(figures are unaudited and in US$ except where stated)

Strong June Quarter delivers FY21 guidance and quarterly records

- Creating a brighter future for people through safe and responsible mining

- Goal of net zero carbon emissions by 2050(1)

- Industry leading low injury rates(2) underpinned by a 27% improvement in TRIFR(3) in the June 2021 quarter

- Achieved FY21 production guidance, with Cadia exceeding the top end of its guidance range(4)

- Quarterly gold production of 542koz(5) and copper production of 38kt

- All-In Sustaining Cost (AISC) of $797/oz(5)in the June quarter

- June quarter AISC margin of 55% or $983/oz(6)

- Cadia achieved record annualised mined ore and mill throughput rates

- Cadia recorded its lowest reported quarterly AISC of negative $377/oz

- Red Chris recorded its lowest reported quarterly AISC of $651/oz

- FY21 AISC of $905/oz, delivering an AISC margin of 49% or $884/oz(6) for the financial year

- Advancing multiple organic growth options

- Exploration decline development works progressing well at Red Chris and Havieron

- Cadia Molybdenum Plant first production is expected by the end of September 2021(7)

- Lihir Phase 14A Pre-Feasibility Study expected to be released by the end of September 2021(8)

- Cadia PC1-2 Pre-Feasibility Study expected to be released by the end of September 2021(8)

- Red Chris Pre-Feasibility Study expected to be released by the end of September 2021(8)

- Havieron Pre-Feasibility Study expected to be released in the second half of CY21(8)

Newcrest Mining Limited (ASX: NCM) (TSX: NCM) Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas, said, “Newcrest has safely delivered its group production and cost guidance for the year following a strong fourth quarter. Cadia exceeded the top end of its production guidance range and delivered mine and mill throughput records, showcasing the quality of this world class asset. Newcrest’s All-In Sustaining Cost of $797oz for the June quarter was underpinned by record quarterly AISC outcomes for Cadia and Red Chris, translating to an impressive All-In Sustaining Cost margin of $983oz.”

“We have made significant progress advancing our multiple organic gold and copper growth options during the quarter. At Red Chris and Havieron we commenced decline development works which are the critical path to reaching commercial production. We are also on track to release the outcomes of several of our exciting growth studies through the remainder of the calendar year which we believe will help articulate the future potential of our business.”

“Following the localised seismic event at Cadia earlier this month, the Prohibition Notice has been lifted and we are currently rehabilitating the affected area. As previously disclosed, we do not expect this event to impact gold and copper production in FY22 and our development and expansion works continue uninterrupted,” said Mr Biswas.

Overview

Gold production was 6% higher than the prior period(9) driven by a strong performance from Cadia and Telfer. Lihir’s gold production was 4% lower in the quarter due to unplanned downtime in the autoclaves, lower head grade and recovery rates, and the overrun of the planned March 2021 shutdown.

Newcrest’s AISC for the June 2021 quarter of $797/oz(5) was$96/oz lower than the prior period, reflecting the benefit of higher copper sales volumes at Cadia, Telfer and Red Chris, a higher realised copper price and higher gold sales volumes at Telfer and Cadia. These benefits were partially offset by the associated increase in treatment, refining and transportation costs and royalties.

| Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020Qtr | Sep 2020Qtr | FY21 | FY20 | FY21 Guidance(10) | ||

| Group(5) | – gold | oz | 542,332 | 512,424 | 535,477 | 503,089 | 2,093,322 | 2,171,118 | 1,950-2,150koz |

| – copper | t | 38,370 | 35,034 | 34,557 | 34,763 | 142,724 | 137,623 | 135-155kt | |

| – silver | oz | 270,797 | 228,543 | 230,769 | 214,412 | 944,521 | 983,431 | ||

| Cadia | – gold | oz | 194,757 | 179,546 | 194,088 | 196,504 | 764,895 | 843,338 | 680-760koz |

| – copper | t | 28,105 | 26,324 | 26,643 | 25,329 | 106,402 | 96,042 | 95-105kt | |

| Lihir | – gold | oz | 176,341 | 183,231 | 200,173 | 177,337 | 737,082 | 775,978 | 720-820koz |

| Telfer | – gold | oz | 125,603 | 105,228 | 98,855 | 86,452 | 416,138 | 393,164 | 360-420koz |

| – copper | t | 4,685 | 3,666 | 2,443 | 2,384 | 13,177 | 16,278 | 10-20kt | |

| Red Chris(11) | – gold | oz | 10,815 | 11,095 | 11,375 | 12,636 | 45,922 | 38,933 | 45-55koz |

| – copper | t | 5,580 | 5,044 | 5,471 | 7,050 | 23,145 | 25,302 | 25-30kt | |

| Gosowong(12) | – gold | oz | – | – | – | – | – | 103,282 | |

| Fruta del Norte(5),(13) | – gold | oz | 34,816 | 33,324 | 30,986 | 30,160 | 129,285 | 16,422 | 95-110koz |

| Fatalities | Number | 0 | 0 | 0 | 0 | 0 | 0 | ||

| TRIFR(14) | mhrs | 1.9 | 2.6 | 1.6 | 2.6 | 2.3 | 2.6 | ||

| All-In Sustaining Cost(5),(15) | $/oz | 797 | 893(16) | 963(16) | 980 | 905 | 862 | ||

| All-In Cost(17) | $/oz | 1,242 | 1,253 | 1,349 | 1,275 | 1,278 | 1,044 | ||

| All-In Sustaining Cost margin(6) | $/oz | 983 | 854 | 836 | 847 | 884 | 668 | ||

| Realised gold price(18) | $/oz | 1,780 | 1,751 | 1,815 | 1,837 | 1,796 | 1,530 | ||

| Realised copper price(18) | $/lb | 4.42 | 3.86 | 3.26 | 2.97 | 3.66 | 2.57 | ||

| Realised copper price(18) | $/t | 9,744 | 8,510 | 7,187 | 6,548 | 8,069 | 5,666 | ||

| Average exchange rate | AUD:USD | 0.7700 | 0.7729 | 0.7303 | 0.7147 | 0.7467 | 0.6715 | ||

| Average exchange rate | PGK:USD | 0.2843 | 0.2846 | 0.2853 | 0.2872 | 0.2854 | 0.2927 | ||

| Average exchange rate | CAD:USD | 0.8124 | 0.7896 | 0.7667 | 0.7504 | 0.7789 | 0.7452 | ||

All figures are shown at 100% unless stated otherwise.

Operations

Cadia, Australia

| Highlights | Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020Qtr | Sep 2020Qtr | FY21 | FY20 | FY21 Guidance | |

| TRIFR | mhrs | 2.0 | 11.3 | 7.5 | 3.6 | 6.1 | 4.9 | ||

| Total production | – gold | oz | 194,757 | 179,546 | 194,088 | 196,504 | 764,895 | 843,338 | 680-760koz |

| – copper | t | 28,105 | 26,324 | 26,643 | 25,329 | 106,402 | 96,042 | 95-105kt | |

| Head Grade | – gold | g/t | 0.92 | 0.94 | 0.95 | 1.02 | 0.95 | 1.14 | |

| – copper | % | 0.40 | 0.41 | 0.39 | 0.40 | 0.40 | 0.39 | ||

| Sales | – gold | oz | 201,494 | 175,295 | 194,183 | 195,146 | 766,118 | 848,959 | |

| – copper | t | 29,039 | 25,332 | 26,477 | 24,596 | 105,444 | 96,437 | ||

| All-In Sustaining Cost | $/oz | (377) | (160) | (6) | 113 | (109) | 160 | ||

| All-In Sustaining Cost margin | $/oz | 2,157 | 1,911 | 1,821 | 1,724 | 1,905 | 1,370 | ||

Cadia achieved record annualised mined ore volumes from Cadia East of 38.1mtpa and a record annualised mill throughput rate of 34.3mtpa in the June 2021 quarter. The higher volumes of ore processed offset the reduction in grade and contributed to an 8% increase in gold production in the period. Mill throughput also benefited from no major planned shutdown events, higher plant availability and debottlenecking initiatives in Concentrator 1.

Cadia’s new quarterly AISC record of negative $377/oz reflects the benefits of higher gold and copper sales volumes and a higher realised copper price. These benefits were only partially offset by associated higher royalty payments and treatment, refining and transportation costs.

On 2 July 2021, a localised seismic event occurred in the Eastern end of Panel Cave 2. No injuries were sustained and all personnel working in the affected area were accounted for and safely returned to surface in accordance with Newcrest’s standard operating procedure. Mining operations in all other areas, development activities and

above-ground operations all continued uninterrupted. The Prohibition Notice that was issued by the New South Wales Government Resources Regulator in respect of the event was lifted on 5 July 2021. An improvement notice has been issued and rehabilitation of the affected area is currently underway. Newcrest does not expect this event to impact gold or copper production in FY22.

As foreshadowed in Newcrest’s March 2021 quarterly report, the replacement of the SAG mill motor commenced in early July 2021 and is expected to take ~19 weeks(19) to complete. Newcrest has implemented a SAG bypass for the duration of the SAG mill motor replacement and Concentrator 1 is operating at ~60% of its normal capacity, which will temporarily reduce gold and copper production and increase AISC/oz during this period.

Newcrest is on track to complete commissioning of the Molybdenum Plant (Moly Plant) and expects to achieve first production by the end of September 2021(19). The Moly Plant is expected to deliver an additional revenue stream for Cadia in the form of a molybdenum concentrate which will be recognised as a by-product credit to AISC.

The Cadia PC1-2 Pre-Feasibility Study is expected to be released by the end of September 2021(20).

Lihir, Papua New Guinea

| Highlights | Metric | Jun 2021Qtr | Mar 2021Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 | FY21 Guidance | |

| TRIFR | mhrs | 0.4 | 0.4 | 0.0 | 0.5 | 0.3 | 0.6 | ||

| Production | – gold | oz | 176,341 | 183,231 | 200,173 | 177,337 | 737,082 | 775,978 | 720-820koz |

| Head Grade | – gold | g/t | 2.45 | 2.58 | 2.27 | 2.34 | 2.40 | 2.38 | |

| Sales | – gold | oz | 197,651 | 194,356 | 170,308 | 210,831 | 773,146 | 760,724 | |

| All-In Sustaining Cost | $/oz | 1,481 | 1,293 | 1,438 | 1,283 | 1,370 | 1,206 | ||

| All-In Sustaining Cost margin | $/oz | 299 | 458 | 377 | 554 | 426 | 324 | ||

Gold production of 176koz was 4% lower than the prior period reflecting the impact of unplanned downtime in the autoclaves, lower head grade and recovery rates, and the overrun of the planned March 2021 shutdown. This was partially offset by the benefit of there being no planned shutdown events in the period, which enabled a 6% increase in mill throughput. Head grade and recovery were impacted by a higher proportion of lower grade stockpile feed as access to expit ore in Phase 14 was obstructed by high rainfall events.

Scheduled maintenance activities that were planned for September 2021 have been brought forward and are expected to be completed during a period of unplanned downtime of Autoclave 4. This planned maintenance activity is currently underway, largely offsetting the impact on FY22 gold production associated with the Autoclave 4 downtime.

Lihir’s AISC of $1,481/oz was 15% higher than the prior period driven by an increase in stripping activities in Phase 15, timing of sustaining capital spend and higher COVID-19 related costs. These impacts were partially offset by marginally higher gold sales volumes.

Technical and risk mitigation studies to support the Phase 14A Pre-Feasibility Study were substantially progressed during the June 2021 quarter. Newcrest expects to release the findings of the Phase 14A Pre-Feasibility Study by the end of September 2021(21). Newcrest also expects to complete the Seepage Barrier Feasibility Study by the end of September 2021.

Lihir – Material Movements

| Ore Source | Metric | Jun 2021 Qtr | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 |

| Ex-pit crushed tonnes | kt | 819 | 1,407 | 1,918 | 1,236 | 5,379 | 5,445 |

| Ex-pit to stockpile | kt | 364 | 695 | 615 | 1,610 | 3,283 | 6,585 |

| Waste | kt | 6,776 | 6,967 | 4,793 | 6,269 | 24,805 | 18,055 |

| Total Ex-pit | kt | 7,959 | 9,068 | 7,326 | 9,115 | 33,467 | 30,085 |

| Stockpile reclaim | kt | 2,229 | 1,566 | 1,765 | 2,192 | 7,752 | 8,250 |

| Stockpile relocation | kt | 3,164 | 3,139 | 2,884 | 3,306 | 12,493 | 13,599 |

| Total Other | kt | 5,393 | 4,705 | 4,649 | 5,498 | 20,244 | 21,850 |

| Total Material Moved | kt | 13,352 | 13,774 | 11,975 | 14,613 | 53,712 | 51,935 |

Lihir – Processing

| Equipment | Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 |

| Crushing | kt | 3,048 | 2,973 | 3,683 | 3,426 | 13,130 | 13,696 |

| Milling | kt | 3,010 | 2,835 | 3,691 | 3,255 | 12,792 | 13,798 |

| Flotation | kt | 2,191 | 2,070 | 2,835 | 2,780 | 9,876 | 10,414 |

| Total Autoclave | kt | 1,722 | 1,642 | 1,998 | 1,592 | 6,954 | 7,319 |

Telfer, Australia

| Highlights | Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 | FY21 Guidance | |

| TRIFR | mhrs | 4.3 | 5.2 | 1.8 | 4.6 | 4.2 | 4.9 | ||

| Production | – gold | oz | 125,603 | 105,228 | 98,855 | 86,452 | 416,138 | 393,164 | 360-420koz |

| – copper | t | 4,685 | 3,666 | 2,443 | 2,384 | 13,177 | 16,278 | 10-20kt | |

| Head Grade | – gold | g/t | 0.87 | 0.88 | 0.94 | 0.86 | 0.89 | 0.90 | |

| – copper | % | 0.13 | 0.12 | 0.09 | 0.09 | 0.11 | 0.14 | ||

| Sales | – gold | oz | 135,799 | 102,449 | 87,992 | 85,096 | 411,336 | 391,339 | |

| – copper | t | 5,098 | 3,000 | 2,152 | 2,311 | 12,560 | 16,283 | ||

| All-In Sustaining Cost | $/oz | 1,203 | 1,489 | 1,560 | 1,797 | 1,473 | 1,281 | ||

| All-In Sustaining Cost margin(22) | $/oz | 577 | 262 | 255 | 40 | 323 | 249 | ||

Gold production of 126koz was 19% higher than the prior period driven by higher throughput and recovery, partially offset by lower head grade and a reduction in dump leach ounces. Mill throughput was 20% higher in the June 2021 quarter reflecting the increased operational run time. The increase in gold recovery is a result of successful sulphur blending strategies together with other recovery improvement initiatives.

Telfer’s AISC of $1,203/oz was 19% lower than the prior period primarily driven by higher gold and copper sales volumes and a higher realised copper price. These benefits were partially offset by an increase in sustaining capital expenditure and higher treatment, refining and transportation costs and royalty payments.

Red Chris, Canada

| Highlights(23) | Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 | FY21 Guidance | |

| TRIFR | mhrs | 6.6 | 4.1 | 1.8 | 11.1 | 6.6 | 12.7 | ||

| Production | – gold | oz | 10,815 | 11,095 | 11,375 | 12,636 | 45,922 | 38,933 | 45-55koz |

| – copper | t | 5,580 | 5,044 | 5,471 | 7,050 | 23,145 | 25,302 | 25-30kt | |

| Head Grade | – gold | g/t | 0.35 | 0.42 | 0.42 | 0.40 | 0.39 | 0.39 | |

| – copper | % | 0.40 | 0.43 | 0.45 | 0.46 | 0.44 | 0.54 | ||

| Sales | – gold | oz | 10,390 | 10,778 | 12,641 | 11,834 | 45,643 | 37,271 | |

| – copper | t | 5,299 | 4,988 | 6,072 | 6,642 | 23,002 | 24,432 | ||

| All-In Sustaining Cost | $/oz | 651 | 2,169 | 3,278 | 2,621 | 2,248 | 1,703 | ||

| All-In Sustaining Cost margin | $/oz | 1,129 | (418) | (1,463) | (784) | (452) | (173) | ||

Gold production of 11koz was in line with the prior period, with higher throughput and recovery offset by lower gold head grade.

Red Chris’ AISC of $651/oz is 70% lower than the prior period and is a quarterly record for the site. This record outcome reflects Phase 7 stripping costs being of a non-sustaining nature, the benefit of a higher copper price, higher copper sales volumes and the completion of production stripping activities in Phase 5. These benefits were partially offset by an increase in sustaining capital expenditure and lower gold sales volumes.

In the period, production stripping costs relating to Phase 7 have been classified as Non-Sustaining in accordance with World Gold Council guidance, reflecting the multi-year nature of the stripping and that the associated ore production phase is expected to be more than five years. These costs will continue to be classified as Non-Sustaining over the expected duration of the Phase 7 stripping campaign.

During FY21, Newcrest invested in a number of additional improvement initiatives across the site including a new fleet management system, the replacement of the conventional CAT 793 truck tubs with high performance trays and a new cleaner column that was commissioned in the June 2021 quarter and is expected to improve recoveries. These initiatives have contributed to elevated full year AISC expenditures but are expected to help deliver reductions in site unit costs in the longer term.

The latest drilling results for Red Chris are included in the June 2021 Quarterly Exploration Report which was also released today. An update on the Red Chris Block Cave studies and associated activity is contained later in this report.

Fruta Del Norte, Ecuador

Newcrest acquired the gold prepay and stream facilities and an offtake agreement in respect of Lundin Gold Inc’s Fruta del Norte mine for $460 million in April 2020.

In the June 2021 quarter, Newcrest received net pre-tax cash flows of ~$33 million from these financing facilities, and has received a total of ~$95 million net pre-tax cash flows since acquisition of the facilities.

Included within Newcrest’s gold production for the June 2021 quarter is 35koz relating to Newcrest’s 32% equity interest in Lundin Gold Inc, the owner of the Fruta del Norte mine.

Project Development

Red Chris, Canada

Newcrest commenced development of the exploration decline at Red Chris following receipt of regulatory approval at the end of April 2021. Other achievements include:

- Box cut excavation has been completed

- Exploration decline has advanced 21 metres as at 14 July 2021

- Surface earthworks, offices and other infrastructure is in place to support the decline development

- Pre-permitting activities for the next stages of the early works program are underway

Newcrest expects to release its Red Chris Block Cave Pre-Feasibility Study by the end of September 2021(24).

Havieron, Western Australia

The Havieron Project is located 45km east of Newcrest’s Telfer operation and is operated by Newcrest under a Joint Venture Agreement with Greatland Gold plc.

Newcrest received the required regulatory approvals to commence construction of an exploration decline at Havieron following approval of the Water Management Plan on 30 April 2021.

Construction activities are progressing to plan with achievements as at 14 July 2021 including:

- Box cut and portal completed in May 2021

- Exploration decline commenced on 14 May 2021 and has advanced 69 metres

- Decline contractor has moved to 24 hour operations

- All surface support infrastructure is nearing completion

Works to progress the necessary approvals and permits that are required to commence the development of an operating underground mine and associated infrastructure at the Project are ongoing(25).

Newcrest expects to release its Havieron Pre-Feasibility Study in the second half of CY21(24).

The latest drilling results for the Havieron Project are included in the June 2021 Quarterly Exploration Report which was also released today.

Wafi-Golpu, Papua New Guinea

In December 2020 an Environment Permit for the Wafi-Golpu Project was granted.

As previously advised, subsequent to the grant of the Environment Permit, the Governor of Morobe Province and the Morobe Provincial Government commenced legal proceedings in the National Court in Papua New Guinea seeking judicial review of the decision to issue the Environment Permit. The participants in the Wafi-Golpu Joint Venture (including Newcrest) are not defendants to the proceedings. The National Court is yet to determine this judicial review application. At this stage, project and permitting activities can still progress.

Newcrest, together with its Wafi-Golpu Joint Venture partner Harmony, is currently engaging with the State of Papua New Guinea to progress permitting of the Wafi-Golpu Project and has commenced discussions in relation to the Special Mining Lease.

Exploration

See the separately released “Quarterly Exploration Report” for the June 2021 quarter.

COVID-19 Update

To date, Newcrest has not experienced any material COVID-19 related disruptions to production or to the supply of goods and services.

The number of COVID-19 cases at Lihir remains at levels that are within the capability of the care and treatment and isolation facilities, with the majority of these cases continuing to be asymptomatic. Newcrest continues to strengthen its COVID-19 controls at Lihir, focusing on containment through extensive contact tracing and isolation procedures. Charter flights with restricted capacity are operating between Papua New Guinea and Australia, as are limited commercial flights between Port Moresby and Brisbane.

There were no material COVID-19 related events impacting gold production at Lihir during the financial year. However, as advised in the March 2021 quarterly report, the ability to attract labour, travel restrictions, contact tracing and associated isolation requirements has impacted total material mined. Delays have also been experienced on development projects (including Phase 14A ground support trials) and shutdown performance due to difficulty in mobilising and accommodating labour. There remains a risk of COVID-19 impacting production at Lihir and this continues to be closely managed.

There is currently a COVID-19 related lockdown in the Orange district of New South Wales in which the Cadia operation is located. Cadia has escalated the controls under its Pandemic Response Plan in order to manage risks pertaining to the health and safety of its workforce and ongoing operations.

All Newcrest operations have business continuity plans and contingencies in place which strive to minimise disruptions due to the pandemic and to best position the operations to continue producing. Should any material impacts arise, Newcrest will inform the market in line with its continuous disclosure obligations.

In FY21, Newcrest incurred ~$70 million in COVID-19 management costs, of which $53 million related to Lihir. Costs associated with managing COVID-19 risks in FY21 were around $30 million higher than anticipated due to more extensive testing, longer quarantining periods, additional accommodation, rostering and other labour costs, and other preventative actions. Elevated costs related to the pandemic are expected to continue through FY22.

Corporate

Goal of Net Zero Carbon Emissions

As previously announced, Newcrest has set a goal of net zero carbon emissions by 2050 which relates to its operational (Scope 1 and Scope 2) emissions. Additionally, Newcrest will continue to work across its value chain to reduce its Scope 3 emissions. See release titled “Newcrest sets goal of net zero carbon emissions by 2050” dated 18 May 2021 for further information.

Community Support Fund

Newcrest’s A$20 million Community Support Fund was established in April 2020 in response to the COVID-19 pandemic. Since its inception it has supported a variety of initiatives ranging from immediate health assistance to livelihood restoration and economic recovery across Papua New Guinea, Australia, Canada (British Columbia) and Ecuador. Recent initiatives have included:

- A commitment of ~US$1.8 million to support vaccine rollout (and additional in-kind logistical support) as part of the UNICEF Australia COVID Vaccination Alliance in Papua New Guinea with a focus on New Ireland Province.

- The establishment of the first Intensive Care Unit (ICU) in the Province of Zamora-Chinchipe (Ecuador) which Newcrest completed in partnership with Lundin Gold, SolGold, and Ecuadorian authorities. The ICU will provide much needed care in response to the COVID-19 pandemic. In the longer term the ICU is expected to support other critical health needs and emergency response capabilities of the regional Yantzaza Hospital.

Board and Executive Announcements

In May 2021, Newcrest announced the impending retirement of Gerard Bond, the Company’s Finance Director and Chief Financial Officer. Mr Bond is the longest serving member of Newcrest’s Executive Committee and Board and he will retire on 3 January 2022 after 10 years in the role. The process to select Mr Bond’s successor has commenced. See separate release titled “Senior Management Announcement – Finance Director & CFO to retire” dated 5 May 2021 for further information.

Ms Jane McAloon was appointed to the Board as an independent Non-Executive Director and a member of the Human Resources and Remuneration Committee, effective from 1 July 2021. See release titled “Newcrest Board Appointment” dated 24 June 2021 for further information.

Interactive Analyst CentreTM

Newcrest’s financial and operational information can now be viewed via the Interactive Analyst CentreTMwhich is locatedunder the Investor tab on Newcrest’s website (www.newcrest.com). This interactive tool allows users to chart and export Newcrest’s current and historical results for further analysis.

Sandeep Biswas

Managing Director and Chief Executive Officer

Gold Production Summary

| June 2021 Quarter | Mine Production Tonnes (000’s)(26) | Tonnes Treated (000’s) | Head Grade (g/t Au) | Gold Recovery (%) | Gold Production (oz) | Gold Sales (oz) | All-In Sustaining Cost ($/oz)(5) |

| Cadia East Panel Cave 1 | 1,057 | ||||||

| Cadia East Panel Cave 2 | 8,189 | ||||||

| Cadia East Panel Cave 2-3 | 263 | ||||||

| Cadia(27) | 9,509 | 8,550 | 0.92 | 77.3 | 194,757 | 201,494 | (377) |

| Telfer Open Pit | 10,209 | 4,821 | 0.81 | 79.5 | 99,360 | ||

| Telfer Underground | 543 | 598 | 1.40 | 84.7 | 22,873 | ||

| Telfer Dump Leach | 3,370 | ||||||

| Telfer | 10,752 | 5,419 | 0.87 | 80.4 | 125,603 | 135,799 | 1,203 |

| Lihir | 7,959 | 3,010 | 2.45 | 74.5 | 176,341 | 197,651 | 1,481 |

| Red Chris | 6,765 | 1,745 | 0.35 | 55.4 | 10,815 | 10,390 | 651 |

| Fruta del Norte(28) | 34,816 | 34,816 | 800 | ||||

| Total | 34,986 | 18,725 | 1.10 | 76.3 | 542,332 | 580,149 | 797 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest’s 70% share and Fruta del Norte which is shown at Newcrest’s 32% attributable share through its 32% equity interest in Lundin Gold Inc.

Copper Production Summary

| June 2021 Quarter | Copper Grade (%) | Copper Recovery (%) | Concentrate Produced (tonnes) | Metal Production (tonnes) |

| Cadia | 0.40 | 82.7 | 119,617 | 28,105 |

| Telfer Open Pit | 0.10 | 61.2 | 29,075 | 3,062 |

| Telfer Underground | 0.30 | 91.4 | 17,644 | 1,623 |

| Telfer | 0.13 | 69.1 | 46,718 | 4,685 |

| Red Chris | 0.40 | 79.6 | 25,573 | 5,580 |

| Total | 0.29 | 80.3 | 191,909 | 38,370 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest’s 70% share.

Silver Production Summary

| June 2021 Quarter | Tonnes Treated (000’s) | Silver Production (oz) |

| Cadia | 8,550 | 166,024 |

| Telfer | 5,419 | 58,896 |

| Lihir | 3,010 | 12,715 |

| Red Chris | 1,745 | 33,162 |

| Total | 18,725 | 270,797 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest 70% share.

All-In Sustaining Cost – June 2021 Quarter

| 3 Months to 30 June 2021 | |||||||

| Units | Cadia | Telfer | Lihir | Red Chris | Corp/ Other | Group(29) | |

| Gold Produced | oz | 194,757 | 125,603 | 176,341 | 10,815 | – | 507,516 |

| Mining | $/oz prod. | 162 | 576 | 259 | 1,906 | – | 335 |

| Milling | $/oz prod. | 287 | 376 | 576 | 1,221 | – | 429 |

| Administration and other | $/oz prod. | 145 | 206 | 410 | 1,188 | – | 274 |

| Lease adjustments | $/oz prod | (3) | (24) | (6) | (218) | – | (14) |

| Third party smelting, refining and transporting costs(30) | $/oz prod. | 201 | 182 | 4 | 722 | – | 139 |

| Royalties | $/oz prod. | 118 | 74 | 47 | 93 | – | 82 |

| By-product credits | $/oz prod. | (1,476) | (407) | (1) | (4,923) | – | (772) |

| Ore inventory adjustments(31) | $/oz prod. | (16) | (3) | 97 | (331) | – | 20 |

| Production stripping adjustments(31) | $/oz prod. | – | – | (111) | (512) | – | (49) |

| AOD adjustments(31) | $/oz prod. | – | 6 | – | – | – | 1 |

| Net Cash Costs | $/oz prod. | (582) | 986 | 1,275 | (854) | – | 445 |

| Gold Sold | oz | 201,494 | 135,799 | 197,651 | 10,390 | – | 545,334 |

| Adjusted operating costs(32) | $/oz sold | (532) | 1,015 | 1,261 | (1,110) | – | 492 |

| Corporate general & administrative costs(33),(34) | $/oz sold | – | – | – | – | 68 | 68 |

| Reclamation and remediation costs | $/oz sold | 6 | 3 | 9 | 73 | – | 8 |

| Production stripping (sustaining)(35) | $/oz sold | – | – | 76 | (3) | – | 27 |

| Advanced operating development | $/oz sold | – | (5) | – | – | – | (1) |

| Capital expenditure (sustaining) | $/oz sold | 146 | 143 | 128 | 1,429 | 19 | 182 |

| Exploration (sustaining) | $/oz sold | – | 15 | 2 | 169 | – | 8 |

| Leases (sustaining) | $/oz sold | 3 | 32 | 5 | 93 | – | 13 |

| All-In Sustaining Cost | $/oz sold | (377) | 1,203 | 1,481 | 651 | 87 | 797 |

| Growth and development costs(34) | $/oz sold | – | – | – | – | 4 | 4 |

| Production stripping (non-sustaining)(35) | $/oz sold | – | – | 23 | 536 | – | 18 |

| Capital expenditure (non-sustaining)(36) | $/oz sold | 708 | – | 131 | 1,655 | 25 | 365 |

| Exploration (non-sustaining) | $/oz sold | 1 | 5 | – | 355 | 43 | 51 |

| Leases (non-sustaining) | $/oz sold | 5 | – | – | – | 5 | 7 |

| All-In Cost | $/oz sold | 337 | 1,208 | 1,635 | 3,197 | 164 | 1,242 |

| Depreciation and amortisation(37) | $/oz sold | 277 | 274 | 395 | 2,316 | 12 | 370 |

All figures are shown at 100%, except for Red Chris which is shown at 70%. AISC and AIC may not calculate based on amounts presented in these tables due to rounding.

All-In Sustaining Cost – Year ended 30 June 2021

| 12 Months to 30 June 2021 | |||||||

| Units | Cadia | Telfer | Lihir | Red Chris | Corp/ Other | Group(38) | |

| Gold Produced | oz | 764,895 | 416,138 | 737,082 | 45,922 | – | 1,964,037 |

| Mining | $/oz prod. | 171 | 731 | 254 | 1,683 | – | 356 |

| Milling | $/oz prod. | 318 | 425 | 554 | 1,107 | – | 447 |

| Administration and other | $/oz prod. | 117 | 202 | 331 | 1,268 | – | 242 |

| Lease Adjustments | $/oz prod | (3) | (28) | (6) | (53) | – | (10) |

| Third party smelting, refining and transporting costs(39) | $/oz prod. | 175 | 139 | 3 | 665 | – | 114 |

| Royalties | $/oz prod. | 103 | 61 | 47 | 78 | – | 73 |

| By-product credits | $/oz prod. | (1,138) | (261) | (1) | (3,982) | – | (592) |

| Ore inventory adjustments(40) | $/oz prod. | (1) | (17) | 83 | (52) | – | 26 |

| Production stripping adjustments(40) | $/oz prod. | – | – | (163) | (606) | – | (75) |

| AOD adjustments(40) | $/oz prod. | – | 9 | – | – | – | 2 |

| Net Cash Costs | $/oz prod. | (258) | 1,261 | 1,102 | 108 | – | 583 |

| Gold Sold | oz | 766,118 | 411,336 | 773,146 | 45,643 | – | 1,996,243 |

| Adjusted operating costs(41) | $/oz sold | (258) | 1,273 | 1,079 | 64 | – | 583 |

| Corporate general & administrative costs(42),(43) | $/oz sold | – | – | – | – | 55 | 55 |

| Reclamation and remediation costs | $/oz sold | 5 | 4 | 10 | 66 | – | 8 |

| Production stripping (sustaining)(44) | $/oz sold | – | – | 135 | 488 | – | 63 |

| Advanced operating development | $/oz sold | – | (9) | – | – | – | (2) |

| Capital expenditure (sustaining) | $/oz sold | 139 | 146 | 140 | 1,538 | 13 | 186 |

| Exploration (sustaining) | $/oz sold | 2 | 19 | 1 | 38 | – | 6 |

| Leases (sustaining) | $/oz sold | 3 | 40 | 5 | 54 | – | 13 |

| All-In Sustaining Cost | $/oz sold | (109) | 1,473 | 1,370 | 2,248 | 68 | 912 |

| Growth and development costs(43) | $/oz sold | – | – | – | – | 5 | 5 |

| Production stripping (non-sustaining)(44) | $/oz sold | – | – | 21 | 122 | – | 11 |

| Capital expenditure (non-sustaining)(45) | $/oz sold | 601 | – | 91 | 636 | 14 | 294 |

| Exploration (non-sustaining) | $/oz sold | 1 | 4 | – | 476 | 40 | 52 |

| Leases (non-sustaining) | $/oz sold | 6 | – | – | – | 1 | 4 |

| All-In Cost | $/oz sold | 499 | 1,477 | 1,482 | 3,482 | 128 | 1,278 |

| Depreciation and amortisation(46) | $/oz sold | 260 | 252 | 358 | 1,538 | 12 | 337 |

All figures are shown at 100%, except for Red Chris which is shown at 70%. AISC and AIC may not calculate based on amounts presented in these tables due to rounding.

Simplified Lihir Pit Material Flow – June 2021 Quarter

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/90915_chart1.jpg

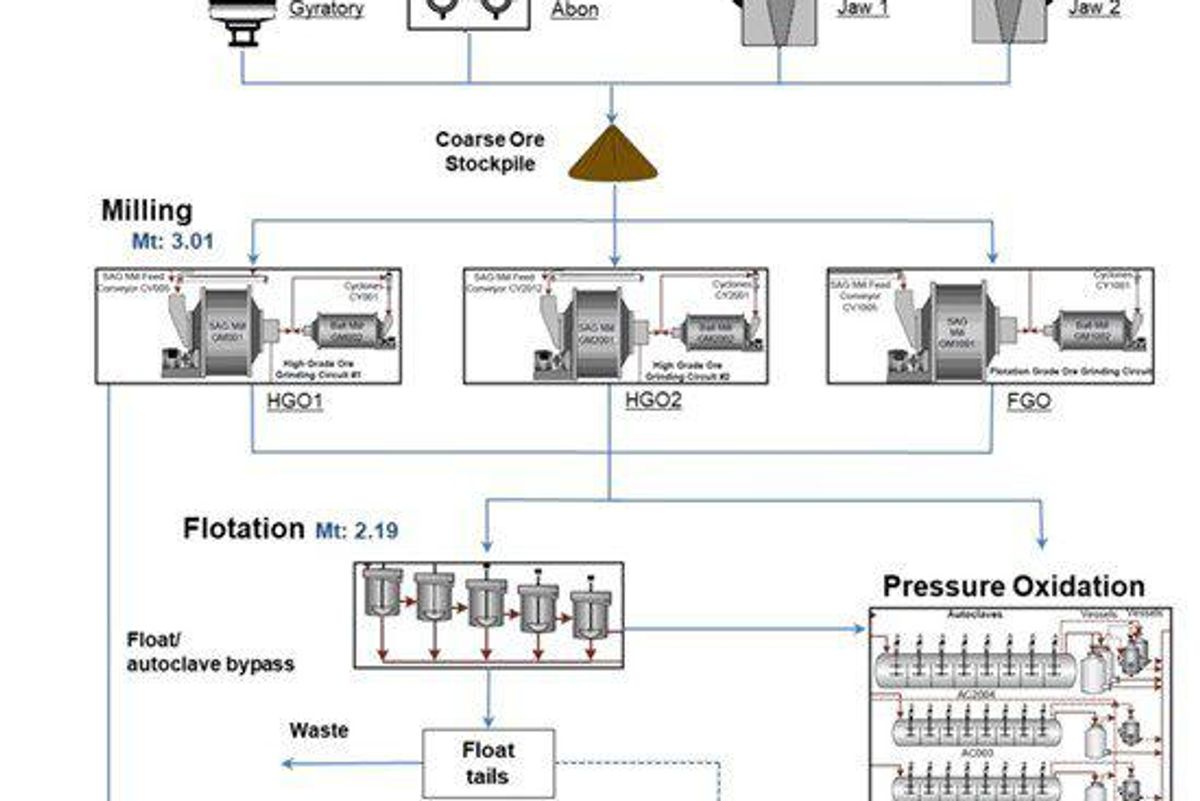

Simplified Lihir Process Flow – June 2021 Quarter

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/90915_chart2.jpg

Corporate Information

Board

| Peter Hay | Non-Executive Chairman |

| Sandeep Biswas | Managing Director and CEO |

| Gerard Bond | Finance Director and CFO |

| Philip Aiken AM | Non-Executive Director |

| Roger Higgins | Non-Executive Director |

| Sally-Anne Layman | Non-Executive Director |

| Jane McAloon | Non-Executive Director |

| Vickki McFadden | Non-Executive Director |

| Peter Tomsett | Non-Executive Director |

Company Secretaries

Maria Sanz Perez and Claire Hannon

Registered & Principal Office

Level 8, 600 St Kilda Road, Melbourne, Victoria, Australia 3004

Telephone: +61 (0)3 9522 5333

Facsimile: +61 (0)3 9522 5500

Email: corporateaffairs@newcrest.com.au

Website: www.newcrest.com

Stock Exchange Listings

| Australian Securities Exchange | (Ticker NCM) |

| Toronto Stock Exchange | (Ticker NCM) |

| PNGX Markets Limited | (Ticker NCM) |

| New York ADR’s | (Ticker NCMGY) |

Forward Shareholder Enquiries to:

Australia:

Link Market Services

Tower 4, 727 Collins Street

Docklands, Victoria, 3008

Australia

Telephone: 1300 554 474

+61 (0)2 8280 7111

Facsimile: +61 (0)2 9287 0303

Email: registrars@linkmarketservices.com.au

Website: www.linkmarketservices.com.au

Canada:

AST Trust Company (Canada)

P.O. Box 700, Station B

Montreal, Quebec, H3B 3K3

Canada

+1 800 387 0825

inquiries@astfinancial.com

www.astfinancial.com

Substantial Shareholder(s)(47) at 30 June 2021

| Allan Gray / Orbis Group | 9.9% |

| BlackRock Group | 9.1% |

Issued Share Capital

At 30 June 2021, Newcrest’s issued capital was 817,289,692 ordinary shares.

Quarterly Share Price Activity

| High | Low | Close | |

| A$ | A$ | A$ | |

| Apr – Jun 2021 | 28.79 | 25.05 | 25.28 |

Forward Looking Statements

This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “believe”, “continue”, “objectives”, “targets”, “outlook” and “guidance”, or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines. Newcrest continues to distinguish between outlook and guidance. Guidance statements relate to the current financial year. Outlook statements relate to years subsequent to the current financial year.

These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Newcrest’s actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Newcrest operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation. For further information as to the risks which may impact on Newcrest’s results and performance, please see the risk factors included in the Annual Information Form dated 13 October 2020 lodged with ASX and SEDAR.

Forward looking statements are based on Newcrest’s good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Newcrest’s business and operations in the future. Newcrest does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Newcrest. Readers are cautioned not to place undue reliance on forward looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. Forward looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, Newcrest does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

Non-IFRS Financial Information

Newcrest results are reported under International Financial Reporting Standards (IFRS). This document includes non-IFRS financial information within the meaning of ASIC Regulatory Guide 230: ‘Disclosing non-IFRS financial information’ published by ASIC and within the meaning of Canadian Securities Administrators Staff Notice 52-306 – Non-GAAP Financial Measures. Such information includes All-In Sustaining Cost (AISC) and All-In Cost (AIC) as per updated World Gold Council Guidance Note on Non-GAAP Metrics released in November 2018. AISC will vary from period to period as a result of various factors including production performance, timing of sales and the level of sustaining capital and the relative contribution of each asset. AISC Margin reflects the average realised gold price less AISC per ounce sold.

These measures are used internally by Newcrest management to assess the performance of the business and make decisions on the allocation of resources and are included in this document to provide greater understanding of the underlying performance of Newcrest’s operations. The non-IFRS information has not been subject to audit or review by Newcrest’s external auditor and should be used in addition to IFRS information. Such non-IFRS information/non-GAAP measures do not have a standardised meaning prescribed by IFRS and may be calculated differently by other companies. Although Newcrest believes these non-IFRS/non-GAAP financial measures provide useful information to investors in measuring the financial performance and condition of its business, investors are cautioned not to place undue reliance on any non-IFRS financial information/non-GAAP financial measures included in this document. When reviewing business performance, this non-IFRS information should be used in addition to, and not as a replacement of, measures prepared in accordance with IFRS, available on Newcrest’s website and the ASX and SEDAR platforms.

Technical and Scientific Information

The technical and scientific information contained in this document relating to Wafi-Golpu and Lihir was reviewed and approved by Craig Jones, Newcrest’s Chief Operating Officer PNG, FAusIMM and a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). The technical and scientific information contained in this document relating to Cadia was reviewed and approved by Philip Stephenson, Newcrest’s Chief Operating Officer Australia and Americas, FAusIMM and a Qualified Person as defined in NI 43-101.

Authorised by the Newcrest Disclosure Committee

For further information please contact

Investor Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Ben Lovick

+61 3 9522 5334

+61 407 269 478

Ben.Lovick@newcrest.com.au

North American Investor Enquiries

Ryan Skaleskog

+1 866 396 0242

+61 403 435 222

Ryan.Skaleskog@newcrest.com.au

Media Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

This information is available on our website at www.newcrest.com

Appendix

Reconciliation of Newcrest’s operational performance including its 32% attributable share of Fruta del Norte through its 32% equity interest in Lundin Gold Inc.

| Gold production | Metric | Jun 2021 Qtr | Mar 2021Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 | FY20 |

| Gold production – Newcrest operations | oz | 507,516 | 479,100 | 504,491 | 472,929 | 1,964,037 | 2,154,696 |

| Gold production – Fruta del Norte (32%) | oz | 34,816 | 33,324 | 30,986 | 30,160 | 129,285 | 16,422 |

| Gold production | oz | 542,332 | 512,424 | 535,477 | 503,089 | 2,093,322 | 2,171,118 |

| All-In Sustaining Cost | Metric | Jun 2021 Qtr(48) | Mar 2021Qtr(49) | Dec 2020Qtr(50) | Sep 2020 Qtr(51) | FY21 |

| All-in Sustaining Cost – Newcrest operations | $m | 434 | 433 | 455 | 498 | 1,820 |

| All-in Sustaining Cost – Fruta del Norte (32%) | $m | 28 | 22 | 26 | 14 | 90 |

| All-In Sustaining Cost | $m | 462 | 455 | 481 | 512 | 1,910 |

| Gold ounces sold – Newcrest operations | oz | 545,334 | 482,878 | 465,125 | 502,907 | 1,996,243 |

| Gold ounces sold – Fruta del Norte (32%) | oz | 34,816 | 26,178 | 33,981 | 19,891 | 114,866 |

| Total gold ounces sold | oz | 580,149 | 509,056 | 499,105 | 522,798 | 2,111,109 |

| All-In Sustaining Cost – Newcrest operations | $/oz | 797 | 897 | 979 | 990 | 912 |

| All-In Sustaining – Fruta del Norte (32%) | $oz | 800 | 830 | 747 | 728 | 779 |

| All-In Sustaining Cost | $/oz | 797 | 893 | 963 | 980 | 905 |

| All-In Sustaining Cost margin | Metric | Jun 2021 Qtr | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | FY21 |

| Realised gold price(52) | $/oz | 1,780 | 1,751 | 1,815 | 1,837 | 1,796 |

| All-In Sustaining Cost – Newcrest operations | $/oz | 797 | 897 | 979 | 990 | 912 |

| All-In Sustaining Cost margin | $/oz | 983 | 854 | 836 | 847 | 884 |

[1]Relating to its operational (Scope 1 and 2) emissions. Newcrest will work across its value chain to reduce its Scope 3 emissions.

[2] Injury rates are lowest quartile when compared to the International Council on Mining & Metals report titled “Safety Performance – Benchmarking progress of ICMM members in 2020“.

[3] Total Recordable Injury Frequency Rate (injuries per million hours).

[4]See information under heading “Non-IFRS Financial Information” on Page 17 of this report for further information.

[5] Includes 35koz based on Newcrest’s 32% attributable share of Fruta del Norte. The AISC estimate for Fruta del Norte did not impact Newcrest’s AISC from its operations for the quarter.Refer to the Appendix for calculation and further details.

[6]Newcrest’s AISC margin has been determined by deducting the All-In Sustaining Cost attributable to Newcrest’s operations from Newcrest’s realised gold price.Refer to the Appendix for details.

[7]Subject to market and operating conditions and potential delays due to COVID-19 impacts.

[8]Subject to Board approval.

[9] References to the prior period are to the March 2021 quarter.

[10]Newcrest’s guidance for Fruta del Norte is an annualised figure based on Lundin Gold Inc’s production guidance for 1 July 2020 to 31 December 2020. See Appendix for further details.

[11]The figures shown represent Newcrest’s 70% share of the unincorporated Red Chris JV.Production outcomes for FY20 are reported from the date of acquisition (15 August 2019).

[12] The figures shown represent 100%. Prior to the divestment on 4 March 2020, Newcrest owned 75% of Gosowong through its holding in PT Nusa Halmahera Minerals, an incorporated joint venture. Production and financial outcomesfor FY20 represent Newcrest’s period of ownership to the divestment date.

[13]The figures shown represent Newcrest’s 32%attributable share, through its 32% equity interest in Lundin Gold Inc.

[14]TRIFR for FY20 includes safety results for Red Chris from acquisition.

[15]Due to the negligible impact of Fruta del Norte on Newcrest’s Group AISC for FY20 it has been excluded from the FY20 calculation.

[16]AISC for the March 2021 and December 2020 quarters have been restated following the release of Lundin Gold’s March 2021 quarterly results on 12 May 2021 and their 2020 Annual Report on 15 March 2021. This resulted in a $2/oz increase to Newcrest’s previously reported AISC outcome for the March 2021 quarter and a $5/oz benefit to Newcrest’s previously reported AISC outcome for the December 2020 quarter.

[17]From Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte through its 32%equityinterest in Lundin Gold Inc.

[18]Realised metal prices are the US$ spot prices at the time of sale per unit of metal sold (net of Telfer gold production hedges), excluding deductions related to treatment and refining charges and the impact of price related finalisations for metals in concentrate. The realised price has been calculated from sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

[19]Subject to market and operating conditions and potential delays due to COVID-19 impacts.

[20]Subject to Board approval.

[21]Subject to Board approval.

[22] AISC margin calculated with reference to the Group average realised gold price.

[23]The figures shown represent Newcrest’s 70% shareof the unincorporated Red Chris JV. Productionand financial outcomesfor FY20 are reported fromthe date of acquisition (15 August 2019).

[24]Subject to Board approval.

[25] In addition, the development of any underground mine at the Havieron Project will also be subject to the completion of a successful exploration program and further studies, market and operating conditions, Board approvals, and a positive decision to mine.

[26] Mine production for open pit and underground includes ore and waste.

[27] Includes development tonnesfrom the Cadia East PC2-3 project. Costs associated with this production were capitalised and are not included in the AISC calculation in this report.

[28]Due to timing of Lundin Gold’s June 2021 quarterly report, Newcrest has estimated its 32% attributable share, through its 32% equity interest in Lundin Gold Inc, of Fruta del Norte’s All-In Sustaining Cost for the quarter. For the purposes of All-In Sustaining Cost, Newcrest has assumed that production is equal to sales. Refer to the Appendix for further details.

[29]Group AISC is for Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte.

[30] Includes deductions related to treatment and refining charges for metals in concentrate.

[31] Represents adjustment for ore inventory movements, removal of production stripping costs and movement in Advanced Operating Development costs.

[32] Adjusted operating costs represents net cash costs adjusted for finished goods inventory movements, divided by ounces sold.

[33] Corporate general & administrative costs includes share-based remuneration.

[34] Costs of this nature were previously reported within Corporate Costs. In accordance with the updated World Gold Council guidance, growth and development costs are now presented in AIC.

[35]In accordance with World Gold Council Guidance stripping campaigns can be classified as non-sustaining expenditure if they are expected to take at least 12 months and are expected to deliver ore production for more than five years. Newcrest has determined that Phase 16 at Lihir and Phase 7 at Red Chris satisfies this criteria and has reported spend in relation to these campaigns as capitalised stripping (non-sustaining).

[36] Represents spend on major projects that are designed to increase the net present value of the mine are not related to current production. Significant projects in the current period include key expansion projects at Cadia (including PC2-3 developmentand the molybdenum plant)and Lihir (Seepage Barrier feasibilitystudy, front end recovery and HV upgrade).

[37] Depreciation and amortisation of mine site assets is determined on the basis of the lesser of the asset’s useful economic life and the life of the mine.Life-of-mine assets are depreciated according to units of production and the remainder on a straight line basis. Depreciation and amortisation does not form part of All-In Sustaining Cost or All-in Cost with the exception of amortisation on reclamation and remediation (rehabilitation) assets.

[38]Group AISC is for Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte.

[39] Includes deductions related to treatment and refining charges for metals in concentrate.

[40] Represents adjustment for ore inventory movements, removal of production stripping costs and movement in Advanced Operating Development costs.

[41] Adjusted operating costs represents net cash costs adjusted for finished goods inventory movements, divided by ounces sold.

[42] Corporate general & administrative costs includes share-based remuneration.

[43] Costs of this nature were previously reported within Corporate Costs. In accordance with the updated World Gold Council guidance, growth and development costs are now presented in AIC.

[44]In accordance with World Gold Council Guidance stripping campaigns can be classified as non-sustaining expenditure if they are expected to take at least 12 months and are expected to deliver ore production for more than five years. Newcrest has determined that Phase 16 at Lihir and Phase 7 at Red Chris satisfies this criteria and has reported spend in relation to these campaigns as capitalised stripping (non-sustaining).

[45]Represents spend on major projects that are designed to increase the net present value of the mine are not related to current production. Significant projects in the year include key expansion projects at Cadia (including PC2-3 feasibility study and the molybdenum plant) and Lihir (Seepage Barrier feasibility study, front end recovery and HV upgrade).

[46] Depreciation and amortisation of mine site assets is determined on the basis of the lesser of the asset’s useful economic life and the life of the mine.Life-of-mine assets are depreciated according to units of production and the remainder on a straight line basis. Depreciation and amortisation does not form part of All-In Sustaining Cost or All-in Cost with the exception of amortisation on reclamation and remediation (rehabilitation) assets.

[47]As notified to Newcrest under section 671B of the Corporations Act 2001.

[48]Due to timing of Lundin Gold’s June 2021 quarterly report, Newcrest has estimated its 32% attributable share, through its 32% equity interest in Lundin Gold Inc, of Fruta del Norte’s All-In Sustaining Cost for the June quarter. The AISC estimate was derived by taking the mid-point of Lundin Gold’s CY21 AISC guidance of $770-830/oz (released 15 March 2021). For the purposes of AISC, Newcrest has assumed that production is equal to sales. Newcrest will restate its June quarter and full year AISC outcome once the outcomes for Fruta del Norte’s June quarter are known. On the basis of materiality, Newcrest has not restated its FY21 guidance for Fruta del Norte. Newcrest’s guidance with respect to the gold production of Fruta del Norte is based on Lundin Gold’s July to December 2020 guidance of 150,000 – 170,000 ounces which has been annualised on the assumption that production levels will be same for the January to June 2021 period (presented at 32% and rounded to nearest 5koz). With respect to Newcrest’s guidance for AISC, the dollar million range has been derived by multiplying the low end of annualised production of Newcrest’s guidance by the high end of Lundin Gold’s July – December 2020 AISC guidance of $770/oz – $850/oz, and the high end of annualised production of Newcrest’s guidance multiplied by the low end of the same AISC guidance range.

[49]The All-In Sustaining Cost and gold ounces sold outcomes for Fruta del Note for the March 2021 quarter have been restated following the release of Lundin Gold’s March quarterly report on 12 May 2021. This resulted in a $2/oz increase to Newcrest’s previously reported All-In Sustaining Cost outcome for the March quarter.

[50]The All-In Sustaining Cost and gold ounces sold outcomes for Fruta del Note for the December 2020 quarter have been restated following the release of Lundin Gold’s 2020 Annual Report on 15 March 2021. This had a $5/oz benefit to Newcrest’s previously reported All-In Sustaining Cost outcome for the December quarter.

[51]The All-In Sustaining Cost and gold ounces sold outcomes for Fruta del Norte for the September 2020 quarter have been restated following the release of Lundin Gold’s September quarterly report on 9 November 2020. Newcrest’s All-In Sustaining Cost outcome of $980/oz for the September quarter remains unchanged.

[52]Realised metal prices are the US$ spot prices at the time of sale per unit of metal sold (net of Telfer production hedges), excluding deductions related to treatment and refining charges and the impact of price related finalisations for metals in concentrate. The realised price has been calculated from sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/90915