- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Further Significant Step-Out Intercepts Returned at Seymour

Green Technology Metals Limited (ASX: GT1) (GT1 or the Company) is pleased to provide further assay results from the Phase 1 diamond drilling program at its Seymour Lithium Project in Ontario, Canada.

HIGHLIGHTS

- Assays received for further seven holes from Phase 1 step-out diamond drilling of North Aubry deposit at GT1’s flagship Seymour Lithium Project.

- Additional thick, high-grade extensional intercepts of North Aubry deposit including:

- GTDD-22-0001 for 10.5m @ 1.77% Li2O from 123.2m (incl. 7.0m @ 2.11% Li2O)

- GTDD-22-0013 for 18.2m @ 1.10% Li2O from 304.2m (incl. 3.1m @ 2.05% Li2O)

- GTDD-22-0014 for 4.5m @ 0.61% Li2O from 250.7m (incl. 2.5m @ 1.01% Li2O)

- Further northern step-out drilling of North Aubry deposit commenced; hole GTDD-22-0320 intercepts 10.7m of pegmatite with significant visible spodumene (assays pending), extending the known North Aubry pegmatite a further 150m down-dip from the nearest intercept.

- Results from Phase 1 drilling (assays now returned for all 16 holes) indicate substantial potential upside to existing Seymour Mineral Resource estimate of 4.8 Mt @ 1.25% Li2O 1 .

- Updated Mineral Resource estimate for Seymour on track for completion during Q2 CY2022.

- No significant lithium intercepts >1.0% Li20 were returned from initial exploration drilling of the eastern Central Aubry zone (7 holes) and Pye prospect (6 holes).

- Drilling is targeted to resume from June at both Central Aubry (western) and Pye (targeting LCT�type pegmatites of over 250m strike that were identified in the initial drilling).

“In total, the Phase 1 drilling program at Seymour has been highly successful. The results are expected to drive a substantial increase to the existing Seymour resource this quarter. We are also pleased to have commenced further northern and down-dip extensional drilling of the North Aubry pegmatite so rapidly. The initial result from hole GTDD-22-0320 offers further immediate potential to positively impact on mineralised pegmatite extents and volume.” - GT1 Chief Executive Officer, Luke Cox

Further significant step-out intercepts at North Aubry

The Phase 1 drilling program at Seymour was designed to evaluate potential along-strike and down-dip extensions of the North Aubry deposit that were open and untested. The final program consisted of 16 diamond drill holes for a total of 5,826 metres.

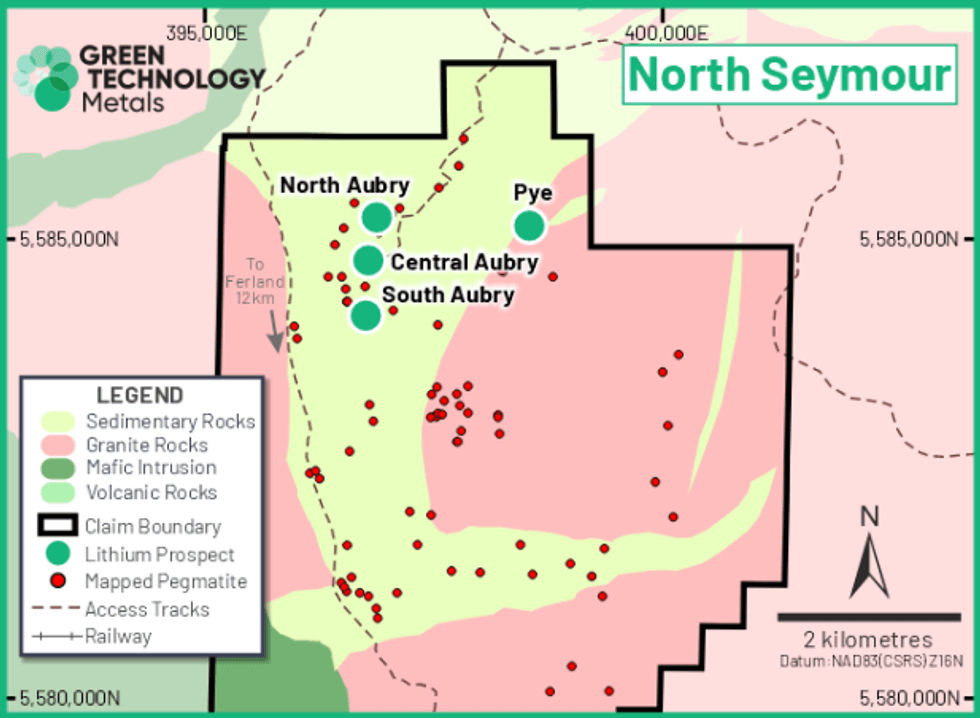

Figure 1: Location map of northern area of the Seymour Project showing North and South Aubry deposits, Central Aubry zone and Pye prospect

All but one hole in the Phase 1 program intersected pegmatite along strike and down dip (refer GT1 ASX release dated 28 April 2022) with the single hole barren of pegmatite, GTDD-22-011, on the southeast flank of the deposit, marking the southerly limit of the North Aubry pegmatites. The intercepts returned from solely the upper pegmatite at North Aubry range in thickness up to 42.7m, with the widest intervals located in the northern extensions of the deposit.

Assays have now been returned for all 16 of the holes drilled in the Phase 1 program.

Significant assay results from the seven further holes that were recently received are detailed in Table 1 (along with details of the previously released intercepts also). The key intercepts were:

- GTDD-22-0001 for 10.5m @ 1.77% Li2O from 123.2m (incl. 7.0m @ 2.11% Li2O)

- GTDD-22-0013 for 18.2m @ 1.10% Li2O from 304.2m (incl. 3.1m @ 2.05% Li2O)

- GTDD-22-0014 for 4.5m @ 0.61% Li2O from 250.7m (incl. 2.5m @ 1.01% Li2O)

- GTDD-22-0002 for 9.0m @ 0.68% Li2O from 174.0m

Click here for the full ASX Release

This article includes content from Green Technology Metals Limited (ASX: GT1), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Field Work Extends Liwa Creek Gold Prospect; Samples 55 g/t Gold and 379 g/t Silver in Outcrop And Discovers Significant New Gold Zone

Thunderstruck Resources Ltd. (TSXV:AWE) (OTC:THURF) (The “Company” or “Thunderstruck”) is pleased to announce that ongoing geochemical sampling on the Liwa Creek gold prospect has expanded known targets and discovered a significant new gold zone.

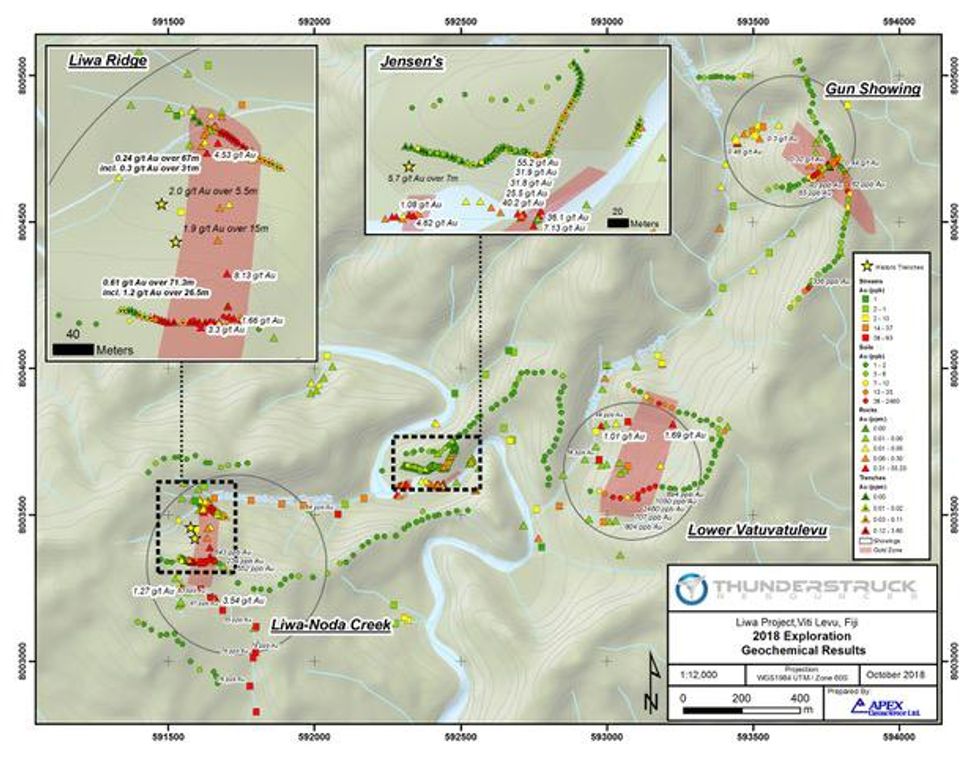

The combined 2017 and 2018 prospecting and geochemical sampling programs at Liwa Creek have resulted in the discovery of multiple gold showings over a three-km, northeast-trending structural corridor that is open in all directions. The Company’s intensive exploration approach combining initial stream BLEG sampling, followed by ridge-and-spur soil sampling, and anomaly-focused prospecting has, and continues, to lead to new discoveries.

In particular, sampling programs have returned high-grade gold and silver assays over previously discovered zones and expanded those zones. In addition, a potentially significant new zone, featuring the highest-grade soil sample yet collected, has been discovered.

Brien Lundin, Thunderstruck’s Chairman stated, “Following up on the successful results from our Rama prospect, field work continues to expand our Liwa prospect as well. In combination with our Nakoro and Wainaleka VMS discoveries, it’s becoming obvious that our Fiji properties offer tremendous potential. We are excited about continuing to advance on all fronts.”

As detailed in the Appendix, prospecting and geochemical sampling programs at Liwa Creek have resulted in the discovery of multiple gold showings over a three-km, northeast-trending structural corridor that is open in all directions.

Two distinct styles of gold mineralization have been identified at Liwa Creek: narrow northeast-trending high-grade gold plus base metal veins lacking significant wall rock alteration typified by the Jensen’s Showing; and dominantly north-south trending wide zones of gold-silver mineralized quartz-sericite-illite-pyrite altered volcanic rocks such as those occurring at the Liwa Ridge Showing and possibly the newly discovered Lower Vatuvatulevu gold target.

The two styles of mineralization exhibit characteristics of sub-epithermal gold-base metal and intermediate sulphidation epithermal gold-silver veins, respectively. The classification is significant in that both deposit styles are interpreted to have close copper porphyry deposit association, with intermediate sulphidation veins being interpreted as shallow-level counterparts of deeper gold plus base metal sub-epithermal veins located alongside porphyry copper deposits.

Juxtaposition of relatively shallow high-level intermediate sulphidation gold-silver vein system and deeper sub-epithermal high grade gold veins is interpreted to indicate overprinting of early deep copper porphyry related high grade gold veins by relatively late high-level gold-silver mineralization. The Company believes this indicates the presence of a significant and long-lived hydrothermal system at Liwa Creek.

Lawrence Roulston, Thunderstruck Director, noted, “The methodical exploration program at Liwa continues to be very effective at outlining this extensive gold system under soil cover. On-going work continues to push out the limits in prospective areas. Liwa already has a footprint in line with major gold-bearing systems. The size and the gold tenor of this system are extremely encouraging, especially in this Pacific Ring of Fire setting that hosts multiple world-class gold deposits.”

Thunderstruck is advancing toward securing joint venture partners on its VMS and porphyry targets as it focuses on this highly prospective gold zone.

About Fiji

Viti Levu, the main island of Fiji, has a long mining history. It is on the prolific Pacific Ring of Fire, a trend that has produced numerous large deposits, including Porgera, Lihir and Grasberg. The island of Viti Levu hosts Namosi, held by a joint venture between Newcrest and Mitsubishi. Newcrest published Proven and Probable Reserves for Namosi of 1.3 billion tonnes at 0.37% Cu and 0.12 g/t Au (5.2M ounces Au and 4.9M tonnes Cu). Namosi is now undergoing environmental assessment as part of the permitting process. Lion One Metals is now developing its Tuvatu Project, with Indicated Resources of 1.1 million tonnes at 8.17 g/t Au (294,000 ounces Au), and Inferred Resources of 1.3 million tonnes at 10.6 g/t Au (445,000 ounces Au). The Vatukoula Gold Mine has been operating for 80 years, producing in excess of 7 million ounces.

About Thunderstruck Resources

Thunderstruck Resources is a Canadian mineral exploration company that has assembled extensive and highly prospective properties in Fiji on which recent and previous exploration has confirmed VMS, copper and precious metals mineralization. Liwa Creek is one of four projects, each of which is being marketed as potential joint venture opportunities. The Company provides investors with exposure to a diverse portfolio of exploration stage projects with potential for zinc, copper, gold and silver in a politically safe and stable jurisdiction. Thunderstruck trades on the Toronto Venture Exchange (TSX-V) under the symbol “AWE” and United States OTCQB under the symbol “THURF”.

Qualified Person Statement

Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, is a qualified person for the project as defined by National Instrument NI 43-101. Mr. Raffle has reviewed and approved the portion of the technical content of this news release as it relates to the Liwa Creek Prospect.

During 2018 all stream sediment samples were submitted to Australian Laboratory Services Pty. Ltd (ALS) labs Perth for BLEG determination of gold. Auger soil samples were submitted for gold and multi-element geochemical analysis via a 25 gram (g) sample split subject ICP-MS. Prospecting and trench rock samples submitted for 30g gold Fire-Assay analysis and multi-element geochemistry by four-acid ICP-ES. Given the reconnaissance nature of the samples, Thunderstruck has relied on the external QA/QC of ALS which included the insertion of insertion of standard, blank and duplicate samples at a rate of 10% into the sample stream to confirm the accuracy of the reported results.

For additional information, please contact:

Rob Christl, Investor Relations

Email: rob@thunderstruck.ca

P: 778 840-7180

or, visit our website: https://www.thunderstruck.ca

APPENDIX – LIWA CREEK GOLD PROJECT EXPLORATION DETAILS

Rock Sampling

At Liwa Creek exploration was designed to follow-up and expand on broad trenched gold zones at the Liwa Ridge Showing (0.61 g/t gold over 71.3 metres; including 1.2 g/t gold over 26.5. metres); further develop the high-grade Jensen’s Showing (previous outcrop quartz vein rock grab samples returning 36 and 32 g/t gold from outcrop); and locate the source of widespread gold in float rock located within confined drainages of the Lower Vatuvatulevu Creek and Gun showing areas (see the Company’s February 13, 2018 news release).

Of the 55 current rock grab samples collected at Liwa, a total of 15 samples returned greater than 1 g/t gold or 10 g/t silver; and up to 55.2 g/t gold and 379 g/t silver (Table 1).

At the Jensen’s Showing two parallel, northeast trending, high-grade gold bearing quartz veins are exposed in the bed of Wainamoli Creek over a distance of 50 metres. The veins dip 60 to 80 degrees to the northwest and occur along the upper and lower contacts of an approximately 10 metre thick intrusive dyke cutting volcaniclastic rocks of the Wainimala Group.

Rock grab and small diameter backpack core drilling of the northern vein resulted in four (4) samples returning gold assays of 55.2 , 40.2 , 31.9, and 25.5 g/t gold (the later cored over a 0.22-metre true-width of the vein) with associated lead, copper and zinc values. Jensen’s Showing quartz veins are brecciated and contain massive to semi-massive galena, chalcopyrite and sphalerite with vuggy comb to crustiform banded quartz vein textures in association with sericite-illite host rock alteration. The Jensen’s south vein ranges in width from 0.1 to 0.5 metres in width and exhibits similar polyphase brecciated, anastomosing pinch-and-swell, comb and crustiform banded textures, with a total of 6 rock outcrop samples returning between 1.45 to 7.13 g/t gold.

Table 1: Liwa Creek Gold Prospect Significant Rock Grab Sample Results

| Sample ID | Showing | Au (g/t) | Ag (g/t) | Pb (%) | Cu (%) | Zn (%) |

| 28028 | Jenson’s | 55.2 | 24.8 | 10.0 | 0.35 | – |

| 28014 | 40.2 | 19.4 | 1.85 | 0.39 | – | |

| 28003 | 31.9 | 21.8 | 0.99 | 0.34 | – | |

| 28021 | 25.5 | 27.8 | 0.94 | 1.42 | 1.94 | |

| 28015 | 7.13 | 13.4 | 0.65 | 0.12 | 0.63 | |

| 28004 | 4.62 | 8.3 | 0.36 | 0.3 | – | |

| 28002 | 4.14 | 8.2 | 0.34 | – | – | |

| 28013 | 3.33 | 7.1 | 0.17 | – | – | |

| 28029 | 3.24 | 8.9 | 0.24 | – | 0.29 | |

| 28018 | 1.82 | 11.7 | 0.61 | 0.1 | 0.16 | |

| 28017 | 1.45 | 5.7 | 0.23 | – | – | |

| 28010 | Liwa Ridge | – | 379 | 0.28 | – | 0.54 |

| 28009 | 4.53 | 9.2 | 0.36 | – | – | |

| 28027 | 0.85 | 13.0 | 0.1 | – | – | |

| 28007 | 0.30 | 36.2 | – | – | – |

A distance of 100 metres to the east of the main Jensen’s discovery outcrops a rock grab sample of silicified and comb textured quartz veined Wainimala Group volcanic breccia rocks returned 4.62 g/t gold.

Rock outcrop and subcrop float grab sampling within Liwa Creek at the northern extent of the Liwa Ridge Showing, 800 metres west of Jensen’s, returned 4.53 g/t gold and 379 g/t silver (the highest silver assay to date at Liwa Creek), respectively, from silica-flooded and quartz stockwork veined intrusive.

Soils

A total of 141 additional ridge-and-spur aguer soil geochemical samples were collected Liwa Creek. Sampling was designed to isolate potential source zones to the northeast of the Jenson’s gold zone, and widespread gold in float rock recovered within the Lower Vatuvatulevu Creek and Gun showing areas.

Auger soil sampling within the Lower Vatuvatulevu Creek area resulted in the discovery of a significant new gold zone. Prior stream BLEG and prospecting float rock grab sampling within this small 400 x 400 metre drainage returned anomalous gold values. Current soil sampling along the southern ridge resulted in 8 soils collected over a 160-metre interval returning greater than 20 ppb gold, and up to 2,480 ppb gold (2.48 g/t gold) in soil. The result is four times greater than any previous soil sample collected on the project (643 ppb gold from the Liwa Ridge Gold Zone 1.5 km to the west). The five highest soils samples returned 707, 804, 894, 1050 and 2,480 ppb gold. The orientation of this newly discovered gold zone is presently not known. An aggressive follow-up via intensive prospecting, hand trenching and expansion of ridge-and-spur aguer soils to the south is warranted.

In addition, soil sampling along the Gun Showing ridge returned isolated anomalous gold values including 336 ppb and 82 ppb gold, which warrant additional follow-up sampling and prospecting.

Trenching

Hand excavated trenching at three locations (GT1, GT2, and GT3) totaling 29 metres within the Gun Showing area was designed to follow up on previously reported anomalous gold in soil values of 65 and 82 ppb gold (see the Company’s February 13, 2018 news release). Trenches were excavated to a depth of 1 metre into the subsoil, however competent outcrop was not reached in any of the trenches. Trench GT3 returned 0.2 g/t gold over 2 metres from 0 to 2 metres; and 0.17 g/t gold over 3 metres between 8 and 11 metres. Trench GT2 returned 0.12 g/t gold over 2 metres; in addition to silicified and veined float rock grab samples recovered during excavation that returned 0.44, 0.20, and 0.15 g/t gold; including 4.5, 6.2 and 9.6 g/t silver, respectively. Trench GT1 did not return significant values.

Stream BLEG Sampling

Completion of stream BLEG geochemical sampling in the Noda Creek drainage designed to evaluate the potential southern extension of the north-south trending Liwa Ridge Gold Zone. Of the 23 Noda Creek stream BLEG samples collected a total of 13 samples returned greater than 20 parts-per-billion (ppb) gold and are considered anomalous. A stream BLEG collected from the Noda Creek headwaters at the southernmost known extent of the Liwa Ridge gold zone returned 93 ppb gold. This sample represents the highest gold in stream sediment value returned form the Project to date, and underscores the potential to expand the Liwa Zone southward.

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain statements that may be deemed “forward-looking statements”. Although Thunderstruck believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements.Forward looking statements are based on the beliefs, estimates and opinions of Thunderstruck’s management on the date the statements are made. Except as required by law, Thunderstruck undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Figure 1

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/2901/40686_

Source: www.newsfilecorp.com

Top 7 Canadian Lithium Stocks of 2024

After a tumultuous 2023 that saw prices for lithium carbonate shed 80 percent, Q1 2024 was much less volatile.

Starting the year at US$13,377.44 per metric ton, lithium carbonate prices ended the three month period in the US$14,874,31 range, up 11 percent. Strong electric vehicle sales in January helped sustain lithium prices into February.

Prices began climbing at the end of the month and through March, reaching a Q1 high of US$16,109. The rally came on the back of optimism that lithium demand for batteries and energy storage is locked in an “irreversible” growth trend.

"If lithium prices can stabilize between 80,000 and 150,000 yuan, leaving upstream and downstream (companies) along the industry chain certain profit, it might be the best development environment for the whole industry," Li Liangbin, chair of Ganfeng Lithium (OTC Pink:GNENF,HKEX:SZSE:002460), told Reuters.

That currently converts to about US$11,050 to US$20,725.

Against that backdrop, a number of Canada-listed lithium companies saw share price growth during Q1. This list was created on April 10, 2024, using TradingView‘s stock screener, and all data was current at that time. Only companies with market caps above C$10 million for the TSX and TSXV and above C$5 million for the CSE are included.

TSX and TSXV lithium stocks

1. Century Lithium (TSXV:LCE)

Year-to-date gain: 78 percent; market cap: C$131.49 million; current share price C$0.89

US-focused Century Lithium is currently advancing its Clayton Valley lithium project in West-Central Nevada. The company is also completing the pilot testing phase at its lithium extraction facility in the state's Amargosa Valley.

Century Lithium began the year trading in the C$0.48 range and rose to a quarterly high of C$0.80 on March 27.

While the company made no announcements in Q1, some of its positive momentum may have resulted from two press releases from December 2023. The first provides an update on the company’s ongoing feasibility study for Clayton Valley.

“This comprehensive study covers all areas of the lithium extraction process from shallow surface mining of lithium-bearing clay to on-site production of battery-grade lithium carbonate,” the statement reads. “Target production for the study follows that of the project’s earlier Pre-Feasibility Study, which was based on a mill feed of 15,000 tonnes per day and average annual output of 27,000 tonnes per year of lithium carbonate equivalent.”

The second December announcement provides an overview of work at the extraction facility. During testwork at the pilot plant, the company achieved increased lithium grades with an average grade of 7.5 grams per liter lithium.

“This increase in concentration was attributed to the integration of Koch Technology Solutions Li-ProTM equipment into the direct lithium extraction area,” the company said at the time.

2. Lithium Chile (TSXV:LITH)

Year-to-date gain: 50.94 percent; market cap: C$164.97 million; current share price: C$0.80

South America-focused Lithium Chile owns several lithium land packages in Chile and Argentina. Presently, the explorer is working to delineate the deposit at its Salar de Arizaro property in Argentina.

Company shares initially trended down, but ultimately rose 32 percent between January 1 and the end of February.

On February 28, the company released “favorable” results from a new drill hole completed on the northeastern side of Salar de Arizaro, calling them an important step in its roadmap. Hole ARDDH-08 was drilled to a depth of 606 meters, encountering a brine-rich sandy formation at 200 meters. Samples were sent to Alex Stewart Laboratory in Jujuy, Argentina, revealing lithium grades of 180 milligrams per liter at 50 meters and 690 milligrams per liter at 200 meters.

In early March, Lithium Chile penned a farm-In agreement with European mining company Eramet (EPA:ERA). The agreement aims to expedite exploration efforts on four of Lithium Chile's Chilean properties — Llamara, Aguilar, Rio Salado and Aquas Caliente — with a total land area exceeding 40,000 hectares

3. Power Metals (TSXV:PWM)

Year-to-date gain: 24 percent; market cap: C$55.22 million; current share price: C$0.35

Exploration company Power Metals holds a portfolio of diversified assets in Ontario and Quebec, Canada.

In late February, Power Metals commenced a winter drill program at its Case Lake property in Northeastern Ontario. The program was designed to expand and define lithium-cesium-tantalum mineralization, building on previous work by the company that revealed high-grade lithium and cesium mineralization.

Company shares traded flatly for most of Q1, locked in the C$0.27 range. Prices began to rise in mid-March and hit a three month high of C$0.43 on March 31. The 59 percent uptick coincided with news that Power Metals was acquiring the 7,000 hectare Pelletier project, which consists of 337 mineral claims in Northeast Ontario.

According to the company, the project features lithium-cesium-tantalum potential, with peraluminous S-type pegmatitic granites intruding into metasedimentary and amphibolite formations.

4. Q2 Metals (TSXV:QTWO)

Year-to-date gain: 24 percent; market cap: C$27.71 million; current share price: C$0.31

Exploration firm Q2 Metals is exploring its flagship Mia lithium property in the Eeyou Istchee James Bay region of Québec, Canada. The property contains the Mia trend, which spans over 10 kilometers. Also included in Q2's portfolio is the Stellar lithium property, comprising 77 claims and located 6 kilometers north of the Mia property.

Company shares were trading below C$0.20 for most of January and February. On February 27, Q2 rose rapidly, climbing from C$0.19 on February 26 to the C$0.45 level to end the month.

The share price growth corresponded with the the completion of a winter drill program.

“The winter drill program at the Mia Property has confirmed the spodumene mineralized pegmatite at the western end of the Mia Trend,” Neil McCallum, Q2's vice president of exploration, said at the time. “The drilling has successfully evaluated a large portion of the Mia Trend that had been explored at the surface.”

Days later, Q2 reported the acquisition of the 11,374 hectare Cisco lithium property, also located in the Eeyou Istchee James Bay region. The upward trend continued, and shares reached a Q1 high of C$0.51 on March 4.

5. Volt Lithium (TSXV:VLT)

Year-to-date gain: 23.91 percent; market cap: C$37.14 million; current share price: C$0.28

Volt Lithium is a lithium development and technology company aiming to become a premier North American lithium producer utilizing its unique technology to extract lithium from oilfield brines.

In late January, Volt made its first announcement of 2024, highlighting its success in producing 99.5 percent battery-grade lithium carbonate. The achievement happened at the company’s demonstration plant in Calgary, Alberta.

Commenting on the milestone, CEO Alex Wylie expressed his excitement. “The Volt team continues to advance our DLE capabilities at our demonstration plant and showcased our ability to transform oilfield brine into a commercially saleable grade of lithium carbonate," he said. “Bringing the full-cycle process in-house greatly reduces the cost to produce lithium carbonate, which is expected to enhance margins and position Volt as a low-cost operator.”

The cost savings were reiterated in late February, when the company announced a 64 percent reduction in full-cycle direct lithium extraction operating costs at the Calgary-based demonstration plant.

Volt's share price marked a Q1 high of C$0.27 on March 12.

CSE lithium stocks

1. Foremost Lithium (CSE:FAT)

Year-to-date gain: 18.69 percent; market cap: C$19.17 million; current share price: C$4

Foremost Lithium is an exploration company with hard-rock lithium properties in Snow Lake, Manitoba, and Lac Simard South, Québec. Included in the company’s portfolio is the Winston gold-silver property in New Mexico, US.

In January, Foremost received its third C$300,000 grant from the Manitoba Mineral Development Fund. The funds have been earmarked for continued exploration and drilling at the Snow Lake property.

Throughout the first quarter, Foremost released several updates, including the receipt of a multi-year work permit for the Jean Lake lithium-gold project in Manitoba, the start of a drill program at the Zoro lithium property in the Snow Lake region and the of filing an application for C$10 million from Canada’s Critical Minerals Infrastructure Fund.

Shares of the company hit a high for the first quarter of C$4.51 in late February, when Foremost released promising intercepts from the Zoro property drill program.

“The presence of spodumene and the length of pegmatite encountered in multiple holes, highlighted by over 32-meters of spodumene-bearing pegmatite hit in one hole, are very positive in terms of the potential for our maiden resource to now grow in significant scale,” Jason Barnard, president and CEO of Foremost Lithium, said in a February 27 statement.

“As drilling progresses, the focus will continue to build resource to the south of Dyke 1, a promising new uncharted area, which has confirmed spodumene pegmatite as drilling progresses.”

2. Quantum Battery Metals (CSE:QBAT)

Year-to-date gain: 5.56 percent; market cap: C$6.9 million; current share price: C$0.19

Exploration company Quantum Battery Metals is focused on identifying lithium and cobalt deposits in Canada.

In mid-January, the company announced it was actively looking to “acquire additional properties to expand on its portfolio to help address the world's shortage in technology metals.”

The statement continues, “There is an increasing demand for metals as the world is transitioning to a low-carbon economy and global conflicts continue to arise that require massive amounts of metals for producing batteries, clean energy technologies, and national defense applications.”

Subsequently, Quantum submitted a letter of intent to acquire the Copper Coffer property in Newfoundland, Canada.

Company shares reached a Q1 high of C$0.20 on March 17, and ended the three month session in the same range.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Century Lithium is a client of the Investing News Network. This article is not paid-for content.

Top 4 ASX Lithium Stocks of 2024

In contrast to the volatility of 2023, Q1 2024 saw a more stable lithium market. Prices for lithium carbonate started the period at US$13,377.44 per tonne and finished at US$14,874.31, marking an 11 percent increase.

Strong electric vehicle sales in January helped support prices for the important battery metal, which continued to rise through February and March, reaching a quarterly high of US$16,109. This rally was fueled by reports from China indicating a sustained growth trend in lithium demand for batteries and energy storage technology.

Here the Investing News Network looks at the top four ASX-listed lithium companies by year-to-date gains. The list below was generated using TradingView’s stock screener on April 10, 2024, and includes companies that had market caps above AU$10 million at that time. Read on to learn more about their activities over the past year.

1. Prospect Resources (ASX:PSC)

Year-to-date gain: 46.07 percent; market cap: AU$40.31 million; current share price: AU$0.13

Africa-focused exploration company Prospect Resources holds a diversified portfolio of assets located in Zimbabwe, Zambia and Namibia. Its lithium properties — Omarur and Step Aside — are in Namibia and Zimbabwe, respectively.

Shares of Prospect were locked below AU$0.08 from January to mid-March, before rising to a Q1 high of AU$0.09 on March 25. The move occurred shortly after Prospect acquired a 60 percent residual interest in the Omarur property from Osino Resources (TSXV:OSI,OTCQX:OSIF) for US$75,000, taking Prospect’s stake to 100 percent.

Earlier in the quarter, Prospect announced the start of Phase 2 drilling at Omarur. The company said the program will consist of 70 rotary air blast and reverse-circulation drill holes across 4,250 metres.

2. Ioneer (ASX:INR)

Year-to-date gain: 33.33 percent; market cap: AU$432.96 million; current share price: AU$0.20

Emerging producer Ioneer owns the Rhyolite Ridge lithium-boron project in Nevada, US. According to the company, the project is considered the “sole lithium-boron deposit in North America.”

As part of the permitting process for Rhoylite Ridge, Ioneer completed and submitted an administrative draft environmental impact statement to the US Bureau of Land Management (BLM) in mid-January.

After slipping to a first quarter low of AU$0.10 on January 25, shares of Ioneer spent February and March slowly climbing, reaching a quarterly high of AU$0.17 on March 25. News that the BLM has reached a final decision continued to add tailwinds at the beginning of the second quarter; the results of the review are expected in mid-April.

3. Pan Asia Metals (ASX:PAM)

Year-to-date gain: 28 percent; market cap: AU$26.85 million; current share price: AU$0.16

ASX-listed Pan Asia Metals is a mineral exploration company with a diverse portfolio of projects in Southeast Asia, particularly Thailand. Specialising in critical metals such as lithium, tantalum and rare earth elements, the company is also actively engaged in exploration activities in South America.

Shares of Pan Asia Metals rose to a Q1 high of AU$0.21 during the first week of January. The spike came when the company entered into three binding option agreements to secure ownership of the Dolores North, Dolores South, Pozon and Pink project areas, which together comprise the Tama Atacama lithium brine project in Chile; it also agreed to acquire the Ramatidas project area. In total, these assets span about 120,000 hectares.

“The Tama Atacama lithium project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied,” said Pan Asia Metals Managing Director Paul Lock.

Shares subsequently shed some of the positivity, spending the rest of the quarter rangebound below AU$0.17.

4. Mineral Resources (ASX:MIN)

Year-to-date gain: 2.45 percent; market cap: AU$13.81 billion; current share price: AU$71.61

Diversified miner Mineral Resources holds a portfolio of assets in Australia, including lithium and iron ore projects.

Following a share price slump early in the year's first quarter, the company began to rebound in mid-January. On February 21, shares rose to AU$67.69 following the release of Mineral Resources' latest financial results.

The half-year reporting period, which ended on December 31, 2023, saw the company's lithium operations perform well, benefiting from higher lithium prices and increased production volumes.

Shares marked a Q1 high of AU$70.98 at the end of March, when Mineral Resources announced plans to develop a lithium-processing hub in Western Australia's Goldfields region. It aims to capitalise on lithium-ion battery demand.

Plans for the hub include the construction of a lithium hydroxide and carbonate plant, as well as associated infrastructure to support the production of battery-grade lithium chemicals.

FAQs for investing in lithium

What is lithium?

Lithium is the lightest metal on the periodic table, and it is used in a wide variety of applications, including lithium-ion batteries, pharmaceuticals and industrial applications like glass and steel.

How do lithium-ion batteries work?

Rechargeable lithium-ion batteries work by using the flow of lithium ions in the battery's cell to power a device.

A lithium-ion battery has one or more cells, depending on the amount of energy storage it is capable of, and each cell has a positive electrode and negative electrode with an electrolyte separating them. When the battery is in use, lithium ions flow from the negative electrode to the positive electrode, running out of power once all have transferred. When the battery is charging, ions flow the opposite way.

Where is lithium mined?

Lithium is mined from two types of deposits, hard rock and evaporated brines. Most of the world's lithium production comes out of Australia, which hosts the Greenbushes hard-rock lithium mine. The next-largest producing country is Chile, which like Argentina and Bolivia is located in South America's Lithium Triangle. Lithium in this famed area comes from evaporated brines, including the Salar de Atacama. Lithium can also be found in sedimentary deposits, but currently none are producing.

Where is lithium found in Australia?

Australia is the world’s top producer of lithium, and the country’s lithium mines are all located in Western Australia except for one, which is Core Lithium’s (ASX:CXO,OTC Pink:CXOXF) Finniss mine in the Northern Territory. Western Australia accounts for around half of global lithium production, and the state is looking to become a hub for critical elements.

Who owns lithium mines in Australia?

Several companies own lithium mines in Australia, including some of the biggest ASX lithium stocks. In addition to the entities discussed above, others include: Pilbara Minerals (ASX:PLS,OTC Pink:PILBF) with its Pilgangoora operations; Arcadium Lithium with the Mount Cattlin mine; Jiangxi Ganfeng Lithium (HKEX:0358), which owns the Mount Marion mine alongside Mineral Resources (ASX:MIN,OTC Pink:MALRF); and Tianqi Lithium (SZSE:002466), which is a partial owner of Greenbushes via its stake in operator Talison Lithium.

Who is Australia’s largest lithium producer?

Australia’s largest lithium producer is Albemarle, which has interests in both the Greenbushes and Wodgina hard-rock lithium mines. Greenbushes is the world’s largest lithium mine, and Albemarle holds 49 percent ownership of operator Talison Lithium’s parent company. Albermarle also has 60 percent ownership of Mineral Resources’ Wodgina mine, and owns the Kemerton lithium production facility as part of a 60/40 joint venture with Mineral Resources.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Georgia Williams, currently hold no direct investment interest in any company mentioned in this article.

RecycLiCo Grants Stock Options

RecycLiCo Battery Materials Inc. (“RecycLiCo” or the “Company”), TSX.V: AMY, OTCQB: AMYZF, FSE: ID4, has granted an aggregate of 3,000,000 stock options to Kurt Lageschulte, director pursuant to the Company's omnibus equity incentive plan. The stock options have an exercise price of $0.16 per share and an expiry date of April 12, 2029.

About RecycLiCo

RecycLiCo Battery Materials Inc. is a battery materials company specializing in sustainable lithium-ion battery recycling and materials production. RecycLiCo has developed advanced technologies that efficiently recover battery-grade materials from lithium-ion batteries, addressing the global demand for environmentally friendly solutions in energy storage. With minimal processing steps and up to 99% extraction of lithium, cobalt, nickel, and manganese, the patented, closed-loop hydrometallurgical process turns lithium-ion battery waste into battery-grade cathode precursor, lithium hydroxide, and lithium carbonate for direct integration into the re-manufacturing of new lithium-ion batteries.

For more information, please contact:

Teresa Piorun

Senior Corporate Secretary

Telephone: 778-574-4444

Email: InvestorServices@RecycLiCo.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward–looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

AM Resources Identifies 26 New Pegmatites for a Total of 187 Pegmatites on its 1,500 km² Land Package in Austria

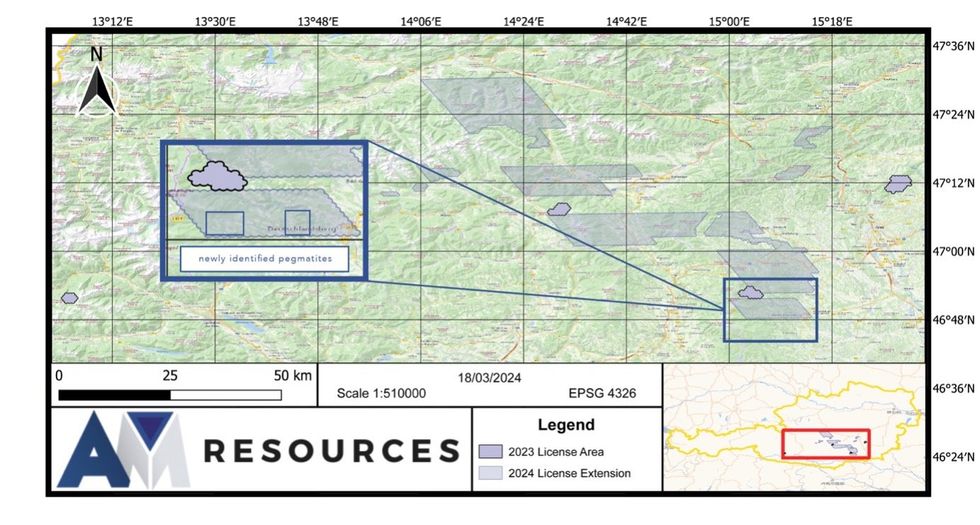

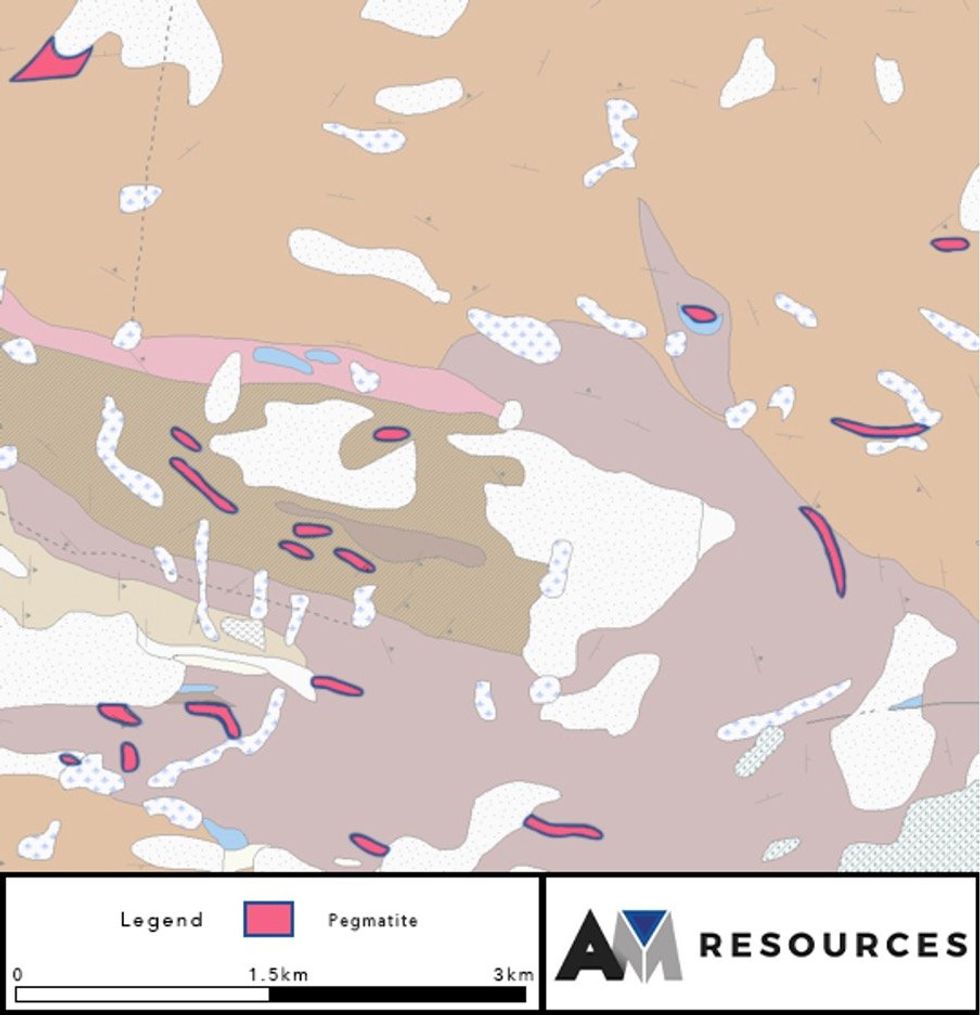

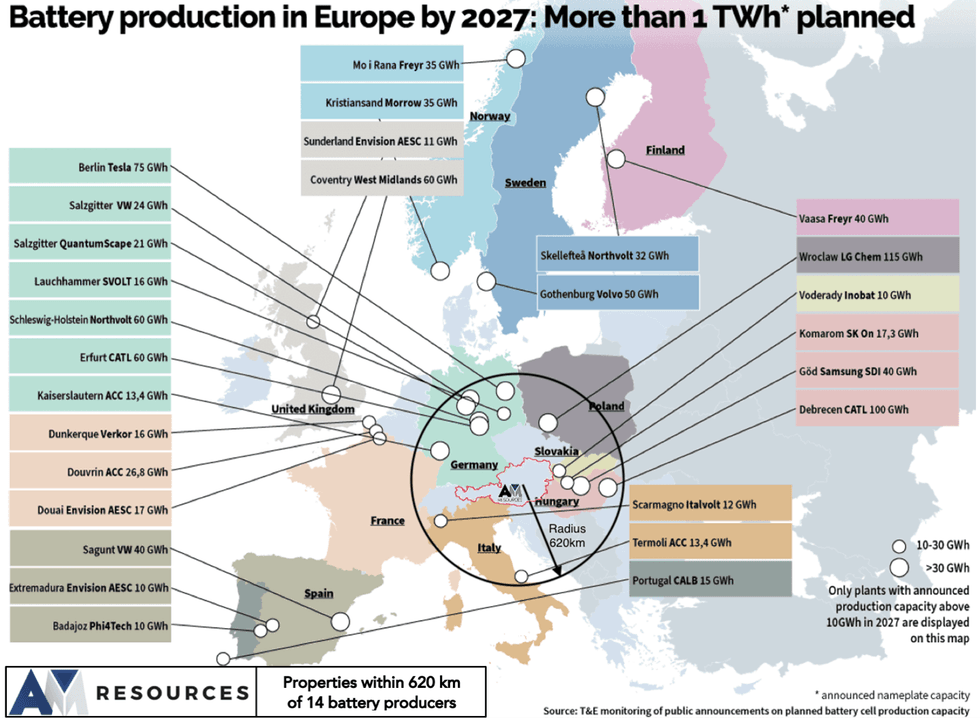

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite lithium deposits, is pleased to announce the discovery of 26 new pegmatites as a result of its ongoing compilation of government databases since it acquired its 1,500 km2 land package (see press release dated March 21, 2024). AM Resources has now identified a total of 187 pegmatites, consolidating its strategic position in one of Austria’s most prospective lithium areas.

- Recently announced 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt.

- Ongoing compilation of government data resulted in the discovery of 26 additional pegmatites across two groups, with sizes ranging from 102 metres to 887 metres.

- Many pegmatites are strategically located within mica schists, indicating favorable conditions for lithium-bearing minerals.

- Latest discoveries continue to reinforce AM Resources' position in the Austrian Pegmatite Belt, located within proximity to European battery manufacturers.

AM Resources’ 1,500 km2 land package

First Group

The Company has identified 8 large pegmatites with lengths varying between 329 metres and 887 metres, with the most extensive pegmatite measuring an impressive 281 metres in width.

Second Group

An additional 18 pegmatites ranging from 102 metres to 560 metres in length were discovered, with the thickest pegmatite reaching 195 metres in width. This group's diversity in size and shape adds to the prospectivity of AM Resources’ holdings. Many of these pegmatites are located within mica schists, a geological setting favorable for the presence of lithium-bearing minerals.

David Grondin, CEO of AM Resources commented: “Since the acquisition, we've been compiling the data available to us in preparation for our upcoming exploration program scheduled for June. We are very pleased with the number and size of the pegmatites found so far. Once we finish compiling the data, we'll have a better picture of the work that needs to be done to fully evaluate the lithium potential of our properties.”

Location, Location, Location

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-583-3490

Notification of Expiry of Options (EUROA) and Announcement of Options Offer

As announced on 25 March 2024, European Lithium Limited (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) has listed options on issue exercisable at $0.075 each that are due to expire on Friday, 19 April 2024 (EUROA Options). Optionholders may exercise their options by way of payment, which must be received no later than 5:00pm (WST) on Friday 19 April 2024 (Expiry Date). All EUROA Options that are not exercised by the Expiry Date will expire with no value and no further entitlement will exist.

Official quotation of the EUROA Options on the ASX will cease at the close of trading on 15 April 2024.

For more information, please refer to the announcement dated 25 March 2024 available on the Company’s ASX Platform.

Options

Offer The Company is pleased to announce that it intends to conduct an offer to all registered holders of EUROA Options on 12 April 2024 (Record Date) with a registered address in Australia and New Zealand (Registered Holders) whereby Registered Holders can apply for one (1) option (New Option) for every one (1) EUROA Option held on the Record Date at an issue price of $0.005 with an exercise price of $0.08 per option, expiring on 14 November 2025 (Options Offer). The Company intends to apply for quotation of the New Options. The New Options will be issued pursuant to the Company’s available Listing Rule 7.1 placement capacity.

The Directors of the Company intend to apply for their full allocation under the Options Offer (a total of 21,750,000 New Options) as follows:

(a) Tony Sage – 10,000,000 New Options;

(b) Malcolm Day – 10,000,000 New Options; and

(c) Michael Carter – 1,750,000 New Options,

(together, the Participation) subject to shareholder approval sought at the Company’s upcoming general meeting which is expected to be held in June 2024 (General Meeting).

To the extent that the Options Offer is not fully subscribed by Registered Holders, the Directors of the Company have each agreed to underwrite the Options Offer in equal proportions (up to an amount of 41,680,491 New Options each). Any issue of New Options pursuant to the Directors’ underwriting will be in addition to the Participation and also subject to shareholder approval to be sought at the General Meeting.

Click here for the full ASX Release

This article includes content from European Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

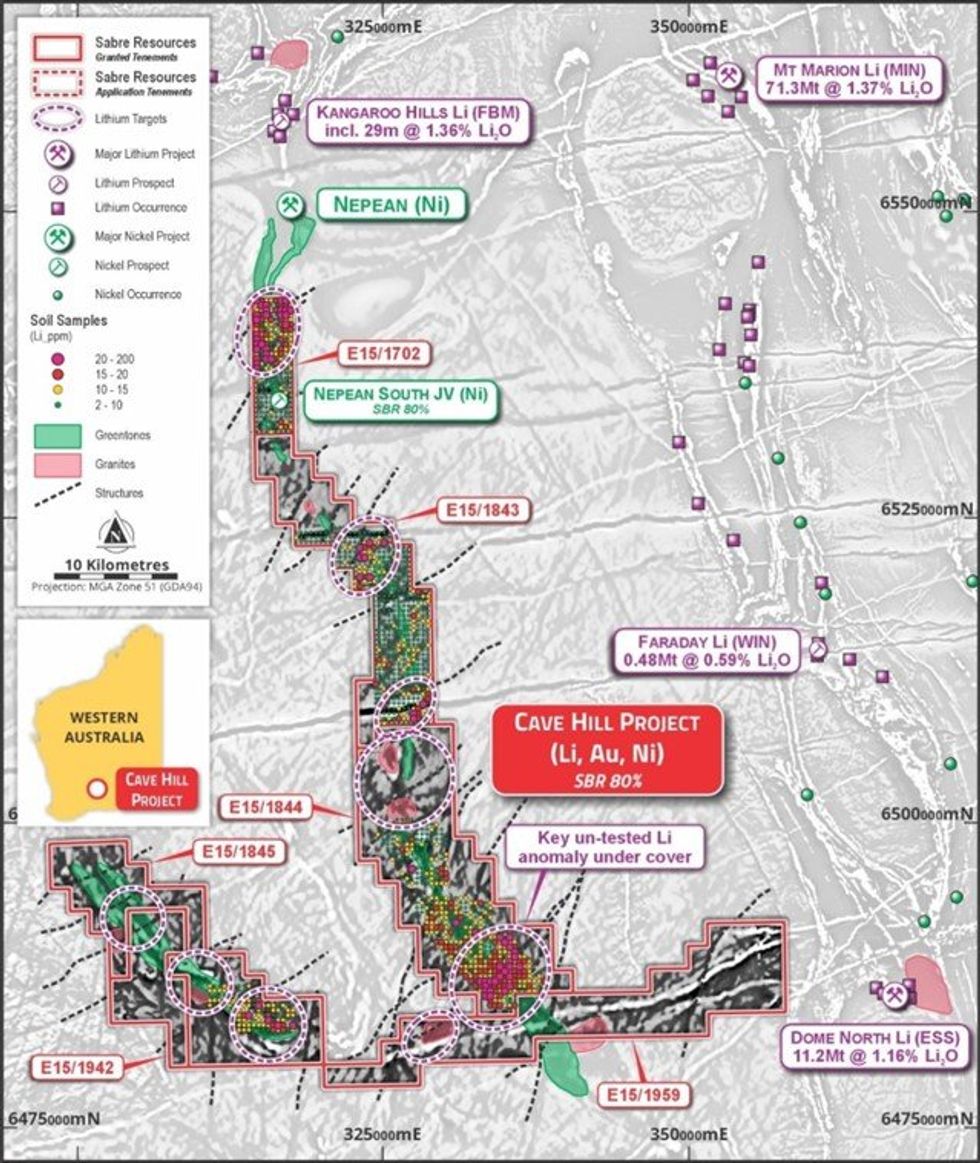

Large New Lithium and Gold Anomalies Identified Over Highly - Prospective Cave Hill Greenstone Belts

- Highly-anomalous lithium and gold targets identified from soil sampling across the Company’s extensive 700 square kilometres (sq.km) Cave Hill Project tenements in WA’s world-class Eastern Goldfields gold, nickel and lithium province (see Figure 1).

- The largest new lithium anomaly, located in the southern part of E15/1844 (Figure 1), is over 5km x 5km and is associated with a northeast-trending fault corridor intersecting an extensive buried greenstone corridor identified from magnetic imagery (Figure 2). This is a similar setting to other high-grade lithium deposits in the region, including the Kangaroo Hills discovery which has produced lithium-spodumene intersections of up to 29m @ 1.36% Li2O1, and the Mt Marion Project which has a large Mineral Resource of 71.3Mt @ 1.37% Li2O2 (see Figure 1).

- Several highly-anomalous gold results also produced from this broad 400m x 400m sampling program, including values of up to 32ppb Au - more than 10 times background in this soil covered area (see Figure 3).

- This extensive and highly prospective >100km strike-length greenstone corridor remains virtually untested and is a continuation of the belt which hosts the Kangaroo Hills lithium discovery1, the 2.8Moz2 Coolgardie Goldfield and the Nepean Nickel Mine (1.1Mt at 3.0% Ni produced3) (Figure 1).

- Extensive infill and extension soil sampling is set to commence to better define targeting for an initial aircore drilling program, to be followed by RC and/or diamond drilling to test for lithium-bearing pegmatites in bedrock and/or greenstone-hosted gold deposits.

SABRE RESOURCES CEO JON DUGDALE COMMENTED:

“The large lithium and gold soil anomalies we have identified across our extensive Cave Hill tenements indicate that the large, untested, greenstone corridor discovered within the project is highly-prospective for lithium-bearing pegmatites, as well as gold deposits.

“The Company will immediately commence infill sampling, and new sampling programs on other recently granted tenements, to define aircore drilling targets for lithium and gold deposits in the underlying greenstone lithologies.

“The Company has over 100km of strike of granted tenements over this newly identified greenstone corridor. The corridor is along strike and parallel to other greenstone belts which host major lithium, gold and nickel deposits in the region, such as the Mt Marion lithium deposit, the 2.8Moz Coolgardie Goldfield and the Nepean nickel mine. The only difference appears to be that the Cave Hill greenstone corridor is under shallow cover, which is why it has remained largely un-explored.

“We look forward to further defining these highly-anomalous lithium and gold zones and testing the bedrock potential for new lithium, gold and nickel sulphide discoveries”.

The results have been received from a further 876 auger soil samples collected on a 400m x 400m grid, mostly from the largest and most prospective tenement, E15/1844 (see Figure 1). An extensive greenstone belt has been identified from magnetics within this tenement and a series of northeast-trending faults are interpreted to intersect the soil-covered greenstone lithologies, which could host lithium-bearing pegmatites (see Figure 2 below).

Click here for the full ASX Release

This article includes content from Sabre Resources Ltd, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.