- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Resource

Popular Lists

Investing Ideas

Outlook Reports

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

Investing Guides

Tech

Popular Lists

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

Investing Ideas

Outlook Reports

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

Investing Guides

Life Science

Popular Lists

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

Outlook Reports

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Investing Guides

March 06, 2023

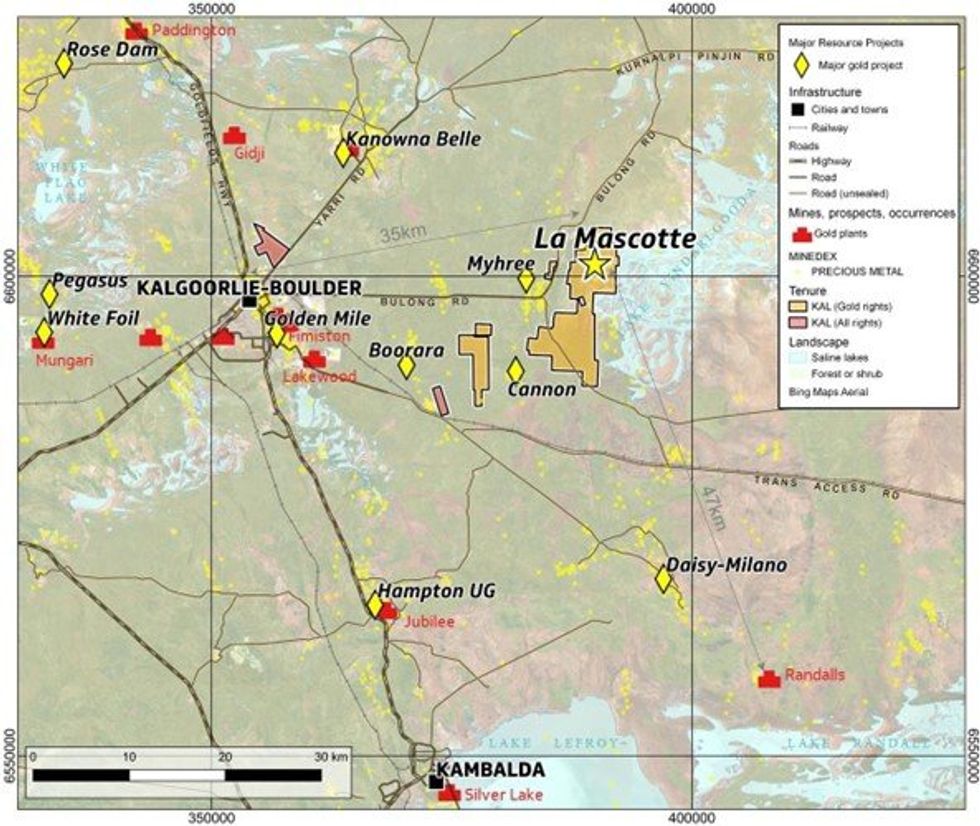

WA-focused gold explorer, Kalgoorlie Gold Mining (ASX:KAL) (‘KalGold’ or ‘the Company’), is pleased to announce the first JORC (2012) Mineral Resource at the La Mascotte gold deposit within the Bulong Taurus project, 35km to the east of Kalgoorlie-Boulder.

Highlights

- La Mascotte is one of the few outcropping gold deposits in the Eastern Goldfields

- First ever La Mascotte JORC (2012) Inferred Mineral Resource Estimate of:

- 3.61 Mt @ 1.19 g/t Au for 138,000 oz (0.6 g/t cut-off)

- Resource is estimated above the 220 mRL, or to a depth of ~140 m below surface on a granted mining lease

- Modelled resource footprint measures 700 m north-south by 500 m east-west, with multiple stacked mineralised horizons demonstrating a total sectional thickness of up to ~175 m

- Mineralisation remains open below 220 mRL at several target areas

- Potential for significant resource growth and upgrade with additional drilling

- KalGold direct expenditure cost of only ~A$5 per gold ounce (including drilling and assays)

The JORC (2012) Mineral Resource Estimate at La Mascotte has been estimated at:

3.61 Mt @ 1.19 g/t Au for 138,000 oz at a 0.6 g/t cut-off (Inferred).

This includes a higher-grade component of 1.35 Mt @ 1.92 g/t Au for 83,000 oz at a 1.0 g/t cut-off.

KalGold Managing Director and CEO Matt Painter said:

“The definition of 138,000 oz of gold from surface only 35km east of Kalgoorlie Boulder is a major milestone in KalGold’s short history. It reinforces our objective of discovering and defining gold resources in the Eastern Goldfields of Western Australia.

“La Mascotte is one of the few remaining outcropping gold deposits in the Eastern Goldfields. This initial JORC (2012) Mineral Resource Estimate highlights our cost-efficient approach to building a mineral resource base and strengthens KalGold’s credentials as a highly effective gold discovery company. For example, the incorporation of historic drill data into this JORC (2012) Mineral Resource Estimate has saved the Company $1.6 million in drilling-related costs, delivering a realised discovery cost of only $5/oz.

“With gold mineralisation remaining open at depth, KalGold will progress the La Mascotte mineral resource with additional work. We look forward to updating investors on our progress throughout CY2023.”

The La Mascotte Gold Deposit

The La Mascotte gold deposit is one of the few remaining outcropping gold deposits near Kalgoorlie- Boulder in the Eastern Goldfields of Western Australia. Located less than 35km east of the city on the sealed Bulong Road, the deposit can be accessed within 30 minutes’ drive from Kalgoorlie.

La Mascotte is located within the (historic gold rush era) Taurus Goldfield, immediately to the east of the Bulong Goldfield. Geologically, the deposit is hosted by a deformed, metamorphosed, felsic-intermediate volcanosedimentary sequence locally intruded by ultramafic to felsic porphyry pods and dykes. This sequence is juxtaposed against a nickel-mineralised ultramafic sequence to the west and north. Separating these sequences is the regionally extensive, deformed Goddard Fault. KalGold believes this fault to be the controlling structure for gold mineralisation throughout the Taurus Goldfield. Further south along strike, this hosts the high-grade Daisy Milano gold mine operations in the Mt Monger Goldfield.

Although outcrop at La Mascotte is poor, gold-mineralised quartz veining and altered felsic-intermediate volcaniclastic rocks are evident as subcrop and float over several hundred metres (Figure 3). Gold nuggets have also been recovered by our prospector partners over the area (Figure 4). Furthermore, shallow excavations in these areas exhibit a prevailing shallow westerly dip of strata, foliation, and veining.

Click here for the full ASX Release

This article includes content from Kalgoorlie Gold Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

13h

John Feneck: Gold Landscape Never Better, Plus 9 Stocks on My Radar Now

John Feneck, portfolio manager and consultant at Feneck Consulting, shares his updated outlook for gold, saying that the yellow metal still has space to run.

He also discusses nine gold and "special situations" companies that are on his radar.

Watch the interview for more, or click here for the Investing News Network's Prospectors & Developers Association of Canada convention playlist on YouTube.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

13h

Brian Leni: Latest Mining Stock Wins and How I'm Deploying Cash Now

Brian Leni, founder of Junior Stock Review, runs through his investment strategy, saying he's looking for stocks with an "X factor" that's being overlooked.

Watch the interview above for more of this thoughts.

You can also click here to view the Investing News Network's Prospectors & Developers Association of Canada convention playlist on YouTube.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

14h

The Mar-a-Lago Accord: What it is and What it Means for the Dollar, Global Trade and Gold

US President Donald Trump’s economic policies and vision for trade have reignited speculation about a potential multinational deal aimed at addressing what some view as a persistently overvalued dollar.

Although no formal agreement has been announced, analysts have coined the term “Mar-a-Lago Accord” to describe a possible effort to rebalance global currency markets, borrowing from the 1985 Plaza Accord.

Origins of the Mar-a-Lago Accord

The phrase has gained traction following the release of a November 2024 paper written by Stephen Miran, Trump’s nominee for the White House Council of Economic Advisers. In it, Miran proposes several strategies to reform global trade and counteract the economic imbalances caused by what he calls an excessively strong dollar.

Similarly, prior to assuming his position as secretary of the treasury, Scott Bessent suggested in June 2024 that a “grand economic reordering” could take place in the coming years.

While details remain speculative, the general premise behind the Mar-a-Lago Accord revolves around Trump’s commitment to boosting American manufacturing and exports. The challenge lies in the dollar’s current strength, which makes US goods less competitive abroad. With the US trade deficit reaching a record US$1.2 trillion in 2024, some economists argue that a weaker dollar could help bridge the gap by making American exports more attractive.

The idea of a coordinated effort to weaken the dollar is not new.

In 1985, the US and key trading partners — including Japan, France, the UK and West Germany — agreed to the Plaza Accord, a deal aimed at curbing the dollar’s strength. At the time, US manufacturers were struggling against Japan’s export dominance, much like today’s concerns regarding China.

The Plaza Accord succeeded in lowering the dollar’s value, but it also had unintended consequences, such as Japan’s economic stagnation in the 1990s.

Potential mechanisms of a Mar-a-Lago Accord

If such an agreement were to take shape, it could involve several key components.

Trade and tariff adjustments could be central, as Trump has floated the idea of replacing the Internal Revenue Service with an “External Revenue Service” that collects funds from foreign countries.

This indicates a shift toward economic policies that could pressure trading partners into compliance.

Currency interventions might also play a role, with governments potentially agreeing to coordinated efforts in foreign exchange markets to adjust currency values. However, given today’s massive US$7.5 trillion daily foreign exchange trading volume, direct interventions might be less effective than they were in the 1980s.

Adrian Day, president of Adrian Day Asset Management, told the Investing News Network that the ideas that make up the Mar-a-Lago Accord form a “loose collection of disparate policies” rather than a cohesive plan.

However, he cautioned against dismissing them outright. “Jim Bianco said you don’t need to take all of this literally, but you need to take it very seriously,” he commented. Day also emphasized in the converation that Trump often starts negotiations with extreme positions before settling on more moderate policies.

A significant aspect of this discussion revolves around security. The US has long subsidized defense for Europe and other allies, and Trump has suggested that foreign governments should bear a larger financial burden.

Debt restructuring is another controversial idea related to the Mar-a-Lago Accord.

“One of the more extreme proposals, frankly, is that the US will require foreign governments who hold treasuries to exchange those treasuries for 100 year non-tradable zero coupons,” Day noted, adding that the proposal would tie these exchanges to security commitments, using military presence as leverage. “Carrot and stick — we’ll keep the Seventh Fleet in the Red Sea if you exchange your treasuries, but if you don’t, you’re on your own.”

A weaker dollar could lead to higher inflation by increasing the cost of imports. Investors who traditionally see US assets as a safe haven might also shift capital toward alternative currencies such as the euro or yen.

Furthermore, any attempt to force trading partners into an unfavorable debt swap could disrupt the US$29 trillion treasury market, a cornerstone of global finance.

What does the Mar-a-Lago Accord mean for gold?

One of the most consistent takeaways from Mar-a-Lago Accord discussions is its bullish implications for gold.

A weaker dollar historically drives demand for gold as a store of value, and uncertainty surrounding US debt policies could further boost the metal’s appeal. “Every single one of these proposals is gold bullish,” Day remarked.

An additional subject of speculation is the idea that the administration could make use of the country’s gold stockpile. At current market prices, the gold held in Fort Knox, Kentucky, and other locations would be worth about US$758 billion, but it is valued at only US$11 billion on the Federal Reserve’s balance sheet due to a 1973 law that set its price.

Trump and Elon Musk have both expressed interest in verifying Fort Knox's gold reserves, fueling speculation.

Meanwhile, Bessent has discussed the potential of monetizing “the asset side of the US balance sheet for the American people,” though he has clarified that a gold revaluation is not what he had in mind.

Analysts speculate that any push to devalue the dollar while restructuring US obligations could set off a chain reaction in commodities markets, further amplifying gold’s importance.

If foreign investors perceive US economic policies as a shift away from traditional fiscal discipline, they may increase their allocations to gold as a hedge against potential volatility in treasury markets.

While the Mar-a-Lago Accord remains more of a concept than a concrete policy, its potential implications are vast.

The coming months will reveal whether the Trump administration will formally pursue these strategies or if they will remain theoretical discussions among economists and strategists.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Keep reading...Show less

11 March

Willem Middelkoop: Gold to Benefit as Chaos Rises, Silver's Path to US$100

Willem Middelkoop, founder of Commodity Discovery Fund, shared his thoughts on the commodities space, saying that an "era of shortages" is arriving.

He believes that will propel prices up from today's rock-bottom levels, creating investment opportunities.

Middelkoop also discussed geopolitics, looking at recent moves from the Trump administration.

Click here to view the Investing News Network's Prospectors & Developers Association of Canada convention playlist on YouTube.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

11 March

Chen Lin: Gold, Silver, Critical Minerals — Where I'm Investing in 2025

Chen Lin of Lin Asset Management told the Investing News Network where he's investing in 2025, mentioning gold, silver and critical minerals.

In his view, the mining industry is returning to exciting times after a long bear market.

Watch the interview above for more from Lin on those topics.

You can also click here to view the Investing News Network's Prospectors & Developers Association of Canada convention playlist on YouTube.

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

11 March

Will Trump Bring Back the Gold Standard?

The gold standard hasn’t been used in the US since the 1970s, but during Donald Trump's first term from 2017 to 2021 there was some speculation that he could bring it back.

Rumors that the gold standard could be reinstated during Trump’s presidency centered largely on positive comments he made about the idea. Notably, he suggested that it would be “wonderful” to bring back the gold standard, and a number of his advisors were of the same mind — Judy Shelton, John Allison and others supported the concept.

Now that Trump is back in the White House, some are again wondering if he will return the country to the gold standard. Speaking on his War Room podcast back in December 2023, Steve Bannon, Trump's former chief strategist, said he believes the president could ditch the US Federal Reserve and bring back the gold standard in his second term in office.

More recently, the Heritage Foundation included a whole chapter on the Federal Reserve in its Project 2025 (a proposed blueprint for Trump's second term), and mentioned the option of eliminating the Federal Reserve to make way for a return to the gold standard.

While Trump has publicly disavowed Project 2025, its creators say he is privately supportive of the initiative, and he has implemented many of their suggestions. Additionally, the chapter's author, Paul Winfree, is a former member of Trump's 2016 transition team and 2017 administration.

Since re-entering office, Trump has also shown interest in the physical gold stored in Fort Knox, Kentucky. The president and Elon Musk have repeatedly questioned whether some of the gold may have been stolen, and Musk has suggested an audit of the 147 million ounces of gold stored in the vault. It remains to be seen whether the audit will take place, but it has added an extra unknown to the gold space.

Read on to learn what the gold standard is, why it ended, what Trump has said about bringing back the gold standard — and what could happen if a gold-backed currency ever comes into play again.

In this article

- What is the gold standard?

- When was the gold standard introduced?

- What countries are on the gold standard today?

- Why was the gold standard abandoned?

- What is the US dollar backed by?

- What has Trump said about the gold standard?

- What does Project 2025 say about the gold standard?

- Would it be feasible for the US to return to the gold standard?

- Is there enough gold to return to the gold standard?

- What would happen if the US returned to the gold standard?

What is the gold standard?

What is the gold standard and how does it work? Put simply, the gold standard is a monetary system in which the value of a country’s currency is directly linked to the yellow metal. Countries using the gold standard set a fixed price at which to buy and sell gold to determine the value of the nation’s currency.

For example, if the US went back to the gold standard and set the price of gold at US$1,000 per ounce, the value of the dollar would be 1/1000th of an ounce of gold. This would offer reliable price stability.

Under the gold standard, transactions no longer have to be done with heavy gold bullion or gold coins. The gold standard also increases the trust needed for successful global trade — the idea is that paper currency has value that is tied to something real. The goal is to prevent inflation as well as deflation, and to help promote a stable monetary environment.

When was the gold standard introduced?

The gold standard was first introduced in Germany in 1871, and by 1900 most developed nations, including the US, were using it. The system remained popular for decades, with governments worldwide working together to make it successful, but when World War I broke out it became difficult to maintain. Changing political alliances, higher debt and other factors led to a widespread lack of confidence in the gold standard.

What countries are on the gold standard today?

Currently, no countries use the gold standard. Decades ago, governments abandoned the gold standard in favor of fiat monetary systems. However, countries around the world do still hold gold reserves in their central banks. The Fed is the central bank of the US, and as of February 2025 its gold reserves came to 8,133.46 metric tons.

Why was the gold standard abandoned?

The demise of the gold standard began as World War II was ending. At this time, the leading western powers met to develop the Bretton Woods agreement, which became the framework for the global currency markets until 1971.

The Bretton Woods agreement was born at the UN Monetary and Financial Conference, held in Bretton Woods, New Hampshire, in July 1944. Currencies were pegged to the price of gold, and the US dollar was seen as a reserve currency linked to the price of gold. This meant all national currencies were valued in relation to the US dollar since it had become the dominant reserve currency. Despite efforts from governments at the time, the Bretton Woods agreement led to overvaluation of the US dollar, which caused concerns over exchange rates and their ties to the price of gold.

By 1971, US President Richard Nixon had called for a temporary suspension of the dollar’s convertibility. Countries were then free to choose any exchange agreement, except the price of gold. In 1973, foreign governments let currencies float; this put an end to Bretton Woods, and the gold standard was ousted.

What is the US dollar backed by?

Since the 1970s, most countries have run on a system of fiat money, which is government-issued money that is not backed by a commodity. The US dollar is fiat money, which means it is backed by the government, but not by any physical asset.

The value of money is set by supply and demand for paper money, as well as supply and demand for other goods and services in the economy. The prices for those goods and services, including gold and silver, can fluctuate based on market conditions.

What has Trump said about the gold standard?

While it’s perhaps not common knowledge, Trump has long been a fan of gold.

In fact, as Sean Williams of the Motley Fool has pointed out, Trump has been interested in gold since at least the 1970s, when private ownership of gold bullion became legal again. He reportedly invested in gold aggressively at that time, buying the precious metal at about US$185 and selling it between US$780 and US$790.

Since then, Trump has specifically praised the gold standard. In an oft-quoted 2015 GQ interview that covers topics from marijuana to man buns, Trump said, “Bringing back the gold standard would be very hard to do, but boy, would it be wonderful. We’d have a standard on which to base our money.”

In a separate interview that year, he said, “We used to have a very, very solid country because it was based on a gold standard.”

According to Politico’s Danny Vinik, “(Trump has) surrounded himself with a number of advisors who hold extreme, even fringe ideas about monetary policy. … At least six … have spoken favorably about the gold standard.” Shelton and Allison, mentioned above, are not alone. Others include Ben Carson and David Malpass. The last two, Rebekah and Robert Mercer, eventually distanced themselves from Trump, but had a strong influence before that.

Emphasizing how unusual Trump’s support for the international gold standard is, Joseph Gagnon, a senior fellow at the Peterson Institute for International Economics, told the news outlet, “(It) seems like nothing that’s happened since the Great Depression.” Gagnon, who has also worked for the Fed, added, “You have to go back to Herbert Hoover.”

Back in 2017, Politico also quoted libertarian Ron Paul, another gold standard supporter, as saying, “We’re in a better position than we’ve ever been in my lifetime as far as talking about serious changes to the monetary system and talking about gold.”

What does Project 2025 say about the gold standard?

In its chapter on the Federal Reserve, Project 2025 discusses the pros and cons of a return to the gold standard or other commodity-backed monetary system. The chapter's author, Paul Winfree, weighs several monetary reform options, listing the gold standard as the second most effective option "against inflation and boom-and-bust recessionary cycles."

Project 2025 aims to severely reduce the current powers of the Federal Reserve, including its ability to purchase federal debt and other financial assets as well as bail out big financial institutions. Winfree also proposes removing maximizing employment from the Fed’s mandate.

The document offers several paths to a potential gold standard, including gold-convertible treasury instruments or a parallel fiat dollar and gold standard system to make a transition easier. However, Winfree writes, "We have good reasons to worry that central banks and the gold standard are fundamentally incompatible—as the disastrous experience of the Western nations on their 'managed gold standards' between World War I and World War II showed."

On the more extreme end, the policy playbook also explores dismantling the Federal Reserve in favor of the gold standard alone. In the view of Project 2025, this would reduce the risk of inflation because there would be no central bank to print money and bail-out the banks. On the other hand, Winfree states that the two-year election system means they should be cautious about causing too much disruption to financial markets and the economy.

While the Trump Administration 2.0 has yet to implement any of the Project 2025 recommendations on the Federal Reserve discussed above, the president did sign an Executive Order in mid-February that would give the Executive Branch oversight and control of regulatory agencies like the Fed. However, the order does provide an exemption for the central bank’s ability to set interest rates.

Would it be feasible for the US to return to the gold standard?

Trump’s first term as president passed without a return to the gold standard, and the consensus seems to be that it’s highly unlikely that this event will come to pass — even with him at the helm once again.

Even many ardent supporters of the system recognize that going back to it could create trouble.

As per the Motley Fool’s Williams, economists largely agree that moving to a lower-key version of the gold standard in 1933 was “a big reason why the US emerged from the Great Depression,” and a return would be a mistake.

This is the take of Kevin Bahr, chief analyst of the Center for Business and Economic Insight. "History has shown that the gold standard was highly ineffective in dealing with inflation and economic downturns. Although the gold standard can limit the printing of money which could cause inflation, the printing of money is not always the reason that inflation occurs," explains Bahr. "Inflationary pressures caused by World War I resulted from supply shortages and the ramp-up in demand for certain products and resources caused by the war effort. Simply having a fixed money supply tied to gold didn’t solve the problems; consequently, countries bailed from the gold standard to gain more control over monetary policy and inflationary pressures."

Bahr also states that the gold standard would not have prevented the most recent bout of inflation that followed the global COVID pandemic. Quite the opposite, in fact. "Rather, the lack of a gold standard helped countries deal with the effects of inflation. The gold standard could have exacerbated the inflationary problem by preventing any central bank actions," he wrote.

But if Trump or a future president did decide to go through with it, what would it take?

According to Kimberly Amadeo at the Balance, due to trade, money supply and the global economy, the rest of the world would need to go back to the gold standard as well. Why? Because otherwise the countries that use the US dollar could stand with their hands out asking for their dollars to be exchanged for gold — including debtors like China and Japan, to which the US owes a large chunk of its multitrillion-dollar national debt.

Is there enough gold to return to the gold standard?

The fact that the US doesn’t have enough gold in its reserves to pay back all its debt poses a huge roadblock to returning to the gold standard. The country would have to exponentially replenish its gold reserves in advance of any return to the gold standard.

"The United States holds around 261.5 million troy ounces of gold, valued at approximately $489 billion. The total US money supply exceeds $20 trillion, necessitating about 272,430 metric tons of gold at current market prices," explained Ron Dewitt, Director of Business Development at the Gold Information Network, in a June 2024 LinkedIn post.

"The supply remains insufficient, even including global gold stocks, which total around 212,582 metric tons."

In addition, it's understood that returning to the gold standard would require the price of gold to be set much higher than it is currently. What would the price of gold need to be worth if the US returned to the gold standard? Financial analyst and investment banker Jim Rickards has calculated the gold price would need to jump up to at least US$27,000 an ounce.

That means the US dollar would be severely devalued, causing inflation, and since global trade uses the US dollar as a reserve currency, it would grind to a halt. Conversely, returning to the gold standard at a low gold price would cause deflation.

What would silver be worth if the US returned to the gold standard? It's not a guarantee that silver would follow in gold's footsteps if a gold standard was re-established due to its many industrial and technological applications. While silver has a long history as a precious metal and played an important role as currency for much of human history, its value today is intrinsically linked to that demand as well.

What would happen if the US returned to the gold standard?

Returning to the gold standard would have a huge impact on all levels of the US economy and make it impossible for the Fed to offer fiscal stimulus. After all, if the US had to have enough gold reserves to exchange for dollars on an as-needed basis, the Fed’s ability to print paper currency would be incredibly limited.

Supporters believe that could be the perfect way to get the US out of debt, but it could also cause problems during times of economic crisis. It’s important to remember that because 70 percent of the US economy is based on consumer spending, if inflation rose due to the gold price rising, then a lot of consumers would cut spending.

That would then affect the stock market as well, which could very well lead to a recession or worse without the ability of the government to soften that blow via money supply. "Transitioning to a gold standard during an economic crisis would severely limit monetary policy options and could lead to economic instability," Dewitt warned.

For that reason, a return to the gold standard would also expose the US economy to the yellow metal’s sometimes dramatic fluctuations — while some think that gold would offer greater price stability, it’s no secret that it’s been volatile in the past. Looking back past the metal’s recent stability, it dropped quite steeply from 2011 to 2016.

Moreover, speaking to Congress on this issue in 2019, Fed Chair Jerome Powell warned against a return to the gold standard.

“You’ve assigned us the job of two direct, real economy objectives: maximum employment, stable prices. If you assigned us (to) stabilize the dollar price of gold, monetary policy could do that, but the other things would fluctuate, and we wouldn’t care,” Powell said. “There have been plenty of times in fairly recent history where the price of gold has sent a signal that would be quite negative for either of those goals.”

As can be seen, returning to the gold standard would be a complex ordeal with pros and cons. The likelihood of the US bringing back the gold standard is slim, but no doubt the question will continue to be up for debate under future presidents.

This is an updated version of an article first published by the Investing News Network in 2017.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

Latest News

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.