- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Clean High Purity Lithium Using Direct Extraction in the Lithium Triangle

This Lake Resources profile is part of a paid investor education campaign.*

Overview

Lake Resources (ASX:LKE,OTCQB:LLKKF) is a lithium exploration and development company focused on producing high-purity sustainable lithium at a low-cost from its three wholly-owned lithium brine projects in Argentina. The projects lie within one of the largest wholly-owned land packages amongst the largest players within the Lithium Triangle, which is home to 40 percent of the world's lithium supply.

Lake Resources is primarily advancing its wholly owned Kachi lithium project which is approximately 100 kilometers south of FMC Lithium's (NYSE:LTHM) Hombre Muerto lithium brine production site. The property hosts a 2018 mineral resource estimate of 4.4 million tonnes of contained lithium carbonate equivalent. The report outlines an indicated resource of 1 million tonnes of lithium carbonate equivalent and an inferred resource of 3.4 million tonnes lithium carbonate equivalent.

In May 2020 Lake Resources released a pre-feasibility study (PFS) for its Kachi lithium project, including a video webinar recording detailing the results. The PFS includes an annual production target of approximately 25,500 tonnes of battery-grade lithium carbonate using Lilac Solutions' direct lithium extraction technology. The study was based on Kachi's indicated resource of 1.01 million tonnes LCE at 290 mg/L lithium. The study projects an operating cost of US$4,178 per tonne, totaling approximately US$544 million in total capital expenses.

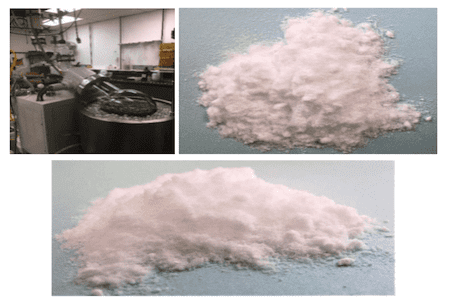

Lake Resources has partnered with Lilac Solutions Inc. to build a direct extraction pilot plant at the Kachi project. Lilac Solutions has developed a proprietary ion-exchange technology for the extraction of lithium from brine resources that can achieve high recoveries, minimal costs, rapid processing times and provide numerous environmental benefits. Together with its technology partner Lilac Solutions, Lake Resources has begun producing samples of lithium chloride from its direct lithium extraction pilot plant module. According to a July 2020 release, the samples taken from the pilot plant have consistently returned high concentrations of lithium chloride.

Moving forward, Lake Resources has appointed Hazen Research Inc (Hazen), a Colorado-based independent assay laboratory, to produce larger samples of its battery-quality lithium carbonate. Through its partnership with Hazen, Lake Resources intends to offer its product to potential off-takers and other interested parties. In addition to its partnerships with Hazen and Lilac, Lake Resources has appointed Novonix Battery Technology Solutions, a Nova Scotia-based independent testing and development laboratory, to create lithium battery test cells using Lake's lithium carbonate.

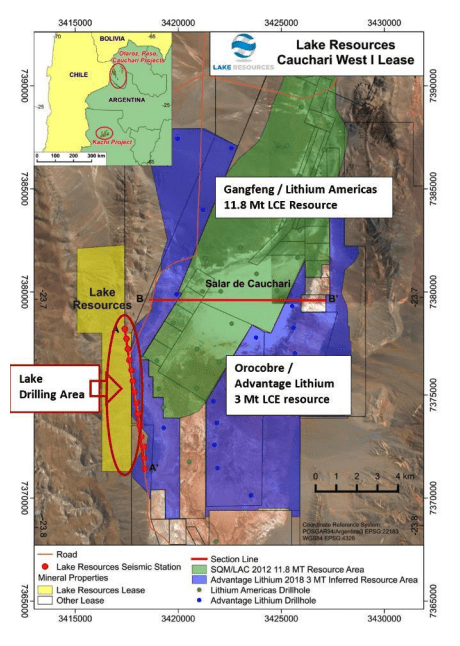

The Cauchari and Olaroz lithium brine projects are adjacent to one another and are surrounded by major players such as Lithium Americas Corp. (TSXV:LAC), SQM (NYSE:SQM), Ganfeng Lithium and Advantage Lithium Corp. (TSXV:AAL). Lake Resources is currently drilling on the Cauchari project and plans to commence drilling at Olaroz once finished at Cauchari. Drilling at Cauchari has so far returned values up to 540 mg/L lithium on the project. Lake Resources hopes to prove that both projects are extensions of the neighboring projects in the area.

Lake Resources' Company Highlights

- Three wholly-owned projects in stable mining jurisdictions in Argentina.

- Projects are near major lithium brine properties operated by Livent (FMC Lithium), Lithium Americas, SQM, Ganfeng Lithium and Orocobre / Advantage Lithium.

- Kachi property has a mineral resource estimate of 4.4 million tonnes of contained lithium carbonate equivalent.

- May 2020 PFS on Kachi projects 25,500 tonnes of battery-grade lithium carbonate at US$4,178 per tonne for a total cost of US$544 million — click here for the webinar recording

- SD Capital Advisory Limited has been retained to secure up to US$25 million to finance Kachi's development.

- In talks with downstream battery partners for the development of Kachi.

- Partnership in place with Lilac Solutions for direct brine extraction pilot plant.

- Working with Hazen Research to produce large samples of its battery-quality lithium carbonate

- Development laboratory Novonix Battery Technology Solutions appointed to produce lithium-ion battery test cells using Lake Resources' lithium carbonate

- Cauchari and Olaroz are thought to be extensions of neighboring resources.

- Drilling at Cauchari proved same brines, similar grades as lithium Americas Cauchari.

- Lake Resources is the only junior with proven lithium brines in Cauchari area.

- Values of up to 540 mg/L lithium have been intersected at Cauchari to date.

Lake Resources

Lake Resources' Kachi Lithium Brine Project

Lake Resources' wholly-owned Kachi lithium brine project encompasses 36 mining leases that cover 69,000 hectares in Catamarca province, Argentina. The property is approximately 100 kilometers south of FMC Lithium's Hombre Muerto lithium brine production site. The Kachi property also covers a 20-kilometer by a 15-kilometer salt lake.

2018 resource estimate

In November 2018, Lake Resources released its maiden resource for the Kachi project. The report outlined a resource estimate of 4.4 million tonnes of contained lithium carbonate equivalent. The report included an indicated resource of 1 million tonnes of lithium carbonate equivalent and an inferred resource of 3.4 million tonnes lithium carbonate equivalent.

“We are very pleased to report such a significant maiden JORC mineral resource estimate for Kachi. The team advanced drilling within 12 months on an undrilled project and defined a large resource and located a project that stands alongside the largest lithium projects in Argentina," said Lake Resources Managing Director Stephen Promnitz. “We will expand the resource with more drilling and move into a pre-feasibility study using conventional and a direct extraction technology from Lilac Solutions which indicate high recoveries, low costs and a reduced time to production of lithium."

Exploration

In 2017, Lake Resources completed a sampling and drill program at Kachi as well as a geophysical survey. The company collected 40 surface samples along the border of the salt lake that returned values up to 322 mg/L lithium and 209 mg/L lithium. The geophysical survey outlined a large, deep basin with brines between 400 meters to 800 meters deep. There is the potential to expand the brines at depth and to the south and west.

Drilling resulted in the discovery of a large, deep lithium brine-bearing basin that is similar in size to producing lithium projects across the globe. Highlights from the program include 308 mg/L lithium and 60 meters grading 326 mg/L lithium. The results also contained low impurities and magnesium content. Six of the seven holes completed remain open at depth.

Direct extraction pilot plant

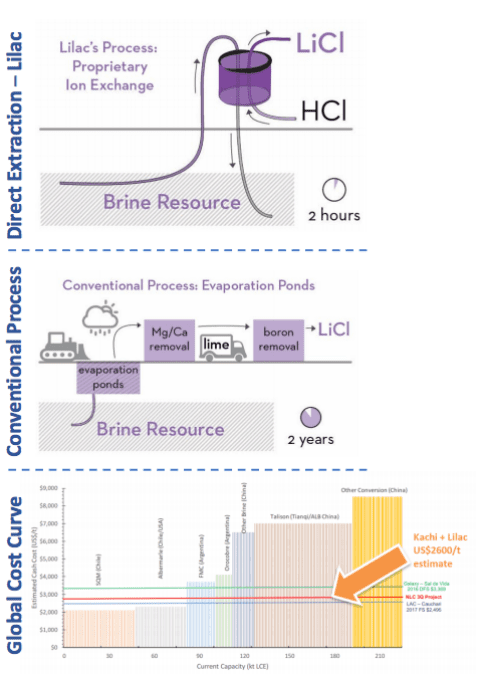

In September 2018, Lake Resources partnered with Lilac Solutions to further the development of the Kachi project. Lilac Solutions has developed a proprietary ion-exchange technology for the extraction of lithium from brine resources.

The technology can achieve high recoveries with minimal costs and has rapid processing times when compared to using evaporation ponds. It also provides numerous environmental benefits as it eliminates the need for evaporation ponds and decreases the footprint of the operation. The technology also allows for the remaining brine to be re-injected into the aquifer.

“Lake Resources is delighted to be partnering with Lilac on a rapid, direct extraction process of lithium from brines. We have reviewed a number of technologies, and we consider Lilac to offer a compelling opportunity to be reviewed in tandem with conventional methods as part of a pre-feasibility study," said Promnitz. “The potential to reduce the timeline to production at low-cost is a major advantage in the current market with a constrained supply of lithium. Increased recoveries indicate that 300 mg/L lithium brine would produce similar volumes of final product as 600 mg/L lithium brine."

Lilac and Lake Resources plan to build a pilot plant at Kachi to demonstrate the viability of the technology. Lake Resources expects to be able to increase its lithium grade to 25,000 mg/L lithium and to produce a clean lithium hydroxide or lithium carbonate product for the battery market. Lake Resources is targeting pre-production at Kachi in early 2020 at the pilot plant.

To aid in the development of the pilot plant and PFS, Lake Resources has appointed SD Capital Advisory Limited to secure up to US$25 million to finance the project's development.

2020 Prefeasibility Study

In May 2020 Lake Resources released a PFS on the Kachi property with a target of producing 25,500 tonnes of battery-grade lithium carbonate equivalent (LCE) using Lilac's direct extraction technology at an operating cost of US$4,178 per tonne. The study was based on an indicated resource of 1.01 million tonnes LCE at 290 mg/L lithium. “The PFS highlights the cost competitive nature and scale of the flagship Kachi project using direct extraction, but has the benefit of producing high-purity product capable of attracting premium pricing, while being a leader in sustainable lithium desired by Tier-1 electric vehicle makers," said Managing Director Steve Promnitz.

The company is also in discussions with various downstream partners in the battery industry to secure future offtake agreements and additional funding for the project's development.

Cauchari-Olaroz Lithium Brine Projects

The Cauchari and Olaroz lithium brine projects are adjacent to one another and surrounded by significant players in Jujuy province in Argentina. The projects are adjacent to the Orocobre's Olaroz lithium brine operations and projects under development by Lithium Americas, SQM, Ganfeng Lithium and Advantage Lithium Corp.

Exploration

Lake Resources began drilling on the Cauchari project, which has never been drilled before, in April 2019. The company encountered conductive lithium brines with values up to 480 mg/L lithium at depths of approximately 186 meters at Cauchari. The results compared favorably with the results from nearby pre-production areas that are currently under development.

In August 2019, Lake Resources announced its final results which included a significant high-grade lithium discovery at Cauchari. Higher grades averaging 493 mg/L lithium over 343 meters were recovered and the highest result returned 540 mg/L lithium.

Drill plans are currently in the works for Olaroz, which has not been drilled before either. Lake Resources hopes to prove that both projects are extensions of the other projects in the area and is targeting the same aquifers as its neighbors.

Additional Properties

Catamarca

The 72,000-hectare Catamarca pegmatite project is located in Ancasti, Catamarca Province and is 50 kilometers east of the city Catamarca. The project is accessible year-round. The area has hosted historical small-scale production for lithium-bearing spodumene pegmatites over a 150-kilometer area. Latin Resources (ASX:LRS) holds mining leases adjacent to the property and has received results of 4.9 percent lithium oxide and 7.1 percent lithium oxide from old mine workings.

Paso

The 29,000-hectare Paso lithium brine project is located in Jujuy Province in Argentina. The province is adjacent to the border of Chile and is immediately west of Orocobre's Olaroz lithium brine operations. Lake Resources' initial sampling program returned elevated results. The company has applied for the requisite drilling and exploration permits to continue its exploration on the property.

Lake Resources

Lake Resources' Management Team

Stephen Promnitz — Managing Director

Stephen Promnitz has considerable technical and commercial experience in Argentina. He is a geologist fluent in Spanish and has a history of exploring, funding and developing projects. He has previously been CEO and second in charge of mid-tier listed mineral explorers and producers (Kingsgate Consolidated, Indochine Mining), in corporate finance roles with investment banks (Citi, Westpac) and has held technical, corporate and management roles with major mining companies (Rio Tinto/CRA, Western Mining).

Stuart Crow — Chairman and Non-Executive Director

Stuart Crow has global experience in financial services, corporate finance, investor relations, international markets, salary packaging and stockbroking. He is passionate about assisting emerging and listed companies to attract investors and capital. He has owned and operated his own businesses.

Nick Lindsay — Non-Executive Director

Dr. Nick Lindsay has over 25 years of experience in Argentina, Chile and Peru in technical and commercial roles in the resources sector with major and mid-tier companies, as well as start-ups. He has a B.Sc. (Hons) degree in Geology, a Ph.D. in Metallurgy and Materials Engineering as well as an MBA. A fluent Spanish speaker, he has successfully taken companies in South America, such as Laguna Resources which he led as Managing Director, from inception to listing, development and subsequent acquisition. Lindsay is currently CEO of Manuka Resources Ltd, an unlisted company, having previously held the position of President – Chilean Operations for Kingsgate Consolidated Ltd and is a member of the AusIMM and AIG.

Dr Robert Trzebski — Non-Executive Director

Dr. Trzebski is currently Chief Operating Officer of Austmine Ltd and holds a degree in Geology, PhD in Geophysics, Masters in Project Management and has over 30 years of professional experience in project management and mining services.

He holds considerable operating and commercial experience in Argentina and Chile, as a Non-Executive Director of Austral Gold since 2007, listed on the ASX and TSX-V and is Chairman of the Audit and Risk Committee. His role with Austmine has allowed him to develop considerable contacts across the operating and technology space of the global resources industry. Dr. Trzebski is also a fellow of the Australian Institute of Mining and Metallurgy and is fluent in Spanish and German as well as English.

Sinead Teague — Company Secretary

Sinead Teague was appointed Company Secretary on July 2, 2019. As a governance and compliance professional, she has over 10 years of company secretarial experience across a range of industries and ASX-listed companies. She is also an associate member of the Governance Institute.

*Disclaimer: This profile is sponsored by Lake Resources N.L. (ASX:LKE). This profile provides information which was sourced by the Investing News Network (INN) and approved by Lake Resources N.L., in order to help investors learn more about the company. Lake Resources N.L. is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Lake Resources N.L. and seek advice from a qualified investment advisor.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2316.22 | -7.47 | |

| Silver | 27.16 | -0.12 | |

| Copper | 4.49 | +0.03 | |

| Oil | 82.84 | -0.52 | |

| Heating Oil | 2.56 | -0.02 | |

| Natural Gas | 1.64 | -0.17 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.