(figures are in US$ except where stated)

Newcrest (ASX: NCM) (TSX: NCM) delivers record profit and free cash flow and a 129% increase in final dividend(1),(2),(3),(4)

- Creating a brighter future for people through safe and responsible mining

- Zero fatalities and life-changing injuries, underpinned by industry-leading low injury rates(5)

- Goal of net zero carbon emissions by 2050(6)

- Cadia renewable energy contract signed – on track for 30% reduction in Group emissions intensity by 2030(7)

- Strong operating performance and higher prices translate to record profit and free cash flow

- Gold production of 2.1 million ounces(8), with record copper production of 142.7 thousand tonnes

- Record Statutory and record Underlying profit of $1.2 billion(9),(10), up 80% and 55% respectively

- Record annual free cash flow of $1.1 billion(10)

- All-In Sustaining Cost (AISC) of $911/oz(8),(10),(11), delivering a record AISC margin of 49% or $876/oz(10),(11),([12])

- Record mine and mill performance at Cadia, underpinning record copper production and its lowest reported annual AISC of negative $109/oz

- Strong balance sheet is well positioned for growth

- Net cash position of $176 million as at 30 June 2021

- Significant liquidity with $3.9 billion in cash and committed undrawn bank facilities

- Early repayment of 2022 Corporate Bonds and renegotiation of bilateral bank debt facilities

- Next corporate bond debt repayment not due until May 2030

- Advancing multiple organic growth options

- Exploration decline development works progressing well at Red Chris and Havieron

- First production from Cadia Molybdenum Plant expected by the end of September 2021([13])

- Board approves Cadia PC1-2 Pre-Feasibility Study to Feasibility Stage

- Board approves Telfer WDS5 cutback

- Sixth consecutive year of increased dividends

- Final fully franked dividend of US 40 cps, 129% higher than the prior year

- Record total dividends for FY21 of US 55 cps, equal to a 41% payout of FY21 free cash flow

- Earnings per share of 142.5 cents, 71% higher than prior year

Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas, said, “Newcrest has delivered a strong operational and financial performance for the 2021 financial year, producing 2.1 million ounces of gold at an AISC of $911 per ounce. Together with the benefit of higher gold and copper prices, this translated into a record statutory and underlying profit of $1.2 billion and a record free cash flow of $1.1 billion.”

“At Newcrest our Purpose of Creating a brighter future through safe and responsible mining is core to how we run our business. We are now nearly six years free of fatalities and life-changing injuries and have reported a 12% improvement in injury rates compared to the prior year. Notwithstanding the challenges brought by COVID-19, our extensive precautionary measures and focus on safety has enabled us to achieve our full year guidance. At the same time, we were also able to contribute our expertise to assist local governments and our host communities with their response to the virus.”

In May 2021 we announced our goal of net zero carbon emissions by 2050. We have made solid progress implementing our sustainability objectives throughout our business and continue to target improvements in water usage, biodiversity and emissions reductions.”

“The Board has approved the Cadia PC1-2 Pre-Feasibility Study to the next stage, the Feasibility Study stage. The Study updates and defines a significant part of Cadia’s future mine plan. The Board also approved the Early Works program to establish critical infrastructure in parallel with the Feasibility Study. PC1-2 has an attractive rate of return and is expected to help sustain Cadia’s position as a Tier 1, low-cost producer for decades to come.”

Mr Biswas noted that Newcrest’s strong financial position enables its investment in attractive growth projects. “We have significant financial capacity to fund our pipeline of attractive organic growth options, both from the expected cash flow generation over the development period and our strong balance sheet.”

On the increase in shareholder returns, Mr Biswas said “Our dividend policy targets total dividends for a financial year to be in the range of 30-60% of that financial year’s free cashflow, with a minimum annual dividend of US 15 cents per share. Given our record free cash flow generation for FY21, strong balance sheet and positive outlook the Board has approved a final dividend of US 40 cents per share, which is 129% higher than last year’s final dividend. This equates to a record total full year dividend of US 55 cents per share which represents a 41% payout of FY21’s free cashflow and marks our sixth consecutive year of increasing dividends to shareholders.”

“In the coming months we look forward to finalising key Pre-Feasibility Studies for Red Chris, Havieron and Lihir. We are striving to bring Havieron and the Red Chris block cave into production as soon as possible. Phase 14A at Lihir represents further upside from the current mine plan and brings forward our aspiration for Lihir to be a 1 million ounce plus annual producer” said Mr Biswas.

Summary of Operating and Financial Results

For the 12 months ended 30 June | |||

| Endnote | UoM | 2021 | 2020 | Change | Change % | ||

| TRIFR | 14 | mhrs | 2.3 | 2.6 | (0.3) | (12%) | |

| Group production | – gold | 8 | oz | 2,093,322 | 2,171,118 | (77,796) | (4%) |

| – copper | t | 142,724 | 137,623 | 5,101 | 4% | ||

| Revenue | $m | 4,576 | 3,922 | 654 | 17% | ||

| EBITDA | 10 | $m | 2,443 | 1,835 | 608 | 33% | |

| EBIT | 10 | $m | 1,770 | 1,191 | 579 | 49% | |

| Statutory profit | 9 | $m | 1,164 | 647 | 517 | 80% | |

| Underlying profit | 10 | $m | 1,164 | 750 | 414 | 55% | |

| Cash flow from operating activities | $m | 2,302 | 1,471 | 831 | 56% | ||

| Free cash flow* | 10 | $m | 1,104 | (621) | 1,725 | 278% | |

| EBITDA margin | 10 | % | 53.4 | 46.8 | 6.6 | 14% | |

| EBIT margin | 10 | % | 38.7 | 30.4 | 8.3 | 27% | |

| All-In Sustaining Cost | 8,10,11 | $/oz | 911 | 862 | 49 | 6% | |

| All-In Sustaining Cost margin | 10,11,12 | $/oz | 876 | 668 | 208 | 31% | |

| Realised gold price | 15 | $/oz | 1,796 | 1,530 | 266 | 17% | |

| Realised copper price | 15 | $/lb | 3.66 | 2.57 | 1.09 | 42% | |

| Earnings per share (basic) | US$ cents | 142.5 | 83.4 | 59.1 | 71% | ||

| Earnings per share (diluted) | US$ cents | 142.1 | 83.1 | 59.0 | 71% | ||

| Dividends paid per share | US$ cents | 32.5 | 22.0 | 10.5 | 48% | ||

| Cash and cash equivalents | $m | 1,873 | 1,451 | 422 | 29% | ||

| (Net cash) or net debt | $m | (176) | 624 | (800) | (128%) | ||

| Leverage ratio | 10 | times | (0.1) | 0.3 | (0.4) | (133%) | |

| Gearing | % | (1.8) | 6.8 | (8.6) | (126%) | ||

| ROCE | 10 | % | 18.5 | 13.8 | 4.7 | 34% | |

*Free cash flow in the prior period includes the acquisition of Red Chris (70%) for $769 million, the acquisition of Fruta del Norte finance facilities for $460 million, further investments in Lundin Gold of $79 million, net proceeds from divesting Gosowong of $20 million and $3 million for an interest in Antipa Minerals Ltd.

Refer to the Company’s “ASX Appendix 4E and Financial Report” released on 19 August 2021, and the Operating and Financial Review in particular, for more detail on the Company’s financial results.

FY21 Final Dividend

Newcrest looks to pay ordinary dividends that are sustainable over time having regard to its cash flow generation, its reinvestment options in the business and external growth opportunities, its financial policy metrics and its balance sheet strength. Newcrest targets a total annual dividend payout of 30-60% of free cash flow generated for the financial year, with the annual total dividends being at least US 15 cents per share on a full year basis.

Having regard to the above-mentioned considerations, the Newcrest Board has determined that a final fully franked dividend of US 40 cents per share will be paid on Thursday, 30 September 2021. The final dividend is 129% higher than the final dividend for FY20 and marks the sixth consecutive year of increasing dividend payments to shareholders.

The record date for entitlement is Friday, 27 August 2021. The financial impact of the FY21 final dividend amounting to $327 million has not been recognised in the Consolidated Financial Statements for the year. The Company’s Dividend Reinvestment Plan remains in place.

COVID-19 Update

To date, Newcrest has not experienced any material COVID-19 related disruptions to production or to the supply of goods and services.

At the date of this report, the number of COVID-19 cases at Lihir remains at low levels that are within the capability of the care and treatment and isolation facilities, with the majority of these cases continuing to be asymptomatic. Newcrest continues to strengthen its COVID-19 controls at Lihir, focusing on containment through extensive contact tracing and isolation procedures. Charter flights with restricted capacity are operating between Papua New Guinea and Australia, as are limited commercial flights between Port Moresby and Brisbane.

There were no material COVID-19 related events impacting gold production at Lihir during the financial year. However, as advised in the March 2021 quarterly report, the ability to attract labour, travel restrictions, contact tracing and associated isolation requirements has impacted total material mined. Delays have also been experienced on development projects (including Phase 14A ground support trials) and shutdown performance due to difficulty in mobilising and accommodating labour. There remains a risk of COVID-19 impacting production at Lihir and this continues to be closely managed.

All of Newcrest’s operations have business continuity plans and contingencies in place which strive to minimise disruptions due to the pandemic and to best position the operations to continue producing. Should any material impacts arise, Newcrest will inform the market in line with its continuous disclosure obligations.

In FY21, Newcrest incurred ~$70 million in COVID-19 management costs, of which $53 million related to Lihir. Costs associated with managing COVID-19 risks in FY21 were around $30 million higher than anticipated due to more extensive testing, longer quarantining periods, additional accommodation, rostering and other labour costs, and other preventative actions. Elevated costs related to the pandemic are expected to continue throughout FY22.

Newcrest established a A$20 million Community Support Fund in April 2020 to support host communities and jurisdictions in their response to the COVID-19 pandemic. In FY21, the Fund supported a range of initiatives in Australia, Papua New Guinea, British Columbia and Ecuador including the provision of emergency medical equipment, food supplies, mental health support, support for small businesses, and vaccine rollout.

Summary of Full Year Financial Results

Statutory profit and Underlying profit was a record $1,164 million in the current period.

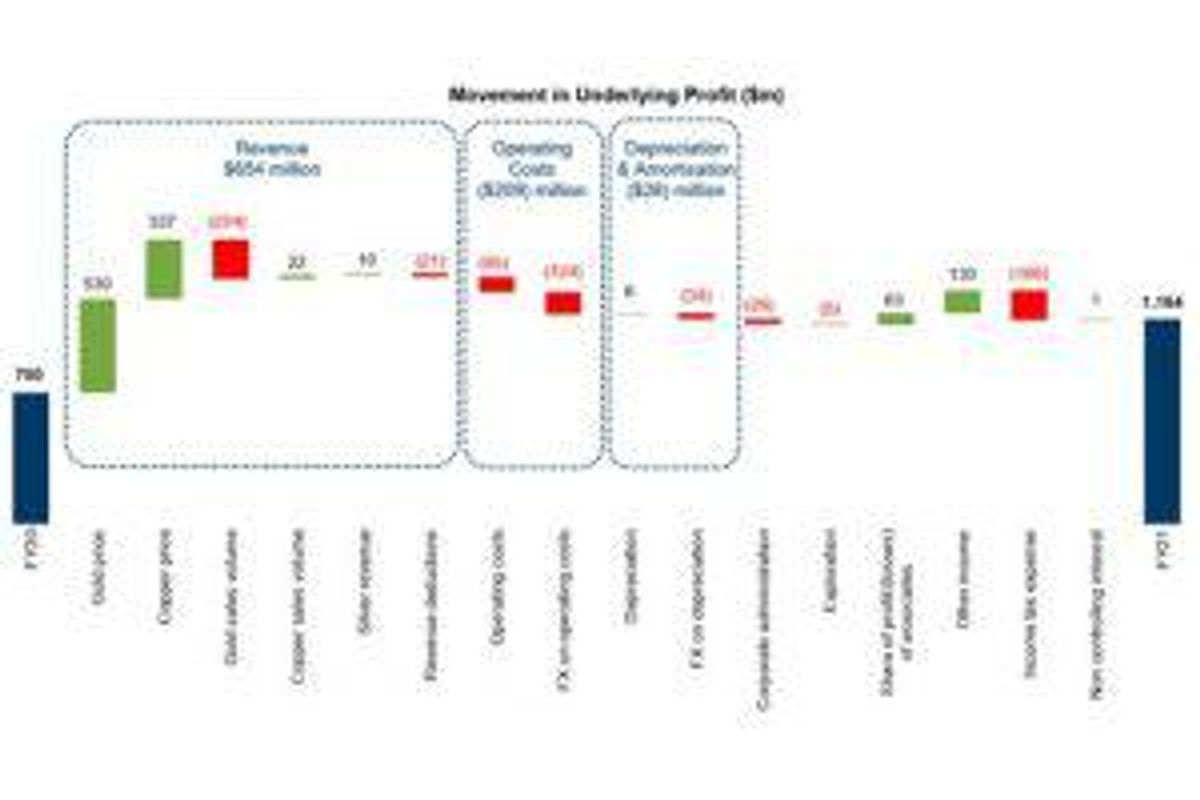

Underlying profit of $1,164 million was $414 million (or 55%) higher than the prior period primarily driven by higher realised gold and copper prices, favourable fair value adjustments recognised on copper derivatives and Newcrest’s investment in the Fruta del Norte finance facilities and record copper production from Cadia. These benefits were partially offset by lower gold sales volumes driven by lower production, increased income tax expense as a result of the Company’s improved profitability in the current period, the unfavourable impact on operating costs (including depreciation) from the strengthening of the Australian dollar against the US dollar, additional costs associated with COVID-19 measures, higher treatment, refining and transportation costs and higher price-linked costs such as royalties.

Underlying profit

| For the 12 months ended 30 June | ||||

| US$m | 2021 | 2020 | Change | Change % |

| Gold revenue | 3,584 | 3,278 | 306 | 9% |

| Copper revenue | 1,137 | 778 | 359 | 46% |

| Silver revenue | 26 | 16 | 10 | 63% |

| Less: treatment and refining deductions | (171) | (150) | (21) | (14%) |

| Total revenue | 4,576 | 3,922 | 654 | 17% |

| Operating costs | (2,155) | (1,946) | (209) | (11%) |

| Depreciation and amortisation | (650) | (622) | (28) | (5%) |

| Total cost of sales | (2,805) | (2,568) | (237) | (9%) |

| Corporate administration expenses | (143) | (117) | (26) | (22%) |

| Exploration expenses | (69) | (64) | (5) | (8%) |

| Share of profit/(losses) of associates | 26 | (37) | 63 | 170% |

| Other income | 185 | 55 | 130 | 236% |

| Net finance costs | (102) | (102) | – | 0% |

| Income tax expense | (504) | (338) | (166) | (49%) |

| Non-controlling interest | – | (1) | 1 | 100% |

| Underlying profit | 1,164 | 750 | 414 | 55% |

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/93684_b129840d74f9a818_001full.jpg

Free cash flow

Newcrest’s record free cash flow of $1,104 million was $1,725 million higher than the prior period, with the prior period also characterised by a net cash outflow of $1,291 million relating to M&A growth investments, compared to $21 million outflow in the current period.

‘Free cash flow before M&A activity’ was $455 million (or 68%) higher than the prior period, with higher operating cash flows only partially offset by an increased investment in major capital projects at Cadia, Lihir, Red Chris and Havieron, higher sustaining capital at all continuing operations and increased production stripping activity at Lihir and Red Chris.

In the current period, Newcrest received net pre-tax cashflows of $92 million from finance facilities acquired from Lundin Gold Inc, relating to the Fruta del Norte mine. This is reflected within the cash flow statement as $54 million in operating cash flow (interest payments received) and $38 million in investing cash flow (primarily principal repayments received).

| For the 12 months ended 30 June | ||||

| US$m | 2021 | 2020 | Change | Change % |

| Cash flow from operating activities | 2,302 | 1,471 | 831 | 56% |

| Production stripping and sustaining capital expenditure | (524) | (422) | (102) | (24%) |

| Major capital expenditure (non-sustaining) | (595) | (273) | (322) | (118%) |

| Total capital expenditure | (1,119) | (695) | (424) | (61%) |

| Reclassification of capital leases | 11 | 4 | 7 | 175% |

| Exploration and evaluation expenditure | (115) | (113) | (2) | (2%) |

| Net receipts from Fruta del Norte finance facilities | 38 | 1 | 37 | 3,700% |

| Proceeds from sale of property, plant and equipment | 8 | 2 | 6 | 300% |

| Free cash flow (before M&A activity) | 1,125 | 670 | 455 | 68% |

| Acquisition payment for a 70% interest of Red Chris | – | (769) | 769 | 100% |

| Acquisition of Fruta del Norte finance facilities | – | (460) | 460 | 100% |

| Payment for investment in Lundin Gold | (8) | (79) | 71 | 90% |

| Payment for investment in SolGold | (10) | – | (10) | – |

| Payment for investment in Antipa Minerals | (3) | (3) | – | 0% |

| Proceeds from sale of Gosowong, net of cash divested | – | 20 | (20) | (100%) |

| Free cash flow | 1,104 | (621) | 1,725 | 278% |

Balance Sheet

| US$m | As at 30 Jun 2021 | As at 30 Jun 2020 | Change | Change % |

| Assets | ||||

| Cash and cash equivalents | 1,873 | 1,451 | 422 | 29% |

| Trade and other receivables | 289 | 305 | (16) | (5%) |

| Inventories | 1,505 | 1,573 | (68) | (4%) |

| Other financial assets | 641 | 546 | 95 | 17% |

| Current tax assets | 3 | 1 | 2 | 200% |

| Property, plant and equipment | 9,788 | 8,809 | 979 | 11% |

| Goodwill | 19 | 17 | 2 | 12% |

| Other intangible assets | 32 | 24 | 8 | 33% |

| Deferred tax assets | 54 | 65 | (11) | (17%) |

| Investment in associates | 442 | 386 | 56 | 15% |

| Other assets | 68 | 65 | 3 | 5% |

| Total assets | 14,714 | 13,242 | 1,472 | 11% |

| Liabilities | ||||

| Trade and other payables | (577) | (520) | (57) | (11%) |

| Current tax liability | (107) | (23) | (84) | (365%) |

| Borrowings | (1,635) | (2,017) | 382 | 19% |

| Lease liabilities | (62) | (58) | (4) | (7%) |

| Other financial liabilities | (110) | (274) | 164 | 60% |

| Provisions | (735) | (623) | (112) | (18%) |

| Deferred tax liabilities | (1,364) | (1,114) | (250) | (22%) |

| Total liabilities | (4,590) | (4,629) | 39 | 1% |

| Net assets | 10,124 | 8,613 | 1,511 | 18% |

| Equity | ||||

| Equity attributable to owners of the parent | 10,124 | 8,613 | 1,511 | 18% |

| Total equity | 10,124 | 8,613 | 1,511 | 18% |

Summary of Full Year Results by Asset(16)

| For the 12 months ended 30 June 2021 | ||||||||

| UoM | Cadia | Lihir | Telfer | Red Chris(17) | Fruta del Norte(8),(11) | Other | Group | |

| Operating | ||||||||

| Production | ||||||||

| Gold | koz | 765 | 737 | 416 | 46 | 129 | – | 2,093 |

| Copper | kt | 106 | – | 13 | 23 | – | – | 143 |

| Silver | koz | 643 | 38 | 149 | 114 | – | – | 945 |

| Sales | ||||||||

| Gold | koz | 766 | 773 | 411 | 46 | 120 | – | 2,116 |

| Copper | kt | 105 | – | 13 | 23 | – | – | 141 |

| Silver | koz | 638 | 38 | 149 | 111 | – | – | 936 |

| Financial | ||||||||

| Revenue | $m | 2,180 | 1,425 | 725 | 246 | – | – | 4,576 |

| EBITDA | $m | 1,615 | 590 | 137 | 79 | – | 22 | 2,443 |

| EBIT | $m | 1,416 | 313 | 33 | 9 | – | (1) | 1,770 |

| Net assets | $m | 3,169 | 4,125 | (59) | 1,003 | – | 1,886 | 10,124 |

| Operating cash flow | $m | 1,796 | 621 | 151 | 114 | – | (380) | 2,302 |

| Investing cash flow | $m | (564) | (300) | (69) | (151) | – | (114) | (1,198) |

| Free cash flow | $m | 1,232 | 321 | 82 | (37) | – | (494)* | 1,104 |

| AISC(11) | $m | (83) | 1,076 | 606 | 103 | 91 | 135 | 1,928 |

| $/oz | (109) | 1,391 | 1,473 | 2,248 | 753 | – | 911 | |

| AISC Margin(11) | $/oz | 1,905 | 405 | 323 | (452) | – | – | 876 |

* Free cash flow for ‘Other’ includes:

- A net inflow of $20 million relating to other investing activities (comprising net receipts from Fruta del Norte finance facilities of $38 million, proceeds from the sale of property, plant and equipment of $3 million, offset by $21 million relating to payments to maintain Newcrest’s existing interests in associates),

- income tax paid of $233 million,

- exploration expenditure of $79 million,

- corporate costs of $105 million,

- other capital expenditure of $57 million,

- net interest paid of $46 million, and

- net working capital inflows of $6 million.

Refer to the Company’s “ASX Appendix 4E and Financial Report” released on 19 August 2021, and the Operating and Financial Review in particular, for an operational overview for the year.

Guidance(3),(16),(18)

Newcrest provides the following guidance for FY22, subject to market and operating conditions.

The production guidance numbers for FY22 assume no COVID-19 related interruptions. However, the AISC expenditure guidance for FY22 includes an estimate for additional costs associated with managing the business in a COVID-19 context (including on matters such as flights, transport, rosters, leave, screening and testing, and disbursements from the Community Support Fund) in the order of $35-45 million.

Guidance for the 12 months ending 30 June 2022

| Cadia | Lihir | Telfer | Red Chris | Fruta del Norte(a) | Havieron | Other(b) | Group | |

| Production | ||||||||

| Gold – koz | 540 – 610 | 700 – 800 | 390 – 440 | 40 – 42 | 120 – 135 | 1,800 – 2,000 | ||

| Copper – kt | 85 – 95 | ~15 | 23 – 25 | 125 – 130 | ||||

| All-In-Sustaining Cost (AISC) – Includes production stripping (sustaining) and sustaining capital | ||||||||

| AISC – $m | (100) – 30 | 950 – 1,040 | 600 – 680 | (25) – 15 | 100 – 104 | 135 – 145 | 1,720 – 1,920 | |

| Capital Expenditure ($m) | ||||||||

| – Production stripping (sustaining) | 105 – 115 | 25 – 35 | 130 – 140 | |||||

| – Production stripping (non-sustaining) | 50 – 70 | 50 – 70 | ||||||

| – Sustaining capital | 160 – 180 | 100 – 120 | 50 – 60 | 65 – 70 | 15 – 20 | 390 – 440 | ||

| – Major projects (non-sustaining) | 580 – 650 | 105 – 135 | 110 – 130 | 65 – 85 | 6 – 8 | 890 – 990 | ||

| Total Capital expenditure | 740 – 830 | 310 – 370 | 75 – 95 | 225 – 270 | 65 – 85 | 21 – 28 | 1,460 – 1,640 | |

| Exploration and Depreciation ($m) | ||||||||

| Exploration expenditure | 150 – 160 | |||||||

| Depreciation and amortisation (including depreciation of production stripping) | 700 – 750 | |||||||

(a) The Fruta del Norte guidance represents Newcrest’s 32% interest in the annualised production and AISC for Fruta del Norte based on Lundin Gold’s market release on 8 December 2020. This release estimated gold production for the 2021 calendar year to be in the range of 380koz to 420koz at an AISC of $770/oz to $830/oz

(b) Other includes major project expenditure (non-sustaining) in relation to Wafi-Golpu

Creating a brighter future for people through safe and responsible mining

Improved Safety Performance

Newcrest’s Safety Transformation Plan continues to yield benefits, with nearly six years free of fatalities and life changing injuries, and a 12% reduction in injury rates (TRIFR) compared to the prior period.

Red Chris delivered a standout safety performance for the financial year, reporting a 48% reduction in injury rates compared to the prior period. This remarkable achievement highlights the success of Newcrest’s NewSafe program in transforming on-site safety behaviours combined with the significant investments that Newcrest has made to improve on-site working conditions.

Lihir and Telfer also delivered a 50% and 14% reduction respectively in injury rates compared to the prior period. Both operations have successfully integrated Newcrest’s NewSafe program over the last six years and have demonstrated how visible safety leadership, proactive hazard reporting and a workforce committed to improving the safety culture at their workplace can deliver improvements to their safety performance.

Goal of Net Zero Carbon Emissions

Newcrest recognises that is has a responsibility to do its part to reduce the impact of climate change. As previously announced, Newcrest has set a goal of net zero carbon emissions by 2050 which relates to its operational (Scope 1 and Scope 2) emissions. Additionally, Newcrest intends to work across its value chain to reduce its Scope 3 emissions.

This goal is in addition to the target set in June 2019 to reduce Newcrest’s greenhouse gas emissions (GHG) intensity by 30% by 2030(7).

Newcrest has developed GHG Management Plans for each of its managed operating sites to understand, define and action abatement opportunities and has linked senior executive incentive payments directly to the achievement of these objectives. The measurement of GHG emissions across the full value chain is progressively improving, the use of renewable energy sources is increasing, and Newcrest is well advanced in assessing the risks and opportunities for the business under selected climate change scenarios in line with the Paris Agreement goals and its commitment to progressive Task Force on Climate-Related Financial Disclosures reporting.

Reducing Greenhouse Gas Emissions

As announced in December 2020, Newcrest has entered into a 15-year renewable Power Purchase Agreement (PPA) with a wind farm developer for an amount of energy which represents a significant portion of Cadia’s future projected energy requirements. The PPA will act as a partial hedge against future electricity price increases and will provide Newcrest with access to large-scale generation certificates which Newcrest intends to surrender to achieve a reduction in its greenhouse gas emissions. The PPA, together with the forecast decarbonisation of electricity generation in New South Wales, is expected to help deliver a ~20% reduction in Newcrest’s greenhouse gas emissions and is a significant step towards the achievement of Newcrest’s targeted 30% reduction by 2030(7).

Lihir Landholder Agreements

On 22 December 2020, Newcrest announced that it had signed new compensation, relocation and benefits sharing agreements with the mining lease area landholders at Lihir. It is expected that these new agreements will enhance socio-economic development outcomes for mining lease area landholders and enable benefits to be distributed directly to their intended beneficiaries. The agreements also enable the efficient and transparent distribution of compensation and benefits without a material increase in quantum.

Growing copper exposure

Newcrest reported record copper production of 142.7kt in FY21, which represents 22% of its total net revenue for the year. Newcrest expects that its copper contribution will continue to increase at Cadia, together with the potential growth in contribution from its development projects at Red Chris, Havieron and Wafi-Golpu. For FY22 Newcrest expects to produce 125-130kt of copper.

Advancing multiple organic growth options

Telfer West Dome Stage 5 Cutback

Newcrest announced on 12 August 2021 that it will proceed with the West Dome Stage 5 cutback (the cutback) at its Telfer operation in Western Australia. The cutback underpins the continuity of operations at Telfer, with further mine life extension opportunities to be assessed within the open pit and underground.

Telfer is strategically well positioned in the highly prospective Paterson Province, with its existing infrastructure and processing capacity providing benefits to the nearby Havieron Project (operated by Newcrest under a Joint Venture Agreement with Greatland Gold) and Newcrest’s other exploration projects in the region.

The Newcrest Board has approved A$246 million (~US$182 million(19)) of funding for the cutback, of which approximately one third will be in the form of capitalised production stripping, and Newcrest has entered into a contract for the works to be undertaken. The cutback is located between West Dome Stage 2 and West Dome Stage 4, both of which will continue to be mined in conjunction with Stage 5.

Drilling in the area between the Stage 2 and Stage 5 boundary has also returned positive results to date, providing further opportunities to extend the life of the West Dome. No additional permits, licences or regulatory approvals will be required for the cutback. There is no intention to undertake any further gold price hedging in relation to this cutback investment.

Production stripping for the Stage 5 cutback will commence in September 2021, with first ore production expected to be delivered to the Telfer mill in March 2022.

Cadia Molybdenum Plant

Newcrest expects to achieve first production from the Molybdenum Plant by the end of September 2021(13). The Molybdenum Plant is expected to deliver an additional revenue stream for Cadia in the form of molybdenum concentrate which will be recognised as a by-product credit to AISC.

Cadia PC1-2 Pre-Feasibility Study

The Newcrest Board has approved the Cadia PC1-2 Pre-Feasibility Study (the Study) to the Feasibility Stage, enabling the commencement of the Feasibility Stage (the Feasibility Study) and Early Works Program.

The Study updates and defines a significant portion of Cadia’s future mine plan, with the development of PC1-2 accounting for ~20% of Cadia’s current Ore Reserves. The approved commencement of the Early Works Program will allow critical infrastructure to be established in parallel with the Feasibility Study before the commencement of the Main Works program in the second half of CY22. A$120 million (~$US90 million) of funding has been approved for this Early Works Program which is expected to commence in the December 2021 quarter.

Pre-Feasibility Study key findings for PC1-2:(20),(21),(22)

Estimated total capital expenditure of ~A$1.3 billion (~US$0.9 billion)

Real, after-tax internal rate of return of 21.5%

Net Present Value of A$2.0 billion (US$1.5 billion)

~17 year mine life from first production, at an average of 15mtpa

Total ore production of 258mt producing 3.5Moz of gold and 660kt of copper

Average AISC of A$54/oz (US$41/oz)

Enhanced footprint design and productivity allowing:

Deferral of ~25% of the previously required footprint into a future PC1-3 project

A$150 million (US$112 million) reduction in the initial capital spend

Enhanced average gold and copper grades in the medium term

The findings of the Study will be progressed in a Feasibility Study which Newcrest expects to complete in Q3 CY22.

See separate release titled “Cadia PC1-2 Pre-Feasibility Study delivers attractive returns” dated 19 August 2021 for further information.

Cadia Expansion Project

Cadia is currently undergoing a previously-approved, significant expansion project which is expected to help sustain its position as one of the largest, lowest cost and long life gold mines in the world.

The Expansion Project is in two stages(23):

Stage 1 comprises the development of the next block cave, PC2-3, and an increase to the nameplate capacity of the process plant to 33mtpa

Stage 2 is focused on increasing the plant processing capacity from 33mtpa to 35mpta as well as delivering life of mine gold and copper recovery improvements and reducing unit costs

Execution of the works for both stages of the Project remain on track(13).

Lihir Phase 14A Pre-Feasibility Study

In February 2021, Newcrest announced the findings of its Lihir Mine Optimisation Study which included the identification of a new opportunity called Phase 14A. This opportunity is currently being progressed in a separate Pre-Feasibility Study (‘Phase 14A PFS’) which Newcrest expects to release by the end of September 2021.

The Phase 14A PFS is focused on extending the Phase 14 cutback and safely steepening the walls of the pit by utilising civil engineering techniques to access existing Indicated Mineral Resources which would have otherwise been inaccessible through standard mining techniques. The Phase 14A PFS work to date has identified approximately 20Mt at 2.4g/t Au (including 13Mt at 3g/t Au) of Indicated Mineral Resource(24) that could be accessed.

Additionally, the cutback would open a separate mining front, providing further flexibility for fresh competent ore feed. The cutback is fully permitted and is within theexisting mine lease.

Site field investigation is underway, including geotechnical drilling and preparation for contractor mobilisation for trial works. Field trials of the wall support technology are planned for FY22 with long lead materials ordered and the mobilisation of specialist contractors in progress.

Newcrest is currently assessing whether applying steep wall engineering techniques to its other cutbacks at Lihir could enable access to additional high grade mill feed and potentially further defer construction of the full Seepage Barrier, which is currently subject to a Feasibility Study.

Havieron Project

The Havieron Project is located 45km east of Newcrest’s Telfer operation and is operated by Newcrest under a Joint Venture Agreement with Greatland Gold plc. Newcrest announced on 30 November 2020 that it had met the Stage 3 expenditure requirement (US$45 million) and is entitled to earn an additional 20% joint venture interest (in addition to its existing 40% interest), resulting in an overall joint venture interest of 60% (Greatland Gold 40%).

Newcrest can earn up to a 70% joint venture interest through total expenditure of US$65 million and the completion of a series of exploration and development milestones (including the delivery of a Pre-Feasibility Study) in a four-stage farm-in over a six year period that commenced in May 2019. Newcrest may acquire an additional 5% interest at the end of the farm-in period at fair market value.

The Joint Venture Agreement also includes tolling principles reflecting the intention of the parties that, subject to a successful exploration program, Feasibility Study and a positive decision to mine, the resulting joint venture mineralised material will be processed at Telfer.

In FY21, Newcrest announced several key milestones for the Project, including:

the completion of infill drilling and the commencement of an extensive growth drilling campaign

an initial Inferred Mineral Resource estimate

the commencement of early works construction activities

Newcrest commenced its exploration drilling program in June 2019 and has progressively increased its drilling activities such that eight drill rigs are currently operational. Results from Newcrest’s infill drilling program at Havieron continue to support the geological and grade continuity for Newcrest’s ongoing studies and continue to confirm Newcrest’s previously reported drilling results.

Exploration activities are also focused on an extensive growth drilling program across several key targets. In June 2021, Newcrest announced a number of new high grade extensions to the South East Crescent zone, located outside of the initial Inferred Mineral Resource estimate. These results support the potential for incremental resource extensions with additional drilling.

In December 2020, Newcrest announced its initial Inferred Mineral Resource Estimate for the Project of 52Mt @ 2.0g/t Au and 0.31% Cu for 3.4Moz Au and 160kt Cu(25),(26),(27). Mineralisation remains open in multiple directions outside of the initial Inferred Mineral Resource, which indicates the possibility that the resource could continue to grow over time with Newcrest’s planned drilling activity.

In the second half of the FY21 financial year, Newcrest announced that it had commenced its early works program. Subsequent to the completion of the box cut and portal, Newcrest commenced construction of the exploration decline in May 2021 which is critical to achieving first production from the Project in the next two to three years(28).

Works to progress the necessary approvals and permits that are required to commence the development of an operating underground mine and associated infrastructure at the Project are ongoing(29).

Newcrest expects to release its Havieron Pre-Feasibility Study in the second half of CY21.

Red Chris

Red Chris is a joint venture between Newcrest (70%) and Imperial Metals Corporation (30%). Newcrest acquired its interest in, and operatorship of, Red Chris on 15 August 2019.

Over FY21, Newcrest announced several key milestones in relation to Red Chris, including:

discovery of East Ridge – a new zone of higher grade mineralisation

its initial Mineral Resource estimate for Red Chris

the commencement of early works construction activities

Since acquisition, Newcrest has undertaken a significant drilling campaign that was focused on the delivery of Newcrest’s initial Mineral Resource estimate for Red Chris. In addition, Newcrest has a brownfields exploration program at Red Chris that is concentrated on the discovery of additional zones of higher grade mineralisation within the Red Chris porphyry corridor (including targets outside of the initial Mineral Resource estimate).

To date, Red Chris’ brownfield exploration program has delivered considerable exploration success, including the discovery of East Ridge which is a new zone of higher grade mineralisation located outside of Newcrest’s initial Mineral Resource estimate. In July 2021, Newcrest reported its highest grade intercept to date from this zone, supporting the potential for resource growth over time.

In FY20, Newcrest reported the existence of multiple discrete ‘pods’ of higher grade mineralisation in the East Zone. Newcrest is currently evaluating options to ‘early mine’ these pods with the aim of generating cash flows prior to the completion of a block cave development at Red Chris.

As announced in March 2021, Newcrest released its initial Mineral Resource estimate(27),(30),(31) for Red Chris which comprised:

A Measured and Indicated Mineral Resource estimate of 980Mt @ 0.41g/t gold and 0.38% copper for 13Moz contained gold and 3.7Mt contained copper

An Inferred Mineral Resource estimate of 190Mt @ 0.31g/t gold and 0.30% copper for 1.9Moz contained gold and 0.57Mt contained copper

Newcrest’s initial Mineral Resource estimate is expected to support the development of a high margin underground block cave(32) and is a key input into the Red Chris Block Cave Pre-Feasibility Study which Newcrest expects to release by the end of September 2021.

Newcrest commenced construction of the exploration decline in June 2021 following the receipt of the necessary regulatory and funding approvals and the completion of the box cut and other surface infrastructure. The commencement of the exploration decline underpins Newcrest’s objective of having a block cave in operation at Red Chris within the next five to six years(28).

Wafi-Golpu Project

In December 2020 an Environment Permit for the Wafi-Golpu Project was granted.

As previously advised, subsequent to the grant of the Environment Permit, the Governor of Morobe Province and the Morobe Provincial Government commenced legal proceedings in the National Court in Papua New Guinea seeking judicial review of the decision to issue the Environment Permit. The participants in the Wafi-Golpu Joint Venture (including Newcrest) are not defendants to the proceedings. The National Court is yet to determine this judicial review application. At this stage, project and permitting activities can still progress.

Newcrest, together with its Wafi-Golpu Joint Venture partner Harmony, is currently engaging with the State of Papua New Guinea to progress permitting of the Wafi-Golpu Project and has commenced discussions with the State in relation to the Special Mining Lease.

Capital Structure

Newcrest’s financial objectives are to meet all financial obligations, maintain a strong balance sheet to withstand cash flow volatility, be able to invest capital in value-creating opportunities, and to provide returns to shareholders. Newcrest looks to maintain a conservative level of balance sheet leverage.

On 2 March 2021, Newcrest renewed its unsecured bilateral bank lending facilities with its existing 13 bank lenders, extending the maturity dates. Each bank has committed approximately US$154 million in facilities for an overall unchanged quantum of US$2 billion on similar commercial terms for Newcrest.

These facilities have tenors of three or five years, the aggregate of which is as follows:

US$1,077 million of facilities maturing in FY24

US$923 million of facilities maturing in FY26

On 28 April 2021, Newcrest completed the mandatory redemption and cancellation of the outstanding US$380 million owing of its 4.200% Senior Guaranteed Notes, otherwise maturing 1 October 2022.

These refinancing and bond buyback transactions underpin Newcrest’s objective of having a strong balance sheet, considerable liquidity and financial flexibility at low cost.

Newcrest’s net cash as at 30 June 2021 was $176 million. This comprises $1,873 million of cash holdings, less $1,635 million of capital market debt and lease liabilities of $62 million.

At 30 June 2021, Newcrest had liquidity coverage of $3,873 million, comprising $1,873 million of cash and $2,000 million in committed undrawn bilateral bank debt facilities with tenors ranging from 2024 to 2026.

Newcrest’s financial policy metrics and its performance against them are as follows:

| Metric | Policy ‘looks to’ | As at 30 Jun 2021 | As at 30 Jun 2020 |

| Credit rating (S&P/Moody’s) | Investment grade | BBB/Baa2 | BBB/Baa2 |

| Leverage ratio (Net debt to EBITDA) | Less than 2.0 times | (0.1) | 0.3 |

| Gearing ratio | Below 25% | (1.8%) | 6.8% |

| Cash and committed undrawn bank facilities | At least $1.5bn, of which ~1/3 is in the form of cash | $3.87bn ($1.87bn cash) | $3.45bn ($1.45bn cash) |

Telfer Gold Hedging

No new hedging in relation to Telfer was undertaken in the current period.

The total outstanding volume and prices of gold hedged for future years at Telfer and in total for Newcrest are:

| Financial Year Ending | Gold Ounces Hedged | Average Price A$/oz |

| 30 June 2022 | 204,615 | 1,902 |

| 30 June 2023 | 137,919 | 1,942 |

| Total | 342,534 | 1,918 |

The current period included 216,639 ounces of Telfer gold sales hedged at an average price of A$1,864 per ounce, representing a net revenue loss of $99 million for the current period. At 30 June 2021, based on gold forward curves, the unrealised mark-to-market loss of the remaining hedges was $110 million.

Approximately 90% of Newcrest’s sales in the period were unhedged and therefore benefitted from the strong gold prices in the period.

Newcrest’s decision in the prior period to cease its program of hedging the impacts of copper and gold price movements during the quotational period resulted in a net fair value gain in other income in the current period of $124 million, driven by the increase in gold and copper prices in the current period.

Dividend Dates, Currency & Dividend Reinvestment Plan

The Newcrest Board has determined that a final fully franked dividend of US 40 cents per share is to be paid on

30 September 2021. The key dates in relation to the final dividend are set out in the table below.

| Action | Date |

| Ex-Dividend Date | Thursday, 26 August 2021 |

| Record Date and Currency Conversion Date | Friday, 27 August 2021 |

| Election Date – final date to elect to participate in DRP and receive foreign currency | Monday, 30 August 2021 |

| VWAP period begins for DRP | Tuesday, 31 August 2021 |

| VWAP period ends for DRP | Monday, 6 September 2021 |

| Payment/Issue Date | Thursday, 30 September 2021 |

The subscription amount for shares allotted under the DRP will be an amount in cents that is the arithmetic average

of the daily volume weighted average sale price for Newcrest shares sold on the ASX during the VWAP period

(31 August – 6 September 2021) rounded down to the nearest full cent.

Payment Currencies

The currencies in which dividend payments will be made are included in the table below:

| Currency to be paid | Shareholders |

| Australian dollars | All shareholders who will not be paid US dollars, PNG kina or NZ dollars in accordance with the circumstances set out below. |

| US dollars | Shareholders who have nominated a US dollar bank account domiciled in the US by 5:00pm (AEST) Monday, 30 August 2021, being the Election Date. |

| Papua New Guinea kina | Shareholders:

|

| NZ dollars | Shareholders:

|

Payments made in Australian dollars, Papua New Guinea kina and New Zealand dollars will be converted from

US dollars at the prevailing exchange rate on 27 August 2021, being the Record Date.

Dividend Reinvestment Plan

The Dividend Reinvestment Plan (DRP) will apply to the final dividend. The DRP allows eligible shareholders to reinvest part or all of their dividends into Newcrest shares. No discount will be applied to allotments made under the DRP. A copy of the DRP Rules is available on the Company’s website at https://www.newcrest.com/investors.

Full Year Financial Results Call

We invite you to join our investor webcast from Melbourne at 9:30am on Thursday, 19 August 2021. Please register prior to this broadcast on the Newcrest website.

https://www.newcrest.com/investors/reports/financial/

Should you be unable to join us, the webcast can be viewed on our website following the live presentation.

Authorised by the Newcrest Board Executive Committee

For further information please contact

Investor Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Ben Lovick

+61 3 9522 5334

+61 407 269 478

Ben.Lovick@newcrest.com.au

North American Investor Enquiries

Ryan Skaleskog

+1 866 396 0242

+61 403 435 222

Ryan.Skaleskog@newcrest.com.au

Media Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

This information is available on our website at www.newcrest.com

Endnotes

______________________

1 All figures in this document relate to businesses of the Newcrest Mining Limited Group (Newcrest’ or the Group) for the 12 months ended 30 June 2021 (current period) compared with the 12 months ended 30 June 2020 (prior period), except where otherwise stated. All references to ‘the Company’ are to Newcrest Mining Limited.

2 Technical and scientific information: The technical and scientific information contained in this document relating to Wafi-Golpu and Lihir was reviewed and approved by Craig Jones, Newcrest’s Chief Operating Officer PNG, FAusIMM and a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). The technical and scientific information contained in this document relating to Cadia was reviewed and approved by Philip Stephenson, Newcrest’s Chief Operating Officer Australia and Americas, FAusIMM and a Qualified Person as defined in NI 43-101.

3 Disclaimer: This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, “outlook” and “guidance”, or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of Management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines. The Company continues to distinguish between outlook and guidance. Guidance statements relate to the current financial year. Outlook statements relate to years subsequent to the current financial year. These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation. For further information as to the risks which may impact on the Company’s results and performance, please see the risk factors included in the Annual Information Form dated 13 October 2020 lodged with ASX and SEDAR and the Operating and Financial Review included in the Appendix 4E and Financial Report for the year ended 30 June 2021 which is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile. Forward looking statements are based on the Company’s good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of the Company. Readers are cautioned not to place undue reliance on forward looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. Forward looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, the Company does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

4 The information in this document that relates to Mineral Resources or Ore Reserves (other than for Cadia East, Havieron and Red Chris) has been extracted from the release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2020” dated 11 February 2021 which is available to view at www.asx.com.au under the code “NCM” (the original release) and has been prepared in accordance with the requirements of Appendix 5A of the ASX Listing Rules by Competent Persons. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original release and, in the case of Mineral Resources or Ore Reserves, that all material assumptions and technical parameters underpinning the estimates in the original release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent person’s findings are presented have not been materially modified from the original release.

5 Injury rates are lowest quartile when compared to the International Council on Mining & Metals report titled “Safety Performance – Benchmarking progress of ICMM company members in 2020”.

6 Relating to Newcrest’s operational (Scope 1 and Scope 2) emissions. Newcrest intends to work across its value chain to reduce its Scope 3 emissions.

7 Kg CO2-e per tonne of ore treated and compared to a baseline of FY18 emissions. Refer to market release titled “Newcrest signs renewable energy PPA to help deliver ~20% reduction in greenhouse gas emissions” dated 16 December 2020 which is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile.

8 Group gold production, gold sales and AISC includes Newcrest’s 32% attributable share of Fruta del Norte (commercial production commenced in the March 2020 quarter) through its 32% equity interest in Lundin Gold Inc. The gold production, gold sales and AISC outcomes for Fruta del Norte are sourced from Lundin Gold’s news releases and have been aggregated to reflect the twelve month period ended 30 June 2021. For further details refer to the Company’s “ASX Appendix 4E and Financial Report” released on 19 August 2021, and Section 6.7 of the Operating and Financial Review in particular.

9 Statutory profit is profit after tax attributable to owners of the Company.

10 Newcrest’s results are reported under International Financial Reporting Standards (IFRS). This document includes certain non-IFRS financial information within the meaning of ASIC Regulatory Guide 230: ‘Disclosing non-IFRS financial information’ published by ASIC and within the meaning of Canadian Securities Administrators Staff Notice 52-306 – Non-GAAP Financial Measures. Such information includes:

- ‘Underlying profit’ (profit or loss after tax before significant items attributable to owners of the Company);

- ‘EBITDA’ (earnings before interest, tax, depreciation and amortisation, and significant items);

- ‘EBIT’ (earnings before interest, tax and significant items);

- ‘EBITDA Margin’ (EBITDA expressed as a percentage of revenue);

- ‘EBIT Margin’ (EBIT expressed as a percentage of revenue);

- ‘ROCE’ is ‘Return on capital employed’ and is calculated as EBIT expressed as a percentage of average total capital employed (net debt and total equity);

- ‘Leverage ratio (net debt to EBITDA)’ (calculated as net debt divided by EBITDA for the preceding 12 months);

- ‘Free cash flow’ (calculated as cash flow from operating activities less cash flow related to investing activities. Free cash flow for each operating site is calculated as Free cash flow before interest, tax and intercompany transactions);

- ‘Free cash flow before M&A activity’ (being ‘Free cash flow’ excluding acquisitions, investments in associates and divestments);

- ‘AISC’ (All-In Sustaining Cost) and ‘AIC’ (All-In Cost) as per the updated World Gold Council Guidance Note on Non-GAAP Metrics released November 2018. AISC will vary from period to period as a result of various factors including production performance, timing of sales and the level of sustaining capital and the relative contribution of each asset; and

- AISC Margin reflects the average realised gold price less the AISC per ounce sold.

These measures are used internally by Management to assess the performance of the business and make decisions on the allocation of resources and are included in this document to provide greater understanding of the underlying financial performance of Newcrest’s operations. The non-IFRS information has not been subject to audit or review by Newcrest’s external auditor and should be used in addition to IFRS information. Such non-IFRS financial information/non-GAAP financial measures do not have a standardised meaning prescribed by IFRS and may be calculated differently by other companies. Although Newcrest believes these non-IFRS/non-GAAP financial measures provide useful information to investors in measuring the financial performance and condition of its business, investors are cautioned not to place undue reliance on any non-IFRS financial information/non-GAAP financial measures included in this document. When reviewing business performance, this non-IFRS information should be used in addition to, and not as a replacement of, measures prepared in accordance with IFRS, available on Newcrest’s website and the ASX and SEDAR platforms.

11 Subsequent to the release of the June 2021 quarterly report, the FY21 AISC outcome for the Group and Lihir has been restated due to a change in the classification of Phase 16 production stripping costs at Lihir. In addition, Group gold sales and the Group AISC outcome for FY21 have been restated to include Newcrest’s 32% share of Fruta del Norte’s June 2021 quarterly results which Lundin Gold Inc released on 11 August 2021.

12 Newcrest’s AISC margin for the current period has been determined by deducting the All-In Sustaining Cost attributable to Newcrest’s operations of $920 per ounce from Newcrest’s realised gold price of $1,796 per ounce. For further details refer to the Company’s “ASX Appendix 4E and Financial Report” released on 19 August 2021, and Section 6.7 of the Operating and Financial Review in particular.

13 Subject to market and operating conditions and potential delays due to COVID-19.

14 Total Recordable Injury Frequency Rate per million hours worked.

15 Realised metal prices are the US dollar spot prices at the time of sale per unit of metal sold (net of Telfer gold production hedges), excluding deductions related to treatment and refining costs and the impact of price related finalisations for metals in concentrate. The realised price has been calculated using sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

16 All data relating to operations is shown at 100%, with the exception of Red Chris which is shown at 70% and Fruta del Norte which is shown at 32%.

17 Newcrest acquired its 70% interest in the Red Chris mine and became the operator on 15 August 2019.

18The guidance stated assumes weighted average copper price of $4.20 per pound, AUD:USD exchange rate of 0.75 and CAD:USD exchange rate of 0.80 for FY22.

19 Converted to USD using the spot AUD:USD exchange rate of 0.74.

20 The Pre-Feasibility Study has been prepared with the objective that its findings are subject to an accuracy range of ±25%. The findings in the Study and the implementation of the PC1-2 Project are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be construed as guidance.

21 The production targets underpinning the Study estimates are 3.5Moz gold and 660kt copper over PC1-2’s expected 17 year mine life. The production target is based on the utilisation of ~20% of the total Cadia East Ore Reserves, being 18Moz Probable Ore Reserves as at 30 June 2021 (see release titled “Cadia PC1-2 Pre-Feasibility Study delivers attractive returns”, dated 19 August 2021 (the original Cadia East release) which have been prepared by a Competent Person in accordance with Appendix 5A of the ASX Listing Rules and is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile), but is subject to depletions for the period since 1 July 2021. The reserves for Cadia East comprise a portion of the reserves for the Cadia operations. The estimates included in the original Cadia East release supersede the estimates for Cadia East that are included in Newcrest’s release titled “Annual Mineral Resource and Ore Reserves Statement – 31 December 2020” dated 11 February 2021 (which is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile). Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original Cadia East release and that all material assumptions and technical parameters underpinning the estimates in the original Cadia East release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent person’s findings are presented have not been materially modified from the original Cadia East release.

22 As Cadia’s functional currency is AUD, the Study has been assessed in AUD. The outcomes presented have been converted to USD using an exchange rate of 0.75.

23 While the targeted capacity of the process plant under the Expansion Project is 33mtpa in Stage 1 and 35mtpa in Stage 2, the actual milling rate will be subject to regulatory and permitting approvals.

24 The estimate of ~20Mt of Indicated Mineral Resource has been prepared in accordance with the requirements in Appendix 5A of the ASX Listing Rules by a Competent Person. For further information as to the total Indicated Mineral Resources for Lihir of which the 20Mt of Indicated Mineral Resources is part, see the release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2020” (the original MR&OR release) which is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile. profile. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original MR&OR release and that all material assumptions and technical parameters underpinning the estimates in the original MR&OR release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent persons’ findings are presented have not been materially modified from the original MR&OR release. Newcrest makes no assurances that these Indicated Mineral Resources can be converted to Ore Reserves.

25 The information in this document that relates to Havieron Mineral Resources has been extracted from the release titled “Initial Inferred Mineral Resource estimate for Havieron of 3.4Moz of gold and 160kt of copper” dated 10 December 2020 which is available to view at www.asx.com.au under the code “NCM” (the original Havieron release) and on Newcrest’s SEDAR profile and has been prepared in accordance with the requirements of Appendix 5A of the ASX Listing Rules by Competent Persons. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original Havieron release and that all material assumptions and technical parameters underpinning the estimates in the original Havieron release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent person’s findings are presented have not been materially modified from the original Havieron release.

26 The Inferred Mineral Resource estimate is presented on a 100% basis. As announced on 30 November 2020, Newcrest has now met the Stage 3 expenditure requirement (US$45 million) and is entitled to earn an additional 20% joint venture interest in addition to its existing 40% interest, resulting in an overall joint venture interest of 60% (Greatland Gold 40%).

27 As an Australian Company with securities listed on the Australian Securities Exchange (ASX), Newcrest is subject to Australian disclosure requirements and standards, including the requirements of the Corporations Act 2001 and the ASX. Investors should note that it is a requirement of the ASX listing rules that the reporting of Ore Reserves and Mineral Resources in Australia is in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code) and that Newcrest’s Ore Reserve and Mineral Resource estimates are reported in accordance with the JORC Code. Newcrest is also subject to certain Canadian disclosure requirements and standards, as a result of its secondary listing on the Toronto Stock Exchange (TSX), including the requirements of National Instrument 43-101 (NI 43-101). Investors should note that it is a requirement of Canadian securities law that the reporting of Mineral Reserves and Mineral Resources in Canada and the disclosure of scientific and technical information concerning a mineral project on a property material to Newcrest comply with NI 43-101. Newcrest’s material properties are currently Cadia, Lihir and Wafi-Golpu.

28 From commencement of the box cut and exploration decline. Subject to market and operating conditions, Board and regulatory approvals and any potential delays due to COVID-19 impacts.

29 The development of any underground mine at the Havieron Project will also be subject to the completion of a successful exploration program and further studies, market and operating conditions, Board approvals, and a positive decision to mine.

30 The Measured and Indicated Mineral Resource estimate is presented on a 100% basis. Newcrest’s equity interest in the Mineral Resource is 70%.

31 The information in this document that relates to Mineral Resources for Red Chris has been extracted from the release titled “Newcrest announces its initial Mineral Resources estimate for Red Chris” dated 31 March 2021 which is available to view at www.asx.com.au under the code “NCM” (the original Red Chris release) and on Newcrest’s SEDAR profile and has been prepared in accordance with the requirements of Appendix 5A of the ASX Listing Rules by Competent Persons. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original Red Chris release and that all material assumptions and technical parameters underpinning the estimates in the original Red Chris release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent persons’ findings are presented have not been materially modified from the original Red Chris release.

32 The development of a block cave mine at the Red Chris project is subject to the completion of a successful exploration program and further studies, market and operating conditions, regulatory approvals and Board approvals.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/93684