(figures are in US$ except where stated)

Newcrest Mining Limited (ASX: NCM) (TSX: NCM) delivers record free cash flow, lifts dividend and identifies opportunity to unlock significant value at Lihir(1),(2),(13),(21)

- Strong operating performance and gold price underpins record free cash flow in December half

- Statutory profit and Underlying profit of $553 million(3),(4), up 134% and 98% respectively

- Earnings per share 121% higher than prior period

- All-In Sustaining Cost (AISC) margin of $842 per ounce, up 48%(4),(5)

- Record December half year free cash flow of $439 million(4)

- A safe and sustainable business

- Zero fatalities and life-changing injuries, together with industry-leading(6) low injury rates

- Second year in a row of an increasing score in the Dow Jones Sustainability Index (DJSI) Australia Metals & Mining Index

- Cadia renewable energy contract signed – on track for 30% reduction in emissions intensity by 2030(7)

- New dividend policy and increase in shareholder returns

- New dividend policy targets 30-60% of annual free cash flow to be paid in dividends (was 10-30%)

- Interim dividend of US$ 15 cps, fully franked, 100% higher than the prior year

- Lihir mine improvements and potential to unlock additional high grade mineralisation(8)

- Improved understanding of treating argillic ores and their likely volume and distribution in ore feed

- New mine plan has a higher average gold grade feed to mill, with a lower proportion of argillic mill feed

- Potential for additional ~1.4Moz of contained gold(9) to be available as mill feed in FY22 to FY34

- Seepage Barrier and associated capital costs deferred by 18 months

- Opportunity identified to access additional existing high grade Indicated Mineral Resource adjacent to existing Phase 14, which has the potential to deliver an additional ~400-600koz of contained gold(10)in FY23-25. This is currently being evaluated in a Pre-Feasibility Study which is expected to be completed in the coming months

- Together, the above underpins an aspiration for Lihir to be a 1 Moz+ per annum producer for ~10-12 years from FY23 onwards at a milling rate of around 15 mtpa

- Organic growth options progressing well

- Stage 2 of Cadia Expansion Project approved, underway and on track

- Initial Inferred Mineral Resource estimate for Havieron of 3.4Moz of gold and 160kt of copper(11),(12),(13)

- Early works construction underway in relation to the box cut and exploration decline at Havieron

- Red Chris box cut commenced and funding approved for exploration decline

- Environment Permit granted for Wafi-Golpu Project

- Forging an Even Stronger Newcrest

- New Company Purpose: “Creating a brighter future for people through safe and responsible mining“

- Refreshed aspirations for the next five years under our five main pillars

Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas, said “In 2018 we set ourselves some ambitious targets to Forge a Stronger Newcrest. Our progress and achievements over the past three years has put us in a very strong position to not just weather the global uncertainty associated with COVID-19, but to keep our eyes firmly on our future growth agenda. We have a fabulous position in our industry, with a long reserve and resource life, a unique set of technical skills, a very strong balance sheet, numerous organic growth options in progress and an exciting exploration pipeline.”

Today we announce our plan entitled Forging an Even Stronger Newcrest, which outlines our aspirations and measures for the next five years in line with our new company purpose, to create a brighter future for our stakeholders through safe and responsible mining. This year we lived that purpose through our success in managing the COVID-19 risk to our workforce and local communities; through the compensation, relocation and benefits sharing agreements we signed with the landowners at Lihir; through our renewable energy agreement that will help significantly reduce our carbon footprint; and in our progress in developing new mines at Havieron and Red Chris.”

“The strong financial results for the half year show how much the increase in gold price has translated into improved profitability, record half year free cashflow and an increase in returns to shareholders in the form of a fully franked interim dividend of US$ 15 cents per share, 100% higher than last year,” said Mr Biswas.

“The Board has approved a new dividend policy that retains the minimum dividend of 15 cents per share per annum but more than doubles the target percentage of free cash flow to be paid in dividends to 30-60%. This change in policy allows shareholders to benefit from the stronger free cash flows that result from higher gold prices and is supported by Newcrest’s robust balance sheet with its minimal near-term debt obligations.”

“This year we have leveraged our technical capabilities to establish a pathway to unlock significant value from Lihir. I am particularly pleased with the work done in the period to better understand and manage the argillic clays together with the finalisation of an optimised mine plan that is expected to reduce the levels of argillic mill feed presentation in the future. Our approach to mining Phase 14 has the potential to bring a considerable amount of high grade mineralisation from resource into production in the very near future, which in turn has the potential to significantly increase gold production and increase profitability and free cashflow. We are progressing a study with an aspiration for Lihir to be a 1 million ounce plus producer each year for around 10-12 years from FY23 at around 15 mtpa milling rates,” said Mr Biswas.

Summary of Operating and Financial Results

| For the 6 months ended 31 December | ||||||

| Endnote | UoM | 2020 | 2019 | Change | Change % | |

| TRIFR | 14 | mhrs | 2.2 | 2.3 | (0.1) | (4%) |

| Group production – gold | 15 | oz | 1,038,566 | 1,062,751 | (24,185) | (2%) |

| – copper | t | 69,320 | 62,468 | 6,852 | 11% | |

| Revenue | $m | 2,172 | 1,790 | 382 | 21% | |

| EBITDA | 4 | $m | 1,146 | 756 | 390 | 52% |

| EBIT | 4 | $m | 826 | 459 | 367 | 80% |

| Statutory profit | 3 | $m | 553 | 236 | 317 | 134% |

| Underlying profit | 4 | $m | 553 | 280 | 273 | 98% |

| Cash flow from operating activities | $m | 992 | 448 | 544 | 121% | |

| Free cash flow* | 4 | $m | 439 | (729) | 1,168 | 160% |

| EBITDA margin | 4 | % | 52.8 | 42.2 | 10.6 | 25% |

| EBIT margin | 4 | % | 38.0 | 25.6 | 12.4 | 48% |

| All-In Sustaining Cost | 4,15,16 | $/oz | 974 | 877 | 97 | 11% |

| All-In Sustaining Cost margin | 4,5 | $/oz | 842 | 569 | 273 | 48% |

| Realised gold price | 17 | $/oz | 1,826 | 1,446 | 380 | 26% |

| Realised copper price | 17 | $/lb | 3.12 | 2.66 | 0.46 | 17% |

*Free cash flow in the prior period includes the payment for the acquisition of Red Chris (70% ownership) of $774 million(18), and further investments in Lundin Gold of $61 million.

| For the 6 months ended 31 December | ||||||

| Endnote | UoM | 2020 | 2019 | Change | Change % | |

| Average exchange rate | AUD:USD | 0.7225 | 0.6846 | 0.0379 | 6% | |

| Average exchange rate | PGK:USD | 0.2862 | 0.2940 | (0.0078) | (3%) | |

| Average exchange rate | CAD:USD | 0.7585 | 0.7575 | 0.0010 | 0% | |

| Closing exchange rate | AUD:USD | 0.7702 | 0.7006 | 0.0696 | 10% | |

| Earnings per share (basic) | US$ cents | 67.7 | 30.7 | 37.0 | 121% | |

| Earnings per share (diluted) | US$ cents | 67.5 | 30.6 | 36.9 | 121% | |

| Dividends paid per share | US$ cents | 17.5 | 14.5 | 3.0 | 21% | |

| Endnote | UoM | As at 31 Dec 2020 | As at 30 Jun 2020 | Change | Change % | |

| Cash and cash equivalents | $m | 1,744 | 1,451 | 293 | 20% | |

| Net debt | 4 | $m | 330 | 624 | (294) | (47%) |

| Net debt to EBITDA | 4 | times | 0.1 | 0.3 | (0.2) | (67%) |

| Gearing | 4 | % | 3.3 | 6.8 | (3.5) | (51%) |

| Total equity | $m | 9,619 | 8,613 | 1,006 | 12% |

Refer to the Company’s “ASX Appendix 4D and Financial Report” released on 11 February 2021, and the Management Discussion and Analysis in particular, for more detail on the Company’s financial results.

New Dividend Policy

Having regard to Newcrest’s strong balance sheet, with minimal near term debt obligations and with financial policy metrics all very comfortably within targets, as well as its high free cash flow generation during a period of high gold prices, the Newcrest Board has approved the following revised Dividend Policy:

Newcrest looks to pay ordinary dividends that are sustainable over time having regard to its cash flow generation, its reinvestment options in the business and external growth opportunities, its financial policy metrics and its balance sheet strength.

Newcrest targets a total annual dividend payout of 30-60% of free cash flow generated for the financial year, with the annual total dividends being at least US$ 15 cents per share on a full year basis.

The declaration of any future dividend remains at the discretion of the Newcrest Board, having regard to circumstances prevailing at that time.

Having regard to the abovementioned considerations, the Newcrest Board has determined that an interim fully franked dividend of US$ 15 cents per share will be paid on Thursday, 25 March 2021.

The record date for entitlement is Friday, 19 February 2021.

The financial impact of the interim dividend amounting to $122 million has not been recognised in the Consolidated Financial Statements for the half year. The Company’s Dividend Reinvestment Plan remains in place.

Summary of Half Year Financial Results

Statutory profit was $553 million, $317 million (or 134%) higher than the prior period.

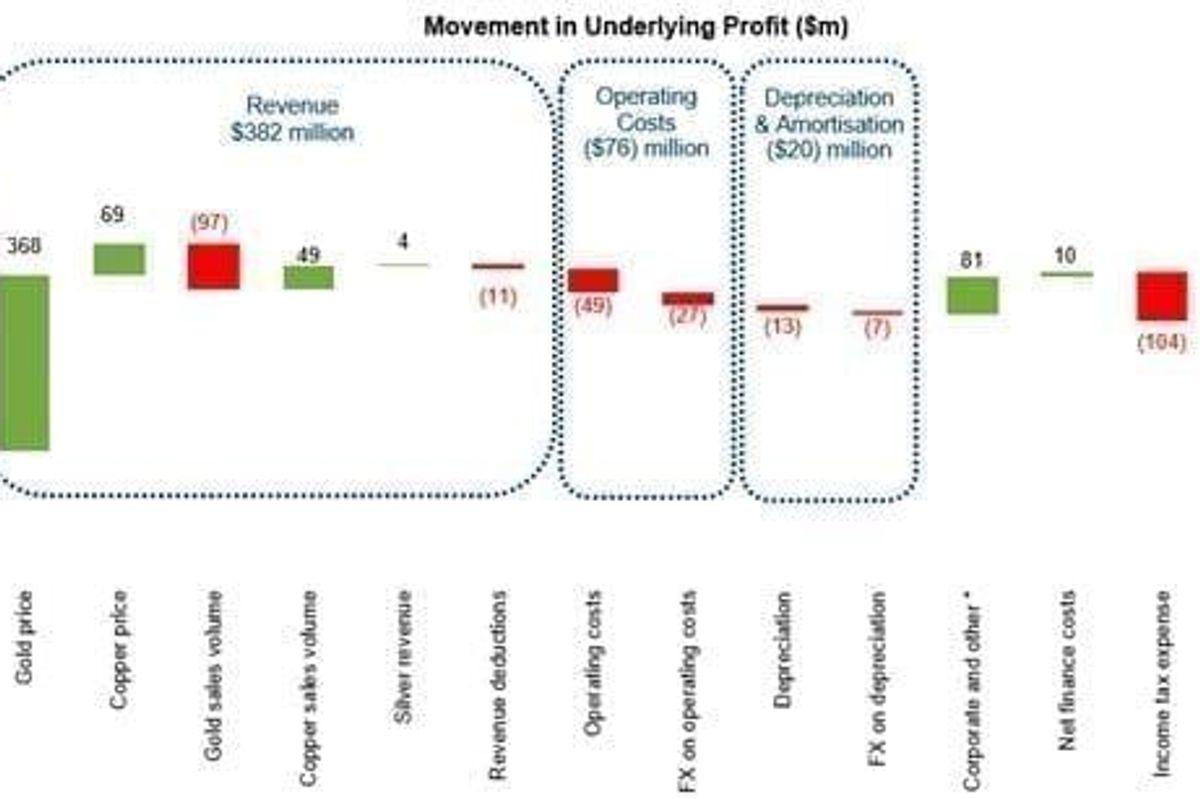

Underlying profit of $553 million was $273 million (or 98%) higher than the prior period primarily driven by higher realised gold and copper prices, higher copper production at Cadia, a positive fair value adjustment recognised on Newcrest’s investment in the Fruta del Norte finance facilities, and a full six months of improved Red Chris performance. These benefits were partially offset by increased income tax expense as a result of the Company’s improved profitability in the current period, lower gold sales driven by lower production, the unfavourable impact on operating costs for the Australian operations from the strengthening of the Australian dollar against the US dollar, higher price-linked costs such as royalties, additional costs associated with COVID-19 precautionary measures and a higher depreciation expense.

Underlying profit

| For the 6 months ended 31 December | ||||

| US$m | 2020 | 2019 | Change | Change % |

| Gold revenue | 1,768 | 1,497 | 271 | 18% |

| Copper revenue | 469 | 351 | 118 | 34% |

| Silver revenue | 12 | 8 | 4 | 50% |

| Less: treatment and refining deductions | (77) | (66) | (11) | (17%) |

| Total revenue | 2,172 | 1,790 | 382 | 21% |

| Operating costs | (1,029) | (953) | (76) | (8%) |

| Depreciation and amortisation | (309) | (289) | (20) | (7%) |

| Total cost of sales | (1,338) | (1,242) | (96) | (8%) |

| Corporate administration expenses | (62) | (57) | (5) | (9%) |

| Exploration expenses | (36) | (37) | 1 | 3% |

| Share of profit/(losses) of associates | 4 | (16) | 20 | 125% |

| Other income | 86 | 21 | 65 | 310% |

| Net finance costs | (40) | (50) | 10 | 20% |

| Income tax expense | (233) | (129) | (104) | (81%) |

| Underlying profit | 553 | 280 | 273 | 98% |

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/74177_2f14094874f44869_001full.jpg

*Corporate and other includes Corporate administration expenses, Exploration expenses, Share of profit/(losses) of associates and Other income.

Free cash flow

Free cash flow was $439 million for the current period.

‘Free cash flow before M&A activity’ was $334 million (or 315%) higher than the prior period which included growth investments in:

- the acquisition of an interest in Red Chris for $774 million(18); and

- an additional $61 million investment in Lundin Gold which increased Newcrest’s ownership to 32%.

Strong operating cash flows were only partially offset by an increased investment in major capital projects at Cadia and Lihir, higher sustaining capital, increased production stripping at Red Chris and Lihir and a higher level of total exploration expenditure (primarily drilling at Havieron and exploration activity at Red Chris).

On 30 April 2020 Newcrest acquired the gold prepay and stream facilities and offtake agreement in respect of Lundin Gold’s Fruta del Norte mine for $460 million. In the current period, Newcrest received net pre-tax cashflows of ~US$35 million from these financing facilities. This is reflected within the cashflow statement as $21 million in operating cash flow (interest payments received) and $14 million in investing cash flow (primarily principal repayments received).

| For the 6 months ended 31 December | ||||

| US$m | 2020 | 2019 | Change | Change % |

| Cash flow from operating activities | 992 | 448 | 544 | 121% |

| Production stripping and sustaining capital expenditure | (264) | (186) | (78) | (42%) |

| Major capital expenditure | (251) | (104) | (147) | (141%) |

| Total capital expenditure | (515) | (290) | (225) | (78%) |

| Reclassification of capital leases | 5 | – | 5 | |

| Exploration and evaluation expenditure | (63) | (52) | (11) | (21%) |

| Net receipts from Fruta del Norte finance facilities | 14 | – | 14 | |

| Proceeds from sale of property, plant and equipment | 7 | – | 7 | |

| Free cash flow (before M&A activity) | 440 | 106 | 334 | 315% |

| Acquisition payment for a 70% interest of Red Chris | – | (774) | 774 | 100% |

| Payment for investment in Lundin Gold | (1) | (61) | 60 | 98% |

| Free cash flow | 439 | (729) | 1,168 | 160% |

Balance Sheet

| US$m | As at 31 Dec 2020 | As at 30 Jun 2020 | Change | Change % |

| Assets | ||||

| Cash and cash equivalents | 1,744 | 1,451 | 293 | 20% |

| Trade and other receivables | 313 | 305 | 8 | 3% |

| Inventories | 1,574 | 1,573 | 1 | 0% |

| Other financial assets | 632 | 546 | 86 | 16% |

| Current tax asset | 16 | 1 | 15 | 1,500% |

| Property, plant and equipment | 9,538 | 8,809 | 729 | 8% |

| Goodwill | 18 | 17 | 1 | 6% |

| Other intangible assets | 20 | 24 | (4) | (17%) |

| Deferred tax assets | 59 | 65 | (6) | (9%) |

| Investment in associates | 401 | 386 | 15 | 4% |

| Other assets | 76 | 65 | 11 | 17% |

| Total assets | 14,391 | 13,242 | 1,149 | 9% |

| Liabilities | ||||

| Trade and other payables | (531) | (520) | (11) | (2%) |

| Current tax liability | (19) | (23) | 4 | 17% |

| Borrowings | (2,013) | (2,017) | 4 | 0% |

| Lease liabilities | (61) | (58) | (3) | (5%) |

| Other financial liabilities | (192) | (274) | 82 | 30% |

| Provisions | (657) | (623) | (34) | (5%) |

| Deferred tax liabilities | (1,299) | (1,114) | (185) | (17%) |

| Total liabilities | (4,772) | (4,629) | (143) | (3%) |

| Net assets | 9,619 | 8,613 | 1,006 | 12% |

| Equity | ||||

| Equity attributable to owners of the parent | 9,619 | 8,613 | 1,006 | 12% |

| Total equity | 9,619 | 8,613 | 1,006 | 12% |

Summary of Half Year Results by Asset(19)

| For the 6 months ended 31 December 2020 | ||||||||

| UoM | Cadia | Lihir | Telfer | Red Chris(20) | Fruta del Norte(15) | Other | Group | |

| Operating | ||||||||

| Production | ||||||||

| Gold | koz | 391 | 378 | 185 | 24 | 61 | – | 1,039 |

| Copper | kt | 52 | – | 5 | 13 | – | – | 69 |

| Silver | koz | 319 | 18 | 52 | 57 | – | – | 445 |

| Sales | ||||||||

| Gold | koz | 389 | 381 | 173 | 24 | 51 | – | 1,019 |

| Copper | kt | 51 | – | 4 | 13 | – | – | 68 |

| Silver | koz | 313 | 18 | 52 | 57 | – | – | 440 |

| Financial | ||||||||

| Revenue | $m | 1,048 | 718 | 283 | 123 | – | – | 2,172 |

| EBITDA | $m | 767 | 325 | 12 | 39 | – | 3 | 1,146 |

| EBIT | $m | 669 | 187 | (32) | 10 | – | (8) | 826 |

| Net assets | $m | 3,129 | 4,169 | (32) | 931 | – | 1,422 | 9,619 |

| Operating cash flow | $m | 808 | 325 | 27 | 57 | – | (225) | 992 |

| Investing cash flow | $m | (248) | (145) | (29) | (80) | – | (51) | (553) |

| Free cash flow | $m | 560 | 180 | (2) | (23) | – | (276)* | 439 |

| AISC | $m | 21 | 516 | 290 | 72 | 39 | 54 | 992 |

| $/oz | 54 | 1,352 | 1,676 | 2,961 | 778 | – | 974 | |

| AISC Margin | $/oz | 1,772 | 474 | 150 | (1,135) | – | – | 842 |

* Free cash flow for ‘Other’ includes:

- an inflow from other investing activities of $20 million (comprising net receipts from Fruta del Norte finance facilities of $14 million, proceeds from the sale of property, plant and equipment of $7 million, and $1 million relating to further investments in Lundin Gold),

- income tax paid of $137 million,

- net interest paid of $25 million,

- exploration expenditure of $49 million,

- corporate costs of $45 million,

- other capital expenditure of $18 million, and

- net working capital inflows of $22 million.

Refer to the Company’s “ASX Appendix 4D and Financial Report” released on 11 February 2021, and the Management Discussion and Analysis in particular, for an operational overview for the period.

COVID-19 Update

To date, Newcrest has not experienced any material COVID-19 related disruptions to its operations or to the supply of goods and services.

Newcrest is managing a number of positive COVID-19 cases at its Red Chris mine in British Columbia, Canada and on Lihir Island, Papua New Guinea. Comprehensive testing, quarantine and precautionary contact tracing procedures continue to be enforced across all Newcrest sites with the cases identified to date at Lihir and Red Chris being largely asymptomatic or presenting minor symptoms.

The Lihir and Red Chris operations remain unaffected by the positive cases with strict hygiene, social distancing and other COVID-19 management protocols in place. As previously highlighted, all of Newcrest’s operations have business continuity plans and contingencies in place to minimise disruptions to the operations in the event of a significant number of operational employees and/or contractors contracting the virus. It is expected that these plans will enable the operations to continue producing in line with the production schedule, and if there are any material impacts, Newcrest will inform the market in line with its continuous disclosure obligations.

Guidance(21),(22)

Group gold and copper production guidance for FY21 remains unchanged(23).

Group gold production is expected to be towards the upper end of the guidance range, subject to market and operating conditions and assuming no material COVID-19 related interruptions. This reflects an expectation that Cadia’s and Telfer’s full year gold production will be towards the upper end of their respective gold production guidance ranges, Lihir’s gold production will be around the mid-point of its guidance range and Red Chris’ gold production will be around the bottom end of its guidance range.

Group AISC expenditure guidance for FY21 is expected to be around the top end of the original guidance range, assuming spot copper prices of $3.50 per pound and an AUD:USD exchange rate of 0.77, reflecting the higher gold production volumes at Telfer and Cadia, the impact of a higher Australian dollar on operating costs and sustaining capital, and the higher than originally expected costs associated with COVID-19 risk management measures (now expected to be in the order of $60-70 million, up from the $30-40 million anticipated at the start of the financial year).

A safe and sustainable business

Newcrest believes sustainability is core to it being a successful business and has a broad range of programmes underway to ensure the Company’s activities are conducted in line with its Sustainability Policy.

Newcrest has seen significant improvements in its ESG performance scores and risk profile over a number of years. This progress reflects its public commitments under Newcrest’s Sustainability Framework.

In particular, Newcrest has seen year on year improvements in its DJSI Australia Metals & Mining Index score, moving from the 61st to the 82nd percentile over the past two years. This significant improvement recognises Newcrest’s focused efforts in this space and reflects its aspiration to be a top decile company in the DJSI Australia Metals & Mining Index.

Newcrest recently announced that it had entered into a 15-year renewable Power Purchase Agreement (“PPA”) with Tilt Renewables Limited, the owner and developer of the Rye Park Wind Farm, to secure a significant portion of Cadia’s future projected energy requirements. The PPA, together with the forecast decarbonisation of electricity generation in New South Wales, is expected to help deliver a ~20% reduction in Newcrest’s greenhouse gas emissions and is a significant step towards the achievement of Newcrest’s targeted 30% reduction by 2030(7). The PPA will act as a partial hedge against future electricity price increases and will provide Newcrest with access to large-scale generation certificates which Newcrest intends to surrender to achieve a reduction in its greenhouse gas emissions.

Optimising our portfolio of Tier One Assets

Lihir Argillic Ores

Over the past six months Newcrest’s understanding of the argillic ores has improved significantly. Further work has identified less argillic ores are present in Lihir’s future ore feed than previously thought and through plant modifications and operational improvements the processing of these ores has improved.

Modifications have been made to conveyors and chutes and are largely complete and, coupled with improved blending control in the mine, ore handling from the crushers to the mills has improved.

Adjustments to the autoclave operational parameters and improvements in managing the viscosity of the autoclave feed has also seen autoclave operation improve, which in turn improves recovery.

Further work to upgrade trommel sprays in the mills in the coming March 2021 shutdown is planned to improve mill performance.

The Lihir Mine Optimisation Study, has confirmed that the level of argillic ore is not expected to be as high a proportion of ore feed in the future as previously thought and the level of argillic feed is expected to be less than 40% of mill feed which is the target for operational stability.

Outcomes of Lihir Optimisation Study(8)

The Lihir Mine Optimisation Study (LMOS) has been completed, with key findings including:

- an expected improvement in grade presentation which has the potential to provide an additional ~1.4Moz of contained gold(9) being delivered to the mill between FY22-FY34

- the deferral of the Seepage Barrier project and its associated $470 million capital cost by 18 months

- the identification of the potential to safely steepen the pit wall angles in Phase 14, deploying civil engineering principles, with the potential to provide access to a further ~400-600koz of contained gold(10) to be delivered to the mill between FY23 and FY25. This is being progressed in a separate Pre-Feasibility Study that aims to be completed in the coming months

- together, the LMOS and Phase 14A PFS underpin an aspiration to transform Lihir into a 1Moz+ per annum producer for ~10-12 years from FY23, at mill throughput rates of around 15 mtpa

The LMOS study found, through further geotechnical analysis, that the eastern limits of Phases 16 and 17 could be moved further east by ~120m (i.e. the ‘no seepage barrier’ pit shell). This increased the amount of higher grade ore accessible prior to requiring the seepage barrier, allowing the capital expenditure associated with the seepage barrier to be deferred by 18 months.

The planned ex-pit mining rate has been increased by between 5-10 mtpa through a combination of additional equipment and mining efficiencies, improving the stripping rate and increasing the access to higher grade ore. The increased mining rate increases access to higher grade ore which improves the overall grade presentation to the mill by displacing lower grade ore and stockpile feed.

The resulting mine plan has a lower level of argillic ore mill feed, enabling the mill feed blend to be limited to 40% of total feed (which is targeted as the maximum for operational stability).

Together, these improvements have the potential to result in an additional ~1.4Moz of contained gold(9) being fed to the mill between FY22 and FY34.

Phase 14A Pre-Feasibility Study

In addition to the above, the LMOS identified the opportunity to safely increase pit wall angles in Phase 14 providing access to additional existing high-grade Indicated Mineral Resource. A Pre-Feasibility Study (‘Phase 14A PFS’) is well advanced and is expected to be completed in the coming months. The Phase 14A PFS is focused on extending the Phase 14 cutback and safely steepening the walls utilising civil engineering techniques to access existing Indicated Mineral Resources. These Resources would have otherwise been inaccessible through standard mining techniques.

The Phase 14A PFS work to date has identified approximately 20Mt at 2.4g/t Au (including 13Mt at 3g/t Au) of Indicated Mineral Resource that could be accessed and which could potentially increase the average mill feed grade between FY23 and FY25. Study work to date has estimated the potential to increase mill feed by ~400-600koz of contained gold(10) during that period, to be processed at current milling rates. Additionally, the cutback would provide a separate mining front, providing further flexibility for fresh competent ore feed.

Site field investigation is underway, including geotechnical drilling, and preparation for contractor mobilisation for trial works. The Phase 14A cutback is fully permitted and is within the existing mine lease. The conversion of some of the existing Indicated Mineral Resource to Probable Ore Reserves is expected to be completed in coming months following the completion of the Phase 14A PFS.

The application of steep wall engineering techniques is being further assessed for other cutbacks which could enable access to additional high grade mill feed and potentially further defer construction of the full Seepage Barrier.

Lihir Landholder Agreements

On 22 December 2020, Newcrest announced that it had signed new compensation, relocation and benefits sharing agreements with the mining lease area landholders at Lihir. It is expected that these new agreements will enhance socio-economic development outcomes for mining lease area landholders and enable benefits to be distributed directly to their intended beneficiaries. The agreements also enable the efficient and transparent distribution of compensation and benefits without a material increase in quantum.

Cadia Moly Plant

The Molybdenum Plant at Cadia is on track to be fully commissioned in the June 2021 quarter. The Molybdenum Plant is expected to deliver an additional revenue stream for Cadia in the form of molybdenum concentrate which will be recognised as a by-product credit to AISC.

Cadia Expansion – Stage 2

As previously announced on 9 October 2020, the Board approved Stage 2 of the Cadia Expansion Project to the execution phase. Stage 2 of the Expansion Project is expected to increase plant capacity to 35mtpa, enable higher gold and copper recoveries and drive an increase in production and reduce unit costs. The estimated capital cost is expected to be $175 million(24), which is $5 million lower than the estimate announced in October 2019. The project is expected to be completed in late FY22.

An attractive suite of organic growth opportunities and exploration potential

Red Chris Regulatory and Funding Approvals(25)

Newcrest recently announced that it has commenced the construction of the box cut for the exploration decline at Red Chris, following receipt of the necessary regulatory approvals. The Newcrest Board has also approved

C$135 million (on a 100% basis) of funding for the construction of the exploration decline, associated infrastructure and permitting costs. These works are expected to commence following the completion of the box cut and are subject to further regulatory approvals which are in progress. Refer to separate Market Release entitled “Red Chris receives regulatory and funding approval”, dated 11 February 2021.

Havieron Project

The Havieron Project is located 45km east of Newcrest’s Telfer operation and is operated by Newcrest under a Joint Venture Agreement with Greatland Gold plc. Newcrest announced on 30 November 2020 that it had met the Stage 3 expenditure requirement (US$45 million) and is entitled to earn an additional 20% joint venture interest in addition to its existing 40% interest, resulting in an overall joint venture interest of 60% (Greatland Gold 40%). Newcrest can earn up to a 70% joint venture interest through total expenditure of US$65 million and the completion of a series of exploration and development milestones in a four-stage farm-in over a six year period that commenced in May 2019. Newcrest may acquire an additional 5% interest at the end of the farm-in period at fair market value.

In December 2020, Newcrest released an initial Inferred Mineral Resource Estimate for the Havieron Project of 52Mt @ 2.0g/t Au and 0.31% Cu for 3.4Moz Au and 160kt Cu(11),(12),(13). Mineralisation remains open in multiple directions outside of the Inferred Mineral Resource estimate, which indicates the possibility that the resource could continue to grow over time with additional planned drilling activity.

Additionally, on 13 January 2021, Newcrest announced that its Board had approved funding of A$146 million (~US$112 million) for the construction of the box cut, exploration decline and associated infrastructure at the Havieron Project, following receipt of the necessary regulatory approvals to commence these construction activities.

Work is ongoing to finalise the Water Management Plan for the early works program and to progress the necessary approvals and permits that are required to commence the development of an operating underground mine and associated infrastructure at the Project.

Environment Permit granted for Wafi-Golpu

In December 2020, following a rigorous environmental impact assessment, the Environment Permit for the Wafi-Golpu Project was approved by the Papua New Guinean Conservation and Environment Protection Authority and issued by the Director of Environment. The Environment Permit is required under the Papua New Guinean Environment Act and is a pre-requisite for the grant of a Special Mining Lease under the Mining Act.

Newcrest, together with its WGJV partner Harmony, looks forward to re-engaging with the State of Papua New Guinea and progressing discussions on the Special Mining Lease for the Wafi-Golpu Project.

Toronto Stock Exchange Listing

On 13 October 2020, Newcrest listed its ordinary shares on the Toronto Stock Exchange (TSX) under the symbol “NCM”. Newcrest retains its primary listing on the Australian Securities Exchange and its secondary listing on PNGX Exchange Market. Newcrest’s listing on the TSX supports its pursuit of growth in the Americas following the 70% acquisition of the Red Chris mine in Canada, its investments in Ecuador and its expanding portfolio of exciting exploration and early stage entry prospects in the Americas.

Fruta del Norte Finance Facilities

On 30 April 2020 Newcrest acquired the gold prepay and stream facilities and offtake agreement in respect of Lundin Gold’s Fruta del Norte mine for $460 million. In the current period, Newcrest received net pre-tax cash flows of ~US$35 million from these financing facilities. This is reflected within the cashflow statement as $21 million in operating cash flow (interest payments received) and $14 million in investing cash flow (primarily principal repayments received).

Telfer Gold Hedging

No new hedging in relation to Telfer was undertaken in the current period.

The total outstanding volume and prices of gold hedged for future years at Telfer and in total for Newcrest is:

| Financial Year Ending | Gold Ounces Hedged | Average Price A$/oz |

| 30 June 2021 (January to June 2021) | 111,434 | 1,874 |

| 30 June 2022 | 204,615 | 1,902 |

| 30 June 2023 | 137,919 | 1,942 |

| Total | 453,968 | 1,907 |

The current period included 105,205 ounces of Telfer gold sales hedged at an average price of A$1,853 per ounce, representing a net revenue loss of $59 million for the current period. At 31 December 2020, based on gold forward curves, the unrealised mark-to-market loss on these hedges was $192 million.

Approximately 89% of Newcrest’s sales in the period were unhedged and therefore benefiting from the strong gold prices in the period.

Capital Structure

Newcrest’s net debt at 31 December 2020 was $330 million. This comprises $2,013 million of capital market debt and lease liabilities of $61 million, less $1,744 million of cash holdings.

At 31 December 2020, Newcrest had liquidity coverage of $3,744 million, comprising $1,744 million of cash and $2,000 million in committed undrawn bilateral bank debt facilities with maturity periods ranging from 2021 to 2023.

Newcrest’s financial objectives are to meet all financial obligations, maintain a strong balance sheet to withstand cash flow volatility, be able to invest capital in value-creating opportunities, and to provide returns to shareholders. Newcrest looks to maintain a conservative level of balance sheet leverage.

Newcrest’s financial policy metrics and its performance against them are as follows:

| Metric | Policy ‘looks to’ | As at 31 December 2020 | As at 30 June 2020 |

| Credit rating (S&P/Moody’s) | Investment grade | BBB/Baa2 | BBB/Baa2 |

| Leverage ratio (Net debt to EBITDA) | Less than 2.0 times | 0.1 | 0.3 |

| Gearing ratio | Below 25% | 3.3% | 6.8% |

| Cash and committed undrawn bank facilities | At least $1.5bn, of which ~1/3 is in the form of cash | $3.74bn ($1.74bn cash) | $3.45bn ($1.45bn cash) |

Dividend Dates, Currency & Dividend Reinvestment Plan

The Newcrest Board has determined that an interim fully franked dividend of US$ 15 cents per share is to be paid on 25 March 2021. The key dates in relation to the final dividend are set out in the table below.

| Action | Date |

| Ex-Dividend Date | Thursday, 18 February 2021 |

| Record Date and Currency Conversion Date | Friday, 19 February 2021 |

| Election Date – final date to elect to participate in DRP and receive foreign currency | Monday, 22 February 2021 |

| VWAP period begins for DRP | Tuesday, 23 February 2021 |

| VWAP period ends for DRP | Monday, 1 March 2021 |

| Payment/Issue Date | Thursday, 25 March 2021 |

The subscription amount for shares allotted under the DRP will be an amount in cents that is the arithmetic average

of the daily volume weighted average sale price for Newcrest shares sold on the ASX during the VWAP period

(23 February – 1 March 2021) rounded down to the nearest full cent.

Payment currencies

The currencies in which dividend payments will be made are included in the table below.

| Currency to be paid | Shareholders |

| Australian dollars | All shareholders who will not be paid US dollars or PNG kina in accordance with the circumstances set out below. |

| US dollars | Shareholders who have nominated a US dollar bank account domiciled in the US by 5:00pm (AEST) Monday, 22 February 2021, being the Election Date. |

| Papua New Guinea kina | Shareholders:

|

Payments made in Australian dollars and Papua New Guinea kina will be converted from US dollars at the prevailing exchange rate on 19 February 2021, being the Record Date.

Dividend Reinvestment Plan

The Dividend Reinvestment Plan (DRP) will apply to the final dividend. The DRP allows eligible shareholders to reinvest part or all of their dividends into Newcrest shares. No discount will be applied to allotments made under the DRP. A copy of the DRP Rules is available on the Company’s website at https://www.newcrest.com/investors.

Half Year Financial Results Call

We invite you to join our investor webcast from Melbourne at 9:30am on Thursday 11 February 2021. Please register prior to this broadcast on the Newcrest website.

https://www.newcrest.com/investors/reports/financial/

Should you be unable to join us, the webcast can be viewed on our website following the live presentation.

Authorised by the Newcrest Board Executive Committee

For further information please contact

Investor Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Ben Lovick

+61 3 9522 5334

+61 407 269 478

Ben.Lovick@newcrest.com.au

North American Investor Enquiries

Ryan Skaleskog

+1 866 396 0242

+61 403 435 222

Ryan.Skaleskog@newcrest.com.au

Media Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Annie Lawson

+61 3 9522 5750

+61 409 869 986

Annie.Lawson@newcrest.com.au

This information is available on our website at www.newcrest.com

1 All figures in this document relate to businesses of the Newcrest Mining Limited Group (‘Newcrest’ or ‘the Group’) for the 6 months ended

31 December 2020 (‘current period’) compared with the 6 months ended 31 December 2019 (‘prior period’), except where otherwise stated. All references to ‘the Company’ are to Newcrest Mining Limited.

2 Technical and scientific information: The technical and scientific information contained in this document relating to Wafi-Golpu and Lihir was reviewed and approved by Craig Jones, Newcrest’s Chief Operating Officer PNG, FAusIMM and a Qualified Person as defined in National Instrument 43- 101 – Standards of Disclosure for Mineral Projects (NI 43-101). The technical and scientific information contained in this document relating to Cadia was reviewed and approved by Philip Stephenson, Newcrest’s Chief Operating Officer Australia and Americas, FAusIMM and a Qualified Person as defined in NI 43-101.

3 Statutory profit is profit after tax attributable to owners of the Company.

4 Newcrest’s results are reported under International Financial Reporting Standards (“IFRS”). This document includes certain non-IFRS financial information within the meaning of ASIC Regulatory Guide 230: ‘Disclosing non-IFRS financial information’ published by ASIC and within the meaning of Canadian Securities Administrators Staff Notice 52-306 – Non-GAAP Financial Measures. Such information includes:

- ‘Underlying profit’ (profit or loss after tax before significant items attributable to owners of the Company);

- ‘EBITDA’ (earnings before interest, tax, depreciation and amortisation, and significant items);

- ‘EBIT’ (earnings before interest, tax and significant items);

- ‘EBITDA Margin’ (EBITDA expressed as a percentage of revenue);

- ‘EBIT Margin’ (EBIT expressed as a percentage of revenue);

- ‘Net debt to EBITDA’ (calculated as net debt divided by EBITDA for the preceding 12 months);

- ‘Free cash flow’ (calculated as cash flow from operating activities less cash flow related to investing activities. Free cash flow for each operating site is calculated as Free cash flow before interest, tax and intercompany transactions);

- ‘Free cash flow before M&A activity’ (being ‘Free cash flow’ excluding acquisitions, investments in associates and divestments);

- ‘AISC’ (All-In Sustaining Cost) and ‘AIC’ (All-In Cost) as per the updated World Gold Council Guidance Note on Non-GAAP Metrics released November 2018. AISC will vary from period to period as a result of various factors including production performance, timing of sales and the level of sustaining capital and the relative contribution of each asset; and

- AISC Margin reflects the average realised gold price less the AISC per ounce sold.

These measures are used internally by Management to assess the performance of the business and make decisions on the allocation of resources and are included in this document to provide greater understanding of the underlying financial performance of Newcrest’s operations. The non-IFRS information has not been subject to audit or review by Newcrest’s external auditor and should be used in addition to IFRS information. Such non-IFRS financial information/non-GAAP financial measures do not have a standardised meaning prescribed by IFRS and may be calculated differently by other companies. Although Newcrest believes these non-IFRS/non-GAAP financial measures provide useful information to investors in measuring the financial performance and condition of its business, investors are cautioned not to place undue reliance on any non-IFRS financial information/non-GAAP financial measures included in this document. When reviewing business performance, this non-IFRS information should be used in addition to, and not as a replacement of, measures prepared in accordance with IFRS, available on Newcrest’s website and the ASX and SEDAR platforms.

5 Newcrest’s AISC margin for the current period has been determined by deducting the All-In Sustaining Cost attributable to Newcrest’s operations of $984 per ounce from Newcrest’s realised gold price of $1,826 per ounce. For further details refer to the Company’s “ASX Appendix 4D and Financial Report” released on 11 February 2021, and Section 6.6 of the Management Discussion and Analysis in particular.

6 Injury rates are top quartile when compared to International Council on Mining & Metals members in 2019.

7 Per tonne of ore treated and compared to a baseline of FY18 emissions. Subject to market and operating conditions in respect of Cadia and the Rye Park Wind Farm.

8 The Lihir Mine Optimisation Study has been prepared to a Pre-Feasibility Study level with the objective that its findings are subject to an accuracy range of ±25%. The findings in the study and the implementation of the Lihir Mine Optimisation Study are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be construed as guidance.

9 The estimate is based on the utilisation of 100% of the Lihir Ore Reserves, being 22moz Probable and Proven Resources as at 31 December 2020, but subject to depletion for the period since 1 January 2021. The information in this document that relates to Lihir Ore Reserves has been extracted from the release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2020” dated 11 February 2021 which is available to view at www.asx.com.au and on Newcrest’s SEDAR profile under the code “NCM” (the Annual MR&OR release). Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the Annual MR&OR release and that all material assumptions and technical parameters underpinning the estimates in the Annual MR&OR release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent persons’ findings are presented have not been materially modified from the Annual MR&OR release.

10 The estimate of an additional ~400-600koz of contained gold in FY23-25 is subject to the successful completion of the Phase 14A Pre-Feasibility Study and assumes the successful conversion of 20Mt of existing Indicated Mineral Resource to Probable Ore Reserves. The estimate represents the difference between the indicative mine plan base case (inclusive of the outcomes of the Lihir Mine Optimisation Study) and any potential uplift that Phase 14A could provide as a result of the replacement of ~11Mt of low grade ore feed with higher grade during this period. The estimate of ~20Mt of Indicated Mineral Resource underpinning the estimate of ~400-600koz of contained gold has been prepared based on an annualised ~15 mtpa mill feed rate, expit TMM range of 41-63 mtpa, from which 6-12 mtpa is allocated to Phase 14A, mill recovery of 75% – 82%, inter-ramp slope design of approximately 79 degrees in the upper argillic rock benches supported by long cables with mesh and shotcrete to enable safe steepening of the existing unsupported slopes of 20-35 degrees, and the lower unsupported benches at historical

62 degree slopes. The estimate of ~20Mt of Indicated Mineral Resource has been prepared in accordance with the requirements in Appendix 5A of the ASX Listing Rules by a Competent Person. For further information as to the total Indicated Mineral Resources for Lihir of which the 20Mt of Indicated Mineral Resources is part, see the release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2020” which is available to view at www.asx.com.au under the code “NCM” and on Newcrest’s SEDAR profile.

11 The Inferred Mineral Resource estimate is presented on a 100% basis. As announced on 30 November 2020, Newcrest has now met the Stage 3 expenditure requirement (US$45 million) and is entitled to earn an additional 20% joint venture interest in addition to its existing 40% interest, resulting in an overall joint venture interest of 60% (Greatland Gold 40%).

12 The information in this document that relates to Mineral Resources, Exploration Targets, Exploration Results, and related scientific and technical information for Havieron has been extracted from the release titled “Initial Inferred Mineral Resource estimate for Havieron of 3.4Moz of gold and 160Kt of copper” dated 10 December 2020 which is available to view at www.asx.com.au under the code “NCM” (the original release) and on Newcrest’s SEDAR profile. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original release and that all material assumptions and technical parameters underpinning the estimates in the original release continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent persons’ findings are presented have not been materially modified from the original release.

13 As an Australian Company with securities listed on the Australian Securities Exchange (ASX), Newcrest is subject to Australian disclosure requirements and standards, including the requirements of the Corporations Act 2001 and the ASX. Investors should note that it is a requirement of the ASX listing rules that the reporting of Ore Reserves and Mineral Resources in Australia is in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code) and that Newcrest’s Ore Reserve and Mineral Resource estimates are reported in accordance with the JORC Code. Newcrest is also subject to certain Canadian disclosure requirements and standards, as a result of its secondary listing on the Toronto Stock Exchange (TSX), including the requirements of National Instrument 43-101 (NI 43-101). Investors should note that it is a requirement of Canadian securities law that the reporting of Mineral Reserves and Mineral Resources in Canada and the disclosure of scientific and technical information concerning a mineral project on a property material to Newcrest comply with NI 43-101. Newcrest’s material properties are currently Cadia, Lihir and Wafi-Golpu.

14 Total Recordable Injury Frequency Rate per million hours worked.

15 Group production and AISC includes Newcrest’s 32% attributable share of Fruta del Norte (commercial production commenced in the March 2020 quarter) through its 32% equity interest in Lundin Gold Inc.

- Gold production in the current period includes 61,146 ounces relating to Newcrest’s 32% attributable share of the 191,080 ounces reported by Lundin Gold Inc. for the six month period ended 31 December 2020; and

- Group AISC in the current period includes an estimated reduction of $10 per ounce, which represents 19,891 ounces of Newcrest’s 32% attributable share of the 62,160 ounces sold at $728 per ounce as reported by Lundin Gold Inc. for the September 2020 quarter plus an estimate for the December 2020 quarter based on the 30,986 ounces relating to Newcrest’s 32% attributable share of the 96,830 ounces reported by Lundin Gold Inc. for the December 2020 quarter at the mid-point of Newcrest’s FY21 guidance ($810 per ounce).

16 AISC reported in the prior period has been restated to reflect adjustments applied to Red Chris following the completion of acquisition and prior period year end processes.

17 Realised metal prices are the US dollar spot prices at the time of sale per unit of metal sold (net of Telfer gold production hedges), excluding deductions related to treatment and refining costs and the impact of price related finalisations for metals in concentrate. The realised price has been calculated using sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

18 The $774 million payment represents the cash consideration based on estimated debt and working capital balance as at 31 December 2019. The debt (assumed equipment loans and other interest-bearing liabilities) and working capital balances were subject to adjustment under the Asset Purchase Agreement ‘APA’ which was finalised in the second half of the 2020 financial year. The final cash consideration paid for the 70% interest in the Red Chris mine was $769 million.

19 All data relating to operations is shown at 100%, with the exception of Red Chris which is shown at 70% and Fruta del Norte which is shown at 32%.

20 Newcrest acquired its 70% interest in the Red Chris mine and became the operator on 15 August 2019.

21 Disclaimer: This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “continue”, “outlook” and “guidance”, or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines. The Company continues to distinguish between outlook and guidance. Guidance statements relate to the current financial year. Outlook statements relate to years subsequent to the current financial year. These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance, and achievements to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which the Company operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation. For further information as to the risks which may impact on the Company’s results and performance, please see the risk factors included in the Annual Information Form dated 13 October 2020 lodged with ASX and SEDAR. Forward looking statements are based on the Company’s good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect the Company’s business and operations in the future. The Company does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of the Company. Readers are cautioned not to place undue reliance on forward looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. Forward looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, the Company does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

22 The original guidance stated assumes weighted average copper price of $2.70 per pound, AUD:USD exchange rate of 0.68 and CAD:USD exchange rate of 0.74 for FY21. Guidance for the full year has been evaluated assuming for the remainder of FY21 a weighted average copper price of $3.50 per pound, AUD:USD exchange rate of 0.77 and CAD:USD exchange rate of 0.77.

23 Subject to market and operating conditions.

24 Stage 2 of the Cadia Expansion Feasibility Study has been prepared with the objective that its findings are subject to an accuracy range of ±10-15%. The findings in the Study and the implementation of the Cadia Expansion Project are subject to all the necessary approvals, permits, internal and regulatory requirements and further works. The estimates are indicative only and are subject to market and operating conditions. They should not be construed as guidance. As Cadia’s functional currency is AUD, the Studies have been assessed in AUD. The outcomes for the Cadia Expansion Project – Stage 2 in this market release have been converted to USD using the following exchange rates: FY21 0.70, FY22 0.71, FY23 0.72, FY24 0.73 and FY25+ 0.75.

25 Subject to market and operating conditions.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/74177