- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Lithium Australia Signs Landmark Joint Development Agreement With Mineral Resources

Lithium Australia Limited (ASX:LIT) (‘Lithium Australia’, or ‘the Company’) is pleased to announce that the Company has entered a joint development agreement (“Agreement”) with leading ASX-listed mining company Mineral Resources Ltd (“MinRes”).

HIGHLIGHTS

- Lithium Australia signs joint development agreement with leading ASX-listed mining company Mineral Resources (ASX:MIN) (“MinRes”) related to disruptive lithium extraction technology LieNA®

- MinRes has extensive operations in lithium and mining services across Western Australia, with a market capitalisation of A$13.6bn1

- MinRes will solely fund the development and operation of a pilot plant up to the total budgeted cost of A$4.5 million and provide raw materials for the pilot plant at no cost to Lithium Australia, with Lithium Australia to contribute its LieNA® technology

- Subject to the results of the pilot plant, MinRes and Lithium Australia will form a 50:50 joint venture to own and commercialise the LieNA® technology through a licensing model

- MinRes can elect to sole fund, develop and operate a demonstration scale plant under a license agreement with the joint venture

- This licence will apply to current and future projects of MinRes and is based on a targeted headline gross product royalty rate of 8.0% with a first mover discount applied

Under the Agreement, MinRes will solely fund the development and operation of a pilot plant and an engineering study for a demonstration plant up to the total budgeted cost of A$4.5 million, and will also supply the required raw materials to support the extraction process at no cost to Lithium Australia. Lithium Australia will contribute its patented LieNA® technology, which has the potential to enhance lithium extraction yields by up to 50%3 over current market performance, and will manage the pilot plant’s production process.

Lithium Australia’s patented extraction technology is underpinned by recovering lithium from fine and low-grade spodumene, which is usually disposed of as waste streams, improving mining efficiency, sustainability and potential profitability.

On successful completion of the pilot plant operations and engineering study, MinRes’ convertible note will convert into equity in a new joint venture (“JV”) between MinRes and Lithium Australia. Lithium Australia and MinRes will each have a 50% interest in the JV entity, which will wholly own the LieNA® technology going forward.

The JV plans to license the LieNA® technology to third-parties at a target headline gross product royalty rate of 8%4. The royalty model materially expands Lithium Australia’s addressable market as it has the potential to capture a fee on all tonnage processed via any mine utilising the LieNA® technology.

The JV will initially license the LieNA® technology to a larger demonstration plant which MinRes can elect to independently fund, develop, and operate. The larger plant will aim to extract lithium salt at a commercial scale under the licence. The licence will apply to current and future projects of MinRes and the royalty payable by MinRes under the licence is based on a discount to the headline royalty rate above in acknowledgement of MinRes’ first mover position.

MinRes is an optimal strategic partner for Lithium Australia, as it mines substantial quantities of lithium at its own operations. Early target jurisdictions for licencing include Western Australia and North America, with potential for expansion into Europe and Africa as well.

Comment from Lithium Australia Chief Executive Officer, Simon Linge

“We are thrilled by the formation of a new partnership with Mineral Resources, one of Australia’s largest and most prominent mining companies. MinRes is the perfect partner to complement our leading lithium extraction technology, given its extensive owned operations and strategic movement downstream into the battery materials sector.

Securing a development partner is also noted as a significant step within Lithium Australia’s recently released roadmap and serves as a powerful validation of our patented technology. We are excited by the future opportunity to license our proven high- value technology to all existing and new lithium mines across Australia and the rest of the world.”

Click here for the full ASX Release

This article includes content from Lithium Australia, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Top 9 Lithium-producing Countries (Updated 2024)

Interest in lithium continues to grow due to its role in the lithium-ion batteries that power electric vehicles (EVs). As a result, more and more attention is landing on the top lithium-producing countries.

About 80 percent of the lithium produced globally goes toward battery production, but other industries also consume the metal. For example, 7 percent of lithium is used in ceramics and glass, while 4 percent goes to lubricating greases.

According to the US Geological Survey, lithium use in batteries has increased in recent years due to the use of rechargeable batteries in portable electronic devices, as well as in electric tools, EVs and grid storage applications.

Manufacturers commonly use lithium carbonate or lithium hydroxide in these batteries rather than lithium metal. Lithium-ion batteries also include other important battery metals, such as cobalt, graphite and nickel.

As demand for lithium continues to rise, which countries will provide the lithium the world requires? The latest data from the US Geological Survey shows that the world’s top lithium-producing countries are doing their best to meet rising demand from energy storage and EVs — in fact, worldwide lithium production rose sharply from 2022 to 2023, coming in at 180,000 metric tons (MT) of lithium content last year (not including US production), compared to 146,000 MT in 2022.

What are the top lithium-producing countries?

Australia, Chile and China were the top three lithium countries in 2023, and Brazil and Zimbabwe rose significantly in the ranks. Read on for an overview of global lithium production by country. As the EV lithium-ion battery market continues to grow, it’s likely these countries will vie for larger roles in supplying the metal in the years to come.

1. Australia

Mine production: 86,000 MT

Kicking off this lithium production by country list is Australia, which produced 86,000 MT of lithium last year, up from 74,700 MT the year before. Following that increase, it's likely the country's lithium production will see a decline in 2024 as demand for EVs has stalled in the current slowing economic climate, leading to much lower lithium prices. In fact, Australia's lithium miners have already begun to curb production rates.

Who owns Australia's largest lithium mines? The Greenbushes lithium mine in Western Australia is operated by Talison Lithium, a subsidiary that is jointly owned by miners Albemarle (NYSE:ALB), Tianqi Lithium (OTC Pink:TQLCF,SZSE:002466) and IGO (ASX:IGO,OTC Pink:IPDGF). Greenbushes has been in operation for over a quarter of a century, making it the longest continuously running mining area in the state. Mount Marion, a joint venture between Mineral Resources (ASX:MIN,OTC Pink:MALRF) and Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460,HKEX:1772), is another key lithium mine in Australia. The mine is located in the Yilgarn Craton, southwest of Kalgoorlie.

Australia also holds over 4.8 million MT of identified JORC-compliant lithium reserves, which puts it behind Chile. It is worth noting that most of the country’s lithium supply is exported to China as spodumene.

2. Chile

Mine production: 44,000 MT

Lithium miners in Chile increased the nation's output from 38,000 MT of lithium in 2022 to 44,000 MT last year, making it the second top lithium producer in the world. Unlike Australia, where lithium is extracted from hard-rock mines, Chile’s lithium is found in lithium brine deposits.

The Salar de Atacama salt flat in Chile generates roughly half the revenue for SQM (NYSE:SQM), a top lithium producer. The Salar de Atacama is also the home of another top lithium brine producer — US-based Albemarle.

In April 2023, market participants and lithium miners were surprised by the Chilean government's plans to nationalize the lithium industry. While ultimately it wasn't a true nationalization, the country is moving to gain controlling stakes in lithium assets in the Salar de Atacama and Maricunga through its state-owned mining company Codelco.

SQM has signed an arrangement with Codelco that will allow it to continue operations in the Salar de Atacama until 2060. The two companies will create a new entity for the operations, with Codelco owning 50 percent plus one share of the company. Albemarle recently agreed to a deal that will give it the option to raise its production quota by meeting certain conditions. In March 2024, Chile also opened over two dozen other salt flats for private investment.

3. China

Mine production: 33,000 MT

China came third for lithium production in 2023, beating fourth place Argentina significantly. The Asian country saw its lithium supply grow to 33,000 MT last year from 22,600 MT the year prior.

China is the largest consumer of lithium due to its electronics manufacturing and EV industries. It also produces more than two-thirds of the world’s lithium-ion batteries and controls most of the world’s lithium-processing facilities. China currently gets the majority of its lithium from Australia, but it is looking to expand its capacity.

In January of this year, China announced the discovery of a massive million-metric-ton lithium deposit in the country's Sichuan Province. However, China's lithium production capacity is unlikely to increase much in 2024 as slowing EV demand in the country has in turn dampened demand for lithium.

4. Argentina

Mine production: 9,600 MT

Lithium producer Argentina’s output ticked up by 3,010 MT from 2022, with the nation putting out 9,600 MT in 2023.

It’s well known that Bolivia, Argentina and Chile make up the Lithium Triangle. Argentina’s Salar del Hombre Muerto district hosts significant lithium brines, and its reserves are enough for at least 75 years.

At present, lithium mining in the country consists of two major brine operations currently in production and 10 projects that are in development. Analysts at consultancy firm Eurasia Group project that Argentina’s lithium production has the potential to grow approximately tenfold by 2027, as per CNBC.

One of the largest lithium miners in Argentina is Arcadium Lithium (ASX:LTM,NYSE:ALTM), the result of the January 2024 merger of Livent and Allkem. The new entity is the third largest lithium producer in the world.

5. Brazil

Mine production: 4,900 MT

Lithium production in Brazil has taken off in the last several years, catapulting it onto the list of the top lithium-producing countries. After achieving output of 400 MT or less from 2011 to 2018, the country’s production hit 2,400 MT in 2019. Brazil saw another significant jump last year, when its lithium output rose by 2,270 MT over 2022's 2,630 MT.

Brazil's government plans to invest more than US$2.1 billion by 2030 into expanding the nation's lithium production capacity. At the state level, in 2023 the Minas Gerais government launched the Lithium Valley Brazil initiative, which is aimed at promoting investment in lithium mining. The program includes four publicly listed lithium companies with assets in the state's Jequitinhonha Valley: Sigma Lithium (TSXV:SGML,NASDAQ:SGML), Lithium Ionic (TSXV:LTH,OTCQX:LTHCF), Atlas Lithium (NASDAQ:ATLX) and Latin Resources (ASX:LRS,OTC Pink:LRSRF).

6. Zimbabwe

Mine production: 3,400 MT

Zimbabwe's lithium output has grown exponentially in a short space of time. Just a few years ago, in 2021, the African nation's output came in at only 710 MT. As of 2023, that figure has grown by 378 percent to reach 3,400 MT of the battery metal. Total reserves in Zimbabwe stand at 310,000 MT, as per the US Geological Survey.

In December 2022, Zimbabwe banned the export of raw lithium in an effort to build out the nation's capacity to process battery-grade lithium domestically. The ban excludes companies that are already developing mines or processing plants in Zimbabwe. Lithium concentrate is now on track to become Zimbabwe's third biggest mineral export, behind gold and platinum-group metals, reported Reuters in November 2023.

Lithium-producing countries in Africa have attracted much attention from Chinese firms in recent years, especially Zimbabwe. Sinomine Resource Group (SZSE:002738), for example, bought a stake in Zimbabwe's emerging lithium industry with the purchase of the Bikita mine, the African nation's oldest lithium mine.

Zimbabwe's other key lithium mines include Zhejiang Huayou Cobalt's (SHA:603799) Arcadia mine and state miner Kuvimba Mining House’s Sandawana mine. A few other advanced lithium projects reached the pilot plant production stage in 2022 and 2023: Premier African Minerals' (LSE:PREM) Zulu lithium-tantalum project; Chengxin Lithium's (SZSE:002240) Sabi Star lithium-tantalum mine; and Lonosphere Investment's open-pit mine in Mataga Mberengwa. Pilot plant stage production is not typically included in total global lithium supply estimates.

6. Canada

Mine production: 3,400 MT

Canada's lithium production for 2023 was on par with Zimbabwe's 3,400 MT. The North American nation substantially increased its production of the battery metal with a rise of more than 553 percent from the previous year.

While Canada is home to a wealth of hard-rock spodumene deposits and lithium brine resources, much of it remains underdeveloped. In an effort to grow a strong North American lithium supply chain for the battery industry, the government has invested in a number of lithium projects, including C$27 million for E3 Lithium (TSXV:ETL,OTCWX:EEMMF), a lithium resource and technology company, and C$1.07 million to Prairie Lithium.

Taking it further, in November 2023, the Canadian government launched the C$1.5 billion Critical Minerals Infrastructure Fund. The fund seeks to address gaps in the infrastructure required for the sustainable development of the nation’s critical minerals production, including battery metals like lithium.

Canada's efforts were rewarded in early 2024, when BloombergNEF gave the nation the top spot in the fourth edition of its Global Lithium-ion Battery Supply Chain Ranking.

8. Portugal

Mine production: 380 MT

Portugal's lithium production dropped by two-thirds in 2022, coming in at 380 MT compared to 900 MT in the previous year. For 2023, the European nation's lithium output remained at 380 MT. The dramatic decline is attributed to public backlash against the environmental impact of lithium mining.

Most of Portugal's lithium comes from the Gonçalo aplite-pegmatite field. Despite this lithium-producing country’s comparatively low output, Portugal’s lithium reserves stand at 60,000 MT.

9. United States

Mine production: withheld

In the final place on this top lithium-producing countries list is the US, which has withheld production numbers to avoid disclosing proprietary company data. Its only output last year came from two operations: a Nevada-based brine operation, most likely in the Clayton Valley, which hosts Albemarle’s Silver Peak mine, and the brine-sourced waste tailings of Utah-based US Magnesium, the largest primary magnesium producer in North America.

There are a handful of major lithium projects underway in the US, including Lithium Americas’ (TSX:LAC,NYSE:LAC) Thacker Pass lithium claystone project, Piedmont Lithium’s (ASX:PLL,NASDAQ:PLL) hard-rock lithium project and Standard Lithium’s (TSXV:SLI,OTCQX:STLHF) Arkansas Smackover lithium brine project.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Lancaster Resources Progresses Permitting for Alkali Flat Lithium Project

Lancaster Resources (CSE:LCR,OTCQB:LANRF,FWB:6UF0) is gearing up to drill an exploration well at its Alkali Flat lithium brine project in New Mexico following the receipt of a technically complete letter from the New Mining and Minerals Division pertaining to its permit application.

“Hopefully we can get started within the next 30 to 60 days,” said CEO Penny White. “Basically we'll be doing our exploratory well, which is really just a drill that will go down about 700 meters. And what we'll be able to do is explore that to really interesting targets that we've delineated through all of our exploratory work to date, and one is about 100 meters down.”

White explained that the Alkali Flat project is a compelling asset due to its high lithium concentrations and potential for environmentally friendly production methods.

“Alkali Flat has everything that you would want to see in a really big, productive, commercially viable brine deposit. And it also had the second highest concentration of brine in the surface sediment samples,” White said.

Watch the full interview with Penny White, president and CEO of Lancaster Resources, above.

Disclaimer: This interview is sponsored by Lancaster Resources (CSE:LCR,OTCQB:LANRF,FWB:6UF0). This interview provides information which was sourced by the Investing News Network (INN) and approved by Lancaster Resources in order to help investors learn more about the company. Lancaster Resources is a client of INN. The company’s campaign fees pay for INN to create and update this interview.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Lancaster Resources and seek advice from a qualified investment advisor.

This interview may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The issuer relies upon litigation protection for forward-looking statements. Investing in companies comes with uncertainties as market values can fluctuate.

Galan Builds Inventory with 1,000t LCE, Advances HMW Project

Galan Lithium (ASX:GLN) reported a contained inventory of 1,000 tons of lithium carbonate equivalent (LCE) at its Hombre Muerto West (HMW) project in Argentina, according to an article by The West Australian.

Galan’s HMW project has reached 33 percent completion with total pond construction of 45 percent and the first two evaporation ponds operating.

The company’s managing director Juan Pablo Vargas de la Vega said Galan is well on its way to its targeted production in the first half of 2025.

The article said Galan has taken a major step towards selling products from the lithium brine project after signing a deal with the Catamarca Government.

Click here to connect with Galan Lithium (ASX:GLN) for an Investor Presentation

Atlantic Lithium

Overview

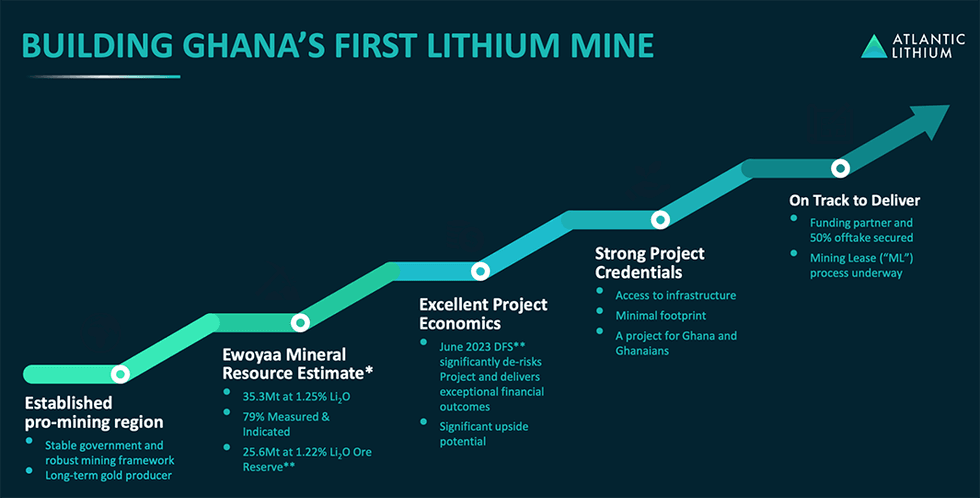

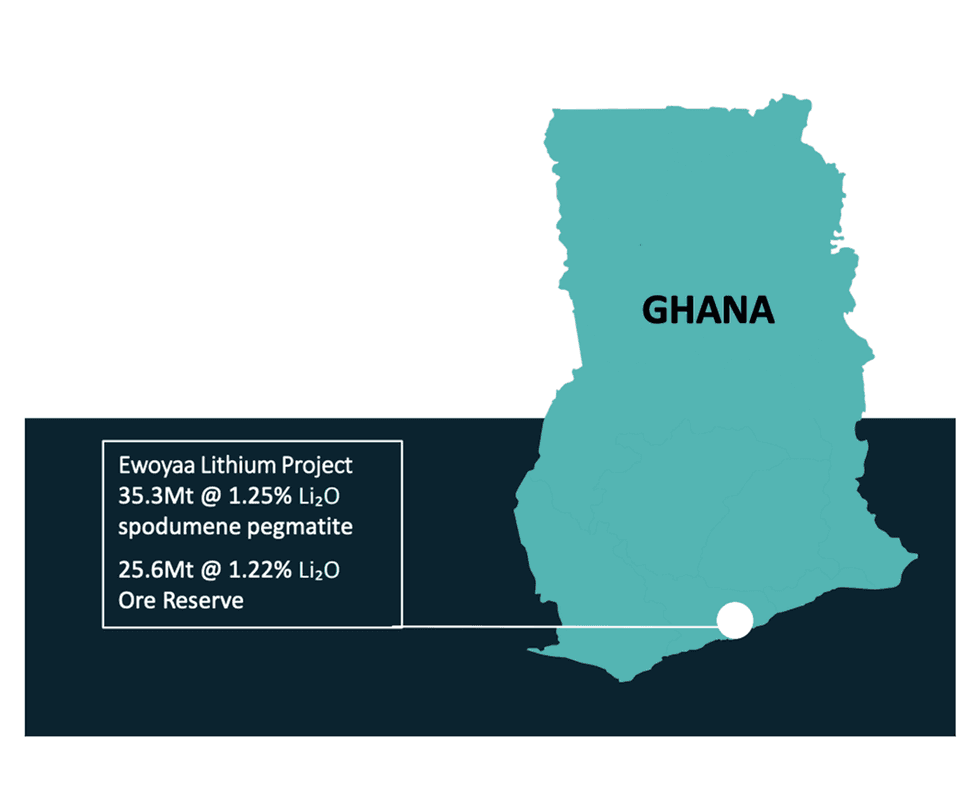

Despite its long mining history, favourable regulatory climate and stable political backdrop, Ghana remains largely overlooked as an investment jurisdiction for battery metals. Situated on the West African coast, the country boasts a strong strategic location and abundance of mineral wealth.

In 2023, the country reclaimed its title as Africa's number one producer of gold. And gold isn't the only precious metal to be found in the country. Ghana is also home to significant lithium reserves, with c. 180,000 tonnes of estimated resources.

Located between Europe, the United States and China, Ghana is perfectly positioned to serve as an important hub for the global supply of the battery metal.

Australian lithium exploration and development company Atlantic Lithium (ASX:A11, AIM:ALL, OTCQX:ALLIF) intends to leverage this opportunity through its flagship Ewoyaa project, set to become Ghana’s first lithium-producing mine. Atlantic intends to produce spodumene concentrate capable of conversion to lithium hydroxide and carbonate for use in electric vehicle batteries, helping drive the transition to decarbonisation.

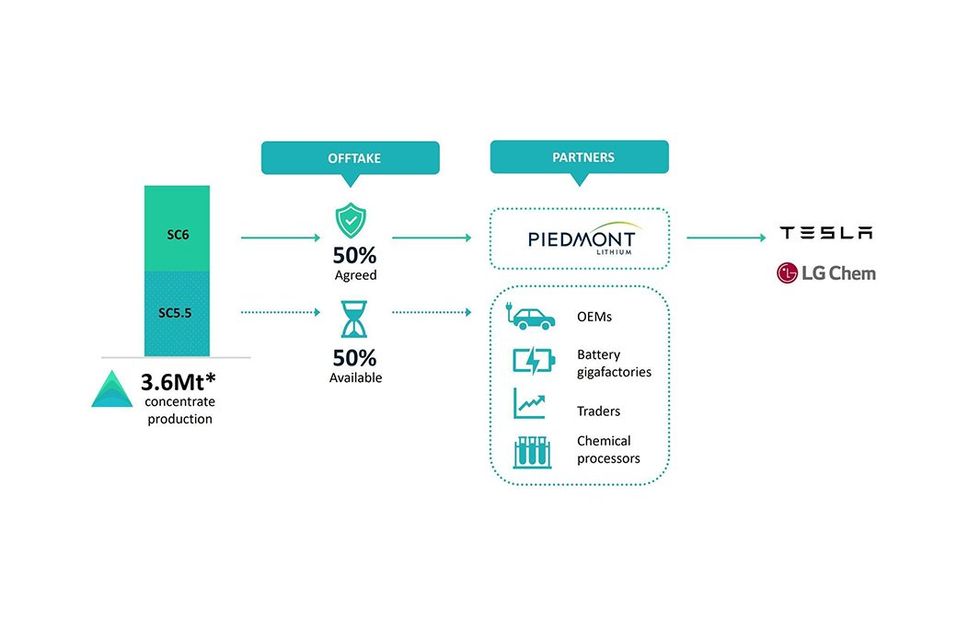

A definitive feasibility study (DFS) released in June 2023 shows that, considering its current 35.3 million tons (Mt) @ 1.22 percent lithium oxide JORC Mineral Resource Estimate and conservative life-of-mine concentrate pricing of US$1,587/t, FOB Ghana Port, Ewoyaa has demonstrable economic viability, low capital intensity and excellent profitability. Through simple open-pit mining, three-stage crushing and conventional Dense Media Separation (DMS) processing, the DFS outlines the production of 3.6 Mt of spodumene concentrate over a 12-year mine life, delivering US$6.6 billion life-of-mine revenues, a post-tax NPV8 of US$1.5 billion and an internal rate of return of 105 percent.

Atlantic Lithium intends to deploy a Modular DMS plant ahead of commencing operations at the large-scale main plant to generate early revenue, which will reduce the peak funding requirement of the main plant. The project is expected to deliver first spodumene production as early as April 2025.

The development of the project is co-funded under an agreement with NASDAQ and ASX-listed Piedmont Lithium (ASX:PLL), with Piedmont expected to fund c. 70 percent of the US$185 million total capex. In accordance with the agreement, Piedmont is funding US$17 million towards studies and exploration and an initial US$70 million towards the total capex. Costs are split equally between Atlantic Lithium and Piedmont thereafter.

In return, Piedmont will receive 50 percent of the spodumene concentrate produced at Ewoyaa, providing a route to consumers through several major battery manufacturers, including Tesla. With 50 percent of its offtake still available, Atlantic Lithium is one of very few near-term spodumene concentrate producers with uncommitted offtake.

Already the largest taxpayer and employer in Ghana’s Central Region, Atlantic Lithium is expected to provide direct employment to roughly 800 personnel at Ewoyaa and, through its community development fund whereby 1 percent of retained earnings will be allocated to local initiatives, will deliver long-lasting benefits to the region and to Ghana.

Atlantic Lithium also has the potential to capitalise upon considerable additional upside across its extensive exploration portfolio — potential it intends to leverage to the fullest as it becomes an early mover in West African lithium production.

Company Highlights

- A mining and exploration company operating in West Africa, Atlantic Lithium is set to deliver Ghana’s first lithium-producing mine with its flagship Ewoyaa Lithium Project.

- Ghana is a well-established mining region with access to reliable, existing infrastructure and a significant mining workforce. There are currently 16 operating mines in the country.

- There is significant government interest in getting Ewoyaa operational to diversify the country’s production from gold.

- Atlantic Lithium is already the leading taxpayer and employer in the region and, through Ewoyaa, expects to bring significant business and development locally.

- The June 2023 definitive feasibility study proves Ewoyaa to be a financially viable, major near-term lithium-producing asset.

- The project is co-funded under an agreement with Piedmont Lithium.

- With 50 percent of offtake still uncommitted, the company is one of few near-term spodumene producers with offtake available.

- Situated on the West African coast, Atlantic Lithium is well-positioned to serve the global electric vehicle markets.

Key Assets

Ewoyaa

Set to be Ghana's first lithium-producing mine, Atlantic Lithium's flagship Ewoyaa Project is situated within 110 kilometres of Takoradi Port and 100 kilometres of Accra, with access to excellent infrastructure and a skilled local workforce. A definitive feasibility study (DFS) released in June 2023 confirmed the project's economic viability and profitability potential, indicating a 3.6-Mt spodumene concentrate production over the mine's 12-year projected life.

Atlantic Lithium is currently in the process of securing a mining lease for the project, which will enable the commencement of the permitting process. Through the deployment of a Modular DMS plant, which will process 450,000 tons of ore as the main 2.7-Mt processing plant is being constructed, the mine is expected to deliver first production in 2025.

Highlights:

- Promising DFS Results: Atlantic Lithium's recent DFS reaffirmed Ewoyaa as an industry-leading asset with low capital intensity and excellent profitability. Highlights include:

- Estimated 12-year life of mine, producing 3.6 Mt spodumene concentrate.

- 365 ktpa steady state production

- Average LOM EBITDA of US$316 million per annum

- NPV of US$1.5 billion

- Free cash flow of US$2.4 billion from life-of-mine revenues of US$6.6 billion

- Modest $185 million capital cost

- Payback within 19 months.

- Favourable Location: The project's starter pits are positioned within one kilometre of its processing plant. Additionally, Ewoyaa has access to reliable existing infrastructure, located within 800 metres from the N1 highway and adjacent to grid power.

- Promising Reserves: Ewoyaa's current mineral resource estimate is 35.3 Mt at 1.25 percent lithium oxide, with ore reserves of 25.6 Mt at 1.22 percent lithium oxide.

- Potential for Further Exploration: There remains significant exploration potential, with only 15 square kilometres of Atlantic Lithium's entire tenure having been drilled to date.

- Strong Partnerships: Atlantic Lithium has a 50-percent offtake deal with Piedmont Lithium, which itself has offtake agreements with both Tesla and LG Chem.

- Positive Presence: Atlantic Lithium will generate significant economic benefits to the region. Once operational, the project is expected to employ roughly 800 personnel.

Côte d'Ivoire

Atlantic Lithium currently has two applications pending for an area of roughly 774 square kilometres in the West African country of Côte d'Ivoire. The underexplored yet highly prospective region is known to be underlain by prolific birimian greenstone belts, characterised by fractionated granitic intrusive centres with lithium and colombite-tantalum occurrences and outcropping pegmatites. The area is also incredibly well-served, with extensive road infrastructure, well-established cellular network and high-voltage transmission line within roughly 100 kilometres of the country's capital, Abidjan.

Management Team

Neil Herbert - Executive Chairman

Neil Herbert is a fellow of the Association of Chartered Certified Accountants and has over 30 years of experience in finance. He has been involved in growing mining and oil and gas companies both as an executive and as an investor for over 25 years. Until May 2013, he was co-chairman and managing director of AIM-quoted Polo Resources, a natural resources investment company.

Prior to this, Herbert was a director of resource investment company Galahad Gold, after which he became finance director of its most successful investment, the start-up uranium company UraMin, from 2005 to 2007. During this period, he worked to float the company on AIM and the Toronto Stock Exchange in 2006, raise US$400 million in equity financing and negotiate the sale of the group for US$2.5 billion.

Herbert has held board positions at a number of resource companies where he has been involved in managing numerous acquisitions, disposals, stock market listings and fundraisings. He holds a joint honours degree in economics and economic history from the University of Leicester.

Keith Muller - Chief Executive Officer

Keith Muller is a mining engineer with over 20 years of operational and leadership experience across domestic and international mining, including in the lithium sector. He has a strong operational background in hard rock lithium mining and processing, particularly in DMS spodumene processing. Before joining Atlantic Lithium, he held roles as both a business leader and general manager at Allkem, where he worked on the Mt Cattlin lithium mine in Western Australia.

Prior to that, Muller served as operations manager and senior mining engineer at Simec. He holds a Master of Mining Engineering from the University of New South Wales and a Bachelor of Engineering from the University of Pretoria. He is also a member of the Australian Institute of Mining and Metallurgy, the Board of Professional Engineers of Queensland, and the Engineering Council of South Africa.

Amanda Harsas - Finance Director and Company Secretary

Amanda Harsas is a senior finance executive with a demonstrable track record and over 25 years’ experience in strategic finance, business transformation, commercial finance, customer and supplier negotiations and capital management. Prior to joining Atlantic Lithium, she worked across several sectors including healthcare, insurance, retail and professional services. Harsas is a chartered accountant, holds a Bachelor of Business and has international experience in Asia, Europe and the US.

Len Kolff - Head of Business Development and Chief Geologist

Len Kolff has over 25 years of mining industry experience in the major and junior resources sector. With a proven track record in deposit discovery and a particular focus on Africa, Kolff most recently worked in West Africa and was instrumental in the discovery and evaluation of the company’s Ewoyaa Lithium Project in Ghana, as well as the discovery and evaluation of the Mofe Creek iron ore project in Liberia. Prior to this, he worked at Rio Tinto with a focus on Africa, including the Simandou iron ore project in Guinea and the Northparkes Copper-Gold mine in Australia.

Kolff holds a Master of Economic Geology from CODES, University of Tasmania and a Bachelor of Science (Honours) degree from the Royal School of Mines, Imperial College, London.

Patrick Brindle - Non-executive Director

Patrick Brindle currently serves as executive vice-president and chief operating officer at Piedmont Lithium. He joined Piedmont in January 2018. Prior to this, he held roles as vice-president of project management and subsequently as chief development officer.

Brindle has more than 20 years' experience in senior management and engineering roles and has completed EPC projects in diverse jurisdictions including the United States, Canada, China, Mongolia, Australia and Brazil. Before joining Piedmont, he was vice-president of engineering for DRA Taggart, a subsidiary of DRA Global, an engineering firm specialising in project delivery of mining and mineral processing projects globally.

Kieran Daly - Non-executive Director

Kieran Daly is the executive of growth and strategic development at Assore. He holds a BSc Mining Engineering from Camborne School of Mines (1991) and an MBA from Wits Business School (2001) and worked in investment banking/equity research for more than 10 years at UBS, Macquarie and Investec prior to joining Assore in 2018.

Daly spent the first 15 years of his mining career at Anglo American’s coal division (Anglo Coal) in a number of international roles including operations, sales and marketing, strategy and business development. Among his key roles were leading and developing Anglo Coal's marketing efforts in Asia and to steel industry customers globally. He was also the global head of strategy for Anglo Coal immediately prior to leaving Anglo in 2007.

Christelle Van Der Merwe - Non-executive Director

Christelle Van Der Merwe is a mining geologist responsible for the mining-related geology and resources of Assore’s subsidiary companies (comprising the pyrophyllite and chromite mines) and is also concerned with the company's iron and manganese mines. She has been the Assore group geologist since 2013 and involved with strategic and resource investment decisions of the company. Van Der Merwe is a member of SACNASP and the GSSA.

Jonathan Henry - Independent Non-executive Director

Jonathan Henry is a senior executive with significant, global listed company experience, primarily in the mining industry, having held various leadership and board roles for nearly two decades. Henry is currently the non-executive chair of Toronto Venture Exchange-listed (TSX-V) Giyani Metals. He has been heavily involved in the strategic management and leadership of projects toward production, commercialisation and, ultimately, the realisation of shareholder value. He has gained significant experience working across capital markets, business development, project financing, key stakeholder engagement (including public and investor relations), and the reporting and implementation of ESG-focused initiatives.

Henry was the executive chair and non-executive director at Euronext Growth and AIM-listed Ormonde Mining, non-executive director at TSX-V-listed Ashanti Gold, president, director and CEO at TSX-listed Gabriel Resources and various roles, including CEO and managing director, at London and Oslo Stock Exchange-listed Avocet Mining PLC.

Edward Nana Yaw Koranteng - Independent Non-executive Director

Edward Koranteng is a lawyer and an experienced corporate and investment banker with over 23 years of experience. He was the chief executive officer of the Minerals Income Investment Fund (MIIF), Ghana’s sovereign minerals wealth fund, since 2021. As CEO, he oversees the management of Ghana’s equity interest in mining companies, manages all royalties paid to the state from mining activities and supports the growth of the mining industry through long-term, sustainable investments in the sector.

Koranteng was the business head for East, Central and Southern Africa for Ghana International Bank (GHIB) leading various financing projects in Ethiopia, Ghana, Tanzania, Kenya and Malawi. He also worked with the Chase Bank Group (Kenya), now SBM Bank of Mauritius, as the group head for energy, oil, gas and mining.

Koranteng is the co-founder of one of Ghana’s leading law firms, Koranteng & Koranteng Legal Advisors, and currently sits on the boards of major gold producer Asante Gold Corporation, the Minerals Income Investment Fund, and Glico General Insurance Ltd in Ghana.

Aaron Maurer – Head of Operational Readiness

Aaron Maurer is a senior-level business executive with over 25 years’ international multi-commodity mining experience, overseeing strategic, operational and financial performance. Over his career, he has held several engineering, production, operational and senior executive roles. Before joining Atlantic Lithium, he served as executive general manager - operations at Minerals Resources, where he oversaw the Mt Marion Lithium mine and three iron ore mines in Western Australia. He was previously the managing director and CEO of PVW Resources and general manager (site senior executive) at Peabody Energy Australia.

His significant expertise spans the development and implementation of safety and cost-saving initiatives, change management, strategic planning, business development and employee development. Maurer holds a Master in Corporate Finance and a Bachelor of Engineering (Mining).

Roux Terblanche - Project Manager

Roux Terblanche is a mineral resource project delivery specialist with proven African and Australian experience working for owners, EPCMs, consultants and contractors. He has a wide range of commodity experiences, including lithium, gold, copper, diamonds and platinum. He has proven to add value and deliver projects safely, on time and within budget.

Terblanche has worked in the UAE and across Africa, including Ghana, the DRC, Burkina Faso, Zambia, Rwanda, Botswana and Senegal. He was instrumental in increasing the operating footprint of an international construction company across Africa and was integral to the building of the Akyem, Tarkwa Phase 4 and Chirano mines in Ghana.

Terblanche holds a national diploma in mechanical engineering, a diploma in project management and a Bachelor of Commerce from the University of South Africa.

Iwan Williams - Exploration Manager

Iwan Williams is an exploration geologist with over 20 years' experience across a broad range of commodities, principally iron ore, manganese, gold, copper (porphyry and sed. hosted), PGE's, nickel and other base metals, as well as chromitite, phosphates, coal and diamond.

Williams has extensive southern and west African experience and has worked in Central and South America. His experience includes all aspects of exploration management, project generation, opportunity reviews, due diligence and mine geology. He has extensive studies experience having participated in the delivery of multiple project studies including resource, mine design criteria, baseline environmental and social studies and metallurgical test-work programmes. He is very familiar with working in Africa having spent 23 years of his 28-year geological career in Africa. Williams is a graduate of the University of Liverpool.

Abdul Razak - Country Manager

Abdul Razak has extensive exploration, resource evaluation and project management experience throughout West Africa with a strong focus on data-rich environments. He has extensive gold experience having worked throughout Ghana with AngloGold Ashanti, Goldfields Ghana, Perseus and Golden Star, as well as international exploration and resource evaluation experience in Burkina Faso, Liberia, Ivory Coast, Republic of Congo, Nigeria and Guinea.

Razak is an integral member of the team, managing all site activities including drilling, laboratory, local teams, geotech and hydro, community consultations and stakeholder engagements and was instrumental in establishment of the current development team and defining Ghana’s maiden lithium resource estimate. He is based at the project site in Ghana.

Investor Presentation via Investor Meet Company

CleanTech Lithium PLC (AIM: CTL, Frankfurt:T2N, OTCQX:CTLHF), an exploration and development company, advancing sustainable lithium projects in Chile for the clean energy transition, is pleased to announce that Executive Chairman and Interim CEO, Steve Kesler will provide a live presentation relating to the DLE Pilot Plant Results via Investor Meet Company on 15 May 2024, 15:00 BST.

The presentation is open to all existing and potential shareholders. Investors can sign up to Investor Meet Company for free and meet CleanTech Lithium via the following link:

https://www.investormeetcompany.com/cleantech-lithium-plc/register-investor

Investors who already follow CleanTech Lithium plc on the Investor Meet Company platform will automatically be invited via email and the platform.

For further information contact: | |

CleanTech Lithium PLC | |

Steve Kesler/Gordon Stein/Nick Baxter | Jersey office: +44 (0) 1534 668 321 Chile office: +562-32239222 |

Or via Celicourt | |

Celicourt Communications Felicity Winkles/Philip Dennis/Ali AlQahtani | +44 (0) 20 7770 6424 cleantech@celicourt.uk |

Beaumont Cornish Limited (Nominated Adviser) Roland Cornish/Asia Szusciak | +44 (0) 20 7628 3396 |

Canaccord Genuity (Joint Broker) James Asensio | +44 (0) 20 7523 4680 |

Fox-Davies Capital Limited (Joint Broker) | +44 (0) 20 3884 8450 |

Daniel Fox-Davies |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

About Reach announcements

This is a Reach announcement. Reach is an investor communication service aimed at assisting listed and unlisted (including AIM quoted) companies to distribute media only / non-regulatory news releases into the public domain. Information required to be notified under the AIM Rules for Companies, Market Abuse Regulation or other regulation would be disseminated as an RNS regulatory announcement and not on Reach.

Notes

CleanTech Lithium (AIM:CTL, Frankfurt:T2N, OTCQX:CTLHF) is an exploration and development company advancing sustainable lithium projects in Chile for the clean energy transition. Committed to net-zero, CleanTech Lithium's mission is to produce material quantities of sustainable battery grade lithium products using Direct Lithium Extraction technology powered by renewable energy. The Company plans to be a leading supplier of 'green' lithium to the EV and battery manufacturing market.

CleanTech Lithium has two key lithium projects in Chile, Laguna Verde and Francisco Basin, and hold licences in Llamara and Salar de Atacama, located in the lithium triangle, a leading centre for battery grade lithium production. The two major projects: Laguna Verde and Francisco Basin are situated within basins controlled by the Company, which affords significant potential development and operational advantages. All four projects have direct access to existing infrastructure and renewable power.

CleanTech Lithium is committed to using renewable power for processing and reducing the environmental impact of its lithium production by utilising Direct Lithium Extraction with reinjection of spent brine. Direct Lithium Extraction is a transformative technology which removes lithium from brine, with higher recoveries than conventional extraction processes. The method offers short development lead times with no extensive site construction or evaporation pond development so there is minimal water depletion from the aquifer. www.ctlithium.com

Admission to Trading on the Ghana Stock Exchange

Atlantic Lithium to commence trading on the Main Market of the GSE on Monday, 13 May 2024

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF, “Atlantic Lithium” or the “Company”), the African-focused lithium exploration and development company targeting to deliver Ghana’s first lithium mine, is pleased to announce that admission of its entire issued share capital (“Admission”), being 649,669,053 ordinary shares ("Ordinary Shares"), by introduction on the Main Market of the Ghana Stock Exchange (“GSE”) and commencement of trading of the Ordinary Shares will take place at 10:00 a.m. GMT on Monday, 13 May 2024, under the ticker “ALLGH”.

The Company will not place or issue any new Atlantic Lithium shares in connection with its GSE listing and Admission will have no impact on the Company’s existing listings on the Australian Securities Exchange or the London Stock Exchange’s AIM.

Further information in relation to the Admission can be found in the Company’s announcement dated 2 May 2024 and the Company’s GSE Listing Prospectus, which can be found on the Company’s website or via the following link: https://www.atlanticlithium.com.au/s/Atlantic-Lithium-Limited-Prospectus-April-2024.pdf.

The Transaction Advisors for the Company’s Listing are Black Star Brokerage Limited as the Sponsoring Broker and Arranger, JLD & MB Legal Consultancy as the Legal Advisor, SCG Chartered Accounts as the Reporting Accountants, Central Securities Depository (GH) LTD as the Registrar and Depository and SRK Exploration Services LTD as the Geological Consultants.

Commenting, Neil Herbert, Executive Chairman of Atlantic Lithium, said:

“Recognising the strategic and socio-economic importance of the Ewoyaa Lithium Project to Ghana, we are delighted to be listing the Company’s shares on the Ghana Stock Exchange, which we believe will provide Ghanaians greater opportunity to share ownership in and contribute to the advancement of the Project towards production.

“During what is set to be a milestone year for Atlantic Lithium, we are grateful for the considerable support we have received from the Minerals Income Investment Fund, the Minerals Commission, Ghana’s Securities and Exchange Commission and the GSE to enable the Company’s Admission.

“We look forward to commencing our journey on the GSE alongside the prospective Ghanaian investors that we hope to welcome through our Admission. This represents an important new chapter for Atlantic Lithium in Ghana as we look to achieve long-term lithium production to support the country’s critical mineral objectives.”

Click here for the full ASX Release

This article includes content from Atlantic Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.