- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Trident Royalties PLC

Ramp Metals

Impact Minerals Limited

Purpose Bitcoin ETF

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Lake Resources: Strong Cauchari Results Confirm Proof of Concept

Lake Resources NL (ASX:LKE) announced today positive drilling results at Lake’s 100% owned Cauchari Lithium Brine Project in Argentina that compare favourably with adjoining major projects, with initial lithium results from conductive brines sampled in the upper section of the drillhole at around 186m depth.

Conductive brines with lithium values up to 480 mg/L obtained from upper sections of hole at approximately 186m depth at Lake’s Cauchari Lithium Brine Project, Argentina.

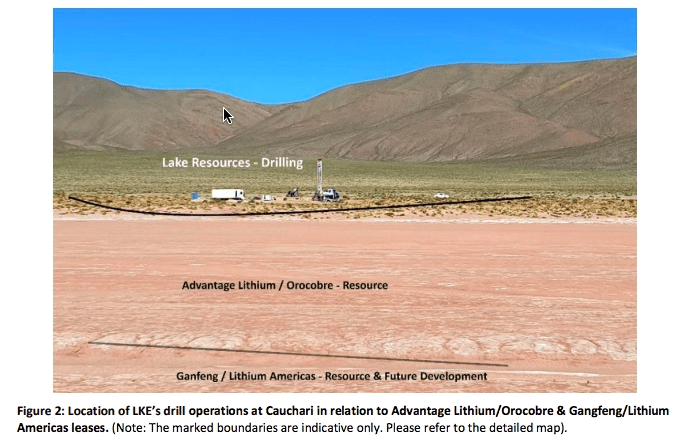

• Results compare favourably to similar lithium brine horizons in publicly available results from adjoining pre-production areas under development. This clearly demonstrates that Lake is drilling in the same basin with similar brines and thus better results are anticipated at depth.

• Diamond drill rig now below 255m having passed a challenging section of high-pressure fluids.

• The target is a ~350-450m sand horizon which has recorded higher lithium values and fluid flows in the adjoining project.

Lake Resources NL (ASX:LKE) announced today positive drilling results at Lake’s 100% owned Cauchari Lithium Brine Project in Argentina that compare favourably with adjoining major projects, with initial lithium results from conductive brines sampled in the upper section of the drillhole at around 186m depth (Figures 1-4).

Conductive brines with lithium values up to 480 mg/L were returned from a depth of 186m with low Mg/Li

ratios. These results echo similar lithium brine horizons in the upper sections of drillholes reported from the adjoining pre-production area of Ganfeng/Lithium Americas (LAC) and Advantage Lithium (AAL)/ Orocobre joint venture. Lake is drilling in the same basin with similar brines and therefore better results are anticipated at depth.

The closest drillhole in the Advantage Lithium (AAL)/ Orocobre joint venture is CAU15D, screened from 6-204m with 450mg/L lithium, located approximately 350m from Lake’s drilling area (refer Orocobre announcement and Advantage Lithium announcement 24/04/19). The closest drillhole in the Ganfeng/Lithium Americas (LAC) joint venture is PE-09, with 34 metres at 741 mg/L Lithium from 164m depth, located approximately 500m from Lake’s drilling area.

These are accredited results however larger samples will be collected once the hole is completed. The diamond drill rig is now below 255m having passed a challenging section of high fluid pressures and sands around 230m.

Lake’s technical team is encouraged that drilling is through this section which has previously caused drilling problems.

The current hole is targeting a sand horizon estimated between 350-450m which has recorded higher lithium

values and fluid flows in the adjoining project. Current drilling aims to unlock value from this rapidly emerging project, located immediately adjacent to a world-class brine project in pre-production in the Lithium Triangle, approximately 500m from the Ganfeng/Lithium Americas Cauchari project.

Commenting on the latest update, Lake’s Managing Director Steve Promnitz said: “This is a watershed moment for Lake, confirming proof of concept for our Cauchari project and highlighting its potential to replicate the success of similar projects in the same basin.

“The results vindicate our exploration thesis that the basin is fault-bonded and extends beneath thin alluvial cover, vindicating our decision to persist with drilling despite difficult conditions to deliver expected high-grade lithium values.

“Notably, the results compare very favorably to those at adjoining major pre-development projects subject to multi-billion dollar transactions. We look forward to reaching our targeted depths of between 350-450m and reporting on the lithium values from conductive brines at these deeper levels.”

Meanwhile, Lake is continuing to advance discussions with potential project partners in Asia and North America regarding development funding, with the aim of advancing towards production as quickly as possible.

Mr Promnitz added: “With a major project under development in the adjoining leases, these results reaffirm Cauchari’s potential to become a highly valuable project for Lake Resources, adding to our portfolio of wholly owned projects located in the heart of the Lithium Triangle.”

Click here to connect with Lake Resources NL (ASK:LKE) for an Investor Presentation

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2387.05 | -2.96 | |

| Silver | 28.58 | -0.07 | |

| Copper | 4.52 | 0.00 | |

| Oil | 83.19 | +0.05 | |

| Heating Oil | 2.54 | -0.01 | |

| Natural Gas | 1.76 | +0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.