- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Moho Placement & Entitlement Issue

Moho Resources Limited (ASX: MOH) (Moho or the Company) is pleased to advise that it has received firm commitments to raise $778,733 through a placement of fully paid ordinary shares (Shares) to sophisticated and professional investors, at an issue price of $0.015 (1.5 cents) each (Placement). The bookbuild was oversubscribed with strong demand from sophisticated and professional investors.

The Shares issued under the Placement will rank equally in all respects with, the existing Shares on issue. The issue price of $0.015 represents a 21% discount to the last trading price of $0.019 on 22 May 2023 and a discount of 19% to the 15-day volume weighted average price of the Company’s shares traded on ASX of $0.0185.

Participants in the Placement will also receive one free attaching option (Placement Option) for every two Shares subscribed for and issued (subject to shareholder approval). The Placement Options will be exercisable at A$0.03 (3 cents) with an expiry date of 1 August 2025. The Company will apply to have the Placement Options quoted and tradeable on the ASX. Quotation of the Placement Options is subject to satisfaction of the ASX Listing Rule requirements.

EverBlu Capital Corporate Pty Ltd (ACN 642 215 343) (EverBlu) acted as Lead Manager to the Placement.

“Moho has had a very positive market response to its’ oversubscribed capital raising. The growth and development of Moho’s critical minerals strategy will be well supported by this injection of capital into the company, placing the Company in a great position within this rapidly developing space.”

– Mr Ralph Winter, Managing Director

Use of Funds

Proceeds from the Placement will be used for general working capital and applied to exploration at Moho’s projects, including:

- Whistlepipe Critical Minerals Projects (Peak Charles, Tambellup, Weld Range North, Stirling Range North & Manjimup) – REE, Ni, Cu & PGE:

- Conceptual targets identified using similar concepts and targeting parameters that led to the discovery of Ni-Cu-Co-PGE-Au mineralisation at Julimar

- Drilling to follow-up discovery of significant clay-hosted REE mineralisation and possible carbonatite at Peak Charles

- Assessment of soil sampling and airborne geophysical survey data for follow up drill targets at Tambellup

- Reconnaissance exploration (soils, geophysical surveys) at Weld Range North, Stirling Range North & Manjimup

- Silver Swan North Project (Ni, Au):

- RC drilling following assessment of EM survey at Dukes Ni prospect

- Extended Ni exploration program across Silver Swan North tenements

- Burracoppin (REE, Au):

- REE expansion exploration program subject to pending aircore drilling assay results

- Geochemical sampling for REE to follow up initial REE sampling program

Placement

Under the Placement a total of 51,915,549 Shares at an issue price of $0.015 to raise gross proceeds of approximately A$778,733 (before costs).

The issue of the 51,915,549 Shares is not subject to shareholder approval and will fall within the Company’s existing placement capacity under ASX Listing Rule 7.1 (31,149,330 Shares) and ASX Listing Rule 7.1A (20,766,219 Shares). The 51,915,549 Shares are expected to be issued on or around Friday, 2 June 2023.

Participants in the Placement will receive one Placement Option for every two Shares subscribed for and issued under the Placement.

Everblu as lead manager to the Placement will receive a fee of 6% of the funds raised and 5,000,000 options on the same terms as the Free Attaching Options (Lead Manager Options).

The Placement Options and Lead Manager Options will be issued pursuant to a prospectus, subject to shareholder approval, which will be sought at a general meeting to be convened as soon as practical, expected to be on or about late July 2023.

The Company intends to seek quotation of the Placement Options and Lead Manager Options (subject to satisfaction of the quotation requirements of the ASX Listing Rules).

Entitlement Issue

In addition to the Placement, the Company is also pleased to announce that it intends to undertake a pro-rata non- renounceable entitlement issue. Eligible shareholders will have the right to apply for one (1) Share for every three (3) Shares held at the record date at an issue price of $0.015 together with one (1) free attaching quoted option for every two (2) Shares subscribed for and issued (Entitlement Issue). The free attaching options to be issued under the Entitlement Issue will be issued on identical terms to the Placement Options and Lead Manager Options.

Full details of the Entitlement Issue (including the record date and eligibility requirements) will be set out in the Prospectus expected to be lodged by the Company in June 2023.

Click here for the full ASX Release

This article includes content from Moho Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IND Establishes HPQ Exploration Target at Pippingarra Project

Industrial Minerals Ltd (ASX: IND or the Company) is pleased to announce a Maiden Exploration Target for High Purity Quartz (HPQ) at its Pippingarra Quarry Project (Pippingarra) located 30km south-east of Port Hedland, in the Pilbara region of Western Australia (Figure 1).

Highlights

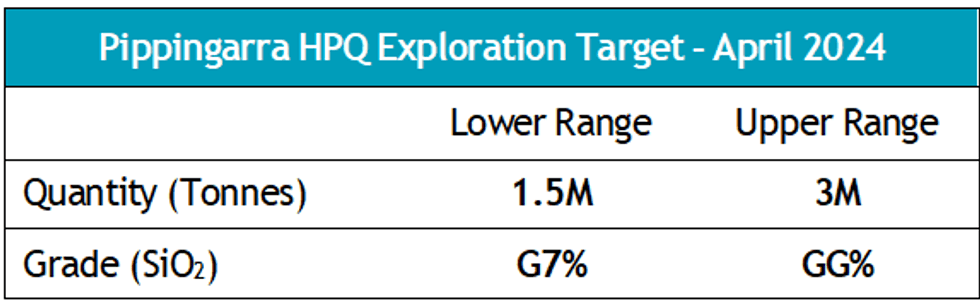

- IND’s recent RC drilling program informs a Maiden High Purity Quartz (HPQ) Exploration Target at the Pippingarra Quarry Project.

- Drilling is planned for the exploration target area and to test several quartz occurrences mapped across the wider Mining Lease area.

- IND plans to commence work on a HPQ Mineral Resource Estimate in parallel with metallurgical testwork being conducted by potential offtake partners and third-party mineral processing laboratories.

- A 300kg Pippingarra quartz sample crushed from existing quarry stockpiles sent to China in late 2023 produced a >GG.GG4% SiO2 end product following standard HPQ processing1.

- A further 24 tonne bulk sample comprising crushed quartz rock has been shipped to China for processing, metallurgical test work, and assessment by potential offtake partners.

In October 2023, IND announced the agreement of binding terms2 with North West Quarries Pty Ltd (NWQ) for an exclusive option to acquire an 80% interest in the non-construction material mineral rights.

Jeff Sweet, Managing Director of Industrial Minerals, commented:

“Following on from one of our potential offtake partners in China achieving a processed High Purity Ǫuartz product grading >SS.SS4% SiO2, we are extremely positive about the potential to supply Pippingarra quartz into high-end quartz markets.

“The Pippingarra Exploration Target is limited to an area where IND completed RC drilling in late 2023, to the east of the existing open pit. There are several quartz outcrops mapped across the broader Mining Lease area that will also be drilled with the intention to include these untested HPǪ target opportunities in the upcoming Mineral Resource Estimate (MRE) for Pippingarra.

“Our motivation to commence work towards a MRE is to leverage our unique position of having an active mining operation at the Pippingarra Ǫuarry. We believe this will give potential offtake partners the confidence to enter into offtake agreements with IND, knowing that we can rapidly advance to be mine ready and have a suitable mine life to support long term supply needs.”

Maiden High Purity Quartz Exploration Target

The potential quantity and grade of the Exploration Target is conceptual in nature, and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been prepared and reported in accordance with the 2012 edition of the JORC Code.

The Exploration Target is based upon the Reverse Circulation (RC) Drilling program completed by IND in December 2023. Drilling was conducted on a 50m x 50m spacing. From this, holes INRC003 – INRC009 recorded thicknesses of white crystalline quartz over widths from 12m to 20m as reported in the Table 2 below.

Click here for the full ASX Release

This article includes content from Industrial Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

China-Based Battery Grade High-Purity Manganese Production Strategy

Investor Site Visit Presentation - April 2024

BUILDING A LOW-COST HIGH-PURITY MANGANESE SULPHATE PLANT

Unique, Low-Cost, Speed-to-Market Strategy

Successfully executing a high-purity manganese sulphate strategy to supply into the rapidly expanding LMFP battery market . Investor Site visit in China to demonstrate the compelling opportunity for Firebird to establish itself as a key, low-cost, near-term producer

Sustainable Economics and Perfect Timing

Firebird to become of one of the lowest-cost battery grade MnSO4 producers, placing the Company in a competitive position in all market environments, at a time when the LMFP market is forecasted for exponential growth and become a >US$20 billion market by 2030

Management, Board and In-Country Team with Sector Leading Credentials

Led by a Board and Management team with proven abilities of building companies through the lifecycle and into production. Assembled a proven and high-quality team in China, who are leaders in the development and production of high-purity manganese

Well-Funded and Supported

Strong cash position of $7.36m (as of 31 Dec 2023) to fund key workstreams across China strategy and at Oakover. Firebird has attracted a strong investor register supported by a highly-reputable investor Canmax Technologies Co., Ltd with a 9.7% holding

DEVELOPMENT PROGRESS IN CHINA CONTINUING AS PLANNED

- Preliminary design work, R&D centre, equipment supplier due diligence & project permitting are all being progressed at full speed

- Estimated permitting & design on track for completion by late Q3 2024

- European customer site visits & off-take discussions commenced with excellent feedback

- Formal advice from Jinshi Government & relevant departments on process to repatriate profits and capital from operations

- As further proof of the strong levels of support in-country, Firebird will also receive a preferential tax rebate for 6 years

- Australian investor & broker site visit to key areas in China, including Jinshi High-Tech Industrial Park, Pilot Plant and Jinshi Port to take place on April 23

- Oakover project development continues as planned and forms an integral part of Firebird’s long term manganese battery materials strategy

Click here for the full ASX Release

This article includes content from Firebird Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Summit to Acquire Transformational Brazilian Niobium, Rare Earth & Lithium Portfolio

Summit Minerals Limited (ASX: SUM) (“Summit” or the “Company”) is excited to announce that it has signed binding agreements (“Agreements”) to acquire tenement packages highly prospective for rare earth elements (REE), niobium, and lithium. Term sheets were signed with vendors RTB Geologia & Mineracao Ltda (RTB), Sandro Arruda Silva Ltda. (SAS), and Mineracao Paranal Ltda (MPL) to acquire legal ownership and title over certain Exploration Permits and Applications for Exploration covering an area of 29,267 hectares in Minas Gerais and Paraiba States, Brazil (Figure 1; Table 2).

HIGHLIGHTS

- Summit has entered into a binding purchase agreement to acquire 100% of JUAZEIRINHO (Nb, REE), EQUADOR (Nb, REE), ARATAPIRA (REE), SANTA SOUSA (REE), T1/T2 (REE) & HERCULES NORTH & SOUTH (Li) Projects situated in the mining friendly and commodity-rich states of Minas Gerais & Paraiba.

NIOBIUM AND REE PACKAGE HIGHLIGHTS

- The Niobium and REE tenement package consists of Juazeirinho, Equador, Aratapira, Santa Sousa and T1/T2 Projects, covering a combined strategic area of 10,747.36 Hectares (107.47 km2) across 11 granted tenements.

- Exceptional grades in Niobium Pentoxide (Nb2O5) and partial rare earth oxide (PREO) were produced in panned concentrates from pegmatite and sediment samples at Juazeirinho and Equador (Paraiba State).1:

JUAZEIRINHO ASSAYS (Niobium & REE)

- 355,400ppm or 35.54% (Nb2O5) + 14,080ppm PREO or 1.408% PREO (SID 099/24)

- 107,010ppm or 10.7% (Nb2O5) + 142,080ppm PREO or 14.208% PREO (SID 098/24)

EQUADOR ASSAYS (Niobium + REE)

- 303,400ppm or 30.34% (Nb2O5) + 15,130ppm PREO or 1.513% PREO. (SID 100/24)

- Nine of 17 rare earth elements were analysed by the previous owner and used in PREO calculations, implying higher TREO (total rare earth oxide) values are probable.

- Numerous LCT-pegmatite bodies were observed at Equador and Juazeirinho, indicating good potential for columbite/tantalite, lithium, with significant concentrations of niobium across these projects.

LITHIUM PACKAGE HIGHLIGHTS

- The lithium tenement package consists of the Hercules North and the Hercules South projects, covering 18,519.44 hectares (185.19 km2) across 14 licenses (granted and applications) situated in the prolific Jequitinhonha or Lithium Valley (Minas Gerais), where 85% of Brazil’s lithium resources are located.

- Numerous artisanal mines exist within & near the tenement boundaries, where large LCT pegmatites have been identified that produced beryl, aquamarine, and spodumene in economic quantities, as evidenced by local stockpiles from garimperios production.

- Artisanal surface mining has been prominent across all projects, providing priority drill targets for deeper-level pegmatite-related mineralisation.

- Summit has established an in-country exploration team ready to conduct an aggressive exploration program on all tenements concurrently.

- Summit has a strong balance street, having ~A2.2m AUD in the treasure as of the last quarterly cash report2.

Summit Managing Director, Gower He, commented:

“We are extremely pleased to acquire these highly prospective projects. We anticipate acquiring these niobium, REE and lithium projects will enhance our company’s status as a critical mineral explorer and developer.

Over the last few months, we have assessed many options for project acquisition and have chosen these highly prospective and large-scale projects within the established mining-friendly jurisdiction of Brazil. Additionally, Brazil, being a relatively geopolitically neutral jurisdiction, should provide us with unrestricted access to global off-take and funding options, giving our projects the best chance of success within the macro environment.

In addition to some of the strong historical grades, we received great observational reports from our recently completed on-site DD, from which we await rock chip and soil assay results. Expansive exploration programs are already being planned as we look to rapidly develop our projects, giving ourselves the highest chance of success.

I would like to personally thank all our loyal shareholders for their ongoing support. We look forward to regularly informing the market of our progress.”

Click here for the full ASX Release

This article includes content from Summit Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Positive Findings from Newmont Ti Benchmarking Study

West Cobar Metals Limited (ASX:WC1) (“West Cobar”, “the Company”) is pleased to provide an update on activities at its Salazar critical minerals project in Western Australia.

Highlights

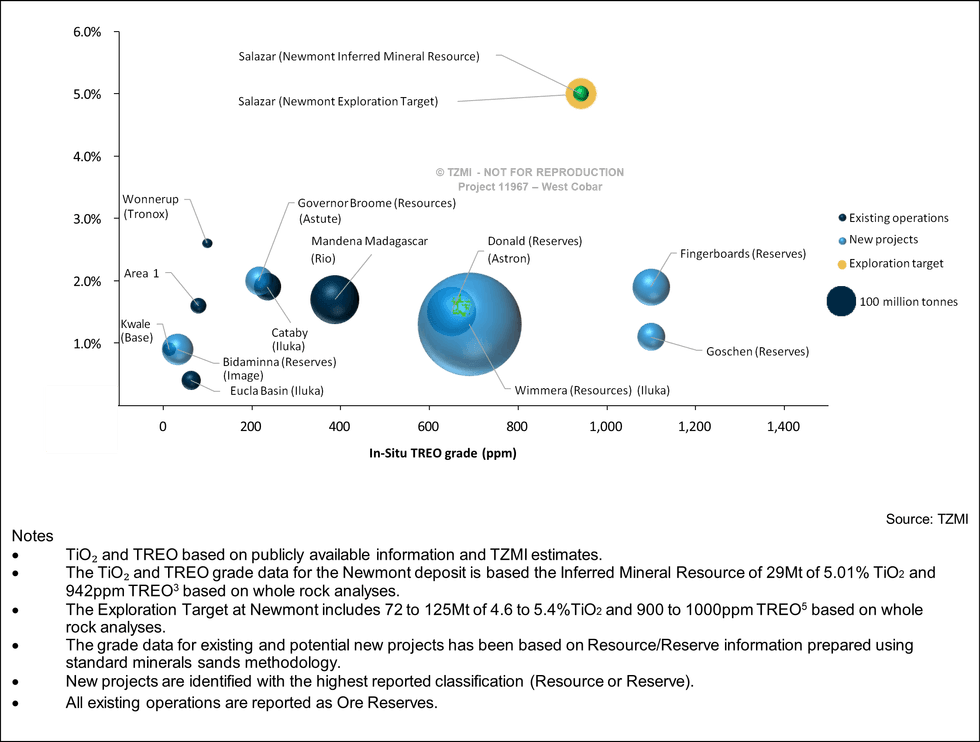

- Titanium industry expert TZMI completes titanium benchmarking study on the Salazar Critical Minerals Project

- Study identifies Newmont as a standout from its peers in terms of Ti and TREO in-situ grade

- Benchmarking study is highly encouraging and supports validating flowsheet for production of titanium minerals from Salazar

Following successful characterisation testwork of Ti mineralisation at the Newmont Deposit area1, West Cobar Metals engaged international titanium expert TZ Minerals International Pty Ltd (TZMI) to complete a benchmarking study of the Newmont resource.

TZMI is a global, independent consulting and publishing company which specialises in all aspects of the mineral sands, titanium dioxide and coatings industries2.

The Newmont resource3 and characterisation data was used by TZMI to benchmark the Salazar project deposit against several existing operations and potential new projects under development using publicly available information and TZMI estimates. The outcomes of the benchmarking are shown in Figure 1.

The benchmarking study shows that the Ti contained within the Newmont deposit has promising potential for economic extraction and that the Newmont resource is positioned favourably amongst peer resources in respect of both Ti and rare earth element content.

The relative positioning of the Newmont Inferred Ti and rare earth element resource is very positive for West Cobar, with relatively high insitu TiO2 grades and TREO grades compared to its peers. The Ti levels of the resource (on a whole rock basis) compare very favourably to both developing and operating projects.

TZMI concluded that “In terms of final ilmenite product quality, the composition of the magnetic fraction (comprising predominantly ilmenite) shows some promise with TiO₂ levels as high as 48.5%. This suggests the ilmenite is likely present as primary ilmenite … the CaO, MgO, V₂O₅, Cr₂O₃ in the magnetic fraction all seem relatively low which is positive and likely to be within the accepted levels for ilmenite used in sulfate pigment production.”

Click here for the full ASX Release

This article includes content from West Cobar Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

High Grade Copper Rock Chips to 18% on New Targets at Ti-Tree

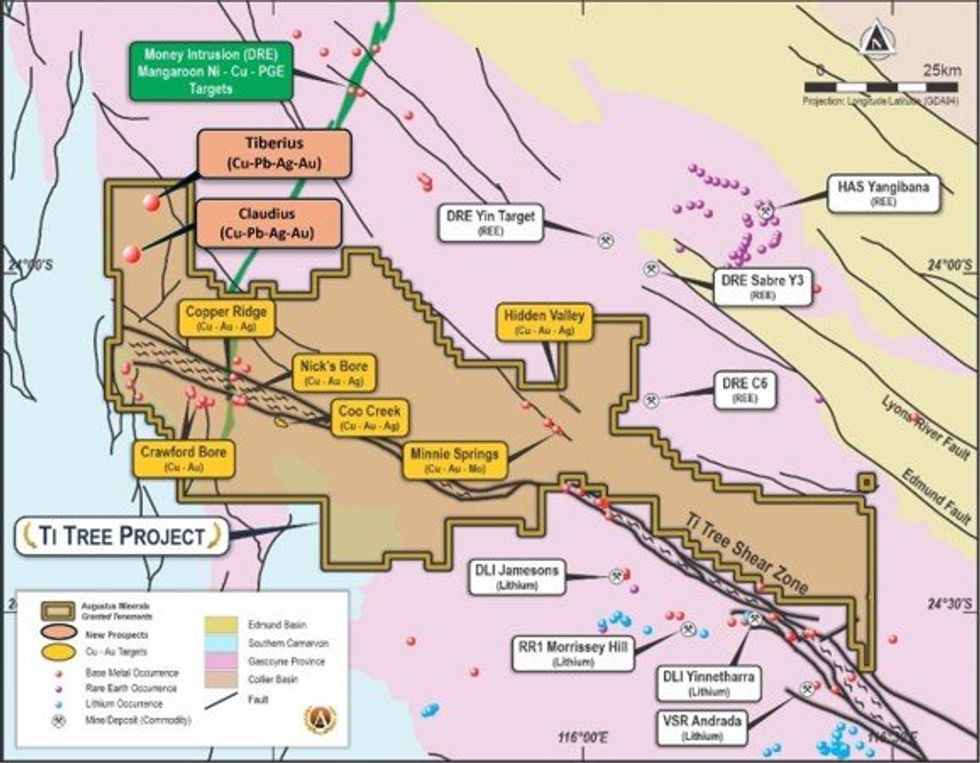

Augustus Minerals (ASX: AUG; “Augustus” or the “Company”) is pleased to advise the results of recent reconnaissance mapping and sampling at the Ti-Tree Project, located 200kms east of Carnarvon in Western Australia. The mapping, supported by 26 rock chip samples, identified two areas containing mineralised veins and historic workings (Figure 1). Neither of these prospects are recorded on GSWA maps.

- Two new prospects, Tiberius and Claudius, have returned high-grade copper and significant silver assays in rock chips from recent field work

- High grade assays up to 17.8% Cu and 282g/t Ag have been discovered on the Tiberius zone, currently 3m wide and extending for over 200m along strike.

- Claudius, 11km south of Tiberius, comprised of several parallel zones over a 100m by 300m area, returned grades up to 6.6% Cu and 86g/t Ag.

- The discovery of these prospects, 30km northwest from Copper Ridge which contain historic workings not marked on GSWA maps, highlights the significant prospectivity of the Gascoyne region.

- Further field work is being planned to determine the extent of these new discoveries.

Andrew Ford, GM Exploration

“These results highlight the potential of this underexplored area to host as yet undiscovered mineralisation. Less than 5% of the 3,600 sq km area of the Ti-Tree Project has had any previous exploration, and to discover unrecorded historic mining areas is very exciting. These results are a credit the Augustus geological team.”

Tiberius

Reconnaissance field work conducted on the Ti Tree Project’s northwestern tenement has discovered high grade copper and silver mineralisation (Figure 3) in two areas. Tiberius, the northern target comprises a quartz-sulphide vein system up to 3m wide and outcrops for over 200m (Figure 5).

A shallow shaft has been dug on the vein system (Figure 2). Another vein set was identified 600m along strike east-northeast of the main vein increasing the potential size of the target. The high grade veins contain both oxidized copper, high silver grades, lead sulphide and anomalous gold (Table 1).

Claudius

The Claudius prospect is located 10km to the southwest of Tiberius, comprised of quartz veined brecciated and silicified granite with mineralised veins mapped over a 100m x 300m area. The main area of outcropping mineralisation has been trenched by prospectors and rock chip sampling returned strong copper mineralisation in an iron rich siliceous vein. Silver was consistently elevated (up to 86g/t) with associated gold anomalism to 0.68g/t (Table 1, Figures 4 and 6).

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

From the Bronze Age to the Green Revolution: Mining's Timeless Role in Shaping Humanity's Future

Mining is one of the oldest industries on Earth. With activity stretching back as many as 40,000 years, human advancement is closely correlated to our relationship with metals and minerals.

Indeed, modern society has been made possible through the extraction of metals and the ages this work has ushered in, from the historic Bronze Age to the more recent Industrial Revolution.

Now, 54 years after the inaugural Earth Day, the world is preparing for the green energy transition. And as this essential shift moves forward, metals are again playing an integral role in achieving the ambitious goals set globally.

During his presentation at the annual Prospectors & Developers Association of Canada convention, mining industry figure Mark Cutifani recounted the role the mining sector has had in humanity's past and will play in its burgeoning future.

“I'm focused on how we might catalyze new conversations around mining and its contribution to society,” he told listeners at the annual event, which took place in early March. “It is through our great pioneers and innovators that we continue to transform our work, and its value to society in so many different dimensions”

In simple terms, everything we use and make is derived from materials like metals and minerals, noted Cutifani.

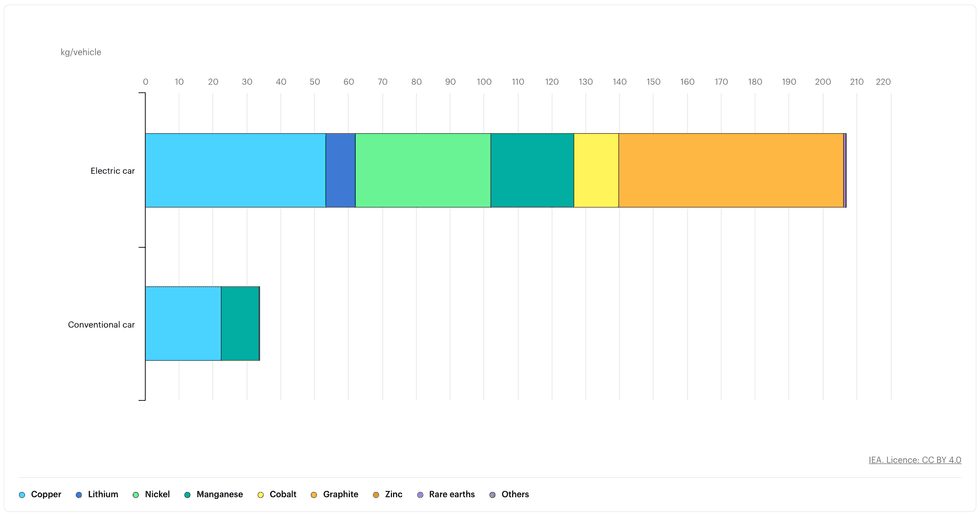

Minerals used in electric cars compared to conventional cars.

Chart via the International Energy Agency.

In his view, while technical discussions about improving industry practices are essential, it's also crucial to help people understand the significance of the mining industry in the functioning of society as a whole.

For example, the average smartphone uses 13 metals and minerals, while electric vehicles require seven, including copper, lithium, nickel, manganese, cobalt, graphite, zinc and rare earths.

Mining's key role in the world's future

Cutifani went on to highlight how metals and minerals contribute to the health of our waterways and oceans.

“The provision of clean water is an absolute necessity to sustain life as we know it. We need minerals to purify, pump, use and recycle water. (We are) an industry that uses about 3 percent of the world's water to support everything else that happens on the planet. We are overwhelmingly a positive for global water balances,” he said.

In addition to water, the mining of phosphate and potash is imperative to global food supply, according to Cutifani, because without the valuable fertilizers they produce, “we could only feed half the planet.”

Even though there may be debates about eliminating certain products like fertilizers, he said it's essential to understand the broader implications and consequences of such decisions on global food security.

Beyond food security, metals and the alloys they produce have allowed us to curb urban sprawl through skyscrapers and high-rise residential towers that require steel and concrete, both of which are produced using mined and quarried materials. While we often hear of the vast amounts of metals needed for the energy transition, Cutifani noted that the energy transition debate tends to overlook other critical global issues like water, food security and shelter.

In his view, addressing global challenges will require the consideration of all fundamental human needs. It's essential to broaden the conversation and recognize the interconnectedness of various societal issues.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.