The Company is progressing the development at the Makuutu Heavy Rare Earths Project through local Ugandan operating entity Rwenzori Rare Metals Limited ("RRM").

Assay results for 56 holes of the 128-hole Phase 5 resource infill and extension drilling program completed on Retention Licence (RL) 00007 have been received. The program is intended to increase resource estimation confidence from inferred to indicated status on resource areas A and B, and to test extensions of those areas to expand the mineral resource area. Figure 1* is a plan of the Makuutu 2022 Mineral Resource Estimate (MRE) and exploration target areas with MRE areas A and B located on the western end of the deposit located within RL00007.

Intersections compiled above the MRE lower cut-off of 200ppm Total Rare Earth Oxide less Cerium Oxide (TREO-CeO2) are listed in Table 1* and shown diagrammatically in plan view in Figure 2*.

Drilling was on a 200 metre spaced pattern with forty nine (49) of the drill holes being extensions to the MRE and seven (7) are MRE Area A infill holes. Figure 2* shows the core hole locations (diamond shape) with intersection thickness (point size) and TREO grade (point colour) with the reported 200 metre spaced holes with bold hole numbers and the previous 400m spaced holes in italic hole numbers. Previously reported regional exploration RAB drill holes are also shown (round points).

The 49 extension holes were drilled up to 1.8 kilometres west of the western boundary of MRE Area A, within the Makuutu mineralised trend. This extension drilling shows mineralisation continues beyond the MRE boundary with narrow intersections in low lying areas on the margins of the mineralised plateaus and increasing in thickness on the plateaus.

The resulted infill holes have generally shown thicker and higher-grade intervals than the original 400 metre spaced drill holes used to estimate the inferred resource. Best intersections include;

- RRMDD762, with 21.8 metres at 783ppm TREO from 4.7 metres depth; and

- RRMDD761, with 16.7 metres at 714ppm TREO from 4.7 metres depth.

Several of both extension and infill drill holes show high grade heavy rare earth (HREO) and critical rare earth (CREO) intersections including extension holes;

- RRMDD712, with 9.9 metres at 952ppm TREO including 430ppm HREO and 530ppm CREO;

- RRMDD713, with 6.7 metres at 1,008ppm TREO with 428ppm TREO and 483ppm CREO; and

- RRMDD767, with 9.9 metres at 1,163ppm TREO with 672ppm HREO and 641ppm CREO.

The elevated proportions of HREO and CREO coincide with weathered limonitic veining and alteration in the clay and underlying saprock. Furter investigations of these results is required to determine the extents of these high-grade zones.

The results from the remaining 72 drill holes are currently at the laboratory in Perth being analysed or in transit from Makuutu to Perth for analysis.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/5K3XL569

About Ionic Rare Earths Limited:

Ionic Rare Earths Limited (ASX:IXR) (OTCMKTS:IXRRF) is focused on developing its flagship Makuutu Rare Earths Project in Uganda into a significant long life, low-cost, supplier of high-value critical and heavy rare earths.

Makuutu is an advanced-stage, ionic adsorption clay-hosted project highlighted by near-surface mineralisation, significant exploration upside, excellent metallurgical characteristics and access to tier-one infrastructure.

The ionic adsorption clay-hosted geology at Makuutu is similar to major rare earths projects in Southern China, which are responsible for the majority of global supply of low cost heavy and critical rare earths, specifically the high value magnet metals (Dysprosium and Terbium) Heavy Rare Earths (>98% originating from ionic clays). Metallurgical testing at Makuutu has returned excellent recovery rates, which provide multiple avenues for a simple process route.

Makuutu is well-supported by tier-one existing infrastructure which includes access to major highways, roads, power, water and a professional workforce.

Rare Earths will play a critical role in the future of clean energy. Rare Earths are a key ingredient in the permanent magnets found in wind turbines and electric vehicles.

IonicRE is led by an experienced and proven team, who have the capabilities to deliver Makuutu into production and realise value for all stakeholders.

Source:

Ionic Rare Earths Limited

Contact:

For Australian Media

Nigel Kassulke

Teneo

E: Nigel.Kassulke@Teneo.com

T: +61 (0) 407 904 874

For Investor Relations

Peter Taylor

NWR Communications

E: peter@nwrcommunications.com.au

T: +61 (0) 412 036 231

For UK Media

Tim Blythe

BlytheRay

E: Tim.Blythe@BlytheRay.com

T: + (0) 20 7138 3553

For NI Media

Katie Doran

Lanyon Group

E: Katie.Doran@LanyonGroup.com

T: +44 (0) 28 9018 3242

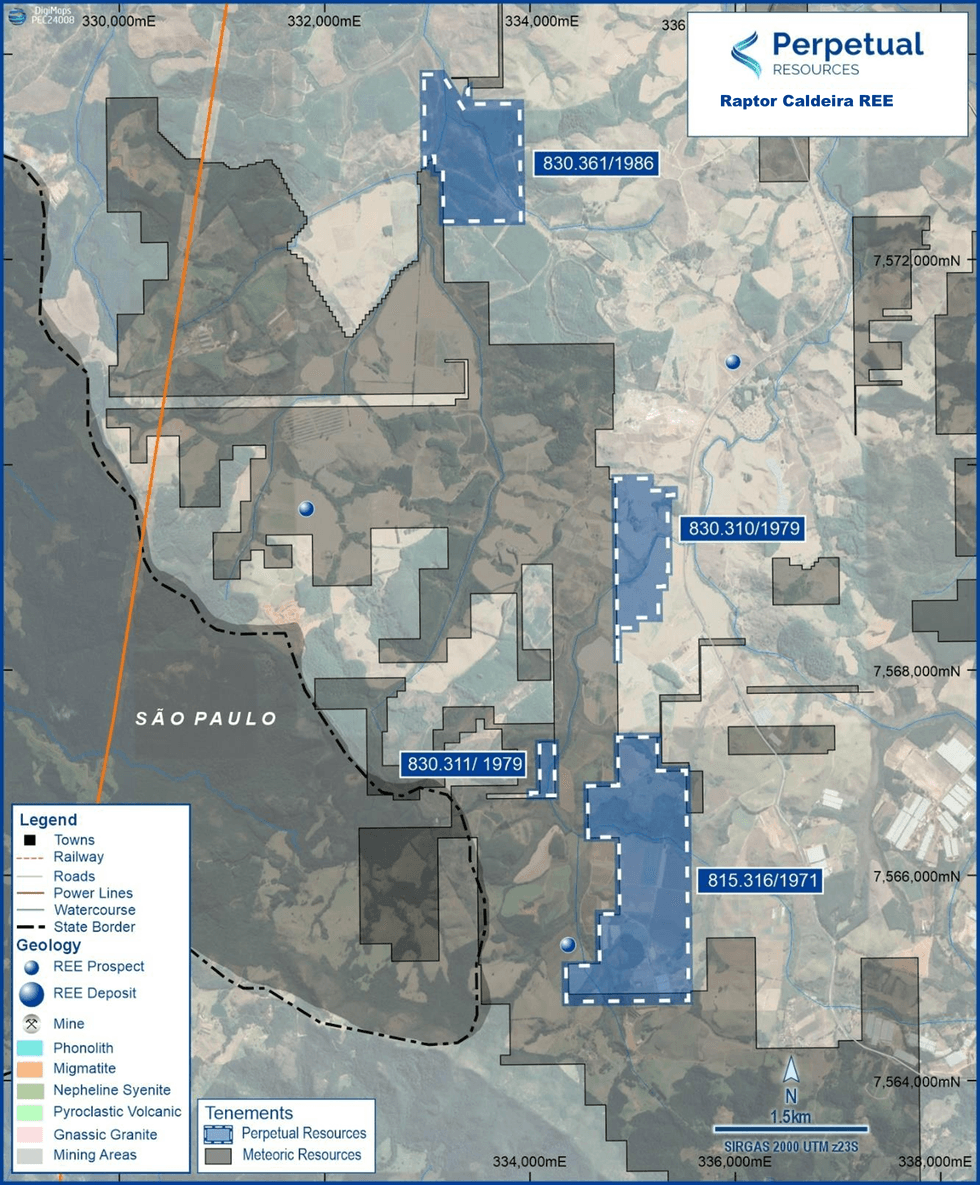

Figure 1 – Regional map showing location of Perpetual’s Raptor Caldeira tenements, located within the Alkaline Complex of Poços de Caldas, Minas Gerais.

Figure 1 – Regional map showing location of Perpetual’s Raptor Caldeira tenements, located within the Alkaline Complex of Poços de Caldas, Minas Gerais. Figure 2 – Close up map showing location of Perpetual’s Raptor Caldeira tenements, located within the Alkaline Complex of Poços de Caldas, Minas Gerais

Figure 2 – Close up map showing location of Perpetual’s Raptor Caldeira tenements, located within the Alkaline Complex of Poços de Caldas, Minas Gerais

Figure 1: MREC testwork flowsheet.

Figure 1: MREC testwork flowsheet.