Who are the Magnificent 7?

The term "Magnificent 7" was coined in 2023 by Bank of America analyst Michael Hartnett (although some give credit to Mike O'Rourke of Jones Trading), and refers to the seven large-cap tech stocks that came to dominate the markets in the final weeks of 2023 — namely, Apple, Meta Platforms, Nvidia, Tesla, Amazon, Microsoft and Alphabet, the parent company of Google.

The term is now a common moniker in the financial world. Daily reports on the companies' market activity have become a staple in all major news outlets, with analysts often speculating on what their record-breaking performances could mean for the stock market and the economy as a whole. The Magnificent 7 now serve as bellwethers of the tech sector, with their movements closely monitored by investors and financial professionals alike. Their influence seems to extend beyond their individual stock prices and serves as a signal of broader market trends and the health of the tech industry.

How are the Magnificent 7 performing?

Early on, some analysts expressed doubts about the continued relevance of the Magnificent 7. Indeed, as Nvidia blows past the other contenders and Tesla continues to lag farther behind – Tesla’s market cap now lags behind pharmaceutical giant Novo Nordisk – the diverging performance of individual stocks within the group has prompted some experts to now speak of the Fab Five, or even the Fab Four. These shifts have led O’Rourke to suggest that the era of the Magnificent 7 may be over.

Conversely, other analysts remain optimistic about the future of the Magnificent 7, highlighting their competitive advantages and dominant positions within their respective sectors.

“The Magnificent 7 group of leading technology companies is still a must-own, led by huge beats and stock reactions during the month from Facebook and Nvidia. But underneath the surface there are cracks emerging,” said Greg Taylor, chief investment officer at Purpose Investments, in a note on March 1, referring to the modest performances of Apple, Google and Tesla compared to Microsoft, Nvidia and Meta.

Tesla shares fell when Elon Musk failed to appease investor concerns over discouraging Q4 results in January, and dropped a further 7.2 percent on Monday (March 4) as the company reported its lowest sales in China since December 2022. Tesla has also been moved to reduce the price of its electric vehicles (EVs) in the face of competition from local makers like BYD. These events have led to Tesla's value diminishing in 2024. Last week (March 7), following positive early trial data for a new obesity drug, shares of Novo Nordisk surged upwards of 8 percent, bringing its market value above that of Tesla’s. As of writing, Novo Nordisk’s market cap sits at US$598.68 billion, while Tesla is valued at US$539.76 billion.

Meanwhile, Apple, which lost its title as the world’s most valuable company to Microsoft earlier this year, abandoned plans to create its own EV to focus on artificial intelligence (AI) projects to meet growing demand. While the company has been slow to unveil a product with AI capabilities, it has reportedly been working on generative AI tools to rival ChatGPT and Microsoft’s GitHub Copilot. Apple is also facing antitrust lawsuits in the US and Europe and was hit with a 1.8 billion euro fine by the European Commission on March 4.

On the other hand, Google’s Pixel 8 comes with AI features powered by its Tensor G3 chip, and its language model Gemini was chosen to be included in the Samsung Galaxy S24 series. Shares surged above the company’s all-time high on January 24 but fell a week later after fourth-quarter earnings revealed missed ad revenue expectations. The company also chose to pause Gemini’s image generation feature after it presented inaccurate historical depictions, an event that brought the stock down a further 4.4 percent.

On the other end of the spectrum, Meta issued its first-ever dividend to investors and made stock market history with its US$197 billion surge on February 2, and Microsoft claimed US$3 trillion in market capitalization for the first time in company history in January. The latter company is also rumored to be unveiling its first AI PC sometime in March.

However, Nvidia is leading the pack by a wide margin. The company’s fiscal year results, ending January 28, exceeded expectations by over US$2 billion, reflecting a remarkable 265 percent year-over-year growth. Nvidia’s performance drove a 10 percent increase in stock value, according to some analyses. Reuters reported an additional US$129 billion in stock market value after the results, with Nvidia as well as other hardware makers like Super Micro Computer, Broadcom and Arm Holdings being the biggest winners.

Is a bubble brewing?

The Magnificent 7 has had a significant impact on the overall performances of stock market indexes. The S&P 500 closed at a record high for the first time in two years in January and has notched a total of 15 record closes in 2024, most notably breaking the 5,000 level for the first time in its history in February. The Nasdaq also reached a new record high last week (February 29), beating its November 19, 2021 record close of 16,057.44 by 34.48 points. These gains were attributed to the strong performance of tech stocks, fueled by the growing enthusiasm and potential of AI.

However, when Reuters reported that all three of Wall Street's major indexes had retreated upwards of one percent on Tuesday, weakness in mega-cap growth and the chip sector was given as one of the reasons why. This observation suggests high sensitivity to the Magnificent 7’s performance and raises the question of how a significant downturn in their stock prices could impact the broader market.

“Markets have experienced an incredible rally since the end of October when everyone was convinced that Central Bankers had kept rates too high for too long. But as the data is getting better and the ‘soft landing’ seems more likely (at least in the US), markets have celebrated with a record run,” Taylor wrote in his note.

“However, the rally has not been broadly based, and concentration risk is becoming very real in many markets.”

Marko Kolanovic of JP Morgan recently cautioned clients in a note that the rapid ascent of both tech stocks and Bitcoin could indicate increasing “froth in the market”, a market condition where the price of an asset is uncorrelated from its intrinsic value. However, as Nils Pratley from The Guardian notes, the presence of froth does not necessarily signal an imminent end to current market conditions, especially given the sustained demand. Yahoo! Finance reported that Tom Lee of Fundsrat believes it’s premature to label the AI boom a “bubble peak”. Nvidia’s chips are the essential component to the speculative AI revolution that’s been driving the surge, and its customers have deep pockets. But while its role in the AI revolution and strong customer base suggests a positive outlook, it's important to consider the potential impact of all factors on the company's financial performance. Nvidia faces challenges that could impact its future growth prospects, such as political influence affecting sales in China. Further, many of its clients are seeking ways to reduce their reliance on Nvidia’s business, such as by developing their own chips.

While Nvidia's performance is emblematic of the broader success of the Magnificent 7, Yahoo! Finance executive editor Brian Sozzi points out that the connection between Nvidia's technology and the immediate financial success of its clients may not be as straightforward as it seems. “Just because Meta owns and uses some new Nvidia chips, how is that going to positively impact (Meta’s) earnings and cash flow over the next four quarters? Will it at all?” He alludes to economist and former Federal Reserve Chairman Alan Greenspan's term “irrational exuberance”, to describe investors indiscriminately increasing the stock prices of related companies as something that “makes sense until it doesn’t”.

He also argues against Solita Marcelli’s justification of Nvidia’s high price-to-earnings (P/E) ratio when compared against the S&P 500. Sozzi points out that Nvidia's stock price already reflects very optimistic assumptions about the company's future earnings growth, which leaves it with no room for anything other than absolute perfection. Therefore, Nvidia’s P/E may not be as "compelling" a value as the analyst suggests.

Past patterns or a new paradigm?

The current market rally is inviting parallels with the Dot-com Bubble of 2001 and a resurgence of investor optimism seen in 2021. In both 1999 and today, stock markets experienced robust bullish trends driven by investor optimism and excitement about technological advancements. Today, more than half of traders at Charles Schwab report a bullish outlook reminiscent of the sentiment seen in 1999, when the Nasdaq Composite Index, which is heavily influenced by tech stocks, saw significant gains.

However, there are important differences to consider between the economic landscapes of 1999 and today. One notable distinction is the inflationary environment. In 1999, inflation was relatively low and stable. Today’s economy faces higher inflation, which has become a significant concern for investors and policymakers alike.

The January 2024 Consumer Price Index (CPI) Report released on February 13 revealed a higher-than-expected inflation rate, reinforcing the Federal Reserve’s stance on maintaining current interest rates, pushing back estimates of potential rate cuts to June or July instead of March, as some optimistic analysts had previously anticipated. The market reacted with a drop in both stocks and bonds, a far cry from the “wide boost” deVere CEO Nigel Green, who advises against investing exclusively in the Magnificent 7, predicted the week prior. In an address to the House Financial Services Committee on March 6, US Federal Reserve Chair Jerome Powell told lawmakers that rate cuts wouldn’t be merited until further evidence of falling inflation was observed. The March 12 release of the February CPI also revealed that inflation remained relatively high, but the market reaction was considerably more muted.

Beyond inflation, another critical aspect to consider when comparing the market conditions of the past to today is the role of market concentration, as David Kostin of Goldman Sachs pointed out in a note. Further, he emphasized that the investment landscape has evolved since 2021. “In contrast with 2021, the cost of capital is much higher today and investors are focused on margins rather than “growth at any cost.” These tech giants have exhibited robust revenue growth and high-profit margins and are backed with large cash reserves and strong balance sheets, fundamentals that support the continued climb in stocks. And unlike the speculative nature of the crypto boom, for example, the AI boom is built around tangible products like GPUs, which have already demonstrated real-world utility and economic value in gaming, data centers and AI.

Is now a good time to invest?

As the market rally continues to forge ahead, some big tech bosses are seizing the opportunity to cash out while the market is hot. Amazon’s Jeff Bezos recently offloaded a staggering US$8.5 billion worth of shares, while Meta CEO Mark Zuckerberg has sold US$661 million shares of company stock in 2024. Nvidia insiders also sold off US$80 million in stocks soon after the company’s Q4 earnings report. While such moves might raise concerns about a potential market correction, finance analysts like Tobi Opeyemi Amure argue that these executives are simply capitalizing on their gains. "These founders and CEOs often wait until shares hit all-time highs before locking in profits or diversifying their wealth," said Amure in correspondence obtained by INN.

Moreover, the current rally is not limited to tech stocks; other assets such as gold are also on the rise. There are indications that the bullish sentiment is being felt globally, with stock markets in countries like Japan and Germany experiencing similar upward trends.

However, it’s important to recognize the potential challenges and risks that may arise. Tim Bray alludes to the macroeconomic factors that could eventually cause the bubble to pop, ranging from the environmental cost to the massive expense of data centers that power it. There is also the risk that AI might not live up to its hype for years, and progress in the field could stall as humans grapple with the challenges of regulating and implementing it at scale.

Furthermore, over-concentration in a few high-performing stocks, as highlighted by Orbis in their report “The Magnificent Middle” can increase the risk of a market correction. The authors advocate diversification and stress that midcap stocks should not be so quickly overlooked.

Taylor agrees. “The dream for investors would be a pause in the large-cap technology names and a catch-up rally for the lagging sectors. Presently, the rally is only held up by a few names, and the risk of a correction increases,” he said.

As the Magnificent 7's individual performances continue to fluctuate, their influence on the tech sector and the stock market as a whole remains a topic of interest for investors and analysts alike.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

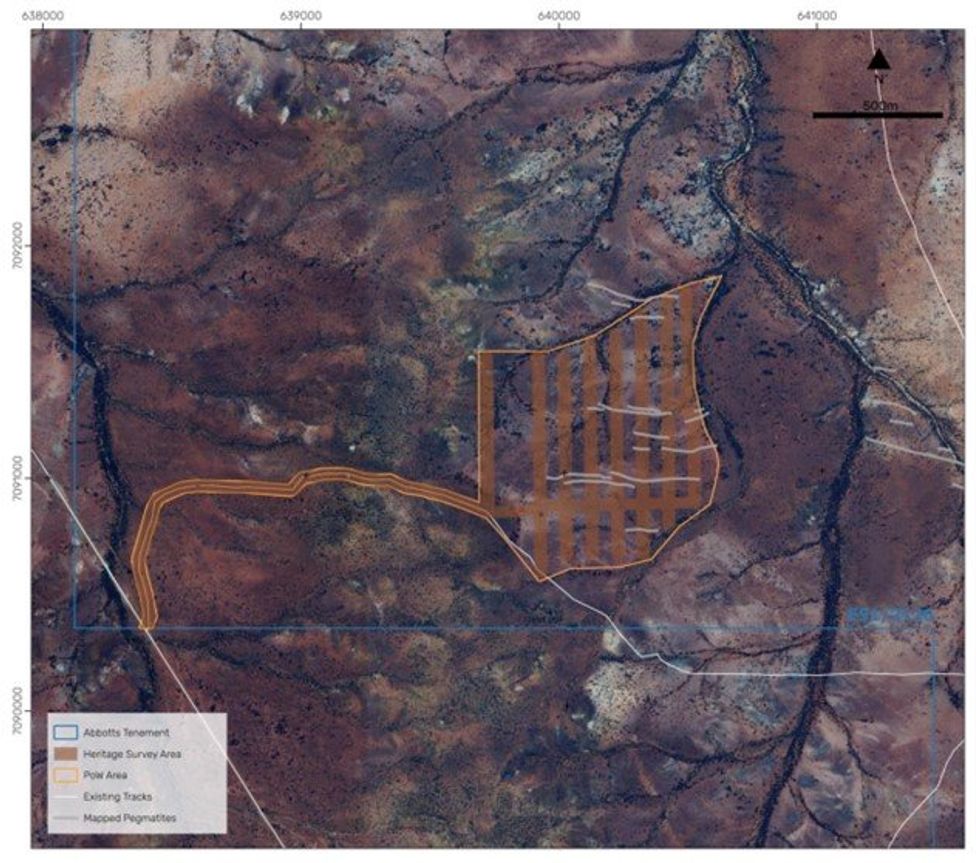

Figure 1: Abbotts North Survey Area.

Figure 1: Abbotts North Survey Area.