- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Rights Issue Prospectus

Blackstone Minerals Limited (ASX:BSX, OTC:BLSTF) continues to intersect Massive Sulfide Vein (MSV) mineralisation at King Snake.

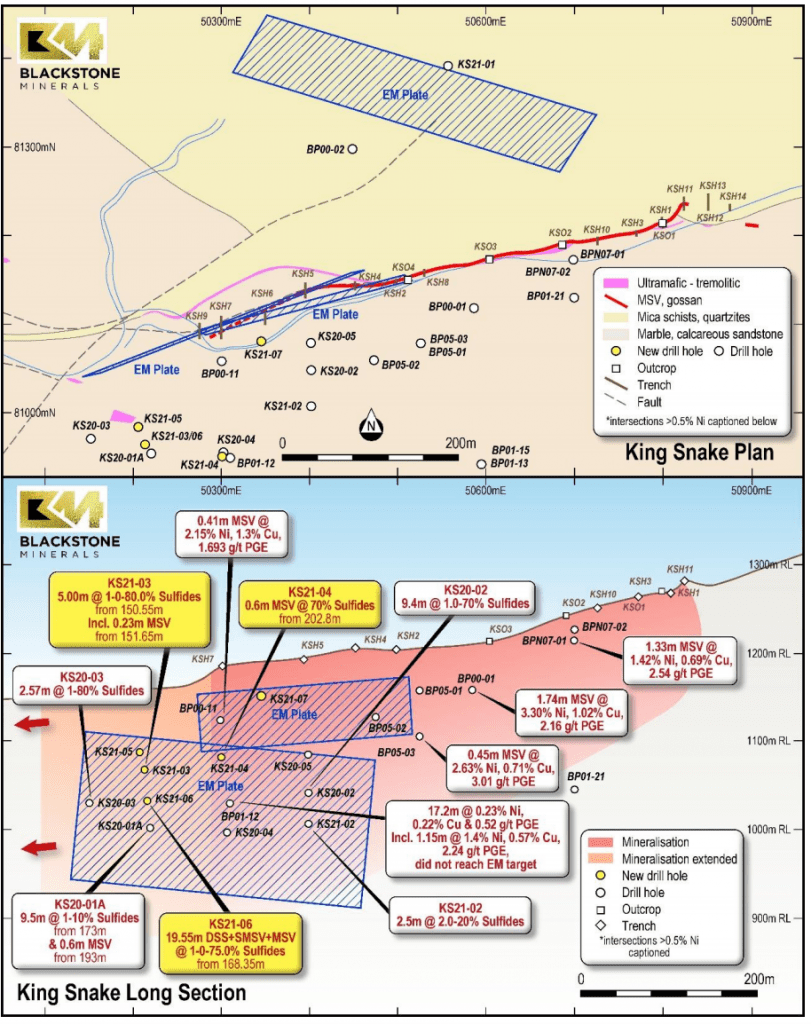

Blackstone Minerals Limited (ASX:BSX, OTC:BLSTF) is pleased to report that it continues to intersect Massive Sulfide Vein (MSV) mineralisation at King Snake. MSV has been observed in all drill holes subsequent to the maiden intersections recently announced (refer Tables 2 & 3 in Appendix 1 of this report and ASX announcement 4 February 2021).

The Company is aggressively drilling at King Snake and sees significant potential for it to be incorporated into ongoing mining and processing studies given the exploration success to date.

Highlights from continued exploration at King Snake include:

The Company expects to provide an update regarding the anticipated King Snake assay results, along with results from ongoing infill drilling at Ban Chang and Ban Phuc DSS over the coming weeks.• All five additional drill holes at King Snake have intersected MSV mineralisation. KS21-06 intersected 19.55m of continuous mineralisation, including disseminated sulfide (DSS), semi-massive sulfide vein (SMSV) and MSV;

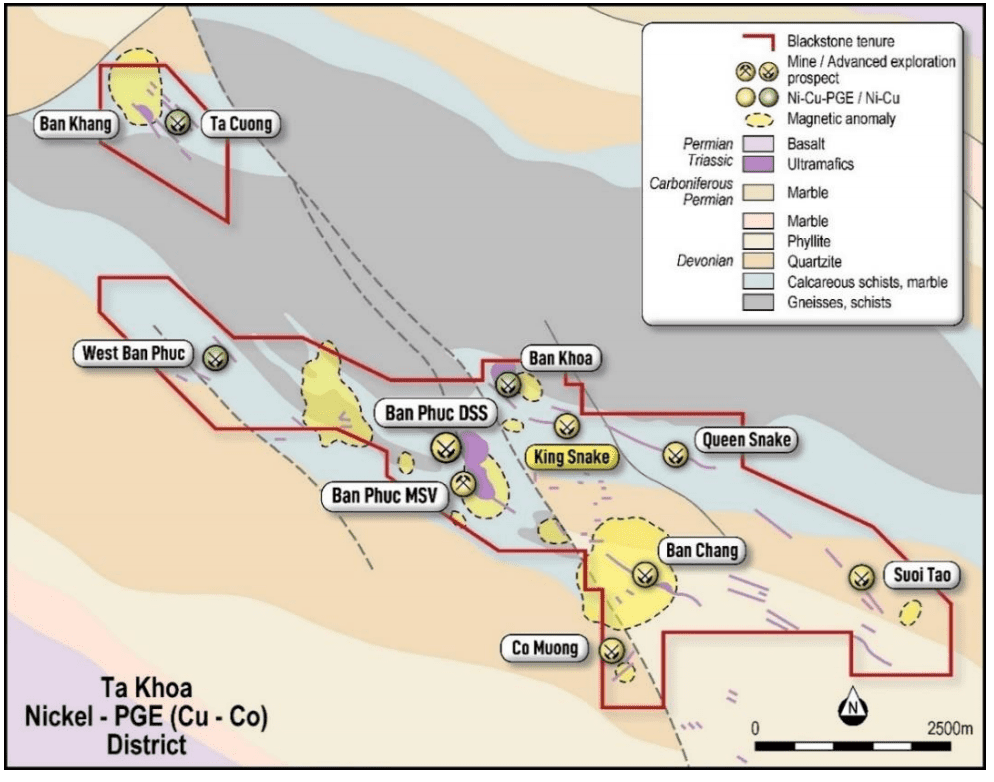

- New intersections together with historic drill results have defined a strike length of 800m. Importantly, the mineralisation is open in multiple directions (refer Figures 2 & 3);

- Blackstone’s drilling at King Snake is focusing on new Electro-magnetic (EM) geophysics targets which extend down plunge to the west of historic drilling. Initial visual results suggest greater thickness of sulfide mineralisation down plunge of historic drilling;

- With resource estimation currently underway at Ban Chang, King Snake has become the Company’s highest priority MSV exploration target. Multiple drill rigs are currently on site and will continue to test the extent of the mineralisation; and

- King Snake has the potential to materially add to the Company’s MSV mining inventory and support the restart of the existing 450ktpa Ban Phuc concentrator.

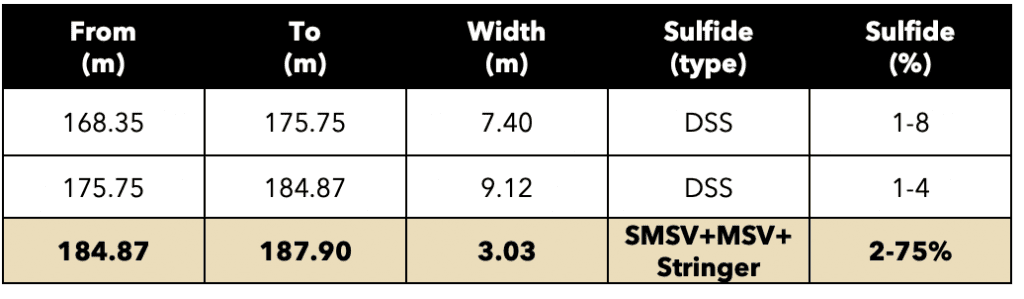

KS21-06:

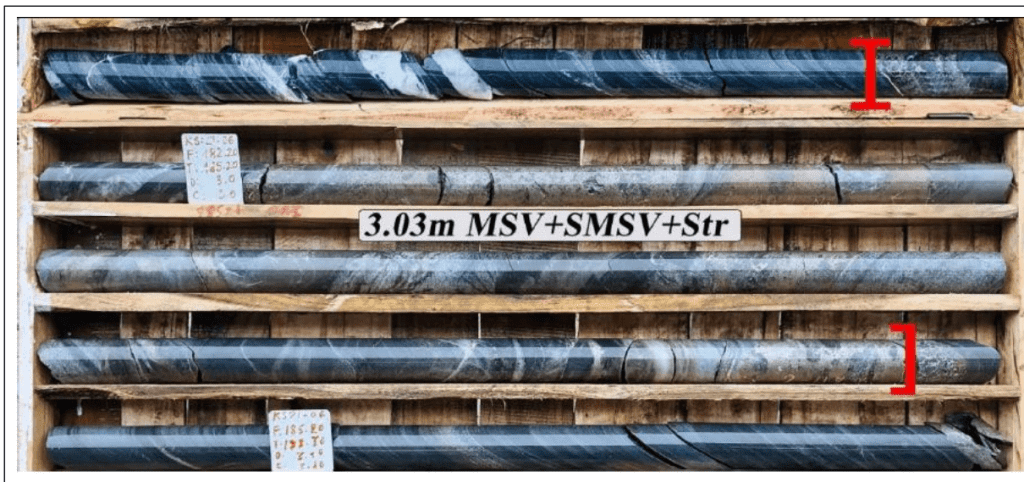

The most significant intercept from the latest round of drilling at King Snake was KS21-06:

Image 1. MSV – KS21-06

Table 1. Sulfide mineralisation zones in KS21-06

Image 2. MSV, SMSV and stringer zones in KS21-06

Image 2. MSV, SMSV and stringer zones in KS21-06

Blackstone Minerals’ Managing Director Scott Williamson commented:

“We are pleased by the rate of drilling at King Snake and the success of our exploration strategy in following up EM targets defined by our in-house geophysics team. King Snake features multiple EM plates and is proving to be one of Blackstone’s best massive sulfide nickel opportunities to date. We look forward to further aggressive drilling, reporting assays as they become available and being able to incorporate King Snake into our massive sulfide strategy.”

Figure 1. Ta Khoa Nickel-PGE (Cu-Co) district

King Snake

King Snake is a MSV prospect, located 1.5km north-east of the processing facility (refer Figure 1). At King Snake, MSV and high-grade brecciated Ni-Cu-Co-PGE (Platinum (Pt), Palladium (Pd) & Gold (Au)) sulfides and gossans are associated with tremolite-altered mafic-ultramafic rocks.

Results from Blackstone’s maiden program at King Snake together with historic drill results have defined a strike length of over 800m at King Snake which includes MSV, SMSV and DSS (refer Figure 2).

The Company is targeting a maiden resource at King Snake in 2021. King Snake may be incorporated into ongoing mining and processing studies as sufficient data becomes available.

Click here to connect with Blackstone Minerals Limited (ASX:BSX) for an Investor Presentation.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2329.93 | +0.36 | |

| Silver | 27.49 | +0.02 | |

| Copper | 4.24 | -0.01 | |

| Oil | 86.73 | +0.14 | |

| Heating Oil | 2.75 | +0.01 | |

| Natural Gas | 1.78 | +0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.