- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Manganese as an Emerging Battery Metal and New Investment Frontier

Demand for manganese is unlikely to decline, and the mineral also emerging as an important battery raw material in the increasing push for electrification

Manganese has a number of traditional applications and is regarded as a critical mineral, particularly in steelworking and heavy industry. The World Steel Association is forecasting that demand for steel will reach 1.82 million metric tons (MT) in 2023 and will grow by 1.7 percent in 2024 to 1.85 million MT.

Although high interest rates will continue to affect steel demand, the association expects demand to accelerate in most regions next year, except in China, where it is expected to decelerate.

Nevertheless, demand for manganese should perform well as the mineral has also emerged as an important battery raw material in the increasing push for electrification.

Like with other battery metals, this shift comes with a renewed emphasis on the need for a stable, diversified and ESG-conscious global supply chain.

The world's continued race toward a more sustainable future represents a significant opportunity for both mining companies and their investors — particularly those in Australia, with its rich manganese reserves.

Applications of manganese

In its pure form, manganese seems somewhat unexceptional. As the fifth most common element in the world, the silvery white metal is incredibly brittle, making it impossible to work with on its own. Commonly found alongside iron, manganese contains ferromagnetic compounds, but is not itself ferromagnetic.

Where manganese truly excels is as an alloy. When added to steel, it increases the metal's hardness, strength, workability and resistance to wear. This is central to its importance as an industrial metal.

Manganese may also be applied as a treatment to reduce corrosion, as a powerful deoxidising agent for non-ferrous metals or as a component in commercial fertilisers and ceramics. In some cases, it may also be used as a rubber additive or a decolourising agent for glass stained green by iron impurities.

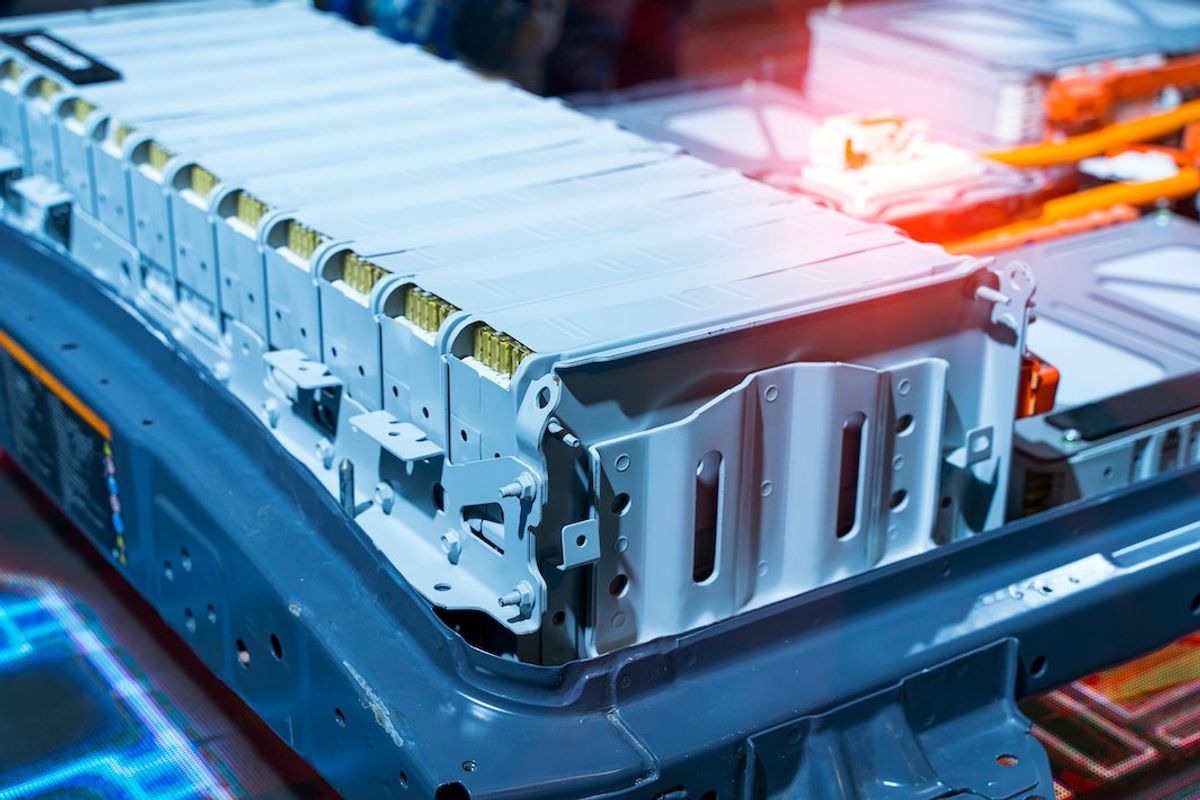

One application of manganese that's frequently overlooked, however, is battery production. Manganese is a key ingredient in many modern lithium-ion batteries, used in cathodes alongside more popular and better-known battery metals such as cobalt, nickel and lithium. In recent years, however, battery technology experts have found that cathodes with high manganese content in the right formulation can provide higher power output, better energy density, greater thermal stability and a longer cycle life, all at a lower unit cost.

Nickel-manganese-cobalt (NMC) and lithium-ion manganese oxide (LMO) are the most common types of manganese cathode batteries in western economies. While NMC batteries are common in electric vehicles in the west, in China, the lithium-iron-phosphate (LFP) chemistry is preferred. Interestingly, some LFP precursor cathode active material manufacturers are shifting to an LMFP mix by adding significant amounts of manganese to boost energy density.

The development and growing prominence of solid-state batteries will likely even further impact the demand for battery-grade manganese, particularly given manganese's comparatively low price point compared to nickel and cobalt. Manganese could also be a game changer for manufacturers that are currently exploring the integration of electric vehicle batteries into car frames to lower weight.

Reflecting this shift toward manganese, in recent years, companies have begun commercialising manganese-rich battery technologies for electric vehicles, such as Umicore’s (EBR:UMI) manganese-rich HLM (high lithium, manganese) cathode active materials technology. Chinese researchers, meanwhile, have developed a 711 watt hours per kilogram high-energy-density rechargeable lithium battery using a high-capacity, lithium-rich manganese-based cathode, a groundbreaking leap from the currently available density of 300 watt hours per kilogram.

Battery manufacturer CATL (SZSE:300750) has also started using manganese for its LFP batteries, achieving 15 percent more energy density.

There can ultimately be no low-carbon future without manganese. It is as much a cornerstone of battery production as any other battery metal. Given the sheer scope and scale of materials required to make a sustainable future a reality, manganese's abundance is quite possibly its greatest strength of all.

There is a caveat here, of course. Abundant or not, if manganese is to play a part on the road to net zero, it must be sourced sustainably. Therein lies the problem.

Sustainable supply and demand

China continues to dominate the market for multiple critical minerals, including both rare earths and battery metals. But the country’s mining practices are not particularly sustainable. For example, the processes used to mine rare earths in Myanmar — where China outsources much of its production — contribute heavily to deforestation, environmental contamination and human rights violations.

China's practices for mining other materials such as manganese are not much better. In fact, the world’s largest suppliers of some of the critical battery metals are also among the worst aggressors when it comes to sustainability and social responsibility. South Africa is the world's largest producer of manganese and the Democratic Republic of Congo supplies roughly 70 percent of the world's cobalt.

In both regions, issues include child labour, unsafe working conditions and environmentally harmful mining practices. Among the poorest countries on earth, some African nations are also rife for exploitation by unscrupulous mining companies. Even if one looks at the matter from a purely pragmatic standpoint, there's also the constant risk that sociopolitical instability might catastrophically interrupt supply chains.

The solution to these problems is two-fold. First is to collectively endeavour for more responsibly sourced materials, and second is to establish more stable and diverse supply chains that are not threatened by geopolitical challenges.

As the third largest global supplier of manganese, Australia has the potential to lead this charge.

Australia’s value proposition

Australia isn't just a major manganese supplier. It's also one of the world's best mining jurisdictions, with three states making the top 10 in the Fraser Institute's 2022 mining company survey. Although government policies and processes related to taxation and sustainability represent minor stumbling points, one might argue that they are also necessary.

And it's clear that, in spite of these small roadblocks, investors and mining companies alike still find Australia to be an incredibly attractive target.

Some, like Element 25 (ASX:E25), even have the potential to singlehandedly shift the manganese market. With 100 percent ownership of the country's largest onshore manganese deposit, Element 25 intends to develop the first zero-carbon source of battery-grade manganese. To that end, it is leveraging sustainable technologies at every step of the production process, including environmentally friendly extraction, renewable energy, low-carbon processing and carbon-offset processes.

Element 25 recently released a definitive feasibility study, which details plans to construct the first commercial-scale, battery-grade, high-purity manganese sulphate (HPMSM) facility in the US. Element 25 will ship its Australian ore to the US and convert it into HPMSM using its proprietary processing technology. The plant will produce low-carbon, fully traceable, ethically sourced HPMSM to supply the fast-growing EV battery industry in the US.

Element 25 has also partnered with industrial supply chain traceability platform Circulor to ensure real-time visibility into the status of its ESG efforts. In this regard, Element 25 is distinguishing itself from other junior mining companies in the region, which include Bryah Resources (ASX:BYH), Pacifico Minerals (ASX:PMY) and Spitfire Minerals (ASX:SPI).

Likely, other companies will soon follow Element 25's lead. This is because, in the current market, sustainability isn't just a matter of ethics. It's simply smart business.

Takeaway

Demand for battery metals has increased exponentially in recent years and it shows no signs of slowing any time soon. Given that production of rarer metals like cobalt and nickel simply cannot keep up, manganese will be needed in increasing quantities. The clear benefits of high-manganese batteries from the perspectives of ESG, performance, cost and longevity make this emerging battery metal one that investors should most definitely watch.

This INNSpired article is sponsored by Element 25 (ASX:E25).This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Element 25in order to help investors learn more about the company. Element 25 is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Element 25and seek advice from a qualified investment advisor.

Element 25 Limited Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Element 25 Limited Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Outlook Reports

Featured Battery Metals Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2332.07 | +15.78 | |

| Silver | 27.43 | +0.25 | |

| Copper | 4.56 | +0.07 | |

| Oil | 83.77 | +0.96 | |

| Heating Oil | 2.57 | +0.01 | |

| Natural Gas | 1.61 | -0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.