- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Nachu High Purity Natural Graphite Significant for the Lithium-Ion Battery Industry

Magnis Energy Technologies Limited (ASX: MNS) is pleased to provide an update on the graphite products produced from the Company’s Nachu Graphite Project in Tanzania.

• Nachu project +99% purity flake graphite from the proposed mine processing plant deemed a high value product, only matched in the graphite industry through high cost downstream purification.

• Once in production, graphite from the Nachu Project is forecasted to demand a premium price, demonstrating the financial viability of the Project, whilst minimising environmental impact without the use of chemical or thermal processes.

• The low cost and sustainable processes for extracting graphite from the Nachu Project, align with the use of LIBs in new emerging sustainable industries

• Recent cell testing results using Nachu graphite exceeds those of current suppliers.

Magnis Energy Technologies Limited (“Magnis”, or the “Company”) (ASX: MNS) is pleased to provide an update on the graphite products produced from the Company’s Nachu Graphite Project in Tanzania (“Project”), as Magnis aims to become one of the lowest cost producers of value added graphite products for the Lithium-ion Battery (LIB) industry, a market which is currently experiencing significant growth.

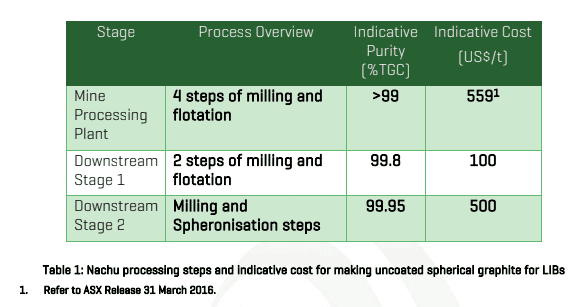

Low Cost and Sustainable Process As announced on 21 May 2020, Magnis’ process optimisation programs have demonstrated the ability to produce graphite products with purities ranging from 99% to 99.95%, without the use of chemical or thermal purification. As highlighted in Table 1 below, the milling and flotation steps are mechanical processes, that are significantly lower in cost than the widely used chemical and thermal purification processes to purify graphite, that typically cost over US$1,000/t.

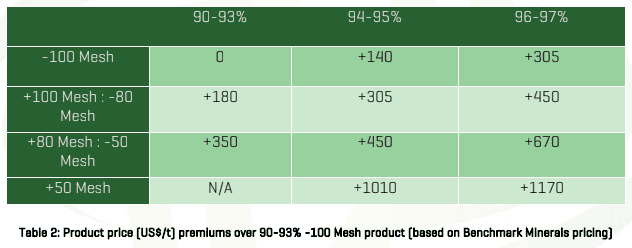

To date, there are currently only a few graphite mines capable of producing such high purity graphite flake, whilst maintaining a large flake size distribution along with high recoveries. Table 2 below details the price premium of varying sizes of flake graphite products (FOB China basis), that are currently sold by producing mines into the global graphite market.

As detailed in Table 2 above, larger size flake graphite of a high purity demands a premium price per tonne, which can be partly contributed to its suitability in meeting specifications for use in the lithium ion battery industry. However, flake graphite at purities greater than 98% are generally produced through additional refining and value adding processes, which generally results in added cost.

Magnis’ market inquiries indicate a further price premium of US$150-200/t for 98% purity, when compared to 96-97% purity detailed in Table 2. Importantly, the pricing of value-added graphite products is related performance, be it expansion properties relating to use in the expandable graphite market, or particle properties for uncoated spherical graphite for LIBs. It should be noted that the above product matrix in Table 1 is based on available data from the majority of flake graphite sold from existing graphite mine operations. From discussion, analysis and feedback from with tier 1 companies operating in the global graphite market, Magnis believes that strong demand exists for a cost-effective, sustainably produced anode for the lithium-ion battery industry.

Recent Cell Testing Results Anode blends containing spherical coated material derived from Nachu Project graphite, have demonstrated excellent battery performance, showcasing 1000 cycles and still retaining around 90% capacity. These initial results are an improvement over most commercially available anode materials, with work on coating optimisation expected to confirm significant performance improvement targeting 80% capacity after 5,000 cycles.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2367.40 | -15.45 | |

| Silver | 28.22 | +0.05 | |

| Copper | 4.36 | 0.00 | |

| Oil | 82.80 | +0.11 | |

| Heating Oil | 2.58 | 0.00 | |

| Natural Gas | 1.72 | 0.00 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.