- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

HIGH GRADE LITHIUM BRINES INCREASE AT CAUCHARI Results at Depth Consistent with Adjoining Major Projects

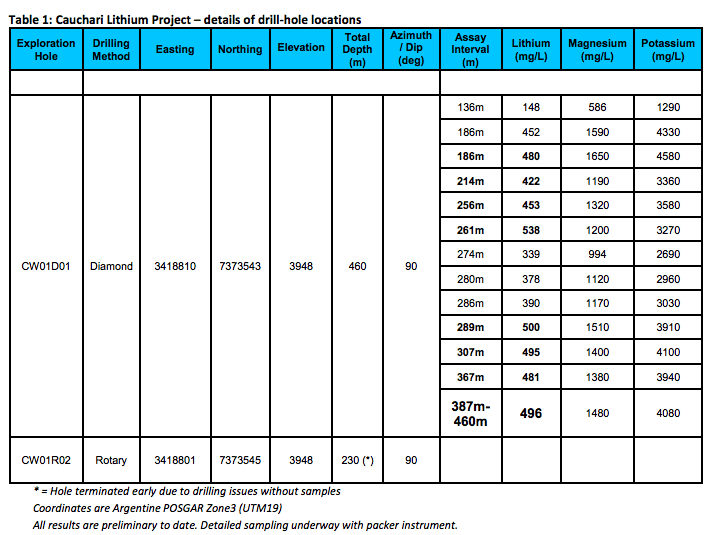

Lake Resources NL (ASX:LKE) announced today consistently high grade lithium brines from the base of the current discovery hole extending the lithium brine zone to 288 metres wide (from 172 – 460m depth) at its Cauchari Lithium Brine Project in Argentina.

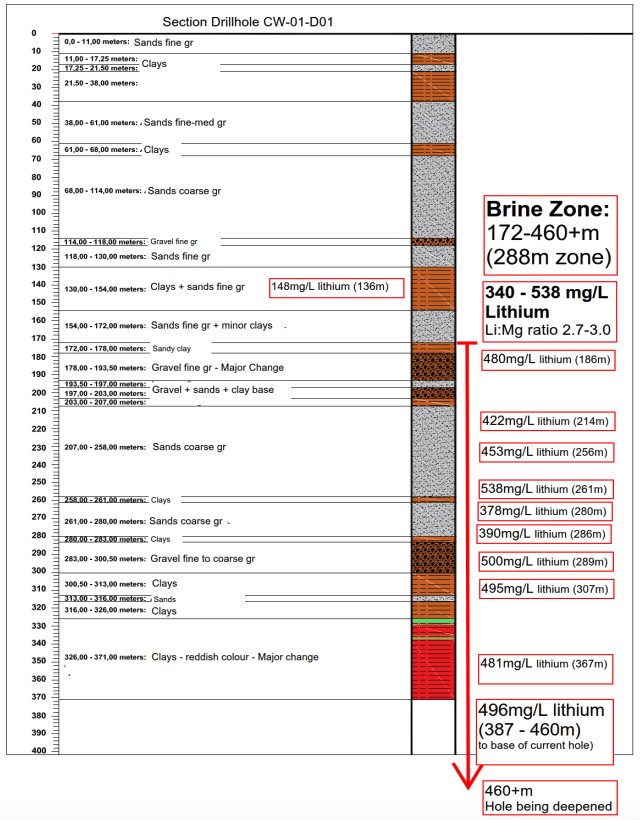

Lake Resources NL (ASX:LKE) announced today consistently high grade lithium brines from the base of the current discovery hole extending the lithium brine zone to 288 metres wide (from 172 – 460m depth) at its Cauchari Lithium Brine Project in Argentina. Results from 480 to 500 mg/L lithium were returned below 289m depth down to 460m depth, with the best results at the base of hole of 496 mg/L lithium over 73m to a depth of 460m.

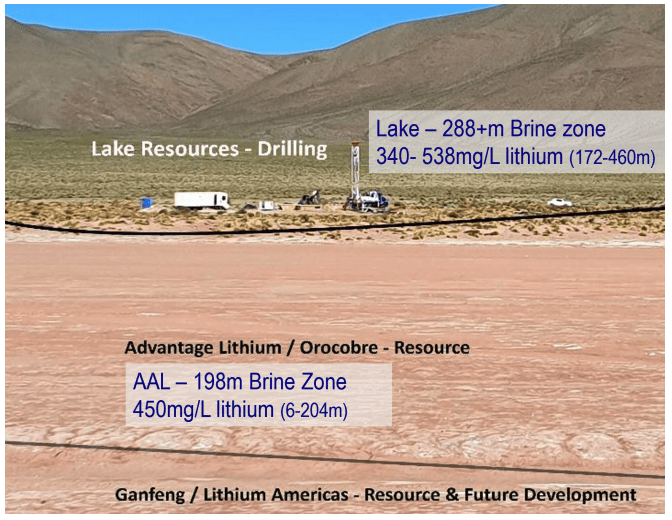

The results are consistent with similar results from the adjoining billion-dollar major projects advancing towards production at Cauchari, in the heart of the Lithium Triangle including Ganfeng/Lithium Americas (LAC) and the Advantage Lithium (AAL)/ Orocobre joint venture.

The drillhole is now being extended at depth. Detailed sampling with a packer instrument has been completed and further results are awaited.

Lake’s Managing Director Steve Promnitz said: “The excellent results are further confirmation of Lake’s major discovery at Cauchari, and the similarity with the adjoining projects moving into production. This is now a wider pay zone of lithium brines than at the adjoining project exceeding what was reported by Advantage Lithium and Lithium Americas in this area. The drill hole will be extended to depth and we are pleased that results are improving with depth”.

“Cauchari continues to advance as a major project for Lake, which added to our prospective Olaroz project and the world-class Kachi project comprises a portfolio of potentially highly valuable projects in the heart of the Lithium Triangle. We look forward to announcing further results from Cauchari, followed by drilling at Olaroz, as we work to add value for shareholders.”

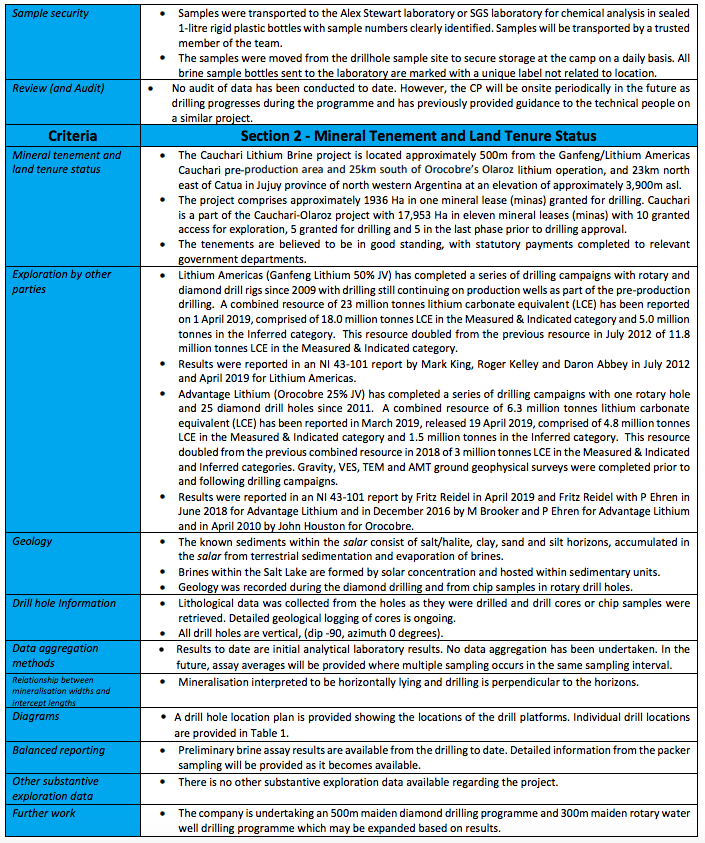

Figure 1: Section of drillhole at Cauchari with the 144m brine zone, results and geological comments on stratigraphy.

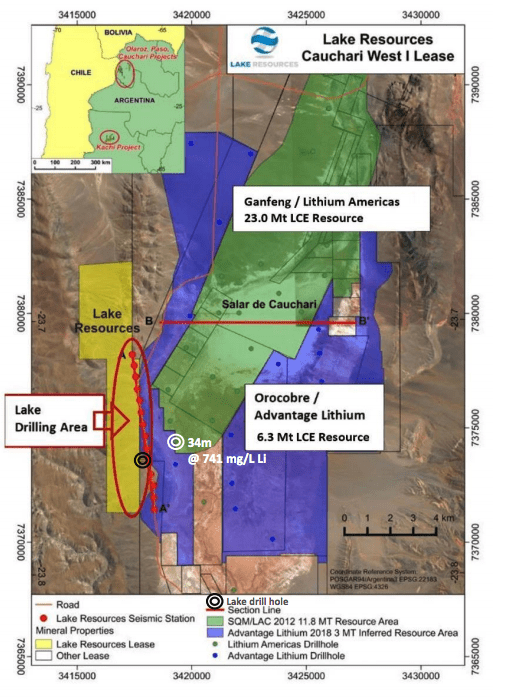

Figure 2,3: Location of LKE’s drill operations at Cauchari in relation to Advantage Lithium/Orocobre & Gangfeng/Lithium Americas leases. (Note: The marked boundaries are indicative only. Please refer to the detailed map).

Figure 4: Cauchari Lithium Project, with adjoining Ganfeng / Lithium Americas combined resource and Orocobre / Advantage Lithium combined resource with (Orocobre announcements 7/11/2017, 4/12/2017, 18/01/2018, 15/03/19; Advantage Lithium announcement 5/3/2018, 10/01/2019, 7/03/19, 24/04/19). (Third Party Resource details summarised in LKE’s ASX announcement dated 6 Sept 2018)

Competent Person’s Statement – Kachi Lithium Brine Project

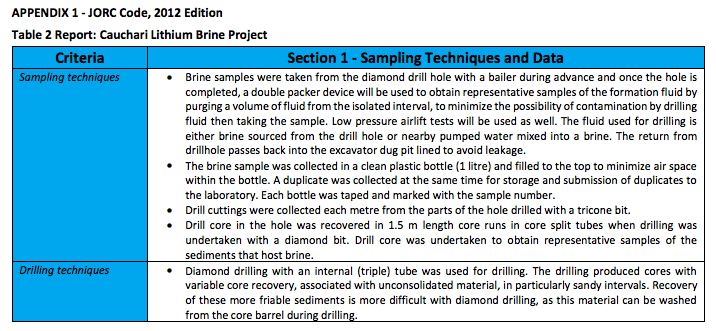

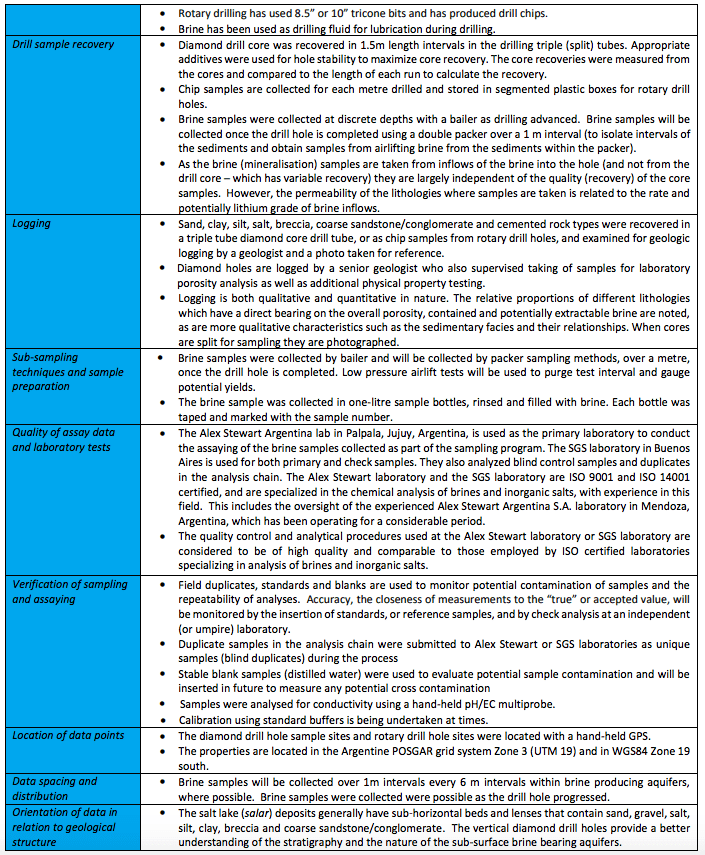

The information contained in this ASX release relating to Exploration Results has been compiled by Mr Andrew Fulton. Mr Fulton is a Hydrogeologist and a Member of the Australian Institute of Geoscientists and the Association of Hydrogeologists. Mr Fulton has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a competent person as defined in the 2012 edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Andrew Fulton is an employee of Groundwater Exploration Services Pty Ltd and an independent consultant to Lake Resources NL. Mr Fulton consents to the inclusion in this announcement of this information in the form and context in which it appears.

About Lake Resources NL (ASX:LKE)

Lake Resources NL (ASX:LKE, Lake) is a lithium exploration and development company focused on developing its three lithium brine projects and hard rock project in Argentina, all owned 100%. The leases are in a prime location among the lithium sector’s largest players within the Lithium Triangle, where half of the world’s lithium is produced. Lake holds one of the largest lithium tenement packages in Argentina (~200,000Ha) secured in 2016 prior to a significant ‘rush’ by major companies. The large holdings provide the potential to provide consistent security of supply, scalable as required, which is demanded by battery makers and electric vehicle manufacturers.

The Kachi project covers 69,000 ha over a salt lake south of FMC’s lithium operation and near Albemarle’s Antofalla project in Catamarca Province. Drilling at Kachi has confirmed a large lithium brine bearing basin over 20km long, 15km wide and 400m to 800m deep. Drilling over Kachi (currently 16 drill holes, 3100m) has produced a maiden indicated and inferred resource of 4.4 Mt LCE (Indicated 1.0Mt and Inferred 3.4Mt) (refer ASX announcement 27 November 2018).

A direct extraction technique is being tested in partnership with Lilac Solutions, which has shown 80-90% recoveries and lithium brine concentrations in excess of 25000 mg/L lithium. Phase 1 Engineering Study results have shown operating costs forecast at US$2600/t LCE in the lowest cost quartile (refer ASX announcement 10 December 2018). This process is will be trialed on site with a pilot plant in tandem with conventional methods as part of the PFS underway. Discussions are advanced with a number of downstream entities, mainly battery makers, to jointly develop the project.

The Olaroz-Cauchari and Paso brine projects are located adjacent to major world class brine projects either in production or being developed in the highly prospective Jujuy Province. The Olaroz-Cauchari project is located in the same basin as Orocobre’s Olaroz lithium production and adjoins Ganfeng Lithium/Lithium Americas Cauchari project, with high grade lithium (600 mg/L) with high flow rates drilled immediately across the lease boundary.

The Cauchari project has shown high grades and high flow rates from a series of horizons over 288 metres, with up to 538 mg/L lithium, similar to lithium brine horizons announced from adjoining pre-production areas under development. Results provide confirmation of the continuity of lithium bearing horizons from adjoining world-class major projects (refer ASX announcements 28 May, 12 June 2019). The Olaroz project is planned to be drilled for the first time in LKE’s 100% owned Olaroz leases as soon as drilling is completed at Cauchari.

Significant corporate transactions continue in adjacent leases with development of Ganfeng Lithium/Lithium Americas Cauchari project with Ganfeng announcing a US$237 million for 37% of the Cauchari project previously held by SQM, followed by a further US$160 million to increase Ganfeng’s equity position to 50% on 1 April 2019, together with a resource that had doubled to be the largest on the planet. Ganfeng then announced a 10 year lithium supply agreement with Volkswagen on 5 April 2019. Nearby projects of Lithium X were acquired via a takeover offer of C$265 million completed March 2018. The northern half of Galaxy’s Sal de Vida resource was purchased for US$280 million by POSCO in June-Dec 2018. LSC Lithium was acquired in Jan-Mar 2019 for C$111 million by a mid-tier oil & gas company with a resource size half of Kachi. These transactions imply an acquisition cost of US$55-110 million per 1 million tonnes of lithium carbonate equivalent (LCE) in resources.

For more information on Lake, please visit https://www.lakeresources.com.au/home/

Click here to connect with Lake Resources NL (ASX:LKE) for an Investor Presentation

Source: www.lakeresources.com.au

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2316.16 | -7.53 | |

| Silver | 27.19 | -0.09 | |

| Copper | 4.48 | -0.01 | |

| Oil | 82.65 | -0.16 | |

| Heating Oil | 2.56 | 0.00 | |

| Natural Gas | 1.66 | 0.00 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.