How did zinc perform in 2023?

Zinc price in H1

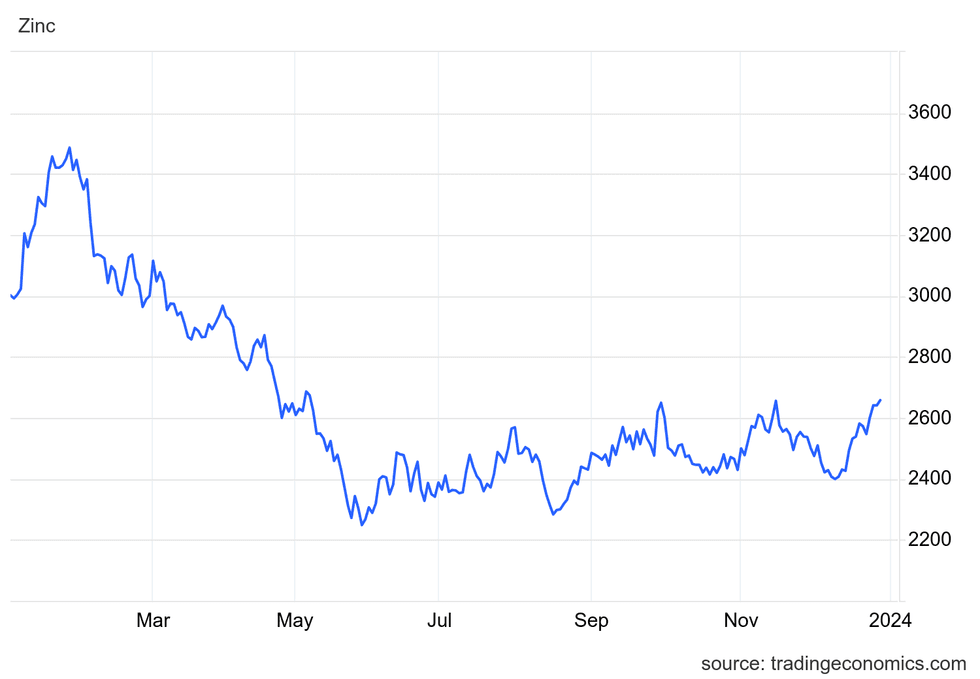

After starting the year at US$3,002 on January 3, zinc rose quickly in the first month of the year, reaching its 2023 high of US$3,486.50 on January 26. This increase came as London Metal Exchange (LME) stockpiles of the metal reached a three decade low of under 20,000 MT, down from 80,000 MT in July 2022. Interestingly, zinc's price was far lower than it was in 2006, when it reached a record high of US$4,442 as LME stockpiles sank to 110,000 MT.

Smelter bottlenecks in Europe helped support the zinc price, with activity low due to high energy prices.

Zinc price from January 3, 2023, to December 29, 2023.

Chart via Trading Economics.

However, falling demand and rising supply added downward pressure to the price of zinc, sending it down to US$2,248.50 on May 31 — its lowest since September 2020 and ultimately its low point for 2023.

This was brought on by a slump in China's real estate sector. The downturn affected the broader base metals market, and lowered demand for all steel products. Zinc was also impacted by European energy prices, which hit 18 month lows, allowing for better economic conditions and the resumption of smelting operations, increasing supply.

The International Lead and Zinc Study Group (ILZSG), an intergovernmental organization of government officials and industry experts, forecast in October 2022 that zinc would face a deficit of 150,000 MT in 2023. Although the group had revised its expectations downward by Q2, it was still calling for a deficit of 45,000 MT.

The combination of a low zinc price and high mining costs caused Boliden (STO:BOL) to place its Tara zinc mine in Ireland on care and maintenance on June 13. Tara, the largest zinc mine in Europe, produced 198,000 MT of concentrates in 2022, and its output feeds the company’s Odda zinc smelter in Norway. The announcement of Tara’s closure caused the price of zinc to jump 5 percent on the LME that day, rising to US$2,491.

Zinc price in H2

The zinc price was at US$2,569 on August 1, but despite the suspension at Boliden’s facility, the market was already shifting from undersupply to oversupply. Stockpiles at the LME had reached 145,975 MT by the middle of August — double the level seen in mid-July — which pushed the metal back down to US$2,283.50.

Some of this excess in supply came from Citigroup (NYSE:C), which has purchased large quantities of zinc to use in rent-share deals with LME warehouses. LME warehouses are paid fees by the companies that eventually buy metal from them, and in rent-sharing deals these fees are shared with the firm that provided the metal — in this case Citigroup.

Daily storage fees for LME warehouses reportedly average US$0.54 per MT, which is over five times higher compared to non-LME storage. According to Reuters, excess supply has made it possible for Citigroup to do these trades.

Zinc rebounded through the second half of August and into September to reach a Q3 high of US$2,649.50 on September 29; it remained rangebound between US$2,400 and US$2,660 through the fourth quarter.

In its last update for the year, released in December, the ILZSG reported that through the first 10 months of 2023, supply for zinc had outstripped demand by 295,000 MT, moving the market from a projected deficit to a surplus.

The continued depression in zinc in H2 caused further temporary closures of mining and smelting operations. Private company Almina-Minas announced it would be putting its Aljustrel zinc-lead operation in Southern Portugal on care and maintenance from September 24 until mid-2025 in part due to low pricing in the market.

This was followed by news that Trafigura subsidiary Nyrstar (LSE:0RH8,EBR:NYR) would suspend operations at the end of November at its two zinc mines in Tennessee, US.

The price of zinc closed out 2023 at US$2,658 on December 29.