- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

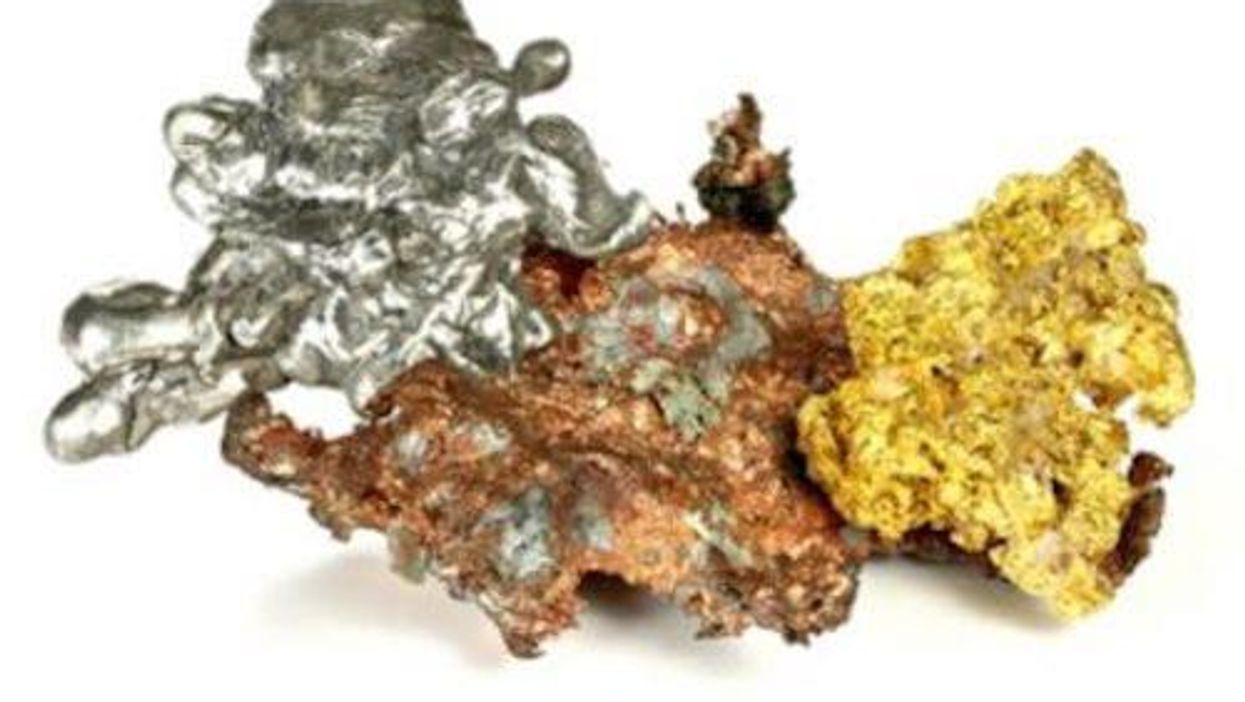

Metals Weekly Round-Up: COVID-19 Cases Rise, Gold Hits Year-to-Date High

A spike in new COVID-19 cases in the US put a damper on economic restart hopes this week, which was beneficial for safe havens like gold.

A spike in new COVID-19 cases in the US this week put a damper on economic restart hopes, benefiting safe haven asset classes.

Gold continued climbing on Friday (June 26), on its way to a third week of gains. The yellow metal hit a year-to-date high on Wednesday (June 24) of 1,777.60 per ounce.

Concern that miners’ Q2 tallies will be more disappointing than first expected are likely to be a tailwind for the yellow metal in the weeks to come.

Despite mostly holding above US$1,700 since passing the threshold in mid-May, analysts at Metals Focus are forecasting a gold price average of only US$1,700 this year.

“And a key reason for that is that we would not be surprised to see a period of stabilization or active corrections in the next couple of months,” Adam Webb, director of mine supply at Metals Focus, said.

The metals consultancy is also calling for a 9 percent increase in physical gold investment this calendar year, as investors react to weak equities, negative bonds and mounting debt.

As reserved as that price forecast may be, Metals Focus did note that gold has the potential to trend higher amid the current uncertainty.

For Thom Calandra of the Calandra Report, the price of gold will easily hold above US$1,700 and should go higher based on the current landscape.

Watch the full interview with Calandra above.

“I think it’s going to easily surpass US$2,000 — as you know … I’m one of those people who believe that gold one day will go so high that we won’t be able to measure it in paper currencies. We’ll have to measure it in purchasing power,” he told the Investing News Network.

An ounce of gold was trading for US$1,748 at 9:50 a.m. EDT on Friday.

Silver edged as high as US$17.99 per ounce this session, but was unable to pass the key US$18 level.

But the rollover of the June contract is expected to take the white metal past US$18 during the next week, according to Jeffrey Christian.

“I wouldn’t be surprised to see US$19 on silver at a spike,” said the head of CPM Group. “We take that as a short-term profit taking.”

At 10:06 a.m. EDT on Friday, silver was valued at US$17.61.

After moving lower since the end of May, platinum soared to US$824 per ounce this week before retreating. Platinum has been plagued by low prices since 2016, falling as low as US$670 in March.

Recognizing the opportunity, China has ramped up purchases of the catalyst and jewelry metal, as per a note from the World Platinum Investment Council.

“Purchases of platinum from the Shanghai Gold Exchange grew significantly in the first quarter of 2020, rising from an average of 171,000 ounce per quarter in 2019 to 455,000 ounce, as manufacturers in the jewelry and industrial sectors responded to the low platinum price and took the opportunity to increase their stock levels,” the missive states.

As of Friday at 10:18 a.m. EDT, platinum was selling for US$790.75.

Palladium also fell lower this week, starting at US$1,836 per ounce and ending down 3.5 percent. Slower-than-anticipated restarts are preventing the metal’s ability to claw back previously lost gains.

An ounce of palladium was priced at US$1,770 at 10:22 a.m. EDT on Friday.

The base metals sector was split during the last full week of June, with two commodities recording modest gains.

Copper climbed from US$5,825 per tonne on Monday to US$5,895 a day later. The red metal has now regained its March losses, adding 27 percent to its year-to-date low of US$4,617.50.

Positioned favorably in relation to the other base metals, analysts at Canaccord Genuity project that copper demand will remain steady in the long term.

“On the demand side, copper is going to be a major beneficiary of electrification of transport and renewable energy into the grid, so from that perspective alone we think it’s got a better outlook,” said Reg Spencer in a webinar.

Copper was moving for US$5,880.50 on Friday morning.

Zinc prices fell lower this week, shedding almost 2 percent. The metal remains well off its year-to-date high of US$2,643 per tonne despite being profoundly affected by COVID-19 closures.

According to a Reuters report, as much as 5 percent of globally supply may have been impacted due to lockdowns in major producer Peru.

On Friday at 10:53 a.m. EDT, zinc was valued at US$2,029.

Weak demand also prevented nickel from surpassing its Monday value of US$12,625 per tonne. Economic uncertainty continues to weigh on industrial demand, keeping the metal 32 percent off its year-to-date high of US$1,8620. Nickel sat at US$12,386 Friday.

Lead was able to add to its value and finished the session higher. At 11:07 a.m. EDT on Friday, lead was priced at US$1,777.50 per tonne.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Outlook Reports

Featured Precious Metals Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2332.59 | +16.29 | |

| Silver | 27.35 | +0.17 | |

| Copper | 4.54 | +0.05 | |

| Oil | 82.38 | -0.43 | |

| Heating Oil | 2.54 | -0.02 | |

| Natural Gas | 1.64 | -0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.