"Meanwhile, ramp-up continues at Lost Creek with additional development and production leading to another shipment of yellowcake being made this month. We continue to overcome ramp-up challenges. Due to those challenges, we are updating and reducing our 2024 production guidance to 550,000 - 650,000 pounds captured."

Lost Creek Production Operations

Ramp-up continues at Lost Creek, with two additional header houses (HH 2-6 and 2-7) coming online in 2024. During Q1, we captured approximately 38,221 pounds, dried and packaged approximately 39,229 pounds, and shipped 35,445 pounds U3O8. At quarter end, our in-process inventory was approximately 80,465 pounds, our drummed inventory was approximately 26,062 pounds, and our finished inventory at the conversion facility was approximately 79,235 pounds U3O8.

While we have experienced some additional equipment and operational challenges, we are seeing more consistent drying and packaging, with 19,331 pounds U3O8 packaged since quarter end and dryer operations keeping pace with wellfield production. We have 13 drill rigs onsite, with an additional rig scheduled to commence work in early May. Drilling has advanced into HH 2-11 with completion work nearly finished in HH 2-8. Fabrication of HH 2-8 and 2-9 is complete, and work on HH 2-10 and 2-11 is advancing in our Casper construction shop. HH 2-8 is expected to come online in May.

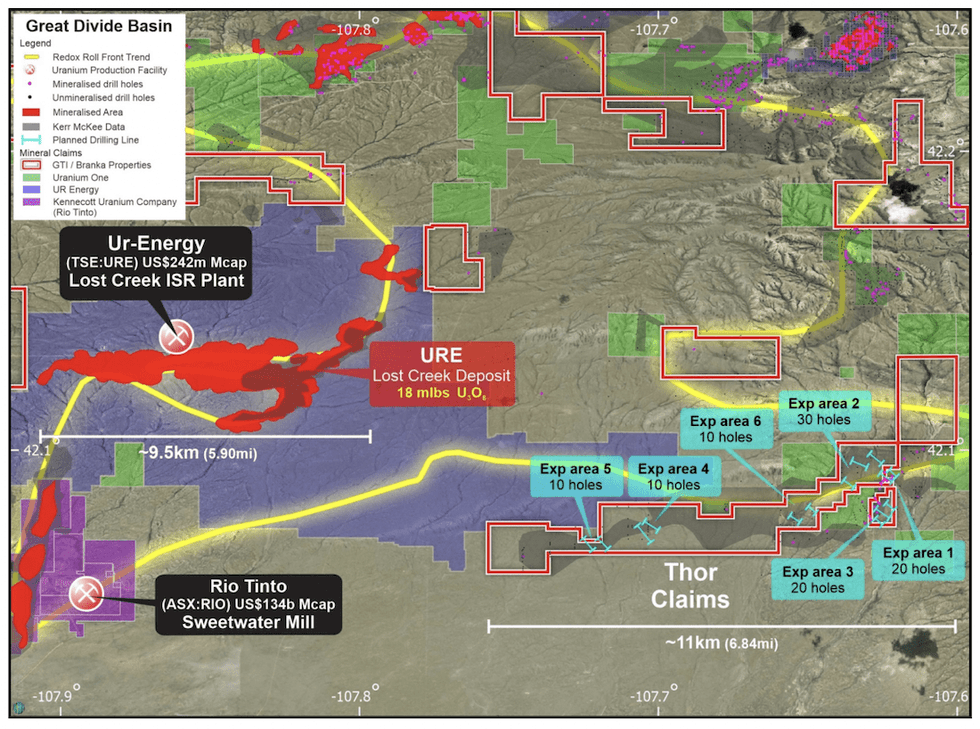

Shirley Basin Development

We were pleased to announce our decision in Q1 to proceed with the buildout of a satellite facility at our wholly owned, fully permitted and licensed Shirley Basin Project in Carbon County, Wyoming. The decision will nearly double our annual permitted mine production to 2.2 million pounds U3O8 while diversifying our supply.

The satellite plant will be a relatively low-cost facility consisting of ion exchange, wastewater, and groundwater restoration circuits. The ion exchange resin at Shirley Basin will be loaded with uranium from the mine and shipped to our Lost Creek ISR facility for processing before being recycled back into operations at Shirley Basin. This satellite approach will help minimize initial facility capital costs to approximately $24.4 million and pre-operational wellfield development costs to $16.3 million.

The satellite plant will be designed with a flow rate of up to 6,000 gallons per minute and capacity to produce up to 1.0 million pounds of U3O8 per year. Our permits and license allow for the construction of the elution, precipitation and drying circuits should it become economically advantageous. No amendments to the existing permits or licenses would be required.

The estimated time to finalize designs, order materials and construct the satellite plant and initial wellfield recovery area is approximately 24 months. Work has already been initiated on long-lead items, including detailed engineering and additional geologic pattern planning for the wellfield. Planning has been completed for the monitor well ring for the first mine unit, with plans to install approximately 120 wells in 2024 Q2 - Q3. This installation will enable hydrologic testing and baseline water quality analyses to proceed prior to the start of installation of production patterns in mid-2025. Significantly, the bid process and award for fabrication of IX columns has been completed. This procurement represents one of the longest lead items in the facility.

Sales and Prepayment of State Bond Loan

As previously announced, we completed two additional uranium sales agreements during 2024 Q1. Our fourth agreement calls for deliveries of a base annual quantity ranging from 100,000 to 350,000 pounds U3O8 from 2026 through 2030. The purchaser may flex the annual quantity up or down by as much as ten percent. This agreement provides in part for market-related pricing. Our fifth U3O8 sales agreement includes delivery commitments for five years beginning in 2026, with an initial delivery of 50,000 pounds U3O8 in 2026 and annual deliveries of 200,000 pounds U3O8 in 2027 through 2030. All sales under this agreement will be made at fixed prices, escalated from the agreed base price.

Subsequent to quarter end, we sold 75,000 pounds U3O8 for which we will receive $4.6 million in early May. In total, we anticipate selling 570,000 pounds U3O8, under two contracts secured in 2022.

As planned, on March 27, we completed the pre-payment of the remaining $4.4 million on our State Bond Loan and now are debt free. At March 31, 2024, we had cash and cash equivalents of $53.9 million.

About Ur-Energy

Ur-Energy is a uranium mining company operating the Lost Creek in-situ recovery uranium facility in south-central Wyoming. We have produced and packaged approximately 2.8 million pounds U3O8 from Lost Creek since the commencement of operations. Ur-Energy now has all major permits and authorizations to begin construction at Shirley Basin, the Company's second in situ recovery uranium facility in Wyoming and is in the process of obtaining remaining amendments to Lost Creek authorizations for expansion of Lost Creek. Ur‑Energy is engaged in uranium mining, recovery and processing activities, including the acquisition, exploration, development, and operation of uranium mineral properties in the United States. The primary trading market for Ur‑Energy's common shares is on the NYSE American under the symbol "URG." Ur‑Energy's common shares also trade on the Toronto Stock Exchange under the symbol "URE." Ur-Energy's corporate office is in Littleton, Colorado and its registered office is in Ottawa, Ontario.

FOR FURTHER INFORMATION, PLEASE CONTACT

John W. Cash, Chairman, CEO & President

720-981-4588, ext. 303

John.Cash@Ur-Energy.com

Cautionary Note Regarding Forward-Looking Information

This release may contain "forward-looking statements" within the meaning of applicable securities laws regarding events or conditions that may occur in the future (e.g., when ramp-up challenges will be overcome to reach steady-state production and our adjusted 2024 production guidance; the timing to complete ongoing development work to bring on header houses and recovery as currently projected; whether the current projections for the timing and ability to complete build out of Shirley Basin will be met; whether we will secure additional off-take sales agreements at advantageous pricing, and whether our current purchasers may exercise the flex option, up or down, in certain agreements) and are based on current expectations that, while considered reasonable by management at this time, inherently involve a number of significant business, economic and competitive risks, uncertainties and contingencies. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "expects," "does not expect," "is expected," "is likely," "estimates," "intends," "anticipates," "does not anticipate," or "believes," or variations of the foregoing, or statements that certain actions, events or results "may," "could," "might" or "will be taken," "occur," "be achieved" or "have the potential to." All statements, other than statements of historical fact, are considered to be forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements express or implied by the forward-looking statements. Factors that could cause actual results to differ materially from any forward-looking statements include, but are not limited to, capital and other costs varying significantly from estimates; failure to establish estimated resources and reserves; the grade and recovery of ore which is mined varying from estimates; production rates, methods and amounts varying from estimates; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; inflation; changes in exchange rates; fluctuations in commodity prices; delays in development and other factors described in the public filings made by the Company at www.sedarplus.ca and www.sec.gov. Readers should not place undue reliance on forward-looking statements. The forward-looking statements contained herein are based on the beliefs, expectations and opinions of management as of the date hereof and Ur-Energy disclaims any intent or obligation to update them or revise them to reflect any change in circumstances or in management's beliefs, expectations or opinions that occur in the future.

SOURCE: Ur-Energy Inc.

View the original press release on accesswire.com