaty, expected to be processed in 2024.

Corporate

- Non-Executive Director John Ribbons was appointed Chairman following Seamus Cornelius’ decision to step down from E25 Board.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25 Commences Butcherbird Stage 2 Expansion

Element 25 Limited (E25 or Company) (ASX: E25; OTCQX: ELMTF) announces it will immediately commence detailed design, planning and procurement for expansion of manganese ore production at its 100%-owned Butcherbird Mine in WA in line with the expansion Feasibility Study (FS) released earlier in January 20241.

Expansion of the processing facility at Butcherbird aligns with E25’s commissioning target date for its planned battery grade high purity manganese sulphate monohydrate (HPMSM) project to be built in Louisiana, USA in partnership with General Motors LLC and Stellantis NV2.

Activities over the next three months will focus on detailed engineering and design, project financing and finalising the required permitting to support the commencement of construction in line with the project schedule.

In parallel with expansion activities, the Company will suspend Butcherbird’s current production operations, aiming to reduce operational cash outflows and re-focus resources and available cash on implementing the expansion plan outlined in the FS. Recent weak manganese prices support this decision.

E25 Managing Director Justin Brown said: “Expanding the scale of operations at Butcherbird beyond our Stage 1 pilot plant has always been a part of our growth plans and given the outstanding metrics reported in the updated Feasibility Study released earlier this month, this is the ideal time to implement those plans to ensure we can increase production ahead of our Louisiana HPMSM facility commencing operation.

Given the current manganese price environment coupled with high interest rates and inflation, we will suspend current operations at Butcherbird to conserve resources and use available cash to achieve this goal. We understand this is a difficult decision for our employees, contractors and suppliers and not one we have made lightly, but it is intended to help E25 better position itself to reach its longer term goals.”

The current schedule anticipates operations to recommence in approximately 11 months, following project financing being secured, when E25 will increase annual production to 1.1 million tonnes per annum of manganese oxide concentrate. Further detail and an updated schedule will be provided at conclusion of front-end engineering and design (FEED) which has now commenced.

Click here for the full ASX Release

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Firebird Metals Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.