(figures are unaudited and in US$ except where stated)

Lower costs, on track to deliver FY21 guidance and growth options advanced

- Operating performance in line with expectations(1)

- Gold production of 512koz(2) and copper production of 35kt

- Improved All-In Sustaining Cost (AISC) of $891/oz(2), delivering an AISC margin of 49% or $854/oz(3)

- Cadia records lowest ever reported quarterly AISC of negative $160/oz

- On track to deliver FY21 guidance

- Advancing multiple organic growth options

- Box cut and surface infrastructure construction progressing well at Red Chris and Havieron

- Newcrest’s initial Mineral Resource estimate for Red Chris released, supporting the potential development of a high margin underground block cave(4)

- Cadia Molybdenum Plant commissioning commenced, with first commercial production expected in September 2021 Quarter(5)

- Lihir Phase 14A Pre-Feasibility Study on track and expected to be released in June 2021 quarter(6)

- Balance sheet further strengthened with debt reduction and bank debt facility extension

- Early repayment of the remaining 2022 Corporate Bonds using available cash

- Maturity dates extended on undrawn bilateral bank debt facilities

Newcrest Mining Limited (ASX: NCM) (TSX: NCM) Newcrest Managing Director and Chief Executive Officer, Sandeep Biswas, said, “Our world-class Cadia asset set a new record during the March 2021 quarter, reporting its lowest ever quarterly All-In Sustaining Cost of negative $160oz. This record, along with unit cost reductions at all other sites, delivered a 7% reduction in our All-In Sustaining Cost per ounce for the quarter and a strong All-In Sustaining Cost margin of $854oz.”

“As part of our plan to forge an even stronger Newcrest, we continue to progress multiple organic growth options across our gold and copper assets with a number of key project milestones delivered during the period. At Red Chris and Havieron, box cut and surface infrastructure construction is progressing to plan, while at Lihir we are on target to deliver the findings of our Phase 14A Pre-Feasibility Study in the June 2021 quarter.”

“In March 2021 we released our initial Mineral Resource estimate for Red Chris, which confirmed the potential we saw in this orebody and further supports our belief that this could be a Cadia-style development. We remain on track to report the findings of our block cave Pre-Feasibility Study by the end of September 2021. We also commenced commissioning of Cadia’s Molybdenum Plant, with commercial production expected in the September 2021 quarter.”

“We are very well positioned to fund our organic growth opportunities, with a strong balance sheet and long-dated debt maturity profile, further enhanced through the early repurchase of outstanding corporate bonds and the maturity extension of our existing undrawn bilateral bank debt facilities.”

“Pleasingly we have experienced no material disruption to production or operations to date as a result of COVID-19. We have further strengthened our COVID-19 controls at Lihir and continue to work closely with all relevant government stakeholders in Australia and Papua New Guinea to manage the risks associated with the virus,” said Mr Biswas.

Overview

Gold production was 4% lower than the prior period, reflecting the impact of planned shutdown events at Cadia and Lihir as foreshadowed in the December 2020 quarterly report. This was partially offset by a 6% increase in gold production at Telfer driven by higher throughput rates and gold recovery improvements.

Newcrest’s AISC for the March 2021 quarter of $891/oz(2) was$72/oz lower than the prior period. The 7% improvement includes the benefit of a higher realised copper price, higher gold sales volumes at Lihir and Telfer, and the timing of sustaining capital expenditure at Lihir and Red Chris. These benefits were partially offset by the impact of a strengthening Australian dollar against the US dollar which resulted in an increase to operating costs together with lower copper sales volumes at Red Chris and Cadia.

| Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 | FY21 Guidance(7) | ||

| Group(2) | – gold | oz | 512,424 | 535,477 | 503,089 | 1,550,990 | 1,581,521 | 1,950-2,150koz |

| – copper | t | 35,034 | 34,557 | 34,763 | 104,354 | 97,427 | 135-155kt | |

| – silver | oz | 228,543 | 230,769 | 214,412 | 673,724 | 731,226 | ||

| Cadia | – gold | oz | 179,546 | 194,088 | 196,504 | 570,138 | 606,633 | 680-760koz |

| – copper | t | 26,324 | 26,643 | 25,329 | 78,297 | 68,409 | 95-105kt | |

| Lihir | – gold | oz | 183,231 | 200,173 | 177,337 | 560,741 | 568,745 | 720-820koz |

| Telfer | – gold | oz | 105,228 | 98,855 | 86,452 | 290,535 | 279,368 | 360-420koz |

| – copper | t | 3,666 | 2,443 | 2,384 | 8,492 | 12,117 | 10-20kt | |

| Red Chris(8) | – gold | oz | 11,095 | 11,375 | 12,636 | 35,107 | 23,493 | 45-55koz |

| – copper | t | 5,044 | 5,471 | 7,050 | 17,565 | 16,901 | 25-30kt | |

| Gosowong(9) | – gold | oz | – | – | – | – | 103,282 | |

| Fruta del Norte(2),(10) | – gold | oz | 33,324 | 30,986 | 30,160 | 94,469 | – | 95-110koz |

| Fatalities | Number | 0 | 0 | 0 | 0 | 0 | ||

| TRIFR(11) | mhrs | 2.6 | 1.6 | 2.6 | 2.4 | 2.6 | ||

| All-In Sustaining Cost(2),(12) | $/oz | 891 | 963([13]) | 980 | 944 | 856([14]) | ||

| All-In Cost(15) | $/oz | 1,253 | 1,349 | 1,275 | 1,291 | 1,020(14) | ||

| All-In Sustaining Cost margin(3) | $/oz | 854 | 836 | 847 | 846 | 633 | ||

| Realised gold price(16) | $/oz | 1,751 | 1,815 | 1,837 | 1,801 | 1,489 | ||

| Realised copper price(16) | $/lb | 3.86 | 3.26 | 2.97 | 3.36 | 2.61 | ||

| Realised copper price(16) | $/t | 8,510 | 7,187 | 6,548 | 7,408 | 5,754 | ||

| Average exchange rate | AUD:USD | 0.7729 | 0.7303 | 0.7147 | 0.7390 | 0.6765 | ||

| Average exchange rate | PGK:USD | 0.2846 | 0.2853 | 0.2872 | 0.2857 | 0.2937 | ||

| Average exchange rate | CAD:USD | 0.7896 | 0.7667 | 0.7504 | 0.7684 | 0.7536 | ||

All figures are shown at 100% unless stated otherwise.

Operations

Cadia, Australia

| Highlights | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 | FY21 Guidance | |

| TRIFR | mhrs | 11.3 | 7.5 | 3.6 | 7.4 | 4.5 | ||

| Total production | – gold | oz | 179,546 | 194,088 | 196,504 | 570,138 | 606,633 | 680-760koz |

| – copper | t | 26,324 | 26,643 | 25,329 | 78,297 | 68,409 | 95-105kt | |

| Head Grade | – gold | g/t | 0.94 | 0.95 | 1.02 | 0.97 | 1.15 | |

| – copper | % | 0.41 | 0.39 | 0.40 | 0.40 | 0.39 | ||

| Sales | – gold | oz | 175,295 | 194,183 | 195,146 | 564,624 | 611,979 | |

| – copper | t | 25,332 | 26,477 | 24,596 | 76,405 | 69,512 | ||

| All-In Sustaining Cost | $/oz | (160) | (6) | 113 | (13) | 156 | ||

| All-In Sustaining Cost margin | $/oz | 1,911 | 1,821 | 1,724 | 1,814 | 1,333 | ||

Gold production of 180koz was 7% lower than the prior period primarily driven by lower throughput. As highlighted in the December 2020 quarterly report, mill throughput was lower in the period due to scheduled maintenance of Concentrator 1 and the materials handling system.

A higher realised copper price and a marginally higher proportion of copper sales to gold sales drove a significant decrease in Cadia’s AISC, which at negative $160/oz is a new quarterly record. Cadia’s AISC also reflects mobile fleet purchases and end-of-life rebuilds driving higher sustaining capital expenditure, the impact on operating costs from the strengthening of the Australian dollar against the US dollar, lower copper sales volumes and the impact to unit costs from lower gold sales volumes.

Newcrest commenced commissioning of its Molybdenum Plant in March 2021, with first commercial production expected in the September 2021 quarter(17). The Molybdenum Plant is expected to deliver an additional revenue stream for Cadia in the form of a molybdenum concentrate which will also be recognised as a by-product credit to AISC.

In August 2020, Newcrest announced that it had deferred the replacement of the SAG mill motor to July 2021. Newcrest now expects the replacement to take ~19 weeks(17), 3 weeks less than its original estimate. Newcrest will implement a SAG bypass for the duration of the SAG mill motor replacement and Concentrator 1 will operate at a reduced capacity of approximately 60% during this time.

Newcrest is currently progressing its Pre-Feasibility Study for the development of the PC1-2 cave. The Pre-Feasibility study is on track to be completed in calendar year 2021.

Lihir, Papua New Guinea

| Highlights | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 | FY21 Guidance | |

| TRIFR | mhrs | 0.4 | 0.0 | 0.5 | 0.3 | 0.5 | ||

| Production | – gold | oz | 183,231 | 200,173 | 177,337 | 560,741 | 568,745 | 720-820koz |

| Head Grade | – gold | g/t | 2.58 | 2.27 | 2.34 | 2.38 | 2.35 | |

| Sales | – gold | oz | 194,356 | 170,308 | 210,831 | 575,495 | 566,873 | |

| All-In Sustaining Cost | $/oz | 1,293 | 1,438 | 1,283 | 1,332 | 1,156 | ||

| All-In Sustaining Cost margin | $/oz | 458 | 377 | 554 | 469 | 333 | ||

Gold production of 183koz was 8% lower than the prior period driven by lower throughput, partially mitigated by grade and recovery improvements. As highlighted in the December 2020 quarterly report, throughput was impacted by a scheduled total plant shutdown in March 2021 together with shut overruns and unplanned outages. Gold head grade was 14% higher than the prior period reflecting a higher proportion of high grade expit ore feed from Phase 14 in addition to an increase in stockpile feed grade. The 4% improvement in gold recovery was driven by an increase in higher grade ore feed and improved flotation performance.

Lihir’s AISC of $1,293/oz was 10% lower than the prior period driven by higher gold sales volumes and timing of sustaining capital expenditure. These benefits were partially offset by higher site operating costs, reflecting the total plant shutdown and associated overruns together with an increase in production stripping activities in Phase 15.

Newcrest expects to release the findings of its Phase 14A Pre-Feasibility Study in the June 2021 quarter(18). As previously announced, study work has identified 20Mt at 2.4g/t Au (including 13Mt at 3g/t Au) of Indicated Mineral Resource that, if accessed, has the potential to increase the average mill feed grade between FY23-25 and could result in an additional ~400-600koz(19) of contained gold in mill feed during that period.

Lihir – Material Movements

| Ore Source | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 |

| Ex-pit crushed tonnes | kt | 1,407 | 1,918 | 1,236 | 4,560 | 3,977 |

| Ex-pit to stockpile | kt | 695 | 615 | 1,610 | 2,919 | 5,423 |

| Waste | kt | 6,967 | 4,793 | 6,269 | 18,029 | 14,090 |

| Total Ex-pit | kt | 9,068 | 7,326 | 9,115 | 25,508 | 23,490 |

| Stockpile reclaim | kt | 1,566 | 1,765 | 2,192 | 5,523 | 6,118 |

| Stockpile relocation | kt | 3,139 | 2,884 | 3,306 | 9,329 | 10,739 |

| Total Other | kt | 4,705 | 4,649 | 5,498 | 14,851 | 16,857 |

| Total Material Moved | kt | 13,774 | 11,975 | 14,613 | 40,359 | 40,346 |

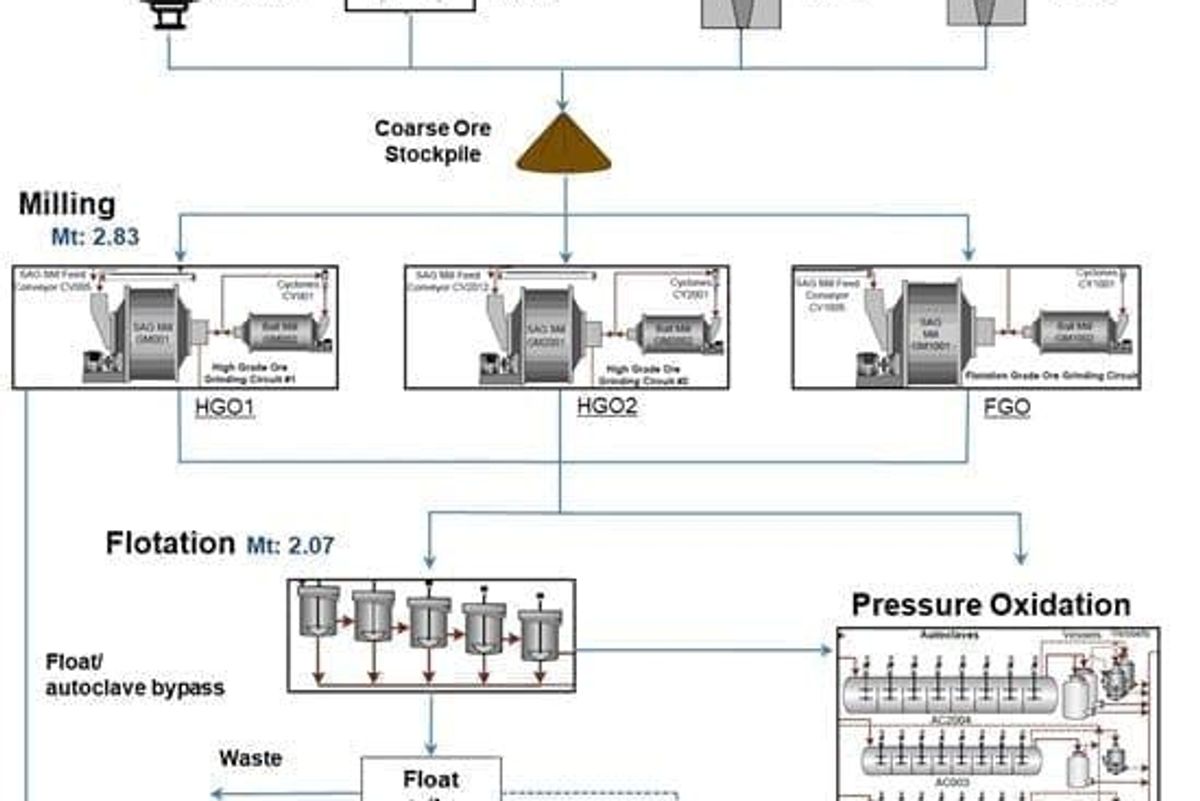

Lihir – Processing

| Equipment | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 |

| Crushing | kt | 2,973 | 3,683 | 3,426 | 10,082 | 10,094 |

| Milling | kt | 2,835 | 3,691 | 3,255 | 9,781 | 10,218 |

| Flotation | kt | 2,070 | 2,835 | 2,780 | 7,685 | 7,641 |

| Total Autoclave | kt | 1,642 | 1,998 | 1,592 | 5,232 | 5,368 |

Telfer, Australia

| Highlights | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 | FY21 Guidance | |

| TRIFR | mhrs | 5.2 | 1.8 | 4.6 | 4.2 | 5.5 | ||

| Production | – gold | oz | 105,228 | 98,855 | 86,452 | 290,535 | 279,368 | 360-420koz |

| – copper | t | 3,666 | 2,443 | 2,384 | 8,492 | 12,117 | 10-20kt | |

| Head Grade | – gold | g/t | 0.88 | 0.94 | 0.86 | 0.89 | 0.93 | |

| – copper | % | 0.12 | 0.09 | 0.09 | 0.10 | 0.16 | ||

| Sales | – gold | oz | 102,449 | 87,992 | 85,096 | 275,537 | 275,592 | |

| – copper | t | 3,000 | 2,152 | 2,311 | 7,462 | 11,452 | ||

| All-In Sustaining Cost | $/oz | 1,489 | 1,560 | 1,797 | 1,607 | 1,308 | ||

| All-In Sustaining Cost margin(20) | $/oz | 262 | 255 | 40 | 194 | 181 | ||

Gold production of 105koz was 6% higher than the prior period, driven by higher throughput and recovery, partially offset by lower head grade and a reduction in dump leach ounces. The 10% increase in mill throughput reflects improved mill utilisation rates, with the 2% improvement in gold recovery driven by the success of sulphur blending strategies together with other recovery improvement initiatives that were delivered in the period. Head grade was 7% lower than the prior period which was driven by a higher proportion of lower grade open pit mill feed.

Telfer’s AISC of $1,489/oz was 5% lower than the prior period driven by higher gold and copper sales volumes and a higher realised copper price. These benefits were partially offset by the impact on operating costs from the strengthening of the Australian dollar against the US dollar, together with higher concentrate sales volumes driving higher treatment, refining and transportation costs. Adverse weather conditions continue to impact shipments leaving Telfer with YTD gold and copper sales volumes lower than production. Newcrest expects to reduce its inventory on hand by the end of the financial year.

Red Chris, Canada

| Highlights(21) | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 | YTD FY20 | FY21 Guidance | |

| TRIFR | mhrs | 4.1 | 1.8 | 11.1 | 6.0 | 15.5 | ||

| Production | – gold | oz | 11,095 | 11,375 | 12,636 | 35,107 | 23,493 | 45-55koz |

| – copper | t | 5,044 | 5,471 | 7,050 | 17,565 | 16,901 | 25-30kt | |

| Head Grade | – gold | g/t | 0.42 | 0.42 | 0.40 | 0.41 | 0.35 | |

| – copper | % | 0.43 | 0.45 | 0.46 | 0.45 | 0.51 | ||

| Sales | – gold | oz | 10,778 | 12,641 | 11,834 | 35,253 | 21,663 | |

| – copper | t | 4,988 | 6,072 | 6,642 | 17,702 | 15,696 | ||

| All-In Sustaining Cost | $/oz | 2,169 | 3,278 | 2,621 | 2,719 | 1,824(22) | ||

| All-In Sustaining Cost margin | $/oz | (418) | (1,463) | (784) | (918) | (335) | ||

Gold production of 11koz was in line with the prior period. In February 2021, a major power outage during an extreme winter weather event caused some mill infrastructure to freeze which damaged the Vertimill upon restart and adversely impacted recovery.

Red Chris’ AISC of $2,169/oz was 34% lower than the prior period driven by timing of sustaining capital expenditure, a higher realised copper price, lower operating costs and a decrease in production stripping expenditure due to positioning in Phase 5. These benefits were partially offset by lower gold and copper sales volumes and the impact to operating costs from a strengthening Canadian dollar against the US dollar.

Also included in Red Chris’ AISC are investments in a number of additional improvement initiatives across the site including a new fleet management system, the replacement of the conventional CAT 793 truck tubs with high performance trays and a number of throughput and recovery related projects. These initiatives are currently contributing to Red Chris’ elevated AISC outcome but are expected to help deliver a reduction in the unit costs of the site in the longer term.

On 31 March 2021, Newcrest released its initial Mineral Resource estimate(23) for Red Chris which comprised:

- A Measured and Indicated Mineral Resource estimate of 980Mt @ 0.41g/t gold and 0.38% copper for 13Moz contained gold and 3.7Mt contained copper

- An Inferred Mineral Resource estimate of 190Mt @ 0.31g/t gold and 0.30% copper for 1.9Moz contained gold and 0.57Mt contained copper

Newcrest’s initial Mineral Resource estimate will support the potential development of a high margin underground block cave(24) and is a key input into the Red Chris block cave Pre-Feasibility Study which is expected to be released by the end of September 2021(25). Newcrest also expects to release its initial Ore Reserve estimate for Red Chris within the same timeframe.

The latest drilling results for Red Chris are included in the March 2021 Quarterly Exploration Report which was also released today.

Fruta Del Norte, Ecuador

On 30 April 2020, Newcrest acquired the gold prepay and stream facilities and an offtake agreement in respect of Lundin Gold Inc’s Fruta del Norte mine for $460 million. In the March 2021 quarter, Newcrest received net pre-tax cash flows of ~$25 million from these financing facilities, and a total of $62 million net pre-tax cash flows received since Newcrest acquired the facilities.

Included within Newcrest’s gold production for the March 2021 quarter is 33koz relating to Newcrest’s 32% equity interest in Lundin Gold Inc, the owner of the Fruta del Norte mine.

Project Development

Red Chris, Canada

Box cut and surface infrastructure construction is progressing well following receipt of the necessary regulatory approvals during the period with achievements as at 28 April 2021 including:

- Box cut excavation is over 50% complete

- First bench completed with blasting and excavation on the lower bench in progress

- Surface earthworks are ~15% complete

- Offices in place with the remainder of infrastructure in progress

Regulatory approval for construction of the exploration decline at Red Chris is nearing completion.

Havieron, Western Australia

The Havieron Project is located 45km east of Newcrest’s Telfer operation and is operated by Newcrest under a Joint Venture Agreement with Greatland Gold plc.

Box cut, surface infrastructure and portal and decline establishment are progressing to plan with achievements as at

28 April 2021 including:

- Box cut excavation is ~90% complete

- Shotcreting of Portal Face has commenced, with ground support complete

- Batch Plant is fully commissioned

- Surface earthworks are ~85% complete

Activities to finalise the Water Management Plan for the early works program are ongoing. Newcrest is also progressing the necessary approvals and permits that are required to commence the development of an operating underground mine and associated infrastructure at the Project(26).

The latest drilling results for the Havieron Project are included in the March 2021 Quarterly Exploration Report which was also released today.

Wafi-Golpu, Papua New Guinea

In December 2020, following a rigorous environmental impact assessment, the Papua New Guinea Conservation and Environment Protection Authority approved, and the Director of Environment issued, the Environment Permit for the Wafi-Golpu Project. The Environment Permit is required under the Papua New Guinea Environment Act and is a pre-requisite for the grant of a Special Mining Lease under the Mining Act.

Subsequently, the Governor of Morobe Province and the Morobe Provincial Government have commenced legal proceedings in the National Court in Papua New Guinea seeking judicial review of the decision to issue the Environmental Permit. The participants in the Wafi-Golpu Joint Venture are not defendants to the proceedings. The National Court is yet to hear and determine this judicial review application. At this stage, project and permitting activities can still progress.

Newcrest, together with its WGJV partner Harmony, looks forward to re-engaging with the State of Papua New Guinea and progressing discussions on the Special Mining Lease for the Wafi-Golpu Project.

Molybdenum Plant, Cadia, Australia

Newcrest commenced commissioning of its Molybdenum Plant in March 2021, with first commercial production expected in the September 2021 quarter(27). The Molybdenum Plant is expected to deliver an additional revenue stream for Cadia in the form of a molybdenum concentrate which will also be recognised as a by-product credit to AISC.

Exploration

See the separately released “Quarterly Exploration Report” for the March 2021 quarter.

COVID-19 Update

To date, Newcrest has not experienced any material COVID-19 related disruptions to production or to the supply of goods and services.

Newcrest continues to work with the Governments of Australia and Papua New Guinea, and other relevant authorities to manage both the escalation of COVID-19 cases across Papua New Guinea and related travel restrictions between Papua New Guinea and Australia.

There has been an increase in the number of cases that have tested positive for COVID-19 at Lihir, with the majority of these cases being asymptomatic. Newcrest continues to provide care and support to its quarantined patients until they are free from the virus.

Newcrest has further strengthened its existing COVID-19 controls at Lihir, with a focus on spread containment through extensive contact tracing and isolation procedures. Tracking devices that record close contacts and enable rapid contact tracing have been widely distributed and further controls to segregate the workforce have been implemented.

No material impacts to gold production at Lihir have occurred. However, the ability to attract labour, the travel restrictions and contact tracing and associated isolation requirements has resulted in an impact to total material mined. Should these conditions persist or worsen, there is the potential for production to be impacted.

As previously highlighted, all of Newcrest’s operations have business continuity plans and contingencies in place which seek to minimise disruptions to the operations in the event of a significant number of operational employees and/or contractors contracting the virus. It is expected that these plans will enable the operations to continue producing in line with the production schedule and if there are any material impacts, Newcrest will inform the market in line with its continuous disclosure obligations.

As previously announced, costs associated with managing COVID-19 risks in FY21 are expected to be higher than anticipated at the start of the year due to more extensive testing, longer quarantining periods, additional accommodation, rostering and other labour costs, and other preventative actions. For the first half of the financial year Newcrest incurred ~$30 million in COVID-19 management costs. The full year costs are expected to be in the order of $60-70 million.

Corporate

Repurchase of Outstanding 2022 Bonds

On 28 April 2021, Newcrest completed the mandatory redemption and cancellation of its outstanding US$380 million 4.200% Senior Guaranteed Notes, otherwise maturing 1 October 2022. The total redemption price paid was

US$400 million which included US$20 million for the make-whole payment. The make-whole payment will be expensed and categorised as “Debt extinguishment and related costs” in the “Finance costs” section of the FY21 income statement, and is expected to be treated as a Significant Item.

Bilateral Bank Debt Facilities

On 2 March 2021, Newcrest announced that it had renewed its unsecured bilateral bank lending facilities and extended the maturity dates.

The renewed facilities are with Newcrest’s existing 13 bank lenders, with each bank committing approximately

US$154 million in facilities for an overall unchanged quantum of US$2 billion, on similar commercial terms.

The facilities have tenors of three or five years, the aggregate of which is as follows:

- US$1,077 million of facilities maturing in FY24

- US$923 million of facilities maturing in FY26

Community Support Fund

Newcrest’s A$20 million Community Support Fund strives to help its host communities in Papua New Guinea, Australia, Canada (British Columbia) and Ecuador cope with the challenges associated with COVID-19. A number of initiatives, ranging from immediate health assistance to livelihood restoration and economic recovery, have been funded to date.

Newcrest continues to work with its partners, host governments, communities and Indigenous Peoples to prioritise and deliver programs under the Fund in the most effective manner.

In line with the global vaccine rollout, the Fund is now primarily focused on supporting vaccination programs in host jurisdictions. Newcrest is one of three Founding Members of the UNICEF Australia COVID Vaccination Alliance which is committed to delivering COVID-19 vaccines to vulnerable communities worldwide. The Alliance brings together Australian organisations, companies and philanthropists to help deliver equitable access to COVID-19 vaccines to most at-risk communities.

Interactive Analyst CentreTM

Newcrest’s financial and operational information can now be viewed via the Interactive Analyst CentreTMwhich is locatedunder the Investor tab on Newcrest’s website (www.newcrest.com). This interactive tool allows users to chart and export Newcrest’s current and historical results for further analysis.

Sandeep Biswas

Managing Director and Chief Executive Officer

Gold Production Summary

| March 2021 Quarter | Mine Production Tonnes (000’s)(28) | Tonnes Treated (000’s) | Head Grade (g/t Au) | Gold Recovery (%) | Gold Production (oz) | Gold Sales (oz) | All-In Sustaining Cost ($/oz)(2) |

| Cadia East Panel Cave 1 | 1,036 | ||||||

| Cadia East Panel Cave 2 | 7,470 | ||||||

| Cadia East Panel Cave 2-3 | 274 | ||||||

| Cadia(29) | 8,780 | 7,873 | 0.94 | 76.2 | 179,546 | 175,295 | (160) |

| Telfer Open Pit | 10,407 | 4,007 | 0.75 | 76.5 | 73,354 | ||

| Telfer Underground | 532 | 496 | 1.94 | 89.6 | 27,725 | ||

| Telfer Dump Leach | 4,149 | ||||||

| Telfer | 10,939 | 4,503 | 0.88 | 79.7 | 105,228 | 102,449 | 1,489 |

| Lihir | 9,068 | 2,835 | 2.58 | 77.8 | 183,231 | 194,356 | 1,293 |

| Red Chris | 6,121 | 1,514 | 0.42 | 54.3 | 11,095 | 10,778 | 2,169 |

| Fruta del Norte(30) | 33,324 | 33,324 | 800 | ||||

| Total | 34,908 | 16,726 | 1.15 | 76.8 | 512,424 | 516,202 | 891 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest’s 70% share and Fruta del Norte which is shown at Newcrest’s 32% attributable share through its 32% equity interest in Lundin Gold Inc.

Copper Production Summary

| March 2021 Quarter | Copper Grade (%) | Copper Recovery (%) | Concentrate Produced (tonnes) | Metal Production (tonnes) |

| Cadia | 0.41 | 82.5 | 110,206 | 26,324 |

| Telfer Open Pit | 0.08 | 59.4 | 21,776 | 1,976 |

| Telfer Underground | 0.37 | 90.9 | 16,466 | 1,690 |

| Telfer | 0.12 | 70.7 | 38,242 | 3,666 |

| Red Chris | 0.43 | 77.0 | 24,088 | 5,044 |

| Total | 0.30 | 80.3 | 172,536 | 35,034 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest’s 70% share.

Silver Production Summary

| March 2021 Quarter | Tonnes Treated (000’s) | Silver Production (oz) |

| Cadia | 7,873 | 158,453 |

| Telfer | 4,503 | 38,457 |

| Lihir | 2,835 | 7,536 |

| Red Chris | 1,514 | 24,096 |

| Total | 16,726 | 228,543 |

All figures are shown at 100%, except for Red Chris which is shown at Newcrest 70% share.

All-In Sustaining Cost – March 2021 Quarter

| 3 Months to 31 March 2021 | |||||||

| Units | Cadia | Telfer | Lihir | Red Chris | Corp/ Other | Group(31) | |

| Gold Produced | oz | 179,546 | 105,228 | 183,231 | 11,095 | – | 479,100 |

| Mining | $/oz prod. | 176 | 709 | 265 | 1,571 | – | 359 |

| Milling | $/oz prod. | 364 | 417 | 550 | 1,098 | – | 464 |

| Administration and other | $/oz prod. | 118 | 213 | 366 | 1,443 | – | 265 |

| Lease adjustments | $/oz prod | (3) | (32) | (6) | (8) | – | (11) |

| Third party smelting, refining and transporting costs(32) | $/oz prod. | 181 | 135 | 4 | 645 | – | 114 |

| Royalties | $/oz prod. | 101 | 62 | 47 | 94 | – | 72 |

| By-product credits | $/oz prod. | (1,228) | (247) | – | (3,843) | – | (604) |

| Ore inventory adjustments(33) | $/oz prod. | (15) | (38) | 77 | (96) | – | 14 |

| Production stripping adjustments(33) | $/oz prod. | – | – | (240) | (302) | – | (99) |

| AOD adjustments(33) | $/oz prod. | – | 10 | – | – | – | 2 |

| Net Cash Costs | $/oz prod. | (306) | 1,229 | 1,063 | 602 | – | 576 |

| Gold Sold | oz | 175,295 | 102,449 | 194,356 | 10,778 | – | 482,878 |

| Adjusted operating costs(34) | $/oz sold | (339) | 1,269 | 988 | 714 | – | 560 |

| Corporate general & administrative costs(35),(36) | $/oz sold | – | – | – | – | 56 | 56 |

| Reclamation and remediation costs | $/oz sold | 6 | 4 | 10 | 65 | – | 8 |

| Production stripping (sustaining)(37) | $/oz sold | – | – | 165 | 311 | – | 74 |

| Advanced operating development | $/oz sold | – | (11) | – | – | – | (2) |

| Capital expenditure (sustaining) | $/oz sold | 168 | 151 | 124 | 1,028 | 14 | 180 |

| Exploration (sustaining) | $/oz sold | 2 | 31 | 1 | – | – | 7 |

| Leases (sustaining) | $/oz sold | 3 | 45 | 5 | 51 | – | 14 |

| All-In Sustaining Cost | $/oz sold | (160) | 1,489 | 1,293 | 2,169 | 70 | 897 |

| Growth and development costs(36) | $/oz sold | – | – | – | – | 5 | 5 |

| Capitalised stripping (non-sustaining)(37) | $/oz sold | – | – | 61 | – | – | 24 |

| Capital expenditure (non-sustaining)(38) | $/oz sold | 650 | – | 78 | 439 | 12 | 290 |

| Exploration (non-sustaining) | $/oz sold | 3 | 3 | – | 808 | 15 | 35 |

| Leases (non-sustaining) | $/oz sold | 6 | – | – | – | – | 2 |

| All-In Cost | $/oz sold | 499 | 1,492 | 1,432 | 3,416 | 102 | 1,253 |

| Depreciation and amortisation(39) | $/oz sold | 258 | 223 | 311 | 1,639 | 11 | 314 |

All figures are shown at 100%, except for Red Chris which is shown at 70%. AISC and AIC may not calculate based on amounts presented in these tables due to rounding.

All-In Sustaining Cost – Nine months to 31 March 2021

| 9 Months to 31 March 2021 | |||||||

| Units | Cadia | Telfer | Lihir | Red Chris | Corp/ Other | Group(40) | |

| Gold Produced | oz | 570,138 | 290,535 | 560,741 | 35,107 | – | 1,456,521 |

| Mining | $/oz prod. | 174 | 798 | 253 | 1,615 | – | 363 |

| Milling | $/oz prod. | 328 | 447 | 547 | 1,072 | – | 454 |

| Administration and other | $/oz prod. | 107 | 201 | 306 | 1,293 | – | 231 |

| Lease Adjustments | $/oz prod | (3) | (30) | (6) | (3) | – | (9) |

| Third party smelting, refining and transporting costs(41) | $/oz prod. | 166 | 121 | 3 | 648 | – | 106 |

| Royalties | $/oz prod. | 98 | 55 | 47 | 73 | – | 70 |

| By-product credits | $/oz prod. | (1,022) | (199) | – | (3,693) | – | (529) |

| Ore inventory adjustments(42) | $/oz prod. | 4 | (23) | 78 | 34 | – | 28 |

| Production stripping adjustments(42) | $/oz prod. | – | – | (180) | (635) | – | (85) |

| AOD adjustments(42) | $/oz prod. | – | 10 | – | – | – | 2 |

| Net Cash Costs | $/oz prod. | (148) | 1,380 | 1,048 | 404 | – | 631 |

| Gold Sold | oz | 564,624 | 275,537 | 575,495 | 35,253 | – | 1,450,909 |

| Adjusted operating costs(43) | $/oz sold | (160) | 1,400 | 1,016 | 410 | – | 617 |

| Corporate general & administrative costs(44),(45) | $/oz sold | – | – | – | – | 50 | 50 |

| Reclamation and remediation costs | $/oz sold | 6 | 5 | 10 | 64 | – | 8 |

| Production stripping (sustaining)(46) | $/oz sold | – | – | 155 | 633 | – | 77 |

| Advanced operating development | $/oz sold | – | (11) | – | – | – | (2) |

| Capital expenditure (sustaining) | $/oz sold | 136 | 148 | 145 | 1,570 | 11 | 187 |

| Exploration (sustaining) | $/oz sold | 2 | 20 | 1 | – | – | 5 |

| Leases (sustaining) | $/oz sold | 3 | 45 | 5 | 42 | – | 13 |

| All-In Sustaining Cost | $/oz sold | (13) | 1,607 | 1,332 | 2,719 | 61 | 955 |

| Growth and development costs(45) | $/oz sold | – | – | – | – | 6 | 6 |

| Capitalised stripping (non-sustaining)(46) | $/oz sold | – | – | 21 | – | – | 8 |

| Capital expenditure (non-sustaining)(47) | $/oz sold | 563 | – | 77 | 336 | 10 | 268 |

| Exploration (non-sustaining) | $/oz sold | 1 | 2 | – | 512 | 38 | 52 |

| Leases (non-sustaining) | $/oz sold | 6 | – | – | – | – | 2 |

| All-In Cost | $/oz sold | 557 | 1,609 | 1,430 | 3,567 | 115 | 1,291 |

| Depreciation and amortisation(48) | $/oz sold | 254 | 242 | 345 | 1,309 | 11 | 325 |

All figures are shown at 100%, except for Red Chris which is shown at 70%. AISC and AIC may not calculate based on amounts presented in these tables due to rounding.

Simplified Lihir Pit Material Flow – March 2021 Quarter

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/82190_newcrest1enhanced.jpg

Simplified Lihir Process Flow – March 2021 Quarter

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/7614/82190_newcrest2enhanced.jpg

Corporate Information

Board

| Peter Hay | Non-Executive Chairman |

| Sandeep Biswas | Managing Director and CEO |

| Gerard Bond | Finance Director and CFO |

| Philip Aiken AM | Non-Executive Director |

| Roger Higgins | Non-Executive Director |

| Sally-Anne Layman | Non-Executive Director |

| Vickki McFadden | Non-Executive Director |

| Peter Tomsett | Non-Executive Director |

Company Secretaries

Maria Sanz Perez and Claire Hannon

Registered & Principal Office

Level 8, 600 St Kilda Road, Melbourne, Victoria, Australia 3004

Telephone: +61 (0)3 9522 5333

Facsimile: +61 (0)3 9522 5500

Email: corporateaffairs@newcrest.com.au

Website: www.newcrest.com

Stock Exchange Listings

Australian Securities Exchange (Ticker NCM)

Toronto Stock Exchange (Ticker NCM)

PNGX Markets Limited (Ticker NCM)

New York ADR’s (Ticker NCMGY)

Forward Shareholder Enquiries to:

Australia:

Link Market Services

Tower 4, 727 Collins Street

Docklands, Victoria, 3008

Australia

Telephone: 1300 554 474

+61 (0)2 8280 7111

Facsimile: +61 (0)2 9287 0303

Email: registrars@linkmarketservices.com.au

Website: www.linkmarketservices.com.au

Canada:

AST Trust Company (Canada)

P.O. Box 700, Station B

Montreal, Quebec, H3B 3K3

Canada

+1 800 387 0825

inquiries@astfinancial.com

www.astfinancial.com

Substantial Shareholder(s)(49) at 31 March 2021

Allan Gray / Orbis Group 9.9%

BlackRock Group 9.1%

The Vanguard Group 5.1%

Issued Share Capital

At 31 March 2021, Newcrest’s issued capital was 817,289,692 ordinary shares.

Quarterly Share Price Activity

| High | Low | Close | |

| A$ | A$ | A$ | |

| Jan – Mar 2021 | 25.25 | 23.24 | 24.42 |

Forward Looking Statements

This document includes forward looking statements and forward looking information within the meaning of securities laws of applicable jurisdictions. Forward looking statements can generally be identified by the use of words such as “may”, “will”, “expect”, “intend”, “plan”, “estimate”, “anticipate”, “believe”, “continue”, “objectives”, “targets”, “outlook” and “guidance”, or other similar words and may include, without limitation, statements regarding estimated reserves and resources, certain plans, strategies, aspirations and objectives of management, anticipated production, study or construction dates, expected costs, cash flow or production outputs and anticipated productive lives of projects and mines. Newcrest continues to distinguish between outlook and guidance. Guidance statements relate to the current financial year. Outlook statements relate to years subsequent to the current financial year.

These forward looking statements involve known and unknown risks, uncertainties and other factors that may cause Newcrest’s actual results, performance and achievements or industry results to differ materially from any future results, performance or achievements, or industry results, expressed or implied by these forward-looking statements. Relevant factors may include, but are not limited to, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary licences and permits and diminishing quantities or grades of reserves, political and social risks, changes to the regulatory framework within which Newcrest operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation. For further information as to the risks which may impact on Newcrest’s results and performance, please see the risk factors included in the Annual Information Form dated 13 October 2020 lodged with ASX and SEDAR.

Forward looking statements are based on Newcrest’s good faith assumptions as to the financial, market, regulatory and other relevant environments that will exist and affect Newcrest’s business and operations in the future. Newcrest does not give any assurance that the assumptions will prove to be correct. There may be other factors that could cause actual results or events not to be as anticipated, and many events are beyond the reasonable control of Newcrest. Readers are cautioned not to place undue reliance on forward looking statements, particularly in the current economic climate with the significant volatility, uncertainty and disruption caused by the COVID-19 pandemic. Forward looking statements in this document speak only at the date of issue. Except as required by applicable laws or regulations, Newcrest does not undertake any obligation to publicly update or revise any of the forward looking statements or to advise of any change in assumptions on which any such statement is based.

Non-IFRS Financial Information

Newcrest results are reported under International Financial Reporting Standards (IFRS). This document includes non-IFRS financial information within the meaning of ASIC Regulatory Guide 230: ‘Disclosing non-IFRS financial information’ published by ASIC and within the meaning of Canadian Securities Administrators Staff Notice 52-306 – Non-GAAP Financial Measures. Such information includes All-In Sustaining Cost (AISC) and All-In Cost (AIC) as per updated World Gold Council Guidance Note on Non-GAAP Metrics released in November 2018. AISC will vary from period to period as a result of various factors including production performance, timing of sales and the level of sustaining capital and the relative contribution of each asset. AISC Margin reflects the average realised gold price less AISC per ounce sold.

These measures are used internally by Newcrest management to assess the performance of the business and make decisions on the allocation of resources and are included in this document to provide greater understanding of the underlying performance of Newcrest’s operations. The non-IFRS information has not been subject to audit or review by Newcrest’s external auditor and should be used in addition to IFRS information. Such non-IFRS information/non-GAAP measures do not have a standardised meaning prescribed by IFRS and may be calculated differently by other companies. Although Newcrest believes these non-IFRS/non-GAAP financial measures provide useful information to investors in measuring the financial performance and condition of its business, investors are cautioned not to place undue reliance on any non-IFRS financial information/non-GAAP financial measures included in this document. When reviewing business performance, this non-IFRS information should be used in addition to, and not as a replacement of, measures prepared in accordance with IFRS, available on Newcrest’s website and the ASX and SEDAR platforms.

Technical and Scientific Information

The technical and scientific information contained in this document relating to Wafi-Golpu and Lihir was reviewed and approved by Craig Jones, Newcrest’s Chief Operating Officer PNG, FAusIMM and a Qualified Person as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects (NI 43-101). The technical and scientific information contained in this document relating to Cadia was reviewed and approved by Philip Stephenson, Newcrest’s Chief Operating Officer Australia and Americas, FAusIMM and a Qualified Person as defined in NI 43-101.

Competent Persons’ Statement

The information in this document that relates to Mineral Resources at Red Chris has been extracted from the release titled “Newcrest announces its initial Mineral Resource estimate for Red Chris” dated 31 March 2021 and which is available to view at www.asx.com.au under the code “NCM” (the original Red Chris release) and on Newcrest’s SEDAR profile. The information in this document that relates to Mineral Resources at Lihir is based on the release titled “Annual Mineral Resources and Ore Reserves Statement as at 31 December 2020” dated 11 February 2021 and which is available to view at www.asx.com.au under the code “NCM” (the Annual Statement) and on Newcrest’s SEDAR profile. Newcrest confirms that it is not aware of any new information or data that materially affects the information included in the original Red Chris release and the Annual Statement and that all material assumptions and technical parameters underpinning the estimates in such releases continue to apply and have not materially changed. Newcrest confirms that the form and context in which the competent persons’ findings are presented have not been materially modified from the original Red Chris release and the Annual Statement.

Authorised by the Newcrest Disclosure Committee

For further information please contact

Investor Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Ben Lovick

+61 3 9522 5334

+61 407 269 478

Ben.Lovick@newcrest.com.au

North American Investor Enquiries

Ryan Skaleskog

+1 866 396 0242

+61 403 435 222

Ryan.Skaleskog@newcrest.com.au

Media Enquiries

Tom Dixon

+61 3 9522 5570

+61 450 541 389

Tom.Dixon@newcrest.com.au

Annie Lawson

+61 3 9522 5750

+61 409 869 986

Annie.Lawson@newcrest.com.au

This information is available on our website at www.newcrest.com

Appendix

Reconciliation of Newcrest’s operational performance including its 32% attributable share of Fruta del Norte through its 32% equity interest in Lundin Gold Inc.

| Gold production | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 |

| Gold production – Newcrest operations | oz | 479,100 | 504,491 | 472,929 | 1,456,521 |

| Gold production – Fruta del Norte (32%) | oz | 33,324 | 30,986 | 30,160 | 94,469 |

| Gold production | oz | 512,424 | 535,477 | 503,089 | 1,550,990 |

| All-In Sustaining Cost | Metric | Mar 2021 Qtr(50) | Dec 2020 Qtr(51) | Sep 2020 Qtr(52) | YTD FY21 |

| All-in Sustaining Cost – Newcrest operations | $m | 433 | 455 | 498 | 1,386 |

| All-in Sustaining Cost – Fruta del Norte (32%) | $m | 27 | 26 | 14 | 67 |

| All-In Sustaining Cost | $m | 460 | 481 | 512 | 1,453 |

| Gold ounces sold – Newcrest operations | oz | 482,878 | 465,125 | 502,907 | 1,450,909 |

| Gold ounces sold – Fruta del Norte (32%) | oz | 33,324 | 33,981 | 19,891 | 87,196 |

| Total gold ounces sold | oz | 516,202 | 499,105 | 522,798 | 1,538,105 |

| All-In Sustaining Cost – Newcrest operations | $/oz | 897 | 979 | 990 | 955 |

| All-In Sustaining – Fruta del Norte (32%) | $oz | 800 | 747 | 728 | 763 |

| All-In Sustaining Cost | $/oz | 891 | 963 | 980 | 944 |

| All-In Sustaining Cost margin | Metric | Mar 2021 Qtr | Dec 2020 Qtr | Sep 2020 Qtr | YTD FY21 |

| Realised gold price(53) | $/oz | 1,751 | 1,815 | 1,837 | 1,801 |

| All-In Sustaining Cost – Newcrest operations | $/oz | 897 | 979 | 990 | 955 |

| All-In Sustaining Cost margin | $/oz | 854 | 836 | 847 | 846 |

[1]See information under heading “Non-IFRS Financial Information” on Page 17 of this report for further information.

[2] Includes 33koz and an estimated reduction of $6/oz based on Newcrest’s 32% attributable share of Fruta del Norte. Refer to the Appendix for calculation and further details.

[3]Newcrest’s AISC margin has been determined by deducting the All-In Sustaining Cost attributable to Newcrest’s operations from Newcrest’s realised gold price.Refer to the Appendix for details.

[4] The development of a block cave mine at Red Chris is subject to the completion of a successful exploration program and further studies, market and operating conditions, regulatory approvals and Board approvals.

[5]Subject to market and operating conditions and potential delays due to COVID-19 impacts.

[6]Subject to Board approval and potential delays due to COVID-19 impacts.

[7]The achievement of guidance is subject to market and operating conditions. Newcrest’s guidance for Fruta del Norte is an annualised figure based on Lundin Gold Inc’s production guidance for 1 July 2020 to 31 December 2020. See Appendix for further details.

[8]The figures shown represent Newcrest’s 70% share of the unincorporated Red Chris JV.Production outcomes for FY20 are reported from the date of acquisition (15 August 2019).

[9] The figures shown represent 100%. Prior to the divestment on 4 March 2020, Newcrest owned 75% of Gosowong through its holding in PT Nusa Halmahera Minerals, an incorporated joint venture. Production and financial outcomesfor FY20 represent Newcrest’s period of ownership to the divestment date.

[10]The figures shown represent Newcrest’s 32%attributable share, through its 32% equity interest in Lundin Gold Inc.

[11]Total Recordable Injury Frequency Rate (injuries per million hours). TRIFR for FY20 includes safety results for Red Chris from acquisition.

[12]Due to the negligible impact of Fruta del Norte on Newcrest’s Group AISC for FY20 it has been excluded from the FY20 calculation.

[13]AISCfor the December 2020 quarter has been restated following the release of Lundin Gold’s 2020 Annual Report on 15 March 2021.This had a $5/oz benefit to Newcrest’s previously reported AISC outcome for the December 2020 quarter.

[14]The prior period AISC and AIC has been restated to reflect adjustments applied to Red Chris following the completion of acquisition and year end processes.

[15]From Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte through its 32%equityinterest in Lundin Gold Inc.

[16]Realised metal prices are the US$ spot prices at the time of sale per unit of metal sold (net of Telfer gold production hedges), excluding deductions related to treatment and refining charges and the impact of price related finalisations for metals in concentrate. The realised price for the September, December and March quarters and for FY20 and FY21 has been calculated from sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

[17] Subject to market and operating conditions and potential delays due to COVID-19 impacts.

[18]Subject to Board approval andpotential delays due to COVID-19 impacts.

[19]At current milling rates. The estimate of an additional ~400-600koz of contained gold in FY23-25 is subject to the successful completion of the Phase 14A Pre-Feasibility Study and assumes the successful conversion of 20Mt of existing Indicated Mineral Resource to Probable Ore Reserves. The estimate represents the difference between the indicative mine plan base case (inclusive of the outcomes of the Lihir Mine Optimisation Study) and any potential uplift that Phase 14A could provide as a result of the replacement of ~11Mt of low grade ore feed with higher grade during this period. The estimate of ~20Mt of Indicated Mineral Resource underpinning the estimate of ~400-600koz of contained gold has been prepared based on an annualised ~15mtpa mill feed rate, expit TMM range of 41-63mtpa, from which 6-12mtpa is allocated to Phase 14A, mill recovery of 75-82%, inter-ramp slope design of approximately 79 degrees in the upper argillic rock benches supported by long cables with mesh and shotcrete to enable safe steepening of the existing unsupported slopes of 20-35 degrees, and the lower unsupported benches at historical 62 degree slopes. The estimate of ~20Mt of Indicated Mineral Resource has been prepared in accordance with the requirements in Appendix 5A of the ASX Listing Rules by a Competent Person. For further information as to the total Indicated Mineral Resources for Lihir of which the 20Mt of Indicated Mineral Resources is part, see the release titled “Annual Mineral Resources and Ore Reserves Statement – 31 December 2020” which is available to view at www.asx.com.auunder the code “NCM” and on Newcrest’s SEDAR profile.

[20] AISC margin calculated with reference to the Group average realised gold price.

[21]The figures shown represent Newcrest’s 70% shareof the unincorporated Red Chris JV. Productionand financial outcomesfor FY20 are reported fromthe date of acquisition (15 August 2019).

[22]Prior period AISC has been restated to reflect adjustments applied following the completion of acquisition and year end processes.

[23]Newcrest’s initial Mineral Resource estimate for Red Chris is presented at 100%. Newcrest’s joint venture interest in the Mineral Resource estimate is 70%.

[24]The development of a block cave mine at the Red Chris project is subject to the completion of a successful exploration program and further studies, market and operating conditions, regulatory approvals and Board approvals.

[25]Subject to Board approval and potential delays due to COVID-19 impacts.

[26] In addition, the development of any underground mine at the Havieron Project will also be subject to the completion of a successful exploration program and further studies, market and operating conditions, Board approvals, and a positive decision to mine.

[27]Subject to market and operating conditions and potential delays due to COVID-19 impacts.

[28] Mine production for open pit and underground includes ore and waste.

[29] Includes development tonnesfrom the Cadia East PC2-3 project. Costs associated with this production were capitalised and are not included in the AISC calculation in this report.

[30]Due to timing of Lundin Gold’s March 2021 quarterly report, Newcrest has estimated its 32% attributable share, through its 32% equity interest in Lundin Gold Inc, of Fruta del Norte’s All-In Sustaining Cost for the quarter. For the purposes of All-In Sustaining Cost, Newcrest has assumed that production is equal to sales. Refer to the Appendix for further details.

[31]Group AISC is for Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte.

[32] Includes deductions related to treatment and refining charges for metals in concentrate.

[33] Represents adjustment for ore inventory movements, removal of production stripping costs and movement in Advanced Operating Development costs.

[34] Adjusted operating costs represents net cash costs adjusted for finished goods inventory movements, divided by ounces sold.

[35] Corporate general & administrative costs includes share-based remuneration.

[36] Costs of this nature were previously reported within Corporate Costs. In accordance with the updated World Gold Council guidance, growth and development costs are now presented in AIC.

[37]In accordance with World Gold Council Guidance stripping campaigns can be classified as non-sustaining expenditure if they are expected to take at least 12 months and are expected to deliver ore production for more than five years. Newcrest has determined that Phase 16 at Lihir satisfies this criteria and has reported spend in relation to this campaign as capitalised stripping (non-sustaining).

[38]Represents spend on major projects that are designed to increase the net present value of the mine are not related to current production. Significant projects in the current period include key expansion projects at Cadia (including PC2-3 developmentand the molybdenum plant)and Lihir (Seepage Barrier feasibilitystudy, front end recovery and HV upgrade).

[39] Depreciation and amortisation of mine site assets is determined on the basis of the lesser of the asset’s useful economic life and the life of the mine.Life-of-mine assets are depreciated according to units of production and the remainder on a straight line basis. Depreciation and amortisation does not form part of All-In Sustaining Cost or All-in Cost with the exception of amortisation on reclamation and remediation (rehabilitation) assets.

[40]Group AISC is for Newcrest’s operations only and does not include Newcrest’s 32% attributable share of Fruta del Norte.

[41] Includes deductions related to treatment and refining charges for metals in concentrate.

[42] Represents adjustment for ore inventory movements, removal of production stripping costs and movement in Advanced Operating Development costs.

[43] Adjusted operating costs represents net cash costs adjusted for finished goods inventory movements, divided by ounces sold.

[44] Corporate general & administrative costs includes share-based remuneration.

[45] Costs of this nature were previously reported within Corporate Costs. In accordance with the updated World Gold Council guidance, growth and development costs are now presented in AIC.

[46]In accordance with World Gold Council Guidance stripping campaigns can be classified as non-sustaining expenditure if they are expected to take at least 12 months and are expected to deliver ore production for more than five years. Newcrest has determined that Phase 16 at Lihir satisfies this criteria and has reported spend in relation to this campaign as capitalised stripping (non-sustaining).

[47]Represents spend on major projects that are designed to increase the net present value of the mine are not related to current production. Significant projects in the year include key expansion projects at Cadia (including PC2-3 feasibility study and the molybdenum plant) and Lihir (Seepage Barrier feasibility study, front end recovery and HV upgrade).

[48] Depreciation and amortisation of mine site assets is determined on the basis of the lesser of the asset’s useful economic life and the life of the mine.Life-of-mine assets are depreciated according to units of production and the remainder on a straight line basis. Depreciation and amortisation does not form part of All-In Sustaining Cost or All-in Cost with the exception of amortisation on reclamation and remediation (rehabilitation) assets.

[49]As notified to Newcrest under section 671B of the Corporations Act 2001.

[50]Due to timing of Lundin Gold’s March 2021 quarterly report, Newcrest has estimated its 32% attributable share, through its 32% equity interest in Lundin Gold Inc, of Fruta del Norte’s All-In Sustaining Cost for the March quarter. The AISC estimate was derived by taking the mid-point of Lundin Gold’s CY21 AISC guidance of $770-830/oz (released 15 March 2021). For the purposes of AISC, Newcrest has assumed that production is equal to sales. Newcrest will restate its March quarter AISC outcome in June once the outcomes for Fruta del Norte’s March quarter are known. On the basis of materiality, Newcrest has not restated its FY21 guidance for Fruta del Norte. Newcrest’s guidance with respect to the gold production of Fruta del Norte is based on Lundin Gold’s July to December 2020 guidance of 150,000 – 170,000 ounces which has been annualised on the assumption that production levels will be same for the January to June 2021 period (presented at 32% and rounded to nearest 5koz). With respect to Newcrest’s guidance for AISC, the dollar million range has been derived by multiplying the low end of annualised production of Newcrest’s guidance by the high end of Lundin Gold’s July – December 2020 AISC guidance of $770/oz – $850/oz, and the high end of annualised production of Newcrest’s guidance multiplied by the low end of the same AISC guidance range.

[51]The All-In Sustaining Cost and gold ounces sold outcomes for Fruta del Note for the December 2020 quarter have been restated following the release of Lundin Gold’s December quarterly report on 15 March 2021. This had a $5/oz benefit to Newcrest’s previously reported All-In Sustaining Cost outcome for the December quarter.

[52]The All-In Sustaining Cost and gold ounces sold outcomes for Fruta del Norte for the September 2020 quarter have been restated following the release of Lundin Gold’s September quarterly report on 9 November 2020. Newcrest’s All-In Sustaining Cost outcome of $980/oz for the September quarter remains unchanged.

[53]Realised metal prices are the US$ spot prices at the time of sale per unit of metal sold (net of Telfer production hedges), excluding deductions related to treatment and refining charges and the impact of price related finalisations for metals in concentrate. The realised price for the September, December and March quarters and for FY21 has been calculated from sales ounces generated by Newcrest’s operations only (i.e. excluding Fruta del Norte).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/82190