- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

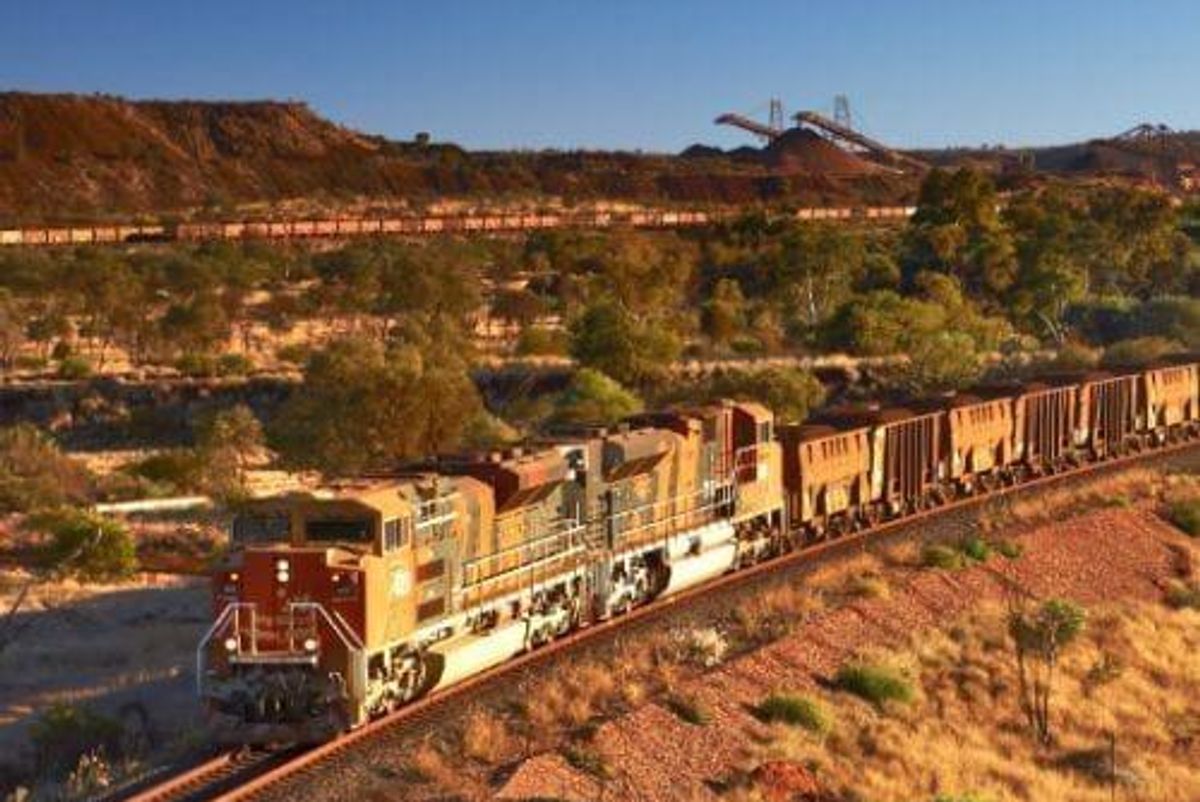

First Train Leaves Koolyanobbing Since MinRes Acquisition

According to Mineral Resources, a train left the operation for Esperance to begin stockpiling ore in preparation for the company’s first shipment.

Mineral Resources (ASX:MIN) acquired the Koolyanobbing iron ore operation less than three months ago, and earlier this week announced that the first train loaded with iron ore had departed for the Port of Esperance.

Koolyanobbing, acquired from former operator Cleveland-Cliffs (NYSE:CLF) in late August, is located about 50 kilometers north of Southern Cross in the Yilgarn region of Western Australia.

According to MinRes, a train left the operation for Esperance to begin stockpiling ore in preparation for the company’s first shipment. That is expected to take place in the next four weeks.

The company says that the successful and safe loading of this train is an important milestone, as the ramp up of production at Koolyanobbing is now complete, with the asset hitting its targeted capacity.

“When we decided earlier this year to take on the Koolyanobbing operations previously operated by Cleveland-Cliffs Inc, we did so because of our firm belief we could sustain a viable iron ore export operation in the region and safeguard hundreds of jobs in regional Western Australia,” MinRes Managing Director Chris Ellison said in a statement.

He added, “[w]e look forward to building up our iron ore stockpiles at the port of Esperance ahead of loading our first ship before the end of this year.”

The first train consisted of 106 wagons carrying a total of 7,488 tonnes of iron ore fines. MinRes has attributed much of the progress made at Koolyanobbing to support received from the Western Australian government — specifically the Southern Port Authority, which helped modify the rail car dumper at Esperance to be capable of unloading the company’s bottom-dump rail wagons.

The company also acknowledged the support it has received from Arc Infrastructure, which owns the train track network that connects Koolyanobbing to Esperance. MinRes expects to transport between 6 and 6.25 million tonnes per annum of iron ore from Koolyanobbing to Esperance based on the capacity of its owned and operated rail rolling stock.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Olivia Da Silva, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2313.43 | -2.87 | |

| Silver | 27.09 | -0.09 | |

| Copper | 4.48 | -0.01 | |

| Oil | 82.90 | +0.09 | |

| Heating Oil | 2.57 | +0.01 | |

| Natural Gas | 1.65 | -0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

A graduate of Durham College's broadcast journalism program, Olivia has a passion for all things newsworthy. She got her start writing about esports (competitive video games), where she specialized in professional Call of Duty coverage. Since then, Olivia has transitioned into business writing for INN where her beats have included Australian mining and base metals.

Learn about our editorial policies.