- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Global Energy Metals Identifies Numerous New Strong Magnetic Trends Utilizing Cutting-Edge UAV-MAG Airborne Geophysics Surveying on its Battery Minerals Project in Nevada

Global Energy Metals Corporation is pleased to announce an update regarding its unmanned airborne magnetometer survey.

Global Energy Metals Corporation (TSXV:GEMC, OTC:GBLEF, FSE:5GE1) (“Global Energy Metals”, the “Company” and/or “GEMC”) is pleased to announce an update regarding its unmanned airborne magnetometer survey on the Company’s Nevada based battery minerals project located in the Stillwater Mountain Range, approximately 150km east of the Tesla Gigafactory in Sparks, Nevada.

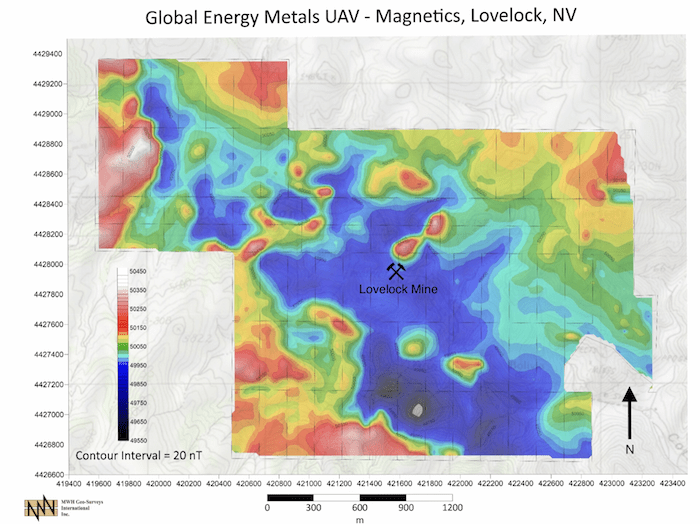

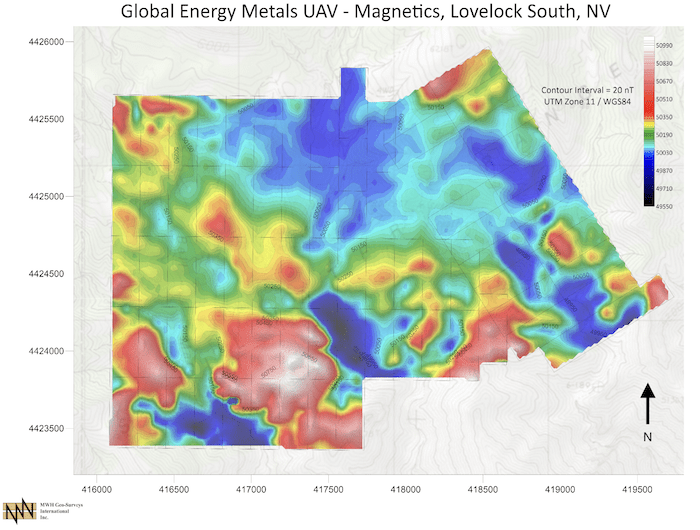

Interpretation of the data is ongoing but preliminary data suggests the following:

– The focus of the initial work program at Lovelock was to further evaluate the subsurface geology and identify areas for future drilling, and serve as an important resource for the creation of a 3D geological model of the nickel-copper-cobalt rich property.

– Good correlation between surface mineralization and historic IP conductors.

– The survey has identified numerous new strong magnetics trends that appear to correlate very well with historic zones of mineralisation.

– The area over the mine was covered by 50-metre line spacing to acquire detailed data for interpretation and modelling.

– Survey covers 248 line kilometers, 12.4 square kilometre area of the historically high-grade Cobalt-Nickel-Copper project.

– Further intepretation of the data is underway with results pending.

– The survey was flown by MWH Geo-Surveys International Inc. (“MWH”), a leader in the UAV space.

Commenting on the survey and its application to the overall global electrification, CEO Mitchell Smith stated the following:

“The EV market is still in its infancy worldwide, but as it continues to mature it presents a tremendous opportunity for exploration and development companies. The United States, like many other nations waking up to the need for resource sovereignty, is seeking to bolster its economic and national security by providing a scalable supply chain of critical minerals, like cobalt, to avoid dependence on competing countries for raw materials.”

“This survey aids in our understanding of a drill ready project in Nevada, home to the world’s largest battery manufacturing facility, and spotlights these projects as a potential future source of cobalt, nickel and copper that are required to produce the vast amount of raw material the EV battery and new energy economy demands.”

This first ever high-quality, detailed magnetic survey completed on the property highlights multiple zones of interest. With additional interpretation and ground truthing the survey will assist Global Energy Metals in planning and executing a targeted ground exploration program culminating in drill testing.

UAV Magnetic Survey

MWH’s UAV mag system uses a GEM GSMP-35U sensor flown under a D-RTK DJI Matrice 600 Pro hexacopter. Due to the high data capture rate, slower flight speeds and lower altitude, the magnetic data is of high accuracy and resolution. Data will be processed and presented as TMI map (PDF) & ASCII grid formats.

Figure 1. Preliminary data image for the north area of the Lovelock and Treausre box Projects.

Figure 2. Preliminary data image for the south area of the Lovelock and Treausre box Projects.

MWH Geo-Surveys International Inc.

MWH Geo-Surveys have since 1980 been exclusively conducting gravity and magnetic surveys and their related topographic surveys. They have extensive experience around the world including surveys in Argentina, Bolivia, Chad, Colombia, Cuba, Eritrea, Ethiopia, Finland, Gambia, Guatemala, Honduras, Indonesia, Iraq, Ireland, Italy, Kenya, Liberia, Madagascar, Mali, Mexico, Mongolia, Nigeria, Oman, Peru, Philippines, Senegal, Spain, Sudan, Thailand, Trinidad, Tunisia, Turkey, Yemen and Zimbabwe. Additional information can be found at www.mwhgeo.com

While the UAV magnetic survey technology is new, MWH has been a leader in developing a field proven system integrating the UAV equipment, the magnetic system and flight controlling software. Their UAV systems have been successfully utilized worldwide on numerous successful surveys consisting of more than 20,000 flown kilometers.

Qualified Person

Mr. Paul Sarjeant, P. Geo., is the qualified person for this release as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects and has reviewed and verified the technical information contained herein.

Global Energy Metals Corporation

(TSXV:GEMC, OTCQB:GBLEF, FSE:5GE1)

Global Energy Metals is focused on offering security of supply of cobalt, a critical material to the growing rechargeable battery market, by building a diversified global portfolio of cobalt assets including project stakes, projects and other supply sources. GEMC anticipates growing its business by acquiring project stakes in battery metals related projects with key strategic partners. Global Energy Metals now holds 100% of the Millennium Cobalt Project and two neighbouring discovery stage exploration-stage cobalt assets in Mt. Isa, Australia. It also currently owns 70% of the Werner Lake Cobalt Mine in Ontario, Canada, has an option to acquire an 85% interest in two cobalt exploration projects in Nevada, 150km East of the Tesla Gigafactory.

For Further Information:

Global Energy Metals Corporation

#1501-128 West Pender Street

Vancouver, BC, V6B 1R8

Email: info@globalenergymetals.com

t. + 1 (604) 688-4219 extensions 236/237

Twitter: @EnergyMetals

Cautionary Statement on Forward-Looking Information:

Certain information in this release may constitute forward-looking statements under applicable securities laws and necessarily involve risks associated with regulatory approvals and timelines. Although Global Energy Metals believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change. For more information on Global Energy and the risks and challenges of their businesses, investors should review the filings that are available at www.sedar.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2331.39 | +15.09 | |

| Silver | 27.37 | +0.19 | |

| Copper | 4.56 | +0.02 | |

| Oil | 83.77 | +0.20 | |

| Heating Oil | 2.57 | +0.01 | |

| Natural Gas | 1.59 | -0.05 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.