MAG Silver Corp. (TSX NYSE American: MAG) ("MAG" or "MAG Silver") reports production from Juanicipio (56% 44% Fresnillo plc ("Fresnillo") and MAG, respectively) for the first quarter ("Q1") ended March 31, 2024.

Q1 Highlights

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) is pleased to announce that Abra Mining Pty Limited (“AMPL”), the joint-venture company for the Abra Base Metals Project (“Abra” or the “Project”) has received US$35 million following completion of the second drawdown of the Taurus Debt Facilities (see Galena ASX announcements of 12 November2020 and 15 June 2021 for more information on the terms of the Taurus DebtFacilities).

Managing Director, Tony James commented,

“The receipt of the US$35 million second drawdown from Taurus is another milestone on our pathway to first commercial production of high-value, high-grade lead-silver concentrate from Abra in the first quarter of 2023. We appreciate Taurus’ continued support for us as our debt funding partner.”

With the US$35 million second drawdown, a total of US$65 million has been drawn under the Taurus Debt Facilities and US$45 million of funding remains undrawn (equivalent to A$62 million at current exchange rates), made up of:

The Taurus Debt Facilities are secured against Abra Project assets and over the shares that each of Galena and Toho own in AMPL, and additional drawdowns remain subject to satisfaction of customary conditions precedent.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Galena Mining Limited (ASX:G1A, Galena) owns 60 percent of the Abra base metals mine located in the Gascoyne region of Western Australia - home to one of the largest lead and silver deposits in the world, set to produce the highest-grade, cleanest lead concentrate available globally. The company is capitalizing on its Tier 1 asset in a Tier 1 jurisdiction, strengthened by and leveraging partnerships with Japan's largest zinc and lead smelter, as well as with one of the top base metals trading firms in the world.

The company also owns 100 percent of the Jillawarra Project, which covers 76 kilometers of strike extension directly to the west of Abra. The Jillawarra Project contains several large-scale analogous exploration targets including the Woodlands Complex, Quartzite Well and Copper Chert areas.

Galena's major partnerships include Toho Zinc (TSE:5707), Japan's largest zinc and lead smelter, and IXM SA, one of the world's top three base metals trading firms. Toho provided AU$90 million project equity and has a long-term offtake agreement to purchase 40 percent of Abra's production; while IXM has entered into a 10-year take-or-pay offtake contract to purchase the remaining 60 percent.

The company's management team brings decades of experience in the mining and base metals industry and has a proven track record of success throughout all stages of exploration, from development to production.

In November 2020, Galena put in place US$110 million in finalized debt facilities arranged by Taurus Funds Management. The facilities include a US$100-million project finance facility plus a US$10-million cost overrun facility.

The project finance facility consists of a 69-month term loan primarily to fund capital expenditures for the development of Abra. Key terms include:

The cost overrun facility is a loan to finance identified cost overruns on the project in capital expenditure and working capital. Fixed interest of 10 percent per annum applies to amounts drawn under the cost overrun facility.

The Taurus debt facilities have been fully drawn and are secured against Abra Project assets and over the shares that each of Galena and Toho own in Abra.

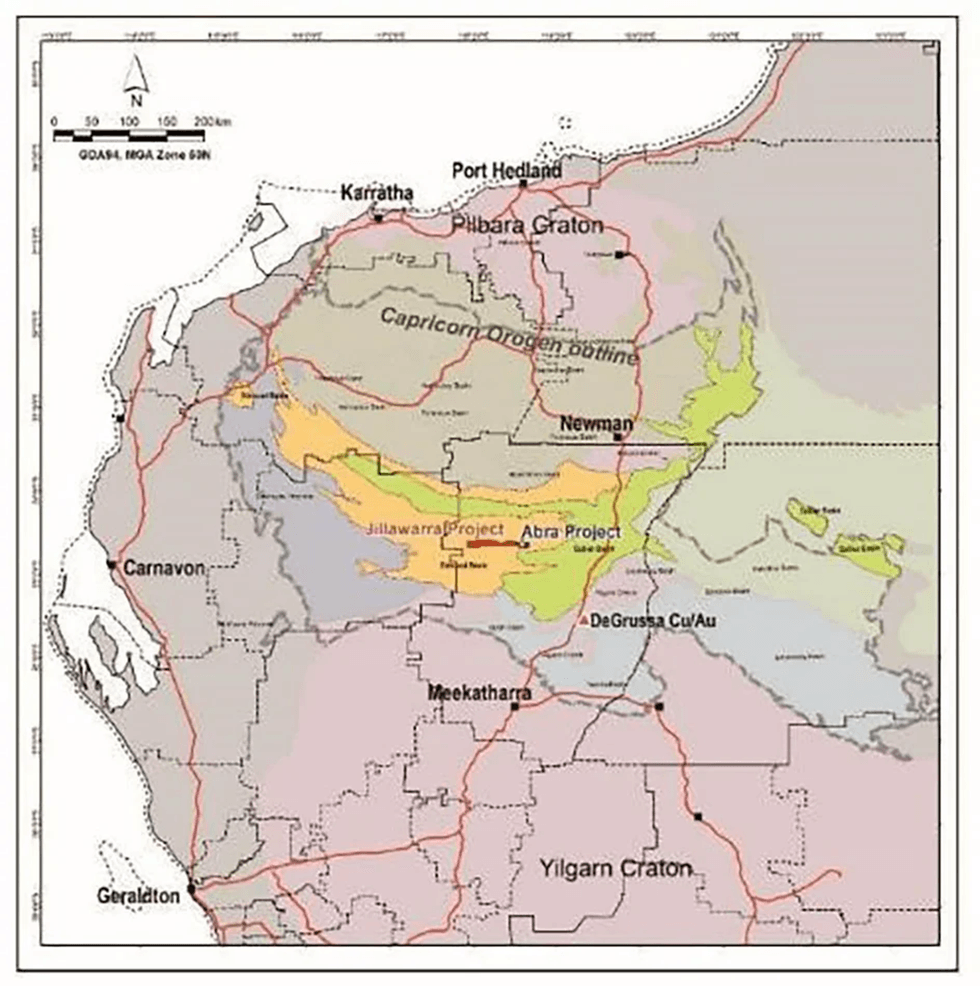

The Abra Mine is a 60:40 joint venture between Galena and Japanese lead producer Toho Zinc. It is a globally significant lead-silver project located in the Gascoyne region of Western Australia, between the towns of Newman and Meekatharra approximately 110 kilometers from the DeGrussa copper mine owned by Sandfire Resources (ASX:SFR).

Abra Mine Site Location

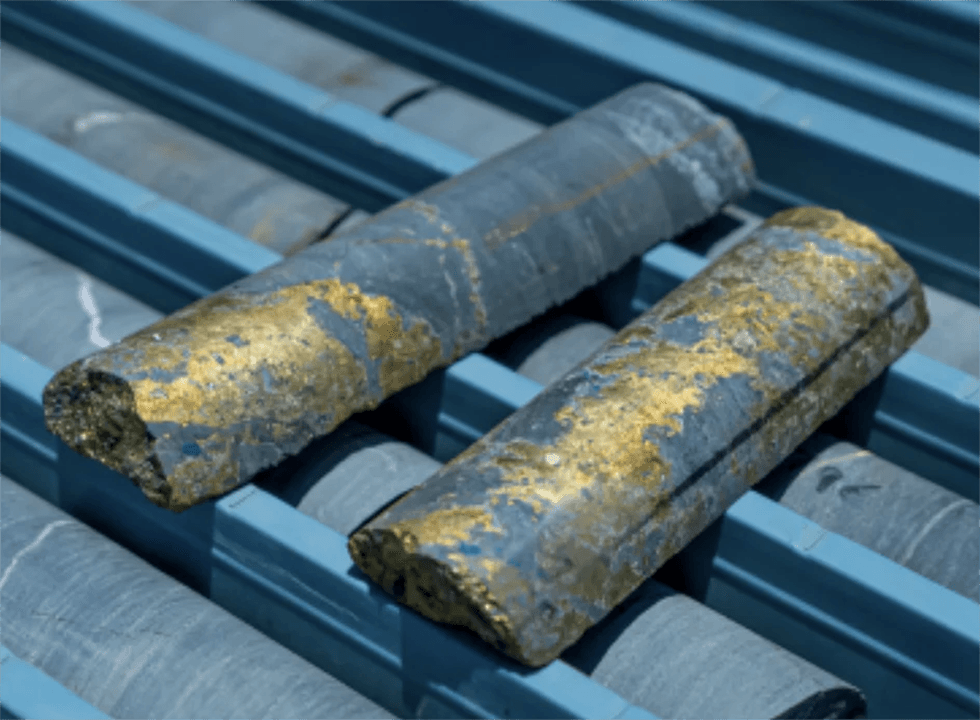

The Abra mine carries a total JORC mineral resource estimate published in July 2023 of 33.4 Mt at 7.1 percent lead and 17 g/t silver (5 percent Pb cut-off grade), which includes 0.3 Mt at 7.3 percent lead and 32 g/t silver in the measured category; 16.2 Mt at 7.3 percent lead and 19 g/t silver in the indicated category; and 16.9 Mt at 6.9 percent lead and 15 g/t silver in the inferred category.

All permits for the Abra project have been obtained from the appropriate Western Australian regulatory bodies. The project is also subject to an existing land use and heritage agreement with the Jidi Jidi Aboriginal Corporation. The Abra property is well-serviced by public roads and highways, and all the necessary infrastructure has been developed to transport lead-sulphide concentrates to the Port of Geraldton, Abra's primary export port.

Abra Processing Plant

A final investment decision to complete the Abra Project was made in June 2021 and construction was completed in December 2022, on time and on budget. Several important milestones were achieved in the March 2023 quarter, including the commissioning of the processing plant, first ore fed into the plant and first concentrate produced in January 2023.

The processing plant achieved in-specification concentrate production from the commencement of concentrate production and during the 2023 calendar year, 967,622 tons of ore was processed and 61,800 tons of lead concentrate was produced.

The company is currently undertaking detailed technical work to develop an updated production plan for 2024 production targets and guidance.

Exploration and growth associated with the 100 percent Galena-owned Jillawarra Project covers a highly prospective elongated tenement package covering approximately 76 kilometers of continuous strike length and 508 square kilometers directly to the west of Abra.

The Jillawarra Project hosts many base metals prospects which have had limited shallow exploration work completed since the 1970s by various companies. The bulk of the exploration work was completed by Amoco, Geopeko, Apex Minerals and Abra Mining Limited. The work completed to date has identified several base metals, manganese and gold prospects, of which the Woodlands Complex, Quartzite Well, Manganese Range, Copper Chert, TP and 46-40 were subject to early-stage exploration. Most of the drilling completed within the Jillawarra Project investigated the first 100 to 200-meter depth which, based on recent knowledge of Abra, may not have reached the depths required.

The main prospective corridor within the Jillawarra Project lies within the margins of the Quartzite Well – Lyons River Fault zones which extend east-west along the entire tenement package. Also, the contact between the dolomitic sediments of Irregully Formation and the lower sedimentary unit, polymictic conglomerate, of the Kiangi Creek Formation represents an important marker for the occurrence of base metal mineralisation as seen at Abra.

The Woodlands Complex is an Australian scaled geophysical anomaly which represents a significant target area with the anomaly being 12 kilometers long and 10 kilometers wide. Limited work and technical evaluation have occurred at Woodlands which presents a great opportunity for Galena in the years to come. Ongoing geophysical and exploration drilling will occur concurrently with the development of Abra. The knowledge and understanding of Abra due to its development will provide a significant exploration advantage at Jillawarra.

Tony James is a mining engineer with over 30 years’ mine operating and project development experience predominantly in Western Australia. He also has previous experience at managing director level of three ASX-listed companies with two of those companies successfully guided through a merger and takeover process benefiting the shareholders. He has a strong mine operating background (examples being the Kanowna Belle gold mine and the Black Swan nickel mine) and a strong feasibility study / mine development background (examples being the Pillara zinc/lead mine and the Trident/Higginsville gold mine).

Adrian Byass has more than 25 years of experience in the mining industry both in listed and unlisted entities globally. He has served as non-executive and executive director of various listed and unlisted mining entities, which have successfully transitioned to production in bulk, precious and specialty metals around the world. He currently serves on the boards of ASX gold, base metals and lithium companies.

Neville Gardiner has over 30 years of experience advising boards on mergers and acquisitions,

equity and debt capital markets, transaction structuring, capital allocation and complex

commercial arrangements. His career achievements include senior executive leadership

roles in Deloitte, Torridon Partners, and at Bank of America Merrill Lynch, where he spent five years as the head of its Australian Natural Resources Team. He also spent nine years with Macquarie Bank, where he had responsibility for its Western Australian Corporate Finance business and its Australian Oil and Gas Advisory business. He has a very strong experience and knowledge base associated with the resources sector in Australia.

Stewart Howe has more than 40 years of experience in the global resource industry including 18 years in mining. He was chief development officer at Zinifex, one of the world’s largest miners and smelters of lead and zinc. He led the spin-off of Zinifex’s smelters to create Nyrstar NV, and restarted the development of the Dugald River mine.

Craig Barnes has over 25 years of experience in senior finance and financial management within the mining industry and previously the financial services industry. He has considerable experience in project financing, mergers and acquisitions, joint ventures, treasury and implementation of accounting controls and systems.

Before joining Galena, he held the position of CFO of Paladin Energy for more than five years and was part of the team that successfully completed the company's capital restructuring in 2018. Prior to that, he was the chief financial officer of DRDGOLD (NYSE and JSE:DRD) and its affiliated subsidiaries for more than seven years.

Aida Tabakovic has over 11 years of experience in the accounting profession, which includes financial accounting reporting, company secretarial services, ASX and ASIC compliance requirements. She has been involved in listing several junior exploration companies on the ASX and is currently company secretary for numerous ASX-listed companies

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) is pleased to announce that the construction progress at its Abra Base Metals Mine (“Abra” or the “Project”) has reached 97% complete as of 30 November 2022. Processing plant commissioning is progressing quickly with practical completion now expected in December 2022. Ore currently being mined from underground is being stockpiled in readiness for processing to begin in January 2023. Concentrate production will commence January 2023.

Managing Director, Tony James commented, “Record underground development in November with delivery of the first 9,000t of ore to the ROM pad along with successful plant commissioning to date puts Abra on the verge of a quick transition into production. Recruitment and other operational readiness activities are well advanced in preparation for January production”.

The following link will show a short video of the Abra crusher commissioning. https://youtube.com/shorts/iSG58MiW_3o

Update on Abra Project progress

Overall progress continues as planned, with first concentrate production expected in Q1 CY2023, following ore commissioning in January 2023. Practical completion of the processing plant is now expected ahead of schedule in December 2022. The processing plant engineering, procurement and construction has reached 99% complete. Piping and electrical works have made significant progress and at the end of November were 96% and 92% complete, respectively. Mechanical items installation is almost complete at 99%.

In November, the first material was crushed and screened as part of the staged commissioning process. The crushing plant ran at design capacity and all commissioning milestones were successfully achieved. Dry commissioning also progressed in most areas of the plant including water and air services, tailings and concentrate thickening, grinding and reagents. Dry commissioning of the remaining areas will be completed in December. Water commissioning commenced in the tailings and concentrate thickening areas of the plant and the remaining areas are expected to be wet commissioned by the end of December. The remaining commissioning schedule is unchanged from the last update and is shown below in Table 1.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Managing Director, Tony James commented, “Reaching first ore underground is extremely rewarding for everyone involved in the project. To see for the first time what we have predicted and interpreted as the Abra orebody delivers a significant step forward for the project. Record development metres in October has taken the mine to the ore and we continue to establish key underground infrastructure with the completion of the 6m diameter surface rise that will be the primary return airway.”

Update on Abra Project progress

Overall progress continues to remain in line for Project completion, with first commercial production expected in Q1 CY2023. The processing plant engineering, procurement and construction has reached 97% complete. Structural steel has been completed in October and mechanical installations are at 96% complete. Piping at 80% and electrical at 71% complete continue to progress quickly.

Pacific Energy’s Hybrid 10MW LNG/solar power station completed full integration with the solar power supply, dry commissioning of the crushing and screening areas was completed in early November and first rock crushing is scheduled for late November. Grinding section dry and wet commissioning will commence in the second half of November and is planned for completion by mid-December. The remaining commissioning schedule is unchanged from the last update and is shown below in Table 1.

Mine decline development continued during October. A total of 311m was developed with the decline reaching 1,284mRL. October represents the highest individual development month since the first cut was fired in the portal in October 2021. The decline location is 266m vertically below the surface and is 29m vertically below the original top of the orebody (1313mRL). Underground drilling has now identified mineralisation as high as 1330mRL which is currently being reviewed for potential extraction. The 1300mRL ore access drive reached first ore in early November (See ASX announcement 14 November 2022).

The 1290mRL horizon is a significant work area for development as underground infrastructure for pumping, ventilation, second means of egress and power are all distributed from this level outwards into the development network. All this infrastructure is currently being established and will result in an increased focus on lateral development and lower decline development in the short term.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Managing Director, Tony James commented, “Reaching first ore underground delivers another significant step in bringing the Abra project on-line. The first cut in the portal was taken in October 2021, and now 2,949m later and 250m below surface we have reached the orebody. Special acknowledgement needs to be given to Byrnecut and the Abra mining team for achieving this milestone, and everyone involved should be very proud of what they have achieved. It’s also important to acknowledge Pacific Energy and the Abra project team for the faultless commissioning of the power station and completing the full integration of the solar system”.

First ore heading underground has been reached on the 1300mRL access drive. Project to date (PTD) underground development to this point in time was 2,949m and first ore is 250m below the surface. Figure 2 below shows the mine development completed to the end of October 2022. The second underground development Jumbo has commenced at Abra in line with multiple headings being established and underground development is expected to increase accordingly. Underground grade control drilling continues and the 6m diameter return airway shaft drilling has been completed in November through to the surface.

On 20 October, the site changed over to mains power station with the commissioning of the Pacific Energy hybrid 10MW gas/solar/BESS power station. On the 10 November the system was fully integrated with the successful integration of the 6MW solar panels. The mine and general site infrastructure is running on mains power and plant commissioning to date includes the energisation of the crushing/screening sections.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GALENA MINING LTD. (“Galena” or the “Company”) (ASX: G1A) reports on its activities for the quarter ended 30 September 2022 (the “Quarter”), primarily focused on construction of its 60%- owned Abra Base Metals Mine (“Abra” or the “Project”) located in the Gascoyne region of Western Australia.

Highlights

ABRA BASE METALS MINE (60%-OWNED)

Abra comprises a granted Mining Lease, M52/0776 and surrounding Exploration Licence E52/1455, together with several co-located General Purpose and Miscellaneous Leases. The Project is 100% owned by Abra Mining Pty Limited (“AMPL” the Abra Project joint-venture entity), which in turn is 60% owned by Galena, with the remainder owned by Toho Zinc Co., Ltd. (“Toho”) of Japan.

Abra is fully permitted and under construction. First production of its high-value, high-grade lead- silver concentrate is currently scheduled for the first quarter of 2023 calendar-year.

Click here for the full ASX Release

This article includes content from Galena Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAG Silver Corp. (TSX NYSE American: MAG) ("MAG" or "MAG Silver") reports production from Juanicipio (56% 44% Fresnillo plc ("Fresnillo") and MAG, respectively) for the first quarter ("Q1") ended March 31, 2024.

Q1 Highlights

MAG expects to release its comprehensive financial and operational results on May 14, 2024.

Comparative production highlights (100% basis):

| Q1 2024 | Q4 2023* | % Chg | Q1 2023** | % Chg | ||

| Tonnes processed | t | 325,684 | 346,766 | -6.1% | 222,023 | 46.7% |

| Head grades | ||||||

| Silver | g/t | 476 | 467 | 1.9% | 363 | 31.1% |

| Gold | g/t | 1.32 | 1.37 | -3.6% | 1.08 | 22.2% |

| Lead | % | 1.35 | 1.35 | 0.0% | 0.74 | 82.4% |

| Zinc | % | 2.49 | 2.44 | 2.0% | 1.44 | 72.9% |

| Production | ||||||

| Silver | koz | 4,445 | 4,505 | -1.3% | 2,250 | 97.6% |

| Gold | oz | 9,927 | 10,591 | -6.3% | 6,057 | 63.9% |

| Lead 1 | klb | 8,704 | 9,189 | -5.3% | 3,201 | 171.9% |

| Zinc 2 | klb | 14,653 | 15,086 | -2.9% | 5,019 | 192.0% |

* Includes material processed at the Saucito and Juanicipio beneficiation plants.

** Includes material processed at the Fresnillo, Saucito and Juanicipio beneficiation plants.

1 Lead recovered to lead concentrate.

2 Zinc recovered to zinc concentrate.

Compared to Q1 2023, Juanicipio's performance significantly improved reflecting the progress made since the commencement of mining ramp-up and plant commissioning in February 2023.

"Q1 continued the trend of consistent operational performance. Despite a major planned maintenance shutdown during the quarter, Juanicipio continued to demonstrate its ability to deliver strong milling rates per operational day," said George Paspalas, MAG Silver's President and CEO. "The quarter puts us in a great position to deliver on our 2024 guidance and with the solid foundation provided by our recently released technical report, we are well positioned for continued long-term success and growth."

Qualified Person: All scientific or technical information in this press release is based upon information prepared by or under the supervision of, or has been approved by Gary Methven, P.Eng., who is a "Qualified Person" for purposes of National Instrument 43-101, Standards of Disclosure for Mineral Projects ("National Instrument 43-101" or "NI 43-101"). Mr. Methven is not independent as he is Vice President, Technical Services of MAG.

About MAG Silver Corp. ( www.magsilver.com )

MAG Silver Corp. is a growth-oriented Canadian exploration company focused on advancing high-grade, district scale precious metals projects in the Americas. MAG Silver is emerging as a top-tier primary silver mining company through its (44%) joint venture interest in the 4,000 tonnes per day (tpd) Juanicipio mine, operated by Fresnillo plc (56%). The mine is located in the Fresnillo Silver Trend in Mexico, the world's premier silver mining camp, where in addition to underground mine production and processing of high-grade mineralized material, an expanded exploration program is in place targeting multiple highly prospective targets. MAG Silver is also executing multi-phase exploration programs at the Deer Trail 100% earn-in Project in Utah and the 100% owned Larder project, located in the historically prolific Abitibi region of Canada.

Neither the Toronto Stock Exchange nor the NYSE American has reviewed or accepted responsibility for the accuracy or adequacy of this press release, which has been prepared by management.

This release includes certain statements that may be deemed to be "forward-looking statements" within the meaning of the US Private Securities Litigation Reform Act of 1995 or "forward-looking information" within the meaning of applicable Canadian securities legislation (collectively, "forward-looking statements"). All statements in this release, other than statements of historical facts are forward looking statements, including statements that address our expectations with respect to the timing and success of the full-scale ramp up of milling activities, provisional estimates relating to production at Juanicipio for Q1 2024, processing rates of development materials, future mineral production, and events or developments. Forward-looking statements are often, but not always, identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Although MAG believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements identified herein include, but are not limited to, a subsequent change in the Company's approach to executive compensation from that approach approved by Shareholders, failure of the Company to receive approval from the Toronto Stock Exchange of the renewal of the unallocated entitlements under the Plans, changes in applicable laws, continued availability of capital and financing, and general economic, market or business conditions, political risk, currency risk and capital cost inflation. In addition, forward-looking statements are subject to various risks, including those risks disclosed in MAG Silver's filings with the Securities Exchange Commission (the "SEC") and Canadian securities regulators. All forward-looking statements contained herein are made as at the date hereof and MAG Silver undertakes no obligation to update the forward-looking statements contained herein. There is no certainty that any forward-looking statement will come to pass, and investors should not place undue reliance upon forward-looking statements.

Please Note: Investors are urged to consider closely the disclosures in MAG's annual and quarterly reports and other public filings, accessible through the internet at www.sedar.com and www.sec.gov .

For further information on behalf of MAG Silver Corp. Contact Michael J. Curlook, Vice President, Investor Relations and Communications Phone: (604) 630-1399 Toll Free: (866) 630-1399 Website: www.magsilver.com Email: info@magsilver.com

News Provided by GlobeNewswire via QuoteMedia

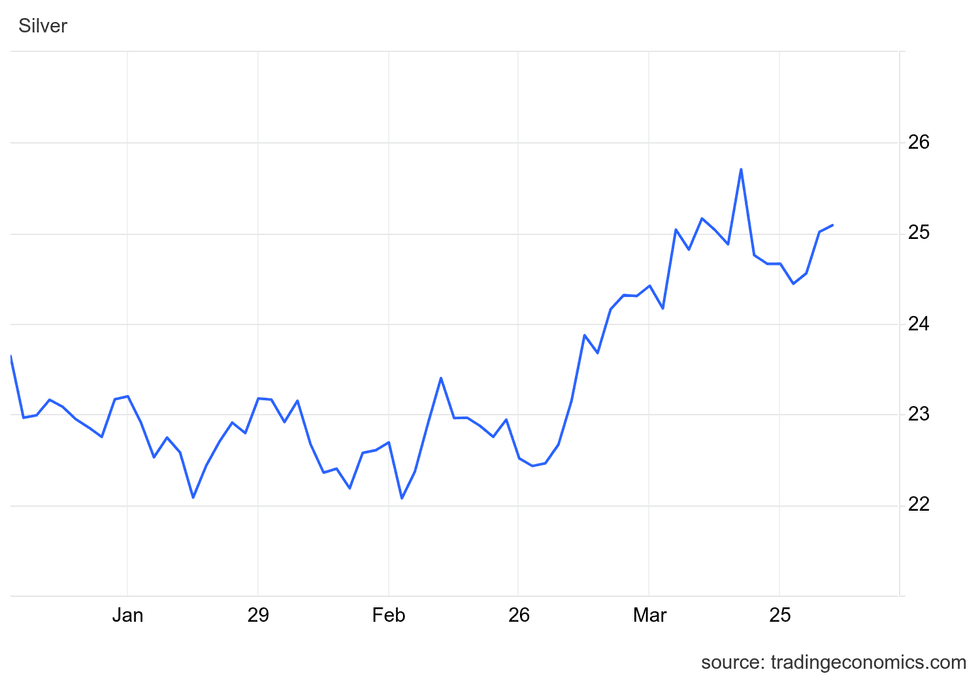

2023 was a relatively lackluster year, silver largely traded on volatility between US$22 and US$25 per ounce.

The white metal started 2024 with less volatility and remained rangebound for the first eight weeks. Silver dropped to US$22.08 per ounce on January 21, marking its quarterly low.

Silver started seeing gains in March with the expectation that the US Federal Reserve was getting closer to lowering interest rates. Improving sentiment gave the precious metals markets momentum, causing silver to reach its quarterly high of US$25.62 on March 20, before continuing on to an 11 year high of US$29.26 on April 12.

Silver started to see gains in early March as speculation over a more dovish policy from the Fed that would see cuts beginning in June added fuel to the the gold and silver markets.

These gains were reinforced by positive language following the banks March meeting that its rate policy was continuing to progress inflation towards the central bank’s target of 2 percent.

Even though it was unwilling to commit to dates, the Fed suggested it was done with rate hikes and it was expecting to make three cuts to its benchmark rate in 2024.

Silver price, Q1 2024.

Chart via Trading Economics.

While gold captured attention as it set record prices in March and April, silver has produced better returns for investors. In an April 9 email to the Investing News Network (INN), Peter Krauth, editor of Silver Stock Investor and author of "The Great Silver Bull," commented on the white metal's performance during the quarter.

“Silver also typically lags gold, then catches up and surpasses it. We’re starting to see that happen in spades right now. Since the end of February, gold is up about 15 percent, while silver is up about 22 percent. Those are breathtaking gains in just a matter of weeks,” he said.

According to Krauth, these gains for the silver price came alongside decreasing inventories at the COMEX, London Bullion Market Association and the Shanghai Gold Exchange, where stockpiles have dropped 40 percent over the past three years.

“The same has happened to silver exchange-traded funds (ETFs) globally. My view is that large silver consumers are buying long contracts and silver ETFs, then taking delivery. That helps explain why the silver price didn’t rise in the face of ongoing deficits. But these inventories are being drained, and I think there may be 12 to 24 months left before they run out,” he said.

Even with decreasing inventories, Krauth still sees silver being held back, citing its increasing role as an industrial metal and concerns over a recession in 2024 as contributing factors to it not seeing stronger gains.

The thinning inventories that contributed to silver’s price gains through Q1 have come about have been driven by the white metal’s increasing demand from industrial sectors. The biggest contributing sectors have come from the energy transition, particularly the production of photovoltaics and electric vehicles.

Krauth pointed to the Silver Institute, a top industry association, which said silver is entering into a structural deficit for a fourth consecutive year in 2024, believing these shortfalls will continue for several more years.

In its latest World Silver Survey, the Silver Institute states that in 2024 demand for the white metal is forecast to reach the second highest amount on record at 1.22 billion ounces, with industrial demand set to see a 9 percent increase to 710.9 million ounces, beating out the record set in 2023 at 654.4. million ounces.

According to the Institute's data, India has been a critical driver of demand, importing 94 million ounces of silver in the first two months of 2024, including 71 million ounces in February alone — that represents nearly an entire month of global mine production.

While the Silver Institute notes that demand for silverware and jewelry in India remains strong, it also says there is a growing industrial demand as India sees an increasing focus on infrastructure development.

To support local manufacturing, the Indian Ministry of New and Renewable Energy reimposed the Approved List of Models and Manufacturers for solar modules this past February, which limits approved solar projects in the country to use domestically produced photovoltaics.

This comes alongside the new N-type solar cells that require greater amounts of silver entering mass production in 2024.

On the supply side, the organization is predicting a decline of 1 percent in total, with 1 billion ounces being made available. In addition, it is expecting recycled quantities of silver to remain flat at 178.9 million ounces. The biggest drop is expected to come from mine production, with an estimated total of 823.5 million ounces in 2024.

This differential suggests a widening deficit of 215.3 million ounces, a year-on-year increase of 17 percent.

Silver is primarily produced as a by-product of gold, lead, zinc and copper mines, and according to the Silver Institute these accounted for 595.2 million ounces produced in 2023. Meanwhile, primary silver mines produced just 235.2 million ounces.

With a contraction in mine output forecast for 2024 and increasing industrial demand over the next several years, the Silver Institute is projecting more tightness over the next few years, meaning limited relief on the horizon from new or existing operations.

Krauth sees two standout projects set to add millions of ounces over the next year.

“There are two major primary silver projects that stand out. Endeavour Silver (TSX:EDR,NYSE:EXK) is building its Terronera project in Mexico, which will bring about 7Moz silver equivalent per year, starting at the end of this year. Then there’s Aya Gold & Silver (TSX:AYA,OTCQX:AYASF), whose Zgounder mine in Morocco is expanding production from about 1.9Moz silver to 8Moz silver, starting with its commissioning in Q2 this year,” he said.

The Silver Institute also sees supply contributions coming from Newmont’s (TSX:NGT,NYSE:NEM) Penasquito mine, which will return to full production in 2024 following strike action in 2023, Coeur Mining’s (NYSE:CDE) expansion of its Rochester mine and the onlining of Kinross Gold's (TSX:K,NYSE:KGC) Manh Choh project.

Even with these additions, the Silver Institute sees steep offsets, including the loss of 17.9 million ounces out of Peru as Hochschild Mining (OTCQX:HCHDF,LSE:HOC) has placed its Pallancata operation into care and maintenance as it waits for permits for its Royropata deposit.

Even when operations come online, the increases amount to tens of millions of ounces for an industry that requires hundreds of millions to overcome supply deficits.

Unlike gold, Krauth sees silver’s industrial applications holding a lot of upside, even though he believes the market hasn’t really come to terms with that, still largely viewing itas a precious metal. He also thinks the there is some opportunity for change on the horizon.

This past January, silver producers penned an open letter to the Canadian government urging the metals inclusion on the critical minerals list. While that decision won’t be known until May, if it is approved it would open up new funding options and a streamlined permitting system. Krauth thinks this would boost silver’s status among investors, and is something to watch for through the second quarter.

“I, along with the entire sector, will be watching closely to see whether silver makes the list or not. If it does, I think that would be a shot in the arm for silver. The broader investment community would pay more attention to silver’s significant structural supply shortages,” he said.

While its inclusion remains uncertain, Krauth is bullish on the white metal, but he also says he wouldn’t be surprised at a pullback this year.

More broadly, he thinks silver is in a sustained bull market and expects the price to continue to hold at US$28 and probably grow to US$30 in the second half of the year.

As silver sees upward momentum going into the next quarter, it may present new opportunities to investors looking for an alternative to gold, or taking advantage of the white metal’s increasing notoriety as an industrial metal.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Endeavour Silver Corp. ("Endeavour" or the "Company") (NYSE: EXK; TSX: EDR) is pleased to provide a Q1 2024 construction progress update for its Terronera Project in Jalisco state, Mexico. A photo gallery presentation accompanies this news release and can be found here or on the Company website at Terronera Project Progress Photos . All dollar ($) references in this news release are United States dollars.

The Terronera project made significant progress in the first quarter, as concrete work was nearly complete on the Upper Plant Platform and erection of structural steel advanced for areas including crushing, coarse-ore storage, grinding, flotation, and thickening. Mechanical installation of major equipment continued to advance on schedule and the project remains on track for commissioning in Q4 2024.

"Site activities ramped up rapidly, as overall construction surpassed the halfway milestone," commented Don Gray, Chief Operating Officer. "We've been very pleased with progress of structural steel erection and major equipment installation including the semi-autogenous grinding ("SAG") and ball mills, apron feeders and flotation cells. Our procurement and materials management planning has been effective in keeping pace with site construction. We've been able to install many components upon immediate arrival to site, while making use of the limited laydown area. Underground mine development continues advancing very well, and we anticipate initial ore access in Q2. We are exceptionally pleased with the progress our Terronera team is making and remain committed to successfully completing and operating Endeavour's next core asset."

Q1 2024 Construction and Development Highlights

As of March 31, 2024, site works and activities included:

Next Steps and Planning

The Terronera Project is on track for commissioning in Q4 2024.

For Q2 2024, surface construction will continue focusing on mechanical installations and initial electrical work for the crushing, coarse-ore stockpile, grinding, flotation and tailing thickener areas. Excavation of the Lower Platform is anticipated to be complete in the coming months. Concrete work is expected to be initiated for the LNG and power generation and concentrate and tailing filtration. Concentrate and tailing filtration structural, mechanical, and electrical installations will commence in early Q3.

Mine development in Portal 1, 2 and 4 declines will continue with first ore development anticipated in Q2. Initial long-hole mining is planned for Q3 followed by cut-and-fill mining; ore will be stockpiled for mill ramp up. Development activities at La Luz are anticipated to begin in Q2 with portal construction and ramp advance to ore access anticipated in Q4. The critical path remains the TSF and lower platform construction and advancing underground mine, where development is meeting expectations.

Visit www.terronera.com , our dedicated project website, to stay informed on the ongoing development at Terronera. Explore updates, learn about our commitment to environmental stewardship, and discover the positive impacts on local communities.

About Endeavour Silver: Endeavour is a mid-tier precious metals company with a strong commitment to sustainable and responsible mining practices. With operations in Mexico and the development of the new cornerstone mine in Jalisco state, the Company aims to contribute positively to the mining industry and the communities in which it operates. In addition, Endeavour has a portfolio of exploration projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer.

Contact Information

Galina Meleger, VP, Investor Relations

Email: gmeleger@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook , X , Instagram and LinkedIn

Footnote:

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the United States private securities litigation reform act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding the development and financing of the Terronera Project including: capital cost estimates, anticipated timing of the project construction; anticipated timing of drawdown under the project loan debt facility, Terronera's forecasted operations, costs and expenditures, and the timing and results of various related activities. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited changes in production and costs guidance; the ongoing effects of inflation and supply chain issues on mine economics; national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada, Chile, the U.S.A and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development; risks in obtaining necessary licenses and permits; satisfaction of conditions precedent to drawdown under the project loan debt facility; the ongoing effects of inflation and supply chain issues on the Terronera Project economics; fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); and challenges to the Company's title to properties; as well as those factors described in the section "risk factors" contained in the Company's most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company's mining operations, no material adverse change in the market price of commodities, forecasted Terronera mine economics as of 2024, mining operations will operate and the mining products will be completed in accordance with management's expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

News Provided by GlobeNewswire via QuoteMedia

Silvercorp Metals Inc. ("Silvercorp" or the "Company") (TSX: SVM) (NYSE American: SVM) reports production and sales figures for the fourth quarter (Q4 Fiscal 2024) and fiscal year ended March 31, 2024 ("Fiscal 2024") and the production and cost guidance for the 2025 fiscal year ending March 31, 2025 ('Fiscal 2025"). The Company expects to release its Fiscal 2024 audited financial results on Thursday, May 23, 2024 after market close.

Q4 Fiscal 2024 Operational Results

Fourth Quarter Fiscal 2024 | Fourth Quarter Fiscal 2023 | |||||||

Ying Mining | GC | Consolidated | 'Ying Mining | GC | Consolidated | |||

Production Data | ||||||||

Ore Mined (tonnes) | 147,122 | 48,038 | 195,160 | 132,205 | 49,643 | 181,848 | ||

Ore Milled (tonnes) | ||||||||

Gold ore | 21,843 | - | 21,843 | - | - | - | ||

Silver ore | 158,424 | 57,226 | 215,650 | 130,910 | 48,483 | 179,393 | ||

180,267 | 57,226 | 237,493 | 130,910 | 48,483 | 179,393 | |||

Head Grades | ||||||||

Silver (gram/tonne) | 197 | 57 | 255 | 88 | ||||

Lead (%) | 3.1 | 1.1 | 3.6 | 1.3 | ||||

Zinc (%) | 0.6 | 2.5 | 0.6 | 2.5 | ||||

Recovery Rates | ||||||||

Silver (%) | 94.4 | 83.2 | 95.2 | 78.9 | ||||

Lead (%) | 95.0 | 89.8 | 95.3 | 90.9 | ||||

Zinc (%) | 70.2 | 89.3 | 68.3 | 89.3 | ||||

Metal production | ||||||||

Gold (ounces) | 1,916 | - | 1,916 | 1,000 | - | 1,000 | ||

Silver (in thousands of ounces) | 1,063 | 87 | 1,150 | 997 | 109 | 1,106 | ||

Silver equivalent (in thousands of ounces) | 1,237 | 87 | 1,324 | 1,086 | 109 | 1,195 | ||

Lead (in thousands of pounds) | 11,317 | 1,210 | 12,527 | 9,688 | 1,250 | 10,938 | ||

Zinc (in thousands of pounds) | 1,750 | 2,809 | 4,559 | 1,164 | 2,413 | 3,577 | ||

Metals sold | ||||||||

Gold (ounces) | 1,916 | - | 1,916 | 1,000 | - | 1,000 | ||

Silver (in thousands of ounces) | 1,052 | 87 | 1,139 | 966 | 107 | 1,073 | ||

Lead (in thousands of pounds) | 10,821 | 1,051 | 11,872 | 8,924 | 1,097 | 10,021 | ||

Zinc (in thousands of pounds) | 1,730 | 2,702 | 4,432 | 1,115 | 2,336 | 3,451 | ||

In Q4 Fiscal 2024, a total of 147,122 tonnes of ore were mined at the Ying Mining District, up 11% over Q4 Fiscal 2023, and 180,267 tonnes of ore were milled, up 38% over Q4 Fiscal 2023. Approximately 1.1 million ounces of silver, 1,916 ounces of gold (or 1.2 million ounces of silver equivalent), 11.3 million pounds of lead, and 1.8 million pounds of zinc were produced, representing production increases of 92%,7%, 14%, 17%, and 50%, respectively, in silver, gold, silver equivalent, lead and zinc over Q4 Fiscal 2023.

At the GC Mine, 48,038 tonnes of ore were mined, down 3% over Q4 Fiscal 2023, and 57,226 tonnes of ore were milled, up 18% over Q4 Fiscal 2023. Approximately 87 thousand ounces of silver, 1.2 million pounds of lead, and 2.8 million pounds of zinc were produced, representing an increase of 16% in zinc, and decreases of 20% and 3%, respectively, in silver and lead over Q4 Fiscal 2023.

Fiscal 2024 Operational Results

Year ended March 31, 2024 | Year ended March 31, 2023 | |||||||

Ying Mining | GC | Consolidated | Ying Mining | GC | Consolidated | |||

Production Data | ||||||||

Ore Mined (tonnes) | 827,112 | 290,006 | 1,117,118 | 769,024 | 299,959 | 1,068,983 | ||

Ore Milled (tonnes) | ||||||||

Gold ore | 58,262 | - | 58,262 | - | - | - | ||

Silver ore | 757,883 | 290,050 | 1,047,933 | 773,057 | 299,597 | 1,072,654 | ||

816,145 | 290,050 | 1,106,195 | 773,057 | 299,597 | 1,072,654 | |||

Head Grades | ||||||||

Silver (gram/tonne) | 231 | 69 | 261 | 75 | ||||

Lead (%) | 3.4 | 1.2 | 3.8 | 1.3 | ||||

Zinc (%) | 0.7 | 2.6 | 0.7 | 2.8 | ||||

Recovery Rates | ||||||||

Silver (%) | 94.9 | 82.0 | 95.6 | 81.9 | ||||

Lead (%) | 95.1 | 90.5 | 95.0 | 89.8 | ||||

Zinc (%) | 70.6 | 90.0 | 63.2 | 89.9 | ||||

Metal production | ||||||||

Gold (ounces) | 7,268 | - | 7,268 | 4,400 | - | 4,400 | ||

Silver (in thousands of ounces) | 5,677 | 527 | 6,204 | 6,024 | 593 | 6,617 | ||

Silver equivalent (in thousands of ounces) | 6,317 | 527 | 6,844 | 6,404 | 593 | 6,997 | ||

Lead (in thousands of pounds) | 56,269 | 6,902 | 63,171 | 60,254 | 7,814 | 68,068 | ||

Zinc (in thousands of pounds) | 8,213 | 15,172 | 23,385 | 7,150 | 16,313 | 23,463 | ||

Metals sold | ||||||||

Gold (ounces) | 7,268 | - | 7,268 | 4,400 | - | 4,400 | ||

Silver (in thousands of ounces) | 5,717 | 518 | 6,235 | 6,049 | 588 | 6,637 | ||

Lead (in thousands of pounds) | 54,292 | 6,333 | 60,625 | 58,240 | 7,447 | 65,687 | ||

Zinc (in thousands of pounds) | 8,240 | 15,010 | 23,250 | 7,175 | 16,263 | 23,438 | ||

At the Ying Mining District, 827,112 tonnes of ore were mined, up 8% over Fiscal 2023, and 816,145 tonnes of ore were milled, up 6% over Fiscal 2023. Approximately 5.7 million ounces of silver, 7,268 ounces of gold (or 6.3 million ounces of silver equivalent), 56.3 million pounds of lead, and 8.2 million pounds of zinc were produced, representing increases of 65% and 15%, respectively, in gold and zinc, and decreases of 6%, 1% and 7%, respectively, in silver, silver equivalent and lead over Fiscal 2023.

The decrease in silver and lead production was mainly due to i) lower head grades achieved due to mining sequences; and ii) 58,262 tonnes of gold ores were mined and processed with grades of 1.8 grams per tonne ("g/t") gold, 77 g/t silver, 1.1% lead, and 0.2% zinc to produce gravity gold concentrates, silver-gold-lead (copper) concentrate, and zinc concentrate in Fiscal 2024. The gold recovery rate for gold ores processed was 92.0%.

At the GC Mine, 290,006 tonnes of ore were mined, down 3% over Fiscal 2023, and 290,050 tonnes of ore were milled, down 3% over Fiscal 2023. Approximately 527 thousand ounces of silver, 6.9 million pounds of lead, and 15.2 million pounds of zinc were produced, representing decreases of 11%, 12% and 7%, respectively, in silver, lead and zinc over Fiscal 2023. The decrease in metal production was mainly due to lower head grades achieved due to mining sequences.

Fiscal 2025 Production, Cash Costs, and Capital Expenditure Guidance

i) Fiscal 2025 production and cash cost guidance |

In Fiscal 2025, the Company expects to mine and process 1,151,000 to 1,256,000 tonnes of ore, yielding approximately 7,900 to 9,000 ounces of gold, 6.8 to 7.2 million ounces of silver, 64.2 to 69.3 million pounds of lead, and 27.1 to 30.1 million pounds of zinc. Fiscal 2025 production guidance represents production increases of approximately 4% to 14% in ores, 8% to 23% in gold, 9% to 17% in silver, 2% to 10% in lead, and 16% to 29% in zinc compared to the production results in Fiscal 2024.

Head Grade | Metal Productions | Production Costs | |||||||||||||||||||||||

Ore processed | Gold | Silver | Lead | Zinc | Gold | Silver | Lead | Zinc | Cash Cost | AISC | |||||||||||||||

Fiscal 2025 Guidance | (tonne) | (g/t) | (g/t) | ( %) | ( %) | (Koz) | (Koz) | (Klb) | (Klb) | ($/t) | (S/t) | ||||||||||||||

Gold ore | 63,000 | - | 70,000 | 2.4 | 78 | 2.1 | - | 4.3 | - | 5.0 | 140 | - | 160 | 2,680 | - | 2,980 | |||||||||

Silver ore | 797,000 | - | 885,000 | - | 249 | 3.3 | 0.8 | 3.6 | - | 4.0 | 6,070 | - | 6,520 | 54,480 | - | 58,910 | 8,877 | - | 10,986 | ||||||

Ying Mining District | 860,000 | - | 955,000 | 0.3 | 235 | 3.1 | 0.8 | 7.9 | - | 9.0 | 6,210 | - | 6,680 | 57,160 | - | 61,890 | 8,877 | - | 10,986 | $ 83.7 | - | $ 88.1 | $ 142.3 | - | $ 153.2 |

GC Mine | 291,000 | - | 301,000 | - | 68 | 1.1 | 3.0 | 540 | - | 550 | 7,070 | - | 7,450 | 18,240 | - | 19,110 | $ 54.4 | - | $ 55.5 | $ 99.3 | - | $ 99.7 | |||

Consolidated | 1,151,000 | - | 1,256,000 | 7.9 | - | 9.0 | 6,750 | - | 7,230 | 64,230 | - | 69,340 | 27,117 | - | 30,096 | $ 77.0 | - | $ 79.6 | $ 143.6 | - | $ 152.3 | ||||

The Ying Mining District plans to mine and process 860,000 to 955,000 tonnes of ore, including 63,000 to 70,000 tonnes of gold ore with an expected head grade of 2.4 g/t gold, to produce approximately 7,900 to 9,000 ounces of gold, 6.2 to 6.7 million ounces of silver, 57.2 to 61.9 million pounds of lead, and 8.9 to 11.0 million pounds of zinc for Fiscal 2025. This production guidance represents production increases of approximately 5% to 17% in ore, 8% to 23% in gold, 9% to 18% in silver, 2% to 10% in lead, and 8% to 34% in zinc compared to the actual production in Fiscal 2024.

The cash production cost is expected to be $83.7 to $88.1 per tonne of ore, and the all-in sustaining production cost is estimated at $142.4 to $153.3 per tonne of ore processed, comparable to the actual costs in Fiscal 2024.

The GC Mine plans to mine and process 291,000 to 301,000 tonnes of ore to produce 540 to 550 thousand ounces of silver, 7.1 to 7.5 million pounds of lead, and 18.2 to 19.1 million pounds of zinc. Fiscal 2025 production guidance at the GC Mine represents production increases of approximately 0% to 4% in ore, 2% to 4% in silver, 2% to 8% in lead, and 20% to 26% in zinc production compared to the production results in Fiscal 2024.

The cash production cost is expected to be $54.4 to $55.5 per tonne of ore, and the all-in sustaining production cost is estimated at $99.3 to $99.7 per tonne of ore processed.

ii) Fiscal 2025 capital expenditure guidance |

In Fiscal 2025, the Company expects to incur a total $90.8 million of capital expenditures as summarized in the table below.

Capitalized Development Work and Expenditures | Expensed | |||||||||

Ramp and development | Exploration tunneling | Diamond Drilling | Facilities and | Total | Mining Preparation | Diamond | ||||

(Metres) | ($ Million) | (Metres) | ($ Million) | (Metres) | ($ Million) | ($ Million) | ($ Million) | (Metres) | (Metres) | |

Fiscal 2025 Capitalized Work Plan and Capita Expenditure Estimates | ||||||||||

Ying Mining District | 45,100 | 27.3 | 45,800 | 17.4 | 137,700 | 3.4 | 30.6 | 78.7 | 37,800 | 117,300 |

GC Mine | 8,000 | 4.5 | 9,700 | 5.0 | 51,500 | 1.3 | 0.3 | 11.1 | 7,100 | 18,700 |

Corporate and others | - | - | - | - | - | - | 1.0 | 1.0 | - | - |

Consolidated | 53,100 | 31.8 | 55,500 | 22.4 | 189,200 | 4.7 | 31.9 | 90.8 | 44,900 | 136,000 |

The total capital expenditures for mine optimization and facilities improvement at the Ying Mining District are estimated at $78.7 million . For mine optimization, the Company plans to spend a total $48.1 million comprised of the following capital expenditures:

(i) | Develop 45,100 metres of ramps and tunnels for transportation and access at estimated capitalized expenditures of $27.3 million (average $605/m). The main goal of these mine optimization programs is to have ramps and a trackless system replace current shafts, and to have more mechanized mining, such as using the shrinkage mining method to gradually replace the more labor intensive "Re-Suing" mining; |

(ii) | Develop 45,800 metres of exploration tunnels at estimated capitalized costs of $17.4 million ($380/m); and |

(iii) | Drill 137,700 metres of exploration diamond drill holes for future production at an estimated capitalized cost of $3.4 million; |

For the tailing storage facilities ("TSF") and mill expansion and equipment, the Company plans to spend $30.6 million :

(i) | Complete the TSF by the 3 rd quarter of 2024 with remaining expenditures of $15.9 million; and |

(ii) | Add a 1,500 tonne per day flotation production line to the No. 2 Mill by the 4 th Quarter of 2024 at a cost of $7.2 million per signed EPCM contract, and add two XRT Ore Sorting systems for $1.7 million. The XRT Ore Sorting system will help to sort out waste rock resulting from the increased dilution rate as the Company shifts to more shrinkage mining method from the "Re-Suing" mining method. |

In addition to the capitalized tunneling and drilling work, the Ying Mining District also plans to complete and expense 37,800 metres of mining preparation tunnels and 117,300 metres of diamond drilling.

For the GC Mine, the Company plans to: i) complete and capitalize 8,000 metres of transportation ramps and mining development tunnels at estimated costs of $4.5 million ( $562 /m); ii) complete and capitalize 9,700 metres of exploration tunnels at estimated costs of $5.0 million ( $515 /m); iii) complete and capitalize 51,500 metres of diamond drilling at an estimated cost of $1.3 million ; and iv) spend $0.3 million on equipment and facilities. The total capital expenditures at the GC Mine are budgeted at $11.1 million in Fiscal 2025.

In addition to the capitalized tunneling and drilling work, the Company also plans to complete and expense 7,100 metres of mining preparation tunnels and 18,700 metres of diamond drilling at the GC Mine.

The Kuanping Project is expected to receive all permits and licenses in the third quarter of 2024, and $1.0 million of capital expenditures are budgeted for the startup of mine construction.

About Silvercorp

Silvercorp is a Canadian mining company producing silver, gold, lead, and zinc with a long history of profitability and growth potential. The Company's strategy is to create shareholder value by 1) focusing on generating free cashflow from long life mines; 2) organic growth through extensive drilling for discovery; 3) ongoing merger and acquisition efforts to unlock value; and 4) long term commitment to responsible mining and ESG. For more information, please visit our website at www.silvercorpmetals.com .

For further information

Silvercorp Metals Inc.

Lon Shaver

President

Phone: (604) 669-9397

Toll Free 1(888) 224-1881

Email: investor@silvercorp.ca

Website: www.silvercorpmetals.com

CAUTIONARY DISCLAIMER - FORWARD-LOOKING STATEMENTS

Certain of the statements and information in this news release constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking information" within the meaning of applicable Canadian and US securities laws (collectively, "forward-looking statements"). Any statements or information that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements relate to, among other things: the price of silver and other metals; the accuracy of mineral resource and mineral reserve estimates at the Company's material properties; the sufficiency of the Company's capital to finance the Company's operations; estimates of the Company's revenues and capital expenditures; estimated production from the Company's mines in the Ying Mining District and the GC Mine; timing of receipt of permits and regulatory approvals; availability of funds from production to finance the Company's operations; and access to and availability of funding for future construction, use of proceeds from any financing and development of the Company's properties.

Actual results may vary from forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation, risks relating to: global economic and social impact of COVID-19; fluctuating commodity prices; calculation of resources, reserves and mineralization and precious and base metal recovery; interpretations and assumptions of mineral resource and mineral reserve estimates; exploration and development programs; feasibility and engineering reports; permits and licences; title to properties; property interests; joint venture partners; acquisition of commercially mineable mineral rights; financing; recent market events and conditions; economic factors affecting the Company; timing, estimated amount, capital and operating expenditures and economic returns of future production; integration of future acquisitions into the Company's existing operations; competition; operations and political conditions; regulatory environment in China and Canada ; environmental risks; foreign exchange rate fluctuations; insurance; risks and hazards of mining operations; key personnel; conflicts of interest; dependence on management; internal control over financial reporting; and bringing actions and enforcing judgments under U.S. securities laws.

This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements. Forward-looking statements are statements about the future and are inherently uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to in the Company's Annual Information Form under the heading "Risk Factors" and in the Company's Annual Report on Form 40-F, and in the Company's other filings with Canadian and U.S. securities regulators. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated, described or intended. Accordingly, readers should not place undue reliance on forward-looking statements.

The Company's forward-looking statements are based on the assumptions, beliefs, expectations and opinions of management as of the date of this news release, and other than as required by applicable securities laws, the Company does not assume any obligation to update forward-looking statements if circumstances or management's assumptions, beliefs, expectations or opinions should change, or changes in any other events affecting such statements. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Additional information related to the Company, including Silvercorp's Annual Information Form, can be obtained under the Company's profile on SEDAR+ at www.sedarplus.ca , on EDGAR at www.sec.gov , and on the Company's website at www.silvercorpmetals.com .

______________________________ |

1 Silver equivalent is calculated by converting the gold metal quantity to its silver equivalent using the ratio between the net realized selling prices of gold and silver achieved, and then adding the converted amount expressed in silver ounces to the ounces of silver. |

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercorp-reports-operational-results-and-financial-results-release-date-for-fiscal-2024-and-issues-fiscal-2025-production-cash-costs-and-capital-expenditure-guidance-302124301.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/silvercorp-reports-operational-results-and-financial-results-release-date-for-fiscal-2024-and-issues-fiscal-2025-production-cash-costs-and-capital-expenditure-guidance-302124301.html

SOURCE Silvercorp Metals Inc

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/23/c8974.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2024/23/c8974.html

News Provided by Canada Newswire via QuoteMedia

Industrial demand for silver rose to a new record high in 2023, coming in at 654.4 million ounces (Moz).

The surge was fueled by significant advancements in green economy sectors, particularly photovoltaics (PV), where demand skyrocketed by 64 percent year-on-year to hit 195.3 Moz, surpassing previous estimates.

PV is included in the electrical and electronics segment, which experienced demand growth of 20 percent year-on-year.

According to the Silver Institute's latest World Silver Survey, other green energy applications, such as power grid construction and automotive electrification, contributed to the overall increase in industrial demand.

“The deficit in the silver market helps to provide robust support and a strong floor for the price,” said Philip Newman, managing director at Metals Focus, which produces the annual survey. “The deficit fell by 30 percent last year, but in absolute terms — at 184.3 million ounces — it was still eye-watering. Global supply has been broadly steady at around the 1-billion-ounce mark, while industrial demand did incredibly well with 11 percent growth,” he added.

Despite an overall 7 percent decline in total silver demand to 1,195 Moz in 2023, industrial demand emerged as the standout category, offsetting losses in the physical investment, jewelry and silverware sectors.

Notably, Chinese industrial demand surged by 44 percent to 261.2 Moz, primarily driven by PV production expansion.

Silver recycling, which accounted for 18 percent of total supply in 2023, saw a modest 1 percent increase to 178.6 Moz, mainly driven by growth in the recycling of ethylene oxide catalysts.

Looking ahead, Metals Focus forecasts 2 percent growth in total silver demand for 2024, with industrial fabrication expected to reach another all-time high, driven by a projected 20 percent gain in the PV market.

However, physical investment in silver bars and coins is anticipated to contract by 13 percent.

In terms of global mine production, Metals Focus notes that in 2023 it witnessed a slight decrease of 1 percent to 830.5 Moz. This fall was influenced by the four month suspension of operations at Newmont’s (TSX:NGT,NYSE:NEM) Peñasquito mine in Mexico due to strike action among workers.

Additionally, lower ore grades and mine closures affected production in countries like Argentina, Australia and Russia. However, increased supply from Chile and Bolivia partially offset these losses.

The report forecasts a marginal 0.8 percent decline in global silver mine production to 823.5 Moz in 2024. Recovery is anticipated in Mexico as Peñasquito resumes full production post-strike action.

Expansions and new projects in the US, Morocco and elsewhere are expected to contribute to supply growth.

Offsetting these increases, a significant drop in production is expected in Peru due to operational issues, while China is anticipated to experience a decline in silver by-product supply alongside decreasing lead and zinc production.

Silver recycling, which hit a 10 year high in 2023, is forecast to remain nearly flat in 2024. Industrial scrap is expected to grow, driven by factors like higher receipts from ethylene oxide recycling. However, declines in other segments such as jewelry and silverware scrap, along with a further decrease in photographic scrap, are likely to offset these gains.

Overall, silver supply is seen coming in at 1,010.7 Moz in 2023 versus 1,015.4 Moz in 2022.

Overall, the silver market is expected to witness another substantial deficit in 2024, amounting to 215.3 Moz. According to Metals Focus, that would be the second highest in over 20 years.

While near-term price weakness remains a possibility for silver due to speculative inflows into gold and short-term downside risks, the outlook for the second half of the year is positive, driven by expectations of looser US monetary policy and sustained investor interest in precious metals.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Endeavour Silver Corp. ("Endeavour" or the "Company") (NYSE: EXK; TSX: EDR) announces a significant milestone in the construction of its new Terronera mine, in Jalisco state, Mexico. The project has surpassed the 50% completion mark, marking a crucial step forward in the Company's expansion efforts.

To celebrate this achievement, the Company is pleased to provide a short video offering investors an exclusive look at the new mine with insights from the executive team. This video highlights the construction progress, showcases the scale and scope of the project, and emphasizes the positive impact on both the company and the local community. Investors, stakeholders, and the public are invited to watch this milestone video here . The video was filmed in mid-March and represents construction progress at that time.

Dan Dickson, Chief Executive Officer stated, "Reaching the halfway mark in our construction schedule is a testament to the hard work and dedication of our team. With commissioning expected in Q4 2024, Terronera will bring tremendous potential to our company's future, as we grow and expand our operations through responsible practices."

Visit www.terronera.com , our dedicated project website, to stay informed on the ongoing development at Terronera. Explore updates, learn about our commitment to environmental stewardship, and discover the positive impacts on local communities.

About Endeavour Silver: Endeavour is a mid-tier precious metals company with a strong commitment to sustainable and responsible mining practices. With operations in Mexico and the development of the new cornerstone mine in Jalisco state, the company aims to contribute positively to the mining industry and the communities in which it operates. In addition, Endeavour has a portfolio of exploration projects in Mexico, Chile and the United States to facilitate its goal to become a premier senior silver producer.

Contact Information

Galina Meleger, VP, Investor Relations

Email: gmeleger@edrsilver.com

Website: www.edrsilver.com

Follow Endeavour Silver on Facebook , X , Instagram and LinkedIn

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of the United States private securities litigation reform act of 1995 and "forward-looking information" within the meaning of applicable Canadian securities legislation. Such forward-looking statements and information herein include but are not limited to statements regarding Endeavour's anticipated performance in 2024 including changes in mining operations and forecasts of production levels, anticipated production costs and all-in sustaining costs and the timing and results of various activities. The Company does not intend to and does not assume any obligation to update such forward-looking statements or information, other than as required by applicable law.

Forward-looking statements or information involve known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, production levels, performance or achievements of Endeavour and its operations to be materially different from those expressed or implied by such statements. Such factors include but are not limited changes in production and costs guidance; the ongoing effects of inflation and supply chain issues on mine economics; national and local governments, legislation, taxation, controls, regulations and political or economic developments in Canada and Mexico; financial risks due to precious metals prices; operating or technical difficulties in mineral exploration, development and mining activities; risks and hazards of mineral exploration, development and mining; the speculative nature of mineral exploration and development; risks in obtaining necessary licenses and permits; fluctuations in the prices of silver and gold, fluctuations in the currency markets (particularly the Mexican peso, Chilean peso, Canadian dollar and U.S. dollar); and challenges to the Company's title to properties; as well as those factors described in the section "risk factors" contained in the Company's most recent form 40F/Annual Information Form filed with the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on assumptions management believes to be reasonable, including but not limited to: the continued operation of the Company's mining operations, no material adverse change in the market price of commodities, forecasted mine economics as of 2024, mining operations will operate and the mining products will be completed in accordance with management's expectations and achieve their stated production outcomes, and such other assumptions and factors as set out herein. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or information, there may be other factors that cause results to be materially different from those anticipated, described, estimated, assessed or intended. There can be no assurance that any forward-looking statements or information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements or information. Accordingly, readers should not place undue reliance on forward-looking statements or information.

News Provided by GlobeNewswire via QuoteMedia

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.