- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Trident Royalties PLC

Impact Minerals Limited

Purpose Bitcoin ETF

Ramp Metals

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

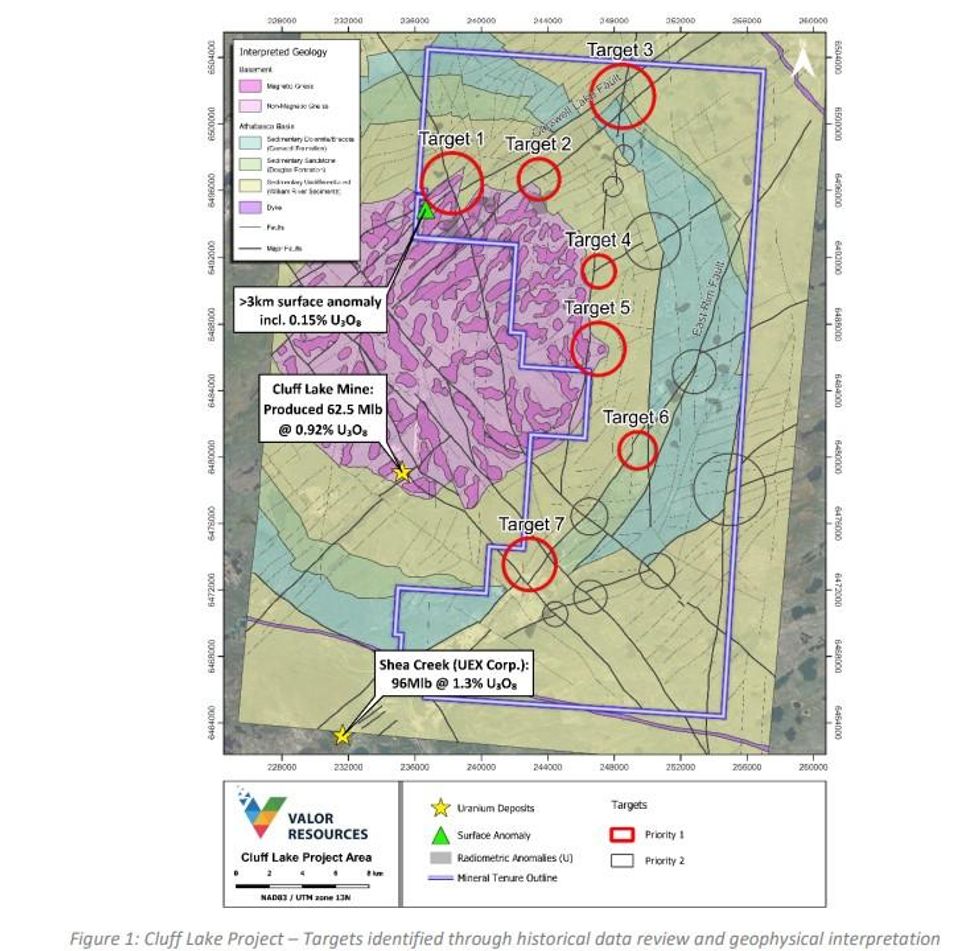

Highly Prospective Uranium Targets Identified at Cluff Lake Project Near Historical Uranium Mine

Valor Resources Limited (Valor) or (the Company) (ASX:VAL) is pleased to announce the completion of an extensive data review and targeting process on the Cluff Lake Uranium Project (the Project) in the western Athabasca Basin. This work has highlighted a significant number of very prospective targets, which will be followed up on-ground in the coming few weeks. In addition, an extensive airborne gravity gradiometry survey has recently been completed at the Project, with additional targets expected to be identified when the final data is reviewed".

HIGHLIGHTS

- Seven high-priority targets defined based on historical data and geophysical interpretation

- Highlighted by surface geochemical anomalies up to 0.15% U3O8

- Airborne gravity gradiometry (AGG) survey completed to identify further targets

- Project located 7km east of Orano’s Cluff Lake Mine which produced 62.5 Mlbs @ 0.92% U3O8

- Potential for both Athabasca basement-hosted and unconformity-style uranium deposits

- Permitting well advanced to start on ground exploration activity in June including mapping and sampling, to design drilling program

Executive Chairman George Bauk comments “The data review has highlighted excellent targets including several key structures, and this combined with outputs from the recently completed airborne gravity gradiometry survey will provide us with the priority targets that require on-ground follow-up leading to drilling. The gravity survey provides the third dimension (depth) to the other geological data sets to assist with identifying and prioritising drill targets.”

“We are within 7km of a significant historical uranium mine, which was operated by Areva (now Orano), the leading French nuclear organisation. This group of deposits produced over 62m pounds of U3O8 at 0.92% U3O8 (or 9,200ppm U3O8). These deposits were small in terms of physical size, but due to their high-grade nature, were economically significant. We are targeting our exploration activity to account for the physical size of known resources in the area.”

“We are also working through compiling all the historical exploration data from our eight projects in the Athabasca Basin, and we plan to release the reviews of all projects in the next three months. During this time, the exploration team will continue on-ground exploration and interpretation of the new airborne survey data from Cluff Lake, Hook Lake and Hidden Bay.”

Airborne gravity survey – recently completed

An airborne gravity gradiometry (AGG) survey has been completed across approximately 80% of the Cluff Lake Project area (622km2). A total of 2,755 line kms were flown in the survey, at a line spacing of 200m. To the Company’s knowledge, this is the first modern airborne gravity survey completed over the project area. The preliminary data is currently being compiled and reviewed, with the results expected later this month.

The AGG data will help delineate geology and structure that are potentially important in the formation of a uranium deposit. Gravity anomalies can provide direct detection of the hydrothermal alteration associated with a uranium deposit. Hydrothermally altered (de-silicified) rocks have a lower density then the unaltered host rocks and can therefore be identified as gravity lows. An example of this is the basement-hosted Arrow Uranium Deposit, which has a Total Mineral Resource of 337.4 million pounds U3O8 at a grade of 1.8%, which was discovered in 2014 by NexGen Energy Ltd. The discovery of the Arrow Deposit was, in part, the result of drill testing a circular gravity low with a diameter of around 1km. (sourcedfromArrowDeposit,RookIProject,Saskatchewan,NI 43-101Technical Report onFeasibility Study).

Historical data review targets

The following targets are based on a thorough review of historical exploration data which has been integrated with a detailed geological interpretation of all publicly available geophysical data completed by Valor’s consultant geophysics team, Terra Resources. The historical exploration data is from the 1960s through to the 1980s. Between the 1990s and the present day, little uranium exploration has been carried out in this area. Details of relevant drill holes and surface sampling information that have been used in determining some of these targets, have been included in Appendices 1 and 2. All diamond drill holes have been reported and other drillholes with maximum U assay of >1ppm have been reported. The surface samples reported have been filtered based on: Organic samples >5ppm U, Soil samples > 2ppm U, rock chip(boulder) and unknown sample types > 5ppm U. Due to the historical nature of some of this data, some aspects of the sampling and drilling cannot be verified and therefore some caution must be applied. The Company intends to carry out on-ground work to verify aspects of the historical data before advancing targets to the drilling stage.

Click here for the full ASX Release

This article includes content from Valor Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Shareholders Approve Firetail Resources’ Acquisition of Peruvian Assets

Firetail received strong shareholder approval with 88 percent of votes in favor of the transaction

Firetail Resources (ASX:FTL) shareholders have approved the acquisition of up to 80 percent interest in Valor Resources’ (ASX:VAL) Picha and Charaque projects in Peru, according to an article published by The West Australian.

About 88 percent of Firetail’s shareholders voted in favour of the transaction, which is set to be completed in the first week of September 2023. The deal involves Firetail issuing an upfront payment of $550,000, 15 million shares and 20 million performance rights. In return, Valor will transfer 80 percent of the issued share capital of Kiwanda S.A.C, Valor’s wholly owned subsidiary which holds the mining concessions for the Peruvian assets.

The article also noted that Valor shall maintain a 20.58 percent stake in Firetail and a 20 percent interest in the acquired assets.

Firetail is advancing its drill planning for the Picha copper project in Peru with regulatory approvals already in place allowing up to 120 drill holes comprising up to 40 drill platforms with three holes per platform.

To read the full article, click here.

Click here to connect with Firetail Resources (ASX:FTL) for an Investor Presentation.

Boss Produces First Drum of Uranium

Major milestone paves way for strong growth in production, cashflow and financial returns as Boss increases production rate by leveraging the infrastructure and extensive JORC Resource

Boss Energy Limited (Boss or the Company) is pleased to announce that it has produced the first drum of uranium at its 100 per cent-owned Honeymoon Uranium Project in South Australia.

This major milestone is part of the highly successful commissioning process at Honeymoon, which will see production ramp up to 2.45Mlb of U3O8 a year.

As well confirming the project’s technical and operational success, Boss has delivered exceptional shareholder returns. The Company has no debt and $298 million of liquid assets (being cash, equity investments and physical uranium) as at March 31, 2024. This is equal to almost 70 per cent of the funds Boss has raised since it acquired Honeymoon in December 2015. This reflects Boss’ focus on creating value for shareholders which has helped Boss grow its market capitalisation from $37M in December 2015 to almost $2B today.

Boss paid US$30.15/lb for its strategic inventory of 1.25Mlbs of U3O8 in March 2021 at a total cost of US$37.68M (A$49.69M). As at 31 March 2024 the inventory was valued at US$110M (A$169M) with the spot price of US$88/lb.

Importantly, Honeymoon is already exceeding feasibility study forecasts, with uranium-rich lixiviant from the wellfields and recoveries of loaded resin in the IX column producing concentrated high-grade eluate in excess of the study estimates.

This provides more firm evidence that the new processing technology adopted by Boss at Honeymoon, which is central to the project’s operating and financial success, as well as its strong organic growth outlook, is meeting or exceeding the Company’s expectations.

With the first drum of uranium successfully processed, Boss will accelerate plans to increase the production rate and mine life at Honeymoon. The current mine plan utilises 36Mlb of the project’s total 71.6Mlb JORC Resource. Half of this Resource is already covered by the existing Mining Licence. Boss also has a valid Uranium Mineral Export Permission for 3.3Mlb a year.

Boss is also set to continue driving growth and superior returns with first production expected within weeks at its 30 per cent-owned Alta Mesa Uranium Project in South Texas. When Alta Mesa reaches steady-state operations, Boss’ share of production will be 500,000lb a year. Alta Mesa has significant potential for further resource growth and drying capacity to expand the 1.5Mlb capacity plant after the resumption of production, which is expected in 1H 2024.

Boss Managing Director Duncan Craib said: “Processing the first drum of uranium is a major milestone. As well as marking the start of production and cashflow, it shows conclusively that our mining and processing strategy is highly effective.

“This is pivotal because it paves the way for strong organic production growth by unlocking the value of our large Resource and leveraging the infrastructure we have in place. We have also made extensive provision in the Honeymoon plant for increased throughput.

“Increased utilisation of these highly valuable assets will enable us to further capitalise on the strong outlook for the uranium price while also ensuring we continue to drive superior financial returns.

“We are now accelerating this growth strategy, with geologists already in the field defining the mineral resources at the Gould’s Dam and Jason’s satellite deposits.

“On behalf of the Board, I sincerely thank our employees, contractors and service providers for their skill and hard work in achieving today’s milestone for Boss. We are also grateful to the governments of Australia and South Australia, Minerals Council of Australia and South Australian Chamber of Mines and Energy, our local communities, and shareholders for their unwavering support to enable Honeymoon to resume production”.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Forum Energy Metals

Overview

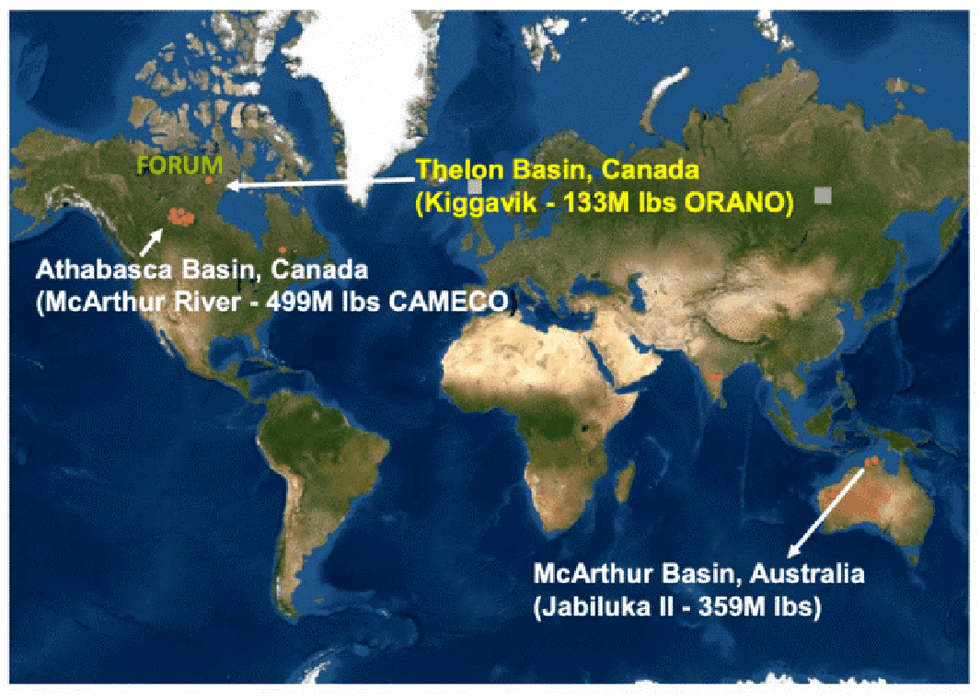

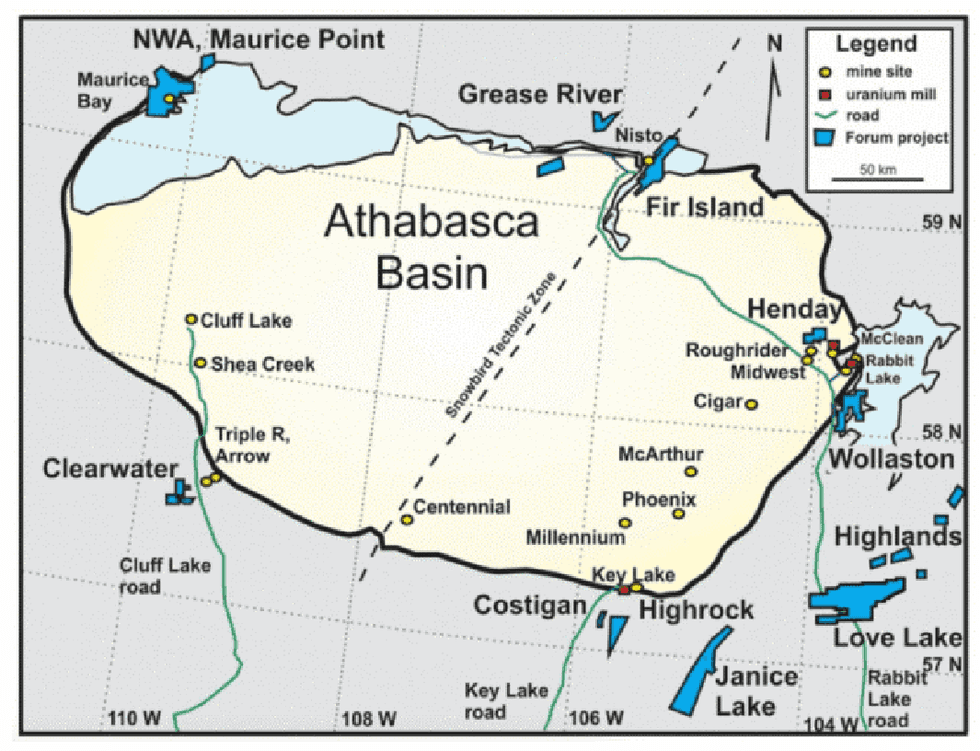

Forum Energy Metals (TSXV: FMC, OTCQB: FDCFF) is an established uranium explorer searching for high-grade deposits in Saskatchewan’s Athabasca Basin and Nunavut’s Thelon Basin. In 2024, the company’s primary focus will be to continue exploring the Aberdeen project in Nunavut, where successful drilling confirmed and expanded high-grade uranium mineralization over significant widths. Nunavut’s underexplored Thelon Basin may be the most prospective region for discovering new, high-grade uranium deposits outside Saskatchewan. With a strong local and regional presence in Saskatchewan, Forum took advantage of weak metals markets to broaden its commodity exposure by adding a diverse portfolio of energy metals exploration projects in the copper, cobalt and nickel space.

Company Highlights

Saskatchewan (Athabasca Basin) and Nunavut (Thelon Basin) Uranium Projects

- Aberdeen Uranium Project (Thelon Basin-Nunavut): Athabasca Basin 2.0?

The Thelon Basin may be the most prospective region in the world for discovering new high-grade uranium deposits outside Saskatchewan’s Athabasca Basin. Both basins exhibit similar geological characteristics.

Forum’s Aberdeen Maiden Drill Program Intersects High-grade Uranium

- Between July and August 2023, Forum completed five drill holes totalling 991 meters. The program successfully expanded shallow high-grade uranium mineralization at the primary Tatiggaq Main and West Zones, and confirmed the team’s understanding of the controls of mineralization. Hole TAT23-002 intersected 2.25 percent U3O8 over 11.1 meters at a depth of 148.5 meters in the Main Zone and Hole TAT23-003, a 200-meter step-out to the southwest of the West Zone intersected 0.40 percent U3O8 over 12.8 meters at a depth of 136.8 meters.

- Subsequent to receiving these assay results, Forum completed a $10.4-million brokered private placement, which will enable the company to follow-up with a major 10,000-meter drill program scheduled for the summer of 2024. Drilling will focus on expanding uranium mineralization along strike and at depth. To date, only 200 meters of this 1.5-kilometer-long anomaly has been drill tested.

- Wollaston Uranium: Forum: 100 percent – Located in eastern Athabasca Basin. Limited drilling in 2023 identified elevated uranium and boron values on several geophysical targets on this large property, well located close to the Orano/Denison McClean Lake mill. Forum is reviewing data from its magnetic/electromagnetic survey to plan the next exploration steps.

- Highrock Uranium: Forum: 80 percent, Sassy Gold 20 percent – On trend with Cameco’s past-producing Key Lake Mine.

- Fir Island: Forum: 49 percent, Orano Canada: 51 percent (operator) – Located on the northeastern edge of the Athabasca Basin. Forum is waiting on further exploration plans following Orano’s data review from an extensive resistivity survey.

- Northwest Athabasca Joint Venture: Forum: 39.5 percent, NexGen: 28 percent, Cameco: 20 percent, Orano:12.5 percent – Future winter drilling subject to agreement among the partners. The project hosts the historical 1.5-million-lb Maurice Bay deposit grading 0.6 percent uranium oxide to a depth of 50 meters (Not NI 43-101 compliant. Sufficient exploration work has not been completed to verify and classify as a current mineral resource, but the estimate is considered relevant and reliable due to extensive exploration work completed by previous operators and sourced from Saskatchewan Industry & Resources Miscellaneous Reports 2003-07).

- Maurice Point: Forum: 100 percent

- Grease River: Forum: 100 percent (Traction Uranium earn-in option) – Forum and Traction recently completed airborne magnetic, electromagnetic (EM) and radiometric surveys over the entire project area to aid structural mapping and help define drill targets. Analysis of the EM data has outlined prospective targets along several conductive trends in the East claim block north of the Grease River shear zone.

- Henday: UEC: 60 percent, Forum: 40 percent – Strategically located along the Midwest/Roughrider trend.

- Costigan: Forum: 100 percent – On trend with Cameco’s past-producing Key Lake mine.

- Clearwater: Forum: 75 percent, Vanadian: 25 percent – Located in the Patterson Lake Corridor, Western Athabasca Basin

Key Projects

Nunavut Uranium Project (Thelon Basin)

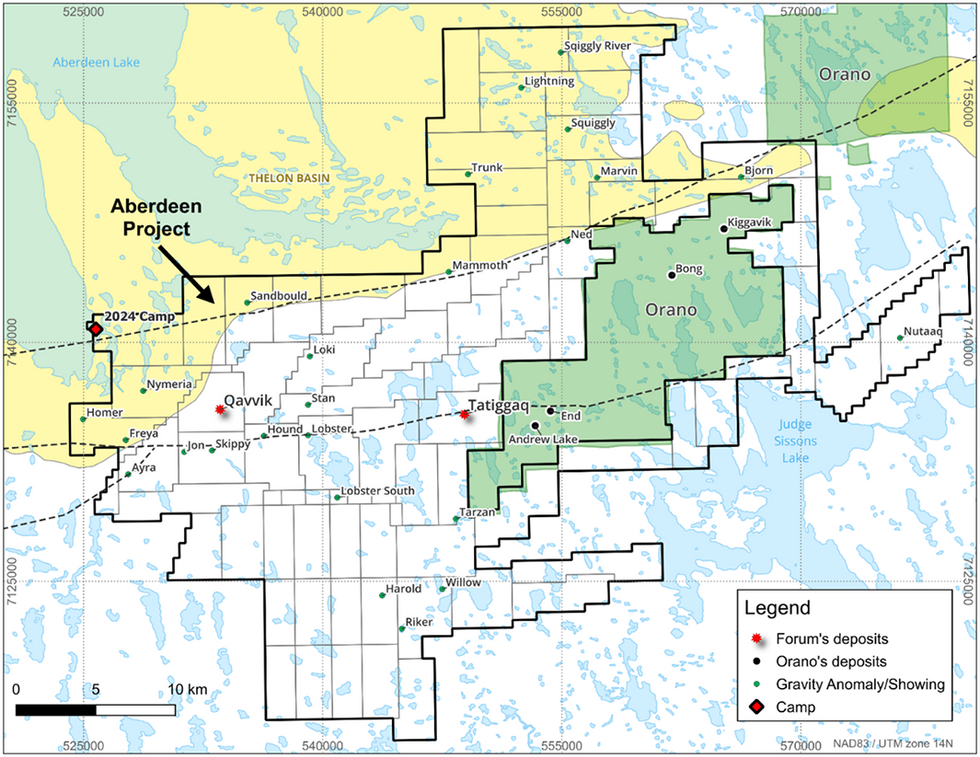

Nunavut Uranium: Forum’s Aberdeen project claims comprise ground formerly held by Cameco with discoveries made at Tatiggaq, Qavvik and Ayra. The claims surround Orano’s mining lease, which hosts the Kiggavik uranium deposit.

Previously explored by Cameco between 2005 and 2012, this prospective ground hosts two uranium discoveries made by former Cameco geologist Dr. Rebecca Hunter, who now leads Forum’s team as VP exploration.

Cameco abandoned the claims due to the decade-long period of low uranium prices during the post-Fukushima period, which were later acquired by Forum. Renamed the Aberdeen project, Forum’s claims surround Orano Canada-Denison-UEC’s 133-million-lb Kiggavik uranium deposit.

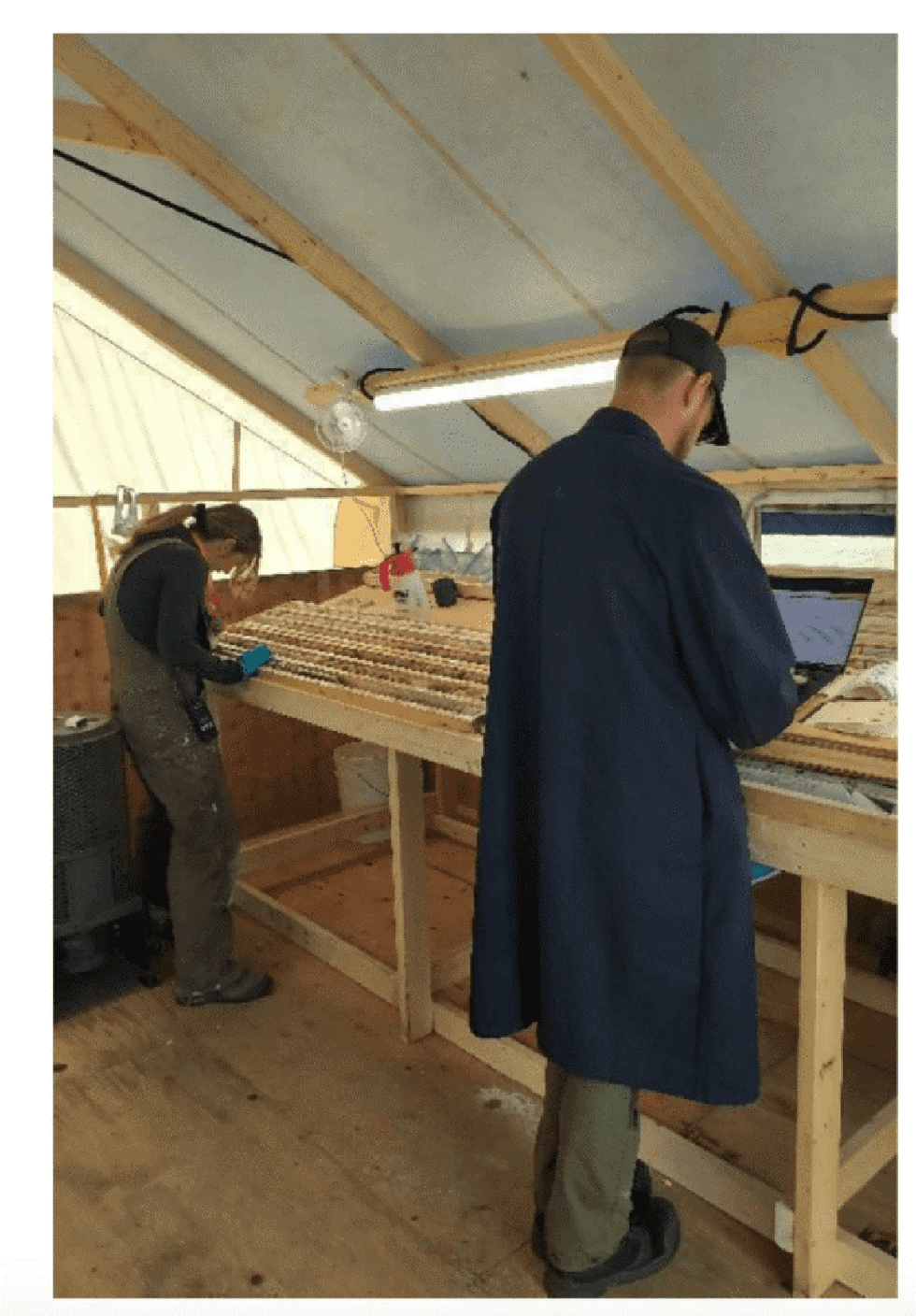

Dr. Rebecca Hunter spotting drill hole locations. As Forum’s VP exploration, Hunter is managing the Aberdeen uranium exploration project.

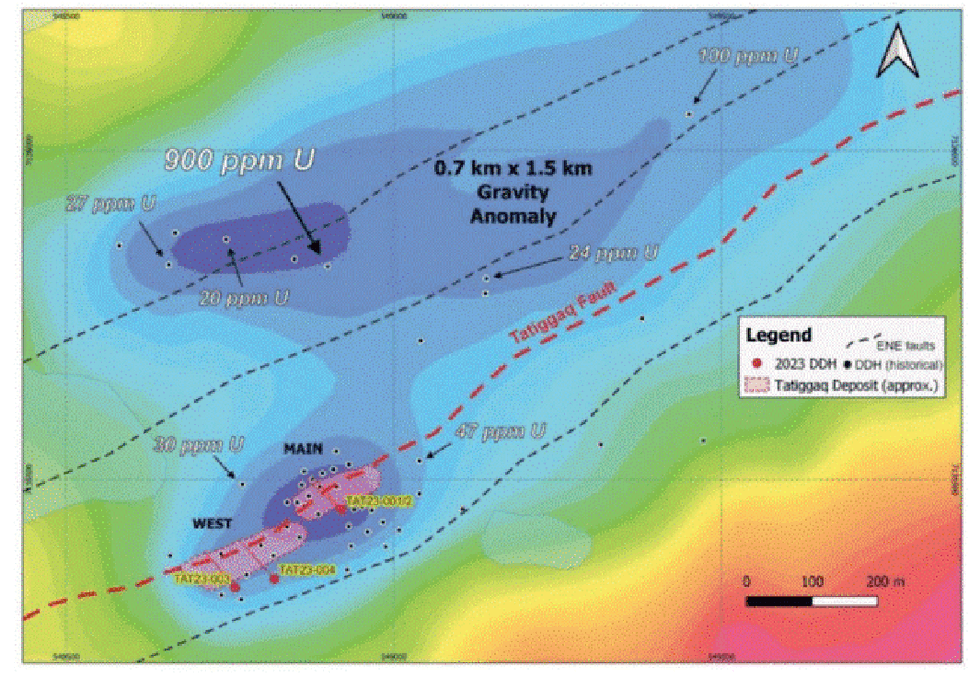

Cameco completed 36,000 meters of drilling in 135 drill holes. After reviewing Cameco’s data, Forum’s technical team determined the Tatiggaq deposit to be the primary exploration target. Tatiggaq is found within a large gravity anomaly that remains open along strike for 1.5 kilometers and at depth. Previous drilling by Cameco identified results as high as 2.69 percent U3O8 over 7.9 meters, including 24.8 percent U3O8 over 0.4 meters at a depth of approximately 200 meters.

Examining drill core in the field at the Nunavut camp, August 2023

Forum’s maiden drill program, completed in August 2023, successfully confirmed and expanded high-grade uranium mineralization at the Tatiggaq and West Zones. At Tatiggaq, drilling intersected high-grade near-surface uranium mineralization with TAT23-002 (Main Zone) intersecting 2.25 percent U3O8 over 11.1 meters, while TAT23-003 a 200-meter step-out at the West Zone) intersected 0.40 percent U3O8 over 12.8 meters.

Results from the Ned anomaly, one of over 20 high-grade unconformity-type targets, identified elevated uranium, boron, silver and nickel.

Forum’s Summer 2023 maiden drilling focused on the primary Tatiggaq deposit. Forum has since established new drill targets over a more than one kilometer east-northeast extension along the Tatiggaq fault zone following the processing of geophysical data from its recent ambient noise tomography survey. An extensive 10,000-meter summer 2024 drilling program has been announced.

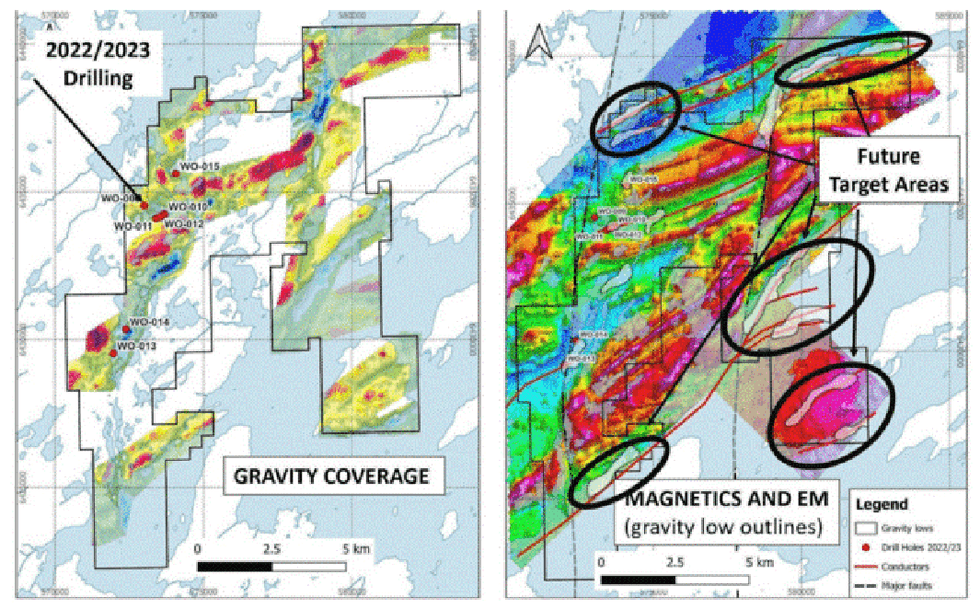

Wollaston Uranium Project

The property is located within 10 kilometers of Cameco’s Rabbit Lake uranium mill and 30 kilometers of Orano/Denison’s McClean Lake uranium mill. Its successful winter 2022 drilling program discovered anomalous uranium in all four holes at the Gizmo target. Forum recently received results of an airborne electromagnetic (EM) and magnetic survey to augment structural interpretations and precisely locate the EM conductors. The following maps show these results and identify new target areas for diamond drilling.

New Gravity Trends and Future Target Areas

Energy Metals Projects

- Janice Lake Copper (Forum 100 percent): Former partner Rio Tinto spent $14 million in exploration expenditures to earn a 51 percent interest in the project. As of November 2023, Forum revised and completed the acquisition of Rio Tinto’s interest in the project giving Forum 100 percent interest.

- Love Lake Nickel-Copper-PGM Project (Forum 100 percent): Strategically positioned near Forum’s Janice Lake copper project.

- Still Nickel-Copper-Cobalt Project (Forum 100 percent): The 11,411-hectare property surrounds the historic Howard Lake nickel-copper-cobalt deposit located 35 kilometers northwest of La Ronge Saskatchewan. Forum has completed a prospecting and geochemical sampling program, and in Q3 2023, completed electromagnetic and magnetic surveys.

- Fisher Copper Claims (Forum 100 percent): The Fisher property is located 40 kilometers west of Pelican Narrows, Saskatchewan. The property hosts a stratabound, volcanogenic massive sulphide deposit with a historical estimate of 650,000 tons grading 0.5 percent copper and 3 percent zinc (Not NI 43-101 compliant. Sufficient exploration work has not been completed to verify and classify as a current mineral resource, but the estimate is considered relevant and reliable due to extensive exploration work completed by previous operators). Forum’s geological team has identified further targets and completed a prospecting and sampling program.

- Quartz Gulch Cobalt, Idaho, USA (Forum 100 percent): On trend with Jervois Mining’s Idaho Cobalt Project, the only permitted cobalt mine in North America.

Forum’s uranium and energy metal projects in northern Saskatchewan

Management & Advisory Team Members

Richard J. Mazur - President, CEO and Director

Richard Mazur is an executive and geoscientist with over 45 years of Canadian and international experience in the exploration and mining industry as a project geologist, financial analyst and senior executive on uranium, gold, diamonds, base metals and industrial minerals projects. Rick founded Forum in 2004. He is also a director of Big Ridge Gold, Impact Silver and Midnight Sun Mining. Mazur graduated with a B.Sc. in geology from the University of Toronto in 1975 and obtained an MBA from Queen’s University in 1985.

Dr. Rebecca Hunter - Vice-President Exploration

Dr. Rebecca Hunter has over 15 years of experience as a uranium exploration geologist in Saskatchewan and Nunavut. As a project geologist for Cameco from 2005 to 2016, Hunter led the Turaqvik-Aberdeen exploration project, where the high-grade Tatiggaq and Qavvik uranium deposits were discovered nearby to the west of Orano’s (formerly AREVA) Kiggavik uranium project in Nunavut. Hunter completed her PhD at Laurentian University, which focused on the litho-geochemistry, structural geology and uranium mineralization systems of the Tatiggaq-Qavvik uranium trend in the Thelon Basin. She was recently appointed VP Exploration and will continue her work as the lead member of Forum’s Aberdeen uranium project exploration team in the Thelon Basin, a geologic analogue to the prolific Athabasca Basin.

Allison Rippin Armstrong - Vice-President, Nunavut Affairs

Allison Rippin Armstrong is a biologist and environmental scientist with over 25 years experience specializing in Environmental, Social and Governance (ESG) practices across Canada and internationally. Allison’s accomplishments over the years have been recognized on a number of occasions, including being awarded the 2009 Kivalliq Inuit Association Expert Counsel Award and the 2011 Mike Hine Award for her contributions to the mining industry in Nunavut. A long-standing board member of Yukon Women in Mining, past member of the NWT & Nunavut Chamber of Mines, and founding member of the Yukon University Foundation Board, she is also the Board Chair of Tectonic Metals Inc.

As VP Nunavut Affairs, Allison’s focus will be in community, regulatory and government relations in Nunavut Territory.

Dan O’Brien - Chief Financial Officer

Dan O’Brien is a member of the Institute of Chartered Professional Accountants of British Columbia and has over 15 years experience working with public companies in the resource industry. O’Brien is the chief financial officer for a number of publicly listed exploration companies trading on the TSX and TSXV exchanges and was previously a senior manager at a leading Canadian accounting firm where he specialized in the audit of public companies in the mining and resource sector.

Anthony Balme - Director

Anthony Balme is the managing director of Carter Capital and Lymington Underwriting, two private UK investment funds, where he is an active participant in several global base and precious metals resource ventures in North America, Sweden and the DRC.

Paul Dennison - Director

Paul Dennison worked for 27 years in the front end of three leading investment banks: Credit Suisse, Merrill Lynch & Deutsche Bank. His focus was capital markets origination, underwriting, sales and trading in all regions outside the Americas. Thereafter, Dennison managed his own asset management company for 12 years, which was licensed in Singapore, Switzerland and the United States. He is currently based in Zurich and Singapore with his own firm, specializing as an introducing broker, sourcing international investment capital for clients.

Janet Meiklejohn - Director

Janet Meiklejohn is the principal of Emerald Capital, a consulting company providing CFO, strategic, valuation, corporate governance and marketing services to high-growth companies. She was formerly VP of institutional equity sales focused on the mining sector with several Canadian investment banks including Desjardins Securities, National Bank, Salman Partners and Macquarie Capital from 1997 to 2015. Meiklejohn grew up in Saskatchewan and has a close personal interest in the development of the uranium industry in the province.

Larry Okada - Director

Larry Okada is a member of both the Canadian Chartered Professional Accountants and the Washington State Certified Public Accountants Association with over 45 years of experience in providing financial management services to publicly traded companies, with emphasis on junior mineral exploration companies. He holds a B.A. in economics and was in public practice with his own firm of Staley, Okada and Partners and PricewaterhouseCoopers LLP. Okada also serves as chairman of Forum’s Audit Committee.

Michael A. Steeves - Director

Michael A. Steeves has been involved in the mining industry for over 50 years. He has previously held executive positions with Zazu Metals, Glamis Gold, Coeur D’Alene Mines, Homestake Mining and Pegasus Gold. Steeves also worked for several years as a mining analyst. He holds a Master of Science degree in earth sciences from the University of Manitoba and is also a chartered financial analyst.

Brian Christie - Director

Brian Christie’s professional career spans over 45 years as a geologist, securities analyst, and investor relations executive. During his tenure as vice-president investor relations at Agnico Eagle Mines from 2012 to 2022, Agnico Eagle was consistently recognized as having one of the top investor relations programs in Canada. Christie is currently retained by Agnico Eagle as a senior advisor, investor relations. Prior to joining Agnico Eagle, he worked for over 17 years as a precious and base metals analyst with Desjardins Securities, National Bank Financial, Canaccord Capital, and HSBC Securities, in addition to 13 years as a geologist with several mining companies including Homestake, Billiton, Falconbridge Copper, and Newmont. Christie holds a BSc. in geology (University of Toronto) and an MSc. in geology (Queen’s University). He is also a member of the Canadian Investor Relations Institute (CIRI) and the National Investor Relations Institute (NIRI).

Top 5 ASX Uranium Stocks of 2024

Uranium has broken out, with the spot price rising to a 16-year high of US$106 per pound in early 2024. Despite a pullback, uranium prices in April still remain 30 percent higher than last year's average.

Although the market's turnaround has taken time, experts are predicting a bright future as countries around the world pursue clean energy goals. Against that backdrop, some ASX-listed uranium companies have been making moves in 2024.

Below the Investing News Network has listed the top uranium stocks on the ASX by year-to-date gains. Data was gathered using TradingView's stock screener on April 10, 2024, and all companies included had market caps above AU$50 million at the time. Read on to learn more about these firms and what they've been up to so far this year.

1. Paladin Energy (ASX:PDN)

Year-to-date gain: 56.12 percent; market cap: AU$4.54 billion; current share price: AU$1.53

Paladin Energy owns a 75 percent stake in the active Langer Heinrich uranium mine in Namibia, and also has an exploration portfolio that spans both Canada and Australia.

First brought into production in 2006, operations at Langer Heinrich were suspended in 2018 as ultra-low uranium prices averaging US$24 per pound U3O8 made the mine uneconomical. The dramatic rebound in the uranium market over the past year prompted Paladin to return Langer Heinrich to commercial production in April 2024.

Shares in company reached AU$1.53, its highest point of 2024 so far, on April 9. This is up by more than 56 percent since the start of the year, and up nearly 300 percent since hitting a yearly low of AU$0.515 in May 2023.

2. Lotus Resources (ASX:LOT)

Year-to-date gain: gain 45.95 percent; market cap: AU$1.24 billion; current share price: AU$0.42

Lotus Resources is another ASX-listed uranium miner working to revive operations at a former mine. The company’s flagship asset is the Kayelekera uranium mine in Malawi, which it acquired from Paladin Energy in 2020.

Kayelekera has been on care and maintenance since 2014 due to the years-long low price environment for the nuclear fuel. In August 2022, Lotus completed a definitive feasibility study for restarting the mine, which it is targeting for Q4 2025.

Last November, Lotus completed a merger with A-Cap Energy, adding the Letlhakane uranium project in Botswana to its portfolio. The company’s plans for the project in 2024 include fast-tracking delivery of a scoping study through the completion of infill drilling aimed at optimizing the mine plan and upgrading the mineral resource estimate.

Shares of Lotus Resources reached a year-to-date high of AU$0.44 on March 21.

3. Bannerman Energy (ASX:BMN)

Year-to-date gain: 44.19 percent; market cap: AU$596.08 million; current share price: AU$3.85

Uranium development company Bannerman Energy has honed its efforts on its Namibia-based Etango uranium project, which it says is one of the world’s largest undeveloped uranium assets. The company has been moving forward at Etango for 15 years and is currently targeting a final investment decision for this year.

Bannerman's latest news on its progress at Etango came on March 18 with the announcement that the company has completed a scoping study on the viability of expanding or extending the base case 8 million tonnes per annum of production outlined in the definitive feasibility study completed in December 2022. In addition, the company is currently advancing Front End Engineering and Design, offtake marketing and strategic financing workstreams.

Bannerman's share price reached AU$4.00, its highest point of 2024 so far, on April 8.

4. Deep Yellow (ASX:DYL)

Year-to-date gain: 31.46 percent; market cap: AU$1.22 billion; current share price: AU$1.40

Deep Yellow's portfolio of uranium assets spans Namibia and Australia, with its two most advanced projects being Tumas and Mulga Rock. The former is located in Namibia, while the latter is in Western Australia; according to the company, together they have a potential production capacity of over 7 million pounds per year of U3O8.

Deep Yellow released a definitive feasibility study (DFS) for Tumas in early February 2023, outlining output of 3.6 million pounds of U3O8 annually along with 1.15 million pounds of V2O5. The property's mine life is set at 22.25 years, but additional resources could increase it to over 30 years. In December, Deep Yellow did a review of the DFS, updating costs and forecast financial outcomes to reflect the more settled economic environment. Tumas received a mining licence from the Namibian government that same month. The company is targeting late Q3 2024 for a final investment decision.

In terms of Mulga Rock, the company has been working on an evaluation program geared at boosting the project's value by looking at its critical minerals potential. In late February 2024, the company updated the mineral resource estimate for the Ambassador and Princess deposits, resulting in a 26 percent increase in the project's total contained uranium and justifying an update to the DFS. Deep Yellow expects to start a revised DFS for Mulga Rock in Q2 2024.

Shares of Deep Yellow reached their 2024 peak on February 2, coming in at AU$1.76.

5. Boss Energy (ASX:BOE)

Year-to-date gain: 20.1 percent; market cap: AU$2.01 billion; current share price: AU$4.84

Boss Energy is focused on restarting its fully permitted Honeymoon uranium mine in South Australia. Production at the asset was suspended in 2013 due to low prices, but the company is now looking to bring it back online to take advantage of uranium's move upward. A JORC-compliant resource for the Honeymoon restart area stands at 36 million pounds of U3O8, and the property's mine life is estimated at over 10 years with output of 2.45 million pounds of U3O8 annually.

News throughout the past year was focused on activities geared at bringing Honeymoon back online, and Boss ultimately started mining operations at Honeymoon back up again in mid-October 2023. The same month, Boss and Coda Minerals (ASX:COD) were awarded four exploration tenements under a mineral rights sharing arrangement. The tenements make up the Kinloch project, which is located 130 kilometres south of Honeymoon.

Boss signed its first binding sales contract for production from Honeymoon in late December 2023. It will sell 1 million pounds of uranium to a US utility for seven years starting in 2025 and ending in 2031.

Then, in late February of this year, Boss announced the completion of a transaction that it said will make it a multi-mine uranium producer in the first half of 2024 — it entered into an agreement to acquire a 30 percent stake in enCore Energy's (TSXV:EU,NASDAQ:EU) Alta Mesa in-situ recovery project in Texas. In mid-March enCore announced its highest grade drill results to date at Alta Mesa, and reported that "at the Alta Mesa Uranium CPP, enCore has met most of the key objectives for the refurbishment of the processing circuits necessary for the planned early 2024 restart."

Boss Energy's share price reached its highest point of the year so far on February 2, when it hit AU$6.11.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Top 10 Uranium-producing Countries (Updated 2024)

Output from the top uranium-producing countries rose steadily for a decade, peaking at 63,207 metric tons (MT) in 2016. However, global uranium production has noticeably declined in the years since then.

Decreased numbers across the world are related to the persistently low spot prices the uranium market has experienced in the wake of the Fukushima disaster; COVID-19 and Russia's war against Ukraine have also had an impact on output.

Now uranium prices have begun to rebound significantly, buoyed by increasingly positive sentiment about the role of nuclear power in the energy transition, and investment demand via new uranium-based funds.

Currently 10 percent of the world’s electricity is generated by nuclear energy, and that number is expected to grow. Looking forward, analysts are calling for a sustained bull market in uranium. In early 2024, prices surged to a 16 year high of more than US$100 per pound, and although they have slipped slightly since then, industry insiders remain optimistic.

Due to its significance in energy generation, it’s important to know where uranium is mined and which nations are the largest uranium-producing countries. Kazakhstan is the leader by a long shot, and has been since 2009. In 2022 — the last year for which data is available — it was followed by Canada and Namibia in second and third place, respectively.

For investors interested in following the uranium space, having familiarity with these uranium production hotspots is essential. Read on to get a closer look at 2022’s largest uranium-producing countries. All statistics are from the World Nuclear Association’s most recent report on uranium mine production.

1. Kazakhstan

Mine production: 21,227 MT

As mentioned, Kazakhstan had the highest uranium production in the world in 2022. In fact, the country’s total output of 21,227 MT accounted for an impressive 43 percent of global uranium supply.

When last recorded in 2021, Kazakhstan had 815,200 MT of known recoverable uranium resources, second only to Australia. Most of the uranium in the country is mined via an in-situ leaching process.

Kazataprom (LSE:KAP,OTC Pink:NATKY), the country’s national uranium miner, is the world’s largest producer, with projects and partnerships in various jurisdictions. News that the top uranium producer may miss its production targets for 2024 and 2025 was a large contributor to uranium prices breaking through the US$100 level this year.

2. Canada

Mine production: 7,351 MT

Canada’s uranium output has fallen dramatically since hitting a peak of 14,039 MT in 2016. After producing 6,938 MT of yellowcake in 2019, Canadian uranium production sank to 3,885 MT in 2020 as the COVID-19 pandemic led to operational shutdowns. However, uranium production in the country began to rebound in 2022.

Saskatchewan’s Cigar Lake and McArthur River are considered the world’s two top uranium mines. Both properties are operated by sector major Cameco (TSX:CCO,NYSE:CCJ). Cameco made the decision to shutter operations at the McArthur River mine in 2018, but returned to normal operations in November 2022.

In 2023, Cameco produced 17.6 million pounds of uranium, which was below its originally planned production of 20.3 million pounds for the year. The company has set its guidance at 22.4 million pounds for 2024.

Uranium exploration is also prevalent in Canada, with the majority occurring in the uranium-rich Athabasca Basin. That area of Saskatchewan is world renowned for its high-quality uranium deposits and friendly mining attitude. The province’s long history with the uranium industry has helped to assert it as an international leader in the sector.

3. Namibia

Mine production: 5,613 MT

Namibia’s uranium production has been steadily increasing after falling to 2,993 MT in 2015.

In fact, the African nation overtook longtime frontrunner Canada to become the third largest uranium-producing country in 2020, and went on to surpass Australia for the second top spot in 2021. Although Namibia slipped back below Canada in 2022, its output for the year was only down by 140 MT from 2021.

The country is home to two uranium mines that are capable of producing 10 percent of the world’s output. Paladin Energy (ASX:PDN,OTCQX:PALAF) owns the Langer Heinrich mine, while large miner Rio Tinto (NYSE:RIO,ASX:RIO,LSE:RIO) sold its majority share of the Rössing mine to China National Uranium in 2019.

In 2017, Paladin took Langer Heinrich offline due to weak uranium prices; however, improved uranium prices over the past few years prompted the uranium miner to ramp up restart efforts. At the close of 2024's first quarter, Langer Heinrich achieved commercial production once again.

4. Australia

Mine production: 4,087 MT

Australia’s uranium production decreased significantly in 2021 to 4,192 MT, down from 2020’s 6,203 MT; it fell further in 2022 to hit 4,087 MT. The island nation holds 28 percent of the world’s known recoverable uranium resources.

Uranium mining is a contentious and often political issue in Australia. While the country permits some uranium-mining activity, it is opposed to using nuclear energy — at least for now. "Australia uses no nuclear power, but with high reliance on coal any likely carbon constraints on electricity generation will make it a strong possibility,” according to the World Nuclear Association. “Australia has a significant infrastructure to support any future nuclear power program.”

Australia is home to three operating uranium mines, including the largest-known deposit of uranium in the world, BHP's (NYSE:BHP,ASX:BHP,LSE:BHP) Olympic Dam. Although uranium is only produced as a by-product at Olympic Dam, its high output of the metal makes it the fourth largest uranium-producing mine in the world. In BHP's 2023 fiscal year, uranium output from the Olympic Dam operation totaled 3.4 million MT of uranium oxide concentrate, an increase of 1.03 million MT from the previous year's production.

5. Uzbekistan

Mine production: 3,300 MT

In 2020, with an estimated 3,500 MT of output, Uzbekistan became one of the top five uranium-producing countries. Domestic uranium production had been gradually increasing in the Central Asian nation since 2016. Previously seventh in terms of global uranium output, it is expanding production via Japanese and Chinese joint ventures. However, for 2022, the country's uranium output was down by 200 MT to 3,300 MT.

Navoi Mining & Metallurgy Combinat is part of state holding company Kyzylkumredmetzoloto, and handles all the mining and processing of domestic uranium supply. The nation's uranium largess continues to attract foreign investment; strategic partnerships with French uranium miner Orano and state-run China Nuclear Uranium were announced in November 2023 and March 2024, respectively.

6. Russia

Mine production: 2,508 MT

Russia was in sixth place in terms of uranium production in 2022. Output has been relatively steady in the country since 2011, usually coming in around the 2,800 to 3,000 MT range.

Experts had been expecting the country to increase its production in the coming years to meet its energy needs, as well as growing uranium demand around the world. But in 2021, uranium production in the country dropped by 211 MT from the previous year to 2,635 MT; it fell further by another 127 MT to reach 2,508 MT in 2022.

In terms of domestic production, Rosatom, a subsidiary of ARMZ Uranium Holding, owns the country’s Priargunsky mine and is working on developing the Vershinnoye deposit in Southern Siberia through a subsidiary. In 2023, Russia surpassed its uranium production target, producing 90 MT more than expected. Rosatom is developing new mines, including Mine No. 6, which is slated to begin uranium production in 2028.

Russian uranium has been an area of controversy in recent years, with the US initiating a Section 232 investigation around the security of uranium imports from the country in 2018. More recently, Russia's ongoing war in Ukraine has prompted countries around the world to look more closely at their nuclear supply chains.

7. Niger

Mine production: 2,020 MT

Niger’s uranium production has declined year-on-year over the past decade, with output totaling 2,020 MT in 2022. The African nation has two uranium mines in production, SOMAIR and COMINAK, which account for 5 percent of the world’s uranium production. Both projects are operated by subsidiaries of Orano, a private uranium miner.

Niger is also home to the flagship project of explorer GoviEx Uranium (TSXV:GXU,OTCQB:GVXXF). The company is presently developing its Madaouela asset, as well as projects in Zambia and Mali. Global Atomic (TSX:GLO,OTCQX:GLATF) is developing its Dasa project in the country, and expects to commission its processing plant by early 2026.

A recent military coup in the African nation has sparked uranium supply concerns, as Niger accounts for 15 percent of France's uranium needs and one-fifth of EU imports. In January 2024, the Nigerian government, now under a military junta, announced it intends to overhaul the nation's mining industry. It has temporarily halted the granting of new mining licenses and will be considering reforms to existing mining licenses in order to increase state profits.

8. China

Mine production: 1,700 MT

China’s uranium production rose from 885 MT in 2011 to 1,885 MT in 2018, and held steady at that level until falling to 1,600 MT in 2021. The country's uranium output grew by 100 MT to hit 1,700 MT in 2022.

China General Nuclear Power, the country’s sole domestic uranium supplier, is looking to expand nuclear fuel supply deals with Kazakhstan, Uzbekistan and additional foreign uranium companies.

China’s goal is to supply one-third of its nuclear fuel cycle with uranium from domestic producers, obtain one-third through foreign equity in mines and joint ventures overseas and purchase one-third on the open uranium market. China is also a leader in nuclear energy; Mainland China has 55 nuclear reactors with 27 in construction.

9. India

Mine production: 600 MT

India produced 600 MT of uranium in 2022, on par with output in 2021.

India currently has 23 operating nuclear reactors with another seven under construction. “The Indian government is committed to growing its nuclear power capacity as part of its massive infrastructure development programme,” as per the World Nuclear Association. “The government has set ambitious targets to grow nuclear capacity.”

10. South Africa

Mine production: 200 MT

South Africa is another uranium-producing country that has seen its output decline over the past decade — the nation's uranium output peaked at 573 MT in 2014. Nonetheless, South Africa surpassed Ukraine's production (curbed by Russia's invasion) in 2022 to become the 10th top uranium producer globally.

South Africa holds 5 percent of the world’s known uranium resources, taking the sixth spot on that list.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Blue Sky Uranium Announces Non-Brokered Private Placement

Blue Sky Uranium Corp. (TSXV: BSK) (FSE: MAL2), ("Blue Sky" or the "Company") is pleased to announce a non-brokered private placement for the sale of up to 16,666,667 units of the Company (each, a "Unit") at a price of C$0.06 per Unit (the "Offering Price") for aggregate gross proceeds of C$1,000,000 (the "Offering"). Red Cloud Securities Inc. will be acting as a finder in connection with the Offering.

Each Unit will consist of one common share in the capital of the Company (each, a "Common Share") and one transferrable Common Share purchase warrant (each, a "Warrant"). Each Warrant will entitle the holder thereof to purchase one additional Common Share (each, a "Warrant Share") at an exercise price of C$0.09 per Warrant Share for a period of two (2) years following the issue date of the Unit.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 – Prospectus Exemptions ("NI 45-106"), the Units will be offered for sale to purchasers resident in Canada other than Quebec and in certain offshore jurisdictions pursuant to the listed issuer financing exemption under Part 5A of NI 45-106 (the "Listed Issuer Financing Exemption"). The Units may also be sold in certain other jurisdictions pursuant to applicable securities laws. The Common Shares issuable from the sale of Units sold under the Listed Issuer Financing Exemption are expected to be immediately freely tradeable under applicable Canadian securities legislation if sold to purchasers resident in Canada, subject to any hold period imposed by the TSX Venture Exchange (the "Exchange") on the securities issued to certain purchasers. There is an offering document relating to the Offering that can be accessed under the Company's profile at www.sedarplus.ca and on the Company's website at www.blueskyuranium.com. Prospective investors should read this offering document before making an investment decision.

Closing of the Offering is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including but not limited to, the approval of the Exchange. Directors, officers and employees of the Company may participate in a portion of the Offering and any securities issued to such directors and officers are subject to the Exchange's four-month hold period. A commission may be paid to arm's length finders on a portion of the Offering. The Company intends to use the proceeds of the Offering for exploration programs on the Company's projects in Argentina and for general working capital.

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "1933 Act") or any state securities laws, and accordingly, may not be offered or sold within the United States except in compliance with the registration requirements of the 1933 Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release does not constitute an offer to sell or a solicitation to buy any securities in any jurisdiction.

About Blue Sky Uranium Corp.

Blue Sky Uranium Corp. is a leader in uranium discovery in Argentina. The Company's objective is to deliver exceptional returns to shareholders by rapidly advancing a portfolio of surficial uranium deposits into low-cost producers, while respecting the environment, the communities, and the cultures in all the areas in which we work. Blue Sky has the exclusive right to properties in two provinces in Argentina. The Company's flagship Amarillo Grande Project was an in-house discovery of a new district that has the potential to be both a leading domestic supplier of uranium to the growing Argentine market and a new international market supplier. The Company is a member of the Grosso Group, a resource management group that has pioneered exploration in Argentina since 1993.

ON BEHALF OF THE BOARD

"Nikolaos Cacos"

______________________________________

Nikolaos Cacos, President, CEO and Director

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. All statements, other than statements of historical fact, that address activities, events or developments the Company believes, expects or anticipates will or may occur in the future, including, without limitation, statements about the closing of the Offering, the participation by insiders in the Offering, finder's fees, and the use of proceeds; the Company's plans for its mineral properties; the Company's business strategy, plans and outlooks; the future financial or operating performance of the Company; and future exploration and operating plans are forward-looking statements. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, the Company. Factors that could cause actual results or events to differ materially from current expectations include, among other things: the impact of COVID-19; risks and uncertainties related to the ability to obtain necessary approvals, including Exchange approval for the closing of the Offering, the ability to obtain, amend, or maintain licenses, permits, or surface rights; risks associated with technical difficulties in connection with mining activities; and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations. Actual results may differ materially from those currently anticipated in such statements. Readers are encouraged to refer to the Company's public disclosure documents for a more detailed discussion of factors that may impact expected future results. Any forward-looking statement speaks only as of the date on which it is made and the Company undertakes no obligation to publicly update or revise any forward-looking statements, unless required pursuant to applicable laws.

Tisdale Clean Energy Appoints Jordan Trimble to Advisory Board

TISDALE CLEAN ENERGY CORP. (“ Tisdale ” or the “ Company ”) (TSX.V: TCEC, OTCQB: TCEFF , FSE: T1KC ) , is pleased to announce the appointment of Jordan Trimble to its newly constituted Advisory Board.

Mr. Trimble is the President and CEO of Skyharbour Resources, a uranium explorer and prospect generator in the Athabasca Basin and Tisdale’s project partner at the South Falcon East Project. He brings significant experience in the uranium sector and will provide vital insight to the Company in his advisory role.

“I’ve known and worked with Jordan for over a decade now, and I’m very happy we’re able to bring him on as a key advisor to Tisdale,” said Alex Klenman, CEO of Tisdale. “As we develop the South Falcon East project and grow the Company, Jordan’s knowledge of the Athabasca Basin combined with his deep understanding of the uranium sector as a whole will have a positive impact on our ability to grow the Company,” continued Mr. Klenman.

“With Skyharbour as a project partner at South Falcon East, and with Tisdale recently commencing their inaugural exploration programs at the project, I am happy to join Tisdale as an advisor,” said Mr. Trimble. The South Falcon East project is an advanced-stage exploration asset that hosts a near-surface uranium resource with strong expansion potential as well as robust discovery upside potential regionally on the property. Skyharbour as a large shareholder of Tisdale is excited for the company to unlock further value at the project.”

Jordan Trimble is the President and Chief Executive Officer as well as a Director of Skyharbour Resources Ltd. Under his leadership Skyharbour has grown from a $2 million shell company to a $90 million market cap as a leading exploration company in the Athabasca Basin. Skyharbour is advancing numerous projects including its co-flagship Moore and Russell Lake uranium projects, and it has a portfolio of over 587,000 hectares of mineral claims across 29 projects.

Through his career Mr. Trimble has founded and helped manage several public and private companies having worked in the resource industry in various roles specializing in management, corporate finance and strategy, shareholder communications, business development and capital raising. He is a frequent speaker at resource and mining conferences globally and has appeared on various media outlets including BNN and the Financial Post. Mr. Trimble holds a Bachelor of Science Degree with a Minor in Commerce from the University of British Columbia, and he is a CFA® Charterholder and served a full term as a Director of the CFA Society Vancouver.

ON BEHALF OF THE BOARD OF TISDALE CLEAN ENERGY CORP.

“Alex Klenman”

Alex Klenman, CEO

For further information please contact:

Alex Klenman, CEO

Tel: 604-970-4330

Tisdale Clean Energy Corp

Suite 2200, HSBC Building, 885 West Georgia St.

Vancouver, BC V6C 3E8 Canada

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain “Forward-Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company’s current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.